公司简介

| CommSec 评论摘要 | |

| 成立时间 | 1995 |

| 注册国家 | 澳大利亚 |

| 监管 | ASIC |

| 交易产品 | 股票、期权、ETF |

| 模拟账户 | ❌ |

| 交易平台 | CommSec 网页版、CommSec 移动应用 |

| 最低存款 | 0 |

| 客服支持 | 电话:13 15 19(澳大利亚境内) |

| 电话:+61 2 8397 1206(澳大利亚境外) | |

CommSec 信息

Commonwealth Securities Limited 经营着自1995年以来一直存在的 CommSec,是澳大利亚最好的在线经纪商之一。它拥有许多不同的产品,如澳大利亚和国际股票、ETF、期权、保证金贷款以及 CommSec Pocket 等微型投资工具。这使其成为新手和资深投资者的不错选择。

优点和缺点

| 优点 | 缺点 |

| 产品和服务范围广泛 | 国际和电话交易费用高昂 |

| 强大的监管支持(ASIC) | 没有演示 账户 可用 |

| 用户友好的网页和移动平台 |

CommSec 是否合法?

是的,CommSec 受到监管。它在由澳大利亚证券和投资委员会(ASIC)监督的持牌公司 Commonwealth Securities Limited 下运营。ASIC 负责规则,许可类型为 做市商(MM)。许可证号码为000238814。

我可以在 CommSec 上交易什么?

CommSec 提供各种商品和服务,如澳大利亚和外国股票、ETF、期权等。这使其成为新手和经验丰富的投资者的不错选择。它还提供保证金贷款、SMSF 管理,甚至为年轻人和小投资者提供投资选择。

| 交易工具 | 支持 |

| 股票 | ✓ |

| 期权 | ✓ |

| ETF | ✓ |

| 外汇 | × |

| 大宗商品 | × |

| 指数 | × |

| 加密货币 | × |

| 债券 | × |

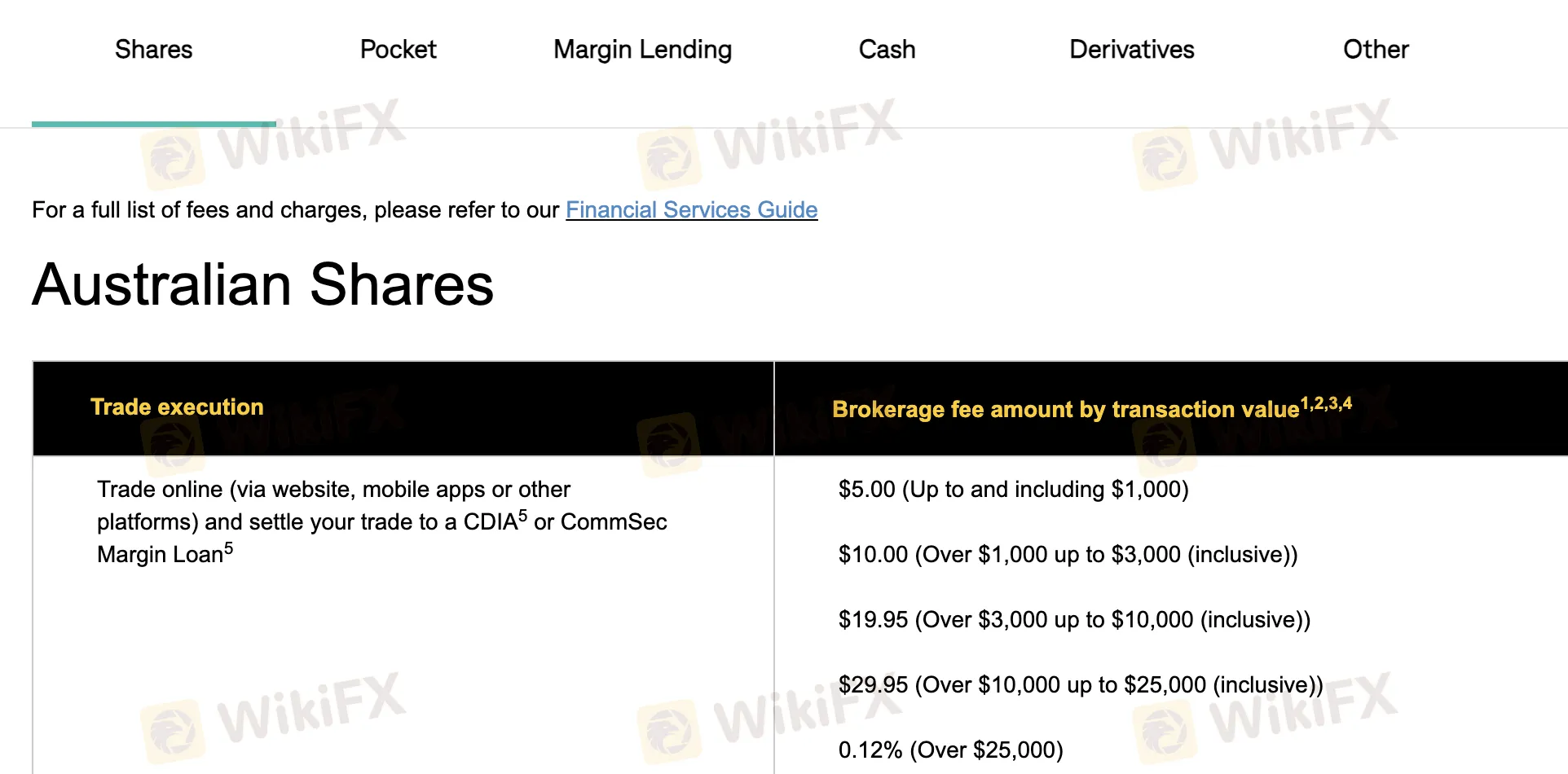

CommSec 费用

CommSec的价格通常与其他经纪商相比是公平合理的,特别是针对澳大利亚境内的在线交易。然而,海外交易和电话交易可能会更昂贵。对于澳大利亚的小额交易,手续费从5美元起。对于外汇和期权交易,都有最低美元或百分比手续费。

| 类型 | 费用详情 |

| 澳大利亚股票(通过CDIA在线交易) | 5美元(≤1000美元),10美元(>1000–3000美元),19.95美元(>3000–10000美元),29.95美元(>10000–25000美元),0.12%(>25000美元) |

| 澳大利亚股票(在线交易,非CDIA结算) | 29.95美元(≤9999.99美元),0.31%(≥10000美元) |

| 电话交易 | 59.95美元(≤10000美元),0.52%(>10000–25000美元),0.49%(>25000–1百万美元),0.11%(>1百万美元) |

| CommSec Pocket App | 2美元(≤1000美元),0.20%(>1000美元) |

| 国际股票(基本账户) | 美国:5美元或0.12%;加拿大:40加元或0.40%;欧洲:12欧元或0.40%;香港:130港元或0.40%;英国:12英镑或0.40% |

| 外汇兑换费 | 每次货币兑换0.55% |

| 保证金贷款利率(浮动) | 约9.15%每年(按月),固定利率(1–5年:约7.49–7.69%每年) |

| 交易所交易期权(在线) | 34.95美元(≤10000美元),0.35%(>10000美元) |

| 交易所交易期权(电话) | 54.60美元(≤10000美元),0.54%(>10000美元) |

| ETO合约费用 | 股票期权:每份合约0.13美元(开/平仓),0.05美元(行权);指数期权:0.45美元(开/平仓),0.35美元(行权) |

非交易费用

| 非交易费用 | 金额 |

| 申请费(个人/公司) | $0 |

| 信托调查费 | 最低 $200 |

| PPSR注册费(政府费用) | 政府费用(如适用) |

| 账户维护费 | $0 |

| 印刷合同说明书(邮寄) | $1.95 |

| 拒付费 | $30 |

| 重新预订费 | $25 |

| 场外转账费 | $54 |

| 政府税费 | 按成本转嫁 |

| 账户关闭费(提前偿还贷款) | 取决于贷款金额和利率变动 |

| 存款/取款(CDIA 账户) | 无限免费电子取款;SMSF CDIA 允许每月免费协助取款 |

| 延迟交割费(买入/卖空) | $100 |

| SRN查询或重新预订费 | $25 |

| 市场数据(实时快照) | $1 美元每月免费,然后每个美国股票报价 $0.01,其他股票 $0.03 |

| 美国税表费 | $0 |

| 资金转账拒绝费 | $0 |

| 即时购买力 | $0 |

| 美国 ACATS 转入/转出 | $0 |

| 美国 DRS 转入 | 每笔已结算交易 $25;拒绝交易 $100 |

| 加拿大 DRS 转入 | 每笔已结算交易 $30 加元加上第三方 手续费 |

| 美国 DRS 转出 | 每笔已结算交易 $5 |

交易平台

| 交易平台 | 支持 | 可用设备 | 适用于 |

| CommSec 网页平台 | ✔ | 网络浏览器(台式机,笔记本电脑) | 积极投资者,投资组合经理 |

| CommSec 移动应用 | ✔ | iOS,Android | 移动交易者,移动用户 |