Company Summary

Note: FXDD's official website: https://www.fxddtrading.com/bm/en is currently inaccessible normally.

| FXDDReview Summary | |

| Founded | 2002 |

| Registered Country/Region | Malta |

| Regulation | Suspicious Clone |

| Market Instruments | Forex, Metals, Stocks, Energies, Indices, Stocks and Cryptocurrencies |

| Account Type | Standard accounts and ECN accounts |

| Demo Account | ✔ |

| Leverage | Up to 1:100 |

| Spread | 1.8 pips |

| Trading Platform | MT4, MT5, WebTrader and FXDD Mobile |

| Min Deposit | $100 |

| Payment Methods | Visa, UnionPay, Neteller, Skrill, Bank Wire and TMI Trust Company |

| Customer Support | Phone: +1 (212) 720-7200 |

| Email: support@fxddtrading.com | |

| Address: 525 Washington Blvdjersey City, NJ 07310 | |

FXDD Information

FXDD, founded in 2002, is a brokerage registered in Malta. The trading instruments it provides cover Forex, Metals, Stocks, Energies, Indices, Stocks and Cryptocurrencies. The Whois website shows that the registration date of this dealer is 2002-05-22.

Pros and Cons

| Pros | Cons |

| Offers diverse market instruments | Suspicious clone |

| No deposit or withdrawal fees for most methods | Some negative reviews from clients |

| MT4 and MT5 supported | No 24/7 customer support |

| Demo account available |

Is FXDD Legit?

FXDD is regulated by Malta. It has 2 types of licenses - MFSA License, NFA License. But the current status of these licenses is suspicious clone.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number | Current Status |

| Malta | MFSA | TRITON CAPITAL MARKETS LTD | Market Making(MM) | C48817 | Suspicious Clone |

| Unites States | NFA | FXDIRECTDEALER LLC | Common Financial Service License | 0397435 | Suspicious Clone |

What Can I Trade on FXDD?

FXDD offers traders the opportunity to trade Forex, Metals, Stocks, Energies, Indices, Cryptocurrencies.

| Tradable Instruments | Supported |

| Metals | ✔ |

| Forex | ✔ |

| Cryptocurrencies | ✔ |

| Indices | ✔ |

| Energies | ✔ |

| Stocks | ✔ |

| Derivatives | ❌ |

| Futures | ❌ |

| Options | ❌ |

Account Types

FXDD offers 2 different types of accounts to traders - Standard accounts and ECN accounts. It also provides an Demo Account.

FXDD Fees

FXDD charges no commissions. But it charges an inactivity fee.

The amount of the fee depends on how long the account has been inactive, $40 for accounts inactive for less than 1year, $50 for accounts inactive for 1-2 years, $60 for accounts inactive for 2-3 years, and $70 for accounts inactive for over 3 years.

Trading Platform

FXDD's trading platform is MT4 Margin WebTrader, MT5 Margin WebTrader and an app - FXDD Mobile, which supports traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT4 Margin WebTrader | ✔ | Web, Mobile |

| MT5 | ✔ | Web, Mobile |

| FXDD Mobile | ✔ | Mobile |

Deposit and Withdrawal

FXDD provides numerous means of deposit and withdrawal choices, consisting of Visa, UnionPay, Neteller, Skrill, Bank Wire and TMI Trust Company. Most deposits and withdrawals do not incur any fees. The minimum deposit is $100.

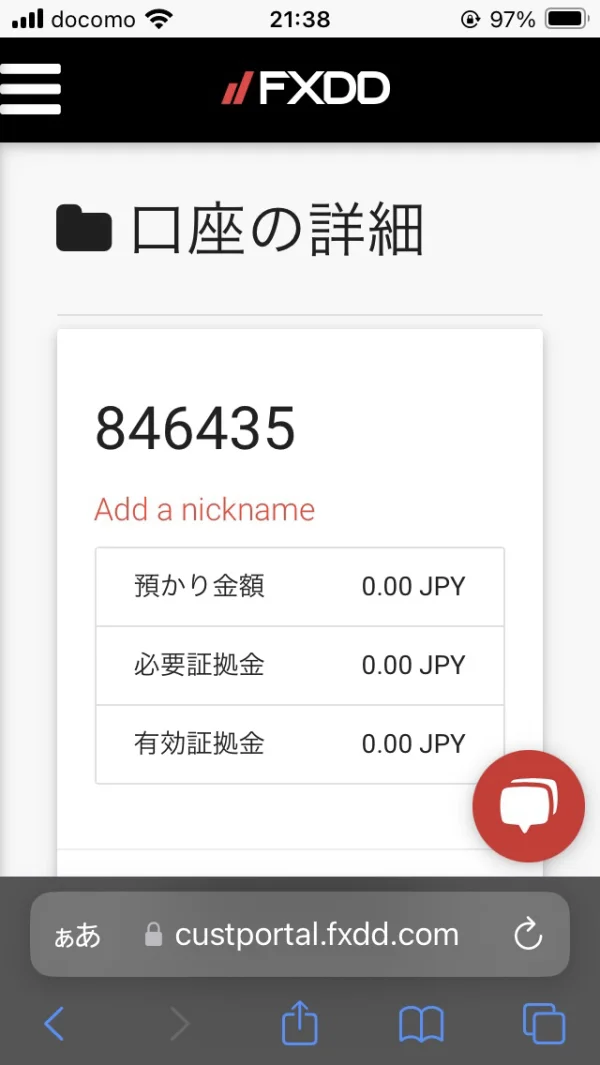

jsc2527

Hong Kong

Customer service and website are closed. I can't log in to my account and can't withdraw several thousand US dollars.

Exposure

糊涂1319

Hong Kong

Cannot contact anything, no response to emails, and cannot access the platform.

Exposure

FX1161189448

Japan

Even after repeatedly requesting withdrawals, the funds remained at 0 without any withdrawals being made... I can't even log in anymore. Even after contacting them, I haven't received any response. Unfortunately, I didn't keep any evidence such as photos, so there's nothing I can do.

Exposure

交易反思

Hong Kong

The problem of not being able to withdraw funds now is due to shell companies in domestic, and it has nothing to do with the American FXDD company.

Exposure

修仙4634

Hong Kong

I am an agent client of FXDD company. Before May 2024, the agent commission was transferred to my account on the 15th of each month. However, the commission of over $4000 for June and July 2024 has not been credited to my account. I have been sending emails to customer service every day, but they have not replied. I have not received any email from FXDD customer service until now.

Exposure

修仙4634

Hong Kong

FXDD is a fraudulent American company; everyone should avoid opening accounts with this company. Currently, FXDD's trading accounts cannot even connect, let alone withdraw funds. Customer service does not respond to emails, and there is no Chinese consultation phone number. Those considering opening an account should opt for companies with dedicated Chinese consultation phone numbers for more reliable and secure financial transactions.

Exposure

修仙4634

Hong Kong

Since June 2024, the commission refunds have not been credited to my account, and now I cannot log in to my account.

Exposure

王岗

Hong Kong

Unable to log in!!

Exposure

交易反思

Hong Kong

Withdrawal of principal for one week, no response, no response to email

Exposure

木子4219

Hong Kong

It's been over two months; I can't withdraw funds, customer service is unreachable, and I can't log into the client. Finally, the MT4 server is gone, and I can no longer log in at all.

Exposure

jsc2527

Hong Kong

Multiple withdrawal requests have been made, but the platform does not pay out, and customer service does not respond.

Exposure

神经蛙75

Hong Kong

It has been over two months, two withdrawal requests, and they are still in pending status. Please help me! 😭

Exposure

FX8747171892

United States

I have been requesting withdrawal of all possible options and amounts since March 18th, and it always remains pending.

Exposure

Rodriguez 06

Pakistan

The FXDD Mobile app works, but it's missing some stuff from the desktop version. Needs a few upgrades. Besides, support usually gets back to you, but sometimes it takes forever. They're friendly, though.

Neutral

cyw2024

Hong Kong

After depositing in June, I haven't received it until now, and customer service hasn't responded either.

Exposure

雀跃

Hong Kong

FXDD platform is a platform I have been using for more than ten years. I didn't expect that I can't withdraw money now, customer service is unresponsive, or I have been scammed. I am speechless.

Exposure

FX1650727096

Hong Kong

I can't withdraw my funds. I applied in early June, but I haven't withdrawn my funds yet. Customer service won't respond.

Exposure

FX1650727096

Hong Kong

They won't process withdrawals, customer service doesn't respond, and I've been unable to withdraw my money. I'm really angry.

Exposure

FX2814111611

Egypt

I requested to withdraw $5,550 since last May 6, and the amount has been deducted from my account and I have not received it yet, in addition to procrastination from support. After all this, no one responds from support. Despite all this, withdrawal and deposit methods have been closed from the customer area, and no one responds to any email or email. Live Chat Broker violated all financial conduct rules and I do not recommend dealing with them

Exposure

FX2032207426

Egypt

I can't withdrawal my money from 4th jun.ni customer service reply.don't ever ever try this company

Exposure

FX3907192483

Japan

Hello, I am in great distress and need assistance. I have submitted a withdrawal request to FXDD, but for some reason, it is being held in suspense. My user profile shows the name as "古賀俊之," but my official name is "古賀敏之." I have notified support via email about this. Last week, I sent dozens of emails, but I have been ignored and received no response. If there are any specific strategies on how I can make a withdrawal, please let me know.

Exposure

木子4219

Hong Kong

I withdrew funds on June 5th, but the funds have not been credited to my account until today. The customer service is not online and the emails are not responded. The customer service urged the finance department, but there was no response later. Only a notification email was sent, and then no news.

Exposure

俭以养德

Hong Kong

I traded in fxdd more than ten years ago, and I always thought that FXDD was a listed company and an experienced forex dealer. On February 16th, I deposited $302, $75 bonus, and earned $100. On May 16th I applied for a withdrawal of $415. The platform said that the amount exceed the limit and did not give me money. The $415 deducted in the account flew. I haven't seen a refund for half a month.

Exposure