公司简介

| 爱证券评论摘要 | |

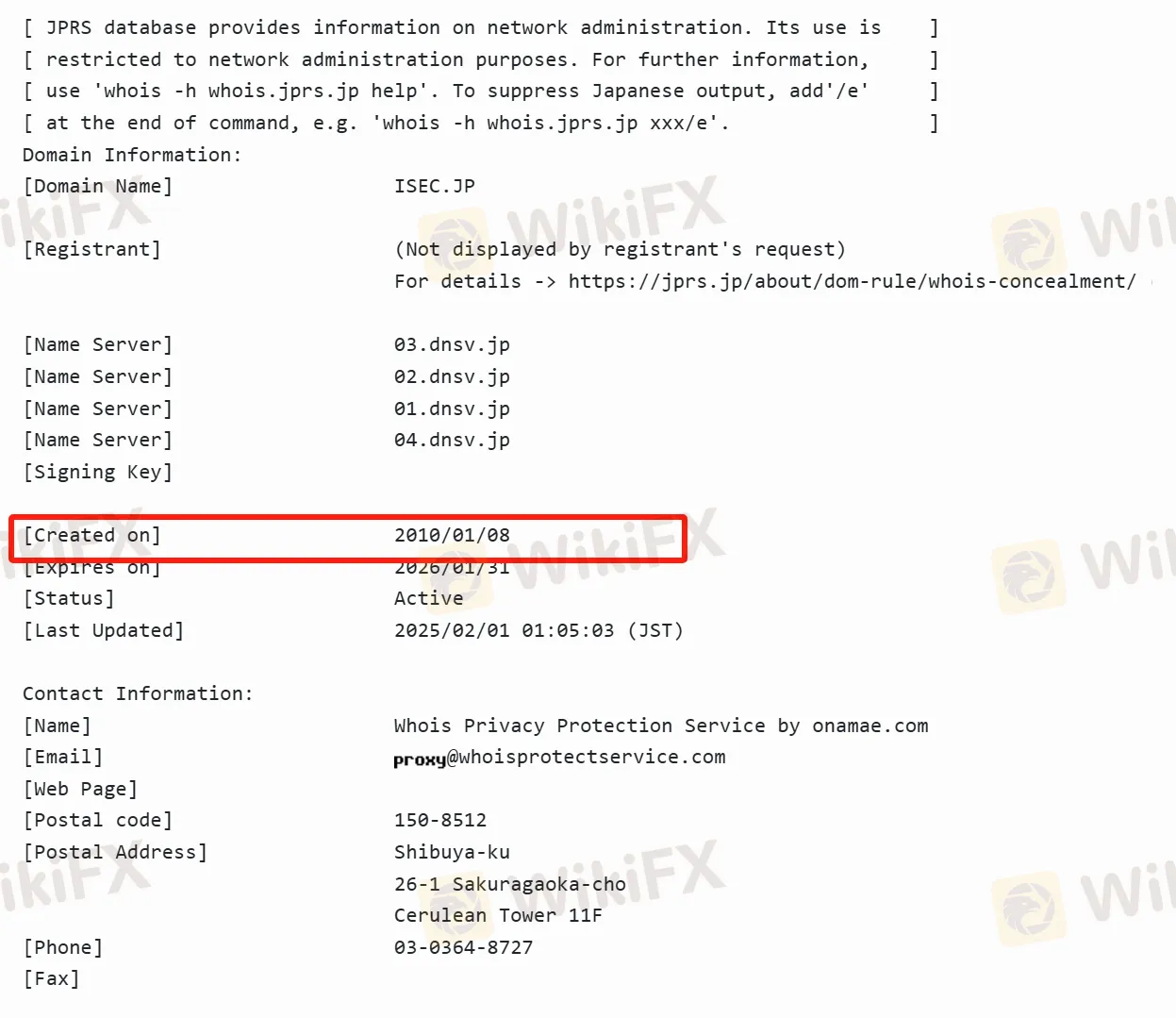

| 成立时间 | 2010/01/08 |

| 注册国家/地区 | 日本 |

| 监管 | 受监管 |

| 市场工具 | 外汇、差价合约、投资信托和基金 |

| 交易平台 | i-Trading(Windows和Mac OS) |

| 客户支持 | 电话:03-3568-5088/0120-849-188 |

| 传真:03-3568-5099 | |

| 电子邮件:info@isec.jp | |

| Facebook、Twitter | |

爱证券 信息

i Securities Co., Ltd. 是一家总部位于东京的金融服务提供商。该公司注册从事一类和二类金融工具业务,并作为商品期货交易商运营,从事场外(场外交易)外汇交易所保证金交易、场外交易差价合约(CFD)交易、场外交易商品差价合约交易、匿名合伙基金业务和投资信托业务。

优缺点

| 优点 | 缺点 |

| 受监管 | 语言障碍(仅限日语) |

| 多样的交易工具和服务 | 交易产品的风险 |

| 与多家银行合作 | |

| 以客户为中心的政策 |

爱证券 是否合法?

爱证券 是一家合法的金融服务公司。金融厅监管爱证券 Co., Ltd.,其注册编号为第236号,由关东地方财政局局长(金融商人)颁发。

在证券中我可以交易什么?

爱证券 提供16种主要货币对的外汇(FX)交易,例如欧元/美元,美元/日元和英镑/美元。投资者还可以选择差价合约(CFDs)、投资信托和基金。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 差价合约(CFDs) | ✔ |

| 投资信托 | ✔ |

| 基金 | ✔ |

爱证券 费用

| 交易方式 | 外汇交易佣金 | CFD 佣金 |

| 高级交易方式 | 每10万货币单位2,500至6,000日元 | 每手6,000日元(含消费税) |

| 在线交易 | 每10,000货币单位300日元 | 免费 |

| 电话 订单 | 每10,000货币单位额外1,000日元 | 每手额外1,000日元 |

| 移动应用/PC软件可用 |

交易平台

爱证券 提供在线交易平台 i-Trading。该平台提供24小时在线交易服务。投资者可以在Windows(建议使用Windows 98 SE及以上版本)和Mac OS系统上使用。部分功能需要Java虚拟机(1.4版本)和Adobe Reader软件。

存款和取款

公司通过外汇保证金账户处理保证金的支付和收款。当保证金超过所需金额时,超额部分将在客户请求后的四个银行工作日内退还。国内转账汇款手续费由公司承担,而国际转账和外币转账由客户承担。转账账户仅限于以客户姓名注册的银行账户。