Company Summary

| i SECURITIESReview Summary | |

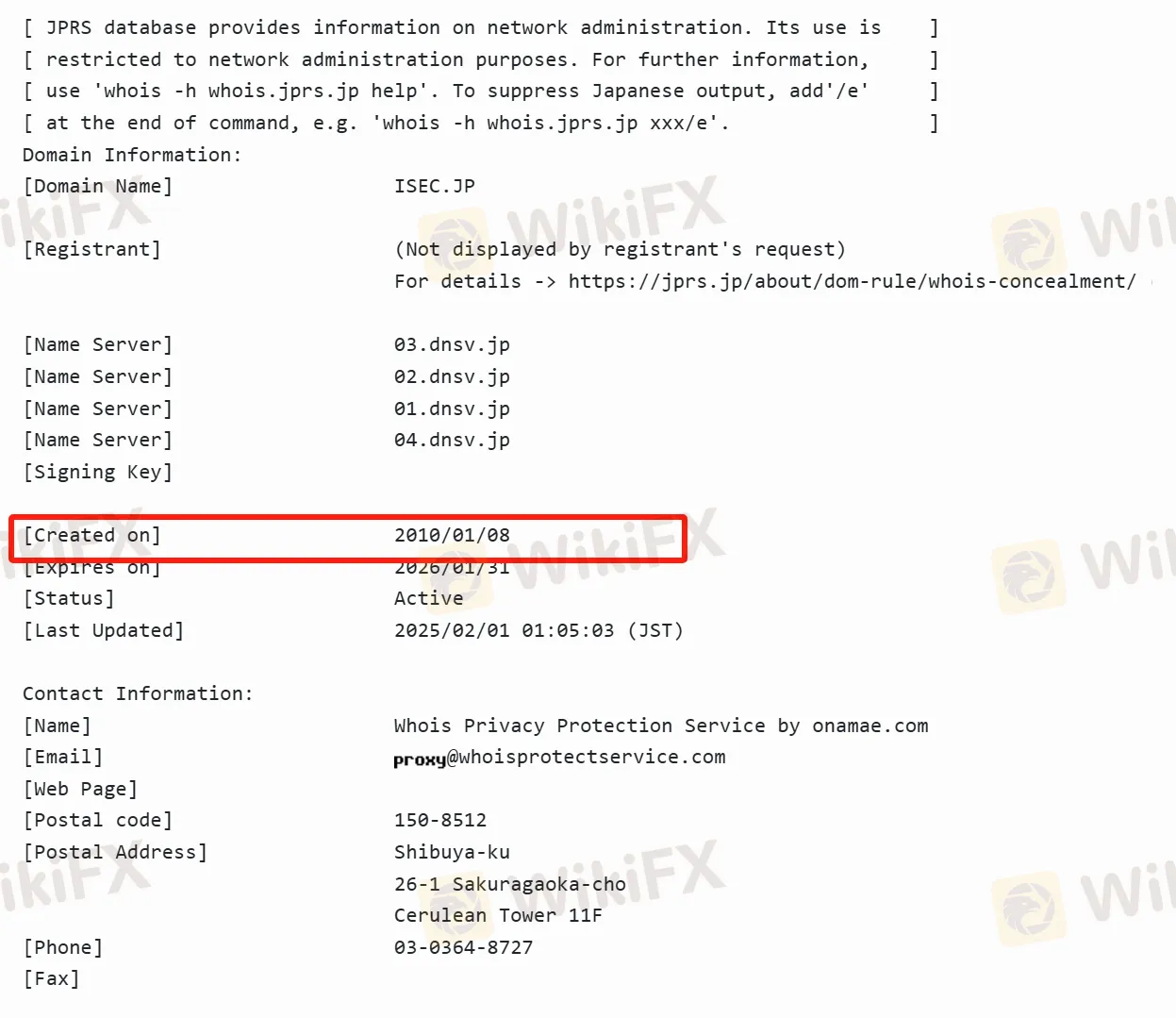

| Founded | 2010/01/08 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Market Instruments | Forex, CDFs, Investment Trusts, and Funds |

| Trading Platform | i-Trading (Windows and Mac OS) |

| Customer Support | Tel: 03-3568-5088/0120-849-188 |

| Fax: 03-3568-5099 | |

| Email: info@isec.jp | |

| Facebook, Twitter | |

i SECURITIES Information

i Securities Co., Ltd. is a financial services provider headquartered in Tokyo. The company is registered for Type I and Type II financial instruments business and operates as a commodity futures trader, engaging in over-the-counter (OTC) foreign exchange margin trading, OTC securities contracts for difference (CFD) trading, OTC commodity CFD trading, anonymous partnership fund business, and investment trust business.

Pros and Cons

| Pros | Cons |

| Regulated | Language barrier (Japanese only) |

| Various trading instruments and services | Risks of trading products |

| Cooperate with multiple banks | |

| Customer-centric policies |

Is i SECURITIES Legit?

i SECURITIES is a legitimate financial services company. The Financial Services Agency regulates i SECURITIES Co., Ltd., and its registration number is No. 236, issued by the Director of the Kanto Local Finance Bureau (Financial Merchants).

What Can I Trade in SECURITIES?

i SECURITIES offers forex (FX) trading of 16 major currency pairs, such as Euro/US Dollar, US Dollar/Japanese Yen, and British Pound/US Dollar. Investors can also choose CFDs, investment trusts, and funds.

| Tradable Instruments | Supported |

| Forex | ✔ |

| CDFs | ✔ |

| Investment Trusts | ✔ |

| Funds | ✔ |

i SECURITIES Fees

| Trading Method | Forex Trading Commission | CFD Commission |

| Advanced Trading Method | 2,500 to 6,000 Japanese yen per 100,000 units of currency | 6,000 Japanese yen per lot (including consumption tax) |

| Online Trading | 300 Japanese yen per 10,000 units of currency | Free |

| Phone Order | An additional 1,000 Japanese yen per 10,000 units of currency | An additional 1,000 Japanese yen per lot |

| Mobile APP/PC software available |

Trading Platform

i SECURITIES provides the online trading platform i-Trading. This platform offers 24-hour online trading services. Investors can use it on Windows (Windows 98 SE and above are recommended) and Mac OS systems. Some functions require the Java virtual machine (version 1.4) and Adobe Reader software.

Deposit and Withdrawal

The company processes payments and receipts of margins through an FX margin account. When the margin exceeds the required amount, the excess is returned within four banking business days after a customer's request. Domestic transfer remittance fees are covered by the company, while international transfers and foreign-currency transfers are at the customer's expense. The transfer account is limited to a bank account registered under the customer's name.