Company Summary

Notice: BTSE website - https://www. BTSE .com/en/home cannot be entered normally at present. Therefore, we can only collect relevant information from the Internet.

risk warning

Trading online involves significant risks and you could lose all of your invested capital. It is not suitable for all traders or investors. Please ensure you understand the risks involved and note that the information contained in this article is for general information only.

Basic Information and Regulations

| basic | details |

| Supervision | No supervision |

| market tool | Cryptocurrencies, futures contracts and NFTs |

| account type | standard account |

| demo account | N/A |

| maximum leverage | 1:100 |

| Spread (EUR/USD) | N/A |

| Mercenary | 0.02%–0.10% for Maker, 0.04%–0.12% for Taker |

| trading platform | mobile software |

| Entry threshold | none |

| Deposit and withdrawal method | SWIFT, local bank transfer, SEPA, credit/debit card, IFSC, IMPS, cryptocurrency |

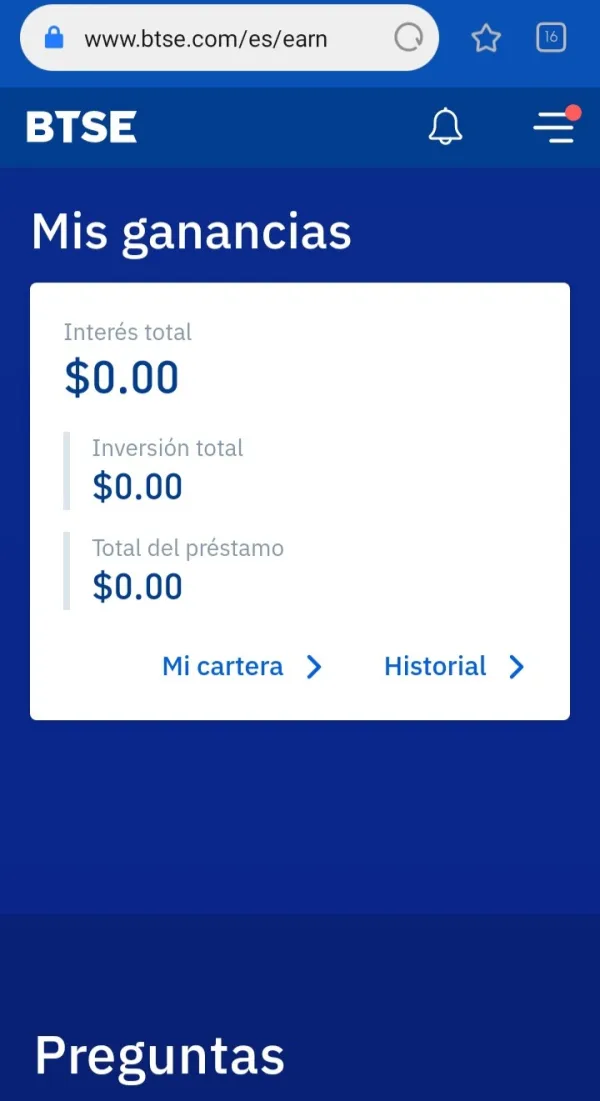

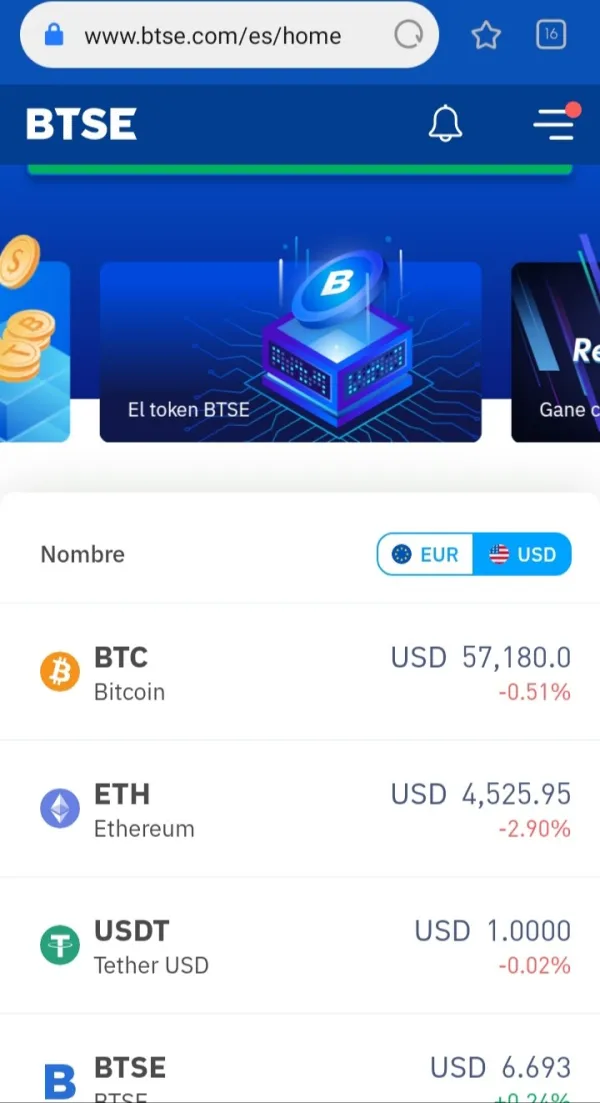

BTSEIt is a cryptocurrency trading platform incorporated in the Virgin Islands in 2018, providing leverage up to 1:100, and also provides 24/7 customer support services. Here is the homepage of the broker’s official website:

As for the regulatory situation, no effective regulatory information has been found so far. that's why BTSE The supervision status on wikifx is listed as "Not yet supervised" and only received a low score of 1.41/10.

market tool

BTSEIt advertises that it offers trading in cryptocurrencies (btc, eth, ltc, xrp, xmr, dot, luna, etc.), futures contracts, and nft.

account type

BTSEOnly one standard account is offered and there is no minimum deposit requirement.

lever

BTSEOffered leverage up to 1:100. Remember, the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can work to your advantage or against you.

Mercenary

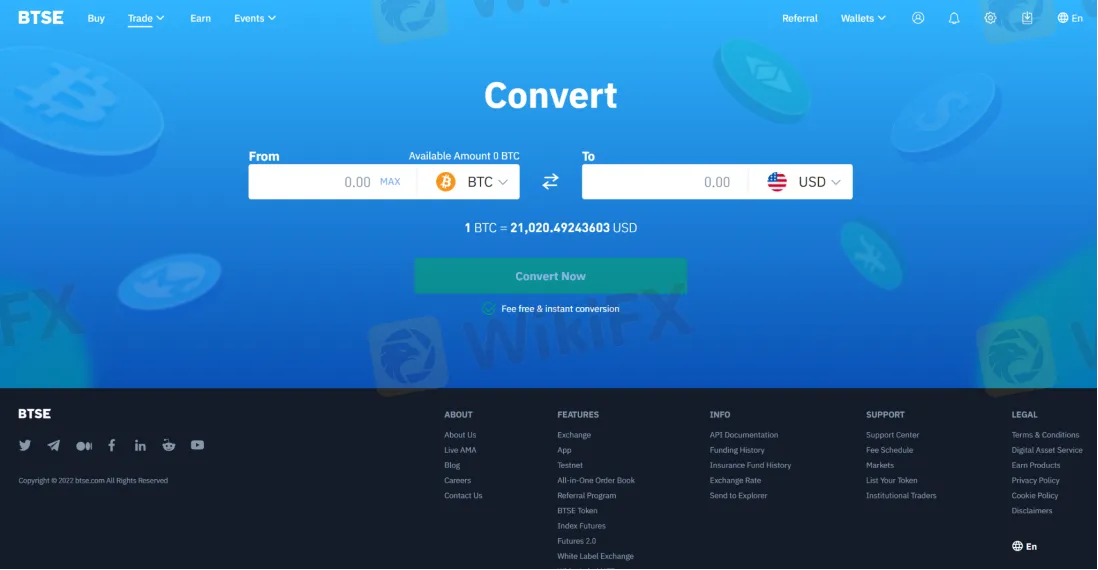

BTSEA certain commission will be charged, for the manufacturer, the commission is 0.02% – 0.10%; for the taker, the commission is 0.04% – 0.12%.

trading platform

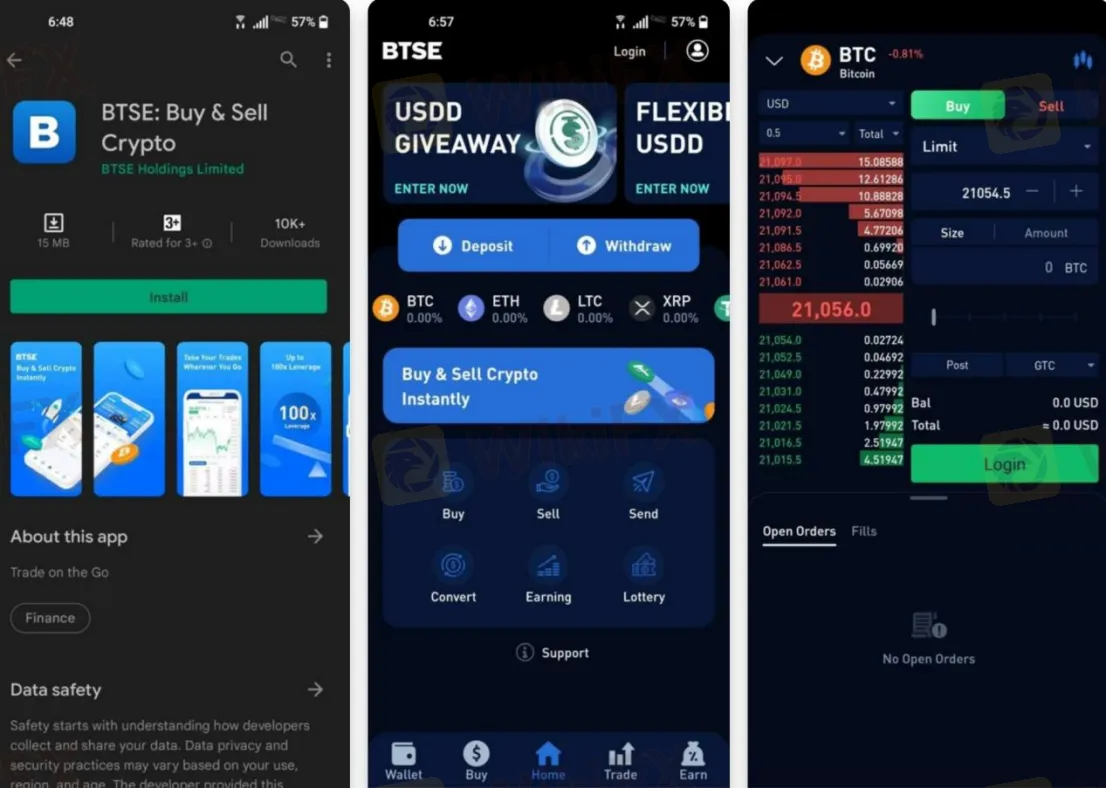

BTSEProvides a mobile application trading platform for Android phones and ios devices, enabling traders to trade anytime, anywhere without going through the hassle of accessing a laptop or desktop computer.

deposit and withdrawal

BTSESupport swift, local bank transfer, sepa, credit/debit card, ifsc, imps, cryptocurrency and other payment methods. The broker will charge a certain deposit and withdrawal fee, which varies according to the deposit and withdrawal method and assets.

Deposit fee:

SWIFT (all available fiat currencies): 0.05%

Global Bank Specialty Bank (UAE Dirham): 0.50%

Local Bank Transfer (Philippine Peso): Free

SEPA (Euro): Free

IFSC (Indian Rupee): 2%

IMPS (Indian Rupee): 2%

Withdrawal fee:

SWIFT (all available fiat currencies): 0.1% (minimum fee: $25)

Local Bank Transfer (Philippine Peso): 0.2% (minimum fee: USD 10)

SEPA (EUR): 0.1% (minimum charge: 3 EUR)

IFSC (Indian Rupees): Free

IMPS (Indian Rupees): Free

customer support

E-mail: support@ BTSE .com;

Social media: Twitter, Facebook, YouTube and LinkedIn;

Advantages and disadvantages

| advantage | shortcoming |

| • No deposit threshold | • not regulated |

| • Rich and diverse cryptocurrency trading tools | • Website won't open |

| • High deposit and withdrawal fees |

common problem

| Q 1: | BTSEIs it regulated? |

| A 1: | No valid regulatory information has been found so far. |

| Q 2: | BTSEtradersAre there any regional restrictions? |

| A 2: | BTSENot available to residents of the United States, Belarus, Cuba, Eritrea, Iran, North Korea, Syria, and Venezuela. |

| Q 3: | BTSEDoes it support mt4 and mt5 trading platforms? |

| A 3: | Not supported, only mobile app is provided. |

| Q 4: | BTSEWhat is the deposit threshold? |

| A 4: | There is no entry threshold. |

| Q 5: | BTSEIs it friendly to newbies? |

| A 5: | It is not recommended for anyone to trade with such unlicensed brokers. Please be sure to check the supervision carefully before trading. |