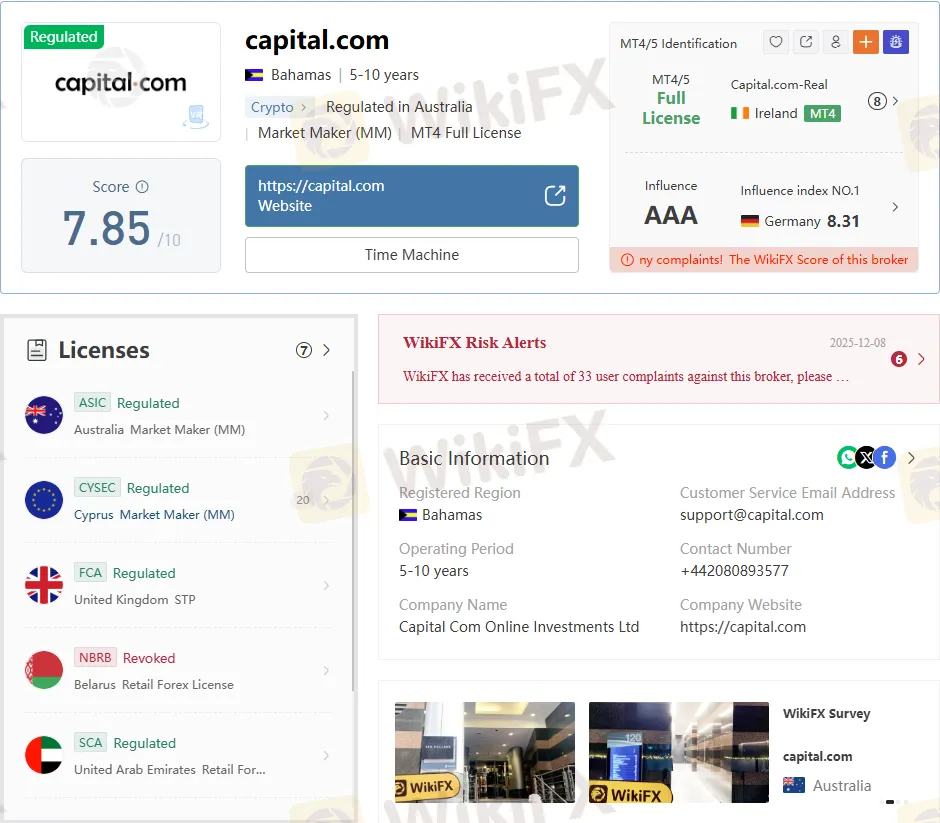

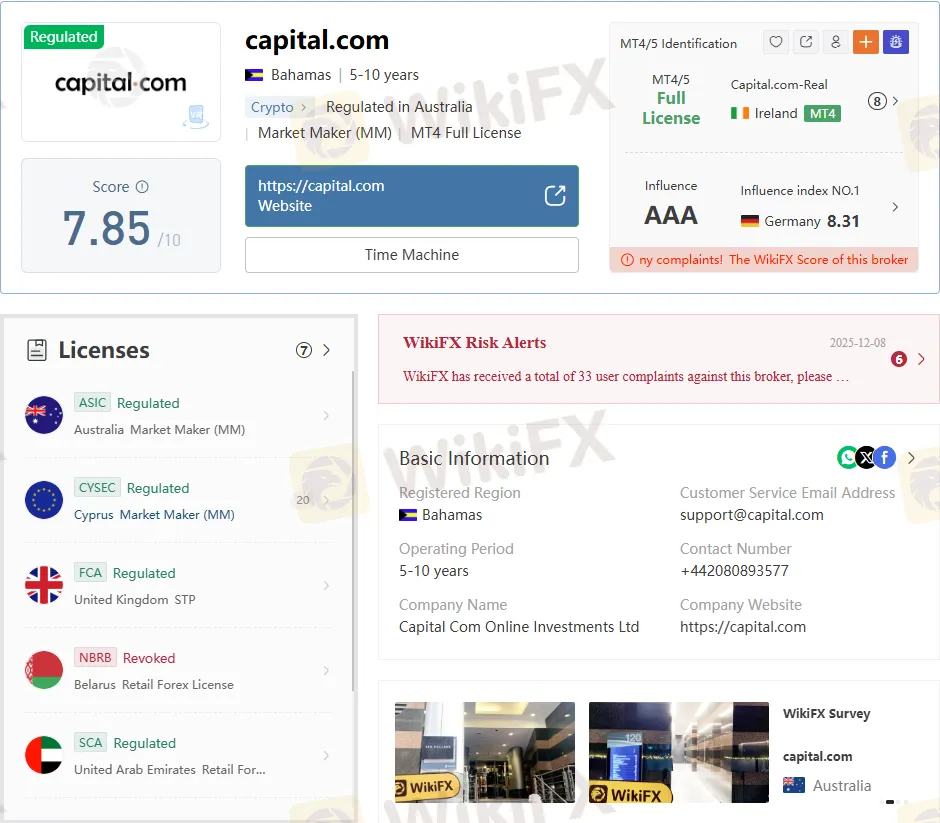

Abstract:Capital.com is regulated by ASIC, FCA, CYSEC, UAE SCA Bahamas SCB. Explore its licenses and broker trustworthiness.

Capital.com stands out as a CFD broker with multi-jurisdictional oversight, serving over 787,000 traders who have executed more than 1 trillion in volume. Regulators like ASIC and FCA enforce strict client protections, making Capital.com Regulation a key draw for risk-conscious traders. This review digs into licenses, platforms, and costs drawn directly from verified records.

Capital.com Regulation Breakdown

Capital.com Regulation spans top-tier bodies, starting with ASIC in Australia (license 513393, CAPITAL COM AUSTRALIA PTY LTD, active since 2021). CYSEC in Cyprus (license 319/17, Capital Com SV Investments Ltd) covers 19 European countries, while FCA in the UK (793714, STP model) adds credibility for retail traders.

UAE's SCA (20200000176) and Bahamas SCB (SIA-F245, offshore) round out the list, with physical offices verified in London, Melbourne, and Limassol. No license sharing detected; all entities maintain independent compliance contacts like compliance@capital.com.

Domain ties to Cyprus registration since 2016 align with operational history, though some addresses lack on-site verification. Traders gain negative balance protection under these rules, unlike unregulated peers.

Capital.com Trading Instruments

Access 3,000+ CFDs on forex majors (EUR/USD at 0.6 pips), indices (US 500, UK 100), commodities (gold, oil), shares (Apple, Tesla), cryptocurrencies (Bitcoin, Ethereum), and ESG assets. No bonds, options, or ETFs, narrowing focus to high-liquidity markets versus eToro's broader ETF lineup.

Execution averages 175ms on MT4 servers, outperforming many market makers.

Account Types at Capital.com

Minimum deposit hits just $10 (USD/EUR/GBP), beating competitors like IG's $250 threshold. Demo accounts offer $100,000 virtual funds indefinitely—ideal for testing. Live accounts lack tiered details, but pros access 1:3000 leverage (retail capped lower by rules).

Islamic swaps-free options are likely available per regional norms, though unconfirmed. Inactivity fee: $10 after 12 months. No multi-account tiers are publicized, unlike XM's standard/pro/vip spread.

Capital.com Platforms Reviewed

Proprietary web/desktop/mobile apps lead with 75+ indicators, risk tools, and seamless execution—named best for new investors. MT4 supports EAs, signals, and up to 1:200 leverage; TradingView integrates charts. No MT5, lagging Plus500's dual support.

TradingView ratings hit 4.6/5; app downloads exceed 8 million.

Fees and Spreads on Capital.com

Zero commissions, deposit/withdrawal fees—earns via spreads (EUR/USD 0.6 pips average). Overnight funding applies (long/short dependent); guaranteed stops add premiums. Currency conversion possible; no opening/closing fees.

Compares favorably to Pepperstone (0.0 pips + commission), but watch swaps on holds. Transparent via real-time tools.

Capital.com Pros and Cons

Pros:

- Multi-regulator shield (ASIC/FCA/CySEC) with verified offices

- Low $10 entry, free funding, demo unlimited

- 3,000 instruments, fast 175ms execution

- 24/7 multilingual support (chat/phone/email)

- Robust education: Investmate app, guides, webinars

Cons:

- No MT5 or tiered accounts

- Swap/guaranteed stop costs add up

- Mixed reviews; some complaints on withdrawals

- Limited research vs. Trading 212

Deposits and Support at Capital.com

Fund via Visa, Apple Pay, wire, Trustly—no fees, instant cards. Withdrawals match, processed promptly per reviews. Support shines: live chat, +44 20 8089 7893, support@capital.com, social channels.

Bottom Line

Capital.com delivers legit value through Capital.com Regulation across ASIC, FCA, CySEC, SCA, SCB—backstopped by low barriers and vast CFDs. Suits beginners with demos/education, pros with high leverage/tools, but monitor extras like swaps. Outweighs risks for regulated access; 81-85% loss disclaimers underscore CFD hazards.