Company Summary

| Questrade Review Summary | |

| Founded | 1999 |

| Registered Country/Region | Canada |

| Regulation | CIRO |

| Market Instruments | Stocks, ETFs, options, GICs, mutual funds, bonds, forex, CFDs, IPOs, international equities, precious metals |

| Demo Account | ✅ |

| Trading Platform | Questrade Trading (web), QuestMobile (iOS, Android), Questrade Edge (web/desktop/mobile), Questrade Global (forex & CFDs) |

| Minimum Deposit | $10 |

| Customer Support | Live chat |

Questrade Information

Questrade, founded in 1999, is a well-known Canadian internet broker regulated by the CIRO. It provides a diverse selection of investment products, including stocks, ETFs, options, FX, CFDs, and more, as well as numerous account kinds customized to specific financial objectives.

Pros and Cons

| Pros | Cons |

| $0 commission on stocks and ETFs | No MetaTrader (MT4/MT5) support |

| Wide range of account types (retirement, TFSA, RESP, forex/CFD, corporate) | Some products (e.g., international equities) have high minimum fees |

| Advanced and user-friendly proprietary platforms | No Islamic (swap-free) accounts offered |

Is Questrade Legit?

Yes, Questrade is legitimate. It is regulated by the Canadian Investment Regulatory Organization (CIRO) under a Market Maker (MM) license.

What Can I Trade on Questrade?

Questrade provides a wide range of investing products, including stocks, ETFs, options, GICs, mutual funds, bonds, FX, CFDs, IPOs, overseas equities, and precious metals.

| Tradable Instruments | Supported |

| Stocks | ✓ |

| ETFs | ✓ |

| Options | ✓ |

| GICs | ✓ |

| Mutual Funds | ✓ |

| Bonds | ✓ |

| Forex | ✓ |

| CFDs | ✓ |

| IPOs | ✓ |

| Equities | ✓ |

| Precious Metals | ✓ |

| Indices | ✗ |

| Cryptocurrencies | ✗ |

Account Type

Questrade provides a comprehensive range of live accounts designed to meet specific life and financial goals, such as tax-free, retirement, education, home savings, trust, corporate, margin, and forex/CFD accounts. It also offers demo accounts for practicing. However, there is no mention of Islamic (swap-free) accounts in their official publications.

| Account Type | Suitable for |

| TFSA (Tax-Free Savings Account) | Individuals wanting tax-free growth & withdrawals |

| RRSP (Registered Retirement Plan) | Retirement savers looking for tax benefits |

| RESP (Registered Education Savings) | Parents saving for childrens education |

| FHSA (First Home Savings Account) | First-time homebuyers saving for down payment |

| Spousal RRSP, Locked-In RRSP, LIRA, etc. | Couples and retirees managing long-term funds |

| Trust Accounts (Formal/Informal) | Families or entities managing funds under trust |

| Individual & Corporate Forex/CFDs | Active forex and CFD traders, individuals or businesses |

| Margin & Cash Accounts (Individual, Joint, Corporate) | Traders and investors using leverage or cash trading |

Questrade Fees

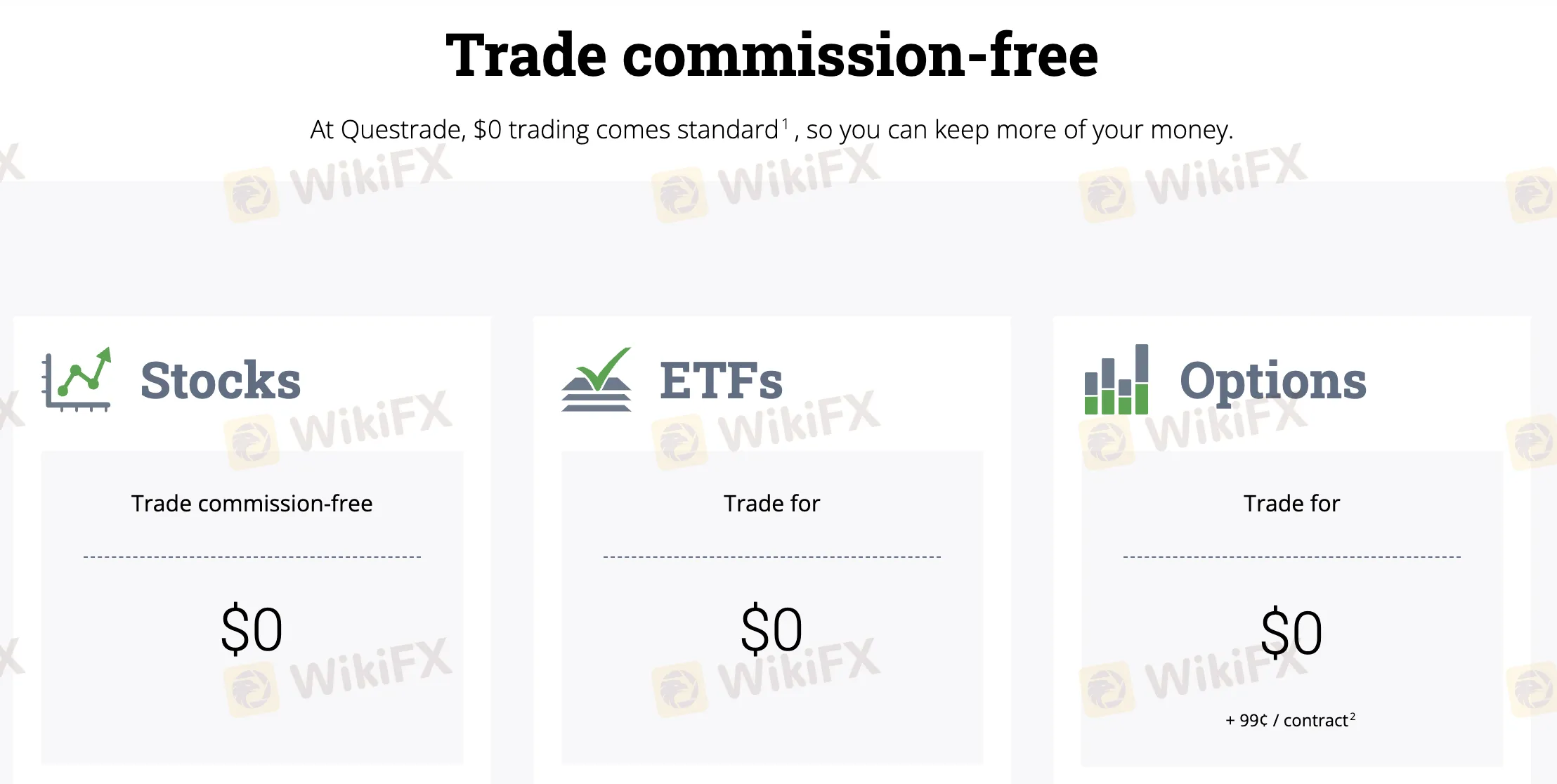

Questrade's overall fees are lower than many industry competitors, particularly for stock and ETF trading, which includes no commissions. Certain products, such as options, mutual funds, bonds, international equities, and precious metals, have specified fees or minimums.

| Trading Product | Fee |

| Stocks | $0 |

| ETFs | |

| Options | $0 + ¢99 per contract |

| Forex (FX) | Spread from 0.08 pips |

| CFDs | |

| Mutual Funds | $9.95 per trade; deferred sales charge if withdrawn early |

| Bonds | Minimum $5,000 purchase |

| GICs | Minimum $5,000 purchase; fees if withdrawn early |

| International Equities | Minimum $195 + exchange/stamp fees; ~1% of trade value |

| IPOs / New Issues | Minimum $5,000 purchase; free to buy |

| Precious Metals | $19.95 USD per trade |

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | 0 |

| Inactivity Fee | 0 |

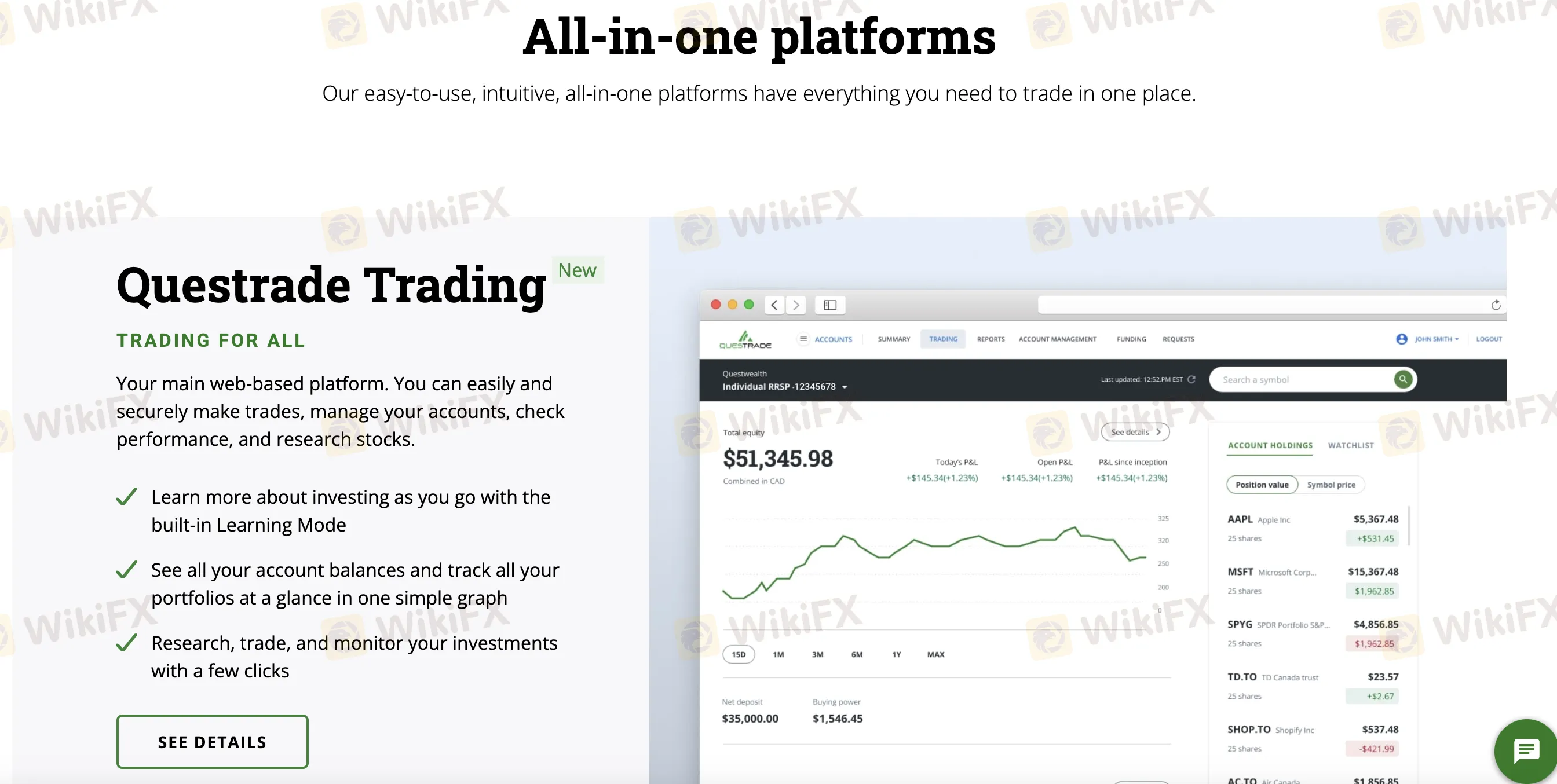

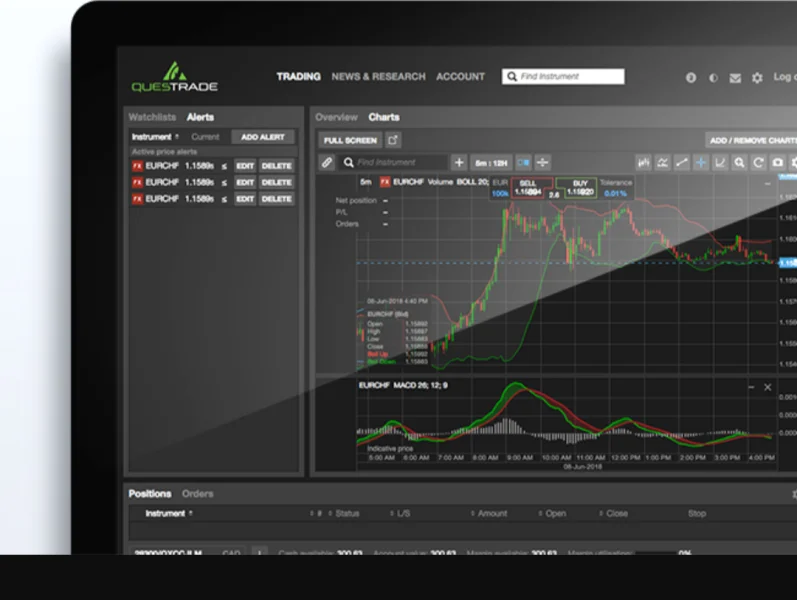

Trading Platform

| Trading Platform | Supported | Available Devices |

| Questrade Trading | ✔ | Web |

| QuestMobile | ✔ | iOS, Android |

| Questrade Edge | ✔ | iOS, Android, Windows, macOS, Web |

| Questrade Global | ✔ | Web |

| MetaTrader (MT4/MT5) | ❌ | — |

Deposit and Withdrawal

Questrade does not impose any deposit or withdrawal fees. When making an Instant amount via Visa Debit or Interac, the minimum amount is $10 (CAD).

Deposit Options

| Deposit Method | Minimum Deposit | Deposit Fees | Deposit Time |

| Visa Debit (Instant) | $10 CAD | 0 | Instant (up to daily limit, e.g., $10,000) |

| Interac e-Transfer | Instant (within banks transfer time) | ||

| Bank Transfer (Bill Pay) | $50 CAD | 1–2 business days | |

| EFT (Electronic Funds Transfer) |

Withdrawal Options

| Withdrawal Method | Withdrawal Fees | Withdrawal Time |

| EFT | 0 | Up to 5 business days |

| Wire Transfer | Varies by bank | |

| Request Withdrawal (online) | Depends on withdrawal method |

Mayaz Ahmad

Bangladesh

A client has complained that he had to lose a lot of money due to the lousy and incompetent behaviour of this broker. He also complained about the poor customer service of this broker and advised others not to invest in this broker. Many other clients also complained about this broker.

Exposure

Nicolas Navarro

Argentina

Most users agree that their web version is suitable for portfolio management. It also offers commission-free trading in stocks and ETFs.

Positive

smiler296

Hong Kong

A few weeks ago, after trying a demo account for a month, I opened a mini live account. Compared to other brokers, QuestradeFX requires a large amount of documents to open an account. I don't like their web-based Java trading platform, it's too slow to start. It also doesn't support hedging and doesn't display swap rates, which is annoying for carry trades. The charts and customer service are acceptable. I chose QuestradeFX because I can easily transfer funds from my stock trading accounts, which are also with Questrade. Once I gain more experience, if the aforementioned issues are not resolved and no automated system (such as Metatrader) is added, I will consider switching to another platform.

Neutral

smiler296

Hong Kong

A few years ago, I traded through this company and closed my account easily and smoothly. Trading in the autumn season was difficult, and I felt that continuing forex trading was not worthwhile, so I closed it. The staff was good, but the waiting time was sometimes long. Now I use the Interactive Broker platform, which is faster and more reliable.

Positive

smiler296

Hong Kong

I have a TFSA account at Questrade, where I deposit money every year but don't make any trades. As long as I remember that market orders are charged double the price of limit orders, it's not a problem. I was originally considering opening a regular trading account, but the comments here have changed my mind. I hope Questrade pays attention to these comments and improves their service.

Neutral

smiler296

Hong Kong

In the past two years of trading with Questrade FX, it is not top-notch but also not encountered fraud. Insufficient under pressure, there are occasional re-quotes, occasional disconnections, and slow customer service, but it is still acceptable for small forex traders. Previous posts mostly complained about stock trading issues, and this forum seems to focus on forex broker evaluations. It is worth noting that profits can be withdrawn by mailing a check and there are no transaction fees, which is commendable.

Positive

smiler296

Hong Kong

I am quite satisfied with Questrade. It took about one to two weeks to open an account in August 2008, and it took roughly the same amount of time to transfer funds from my TD US dollar account to Questrade. After logging in, Questrade displays the balances of my Canadian dollars and US dollars. There are two login steps, one for trading and another to access the trading details from the Montreal-based trading processor, Penson. Their online chat customer service responds promptly and can quickly and effectively answer any questions, no matter how simple. Compared to the high fees charged by banks, their trading fees are more reasonable: $4.95 CAD for stocks and $11.95 USD for US stock options.

Positive

smiler296

Hong Kong

Trading on the Questrade platform for 3 months, I feel stable, with no tricks in the orders. They are executed as requested regardless of when the order is placed or the impact of news. However, the basic charting functionality needs improvement. The customer service is reliable. In conclusion, as a good platform for learning trading fundamentals, I wish you all happy trading and good luck.

Positive

丰收果

New Zealand

This Questrade contacted me very actively and I haven’t figured out now… I wonder if there is anybody who know what this company do, and how it performs, for I do have a plan to make some investments…

Neutral

素素9728

Hong Kong

It is very important to do the Internet with the right team and the right candidates for the project! Knowing Catalan Securities, although the income is not so high, it is safe, legal and stable. Sometimes the system update is a bit stuck. I believe Catalan will get better and better. Thanks 😊

Positive

刘海涛

Hong Kong

Follow a reliable team and earn money every day. By next May, you will be able to achieve financial freedom in life😇😇

Positive

大炮5113

Hong Kong

Thank you Catalina for the platform that is so powerful, my team and I have made money 🥰🥰

Positive