公司簡介

| Patria Finance 評論摘要 | |

| 成立年份 | 1996 |

| 註冊國家/地區 | 捷克共和國 |

| 監管 | 無監管 |

| 市場工具 | 股票、基金、ETF、大宗商品、衍生品、債券 |

| 模擬帳戶 | ✅ |

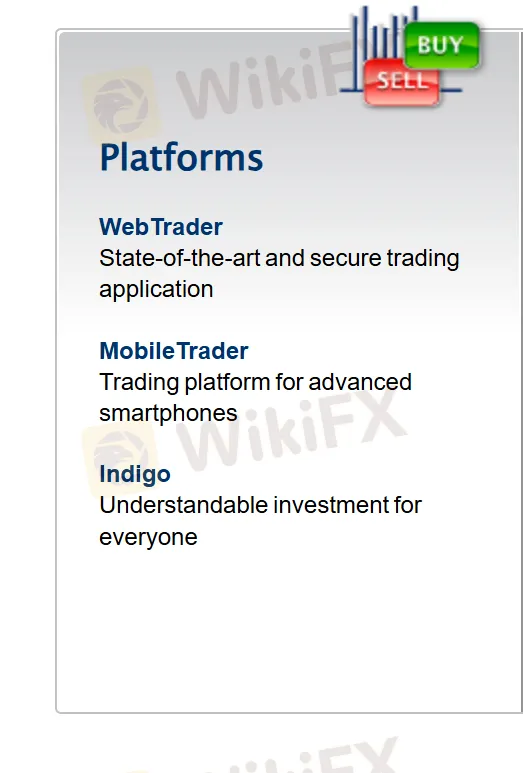

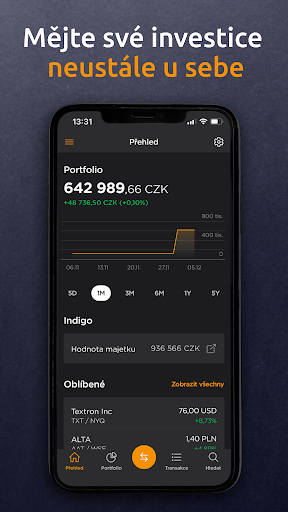

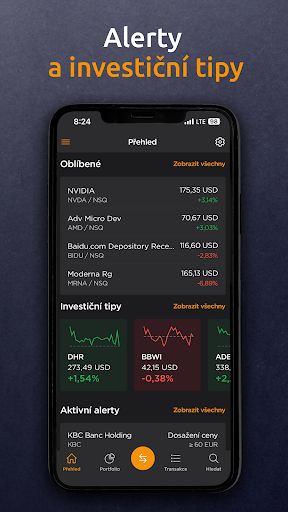

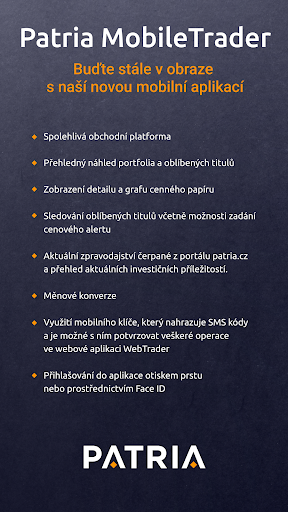

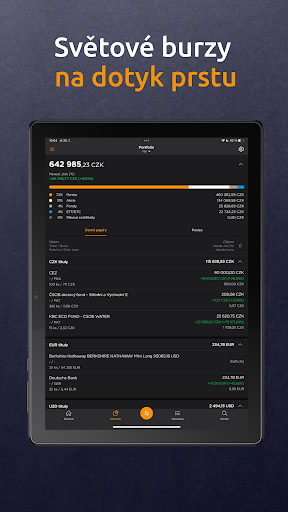

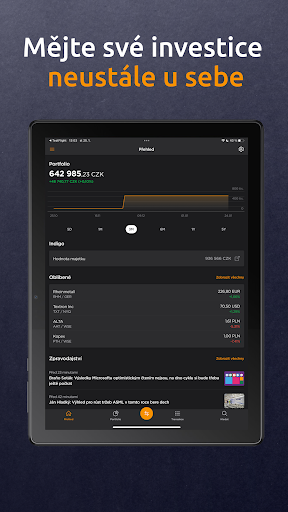

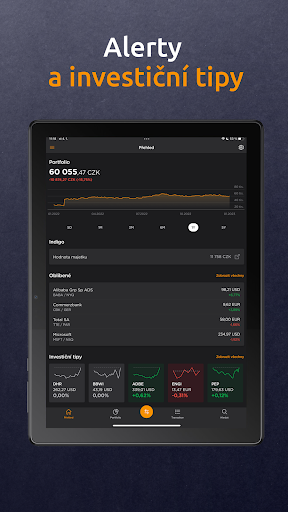

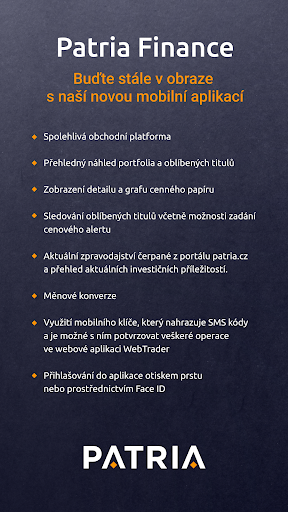

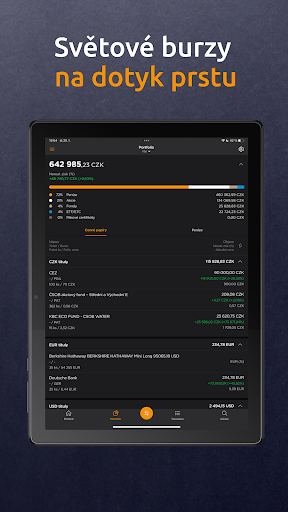

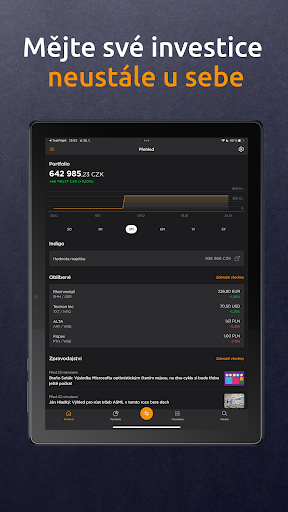

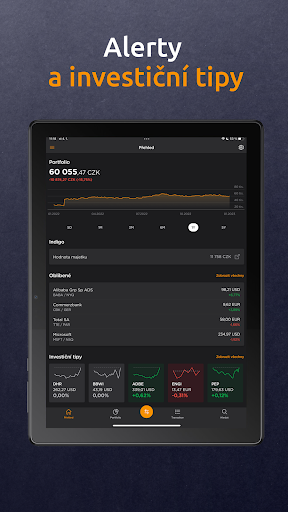

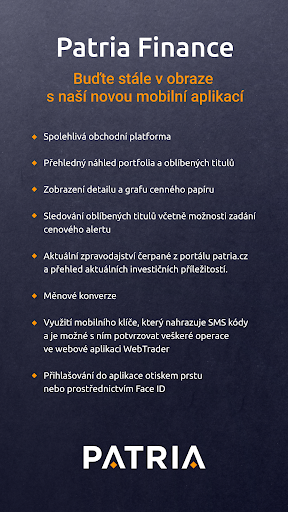

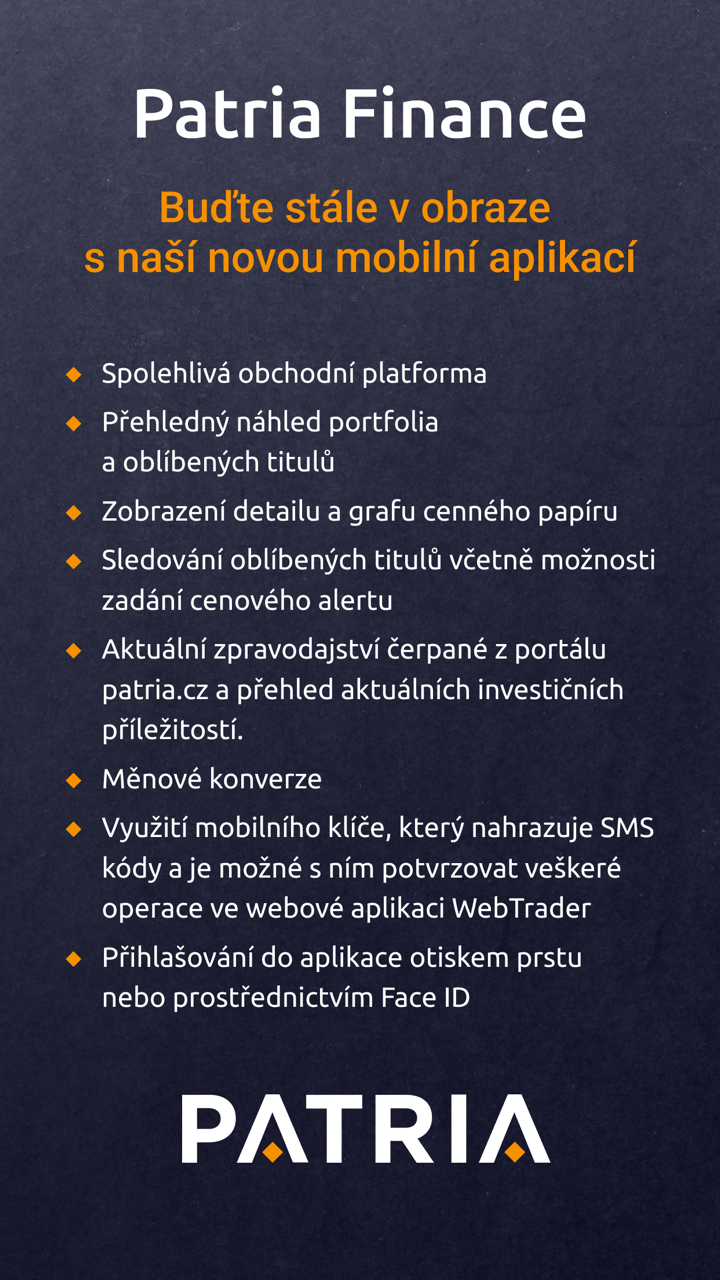

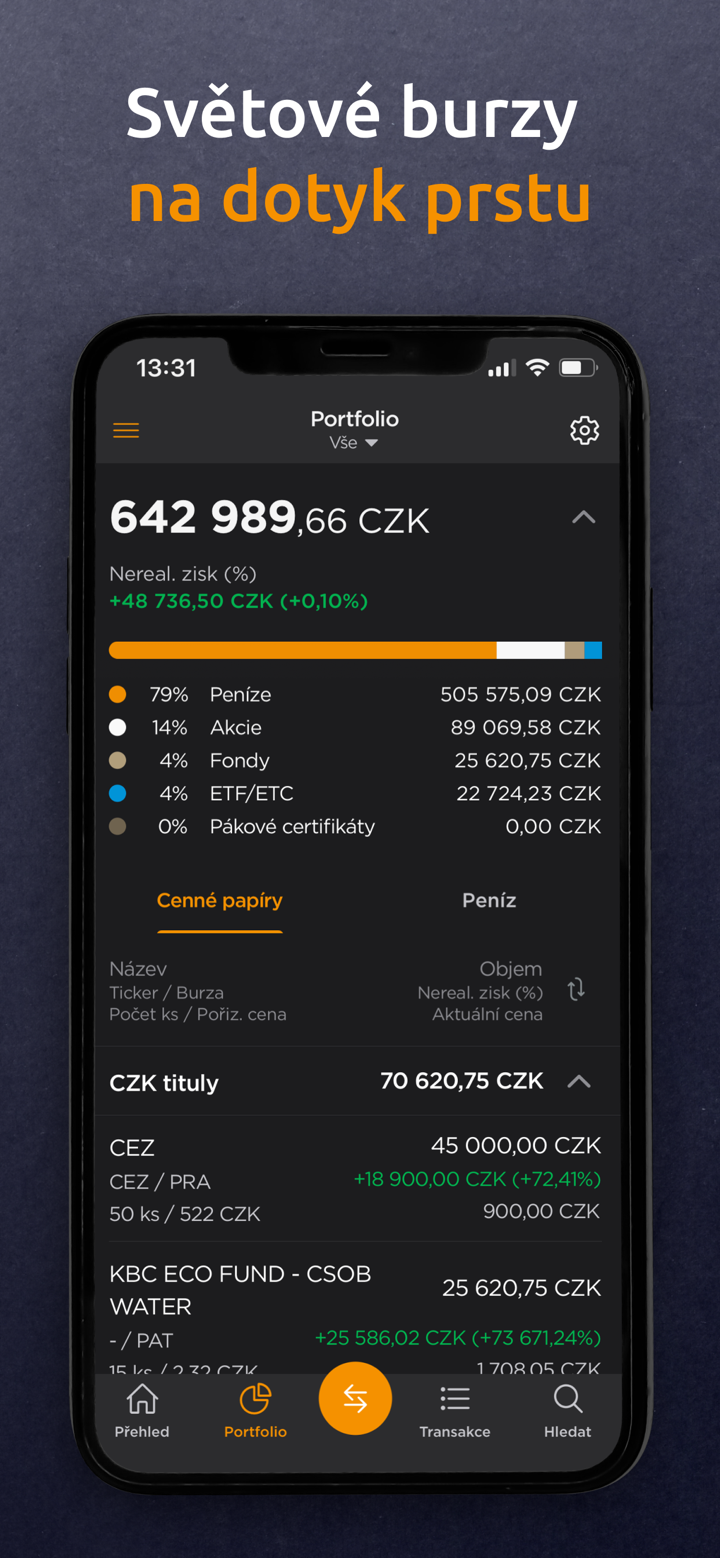

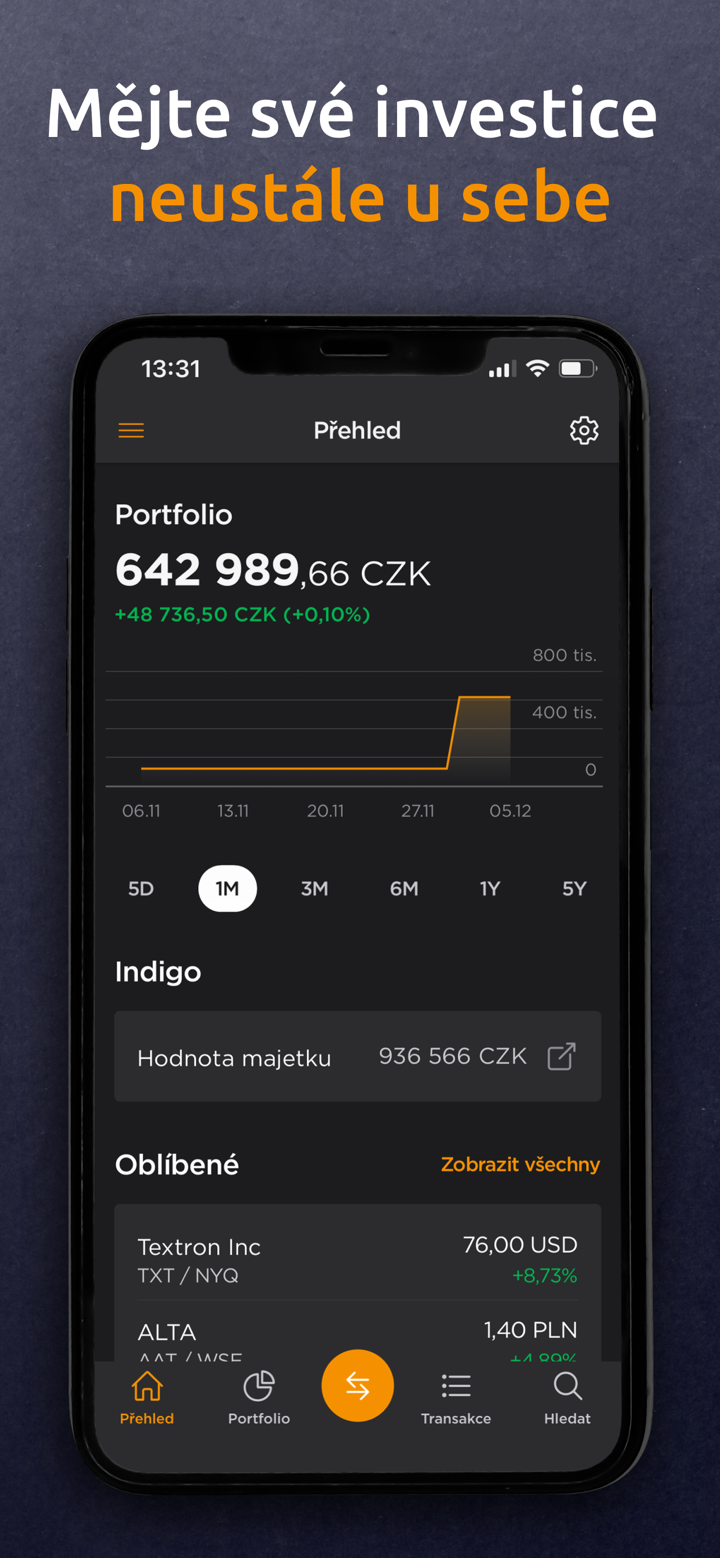

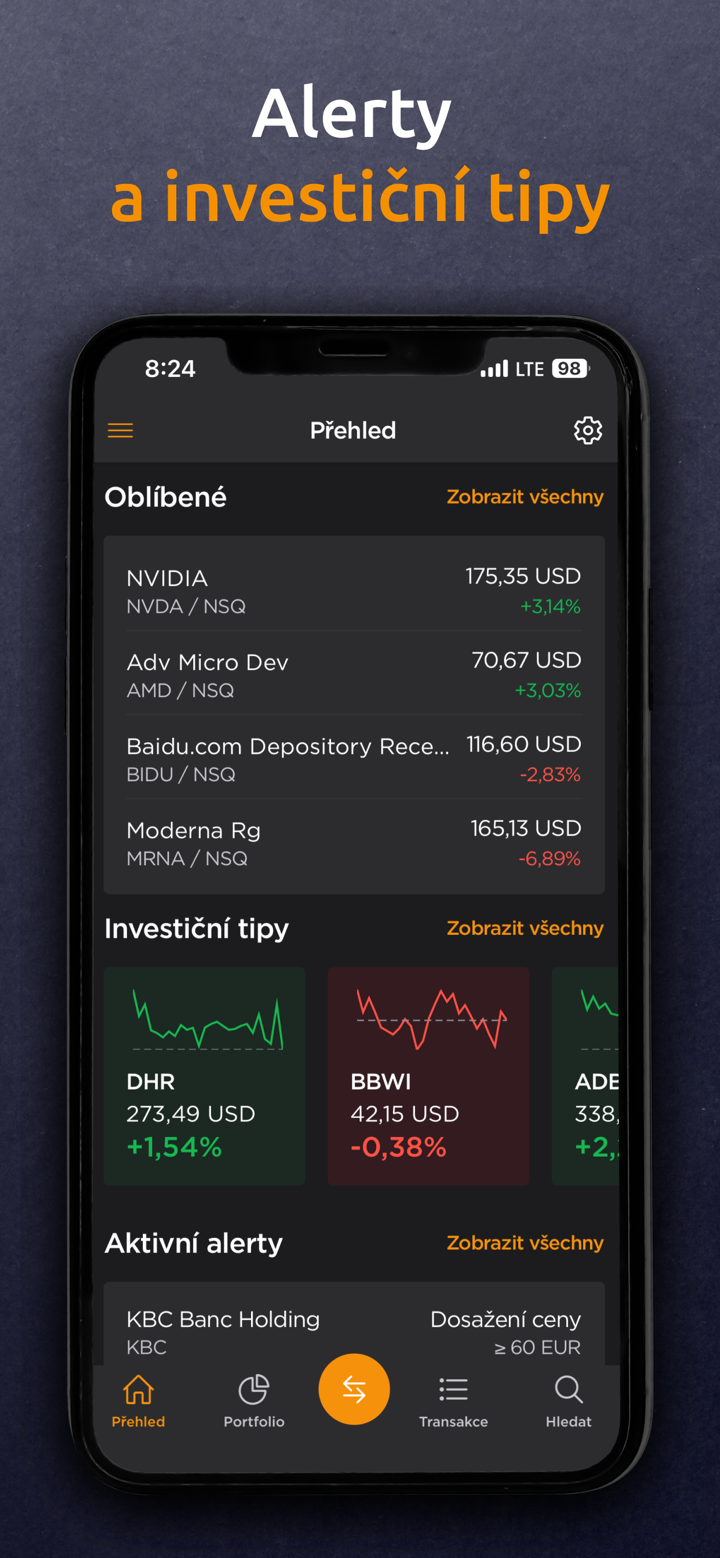

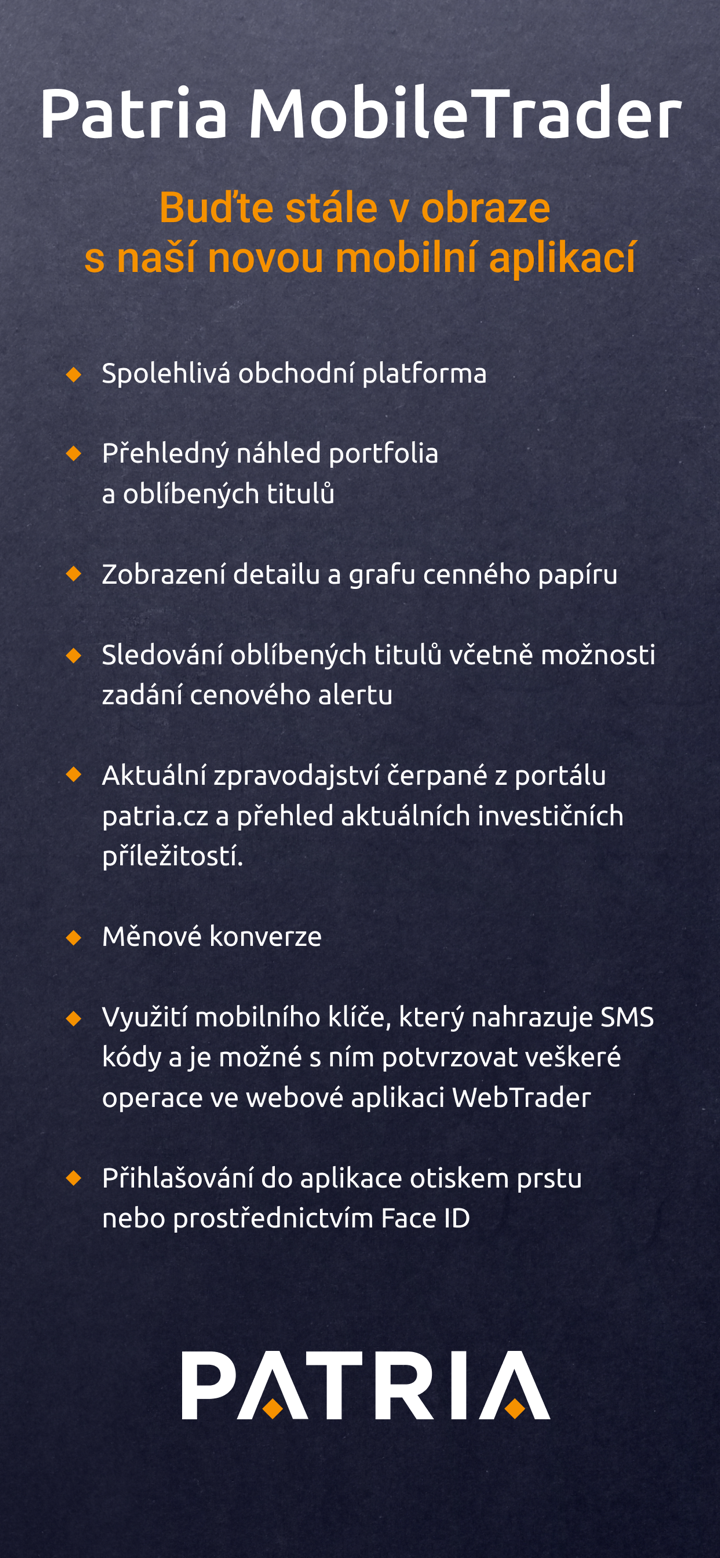

| 交易平台 | WebTrader、MobileTrader、Indigo |

| 最低存款 | / |

| 客戶支援 | 聯絡表格 |

| 電話:(+420) 221 424 240 | |

| 電郵:patria@patria.cz | |

| 地址:Výmolova 353/3, 150 27 Prague 5 | |

Patria Finance 是一家於1996年在捷克共和國成立的無監管金融公司。該公司提供各種市場工具,包括股票、基金、ETF、大宗商品、衍生品和債券。該公司提供模擬帳戶,並支援透過WebTrader、MobileTrader和Indigo平台進行交易。

優缺點

| 優點 | 缺點 |

| 提供模擬帳戶 | 無監管 |

| 多元化的交易產品 | 帳戶資訊有限 |

| 多樣化的交易平台 | |

| 多元化的客戶支援渠道 |

Patria Finance 是否合法?

目前,Patria Finance 缺乏有效監管。該域名似乎於1996年註冊,但目前狀態不明。如果選擇此經紀商,請特別注意您資金的安全。

在 Patria Finance 上可以交易什麼?

在 Patria Finance 上,您可以交易股票、基金、ETF、大宗商品、衍生品和債券。

| 交易工具 | 支援 |

| 股票 | ✔ |

| 基金 | ✔ |

| ETF | ✔ |

| 大宗商品 | ✔ |

| 衍生品 | ✔ |

| 債券 | ✔ |

| 外匯 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 期權 | ❌ |

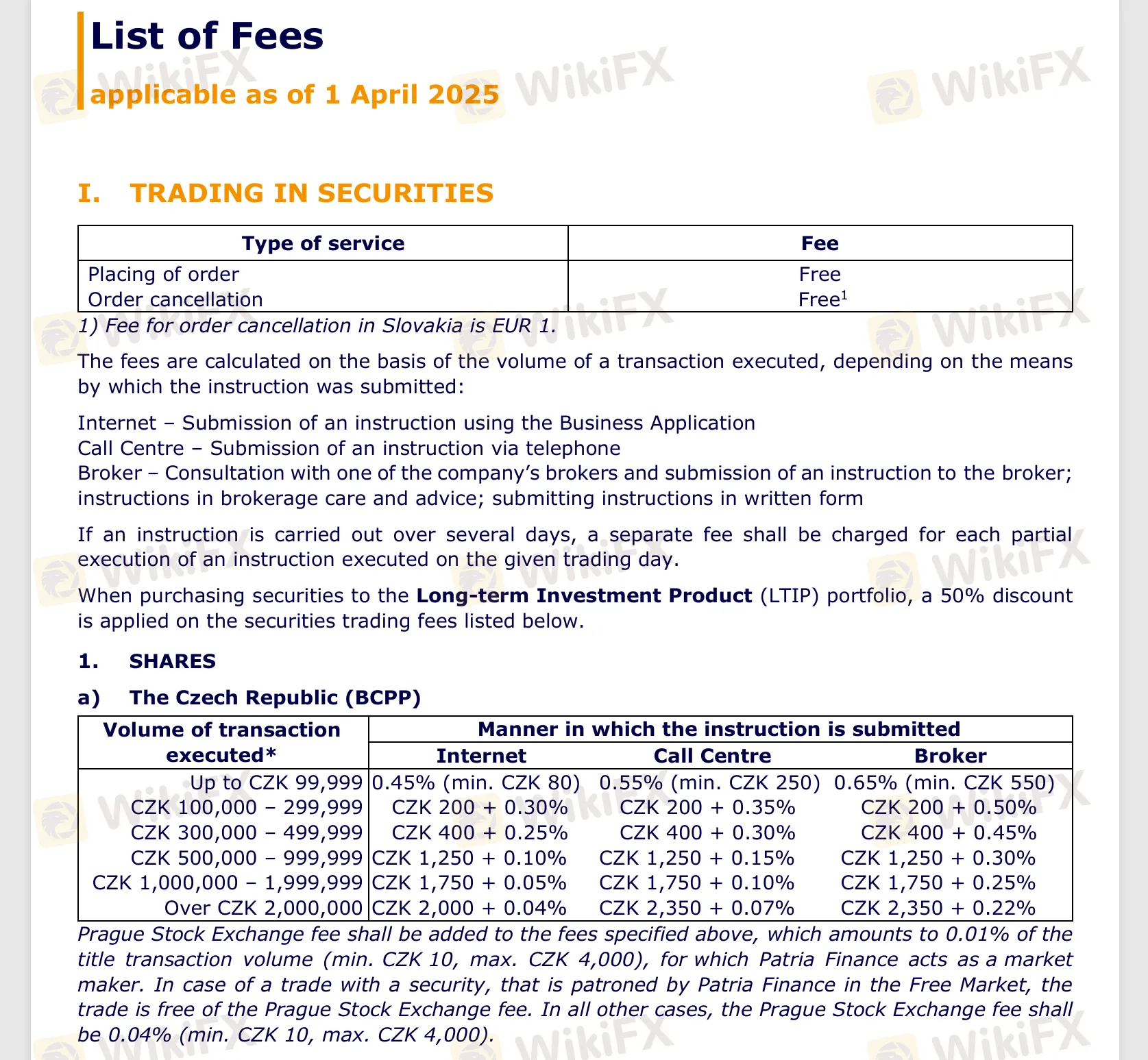

收費

他們的網站上有一份 pdf 檔案(https://cdn.patria.cz/Sazebnik-PD.en.pdf),詳細描述了費用結構,您可以參考。

交易平台

| 交易平台 | 支援 | 可用設備 |

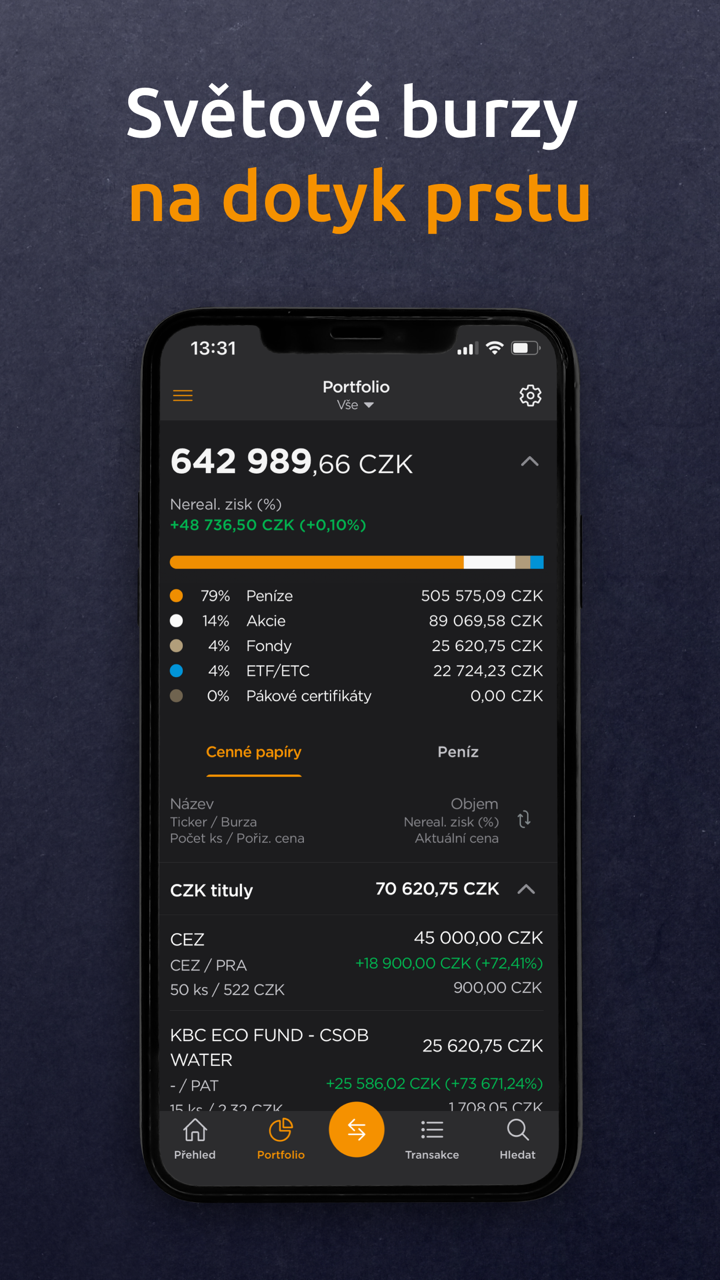

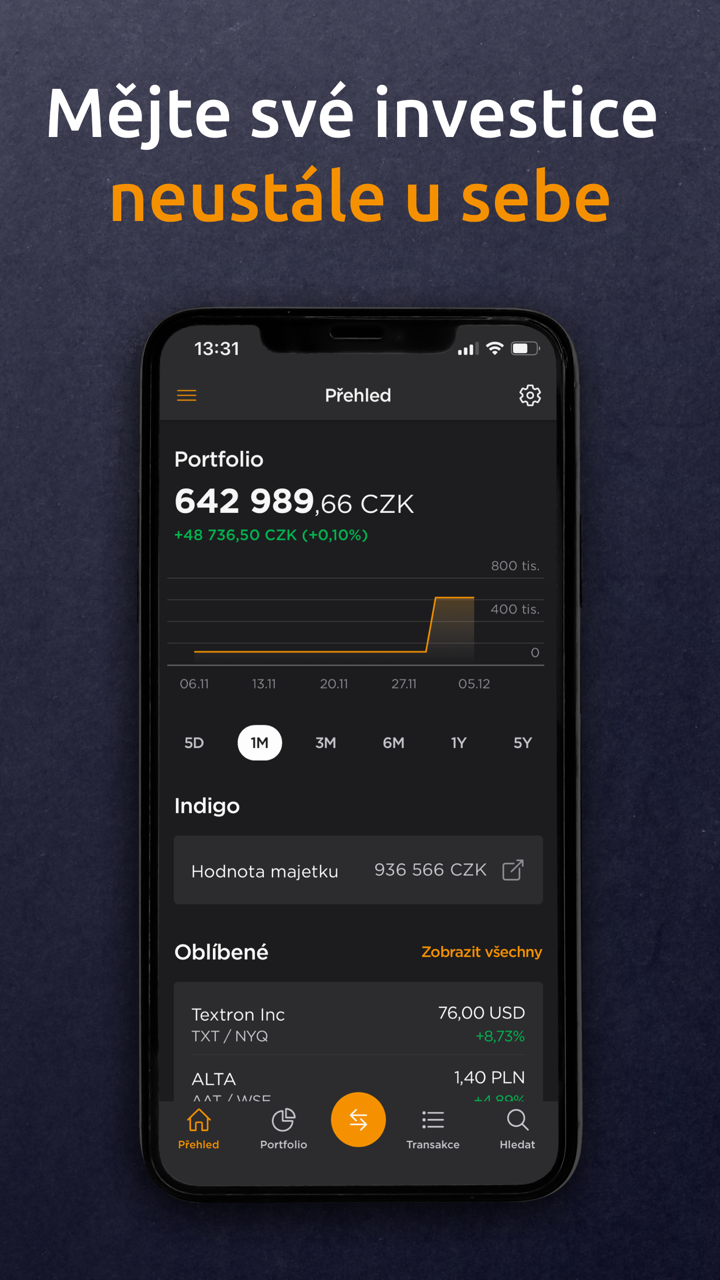

| WebTrader, Indigo | ✔ | / |

| MobileTrader | ✔ | App Store, Google play |