Company Summary

| KIT Review Summary | |

| Founded | 2000 |

| Registered Country/Region | Russia |

| Regulation | No regulation |

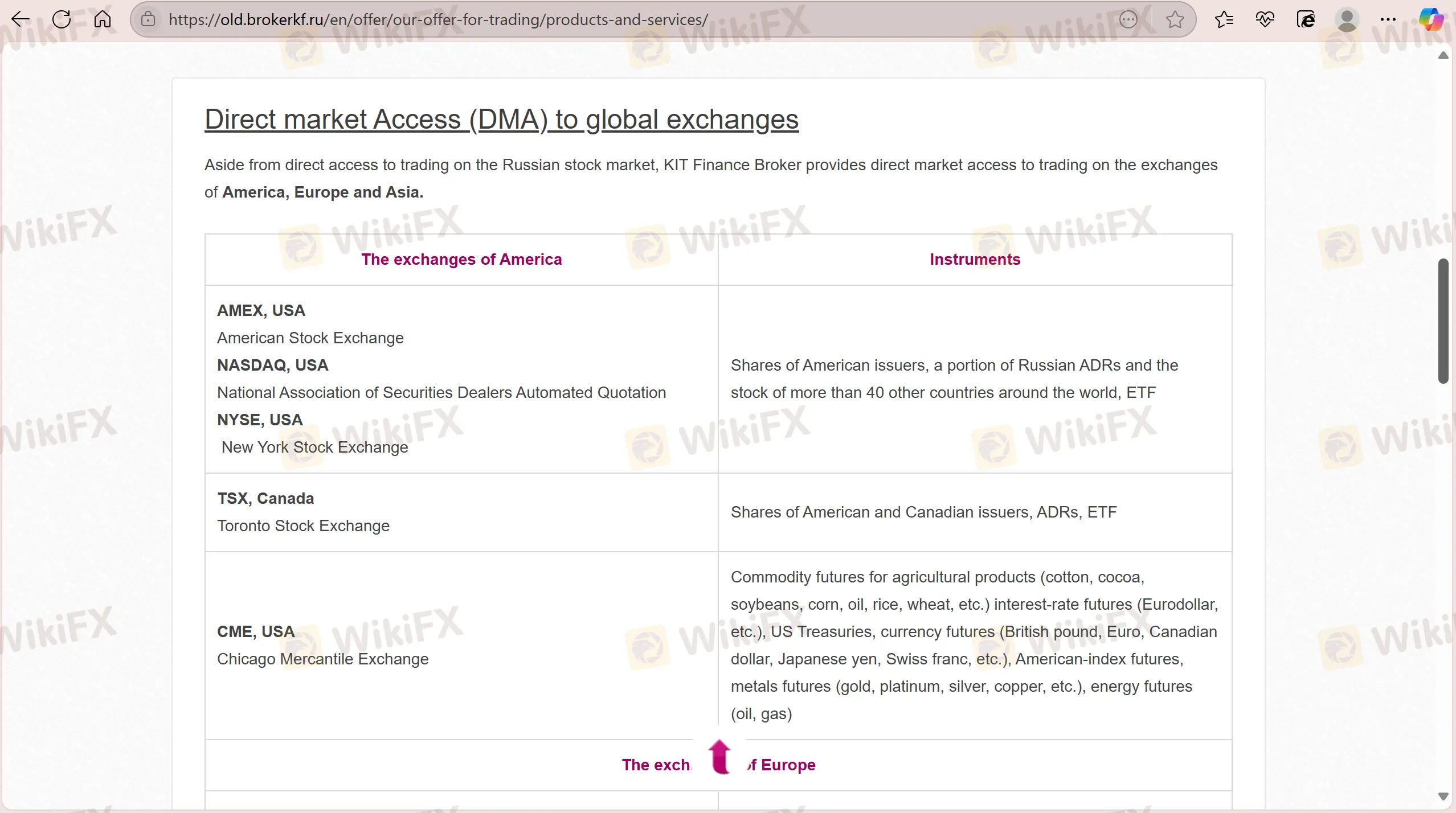

| Products and Services | Asset management, currency conversion, margin lending, ETFs, stocks, futures |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Valdi Market Access |

| Minimum Deposit | / |

| Customer Support | Phone: 8 800 700-00-55 |

| Fax: +7 (812) 332 32 91 | |

| Social Media: Telegram, VK, YouTube | |

| Address: 69-71, Marata str., Business center «Renaissance Plaza», St. Petersburg, Russia, 191119 | |

KIT Information

KIT Finance, founded in 2000 and headquartered in Russia, is an unregulated broker that is not licensed by the Central Bank of Russia or any other major authorities. It provides access to Russian and worldwide financial markets using institutional-grade technologies such as Valdi Market Access.

Pros and Cons

| Pros | Cons |

| Offers access to both Russian and global markets | Not regulated |

| Supports institutional and professional clients | Lack of transparency |

| Long operation history | |

| Advanced trading tools and infrastructure | |

| Various contact channels |

Is KIT Legit?

KIT Finance is not a regulated broker. While it is registered in Russia, it is not supervised by any recognized Russian financial authority, such as the Central Bank of Russia, for brokerage or investing purposes.

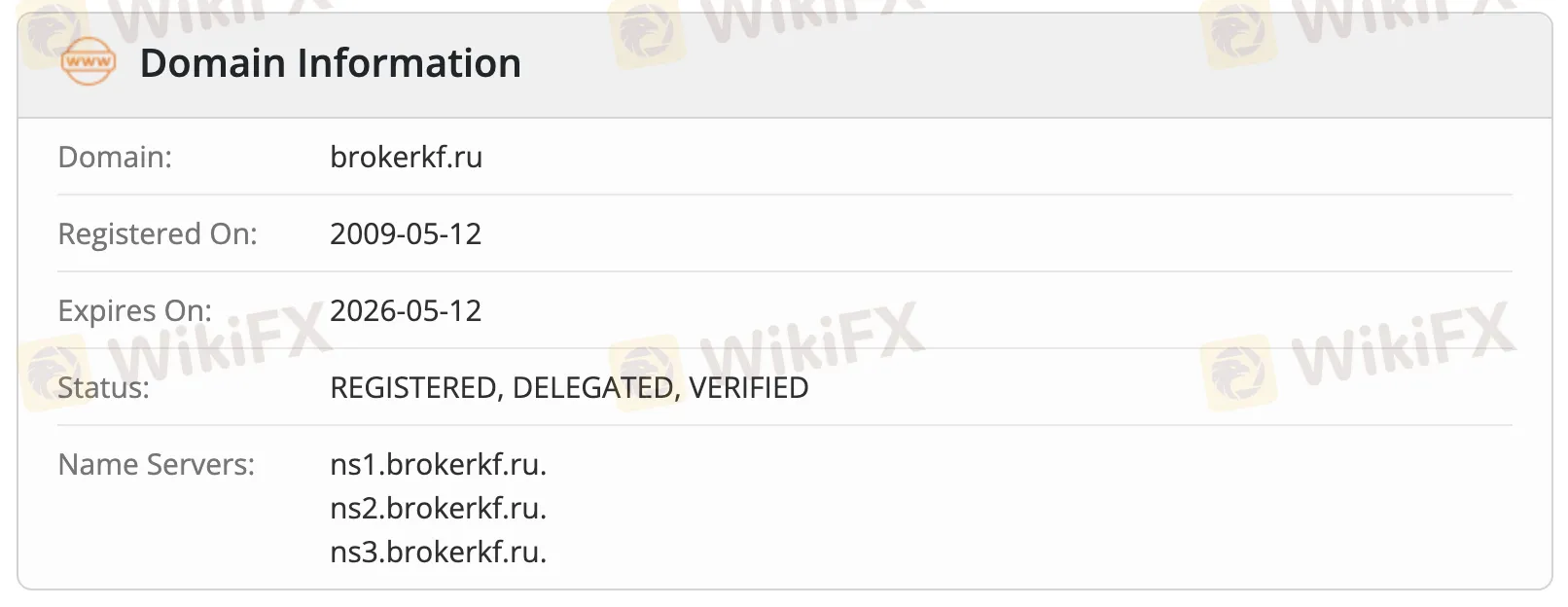

According to WHOIS records, the domain brokerkf.ru was registered on May 12, 2009 and is still alive, with the status “REGISTERED, DELEGATED, VERIFIED”. The domain will expire on May 12, 2026, and is hosted on its own name servers: ns1.brokerkf.ru, ns2.brokerkf.ru, and ns3.brokerkf.ru.

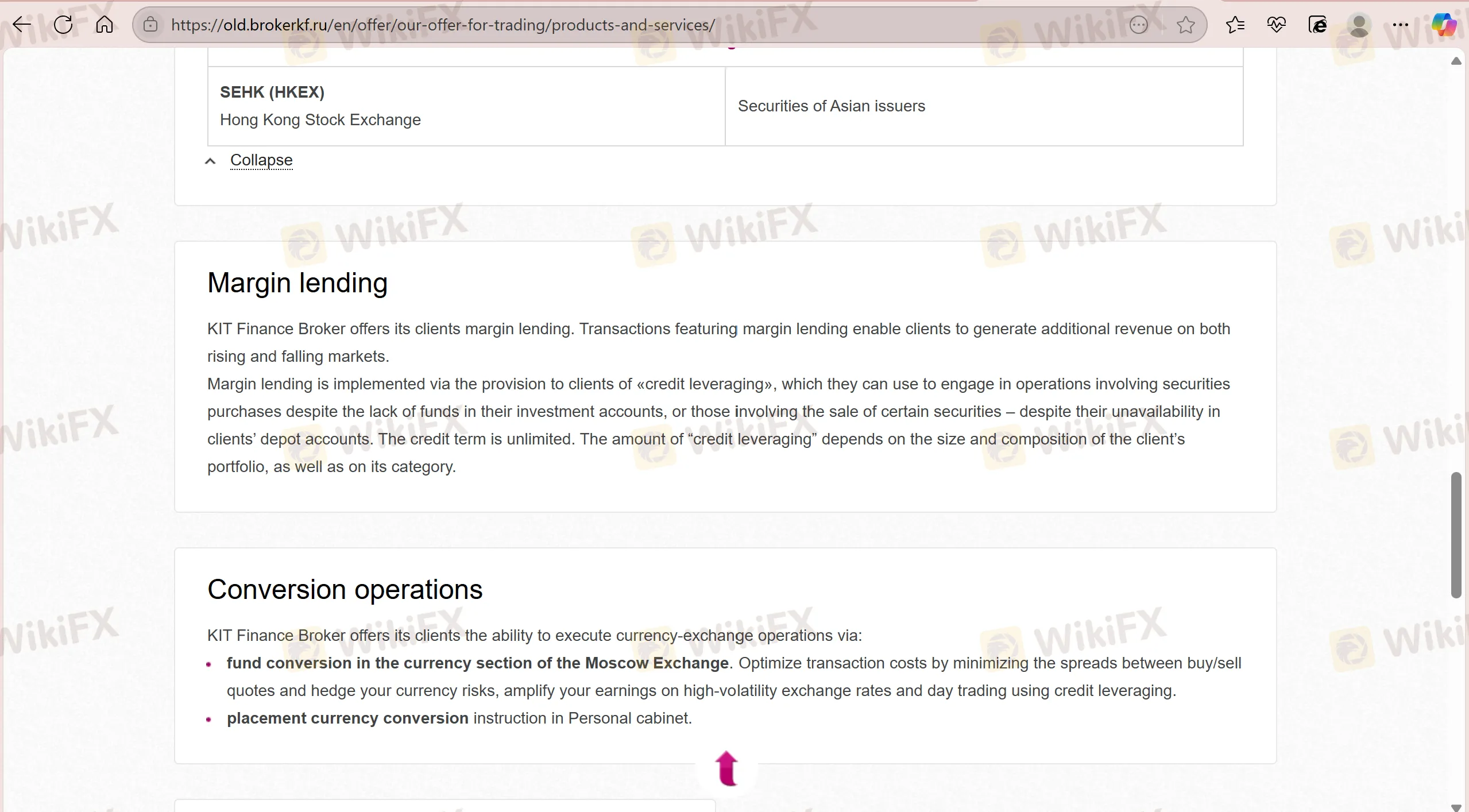

Products and Services

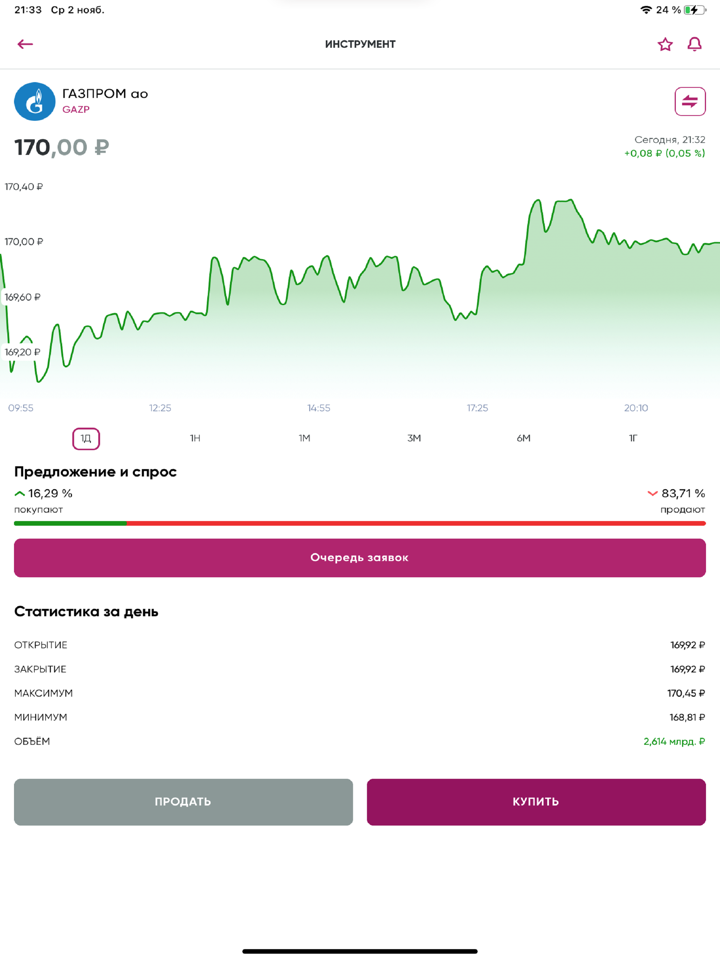

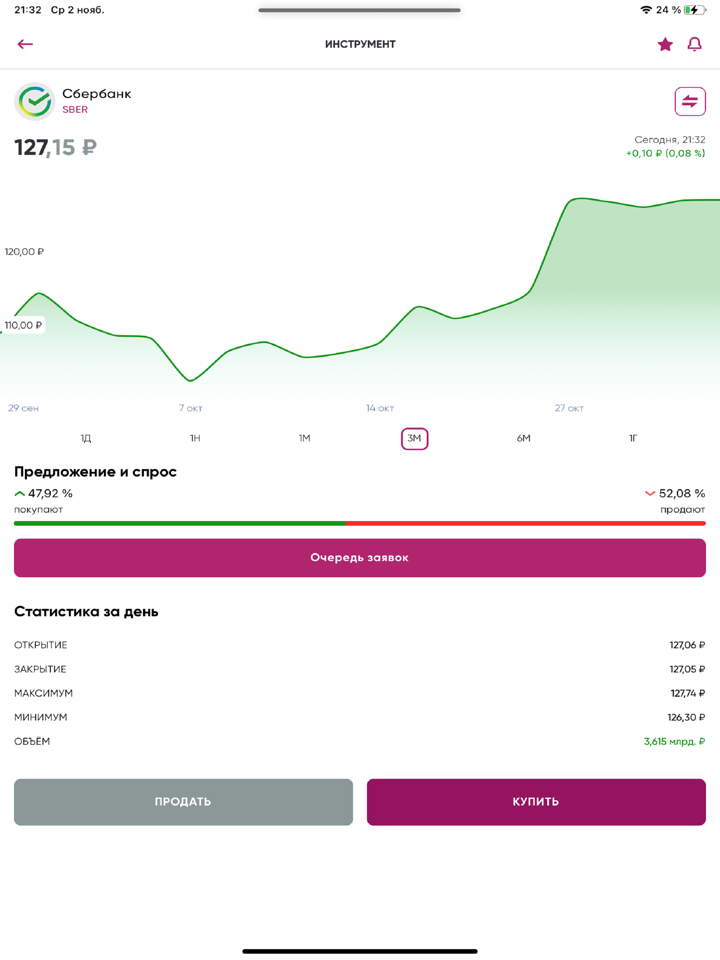

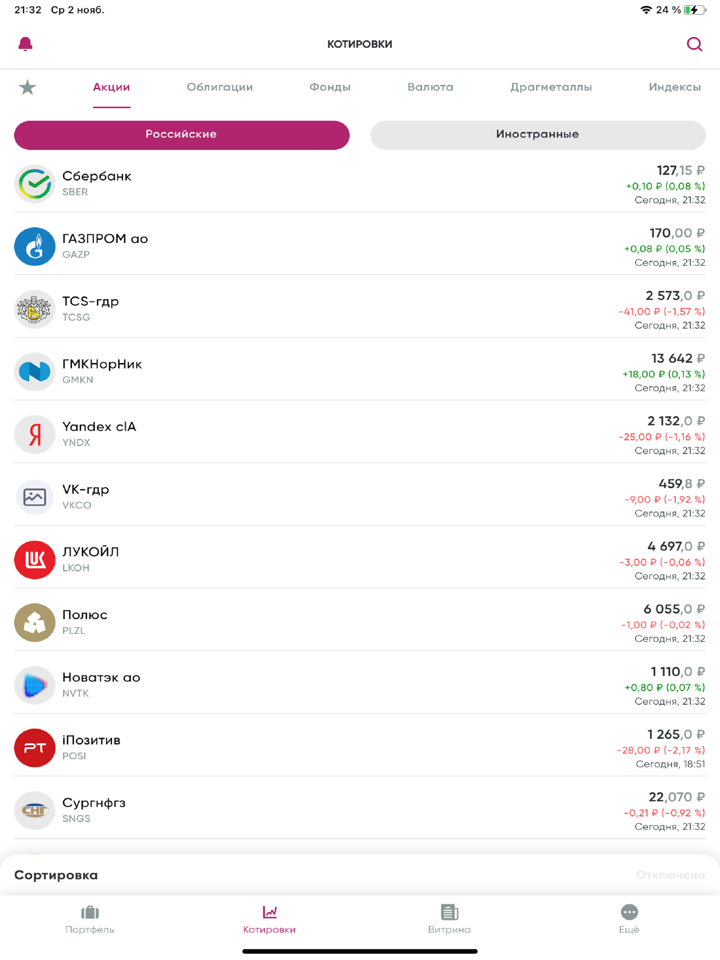

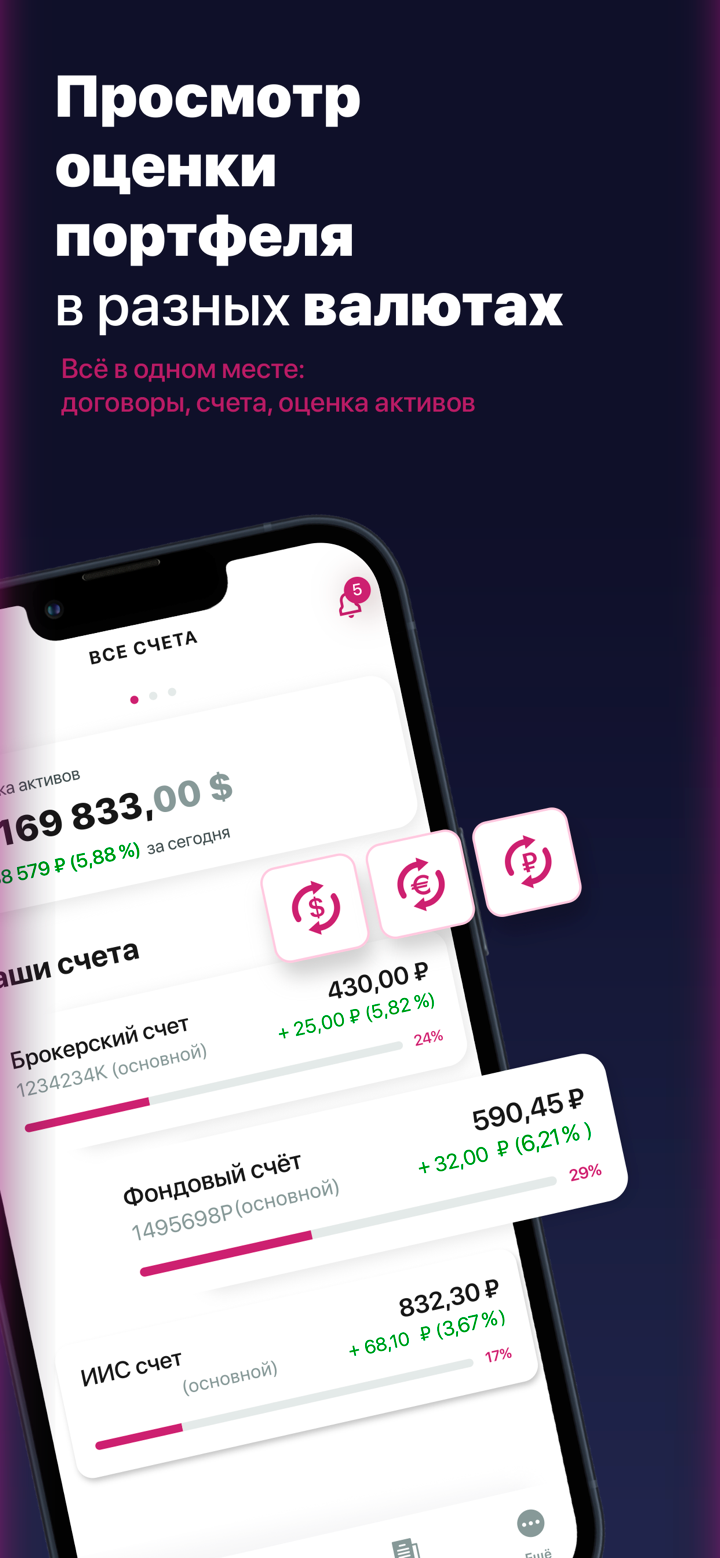

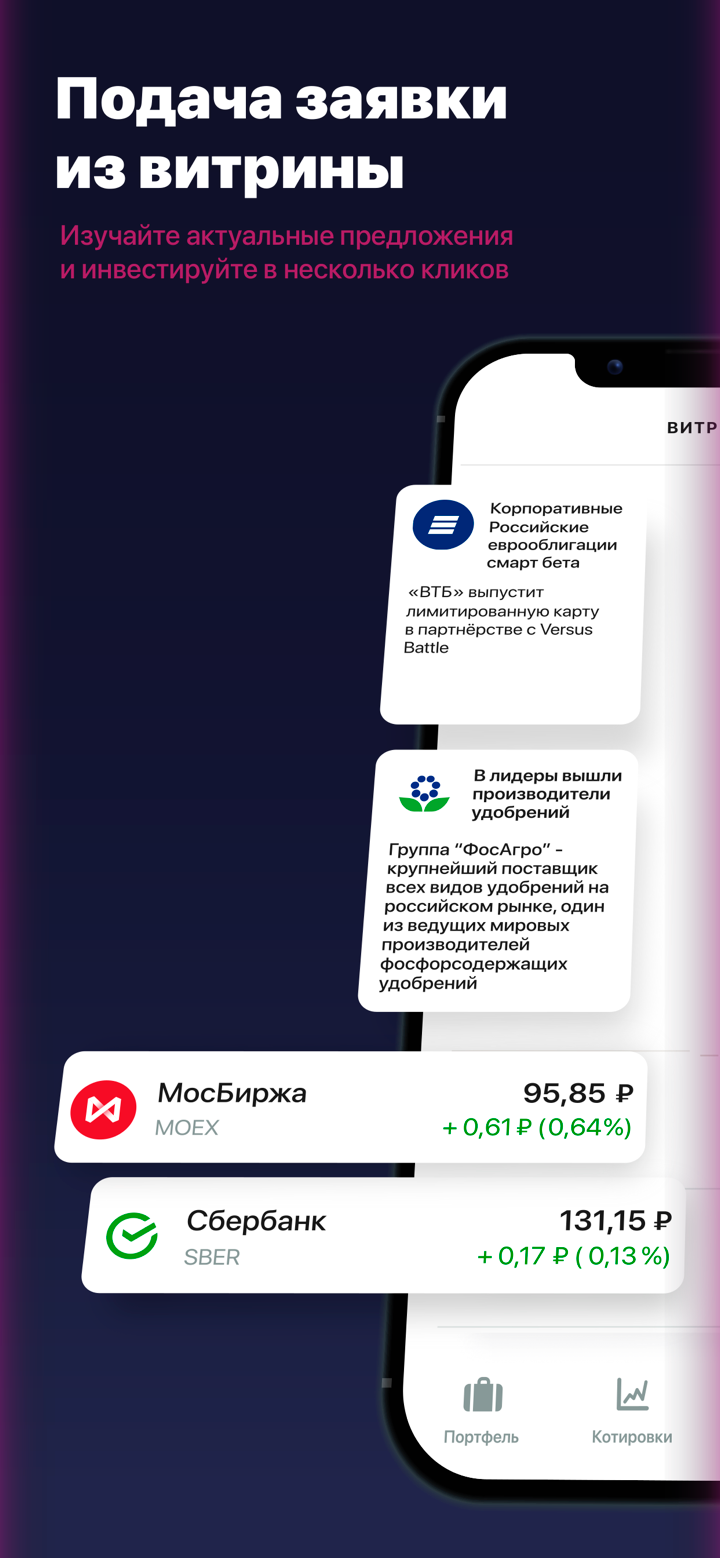

KIT Finance provides brokerage and trading services for Russian and global markets, serving to both institutional clients (banks, insurance companies, asset managers) and private individuals.

| Products / Services | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Futures | ✔ |

| Asset Management | ✔ |

| Margin Lending | ✔ |

| Currency Conversion | ✔ |

Trading Platform

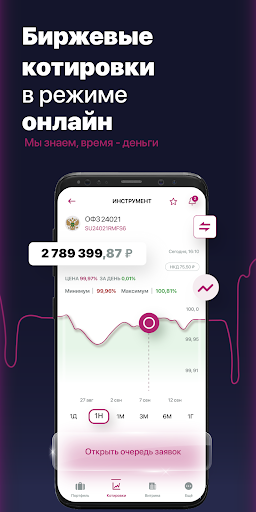

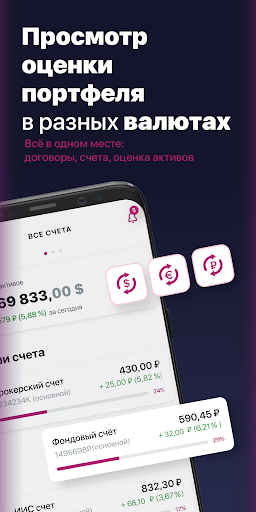

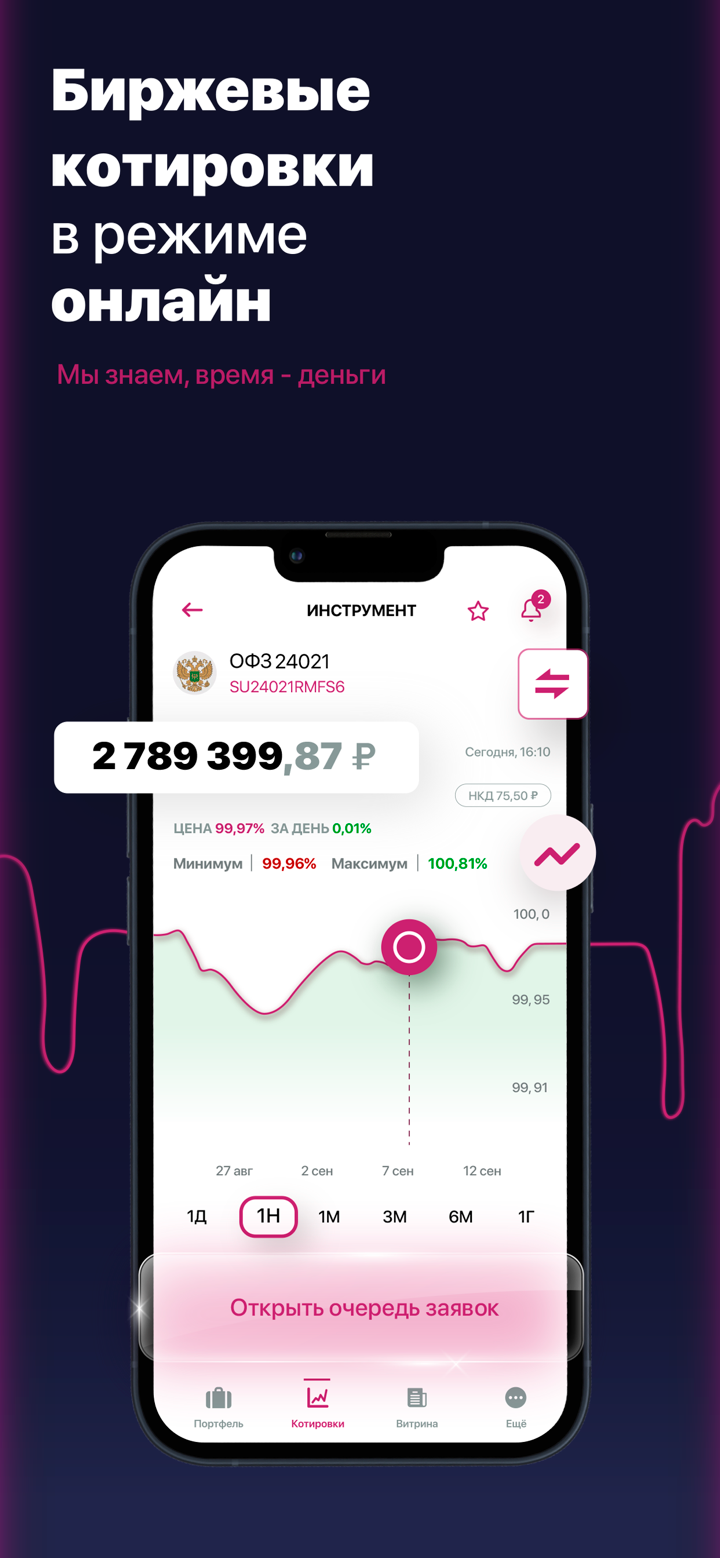

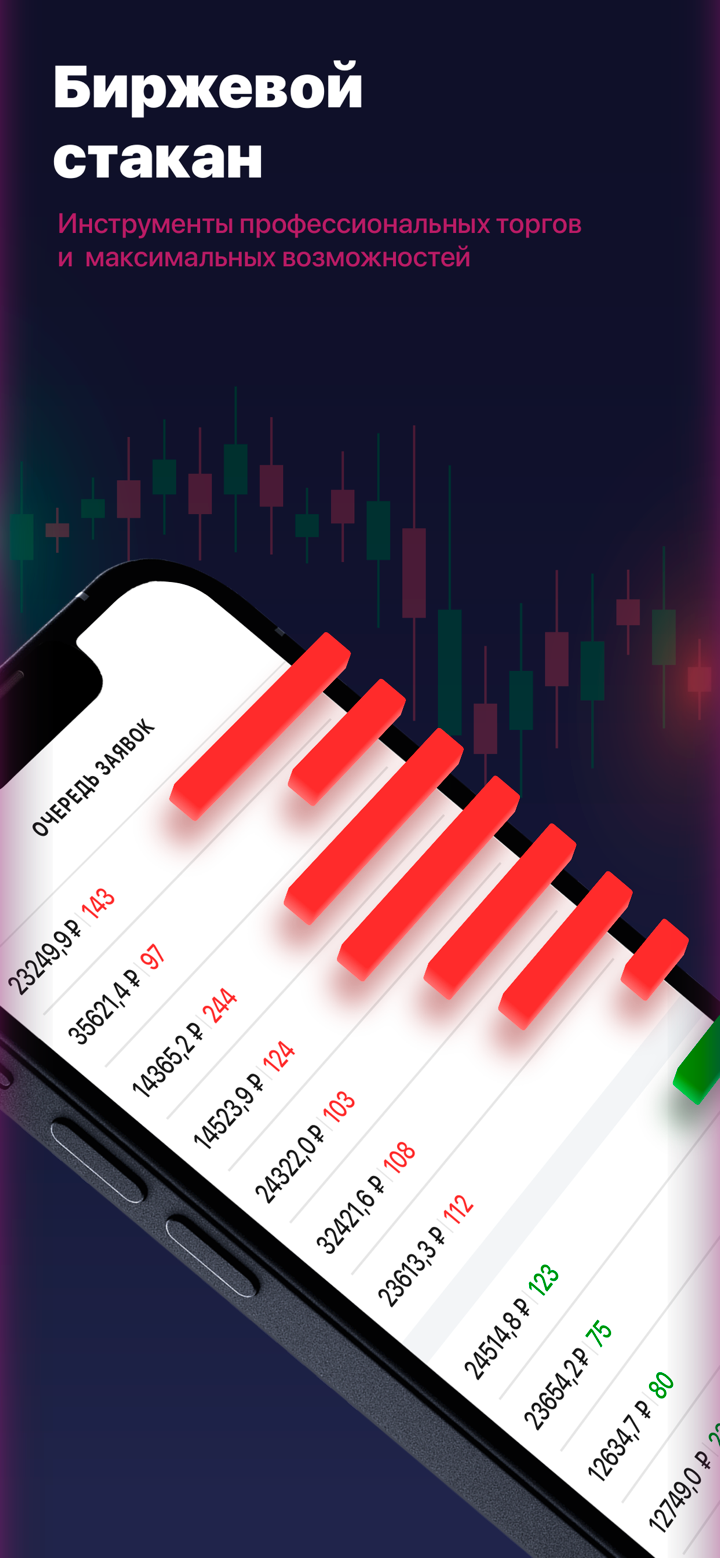

KIT Finance provides Valdi Market Access, a robust trading platform geared largely toward institutional and professional users. It covers the complete transaction lifecycle, from execution to risk management, compliance, and settlement, with an emphasis on speed, automation, and low-latency communication via the SunGard Global Network (SGN). It is not intended for casual retail users.

| Trading Platform | Supported | Available Devices | Suitable for |

| Valdi Market Access | ✔ | Desktop (Windows) | / |

| MT4 | ❌ | / | Beginners |

| MT5 | ❌ | / | Experienced traders |