公司简介

| 第一证券 评论摘要 | |

| 成立时间 | 1985年 |

| 注册国家/地区 | 美国 |

| 监管 | 无监管 |

| 市场工具 | 美国股票、ETF、期权、共同基金 |

| 模拟账户 | ❌ |

| 交易平台 | 第一证券 网页平台、移动应用(iOS和Android)、OptionsWizard工具 |

| 最低存款 | $0 |

| 客户支持 | 电话(美国免费电话):1-888-889-2818 |

| 电话(台湾免费电话):00801-856-958 | |

| 电话(中国免费电话):400-685-8589 | |

| 电话(国际):+1-718-888-2158 | |

| 电子邮件:service@firstrade.com / support@firstrade.com | |

| 微信:第一证券-1985(周一至周五 8:00–18:00 EST) | |

| 传真:+1-718-961-3919 | |

第一证券 信息

第一证券成立于1985年,总部位于美国,是一家在线经纪平台,为股票、期权、ETF和共同基金提供免佣金交易。尽管为新手和经验丰富的投资者提供了用户友好的平台和税收优惠的IRA,但它并未受到美国任何主要金融机构的监管。

优缺点

| 优点 | 缺点 |

| 股票、ETF、期权和基金零佣金 | 无监管 |

| 无账户不活跃费或最低存款要求 | 无伊斯兰账户 |

| 免费工具如OptionsWizard | 仅限美国市场 |

第一证券 是否合法?

第一证券是一家无监管经纪商。尽管在美国注册,但缺乏来自美国主要金融机构(包括证券交易委员会(SEC)或金融业监管局(FINRA))的任何正式监管许可。

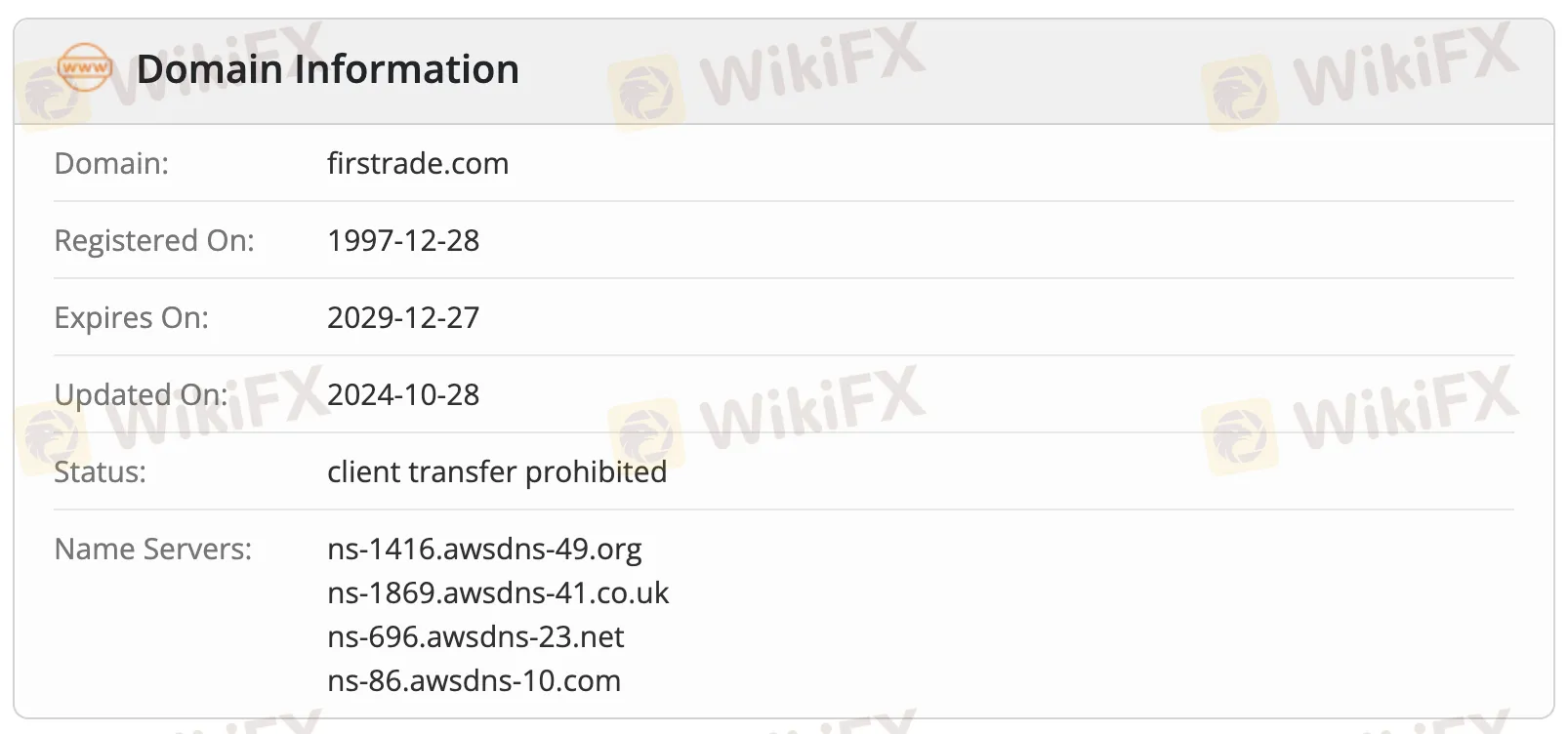

WHOIS域数据显示,firstrade.com的官方域名于1997年12月28日首次注册。最近更新日期为2024年10月28日,到期日为2029年12月27日。该域名目前处于“客户转移禁止”状态,这意味着未经许可无法将其转移到另一注册商。

我可以在第一证券上交易什么?

第一证券为一系列投资产品提供免佣金交易平台,包括美国股票、ETF、期权和共同基金。投资者可以在不产生标准交易费用的情况下构建和分散他们的投资组合。

| 交易工具 | 支持 |

| 美国股票 | ✔ |

| ETF | ✔ |

| 期权 | ✔ |

| 共同基金 | ✔ |

| 外汇 | ❌ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

| 债券 | ❌ |

账户类型

第一证券提供两种主要类型的实盘交易,一种用于投资,一种用于退休。它没有演示账户或不允许交换的伊斯兰账户。这些账户非常适合想要在美国市场投资并获得税收优惠的新手和经验丰富的用户。

| 账户类型 | 特点 | 适合人群 |

| 投资账户 | 个人或联合账户,用于投资股票、ETF、期权等。 | 一般投资者 |

| 退休账户(IRA) | 传统、罗斯或转移IRA,用于税收优惠的退休储蓄。 | 长期退休储蓄者 |

第一证券费用

第一证券的交易费用远低于行业标准,是美国股票和期权交易者中最实惠的经纪商之一。无最低存款或不活跃费,提供共同基金、期权、ETF和股票的免佣金交易。

交易费用

| 交易产品 | 佣金 | 合约费 | 备注 |

| 股票 | ❌ | – | 完全无佣金 |

| ETF | ❌ | – | |

| 期权 | ❌ | ❌ | 无每份合同费用 |

| 共同基金 | ❌ | – | 包括前端和后端收费基金 |

| 债券和CD | 净收益基础 | – | CD:主要市场30美元 |

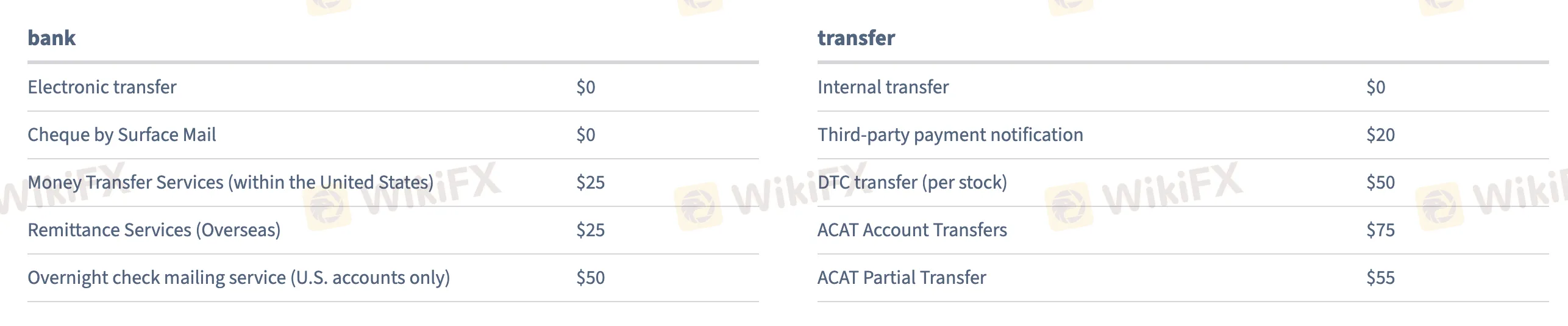

非交易费用

| 费用 | 金额 |

| 账户维护 | ❌ |

| 不活跃费 | ❌ |

| 电子账单/转账 | ❌ |

| 美国电汇 | $25 |

| 国际电汇 | $25 |

| 隔夜支票(仅限美国) | $50 |

| ACAT账户转移(全额) | $75 |

| ACAT部分转移 | $55 |

| 第三方支付通知 | $20 |

| 外国股票交易/转移 | $75 |

| 退休账户设置/关闭 | ❌ |

| ADR费用 | $0.01–$0.05 每股 |

交易平台

| 交易平台 | 支持 | 可用设备 |

| 第一证券 网页版 | ✔ | PC,Mac(Web浏览器) |

| 第一证券 移动应用 | ✔ | iOS,Android |

| OptionsWizard 工具 | ✔ | Web,与主应用集成 |

存款和取款

第一证券 对正常取款或存款不收取费用。然而,某些服务,如海外转账或快速支票递送,是需要付费的。无最低存款要求,因此新手可以简单开始投资。

| 支付方式 | 最低金额 | 存款费用 | 取款费用 | 处理时间 |

| ACH转账(银行链接) | $0 | ❌ | ❌ | 1–3个工作日 |

| 电汇(国内) | $0 | ❌ | $25 | 1–2个工作日 |

| 电汇(国际) | $0 | ❌ | $25 | 3–5个工作日 |

| 邮寄支票(仅限美国) | $0 | – | $0(标准),$50(加急) | 标准或隔夜递送 |

| 内部账户转账 | $0 | ❌ | ❌ | 1个工作日 |