Profil perusahaan

| Banyo Ringkasan Ulasan | |

| Dibentuk | 1962 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Instrumen Pasar | Saham, Obligasi, Exchange Traded Funds (ETF), dan Reksa Dana |

| Akun Demo | Tidak Dinyatakan |

| Deposit Minimum | JYP 10.000 |

Informasi Banyo

Banyo, didirikan pada tahun 1962, menawarkan banyak aset untuk diperdagangkan termasuk Saham, Obligasi, ETF, dan Reksa Dana, dengan regulasi dari Financial Services Agency (FSA). Namun, informasi akun terbatas.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

|

|

|

Banyo Legal?

Banyo memiliki Lisensi Forex Ritel yang diatur oleh Financial Services Agency (FSA) di Jepang dengan nomor lisensi 近畿財務局長(金商)第29号.

Apa yang Bisa Saya Perdagangkan di Banyo?

Banyo menawarkan banyak aset untuk diperdagangkan, terutama termasuk Saham, Obligasi, Exchange Traded Funds (ETF), dan Reksa Dana.

| Instrumen Perdagangan | Didukung |

| Saham | ✔ |

| Obligasi | ✔ |

| ETF | ✔ |

| Reksa Dana | ✔ |

| Kripto | ❌ |

| Saham | ❌ |

| Logam | ❌ |

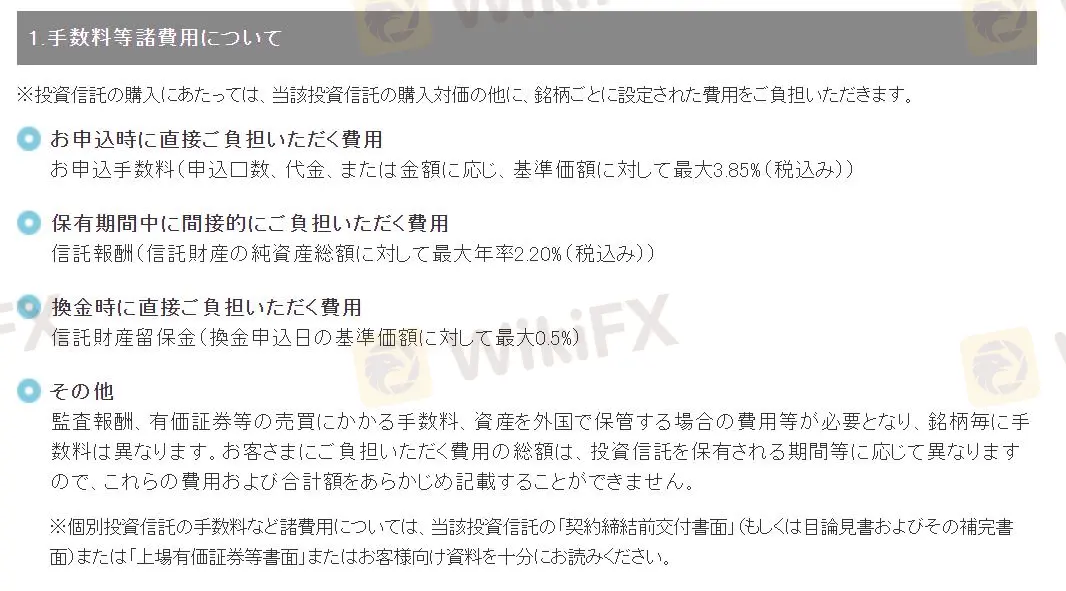

Banyo Biaya

Banyo mengenakan biaya untuk aplikasi akun, pengawasan aset, penarikan, dan layanan lainnya. Anda dapat merujuk ke tabel untuk rincian lebih lanjut.

| Kategori Biaya | Deskripsi | Jumlah | Catatan |

| Biaya Aplikasi | Biaya untuk membuka akun baru | Hingga 3,85% dari nilai aset bersih (NAV) | Bergantung pada jumlah unit, jumlah, atau nilai aplikasi |

| Biaya Pengawasan | Biaya untuk menyimpan aset | Hingga 2,20% per tahun dari NAV | |

| Biaya Penarikan | Biaya untuk menebus unit | Hingga 0,5% dari NAV pada tanggal penarikan | |

| Biaya Lainnya | Biaya audit, komisi perdagangan untuk sekuritas, biaya pengawasan untuk aset yang dipegang di luar negeri, dll. | Bervariasi tergantung pada produk | Biaya dapat berubah tergantung pada periode penahanan |

Deposit dan Penarikan

Deposit minimum Banyo adalah JYP 10.000. Biaya spesifik untuk deposit dan penarikan tidak disediakan.