Présentation de l'entreprise

| Fortune Wealth Review Summary | |

| Founded | 2006 |

| Registered Country/Region | 印度 |

| Regulation | 无监管 |

| Market Instruments | 股票、衍生品 |

| Demo Account | ❌ |

| Trading Platform | NSE Mobile App、NOW(NSE的在线交易平台) |

| Minimum Deposit | / |

| Customer Support | 联系表单 |

| 电话:+91-422-4334333 | |

| 电子邮件:pms@fortunewmc.com,info@fortunewmc.com | |

| 社交媒体:Facebook、Instagram、Twitter | |

Fortune Wealth Information

Fortune Wealth是一家无监管经纪商,提供在NSE Mobile App和NOW(NSE的在线交易平台)上交易股票和衍生品。

Pros and Cons

| Pros | Cons |

| 长时间运营 | 无监管 |

| 多种联系渠道 | 无模拟账户 |

| 有限的支付方式类型 |

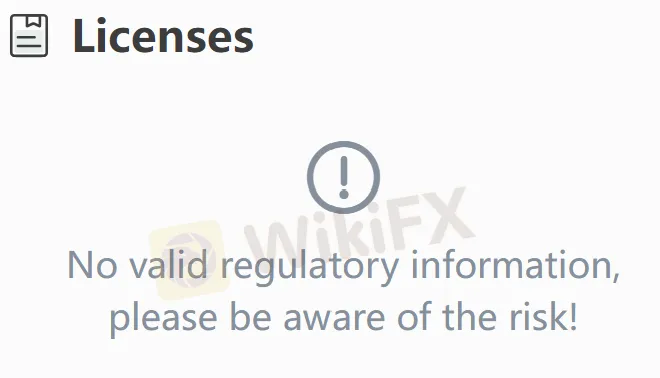

Is Fortune Wealth Legit?

不。Fortune Wealth目前没有有效监管。请注意风险!

What Can I Trade on Fortune Wealth?

Fortune Wealth propose le trading sur actions et dérivés.

| Instruments de trading | Pris en charge |

| Actions | ✔ |

| Dérivés | ✔ |

| Forex | ❌ |

| Matières premières | ❌ |

| Indices | ❌ |

| Actions | ❌ |

| Cryptomonnaies | ❌ |

| Obligations | ❌ |

| Options | ❌ |

| ETFs | ❌ |

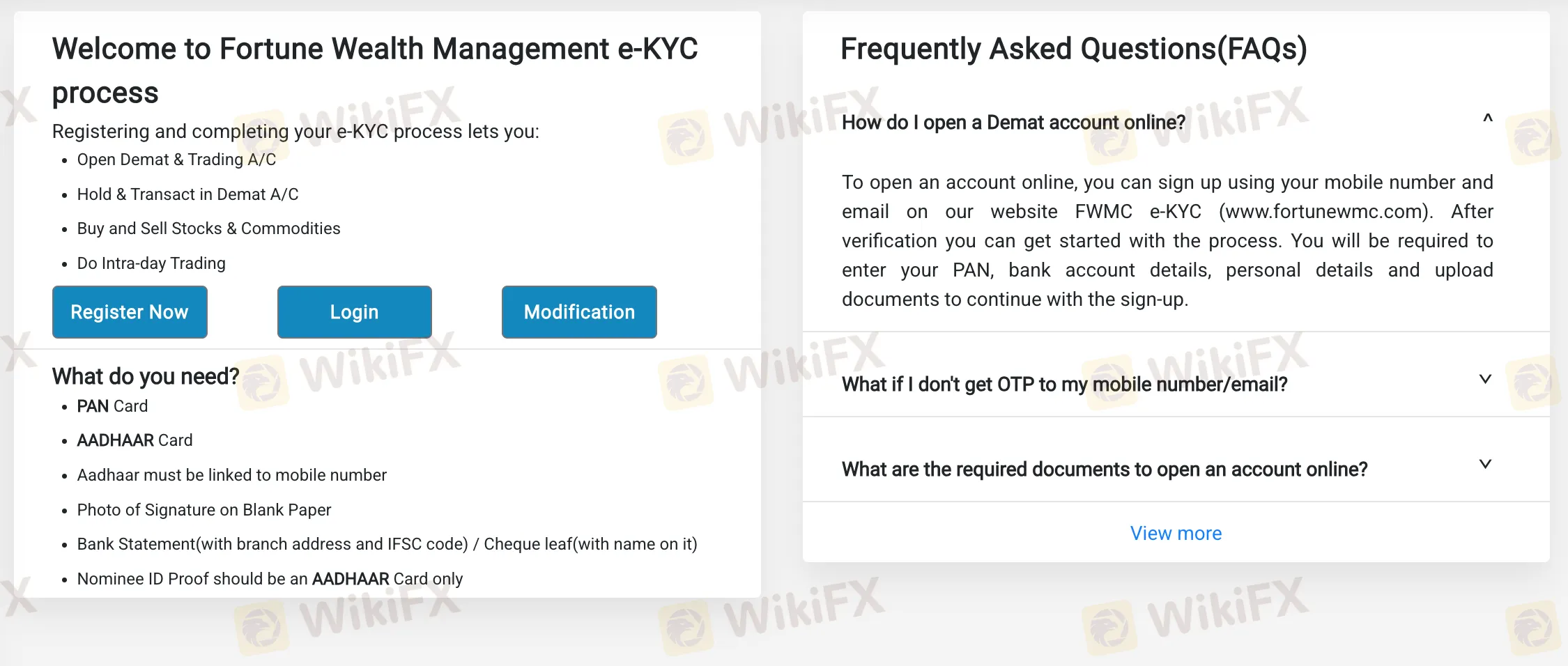

Type de compte

Le courtier propose des comptes Demat. Cependant, il ne fournit pas de détails sur les comptes.

Frais de Fortune Wealth

Les clients doivent payer une marge initiale de 20% de la valeur de la transaction pour trader sur le segment du marché au comptant.

Lors de l'ouverture d'un compte de trading avec le courtier, des frais uniques de Rs 116 sont facturés.

Plateforme de trading

| Plateforme de trading | Pris en charge | Appareils disponibles |

| Application mobile NSE | ✔ | Mobile |

| NOW (plateforme de trading en ligne de la NSE) | ✔ | Web |

Dépôt et retrait

Le courtier accepte les paiements effectués via virement bancaire. Aucun montant minimum de dépôt ou de retrait n'est défini et aucun frais n'est spécifié.