简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The latest trading hours of the stock exchange in 2025

Abstract:For investors groping in the global market, it is very important to understand the trading time of the stock market. Whether you are trading in the Asian market, tracking the Shanghai Composite Index, or monitoring UK time, understanding the opening and closing times of the stock market can have a significant impact on your trading strategy. This guide subdivides the trading hours of major exchanges around the world to help you keep up with the latest information and seize the opportunity.

For investors groping in the global market, it is very important to understand the trading time of the stock market. Whether you are trading in the Asian market, tracking the Shanghai Composite Index, or monitoring UK time, understanding the opening and closing times of the stock market can have a significant impact on your trading strategy. This guide subdivides the trading hours of major exchanges around the world to help you keep up with the latest information and seize the opportunity.

Analysis of Exchange Trading Time and Investment Strategy from a Global Perspective

The trading time of an exchange is a key factor for global investors to make asset allocation and trading decisions. Due to the differences in geographical location, cultural customs, and market structure, there are great differences in transaction time in different regions. This article will explore the trading time characteristics of major exchanges in North America, Europe, Asia, the Middle East, and Oceania and their impact on global investors.

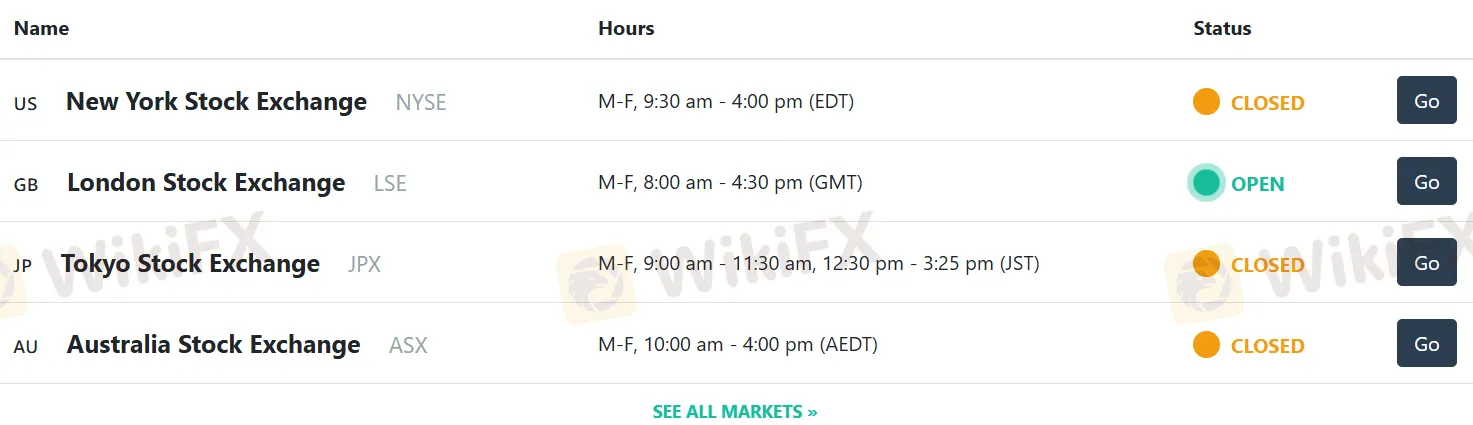

| Markets | Regular Trading Core Time ( M-F ) | Partial transaction core time ( M-F ) |

| NYSE (New York) | 9:30 am - 4:00 pm | 9:30 am - 1:00 pm |

| LSE (London) | 8:00 am - 4:30 pm | 8:00 am - 12:30 pm |

| JPX (Tokyo) | 9:00 am - 11:30 am12:30 pm - 3:25 pm | - |

| SSE (Shanghai) | 9:30 am - 11:30 am1:00 pm - 2:57 pm | - |

| HKEX (Hong Kong) | 9:30 am -12:00 pm1:00 pm - 4:00 pm (2:00 pm - 4:00 pm, irregular) | 9:30 am - 12:00 pm |

| SZSE (Shenzhen) | 9:30 am - 11:30 am1:00 pm - 2:57 pm | - |

| TSX (Toronto) | 9:30 am - 4:00 pm | 9:30 am - 12:50 pm |

| BSE (Mumbai) | 9:15 am -3:30 pm (9:15 am-10:00 am and 11:30 am-12:30 pm, irregular/9:15 am - 3:30 pm, postponed) | 6:00 pm -7:00 pm6:45 pm -7:00 pm |

| NSE (Mumbai) | 9:15 am - 3:30 pm (9:15 am -10:00 am and 11:30 am -12:30 pm, irregular/9:15 am -3:30 pm, postponed) | 6:00 pm -7:00 pm 6:45 pm - 7:00 pm |

| SIX (Zurich) | 9:00 am - 5:20 pm | - |

| ASX (Sydney) | 10:00 am - 4:00 pm | 10:00 am - 2:00 pm |

| JSE (Johannesburg) | 9:00 am - 4:50 pm | 9:00 am - 11:50 am |

| Bovespa (Sao Paulo) | 10:00 am - 4:55 pm | 1:00 pm - 4:55 pm |

| FSX (Frankfurt) | 8:00 am - 10:00 pm | 8:00 am - 2:00 pm |

| SGX (Singapore) | 9:00 am -12:00 pm1:00 pm - 5:00 pm | 9:00 am - 12:00 pm |

North American Market: Continuous Trading and Extended Trading Hours

The trading hours of the North American market represented by the New York Stock Exchange ( NYSE ) and the Nasdaq are 9: 30 a.m. to 4: 00 p.m. Eastern Time ( EST ) ( 2: 30 p.m. to 9: 00 p.m. Greenwich Mean Time ( GMT ) ). Unlike other regions, the North American market has no lunch break to ensure continuous trading throughout the day. This design improves market liquidity and provides investors with more trading opportunities.

In addition, the trading hours of the New York Stock Exchange and the Nasdaq were extended to 4: 00 p.m. to 8: 00 p.m. Eastern Time ( 9: 00 p.m. to 1: 00 a.m. Greenwich Mean Time ). Although the extended trading time is less liquid, it allows investors to adjust their positions outside the normal trading time, which is particularly useful for dealing with unexpected news or market events.

It is worth noting that the North American market is closed on major holidays such as Independence Day and Thanksgiving Day, and investors need to make plans to avoid trading disruptions.

European market: unified time, internationalization

Major European exchanges include the Pan-European Exchange and the London Stock Exchange ( LSE ). The trading hours of these exchanges are generally from 8: 00 a.m.to 4: 30 p.m.Greenwich Mean Time ( 9: 00 a.m.to 5: 30 p.m.Local Time in Paris ), and there is no lunch break. As an important financial center in the world, the London Stock Exchange's trading hours are highly synchronized with other European markets, facilitating cross-market operations for international investors.

European market holidays ( such as Good Friday, Labor Day ) may be different from other regions, investors need to pay special attention to, so as not to affect the trading plan.

Asian markets: lunch break and global trading overlap

The trading time of Asian markets varies from region to region. For example, the trading hours of the Shanghai Stock Exchange ( SSE ) are from 9: 30 a.m.to 3: 00 p.m.local time ( 1: 30 a.m.to 7: 00 a.m.Greenwich Mean Time ), and the lunch break is from 11: 30 a.m.to 1: 00 p.m.local time. The trading hours on the Tokyo Stock Exchange ( TSE ) are from 9: 00 a.m. to 3: 00 p.m. local time ( 12: 00 a.m. to 6: 00 a.m. GMT ), and the lunch break is from 11: 30 a.m. to 12: 30 p.m. local time.

The lunch break system in Asian markets reflects cultural practices, but may affect the continuity of trading for global investors. However, the overlapping trading hours of Asian European and American markets ( such as European morning and Asian afternoon ) provide opportunities for cross-market arbitrage and hedging.

Middle East Market: Unique Weekend Structure and Consecutive Trading

The Middle East market is represented by the Saudi Stock Exchange ( Tadawul ), which is open from 10: 00 a.m. to 3: 00 p.m. local time from Sunday to Thursday ( 7: 00 a.m. to 12: 00 p.m. GMT ). Unlike Western markets, Tadawul is also open on Sundays, reflecting the region's unique weekend structure. In addition, Tadawul has no lunch break to ensure continuous trading.

Middle Eastern market holidays such as Saudi Arabia's National Day and Eid al-Fitr are very different from holidays in other regions, and investors need to pay special attention.

Oceania market: flexible trading time

The Australian Stock Exchange ( ASX ) and the New Zealand Stock Exchange ( NZSX ) are the major exchanges in Oceania. The ASX is open from 10: 00 a.m. to 4: 00 p.m. The trading hours of the New Zealand Stock Exchange are 10: 00 a.m. to 4: 45 p.m. local time ( 10: 00 p.m. to 5: 00 a.m. Greenwich Mean Time ), while the trading hours of the New Zealand Stock Exchange are 10: 00 a.m. to 4: 45 p.m. local time ( 10: 00 p.m. to 5: 00 a.m. Greenwich Mean Time ). There is no lunch break in both markets, and trading hours are relatively flexible.

Oceania holidays, such as Australia Day and Christmas, may affect trading plans and require investors to adjust their strategies in advance.

Key considerations for global investors

Time zone awareness: Global investors must be skilled in using time zone conversion tools ( e.g., CST to IST or GMT to CST ) to match the trading time of the target market.

Market Holidays: Investors should regularly check whether the stock market is open or check the market holiday calendar to avoid trading disruptions.

Extending the trading time: Although extending the trading time provides greater flexibility, its lower liquidity requires careful operation.

Conclusion

The trading hours of major exchanges around the world have regional and cultural differences. The continuous trading and extended trading hours in North America, the unified time in Europe, the lunch break system in Asia, the unique weekend structure in the Middle East, and the flexible trading hours in Oceania all provide diversified trading opportunities for global investors. However, investors must pay close attention to time zone differences, holiday arrangements, and liquidity issues during extended trading hours to optimize their global investment strategies. By effectively planning trading time, investors can better control market dynamics and maximize the benefits of asset allocation.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Is Purple Trading a Scam? Honest User Reviews Reveal the Truth

Kraken Review: A Tale of Unsolved Withdrawal Issues & Poor Customer Support Service

IG Launches 5% Cashback Offer for New UK Customers

Forex Trading During Pakistan Market Hours: Best Time to Trade

KKR Exposed: Traders Allege Fund Scams, Withdrawal Denials & Regulatory Concerns

Gratitude Beyond Borders: WikiFX Thank You This Thanksgiving

Zipphy Exposed: No Valid Regulation, Risk Warning

KEY TO MARKETS Review: Are Traders Facing Withdrawal Delays, Deposit Issues & Trade Manipulation?

FCA Consumer Warning – FCA Warning List 2025

Australia’s Fraud-Intel Network Exposes $60M in Scams

Currency Calculator