公司简介

| 加泰证券 评论摘要 | |

| 成立时间 | 1999 |

| 注册国家/地区 | 加拿大 |

| 监管 | CIRO |

| 市场工具 | 股票、ETF、期权、GIC、共同基金、债券、外汇、差价合约、首次公开募股、国际股票、贵金属 |

| 模拟账户 | ✅ |

| 交易平台 | 加泰证券 交易(网页)、QuestMobile(iOS、Android)、加泰证券 Edge(网页/桌面/移动端)、加泰证券 Global(外汇和差价合约) |

| 最低存款 | $10 |

| 客服支持 | 在线聊天 |

加泰证券 信息

加泰证券成立于1999年,是一家知名的加拿大互联网经纪商,受CIRO监管。它提供多样化的投资产品,包括股票、ETF、期权、外汇、差价合约等,以及针对特定财务目标定制的多种账户类型。

优缺点

| 优点 | 缺点 |

| 股票和ETF免佣金 | 不支持MetaTrader(MT4/MT5) |

| 多种账户类型(退休账户、TFSA、RESP、外汇/差价合约、企业账户) | 部分产品(例如国际股票)有较高的最低投资额手续费 |

| 先进且用户友好的专有平台 | 不提供伊斯兰教账户(无息)账户 |

加泰证券 是否合法?

是的,加泰证券是合法的。它受加拿大投资监管组织(CIRO)监管,持有做市商(MM)许可证。

我可以在加泰证券上交易什么?

加泰证券 提供包括股票、ETF、期权、GIC、共同基金、债券、外汇、差价合约、首次公开发行股票、海外股票和贵金属在内的广泛投资产品。

| 可交易工具 | 支持 |

| 股票 | ✓ |

| ETF | ✓ |

| 期权 | ✓ |

| GIC | ✓ |

| 共同基金 | ✓ |

| 债券 | ✓ |

| 外汇 | ✓ |

| 差价合约 | ✓ |

| 首次公开发行股票 | ✓ |

| 海外股票 | ✓ |

| 贵金属 | ✓ |

| 指数 | ✗ |

| 加密货币 | ✗ |

账户类型

加泰证券 提供全面的实盘账户,旨在满足特定的生活和财务目标,如免税、退休、教育、住房储蓄、信托、公司、保证金以及外汇/差价合约等。它还提供模拟账户供练习使用。然而,在其官方出版物中没有提及伊斯兰教(无隔夜利息)账户。

| 账户类型 | 适用对象 |

| TFSA(免税储蓄账户) | 希望实现免税增长和提款的个人 |

| RRSP(注册退休计划) | 寻求税收优惠的退休储蓄者 |

| RESP(注册教育储蓄) | 为子女教育存钱的父母 |

| FHSA(首次购房储蓄账户) | 为首次购房者存款首付 |

| 配偶RRSP、锁定式RRSP、LIRA等 | 管理长期资金的夫妻和退休者 |

| 信托账户(正式/非正式) | 在信托下管理资金的家庭或实体 |

| 个人和公司外汇/差价合约 | 积极交易外汇和差价合约的个人或企业 |

| 保证金和现金账户(个人、联合、公司) | 使用杠杆或现金交易的交易者和投资者 |

加泰证券 费用

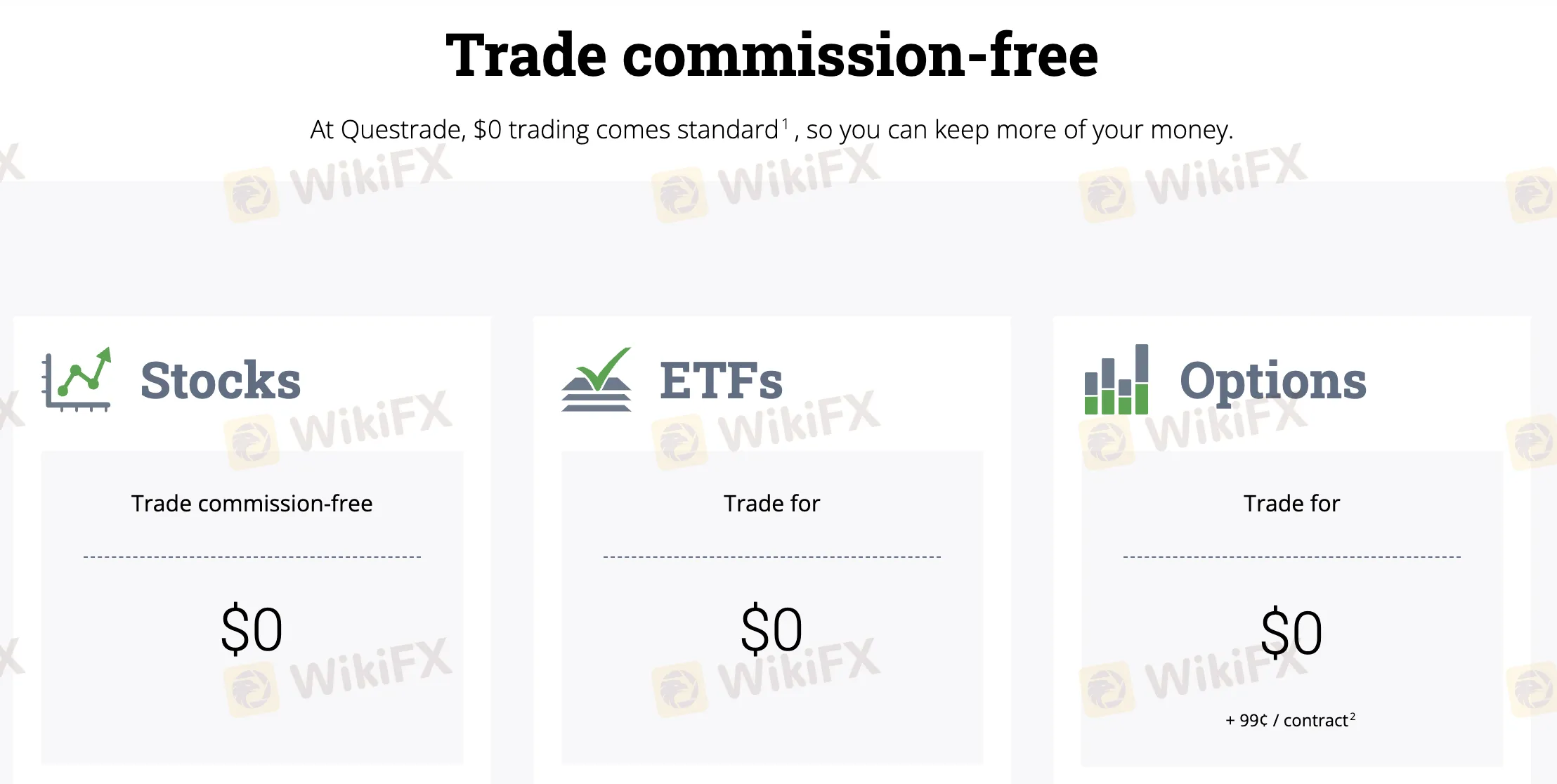

加泰证券的整体费用低于许多行业竞争对手,特别是股票和ETF交易,其中不包括佣金。某些产品,如期权、共同基金、债券、国际股票和贵金属,具有指定的费用或最低限额。

| 交易产品 | 费用 |

| 股票 | $0 |

| ETF | |

| 期权 | $0 + 每合约¢99 |

| 外汇(FX) | 点差从0.08点起 |

| 差价合约(CFD) | |

| 共同基金 | 每笔交易$9.95;如果提前取款则有递延销售费用 |

| 债券 | 最低购买金额$5,000 |

| 保证投资证书(GICs) | 最低购买金额$5,000;如果提前取款则有手续费 |

| 国际股票 | 最低$195 + 交易所/印花手续费;交易价值的约1% |

| 首次公开发行股票/IPO | 最低购买金额$5,000;购买免费 |

| 贵金属 | 每笔交易$19.95美元 |

非交易费用

| 非交易费用 | 金额 |

| 存款费 | 0 |

| 取款费 | 0 |

| 不活跃费 | 0 |

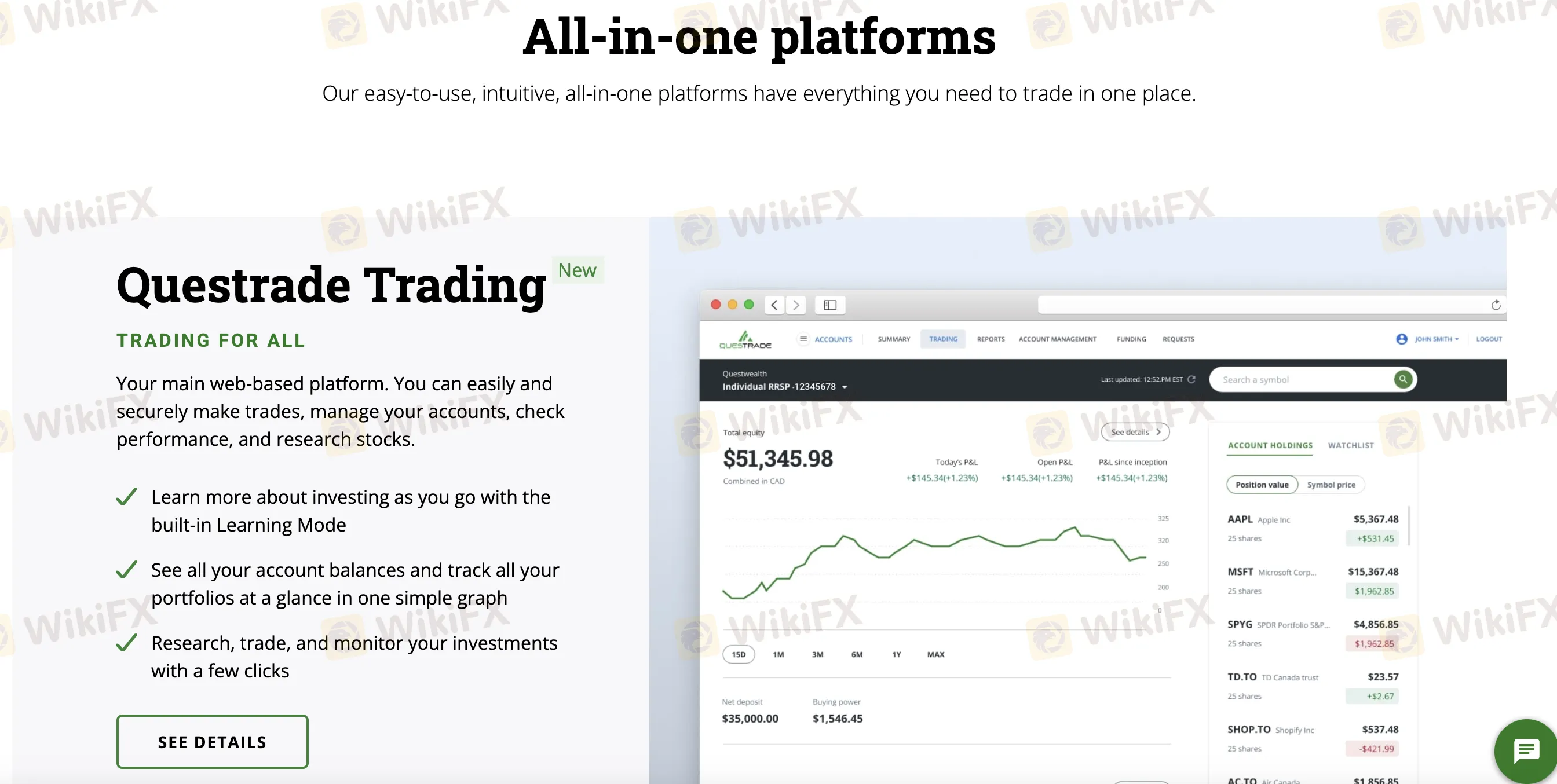

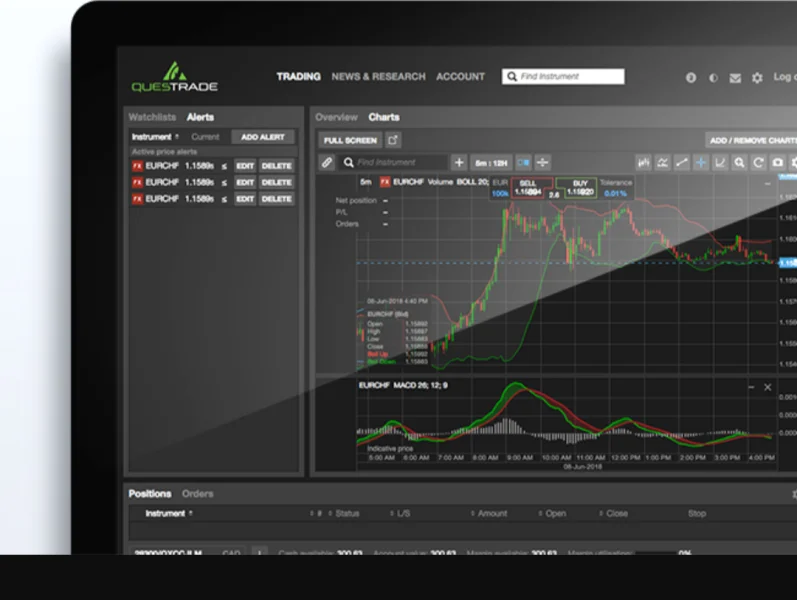

交易平台

| 交易平台 | 支持 | 可用设备 |

| 加泰证券交易 | ✔ | Web |

| QuestMobile | ✔ | iOS, Android |

| 加泰证券 Edge | ✔ | iOS, Android, Windows, macOS, Web |

| 加泰证券 Global | ✔ | Web |

| MetaTrader (MT4/MT5) | ❌ | — |

存款和取款

加泰证券不收取任何存款或取款手续费。通过Visa借记卡或Interac进行即时存款时,最低金额为$10加元。

存款选项

| 存款方式 | 最低存款 | 存款费用 | 存款时间 |

| Visa借记卡(即时) | $10加元 | 0 | 即时(达到每日限额,例如$10,000) |

| Interac电子转账 | 即时(银行内转账时间内) | ||

| 银行转账(账单支付) | $50加元 | 1-2个工作日 | |

| EFT(电子资金转账) |

提款选项

| 提款方式 | 提款费用 | 提款时间 |

| EFT | 0 | 最多5个工作日 |

| 电汇 | 根据银行不同而有所不同 | |

| 在线提款申请 | 取决于提款方式 |

Mayaz Ahmad

孟加拉国

一位客户抱怨,由于交易商无能的行为,他损失了很多钱,客户服务不佳,建议其他人不要投资该交易商。其他客户也投诉过该交易商。

曝光

Nicolas Navarro

阿根廷

大多数用户一致认为其网页版适合进行投资组合管理。此外,它还提供了无佣金交易,包括股票和交易所交易基金。

好评

smiler296

香港

几周前在试用一个月的模拟账户后,我开了一个迷你实盘账户。与其他经纪商相比,QuestradeFX开户需要大量文件。我不喜欢它们基于网页的Java交易平台,启动太慢。也不支持对冲,且不显示换仓利率,这对carry trade很烦人。图表和客户服务尚可。选择QuestradeFX是因为我能方便地从股票交易账户转账,这些账户也是在Questrade开的。一旦经验丰富,若上述问题未解决且未添加自动化系统(如Metatrader),我将考虑转投其他平台。

中评

smiler296

香港

几年前我通过该公司交易,轻松无碍地关闭了账户。秋季节交易艰难,觉得继续外汇交易不值,故而关闭。员工不错,但等待时间有时较长。现在我使用互动经纪人平台,更快更可靠。

好评

smiler296

香港

我在Questrade有一个TFSA账户,每年存钱但不做交易,只要记得市场订单收费是限价订单两倍就没问题。原本考虑开普通交易账户,但这里的评论让我打消了念头。希望Questrade能关注这些评论并提升服务。

中评

smiler296

香港

在Questrade FX交易近两载,非顶级但也未遇诈骗。重压下重新报价、偶尔断连及客服迟缓乃其不足,然对小额外汇交易者尚可。前帖多投诉股票交易问题,此论坛似聚焦外汇经纪评价。其盈利提现邮寄支票且免手续费,值得肯定。

好评

smiler296

香港

我对Questrade较为满意。2008年8月开设账户耗时一周至两周,从TD的美元账户转仓至Questrade也大致相同时间。登录后,Questrade会显示我加元和美元的余额。需要两个登录步骤,一个用于交易,另一个访问蒙特利尔的交易处理商(Penson)下载交易详情。他们的在线聊天客服响应及时,无论问题多么简单都能迅速有效解答。相比银行的高额费用,他们的交易费更为合理:股票4.95加元,美股期权11.95美元。

好评

smiler296

香港

在Questrade平台交易3个月,感受稳健,订单无任何花招,无论何时下单或新闻影响,皆能按要求成交。但基础图表功能需要改进。客户服务可靠。总而言之,作为学习交易基础的良好平台,祝交易愉快,各位加油

好评

丰收果

新西兰

这个Questrade很主动的联系我,我现在还没想好。。。不知道有没有人知道这家公司是做什么的,表现如何,我确实有投资的打算。。。

中评

素素9728

香港

做互联网跟对团队跟对人选对项目很重要!了解加泰证券,收益虽然没那么高,但安全合法稳定,有时候系统更新有点卡顿,相信加泰会越来越好。感恩😊

好评

刘海涛

香港

跟着靠谱的团队,每天都是在躺赚,做到明年五月份,就可以实现人生财务自由了😇😇

好评

大炮5113

香港

感谢加泰给的平台太给力了,我与团队的伙伴都赚到钱了🥰🥰

好评