Buod ng kumpanya

| Buod ng Pagsusuri ng Fortune Wealth | |

| Itinatag | 2006 |

| Rehistradong Bansa/Rehiyon | India |

| Regulasyon | Walang regulasyon |

| Mga Instrumento sa Merkado | Mga Ekitya, derivatives |

| Demo Account | ❌ |

| Platform ng Paggawa ng Kalakalan | NSE Mobile App, NOW (online trading platform ng NSE) |

| Minimum na Deposit | / |

| Suporta sa Customer | Form ng Pakikipag-ugnayan |

| Tel: +91-422-4334333 | |

| Email: pms@fortunewmc.com, info@fortunewmc.com | |

| Social media: Facebook, Instagram, Twitter | |

Impormasyon Tungkol sa Fortune Wealth

Ang Fortune Wealth ay isang hindi nairehistrong broker, nag-aalok ng kalakalan sa mga ekwitya at derivatives sa NSE Mobile App at NOW (online trading platform ng NSE).

Mga Pro at Cons

| Mga Pro | Mga Cons |

| Mahabang oras ng operasyon | Walang regulasyon |

| Iba't ibang mga paraan ng pakikipag-ugnayan | Walang demo accounts |

| Limitadong uri ng mga pagpipilian sa pagbabayad |

Tunay ba ang Fortune Wealth?

Hindi. Ang Fortune Wealth ay walang mga wastong regulasyon sa kasalukuyan. Mangyaring maging maingat sa panganib!

Ano ang Maaari Kong Kalakalan sa Fortune Wealth?

Nag-aalok ang Fortune Wealth ng trading sa equities at derivatives.

| Mga Instrumento sa Trading | Supported |

| Equities | ✔ |

| Derivatives | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

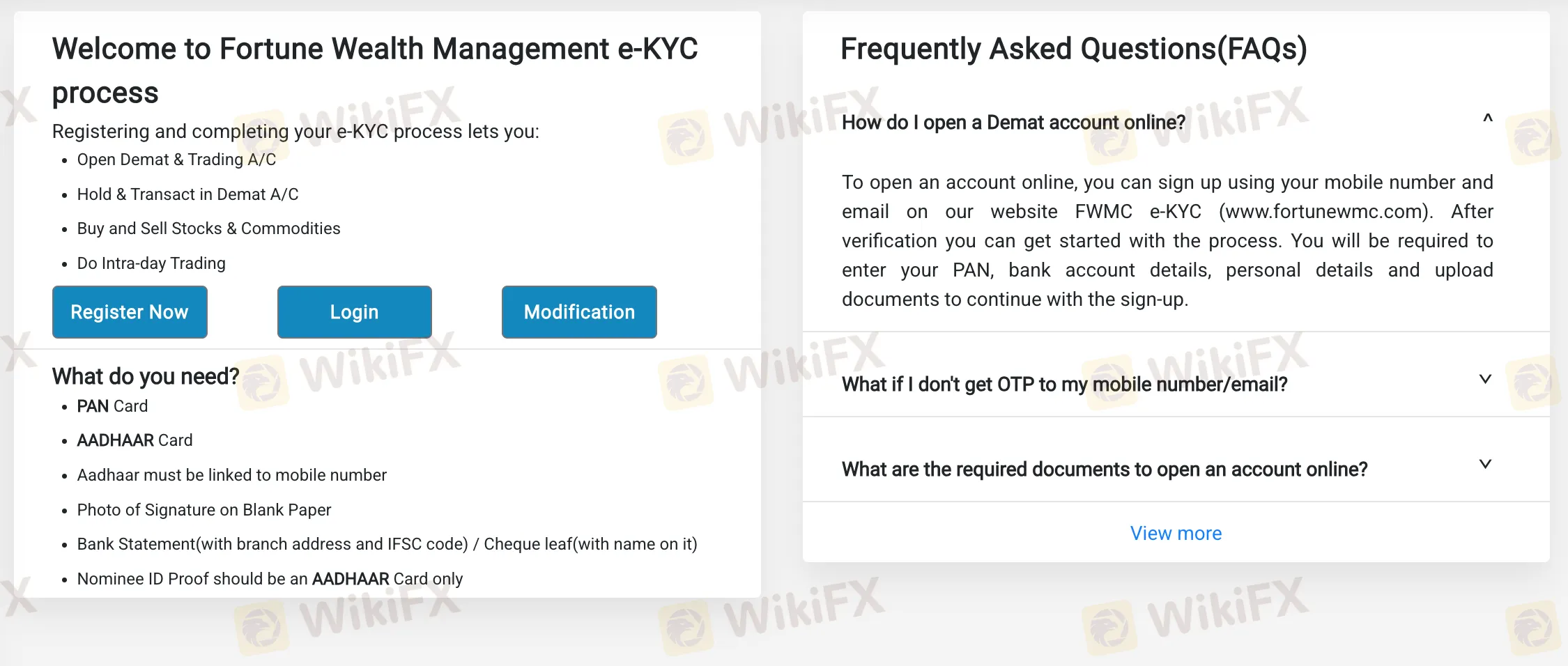

Uri ng Account

Nag-aalok ang broker ng Demat accounts. Gayunpaman, hindi ito nagbibigay ng mga detalye tungkol sa mga account.

Mga Bayad ng Fortune Wealth

Dapat magbayad ang mga kliyente ng 20% na upfront margin ng halaga ng transaksyon para makapag-trade sa cash market segment.

Kapag nagbukas ng trading account sa broker, mayroong one-time fee na Rs 116.

Plataporma sa Trading

| Plataporma sa Trading | Supported | Available Devices |

| NSE Mobile App | ✔ | Mobile |

| NOW (Plataporma sa online trading ng NSE) | ✔ | Web |

Deposito at Pag-Wiwithdraw

Tumatanggap ang broker ng mga bayad na ginagawa sa pamamagitan ng bank wire. Walang itinakdang minimum deposit o withdrawal amount at walang mga bayad o singil na itinakda.