Perfil de la compañía

| Patria Finance Resumen de la reseña | |

| Establecido | 1996 |

| País/Región Registrada | República Checa |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Acciones, Fondos, ETFs, Materias primas, Derivados, Bonos |

| Cuenta Demo | ✅ |

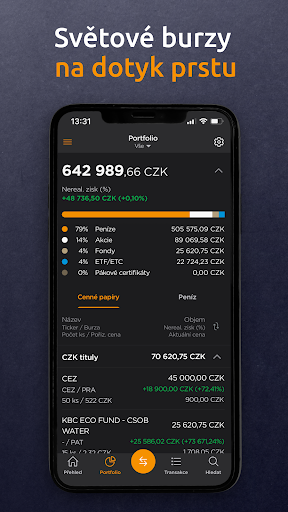

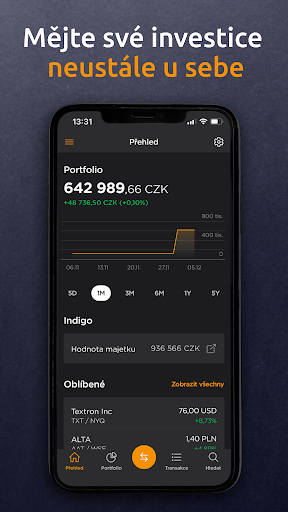

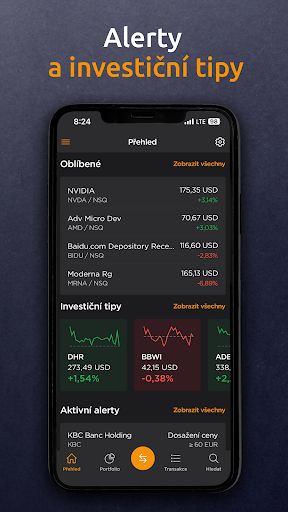

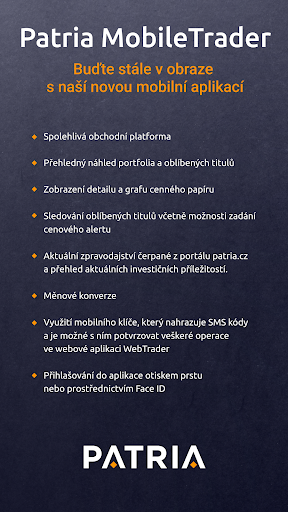

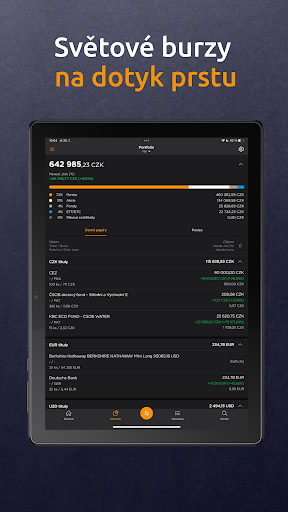

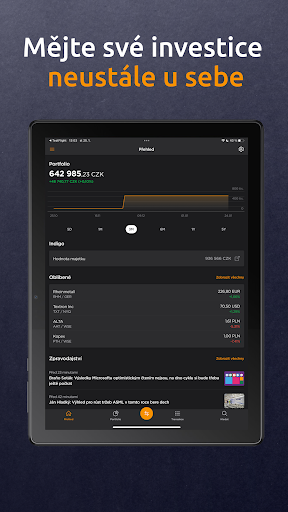

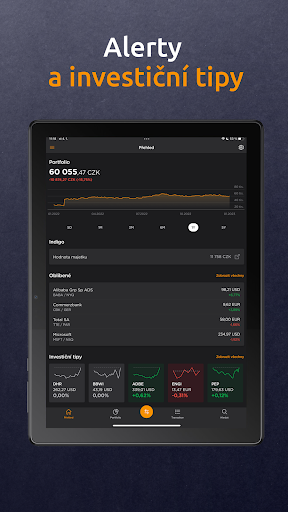

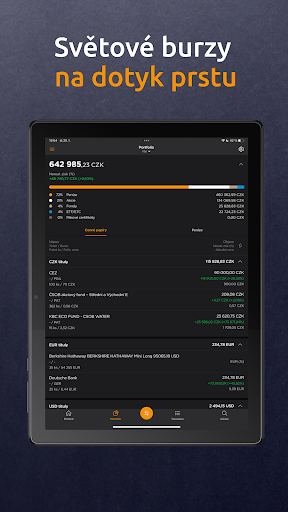

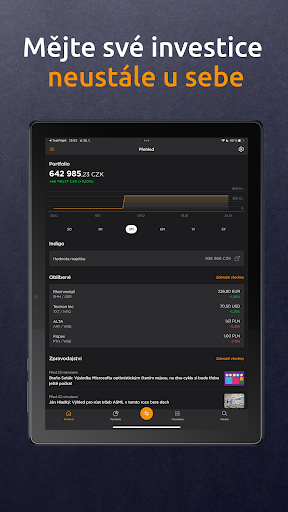

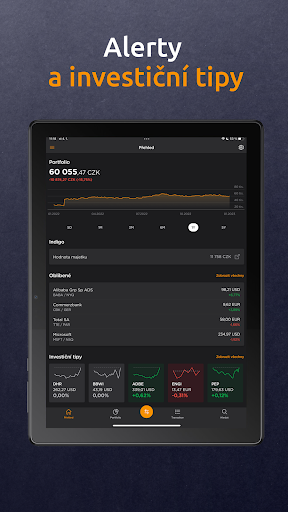

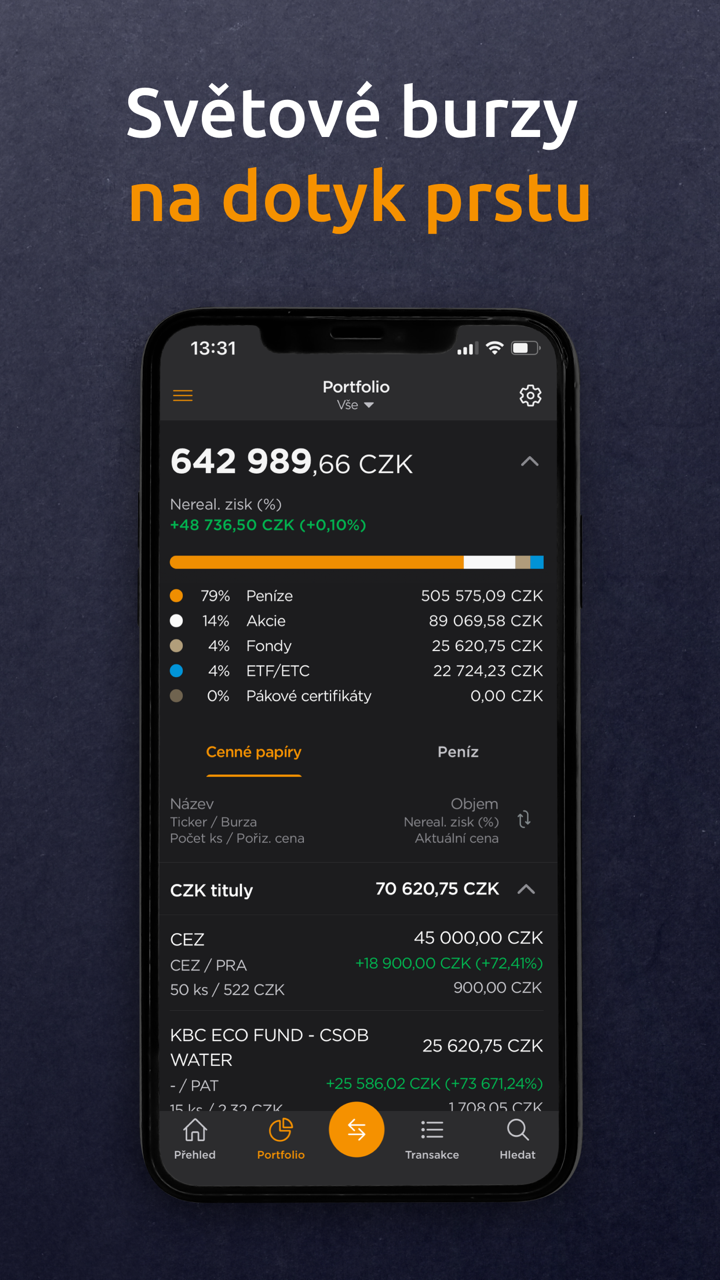

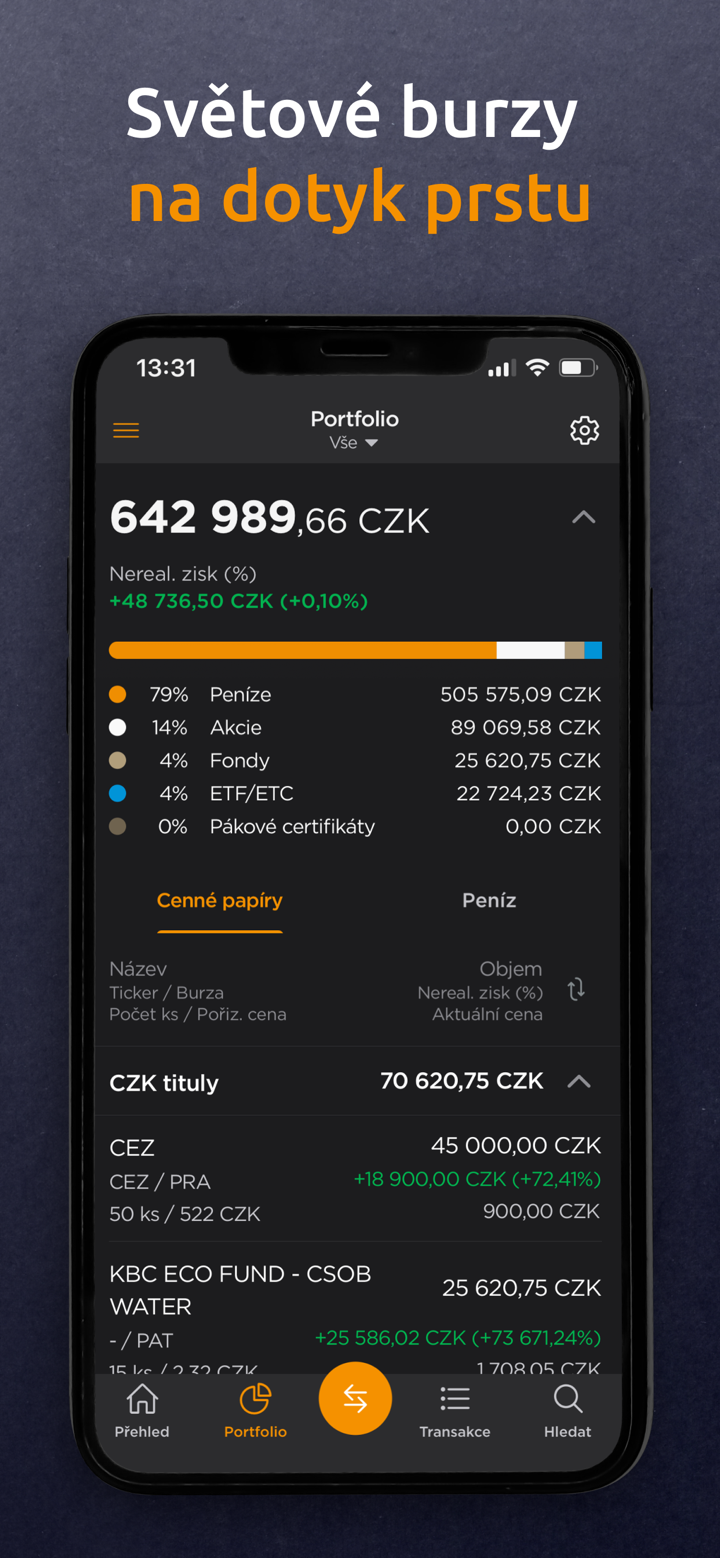

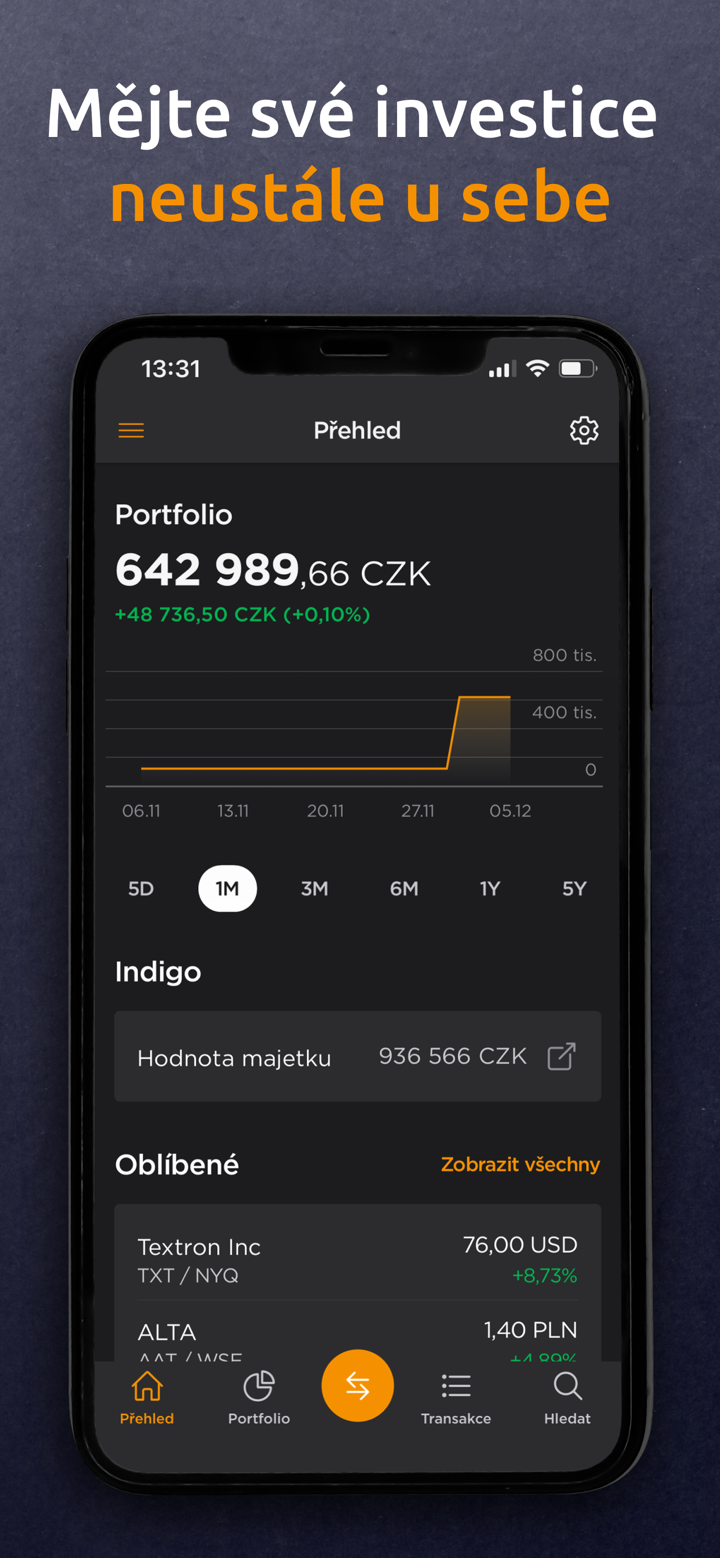

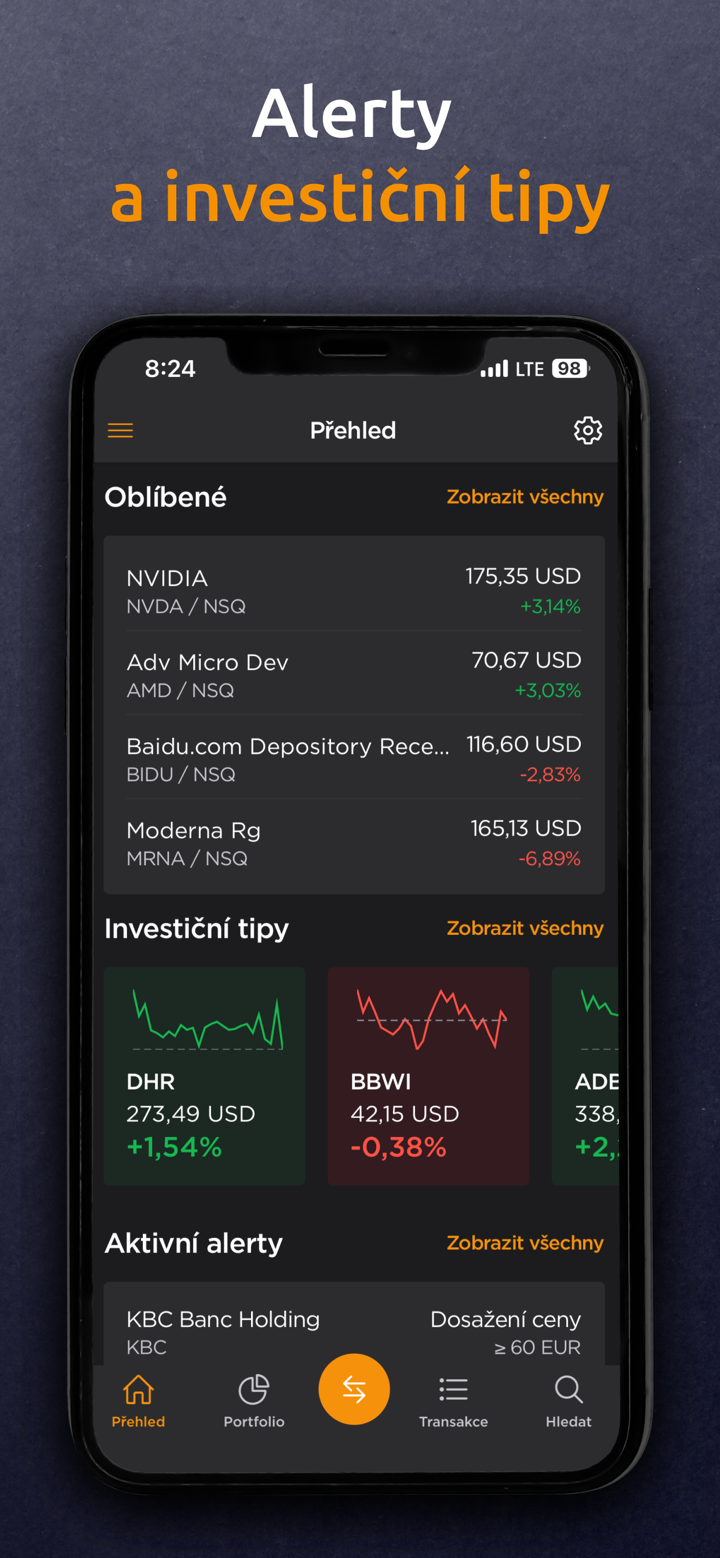

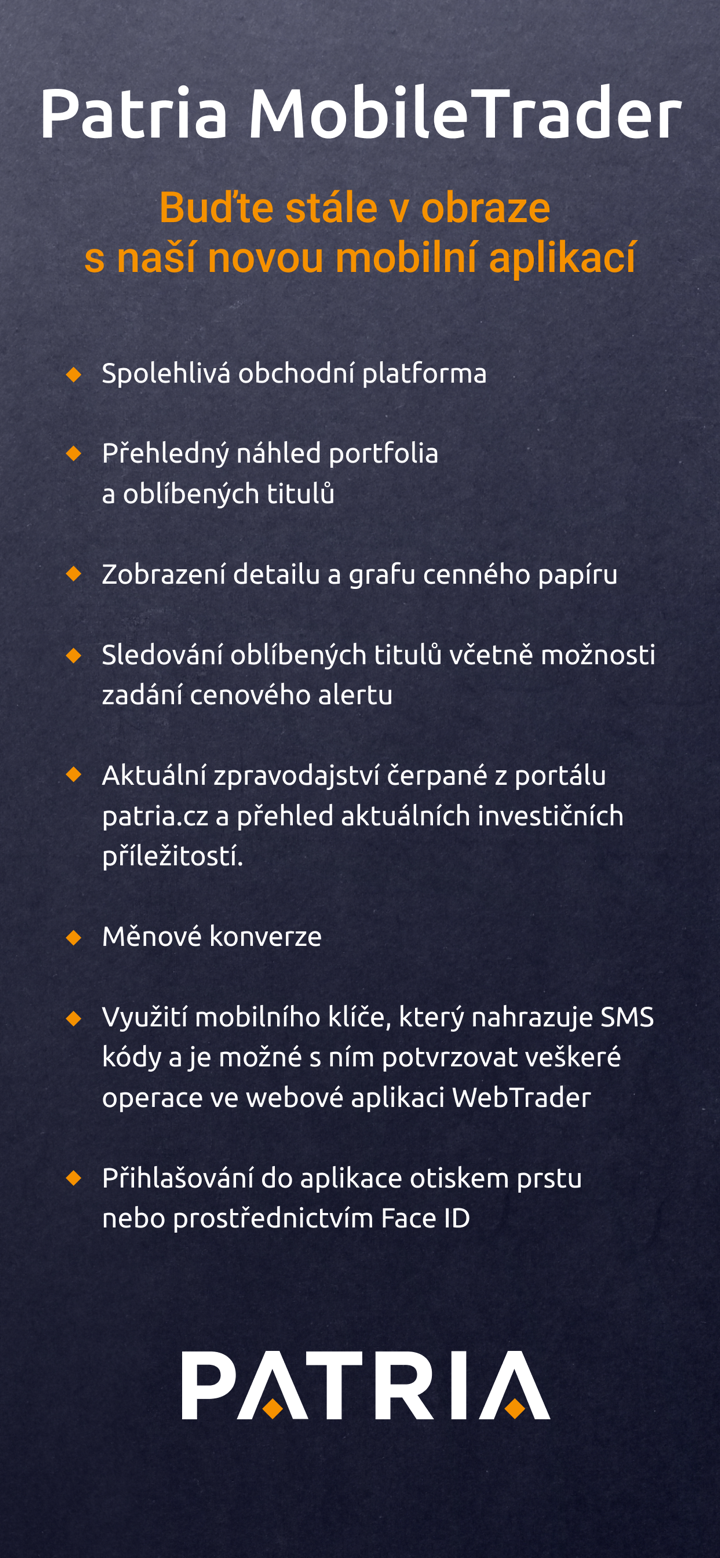

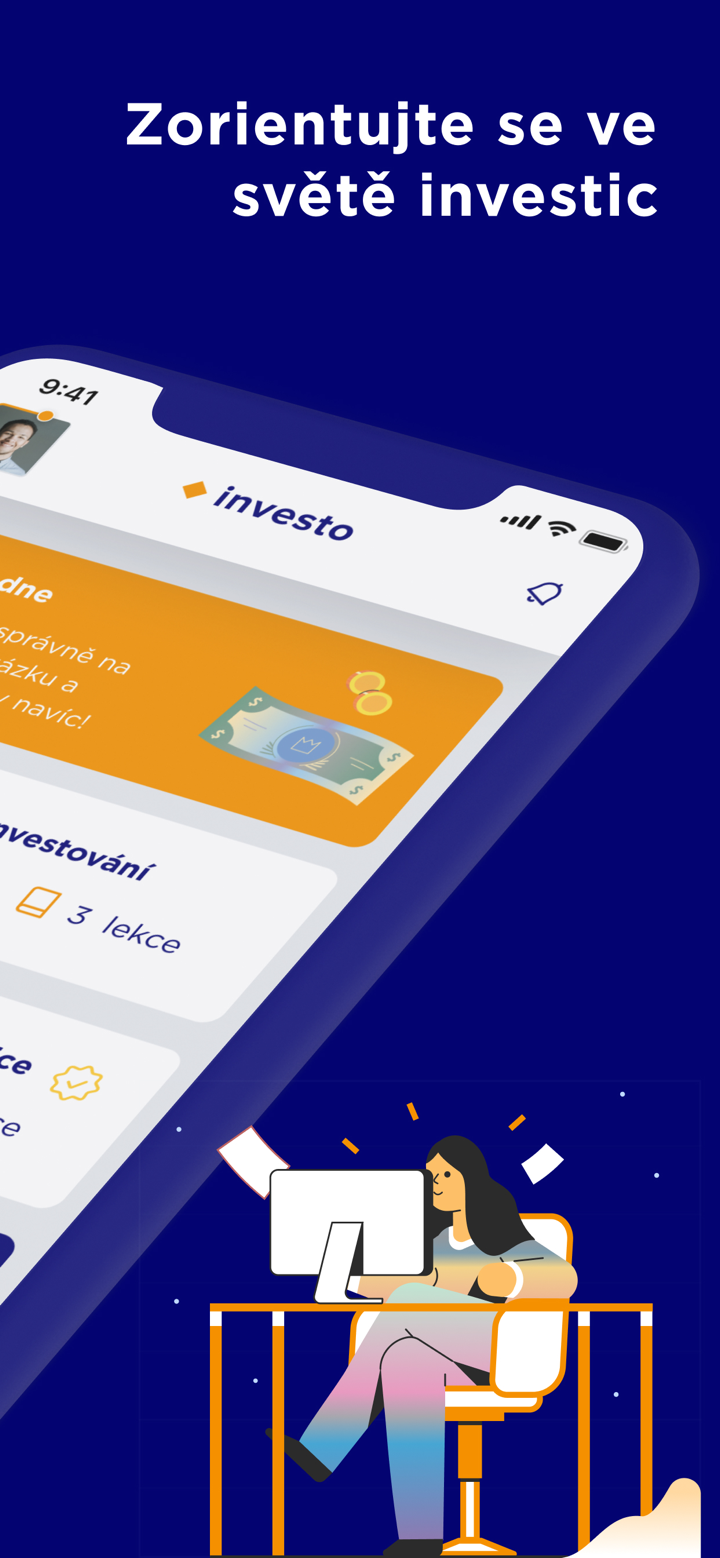

| Plataformas de Trading | WebTrader, MobileTrader, Indigo |

| Depósito Mínimo | / |

| Soporte al Cliente | Formulario de contacto |

| Teléfono: (+420) 221 424 240 | |

| Email: patria@patria.cz | |

| Dirección: Výmolova 353/3, 150 27 Praga 5 | |

Patria Finance es una empresa financiera no regulada establecida en la República Checa en 1996. Ofrece varios instrumentos de mercado, incluyendo acciones, fondos, ETFs, materias primas, derivados y bonos. La empresa proporciona una cuenta demo y admite el trading a través de las plataformas WebTrader, MobileTrader e Indigo.

Pros y Contras

| Pros | Contras |

| Cuentas demo disponibles | Sin regulación |

| Amplia gama de productos de trading | Información limitada sobre cuentas |

| Plataformas de trading diversas | |

| Múltiples canales de soporte al cliente |

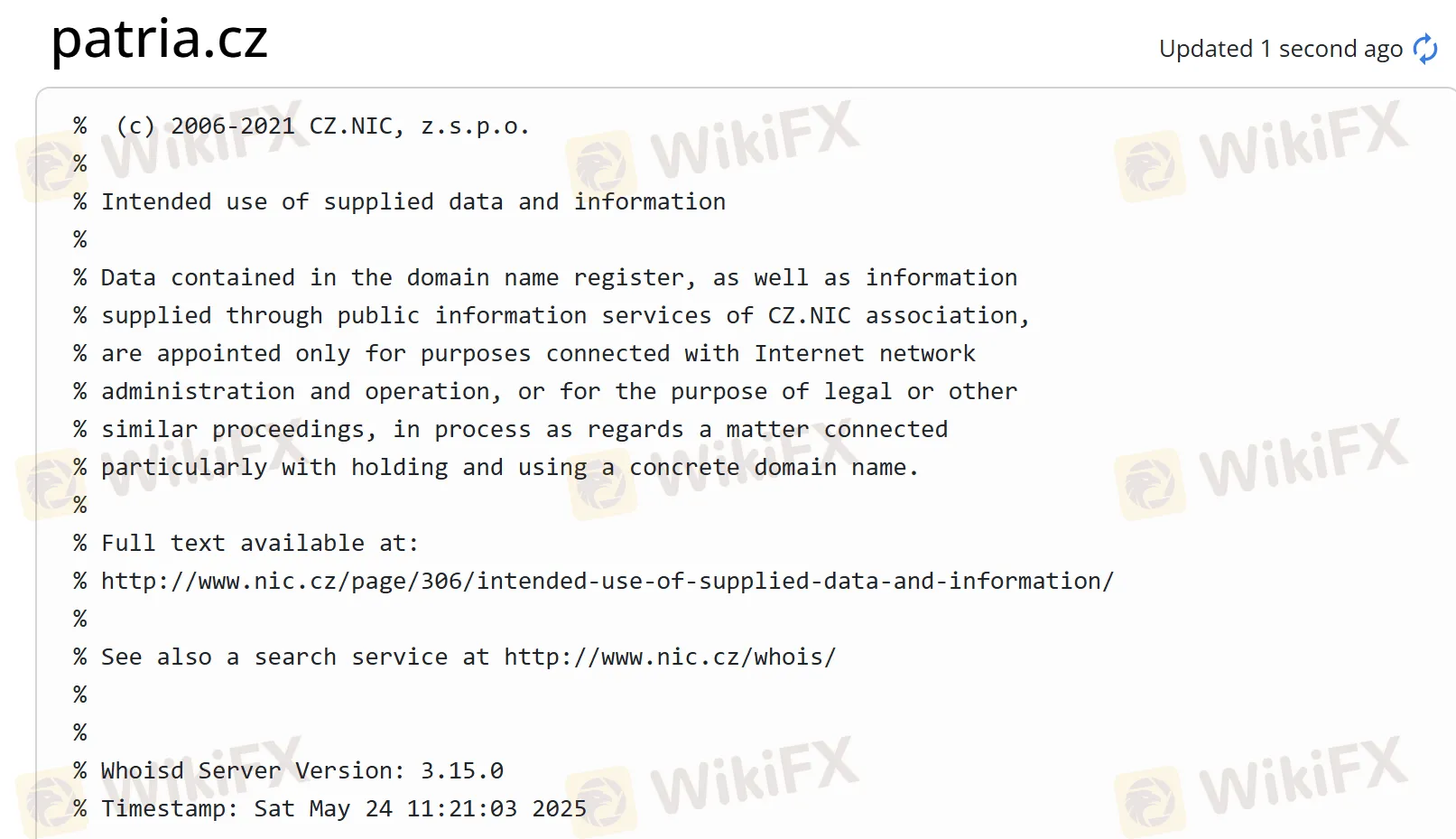

¿Es Patria Finance Legítimo?

En la actualidad, Patria Finance carece de regulación válida. Parece que su dominio fue registrado en 1996, pero su estado actual es desconocido. Por favor, preste mucha atención a la seguridad de sus fondos si elige este bróker.

¿Qué puedo negociar en Patria Finance?

En Patria Finance, puedes negociar con Acciones, Fondos, ETFs, Materias primas, Derivados y Bonos.

| Instrumentos de Trading | Soportados |

| Acciones | ✔ |

| Fondos | ✔ |

| ETFs | ✔ |

| Materias primas | ✔ |

| Derivados | ✔ |

| Bonos | ✔ |

| Forex | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Opciones | ❌ |

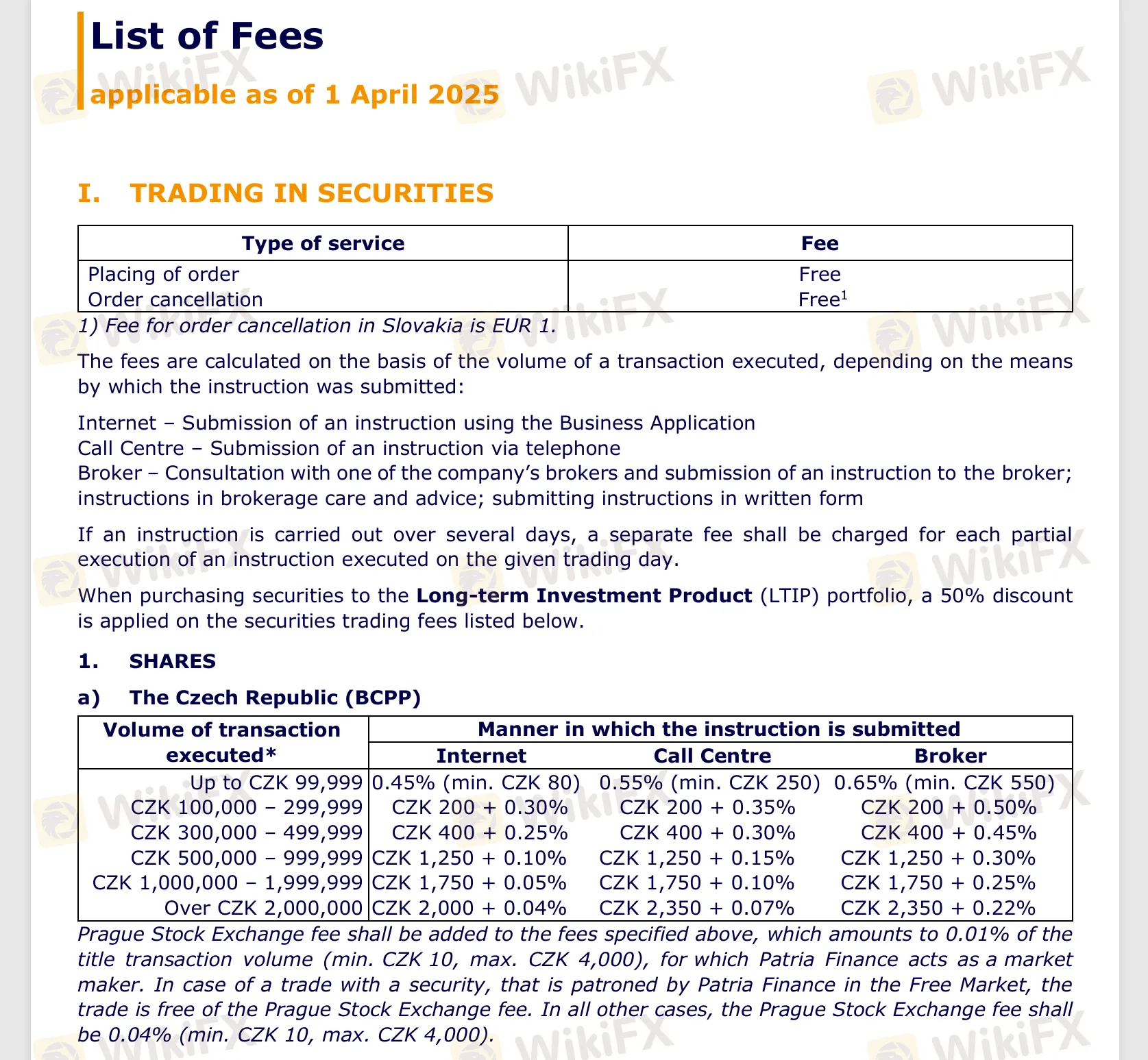

Tarifas

Hay un archivo pdf (https://cdn.patria.cz/Sazebnik-PD.en.pdf) en su sitio web que describe la estructura detallada de tarifas a la que puedes hacer referencia.

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| WebTrader, Indigo | ✔ | / |

| MobileTrader | ✔ | App Store, Google play |