公司简介

| Banyo 评论摘要 | |

| 成立时间 | 1962年 |

| 注册国家/地区 | 日本 |

| 监管机构 | FSA |

| 市场工具 | 股票、债券、交易所交易基金(ETF)和共同基金 |

| 模拟账户 | 未提及 |

| 最低存款 | 日元10,000 |

Banyo 信息

Banyo成立于1962年,提供多种交易资产,包括股票、债券、ETF和共同基金,受日本金融服务机构(FSA)监管。然而,账户信息有限。

优点和缺点

| 优点 | 缺点 |

|

|

|

Banyo 是否合法?

Banyo在日本由金融服务机构(FSA)颁发的零售外汇牌照监管,牌照号为近畿财务局长(金商)第29号。

Banyo 可以交易什么?

Banyo提供多种交易资产,主要包括股票、债券、交易所交易基金(ETF)和共同基金。

| 可交易工具 | 支持 |

| 股票 | ✔ |

| 债券 | ✔ |

| ETF | ✔ |

| 共同基金 | ✔ |

| 加密货币 | ❌ |

| 股份 | ❌ |

| 贵金属 | ❌ |

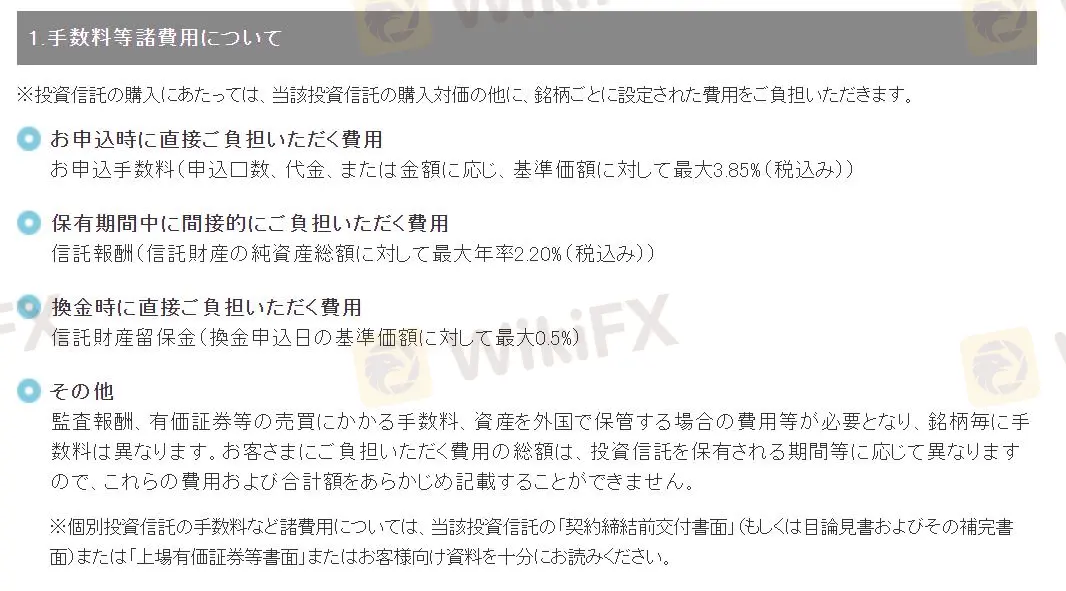

Banyo 费用

Banyo 对账户申请、资产托管、赎回和其他杂项服务收取费用手续费。您可以参考下表了解详情。

| 费用类别 | 描述 | 金额 | 备注 |

| 申请费 | 开设新账户的费用 | 最高净资产价值(NAV)的3.85% | 取决于单位数、金额或申请价值 |

| 托管费 | 持有资产的费用 | 最高净资产价值(NAV)的2.20%每年 | |

| 赎回费 | 赎回单位的费用 | 赎回日的净资产价值(NAV)的0.5% | |

| 其他费用 | 审计手续费、证券交易佣金、境外资产托管手续费等 | 根据产品而异 | 费用可能根据持有期限而变动 |

存款和取款

Banyo的最低存款金额为10,000日元。具体的存款和取款手续费未提供。