Buod ng kumpanya

| Firstrade Buod ng Pagsusuri | ||

| Itinatag | 1985 | |

| Rehistradong Bansa/Rehiyon | Estados Unidos | |

| Regulasyon | Mga Kasangkapan sa Merkado | U.S. Stocks, ETFs, Options, Mutual Funds |

| Demo Account | ❌ | |

| Platform ng Paggawa ng Kalakalan | Firstrade Web Platform, Mobile App (iOS & Android), OptionsWizard Tool | |

| Minimum na Deposito | $0 | |

| Suporta sa Kustomer | Telepono (US Toll-Free): 1-888-889-2818 | |

| Telepono (Taiwan Toll-Free): 00801-856-958 | ||

| Telepono (China Toll-Free): 400-685-8589 | ||

| Telepono (Internasyonal): +1-718-888-2158 | ||

| Email: service@firstrade.com / support@firstrade.com | ||

| WeChat: Firstrade-1985 (Lun–Biy 8:00–18:00 EST) | ||

| Fax: +1-718-961-3919 | ||

Impormasyon Tungkol sa Firstrade

Firstrade, itinatag noong 1985 at may punong tanggapan sa Estados Unidos, ay isang online brokerage platform na nagbibigay ng libreng pagtitingi para sa mga stocks, options, ETFs, at mutual funds. Bagaman nag-aalok ito ng mga user-friendly na plataporma at tax-advantaged IRAs sa parehong baguhan at may karanasan na mga mamumuhunan, hindi ito nireregula ng anumang pangunahing institusyon sa Estados Unidos.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| $0 komisyon sa mga stocks, ETFs, options, at funds | Walang regulasyon |

| Walang bayad sa inactivity ng account o minimum na deposito | Walang Islamic accounts |

| Libreng mga kasangkapan tulad ng OptionsWizard | Nakatuon lamang sa U.S. markets |

Tunay ba ang Firstrade?

Ang Firstrade ay isang hindi nireregulang broker. Bagaman rehistrado sa Estados Unidos, wala itong opisyal na lisensiyang regulasyon mula sa mga pangunahing ahensya sa Estados Unidos kabilang ang Securities and Exchange Commission (SEC) o ang Financial Industry Regulatory Authority (FINRA).

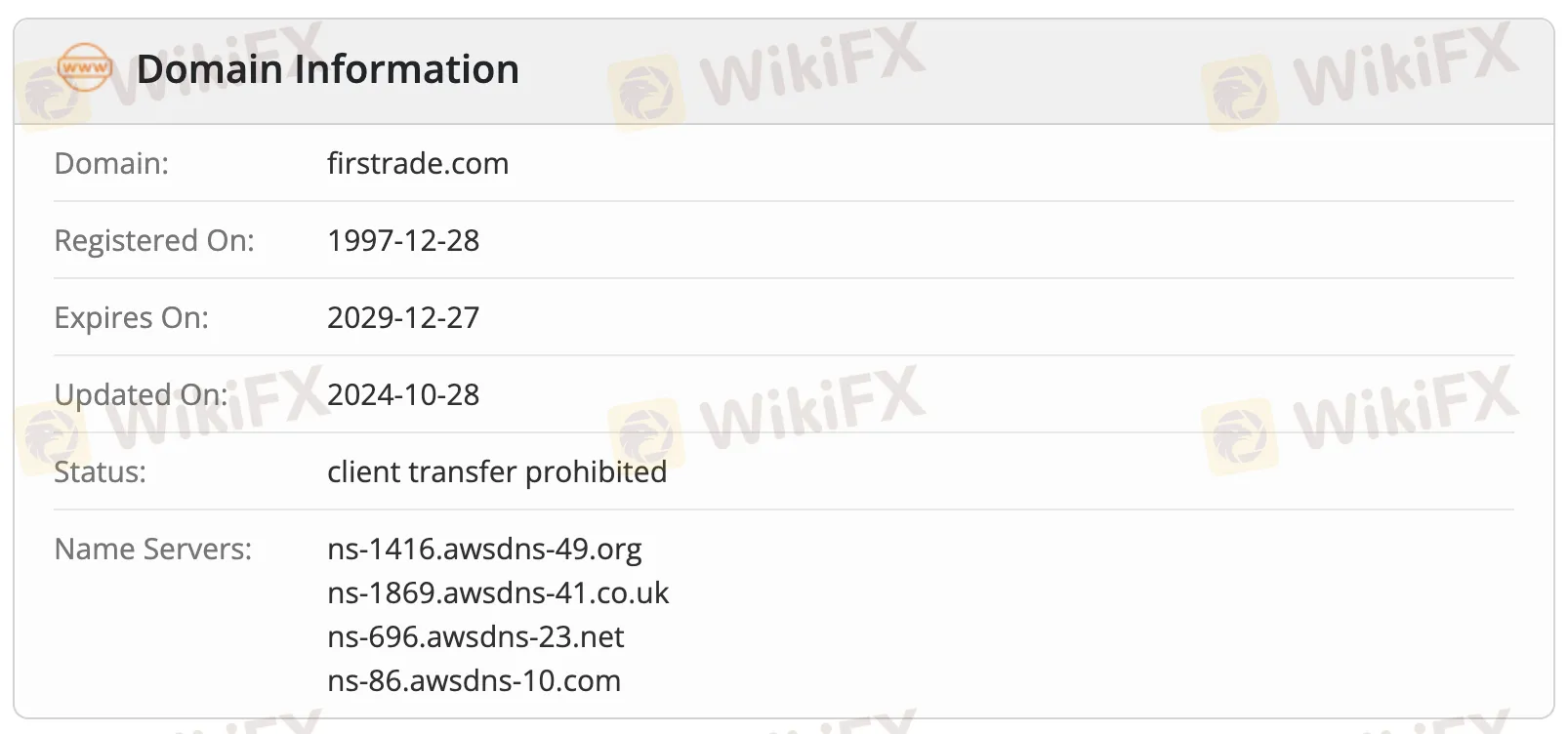

Ang WHOIS domain data ay nagpapakita na ang opisyal na domain na firstrade.com ay unang nirehistro noong Disyembre 28, 1997. Huling na-update noong Oktubre 28, 2024, ito ay mag-eexpire sa Disyembre 27, 2029. Ang domain ay ngayon ay nasa status ng "client transfer prohibited," na nangangahulugang hindi ito maaaring ilipat sa ibang registrar nang walang pahintulot.

Ano ang Maaari Kong Itrade sa Firstrade?

Firstrade nag-aalok ng isang plataporma para sa pag-trade na walang komisyon para sa iba't ibang produkto ng pamumuhunan, kabilang ang mga U.S. stocks, ETFs, options, at mutual funds. Ang mga mamumuhunan ay maaaring magbuo at mag-diversify ng kanilang mga portfolio nang walang karagdagang bayad sa pag-trade.

| Mga Kasangkapan sa Pag-trade | Supported |

| U.S. Stocks | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Mutual Funds | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

Uri ng Account

May dalawang pangunahing uri ng live accounts na inaalok ang Firstrade, isa para sa pamumuhunan at isa para sa pensyon. Walang demo account o isang Islamic account na hindi pinapayagan ang swaps. Ang mga account na ito ay mahusay para sa mga baguhan at mga may karanasan na nais kumuha ng tax breaks habang nag-iinvest sa U.S. markets.

| Uri ng Account | Feature | Angkop para sa |

| Investment Account | Indibidwal o joint account para mamuhunan sa stocks, ETFs, options, at iba pa. | Pangkalahatang mga mamumuhunan |

| Retirement Account (IRA) | Traditional, Roth, o Rollover IRA para sa tax-advantaged retirement savings. | Mga nag-iipon para sa pangmatagalang pensyon |

Mga Bayad sa Firstrade

Dahil sa mga bayad na mas mababa kaysa sa karaniwan sa industriya, ang Firstrade ay isa sa pinakamura na mga broker para sa mga U.S. stock at options traders. Walang minimum deposit o bayad sa inactivity, nagbibigay ito ng commission-free trading sa mutual funds, options, ETFs, at stocks.

Mga Bayad sa Pag-trade

| Trading Product | Commission | Contract Fees | Notes |

| Stocks | ❌ | – | Walang komisyon sa lahat |

| ETFs | ❌ | – | |

| Options | ❌ | ❌ | Walang per-contract fees |

| Mutual Funds | ❌ | – | Kasama ang load & no-load funds |

| Bonds & CDs | Base sa net yield | – | CDs: $30 para sa primary market |

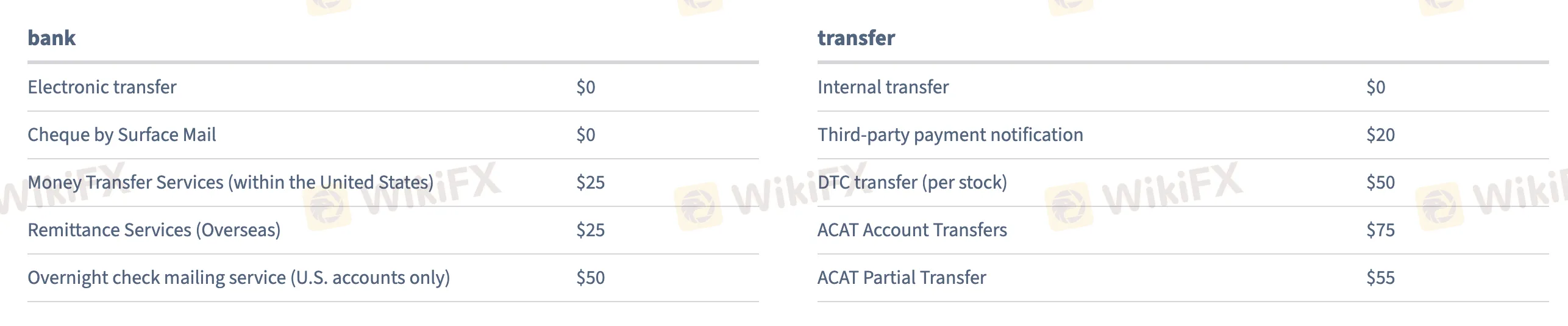

Mga Singil na Hindi Kaugnay sa Paghahalal

| Singil | Halaga |

| Pananatili ng Account | ❌ |

| Inactivity Fee | ❌ |

| Electronic Billing/Transfers | ❌ |

| U.S. Wire Transfer | $25 |

| International Wire Transfer | $25 |

| Overnight Check (U.S. only) | $50 |

| ACAT Account Transfer (Full) | $75 |

| ACAT Partial Transfer | $55 |

| Third-Party Payment Notification | $20 |

| Foreign Stock Trading/Transfer | $75 |

| Retirement Account Setup/Closure | ❌ |

| ADR Fee | $0.01–$0.05 bawat bahagi |

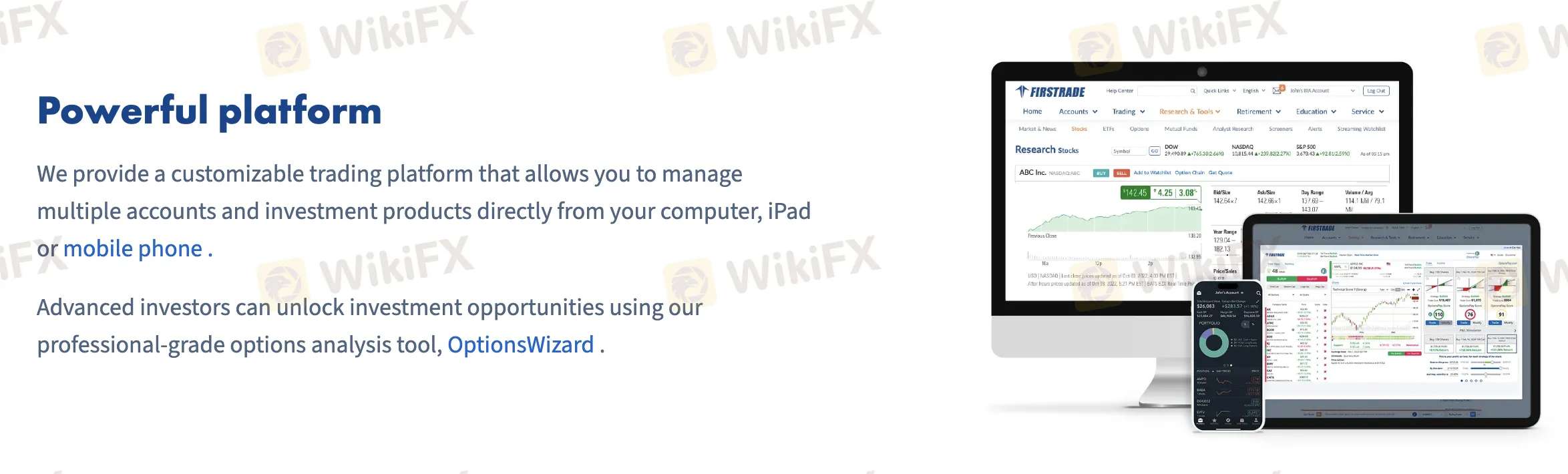

Platform ng Paghahalal

| Platform ng Paghahalal | Supported | Available Devices |

| Firstrade Web Platform | ✔ | PC, Mac (Web browser) |

| Firstrade Mobile App | ✔ | iOS, Android |

| OptionsWizard Tool | ✔ | Web, integrated with main app |

Deposito at Pag-Atas

Firstrade walang singil para sa normal na pag-atas o deposito. Ang ilang serbisyo, tulad ng mga overseas transfer o mabilis na paghahatid ng tseke, ay may bayad. Walang minimum na depositong kailangan, kaya maaaring simulan ng mga baguhan ang kanilang pag-iinvest.

| Pamamaraan ng Pagbabayad | Minimum na Halaga | Singil sa Deposito | Singil sa Pag-Atas | Oras ng Paghahatid |

| ACH Transfer (Bank Linking) | $0 | ❌ | ❌ | 1–3 araw na negosyo |

| Wire Transfer (Domestic) | $0 | ❌ | $25 | 1–2 araw na negosyo |

| Wire Transfer (International) | $0 | ❌ | $25 | 3–5 araw na negosyo |

| Check by Mail (U.S. only) | $0 | – | $0 (karaniwan), $50 (expedited) | Karaniwang o overnight na paghahatid |

| Internal Account Transfer | $0 | ❌ | ❌ | 1 araw na negosyo |