Company Summary

| IBH Review Summary | |

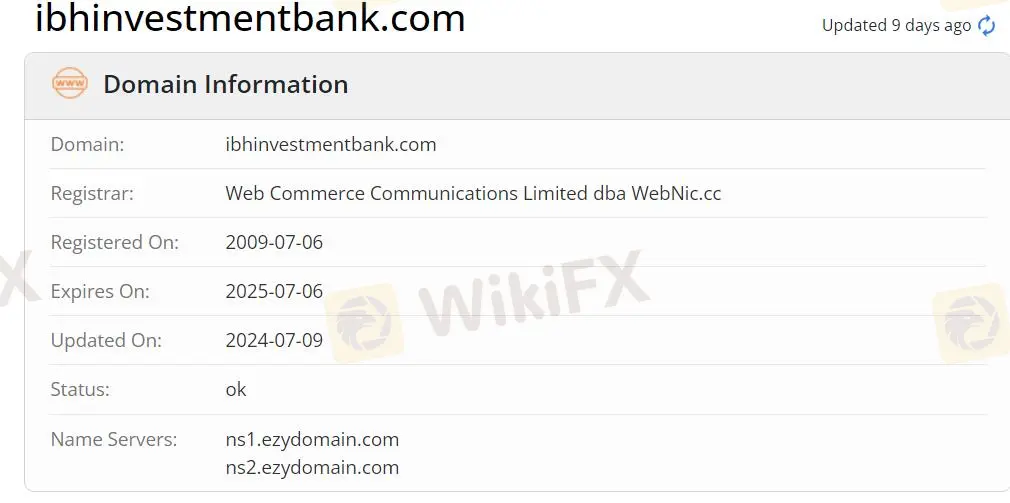

| Founded | 2009 |

| Registered Country/Region | Malaysia |

| Regulation | LFSA |

| Market Instruments | Derivatives, Futures, Forex |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | / |

| Min Deposit | / |

| Customer Support | Email: enquiry@ibhinvestmentbank.com |

| Adderss: Level 6F (2), Main Office Tower, Financial Park Complex, Jalan Merdeka | |

IBH was registered in Malaysia in 2009, offering trading in Derivatives, Futures, and Forex. It is regulated by the Labuan Financial Services Authority (LFSA).

Pros and Cons

| Pros | Cons |

| Regulated by LFSA | Lack of transparency |

| Only email support |

Is IBH Legit?

Yes. IBH is regulated by Labuan Financial Services Authority (LFSA).

| Regulated Country | Regulated Authority | Current Status | Regulated Entity | License Type | License Number |

|---|---|---|---|---|---|

| Labuan Financial Services Authority (LFSA) | Regulated | IBH Investment Bank Limited | Market Making (MM) | LL 06841 |

What Can I Trade on IBH?

| Tradable Instruments | Supported |

| Derivatives | ✔ |

| Futures | ✔ |

| Forex | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account

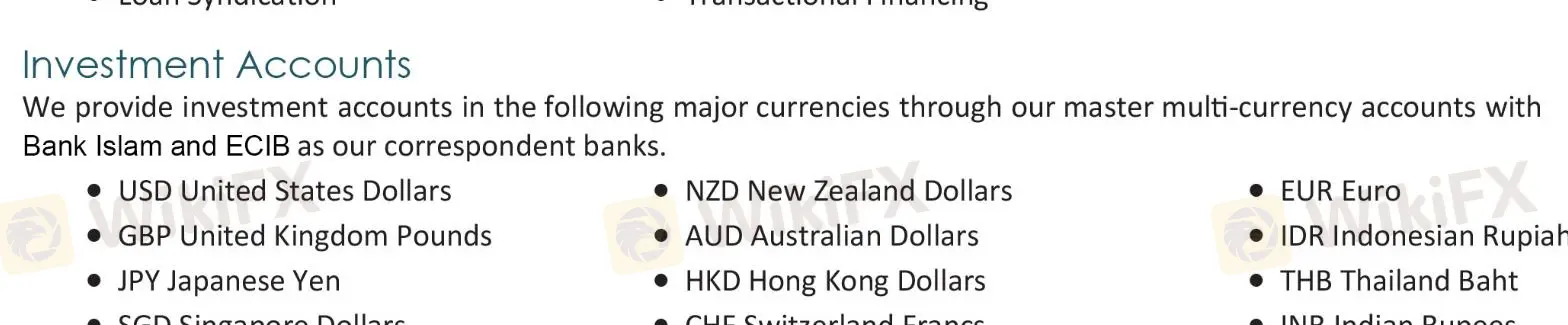

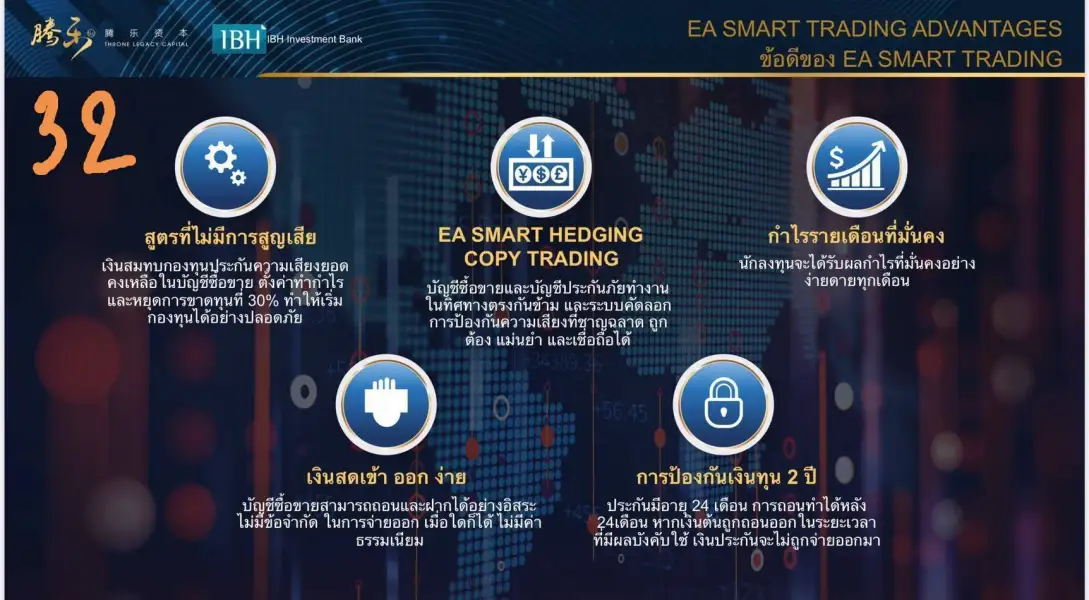

IBH accepts various currencies for the investment accounts, including USD, NZD, EUR, GBP, AUD, IDR, JPY, HKD, THB, SGD, CHF, and INR.

IBH Fees

All payments and investment income are free of withholding tax.

把酒作清欢

Hong Kong

I can't trade since I deposited on September 3 because my account wasn't activated and I can't log in to the website

Exposure

汤圆

Taiwan

This company won the trust of investors in the name of an investment bank. After the deposit, the agent team did not trade for nearly a month, and the contract cannot be terminated. Investors should be careful for such induced fraud behavior.

Exposure

紅色星星

Taiwan

It used to cooperate with TLC to sell financial products, which was vouched by IBH and supposed to operate for investors. Now it transferred to AVA and froze the money invested before. Stay away from it!

Exposure

蔡89405

Taiwan

A fraud platform. What they said that there is no handling fee and no spread in the early stage to lure people in to invest. Then, they do not withdraw after investors earning profit.

Exposure

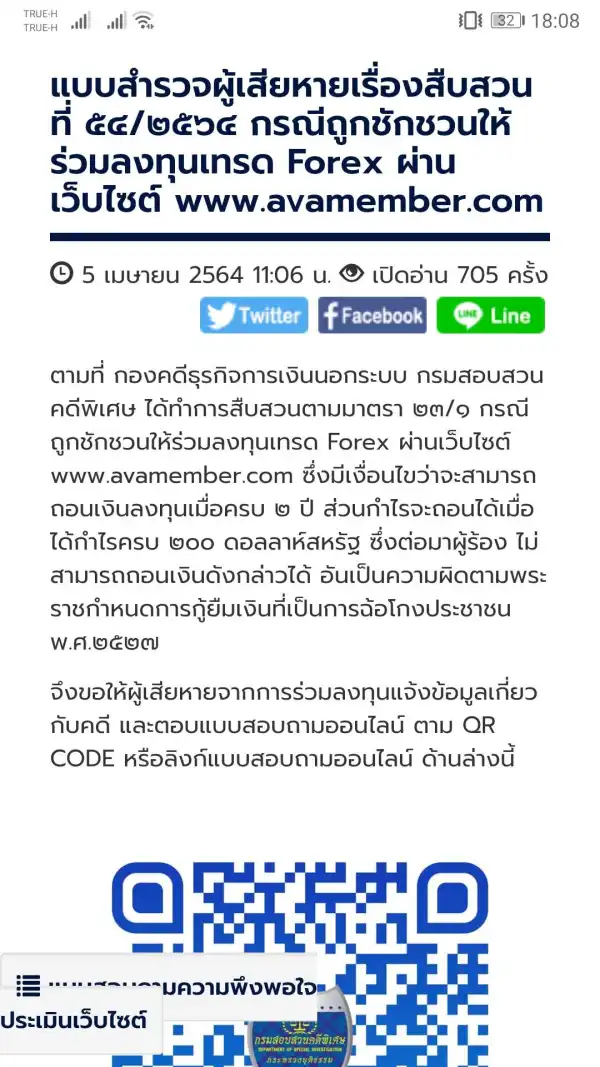

คณาวุฒิ ศรศิลป์

Thailand

Cheat you into investing forex. Unable to withdraw

Exposure

FX2389730430

Thailand

Pay attention

Exposure

FX3182302953

Japan

Transfer the money compulsorily and block it with an excuse! I have been unable to withdraw for half a year!

Exposure

FX1213571767

Thailand

I can't withdraw funds since December 2020. They ensured me that I could withdraw funds in January 2021. But now it was delayed to June.

Exposure

FX2389730430

Thailand

Tricked to buy GWF, PAMM, PAMM 2, PAMM3, APFF funds and unable to withdraw money, unable to close the fund. Brokers move money to another. Bad broker #IBH #AVA #Limestone #TLC

Exposure

sxsx

Thailand

IBH is not professional. You can withdraw your funds here

Exposure

FX2389730430

Thailand

I can't withdraw my money. Very worrying pamm1 pamm2 pamm3 GWF APFF

Exposure

FX2562998659

Singapore

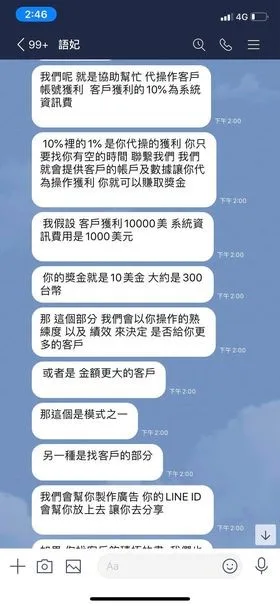

New Scam With investment. I share it with u so you can avoid being cheated. Someoney will teach u how to invest in a group chat. Deposit $100 and you can make three orders at the same time everyday, each order can profit 45. What u should do is to follow teachers’ tips. The first few orders can be profitable. But when u wanna keep investing you should add money. But at that time, you will begin to lose money. This is my own experience, yo u can share with each other! Can deposit funds but can’t withdraw.

Exposure

FX3521779860

Vietnam

Don't allow investors to withdraw funds with varied reasons. And IBH give the fund management right to others to avoid the responsibility

Exposure

Koala

Singapore

No trading, unable to close account, withdrawal not paid, no updates or information from management.

Exposure

FX1323876005

Malaysia

These are frauds who use edit to win customers’ confidence. They are all Chinese.

Exposure

FX2079112332

Malaysia

Can’t join the group to learn or withdraw funds. Keep asking you to deposit. Fraud

Exposure

许董88761

Singapore

I wanna withdraw at the beginning of June. But my application was refused on June 18 and I was told that we can’t withdraw until August. But the withdrawals are delayed agauin and again. I questioned in Zoom but they kept shrinking and asked us to be patient. Then they said they wouldn’t answer such kind of boring questions, still no answer. Injustice.

Exposure

FX2570513206

Malaysia

At first, they said I can profit a lot and asked me to deposit. Now I can’t withdraw but they keep asking me to add funds.

Exposure

FX1895049082

Singapore

The forex investment was initially a collaboration between TLC and IBH since March 2020. Since Jun 2020 the account was creased and withdrawal of fund was not allow at MT4.

Exposure