Company Summary

| CommSec Review Summary | |

| Founded | 1995 |

| Registered Country | Australia |

| Regulation | ASIC |

| Trading Products | Shares, Options, ETFs |

| Demo Account | ❌ |

| Trading Platform | CommSec Web Platform, CommSec Mobile App |

| Minimum Deposit | 0 |

| Customer Support | Phone: 13 15 19 (within Australia) |

| Phone: +61 2 8397 1206 (outside Australia) | |

CommSec Information

Commonwealth Securities Limited runs CommSec, which has been around since 1995 and is one of Australia's best online brokers. It has a lot of different products, such as Australian and international stocks, ETFs, options, margin loans, and micro-investing tools like CommSec Pocket. This makes it a good choice for both new and seasoned investors.

Pros and Cons

| Pros | Cons |

| Wide range of products and services | International and phone trade are costly |

| Strong regulatory backing (ASIC) | No demo accounts available |

| User-friendly web and mobile platforms |

Is CommSec Legit?

Yes, CommSec is regulated. It works under the licensed company Commonwealth Securities Limited, which is overseen by the Australia Securities & Investment Commission (ASIC). ASIC is in charge of the rules, and the license type is Market Maker (MM). The license number is 000238814.

What Can I Trade on CommSec?

CommSec has a wide range of goods and services, such as Australian and foreign shares, ETFs, options, and more. This makes it a good choice for both new and experienced investors. It also has tools like margin loans, SMSF management, and even investment alternatives for youngsters and small investors.

| Trading Instruments | Supported |

| Shares | ✓ |

| Options | ✓ |

| ETFs | ✓ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| Bonds | × |

CommSec Fees

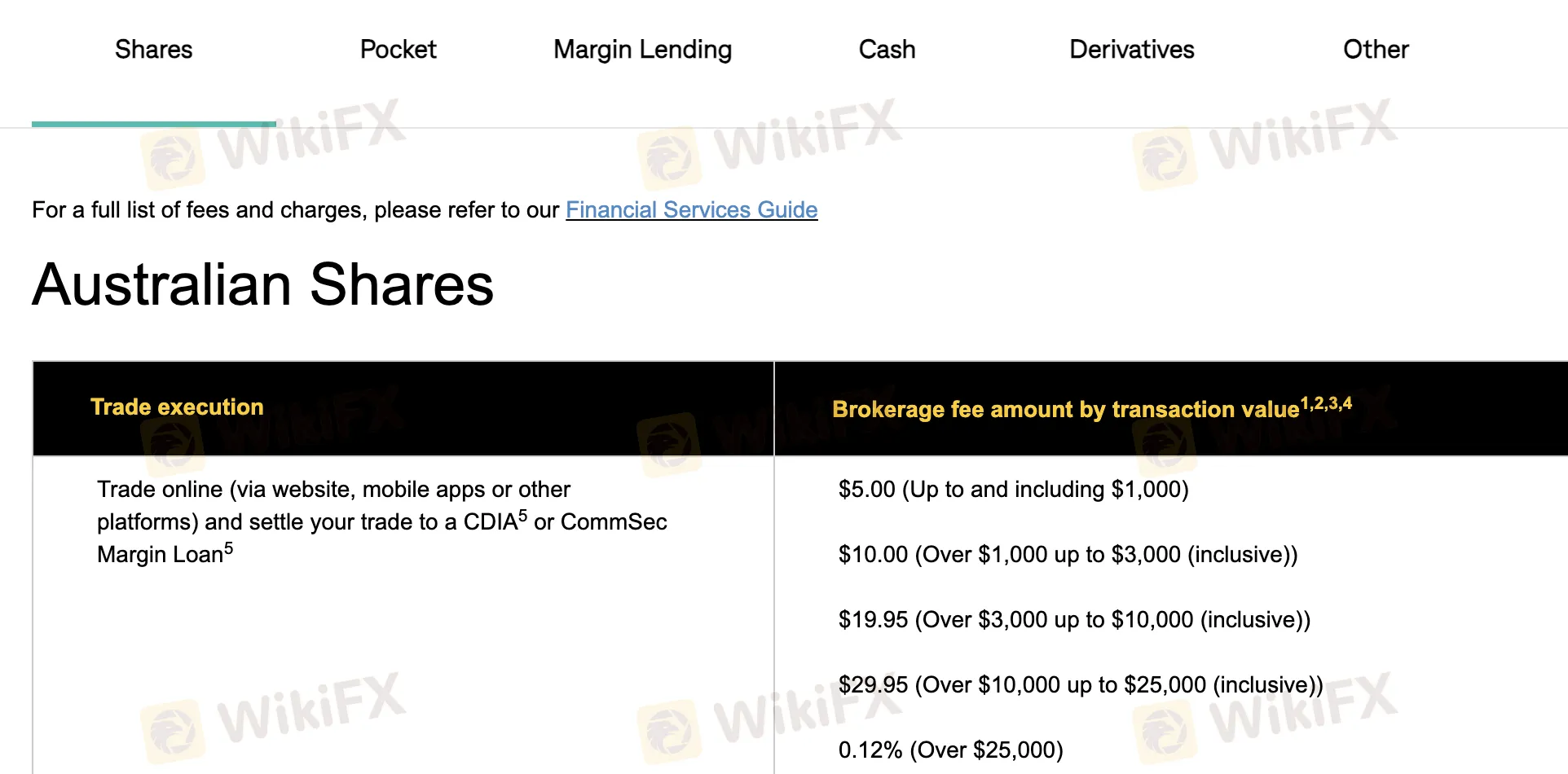

CommSec's prices are usually fair and reasonable compared to other brokers, especially for online trading within Australia. However, overseas trades and phone trades can be more expensive. For modest trades in Australia, fees start at $5. For foreign and options trading, there are minimum dollar or percentage fees.

| Type | Fee Details |

| Australian Shares (online via CDIA) | $5 (≤$1,000), $10 (>$1,000–$3,000), $19.95 (>$3,000–$10,000), $29.95 (>$10,000–$25,000), 0.12% (>$25,000) |

| Australian Shares (online, non-CDIA settlement) | $29.95 (≤$9,999.99), 0.31% (≥$10,000) |

| Phone Trades | $59.95 (≤$10,000), 0.52% (>$10,000–$25,000), 0.49% (>$25,000–$1M), 0.11% (>$1M) |

| CommSec Pocket App | $2 (≤$1,000), 0.20% (>$1,000) |

| International Shares (basic account) | US: $5 or 0.12%; Canada: C$40 or 0.40%; Europe: €12 or 0.40%; Hong Kong: HK$130 or 0.40%; UK: £12 or 0.40% |

| Foreign Exchange Conversion Fee | 0.55% per currency conversion |

| Margin Lending Rates (variable) | ~9.15% p.a. (monthly), fixed rates (1–5 years: ~7.49–7.69% p.a.) |

| Exchange-Traded Options (online) | $34.95 (≤$10,000), 0.35% (>$10,000) |

| Exchange-Traded Options (phone) | $54.60 (≤$10,000), 0.54% (>$10,000) |

| ETO Contract Fees | Equity options: $0.13 per contract (open/close), $0.05 (exercise); Index options: $0.45 (open/close), $0.35 (exercise) |

Non-Trading Fees

| Non-Trading Fees | Amount |

| Application Fee (individual/company) | $0 |

| Trust Deed Investigation Fee | Minimum $200 |

| PPSR Registration Fee (govt fee) | Government fee (if applicable) |

| Account Maintenance Fee | $0 |

| Printed Contract Notes (by mail) | $1.95 |

| Dishonour Fee | $30 |

| Rebooking Fee | $25 |

| Off-market Transfer Fee | $54 |

| Government Taxes/Duties | Passed on at cost |

| Account Closure Fee (early loan payoff) | Depends on loan amount and interest rate movements |

| Deposit/Withdrawal (CDIA accounts) | Unlimited free electronic withdrawals; SMSF CDIA allows monthly free assisted withdrawals |

| Late Settlement Fee (Buy/Short Sell) | $100 |

| SRN Query or Rebooking Fee | $25 |

| Market Data (live snapshots) | $1 USD complimentary per month, then $0.01 per US equity quote, $0.03 for others |

| U.S. Tax Form Fee | $0 |

| Funds Transfer Rejection Fee | $0 |

| Instant Buying Power | $0 |

| U.S. ACATS Transfers In/Out | $0 |

| U.S. DRS Transfers In | $25 per settled transaction; rejected transactions $100 |

| Canada DRS Transfers In | $30 CAD per settled transaction plus third-party fees |

| U.S. DRS Transfers Out | $5 per settled transaction |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| CommSec Web Platform | ✔ | Web browser (desktop, laptop) | Active investors, portfolio managers |

| CommSec Mobile App | ✔ | iOS, Android | On-the-go traders, mobile users |