Company Summary

| Patria Finance Review Summary | |

| Founded | 1996 |

| Registered Country/Region | Czech Republic |

| Regulation | No Regulation |

| Market Instruments | Stocks, Funds, ETFs, Commodities, Derivatives, Bonds |

| Demo Account | ✅ |

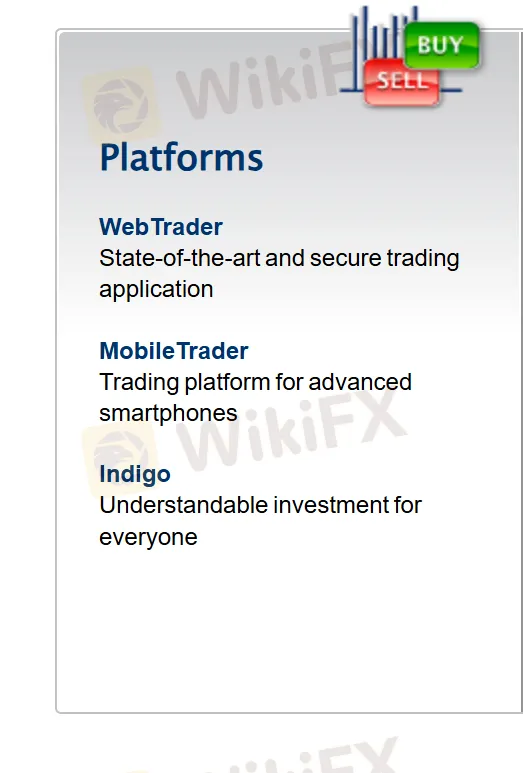

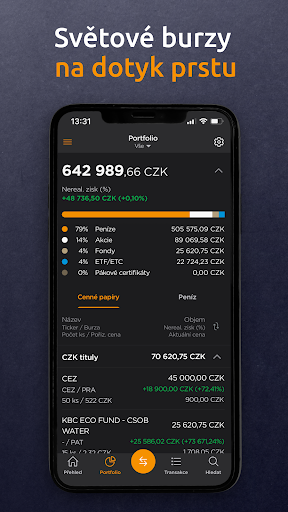

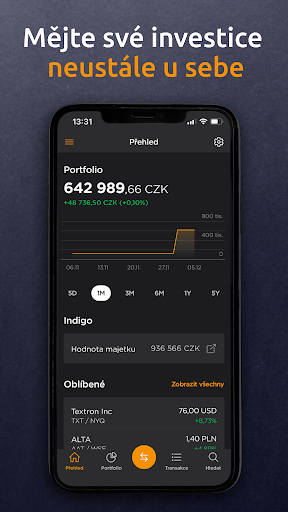

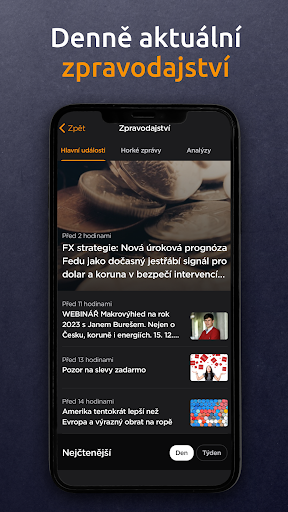

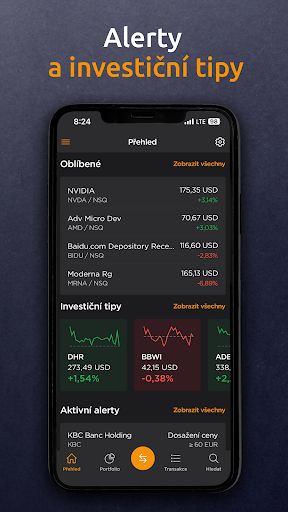

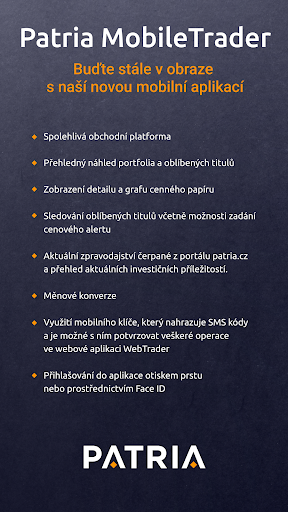

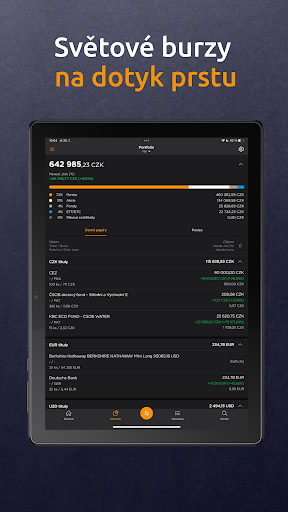

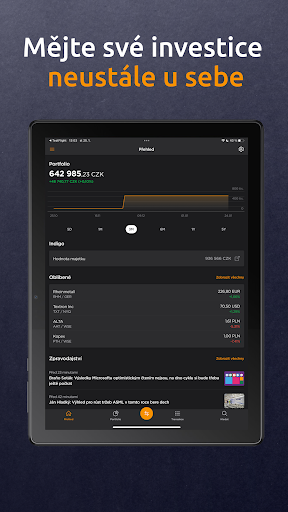

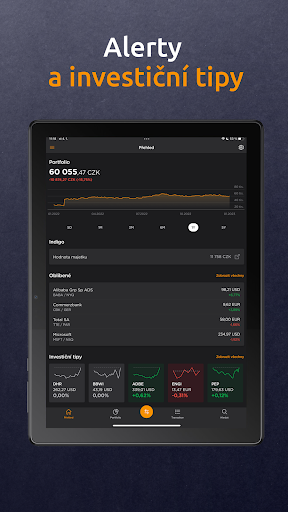

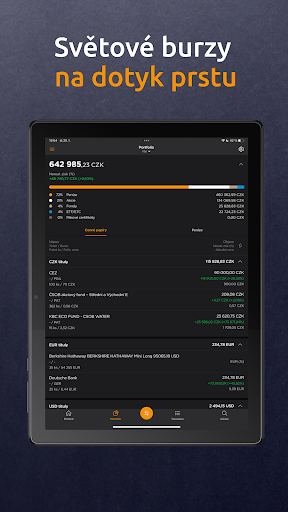

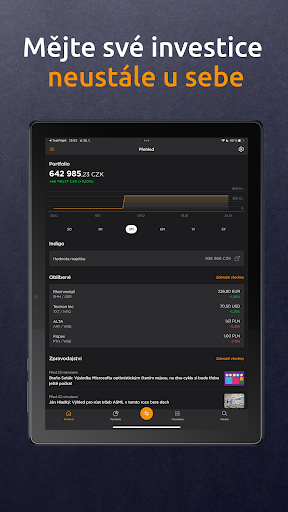

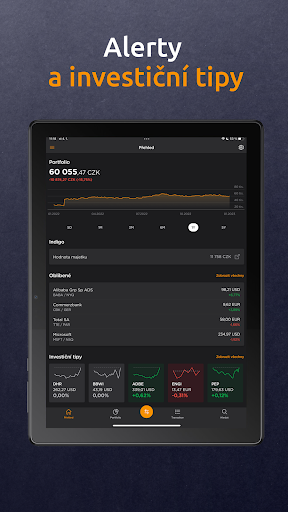

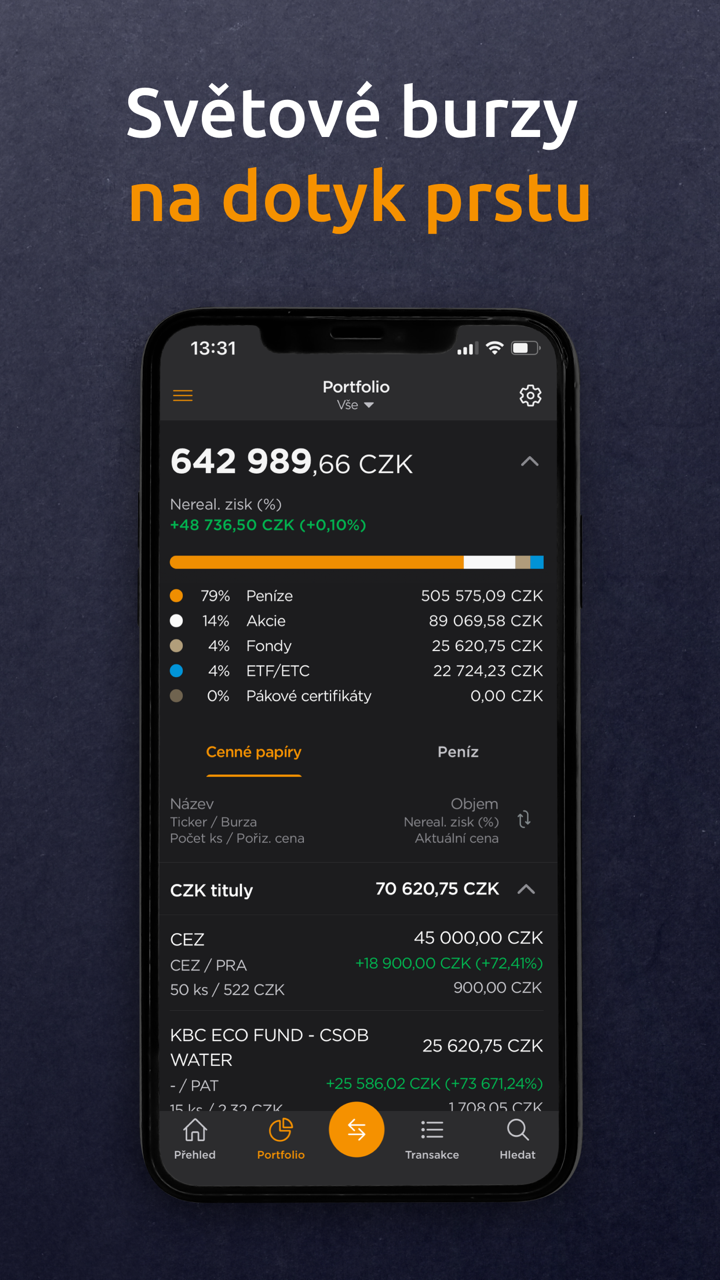

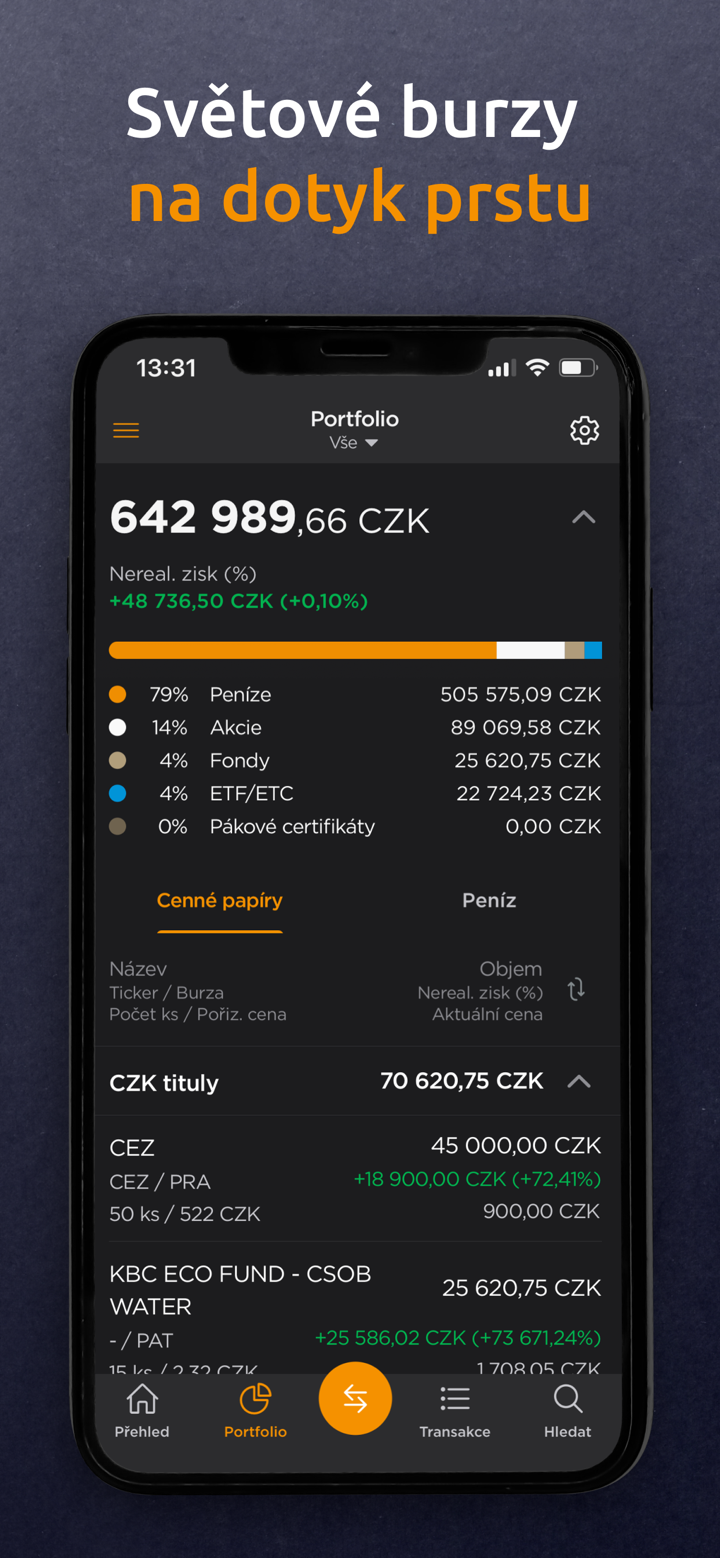

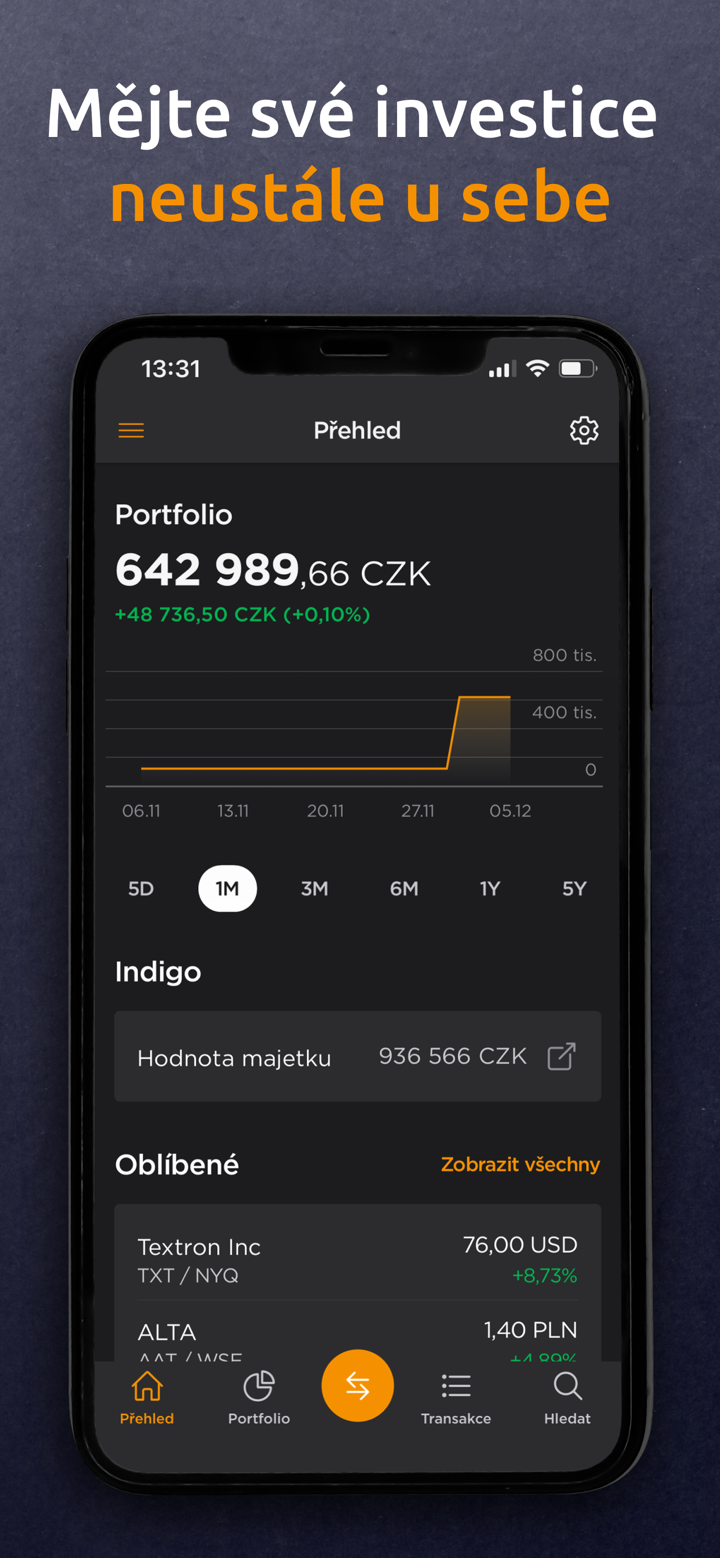

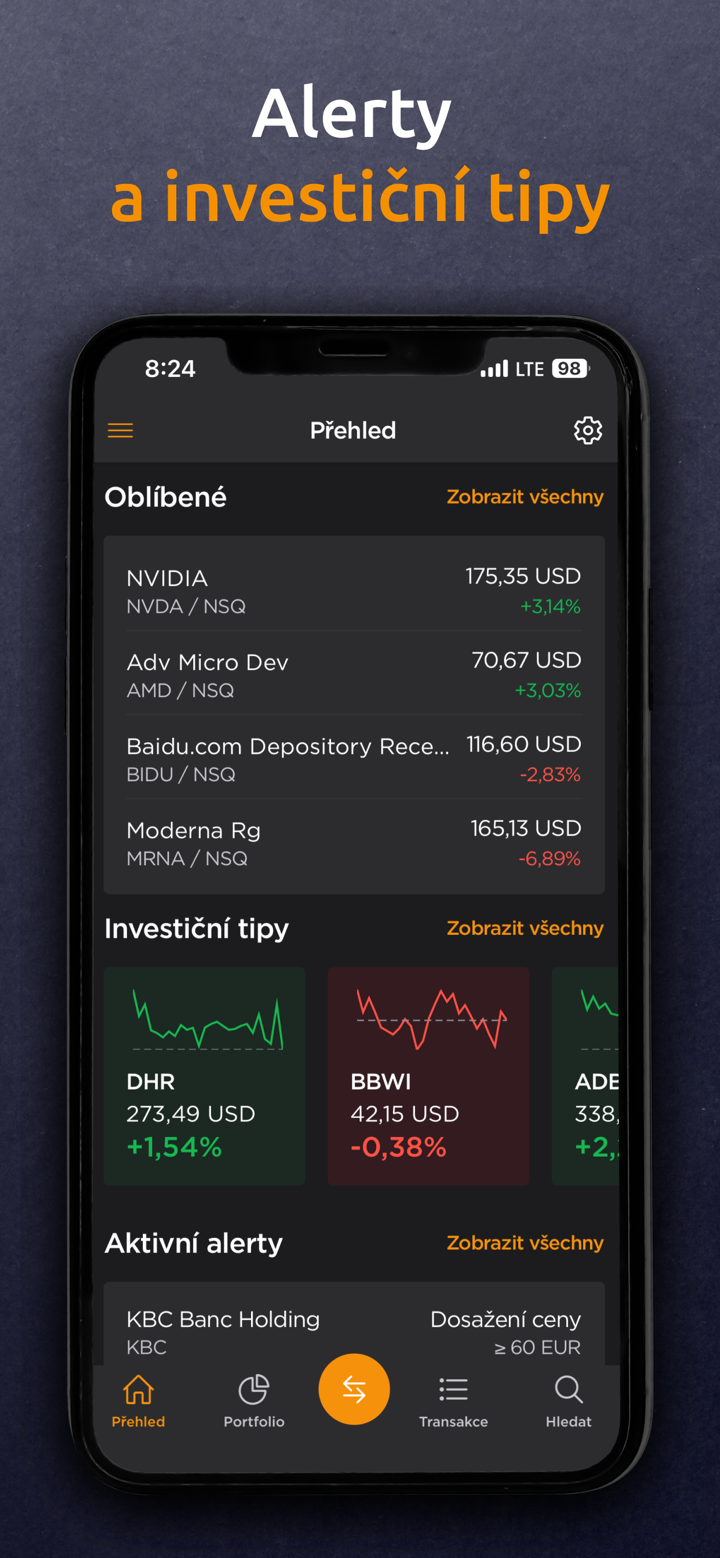

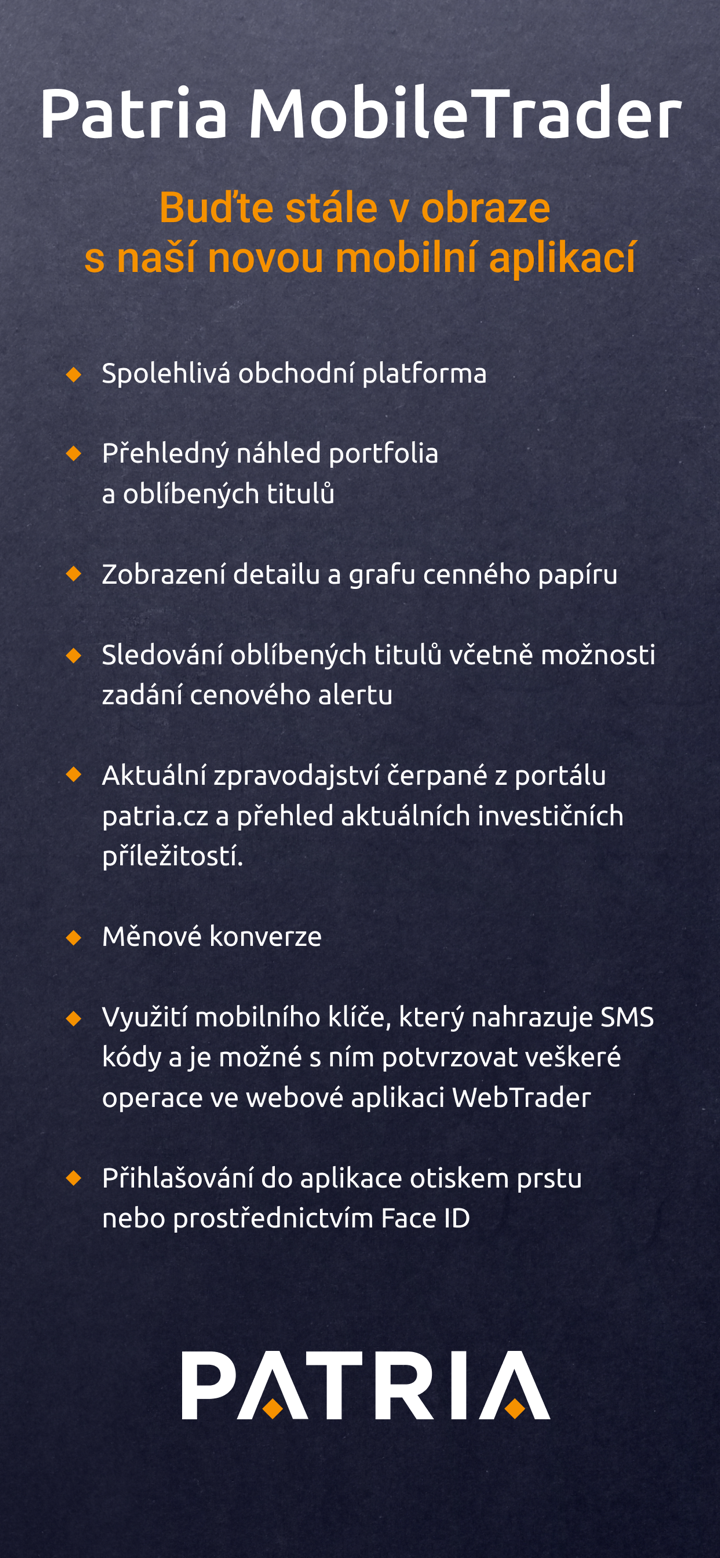

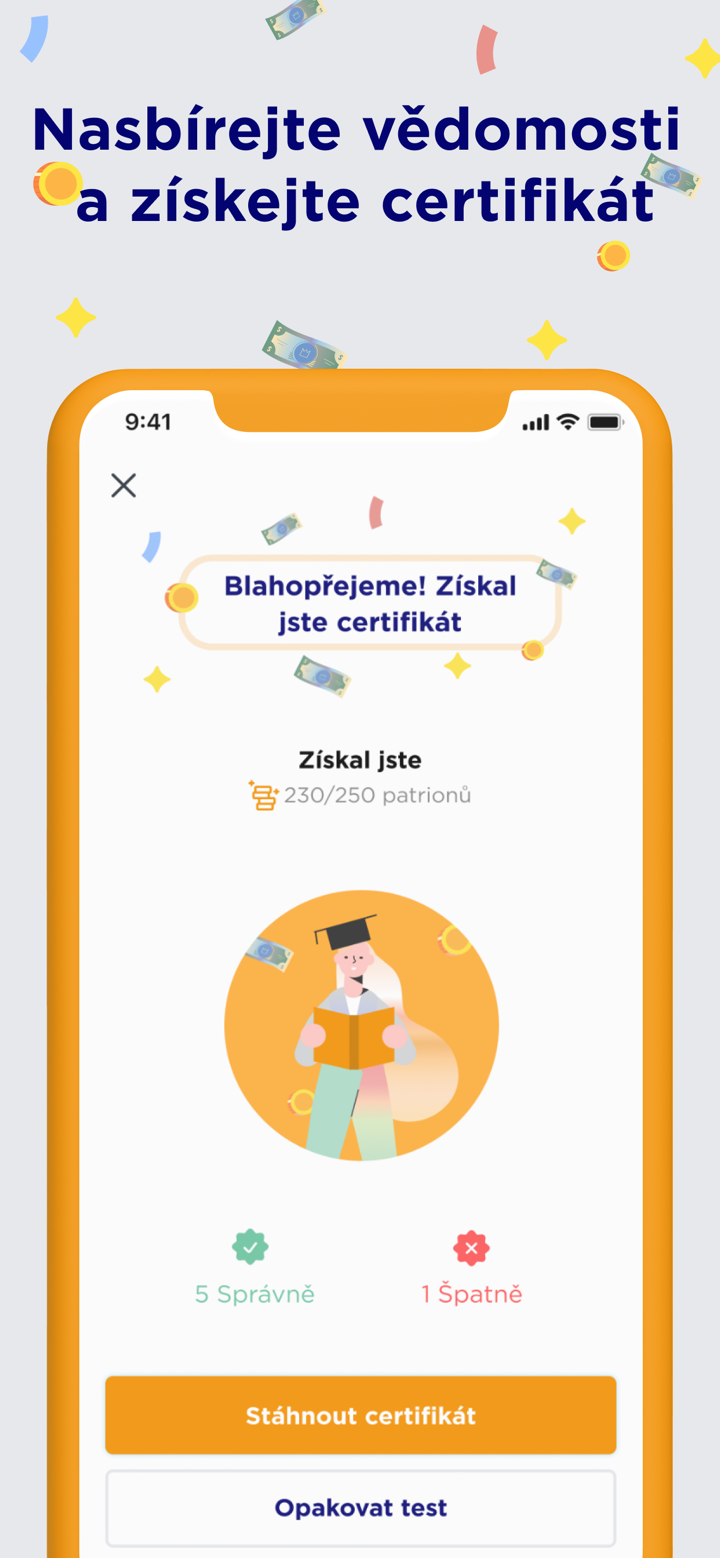

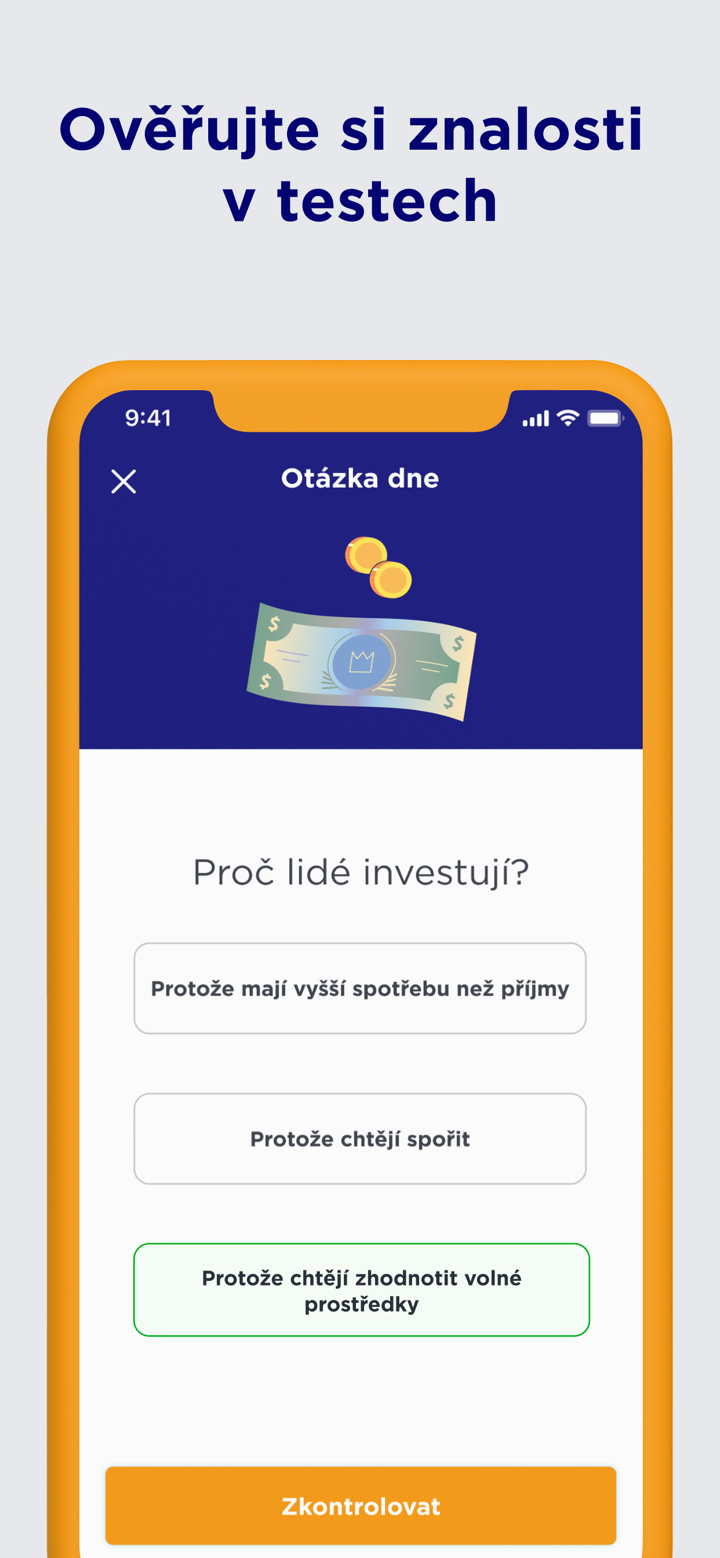

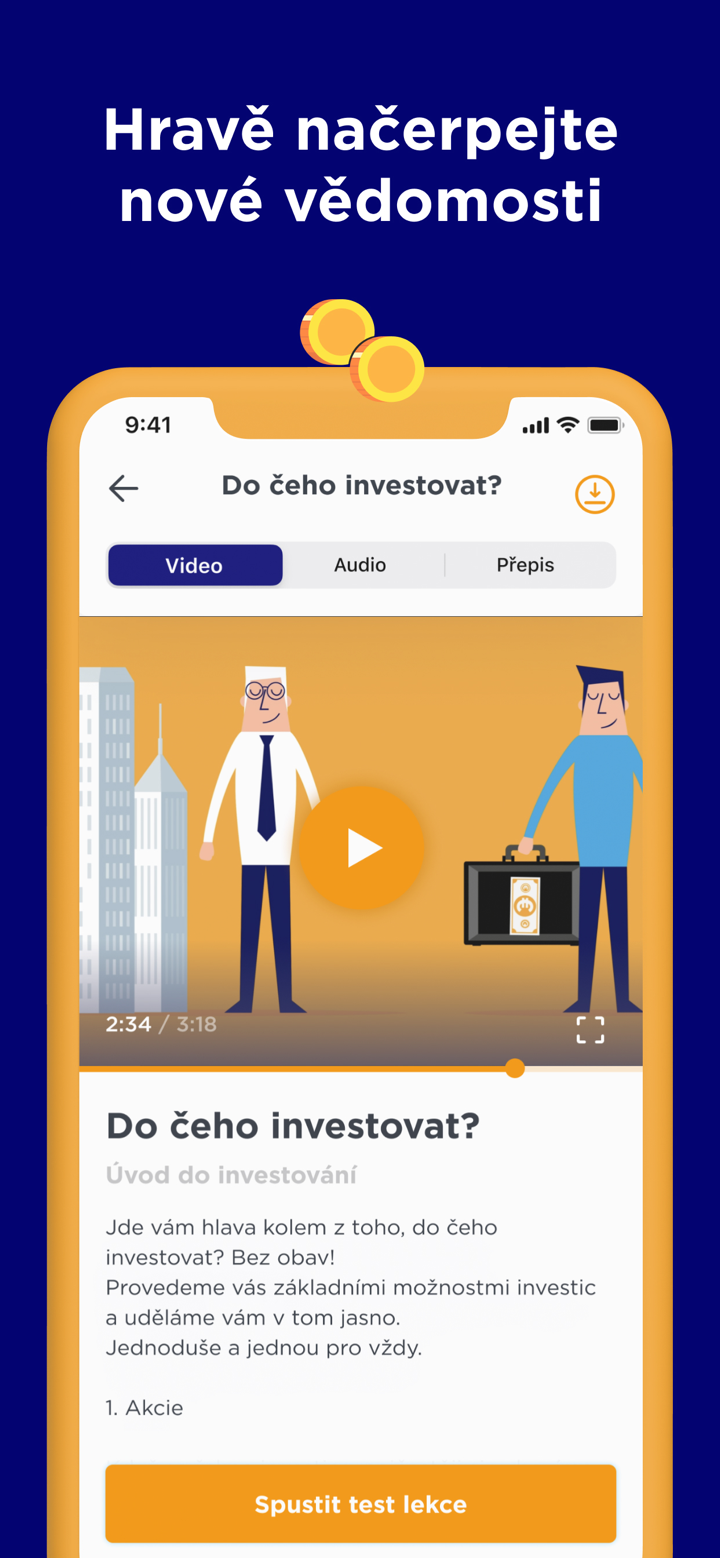

| Trading Platforms | WebTrader, MobileTrader, Indigo |

| Minimum Deposit | / |

| Customer Support | Contact form |

| Phone: (+420) 221 424 240 | |

| Email: patria@patria.cz | |

| Address: Výmolova 353/3, 150 27 Prague 5 | |

Patria Finance is an unregulated financial firm established in the Czech Republic in 1996. It offers various market instruments, including stocks, funds, ETFs, commodities, derivatives, and bonds. The firm provides a demo account and supports trading through WebTrader, MobileTrader, and Indigo platforms.

Pros and Cons

| Pros | Cons |

| Demo accounts available | No regulation |

| A wide range of trading products | Limited info on accounts |

| Diverse trading platforms | |

| Multiple customer support channels |

Is Patria Finance Legit?

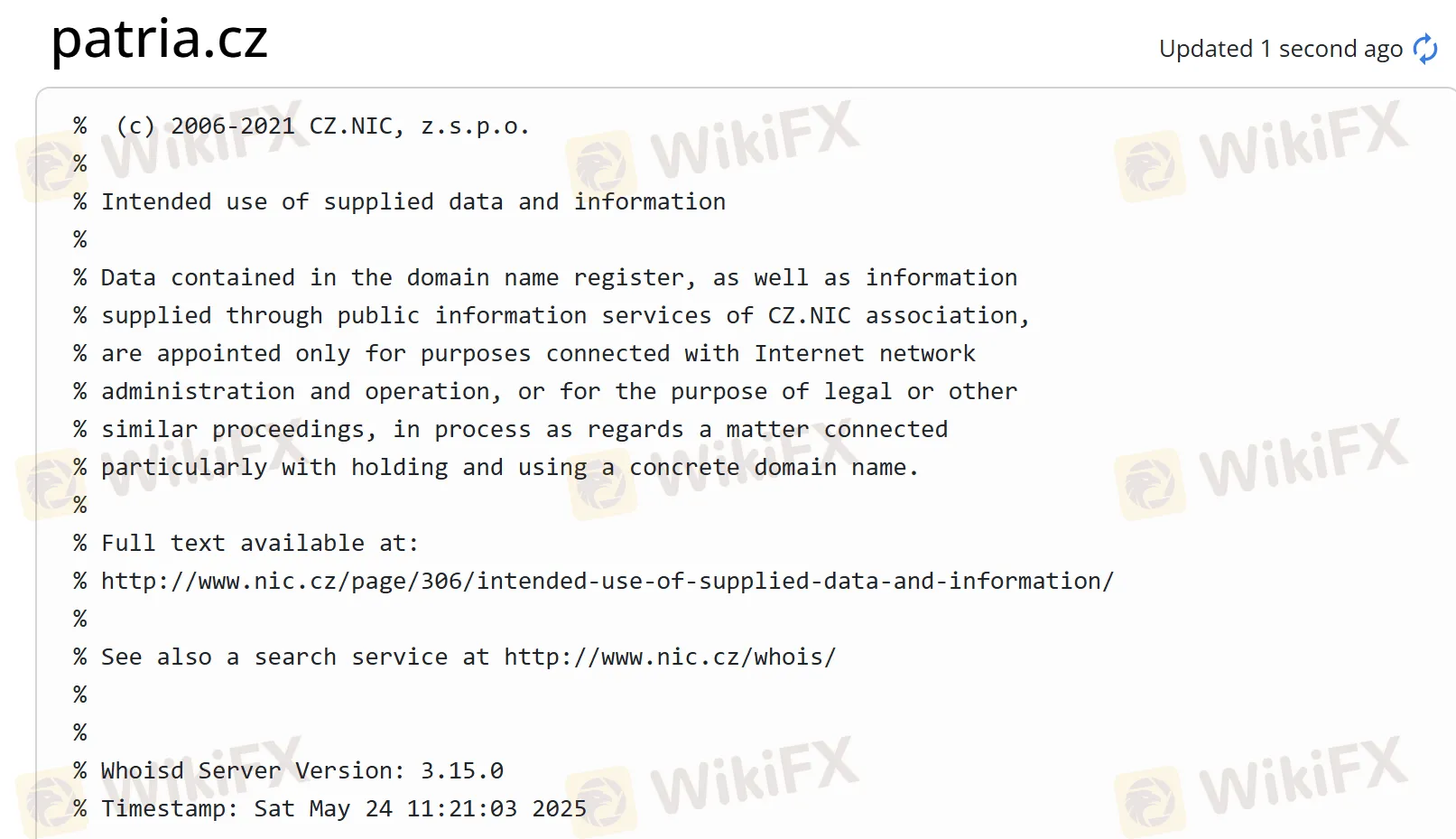

At present, Patria Finance lacks valid regulation. It seems that its domain was registered in 1996, but the current status is unknown. Please pay high attention to the safety of your funds if you choose this broker.

What Can I Trade on Patria Finance?

On Patria Finance, you can trade with Stocks, Funds, ETFs, Commodities, Derivatives, and Bonds.

| Trading Instruments | Supported |

| Stocks | ✔ |

| Funds | ✔ |

| ETFs | ✔ |

| Commodities | ✔ |

| Derivatives | ✔ |

| Bonds | ✔ |

| Forex | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

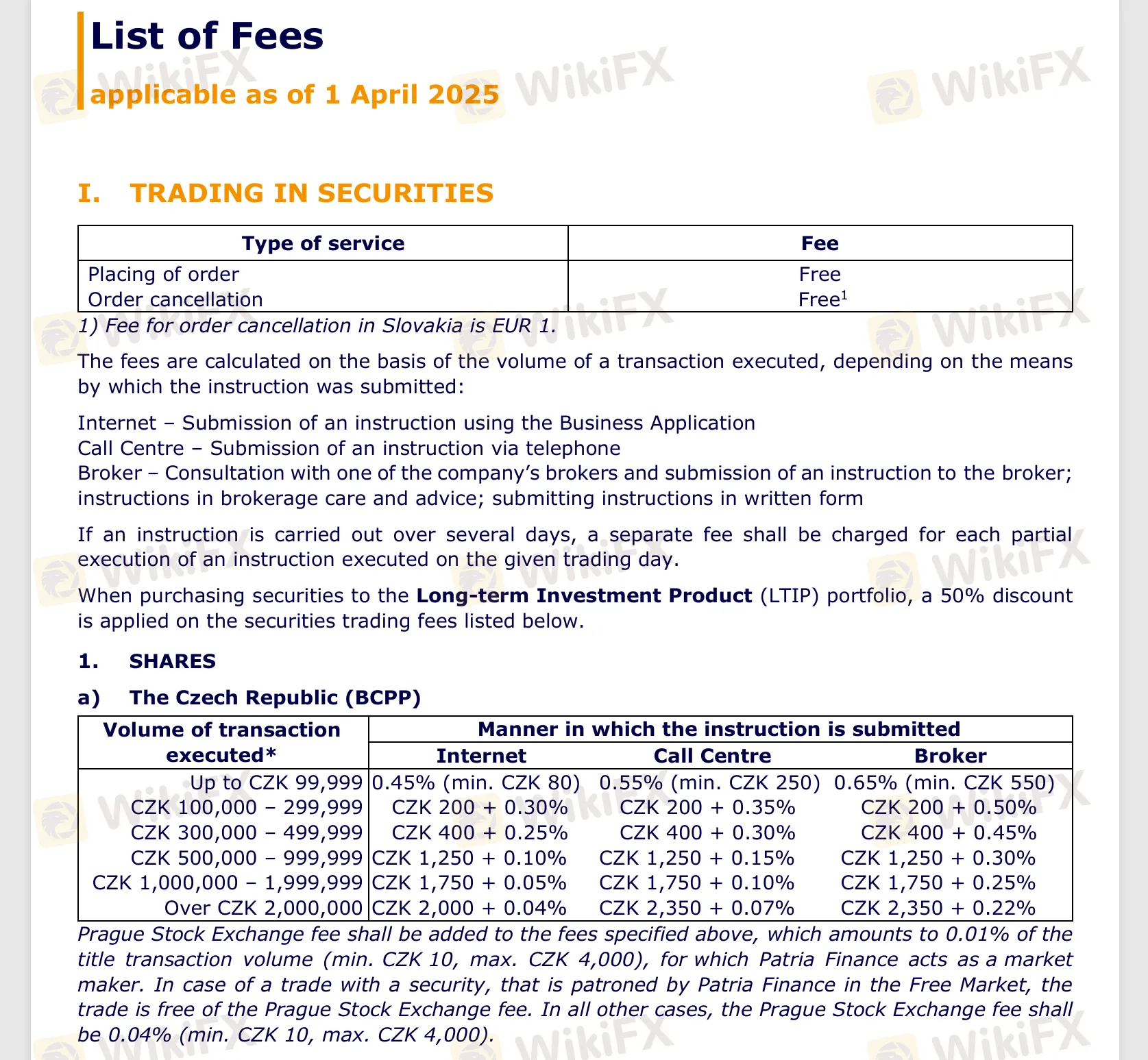

Fees

There is a pdf file (https://cdn.patria.cz/Sazebnik-PD.en.pdf) on their website describing the detailed fee structure which you can refer to.

Trading Platform

| Trading Platform | Supported | Available Devices |

| WebTrader, Indigo | ✔ | / |

| MobileTrader | ✔ | App Store, Google play |