Company Summary

| Quick IB Review Summary | |

| Founded | 1978 |

| Registered | Hong Kong |

| Regulation | ASIC, FCA, FSA, SFC, CIRO |

| Market Instruments | 150 markets, stocks/ETFs, options, futures, spot currencies, bonds, mutual funds |

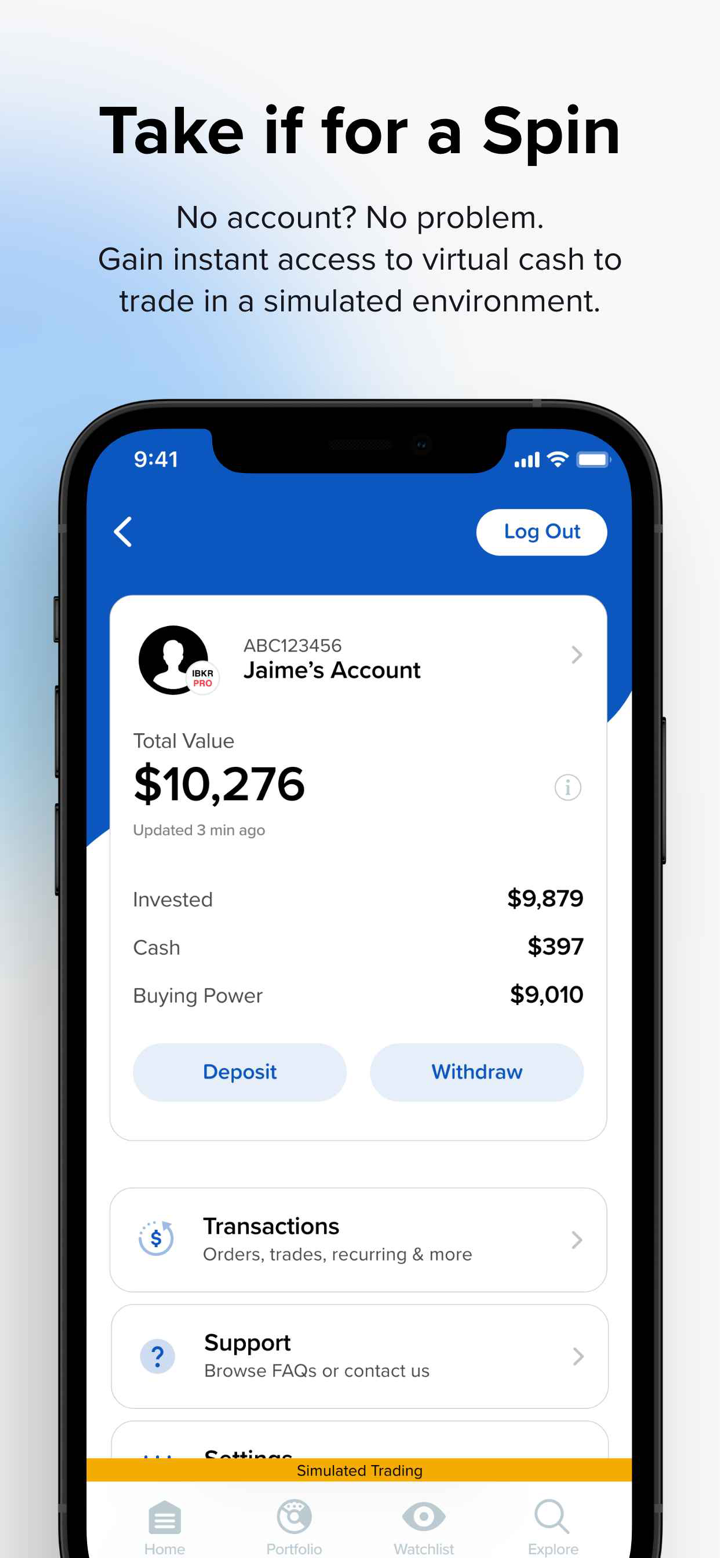

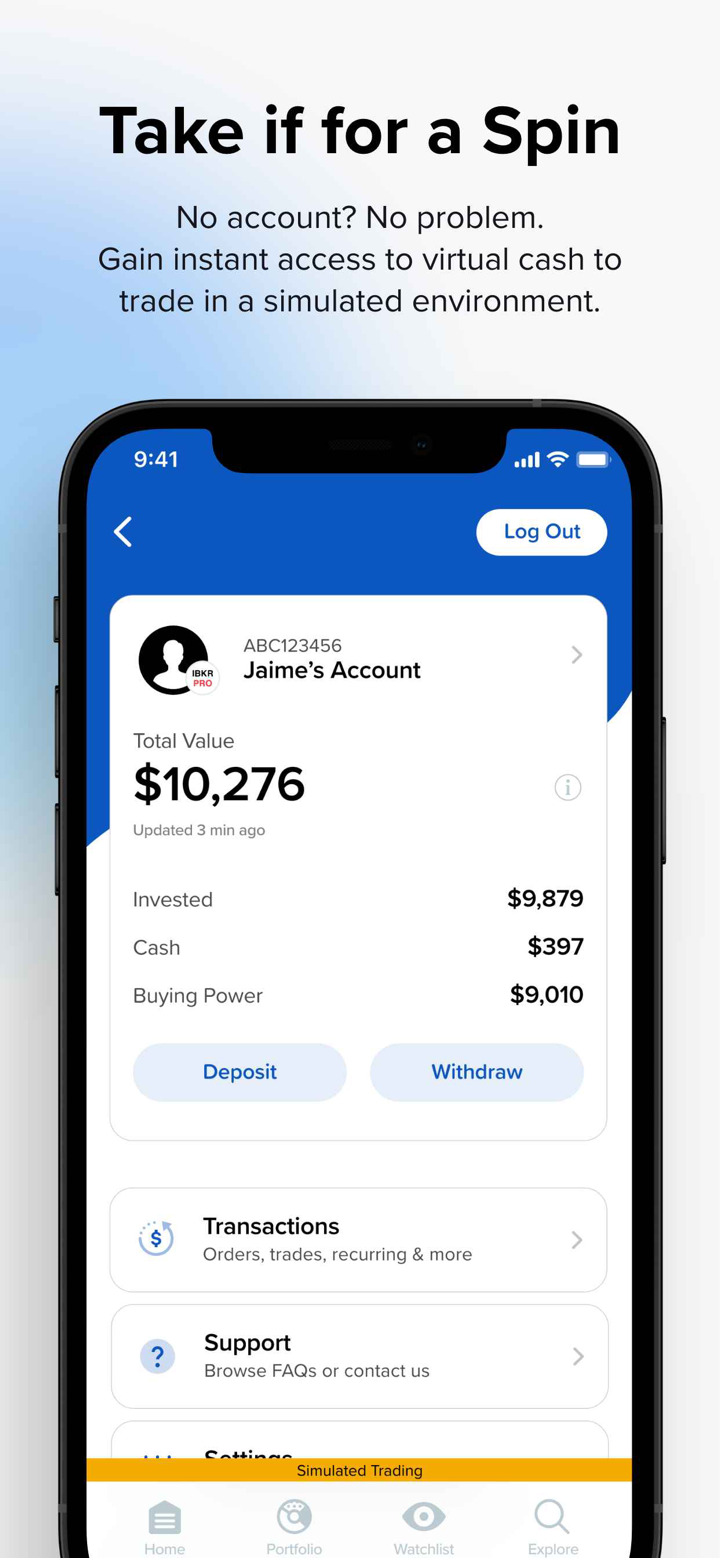

| Demo Account | ✅ |

| Account Type | Individual, Joint, Retirement, Trust, Family, Institutional |

| Min Deposit | $0 |

| Leverage | Up to 1:400 |

| Spread | From 0.1 pips |

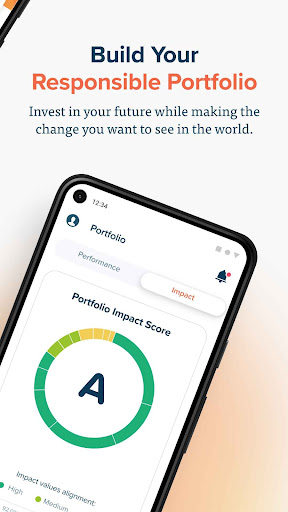

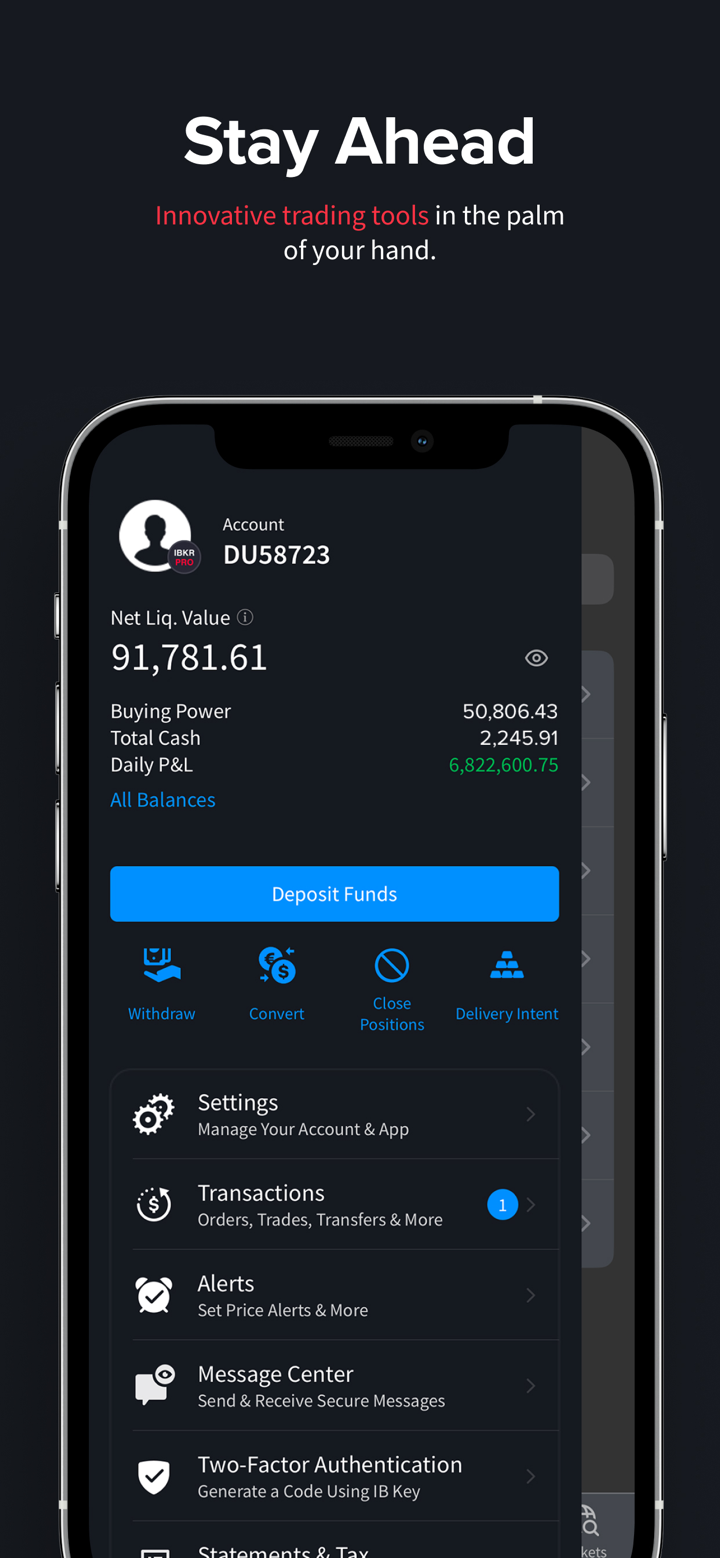

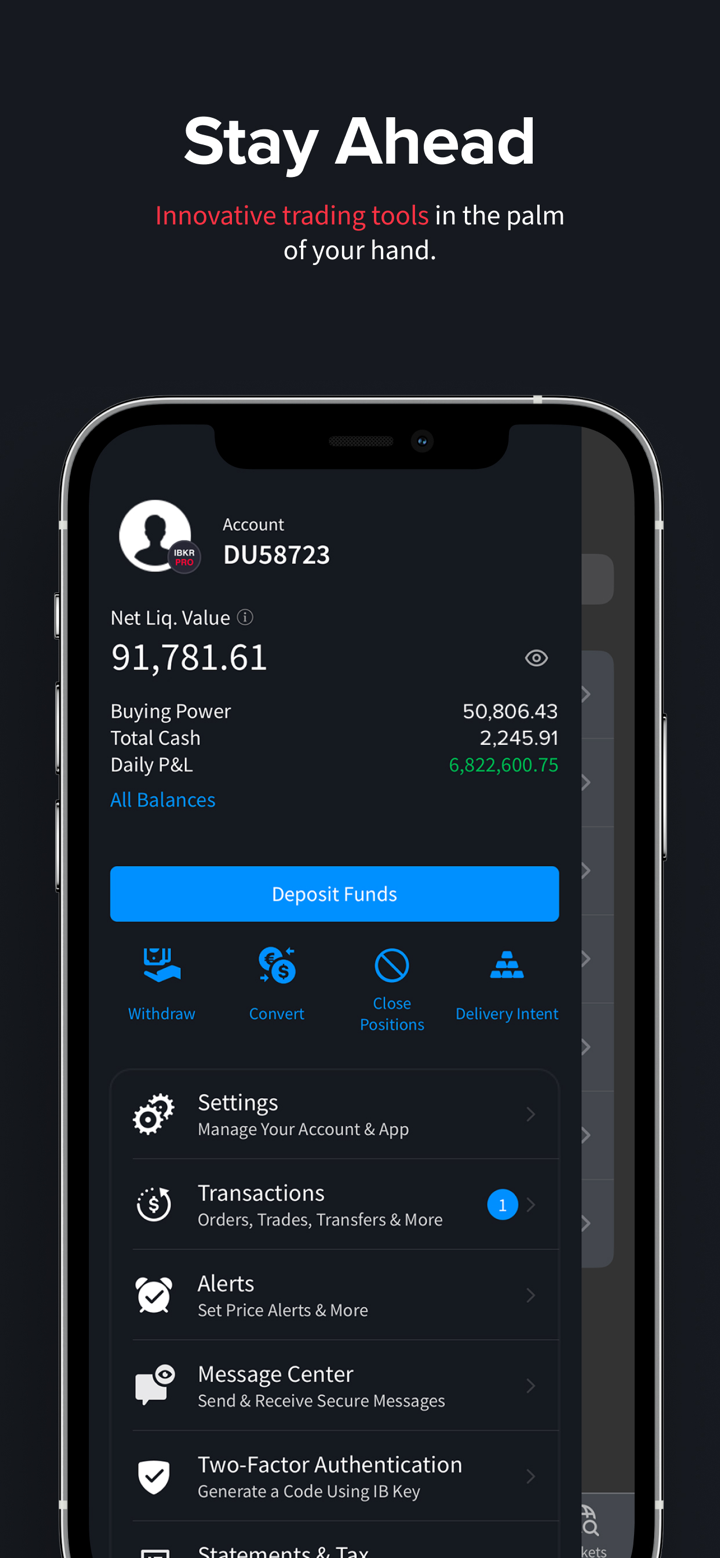

| Trading Platform | IBKR GlobalTrader (Mobile), Client Portal (Web), IBKR Desktop, IBKR Mobile, Trader Workstation (TWS) (Desktop), IBKR APIs (Desktop), IBKR ForecastTrader (Web), IMPACT (Mobile) |

| Inactivity Fee | ❌ |

| Customer Support | Live chat, phone, email, FAQs |

IB Information

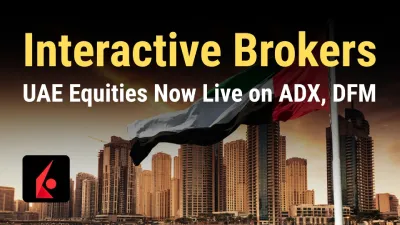

IB, or Interactive Brokers, is a discount brokerage firm founded in the United States in 1978. It is headquartered in Greenwich, Connecticut, and has offices in several other countries, including the United Kingdom, Hong Kong, and Australia. The company provides electronic brokerage services to individual and institutional clients, offering a range of financial products, including 150 markets including stocks/ETFs, options, futures, spot currencies, bonds, and mutual funds. Interactive Brokers is regulated by several financial authorities, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), and CIRO (Canada).

Pros & Cons

Interactive Brokers (IB) has many advantages, including low commissions, access to a wide range of financial products, and a highly customizable trading platform. Additionally, IB is known for its advanced research tools and competitive pricing.

However, complex trading platforms are not suitable for all investors.

Below is a table outlining the pros and cons of Interactive Brokers (IB):

| Pros | Cons |

| • Wide range of trading instruments | • Complex platform and steep learning curve |

| • Advanced trading platform with many features | |

| • Low trading fees and commissions | |

| • Access to international markets and exchanges | |

| • Multiple account types to choose from | |

| • Strong regulatory oversight and safety of client funds |

Note: This table is based on general observations and may not represent the experience of every individual user.

Is IB Legit?

Interactive Brokers is a well-established and reputable broker. The company is publicly traded and regulated by multiple top-tier financial authorities around the world, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), and CIRO (Canada).

| Regulated Country | Regulated by | Regulated Entity | License Type | License Number |

| Australia Securities & Investment Commission (ASIC) | INTERACTIVE BROKERS AUSTRALIA PTY LTD | Market Making (MM) | 000453554 |

| Financial Conduct Authority (FCA) | Interactive Brokers (UK) Ltd | Market Making (MM) | 208159 |

| Financial Services Agency (FSA) | インタラクティブ・ブローカーズ証券株式会社 | Retail Forex License | 関東財務局長(金商)第187号 |

| Securities and Futures Commission of Hong Kong (SFC) | Interactive Brokers Hong Kong Limited | Dealing in futures contracts & Leveraged foreign exchange trading | ADI249 |

| Canadian Investment Regulatory Organization (CIRO) | Interactive Brokers Canada Inc. | Market Making (MM) | Unreleased |

Furthermore, the broker has a long history of providing high-quality services to its clients, with a track record of financial stability and reliability. Therefore, based on these factors, it can be concluded that IB is a legitimate broker.

How Are You Protected?

Interactive Brokers (IB) provides a range of security measures to protect its clients' funds and personal information. Some of the key security measures include:

| Protection Measure | Detail |

| Regulatory Oversight | ASIC, FCA, FSA, SFC, CIRO |

| Account Protection | SIPC protection (up to $500,000) and additional third-party insurance coverage (up to $30 million) |

| Two-Factor Authentication | adding an extra layer of security to their accounts |

| Secure Login System | a proprietary security measure that requires users to have a security device to log in to their accounts |

| Privacy Policy | outlines how it collects and uses customer data |

| Secure Website | uses SSL encryption on its website to protect user data and prevent unauthorized access |

| Cybersecurity Measures | firewalls, intrusion detection systems, and encryption, to protect against cyber threats |

It's important to note that while no investment platform can completely eliminate risk, IB's measures are designed to mitigate risk and protect its clients as much as possible.

Our Conclusion on IB Reliability:

Based on the information provided, Interactive Brokers is a reliable broker with a strong focus on client protection and security measures. It is regulated by multiple authorities and has a history of being in the industry for several decades.

Market Instruments

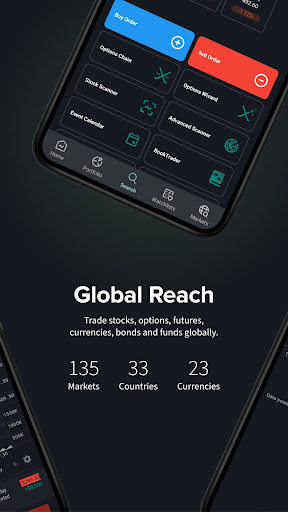

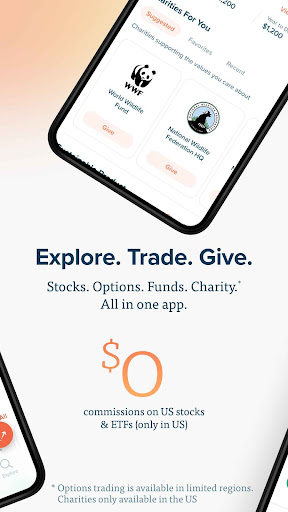

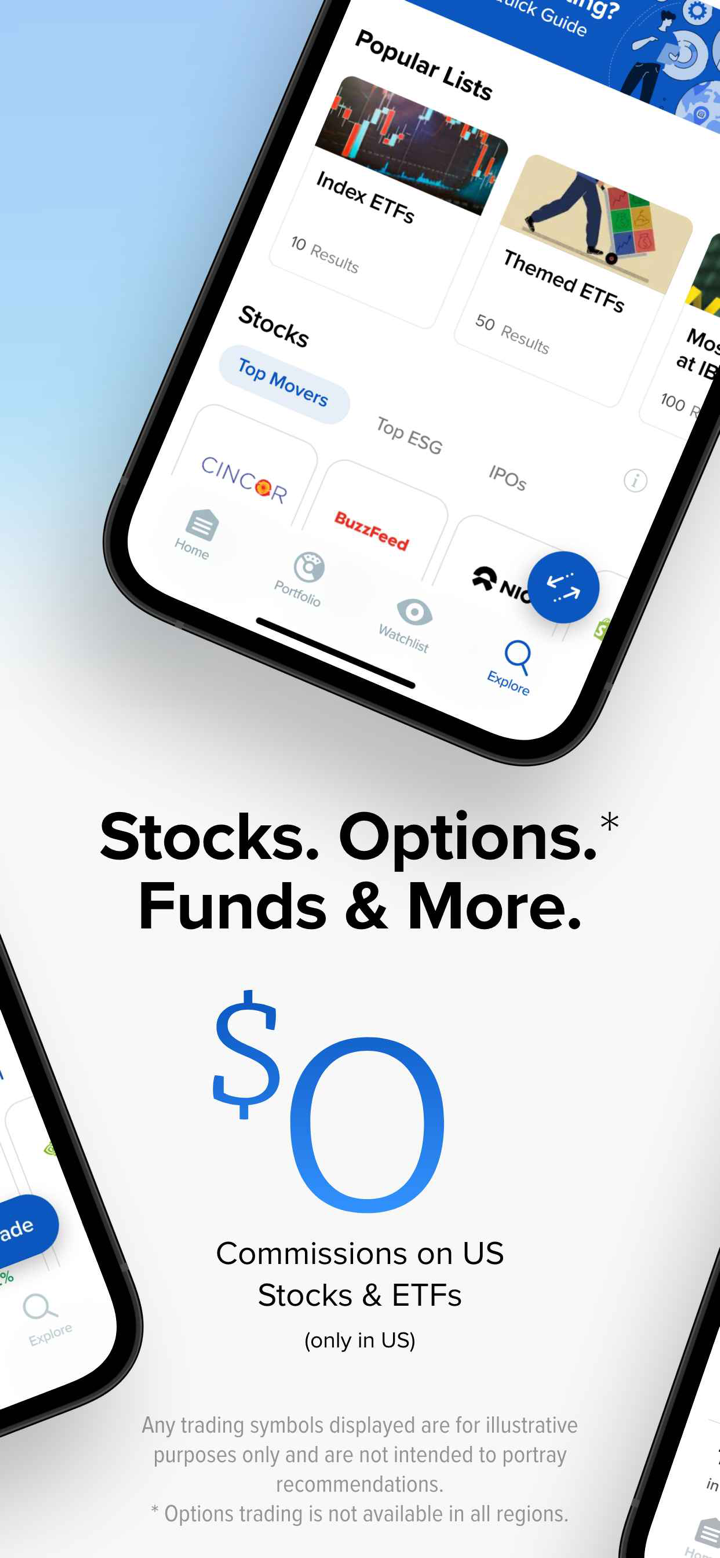

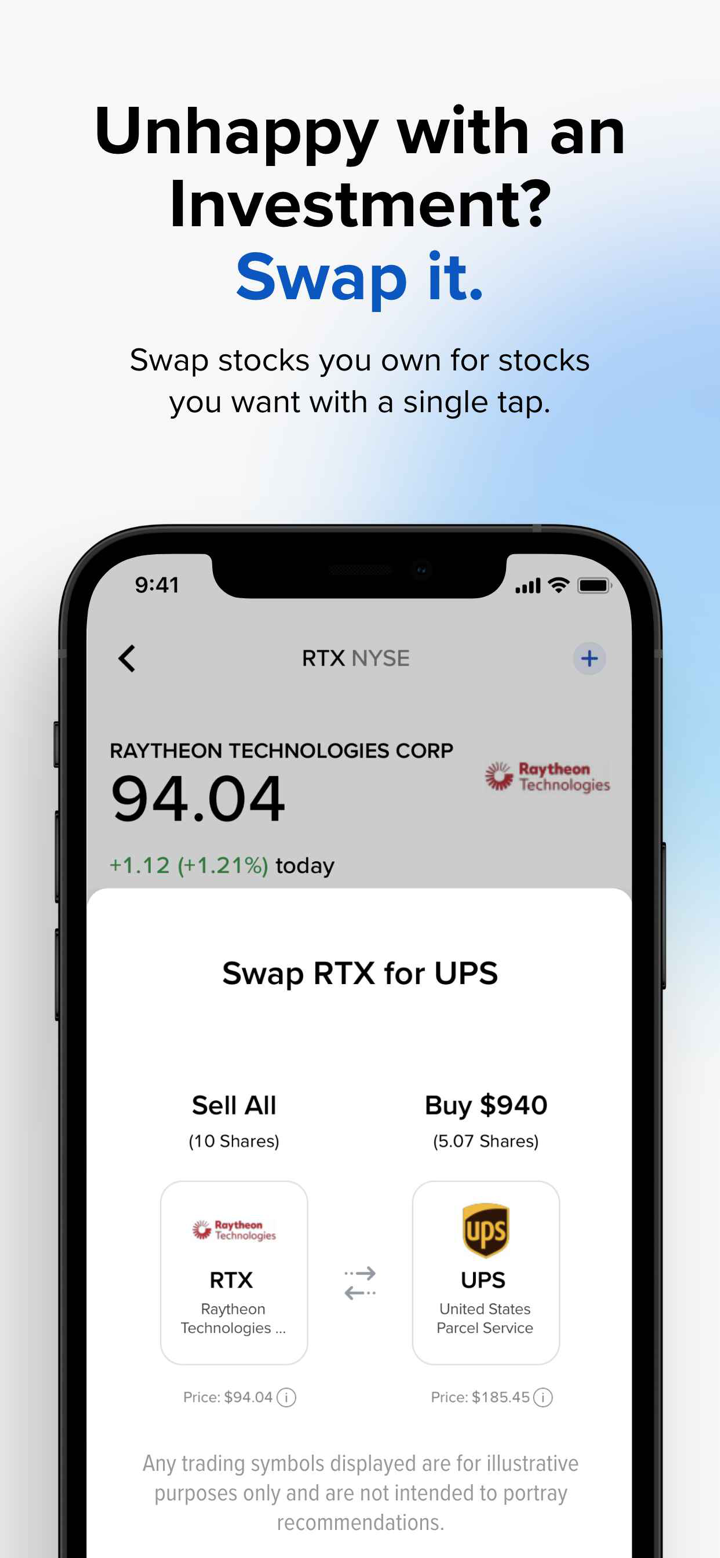

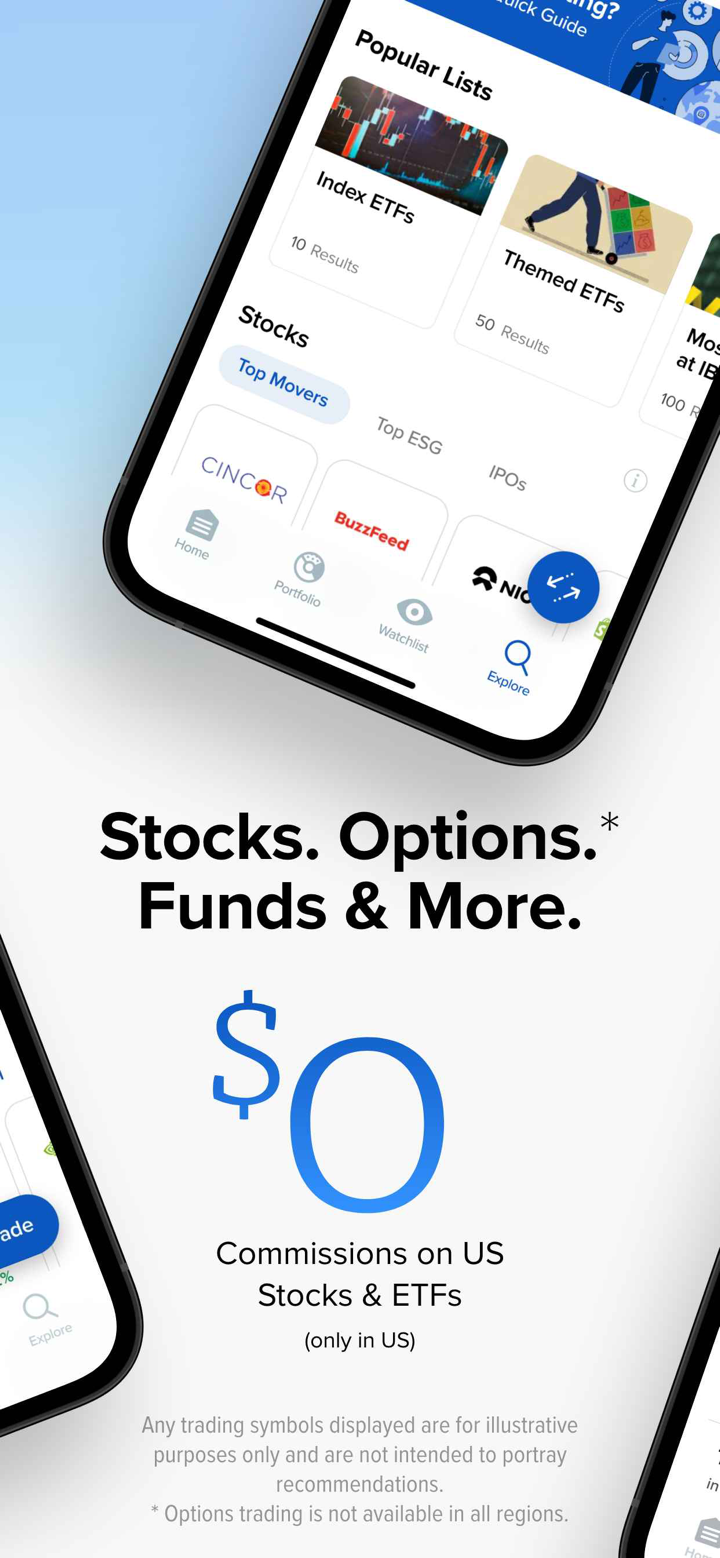

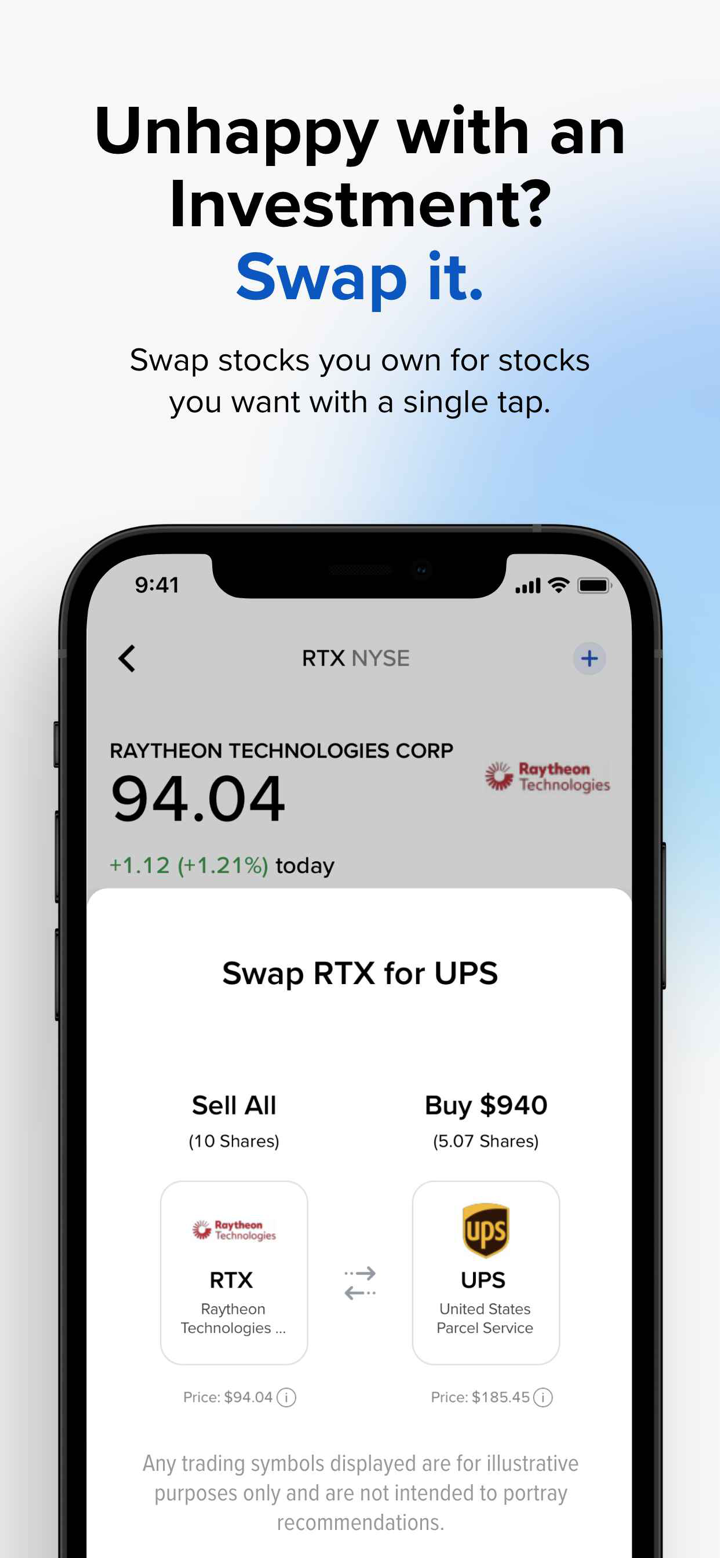

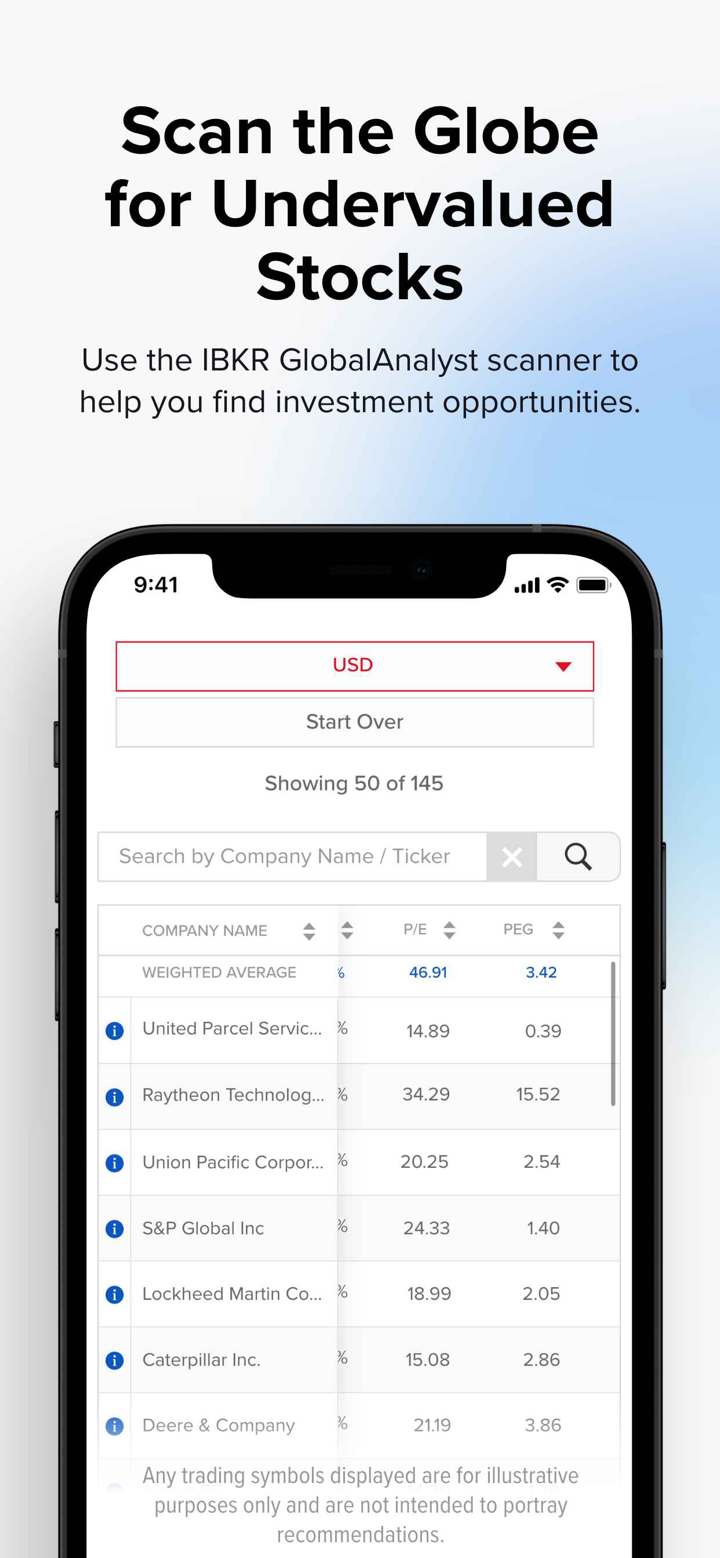

IB offers 150 markets across multiple asset classes, including:

- Stocks: IB provides access to over 135 markets and 35 countries, with more than 9,000 stocks available to trade.

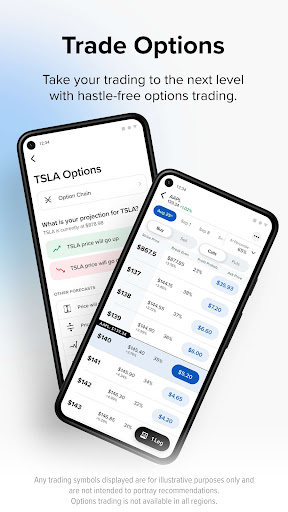

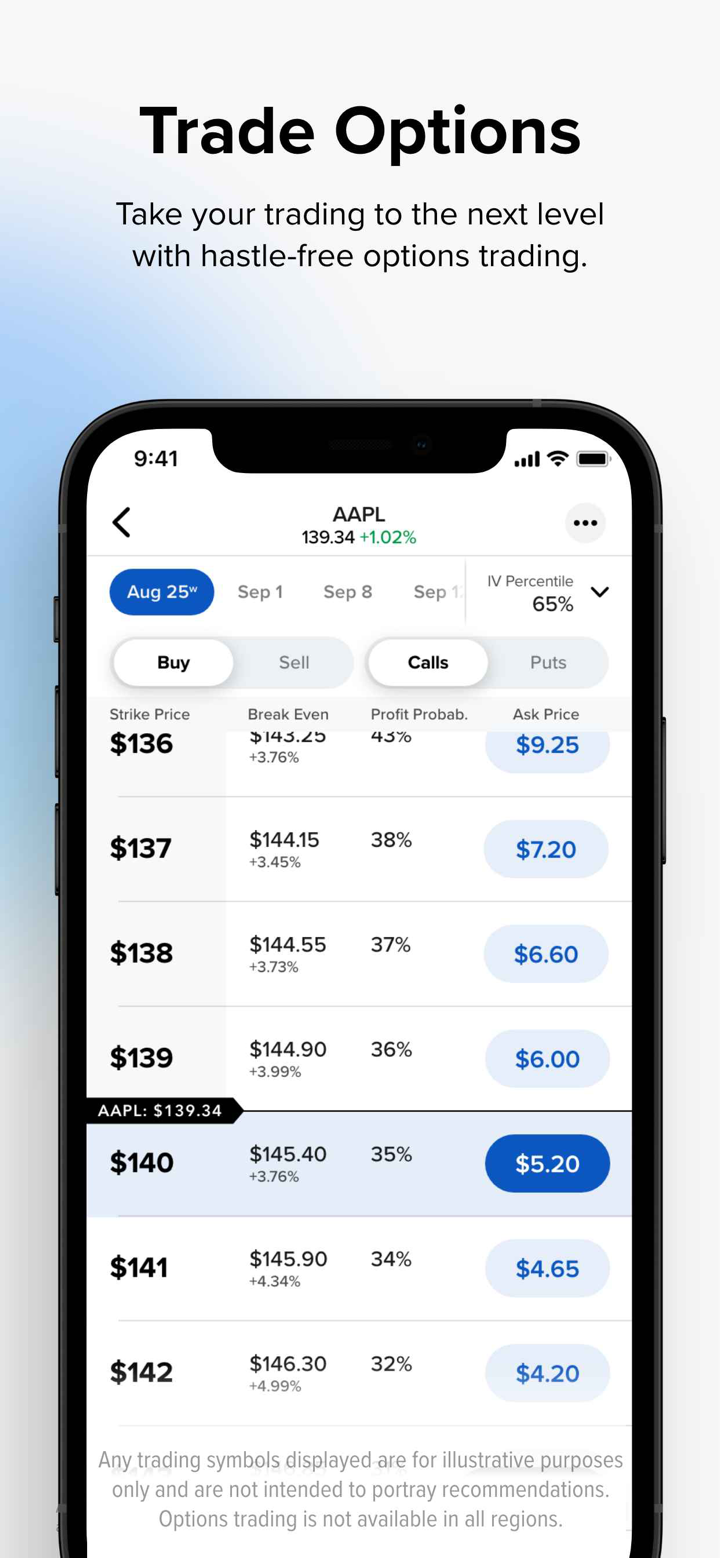

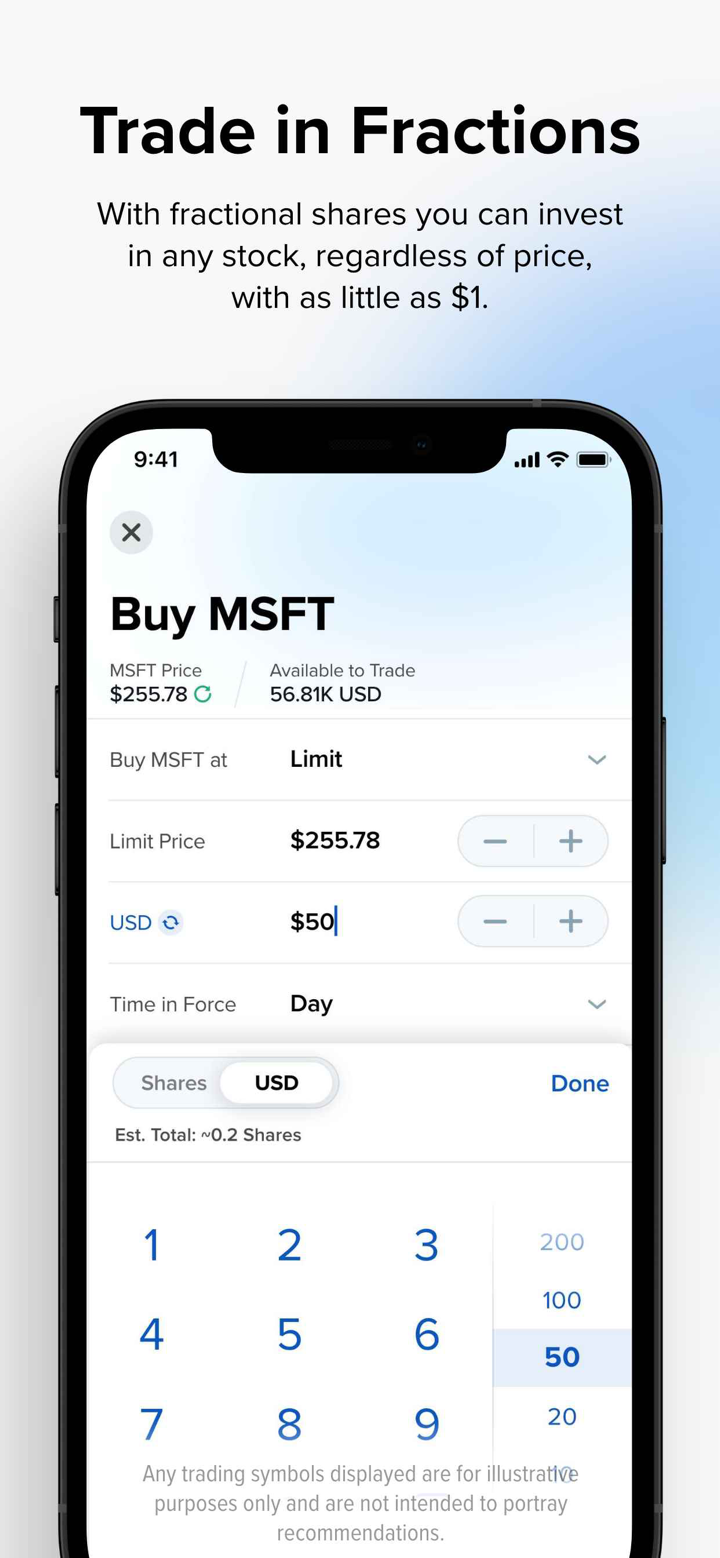

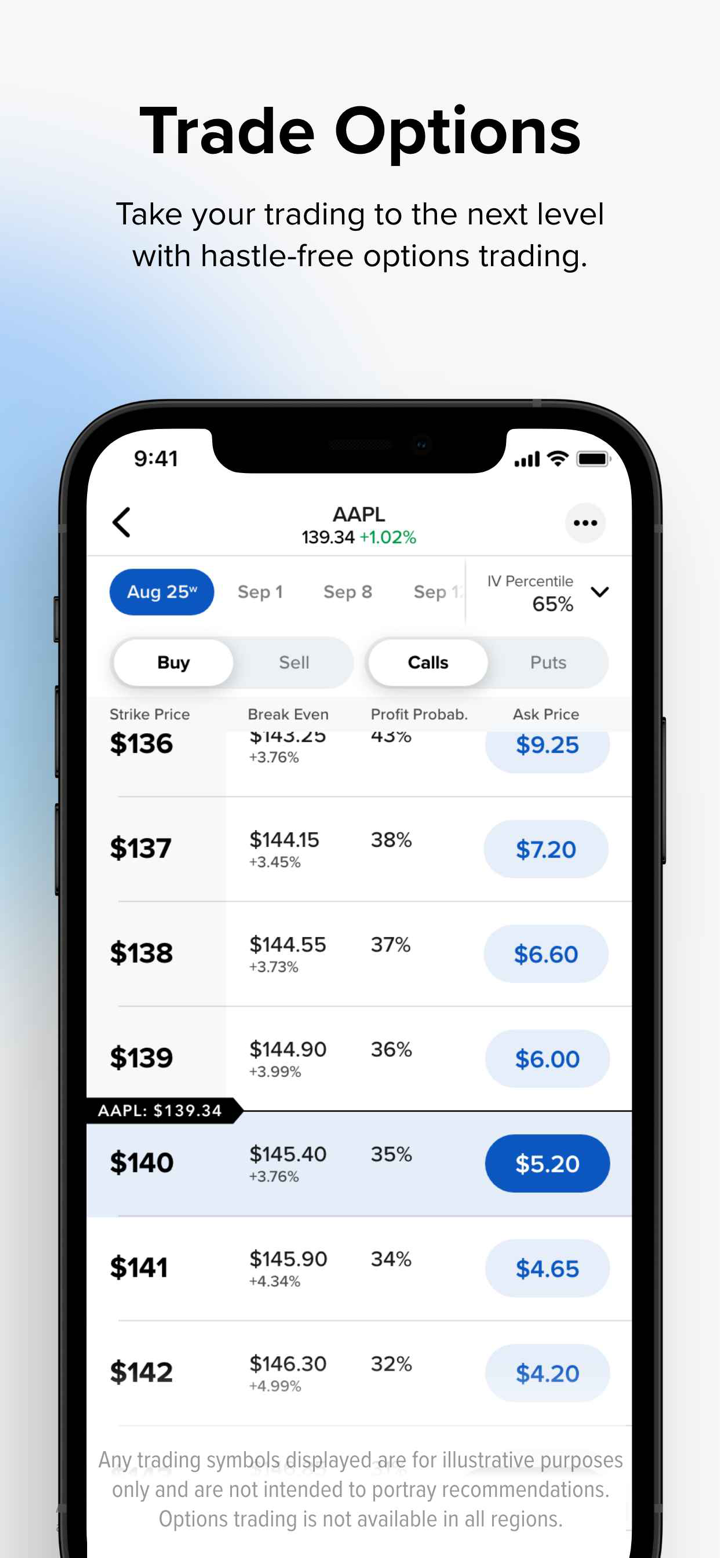

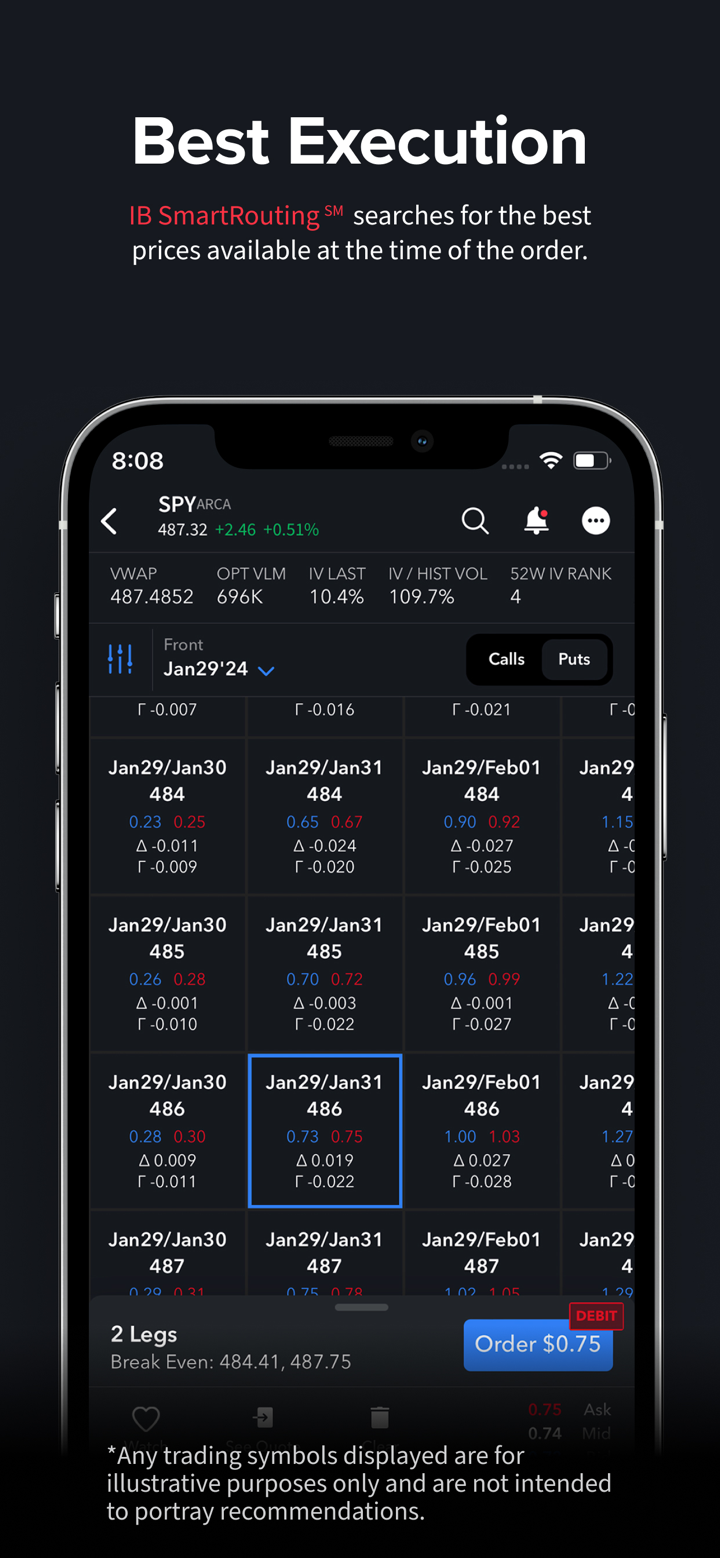

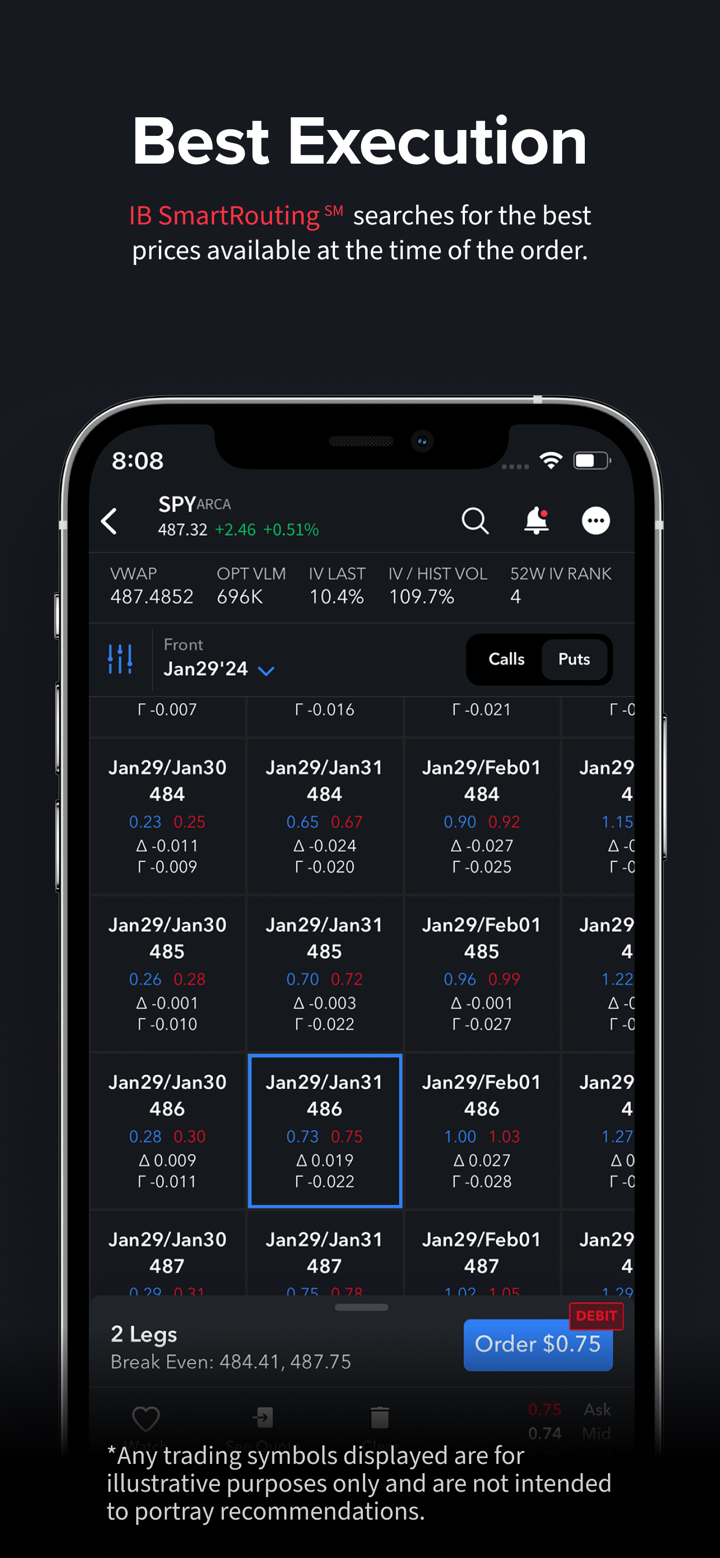

- Options: IB offers options trading across a variety of markets, including stocks, indices, and futures.

- Futures: IB offers futures trading on over 70 global markets, including indices, commodities, and currencies.

- Forex: IB provides access to forex trading in over 100 currency pairs.

- Bonds: IB offers trading in bonds, including corporate, municipal, and government bonds.

- Funds: IB offers trading in funds from over 250 fund families.

| Asset Class | Supported |

| Stocks | ✔ |

| ETFs | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Spot Currencies | ✔ |

| Bonds | ✔ |

| Mutual Funds | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

Account Types

Interactive Brokers (IB) offers various types of accounts for different trading needs, including Individual, Joint, Retirement, Trust, Family, and Institutional accounts.

Margin & Leverage

While the margin rates that IB offers are the same for all customers, local regulators may impose different or higher rates. Regulatory requirements for margin deposits in a given jurisdiction will take precedence over those set by the IB if they are greater.

And since high-risk leverage is regulated differently in different countries, your ability to use it will vary based on the trading instrument you use and the law where you live. As a result, IB provides a convenient online tool to let you quickly and easily view all applicable margins, allowing you to select the optimal trading conditions.

For customers who come under the jurisdiction of the Australian Securities and Investments Commission (ASIC), the maximum leverage available on Forex trades is 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

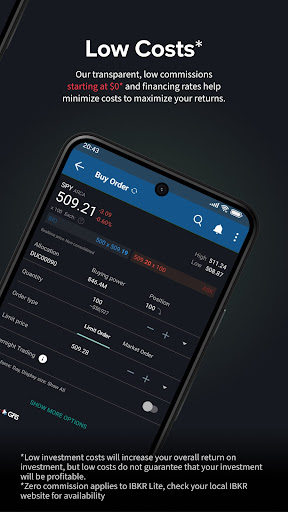

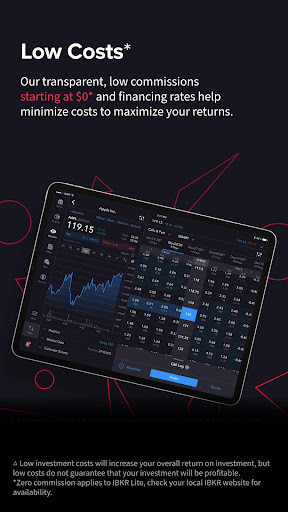

Spreads & Commissions

Spreads:

- Forex: IB offers competitive spreads on major forex pairs, with typical spreads ranging from 0.1 to 0.3 pips for EUR/USD, 0.1 to 0.6 pips for USD/JPY, and 0.3 to 0.7 pips for GBP/USD.

- Stocks: IB offers tiered pricing for stocks, with spreads ranging from $0.0035 to $0.01 per share, depending on monthly volume. For example, the spread for a trade of 100 shares of Apple (AAPL) would be $0.35 to $1.00, depending on the monthly volume.

- Options: IB offers competitive spreads on options, with typical spreads ranging from $0.10 to $0.30 per contract for major options.

Commissions:

A tiered commission of $0.0035 per share for a monthly volume of fewer than 300,000 shares, $0.002 per share for a monthly volume of 300,001-3,000,000 shares, $0.0015 per share for a monthly volume of 3,000,001-20,000,000 shares, and $0.0015 per share for a monthly volume of 20,000,000 shares. $0.001 per share for a monthly volume of 20,000,001-100,000,000 shares and $0.0005 per share for a monthly volume of 100,000,000 shares or more. The minimum commission is $0.35, and the maximum commission is 1% of the trading volume. The commission for metals trading is 0.15 basic points of the volume, with a minimum of $2.

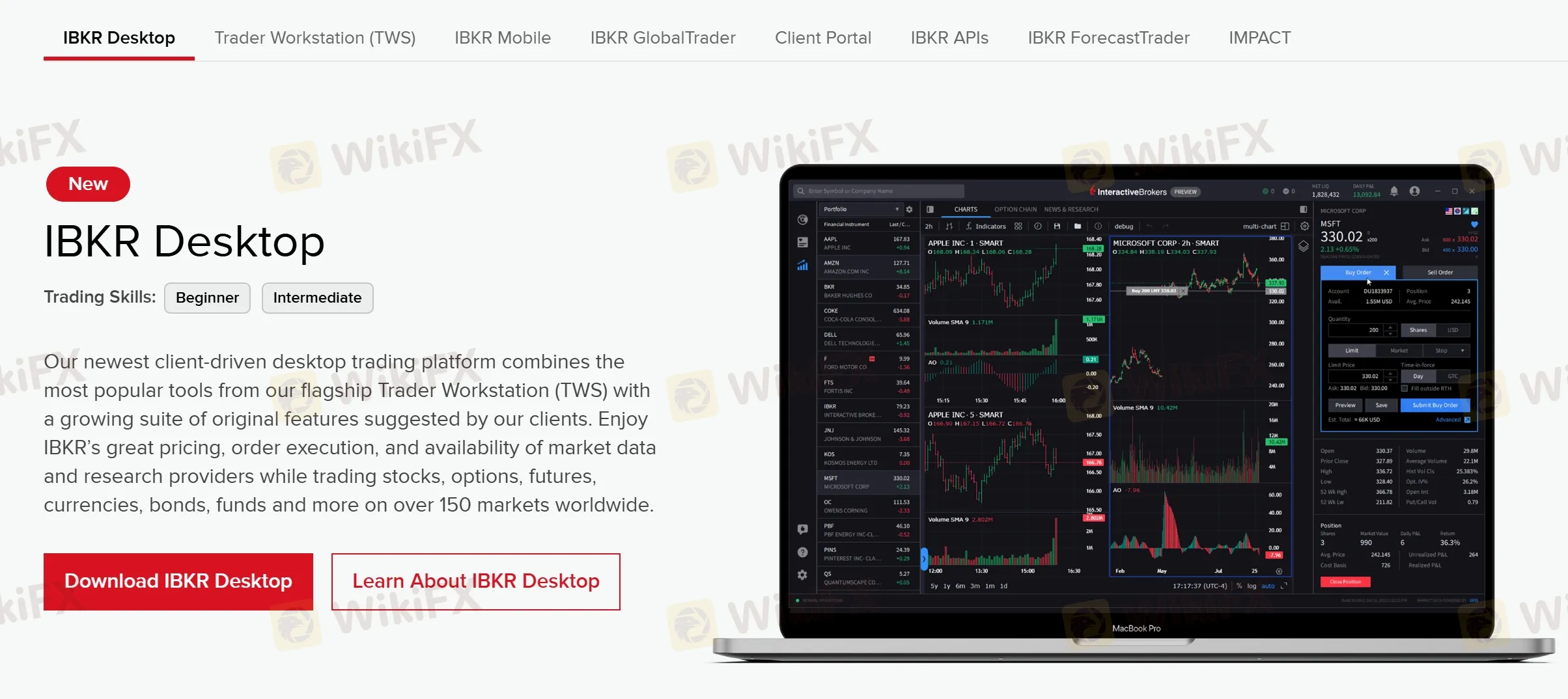

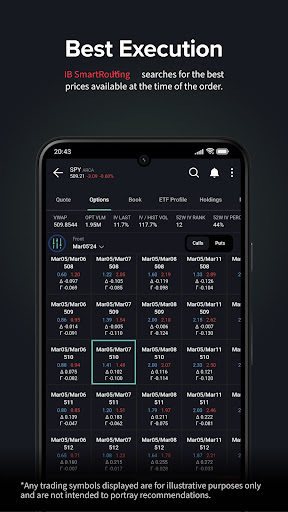

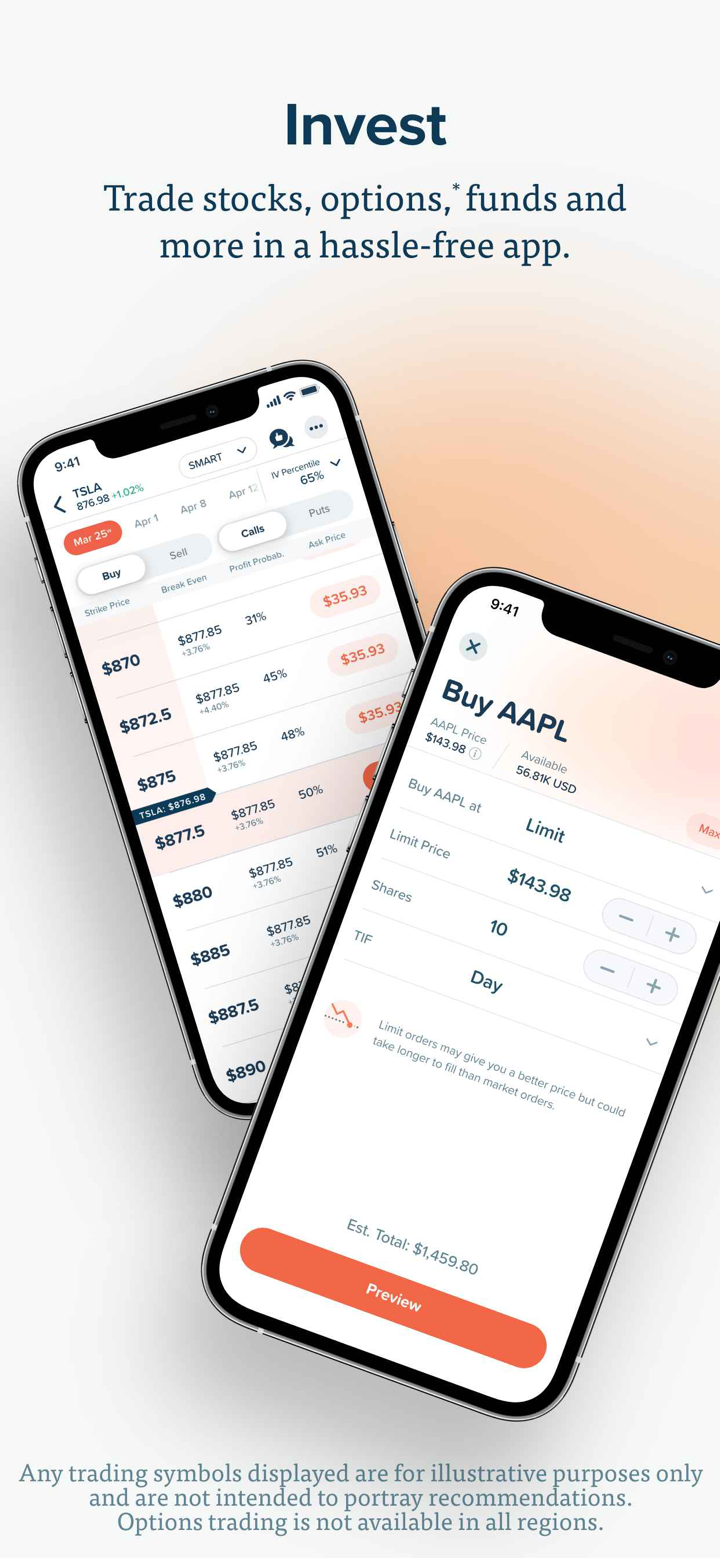

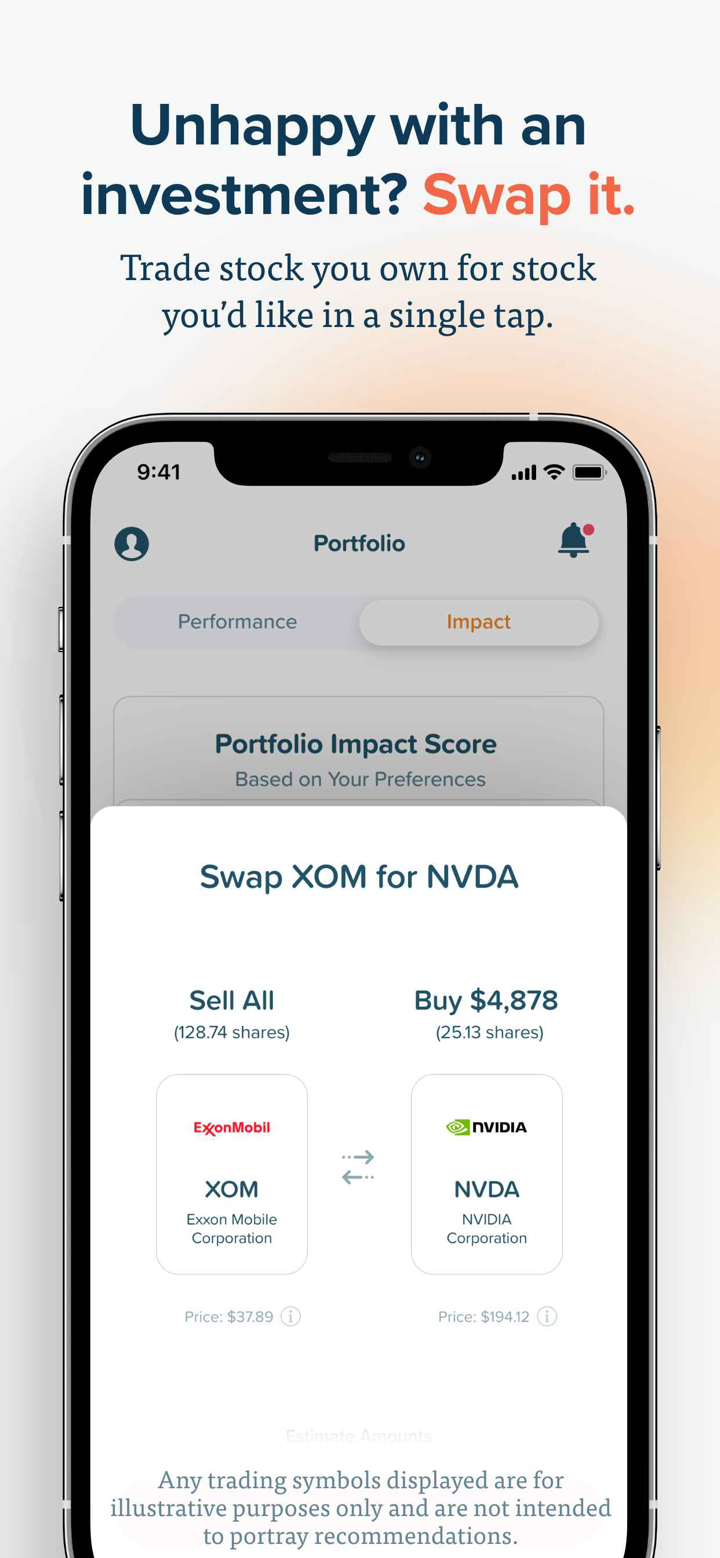

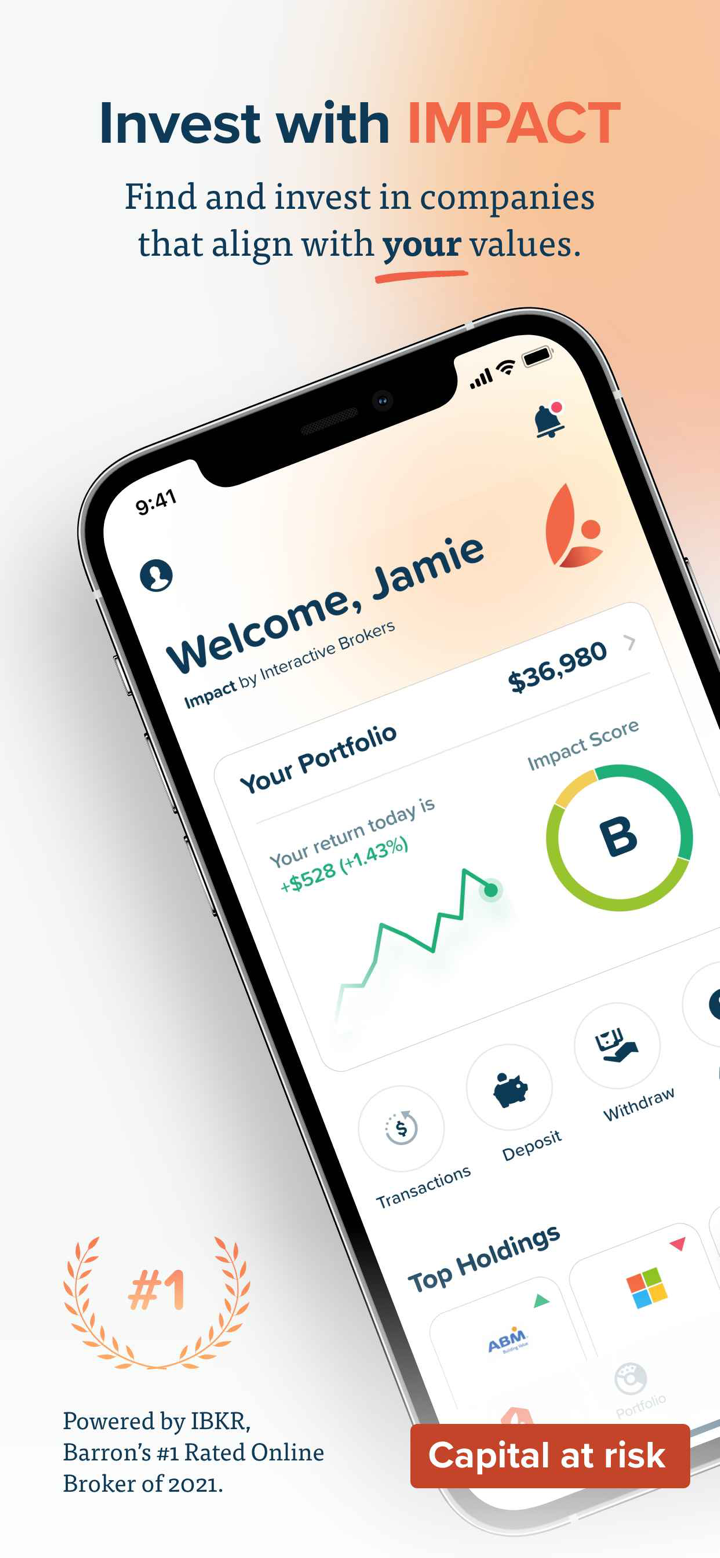

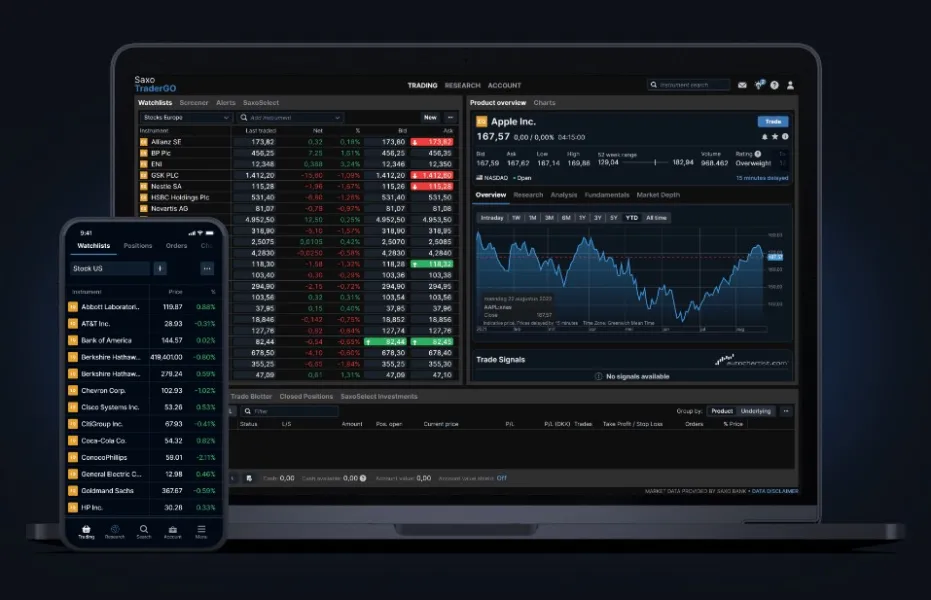

Trading Platforms

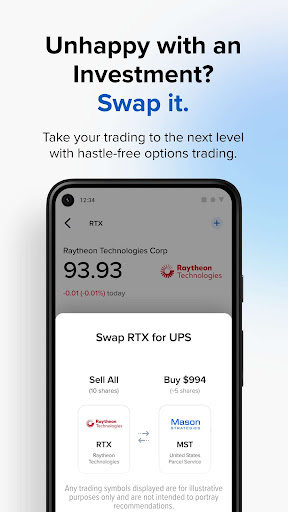

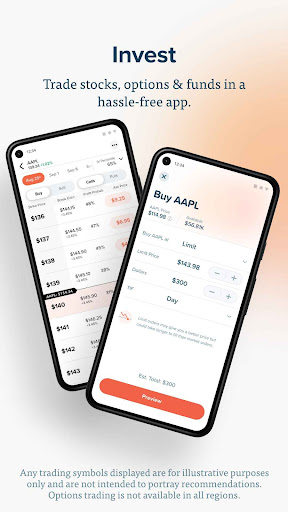

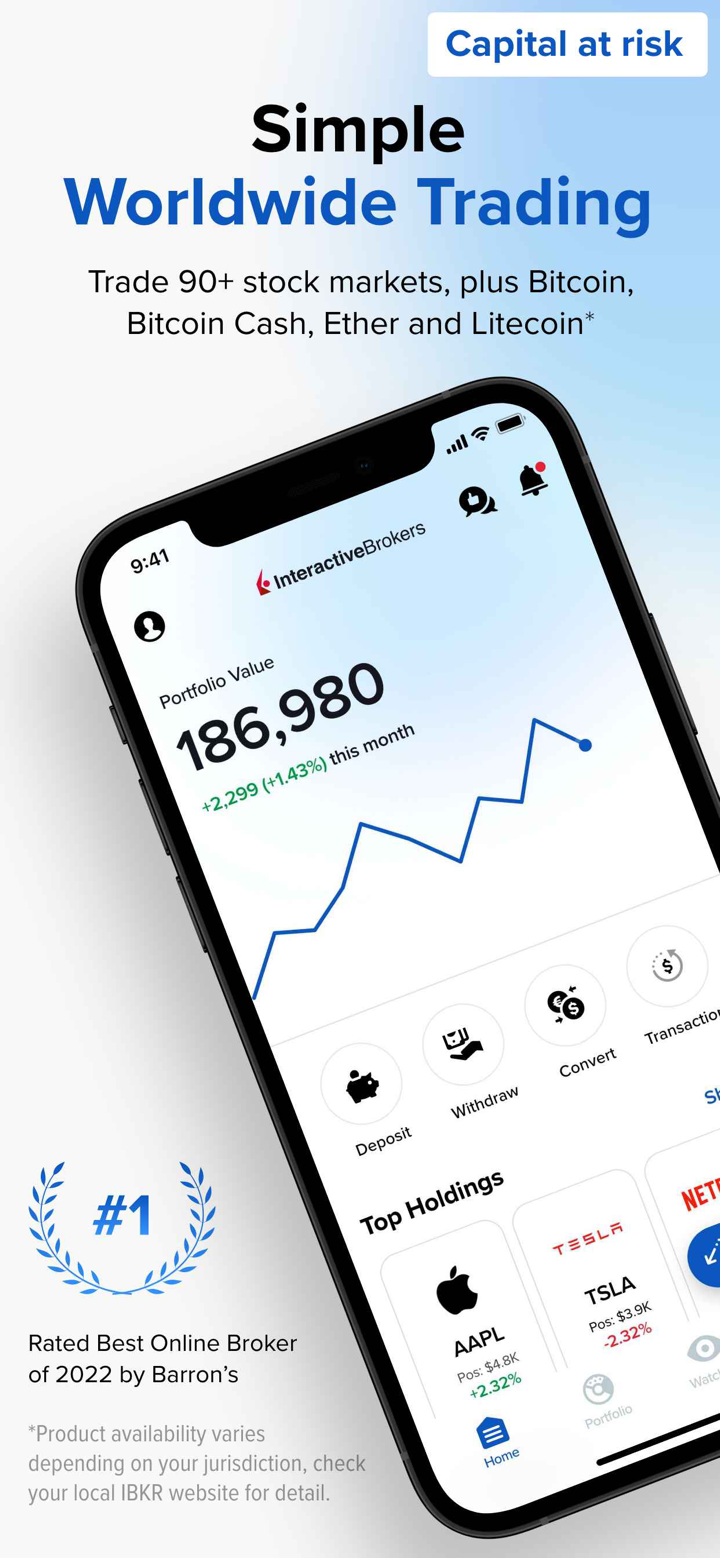

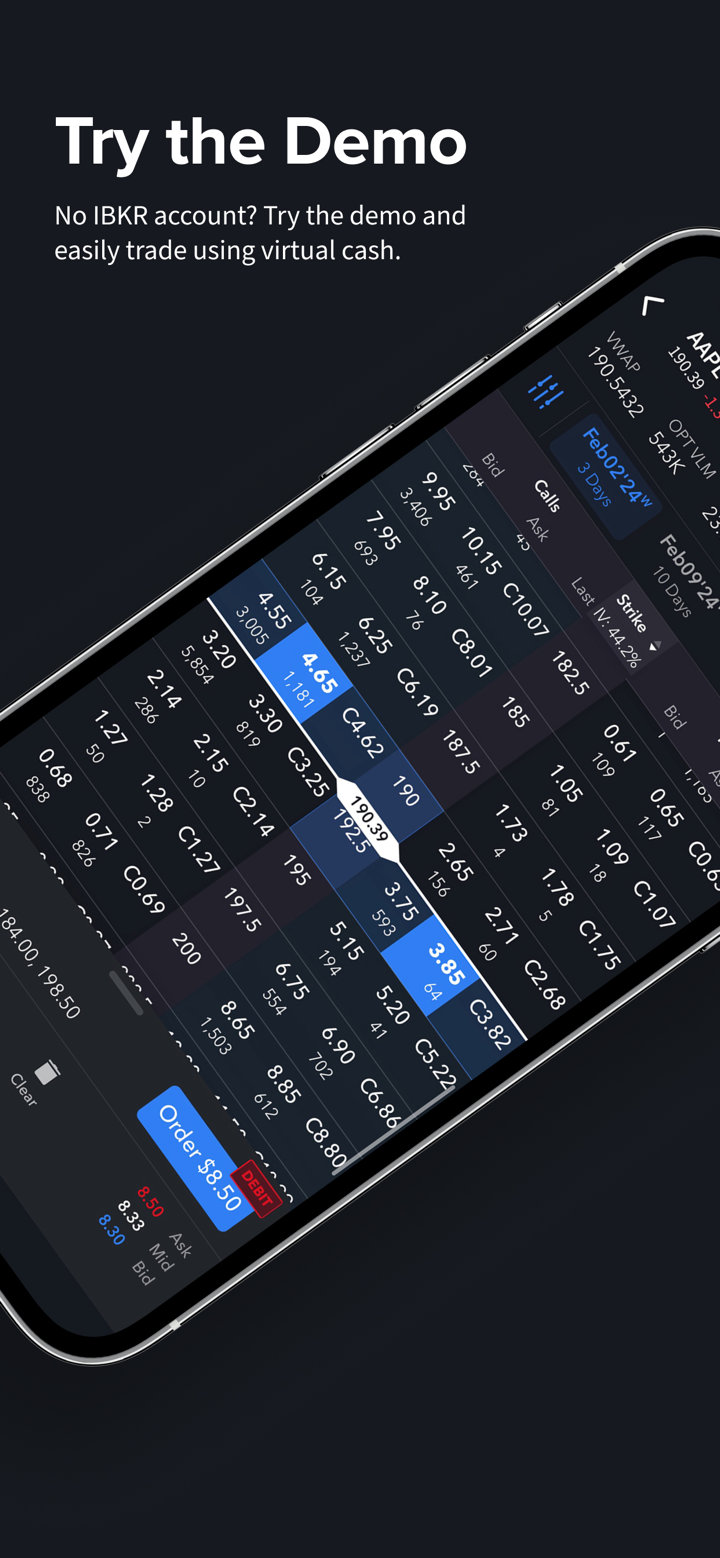

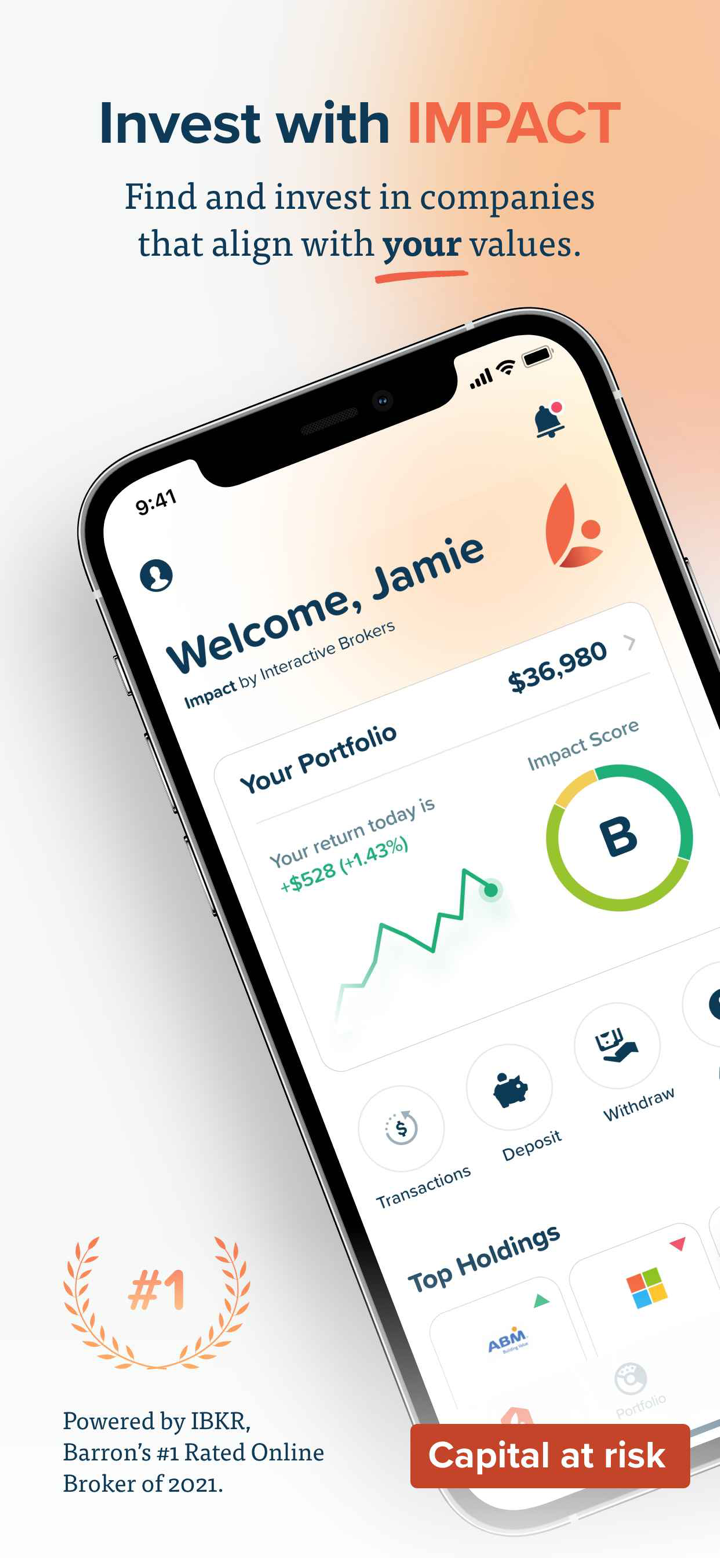

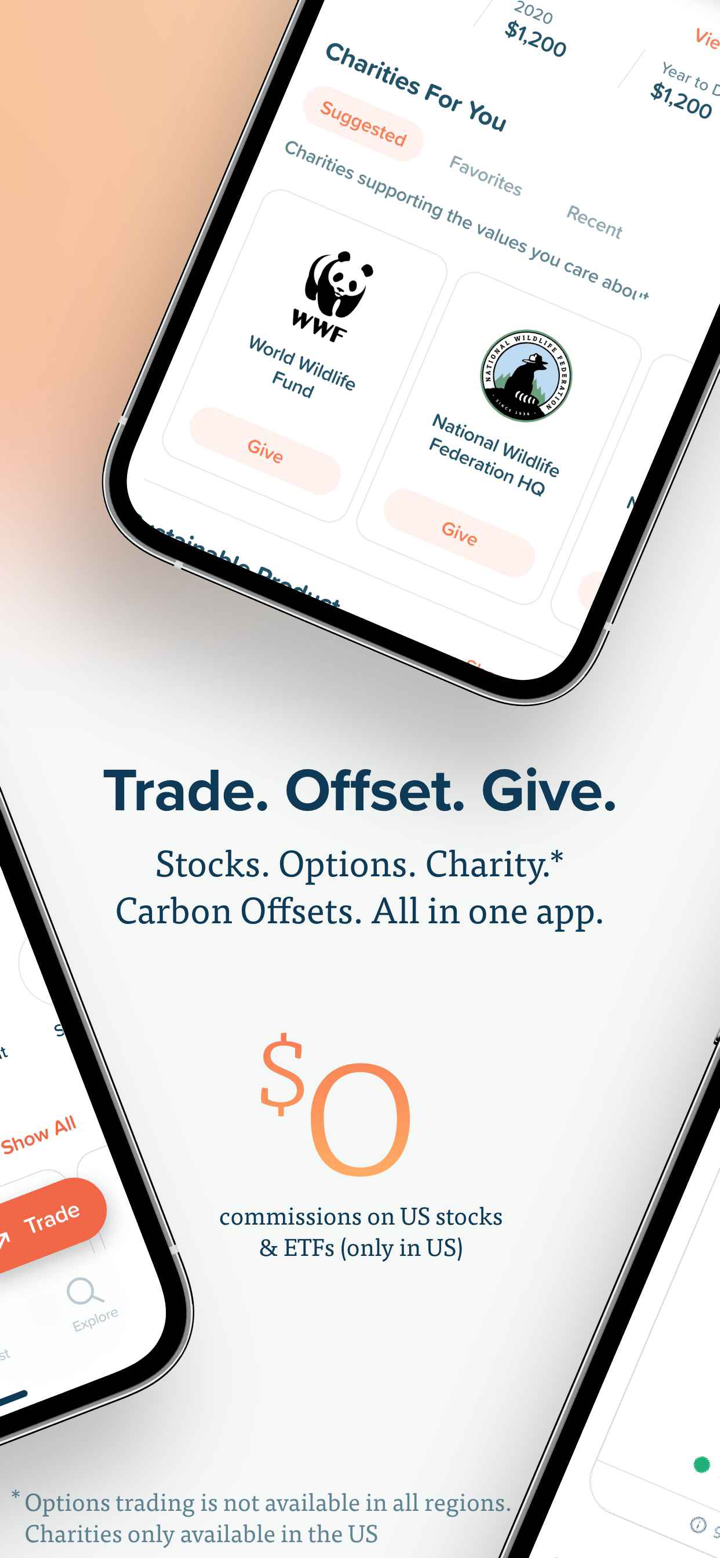

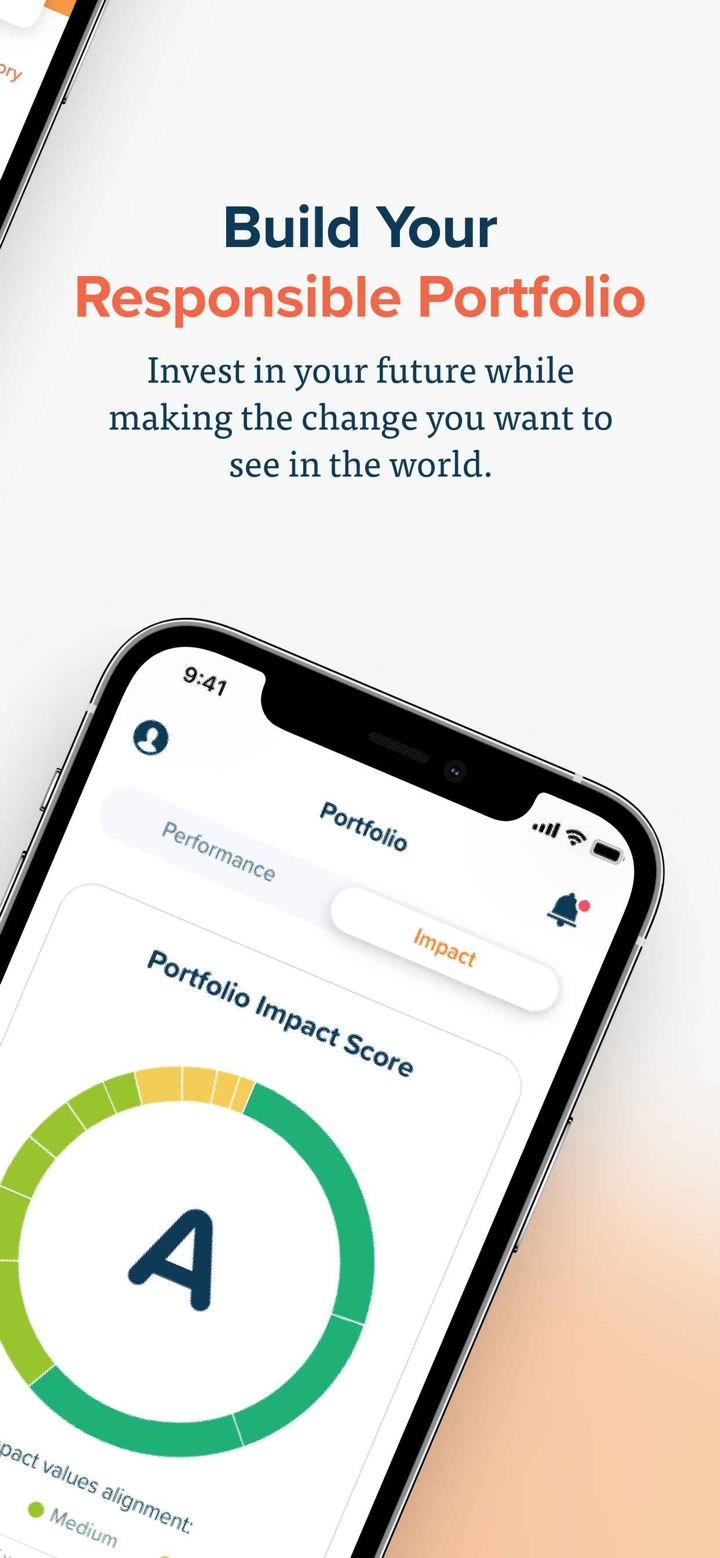

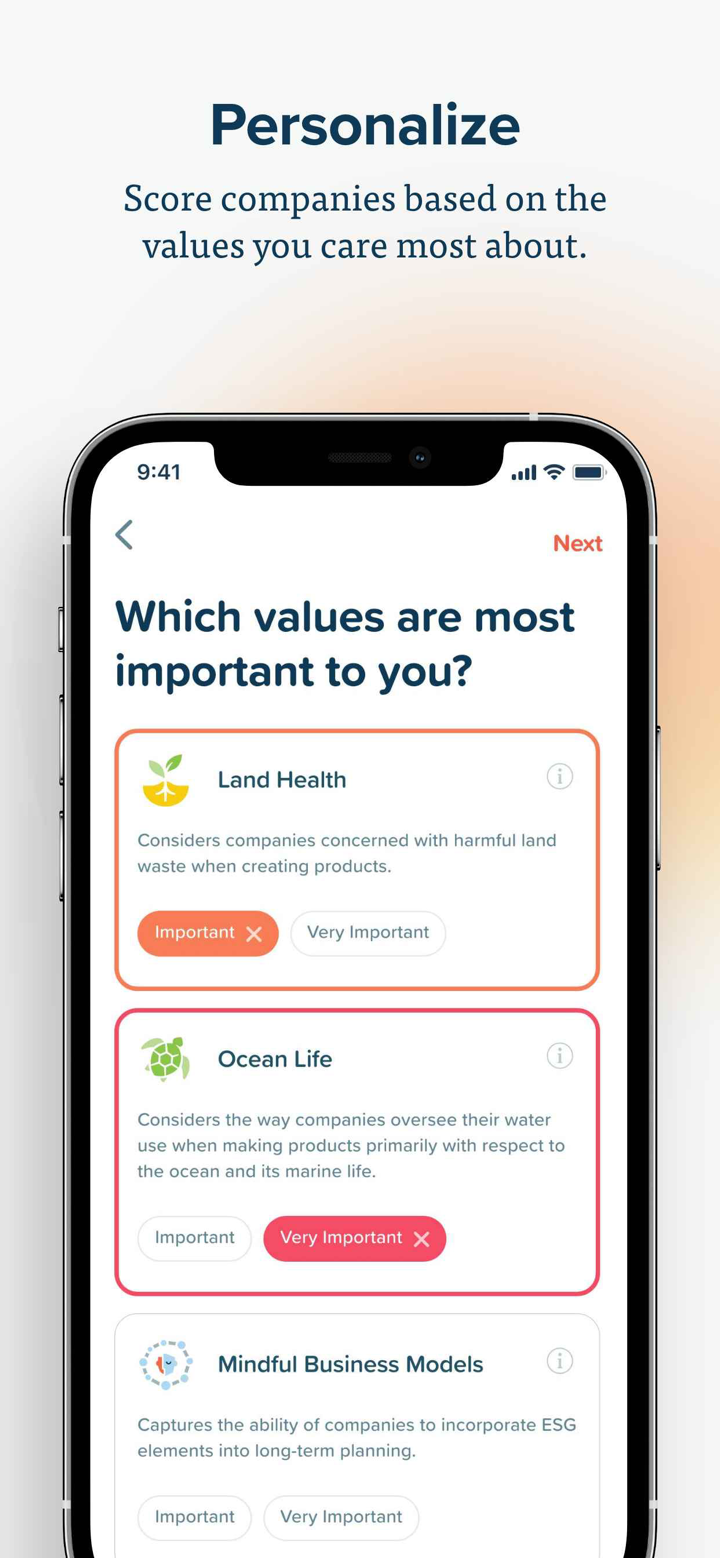

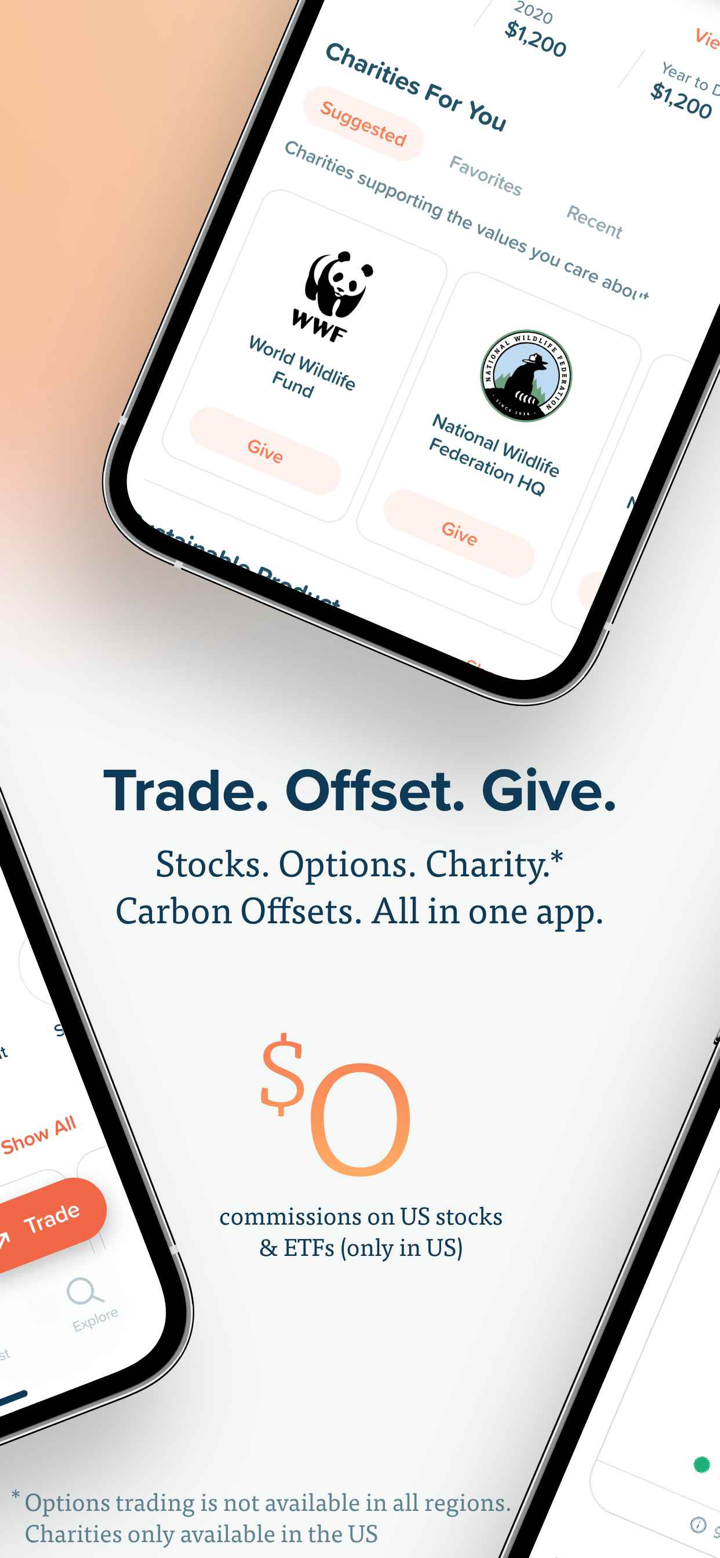

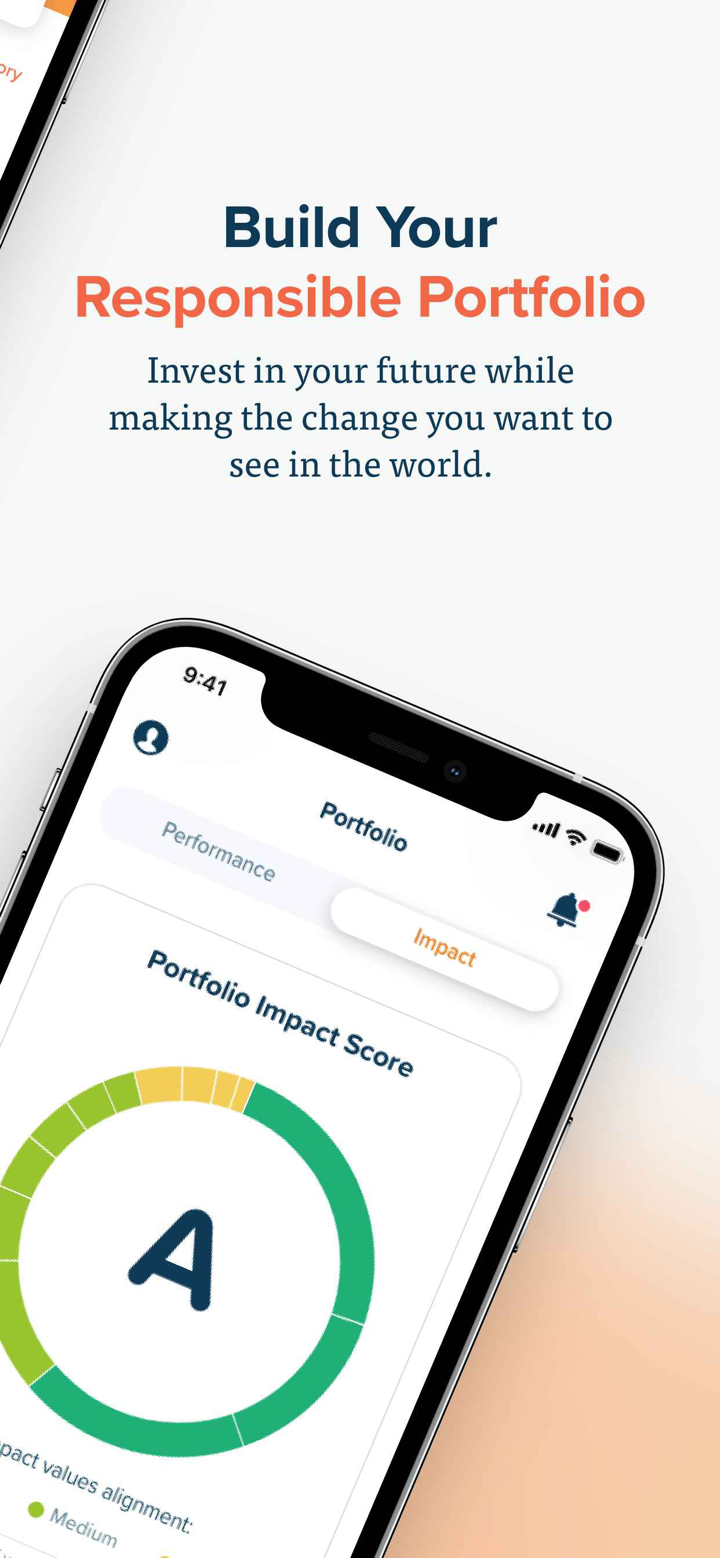

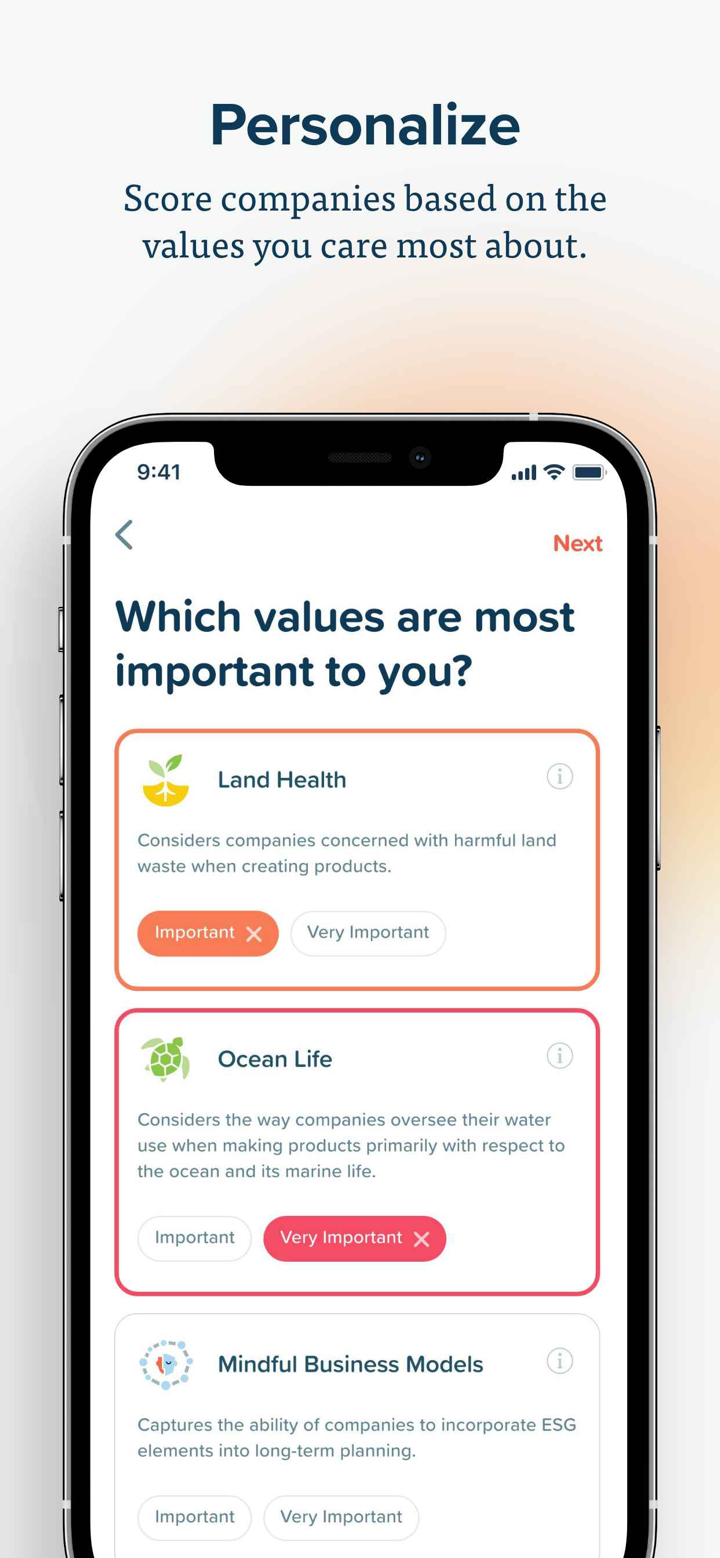

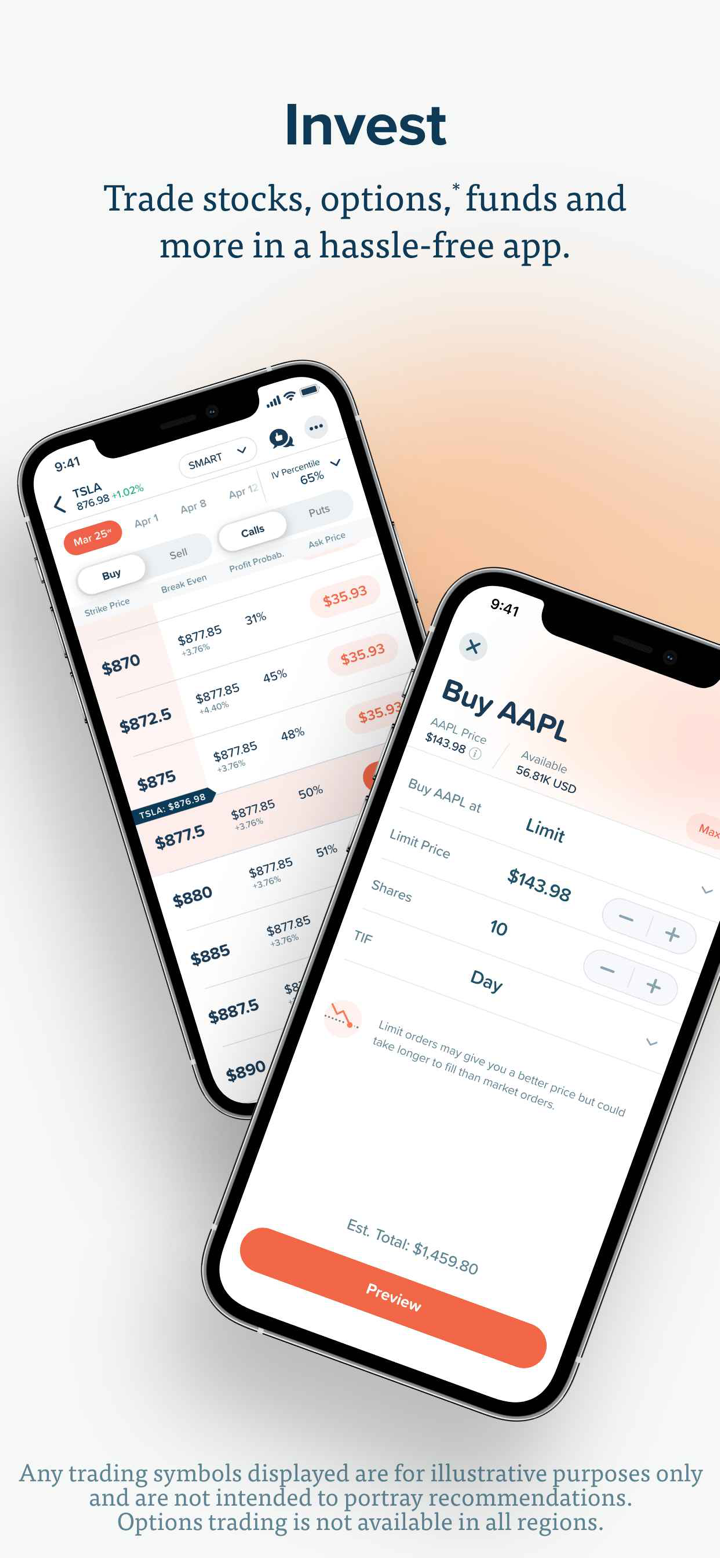

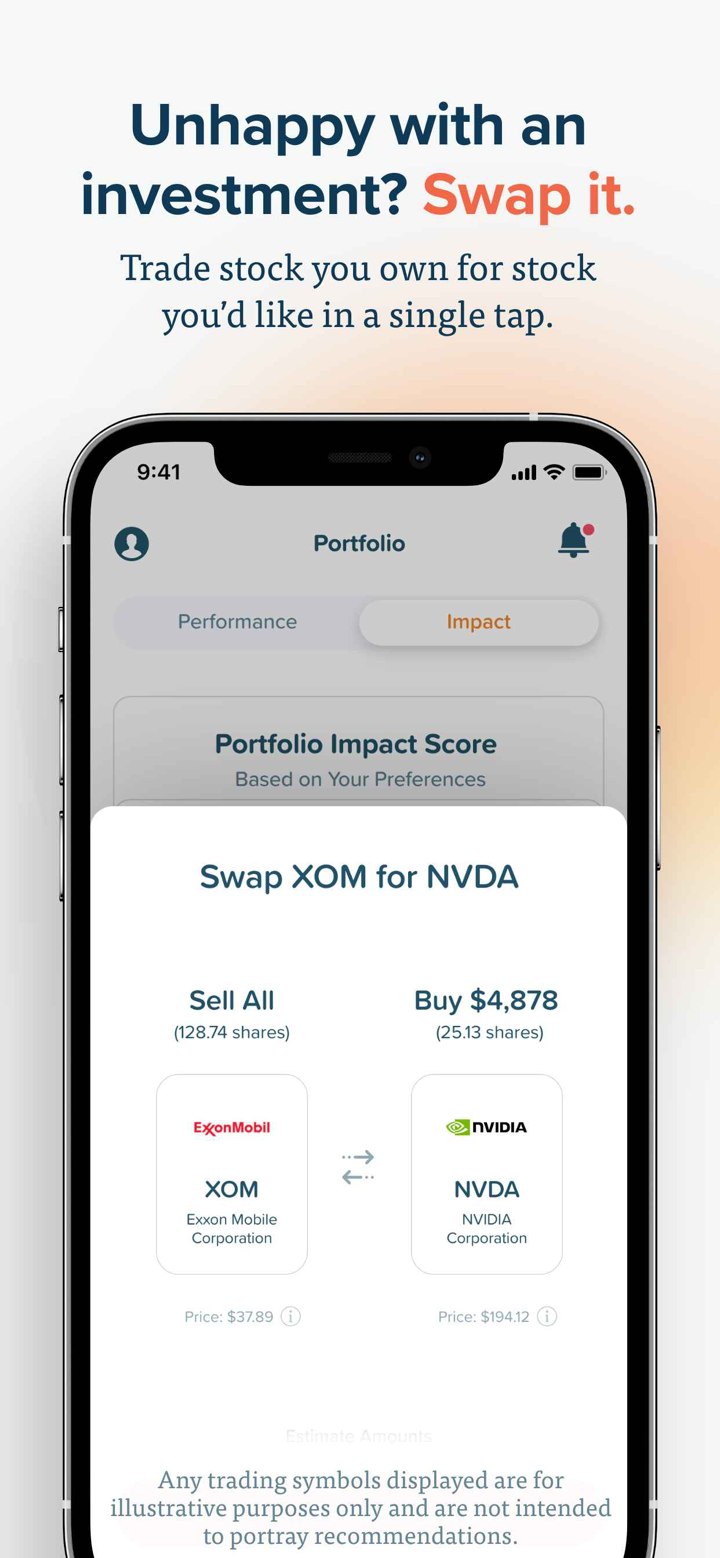

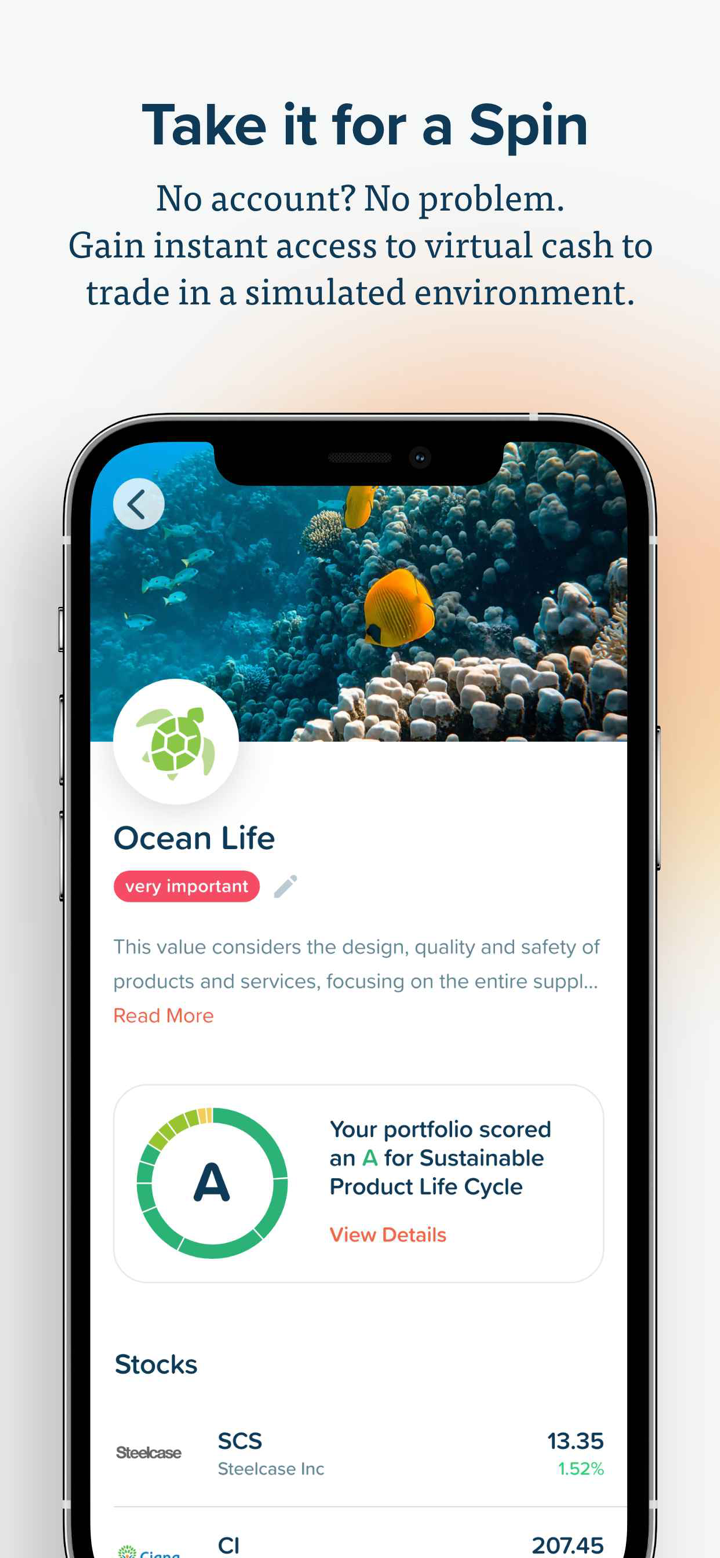

IBKR GlobalTrader, Client Portal, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR Event Trader, and IMPACT are different trading platforms and tools offered by Interactive Brokers (IB) to its clients.

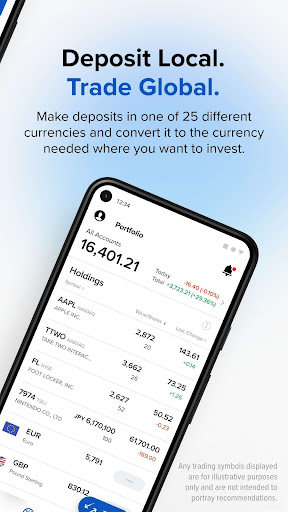

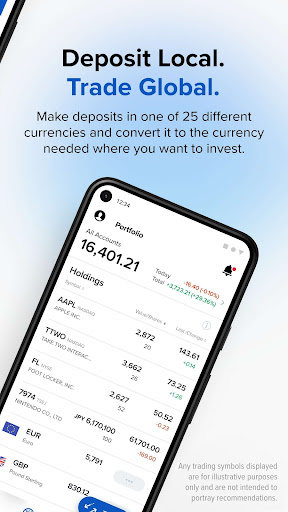

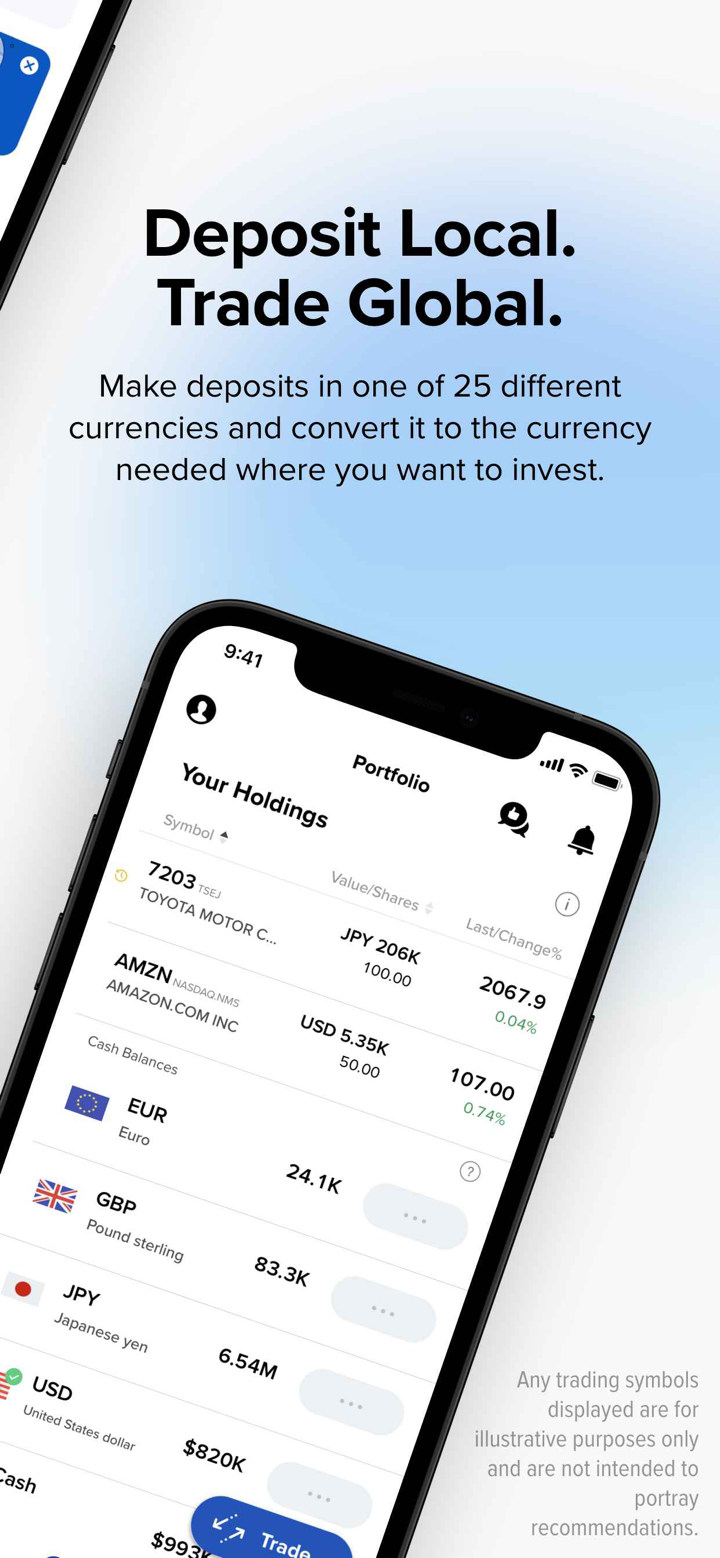

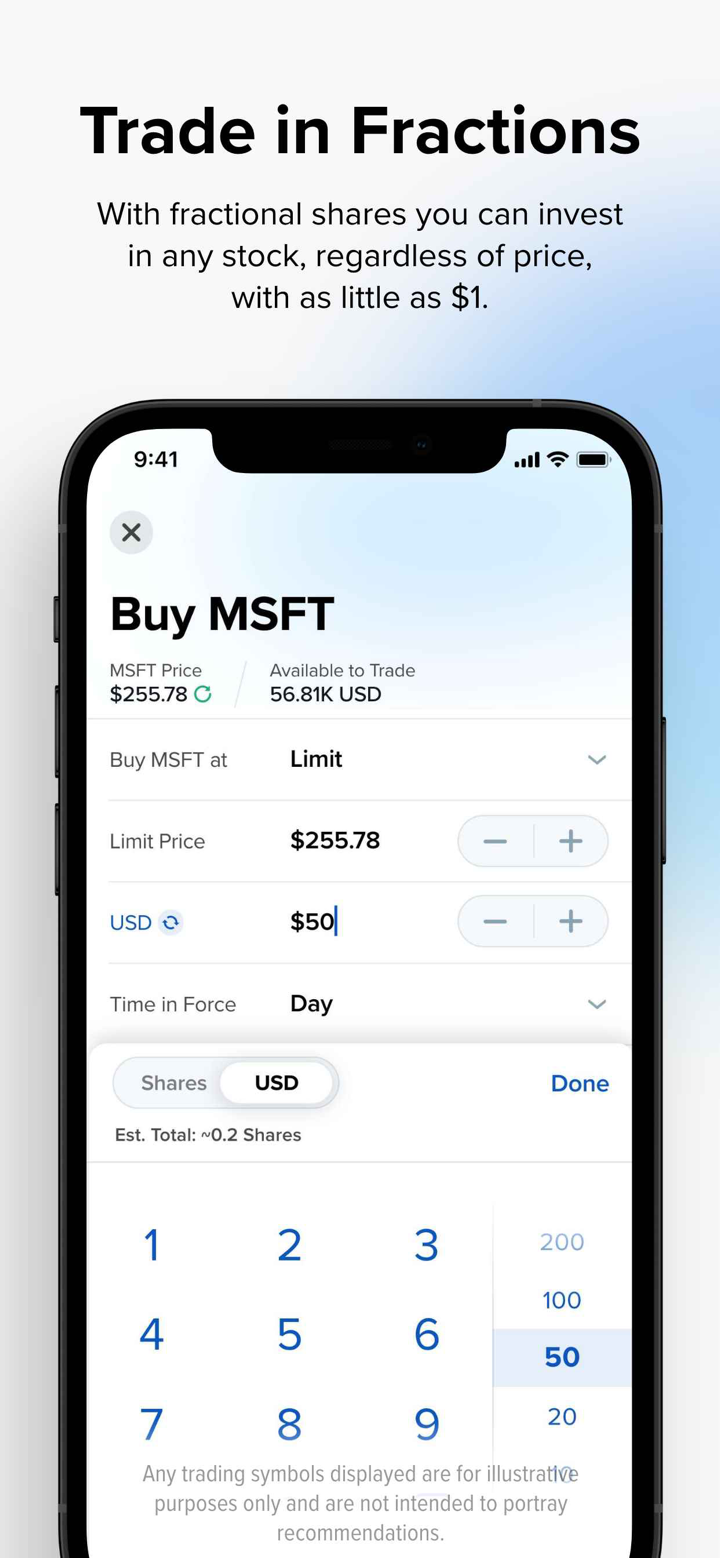

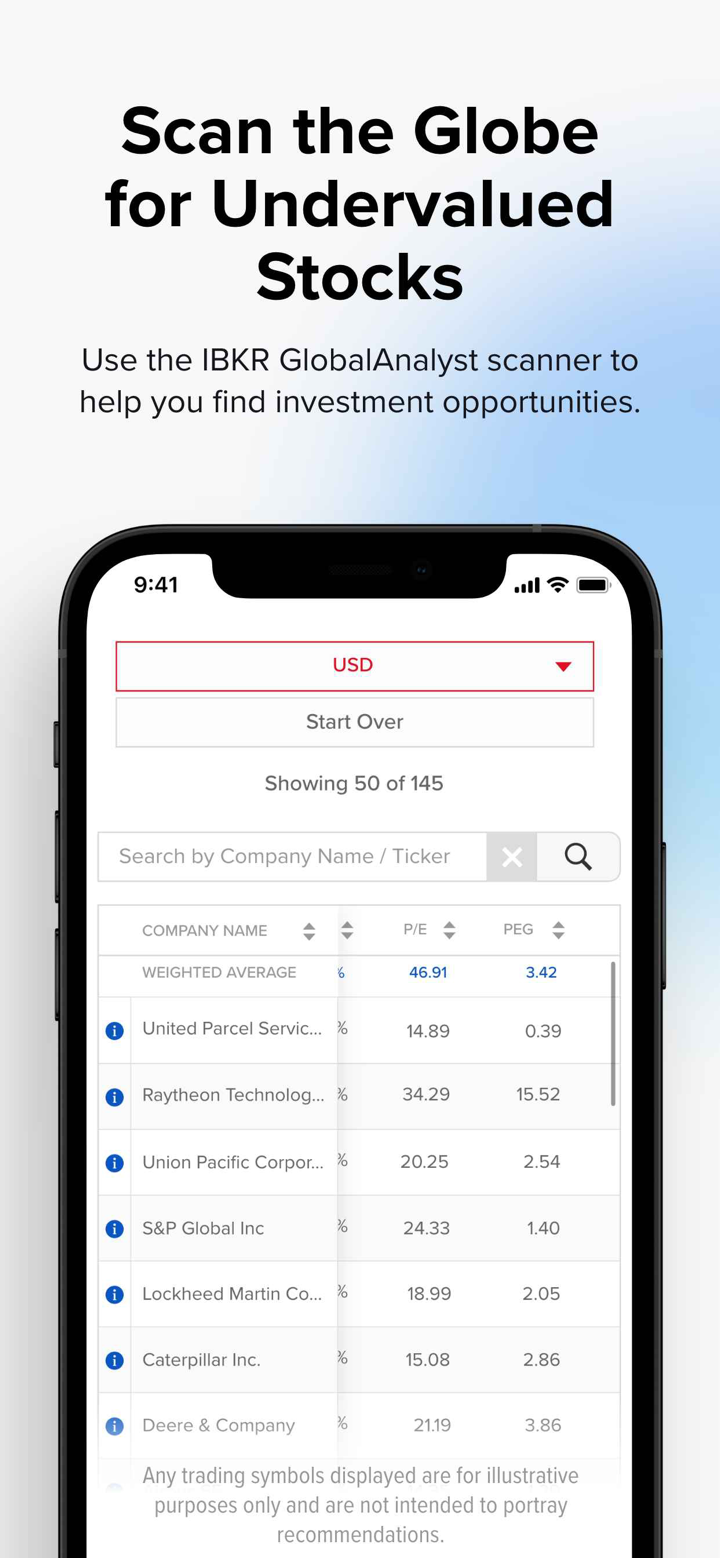

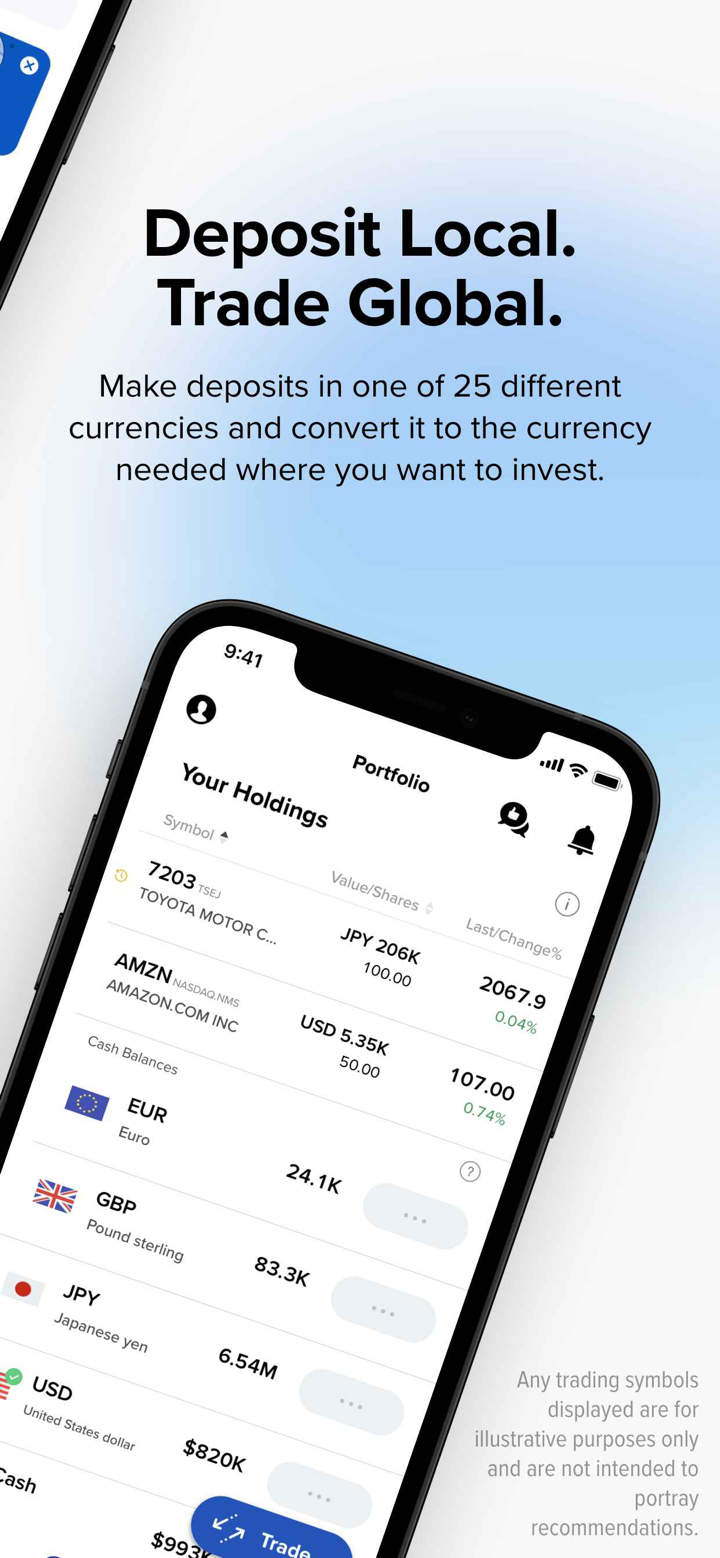

- IBKR GlobalTrader is a web-based platform designed for trading and managing international accounts. It provides access to 125 global markets and 31 countries. It also allows clients to trade in multiple currencies and offers currency conversion at competitive rates.

- Client Portal is a web-based platform that enables clients to manage their accounts, view balances and positions, access research and news, and monitor trading activity. It also provides account management tools such as funding, withdrawals, and statements.

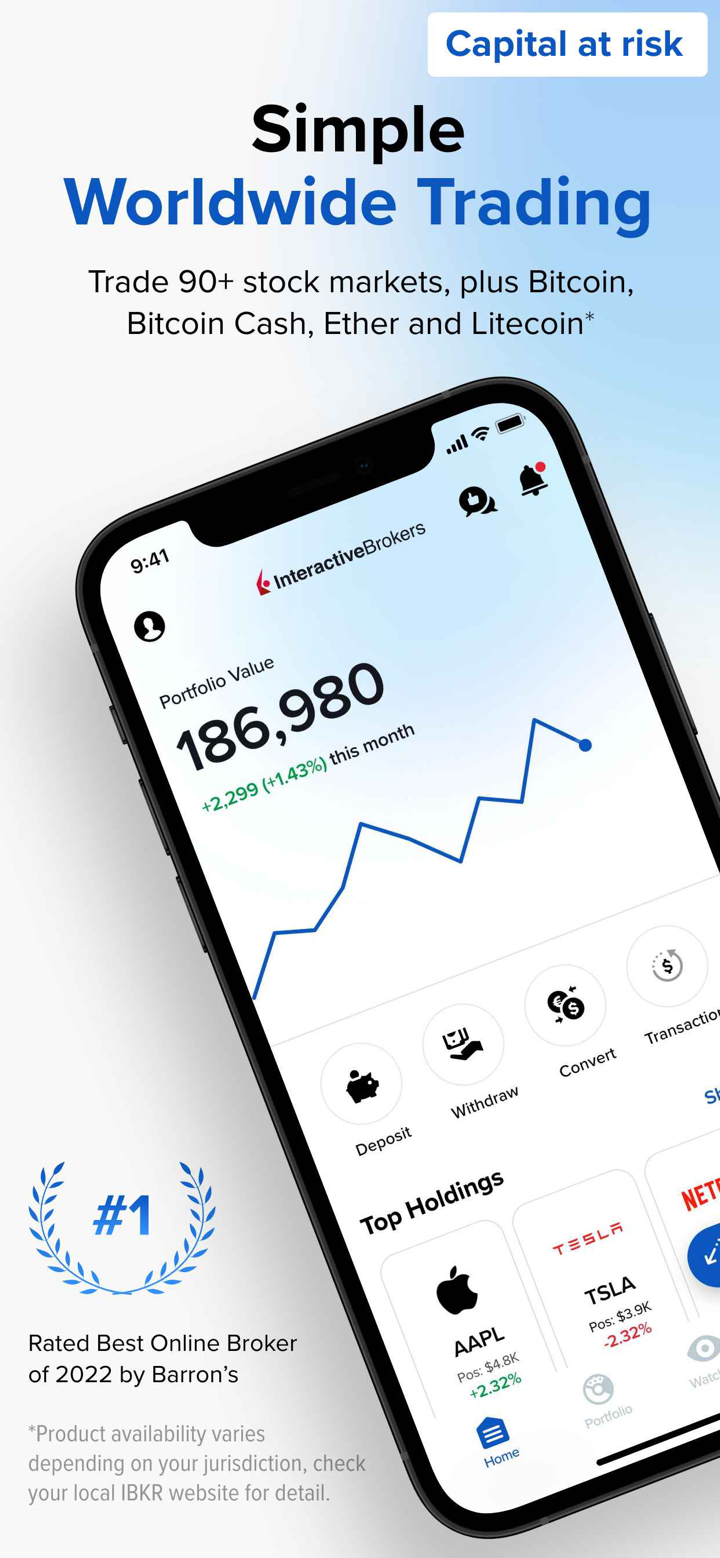

- IBKR Mobile is a mobile application that allows clients to manage their accounts, place trades, and access real-time market data. It is available for both iOS and Android devices.

- Trader Workstation (TWS) is a desktop trading platform that provides advanced trading tools, real-time market data, and research. It is designed for professional traders and investors who require advanced trading capabilities.

- IBKR APIs are a set of programming interfaces that allow clients to integrate their own software and applications with IB's trading systems. This enables clients to automate their trading strategies and access real-time market data.

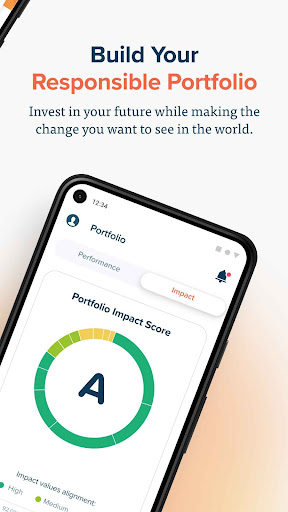

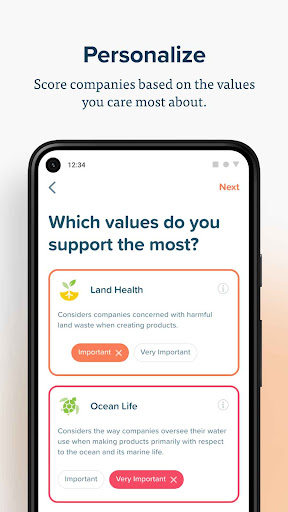

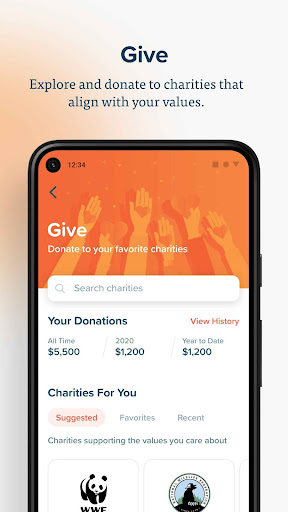

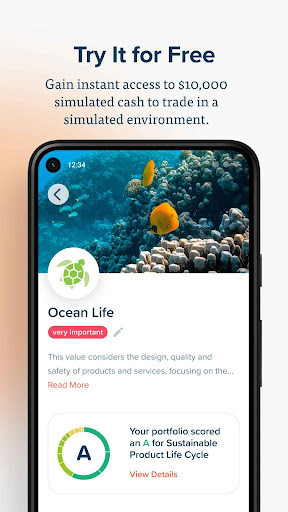

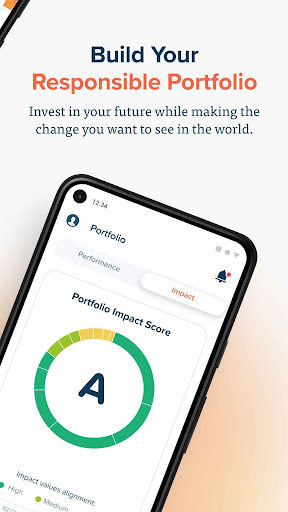

- IMPACT (Interactive Brokers Market Place and Corporate Technology) is an online marketplace that offers a range of third-party applications and services to clients. These include trading tools, research, analytics, and other resources to enhance trading capabilities.

Overall, IB offers a variety of trading platforms and tools that cater to the needs of different types of traders and investors. These platforms provide access to a wide range of markets and instruments, advanced trading tools, real-time market data, and research resources. Additionally, the IBKR APIs enable clients to customize and automate their trading strategies.

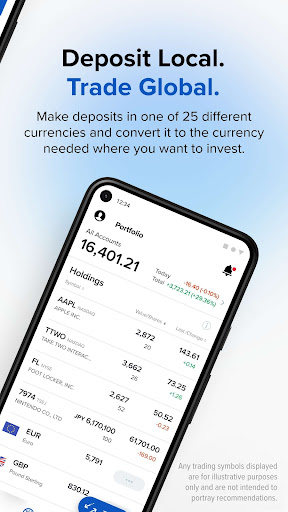

Deposits & Withdrawals

There are several major options for traders to deposit and withdraw funds from their accounts, including bank wire transfers, ACH, BPAY, EFT, online bill payment and more.

Note that the availability of deposit and withdrawal methods may vary depending on your location and account type.

Minimum deposit requirement

The minimum deposit requirement for Interactive Brokers (IB) varies depending on the account type and the location of the account holder. For example, the minimum deposit for a US-based individual account is $0 for IBKR Lite and $0 for IBKR Pro, while for a non-US-based individual account, the minimum deposit is $0 for IBKR Lite and $10,000 for IBKR Pro. However, the minimum deposit for other account types, such as institutional accounts or margin accounts, may be higher.

IB minimum deposit vs other brokers

| IB | Most other | |

| Minimum Deposit | $0 | $/€/£100 |

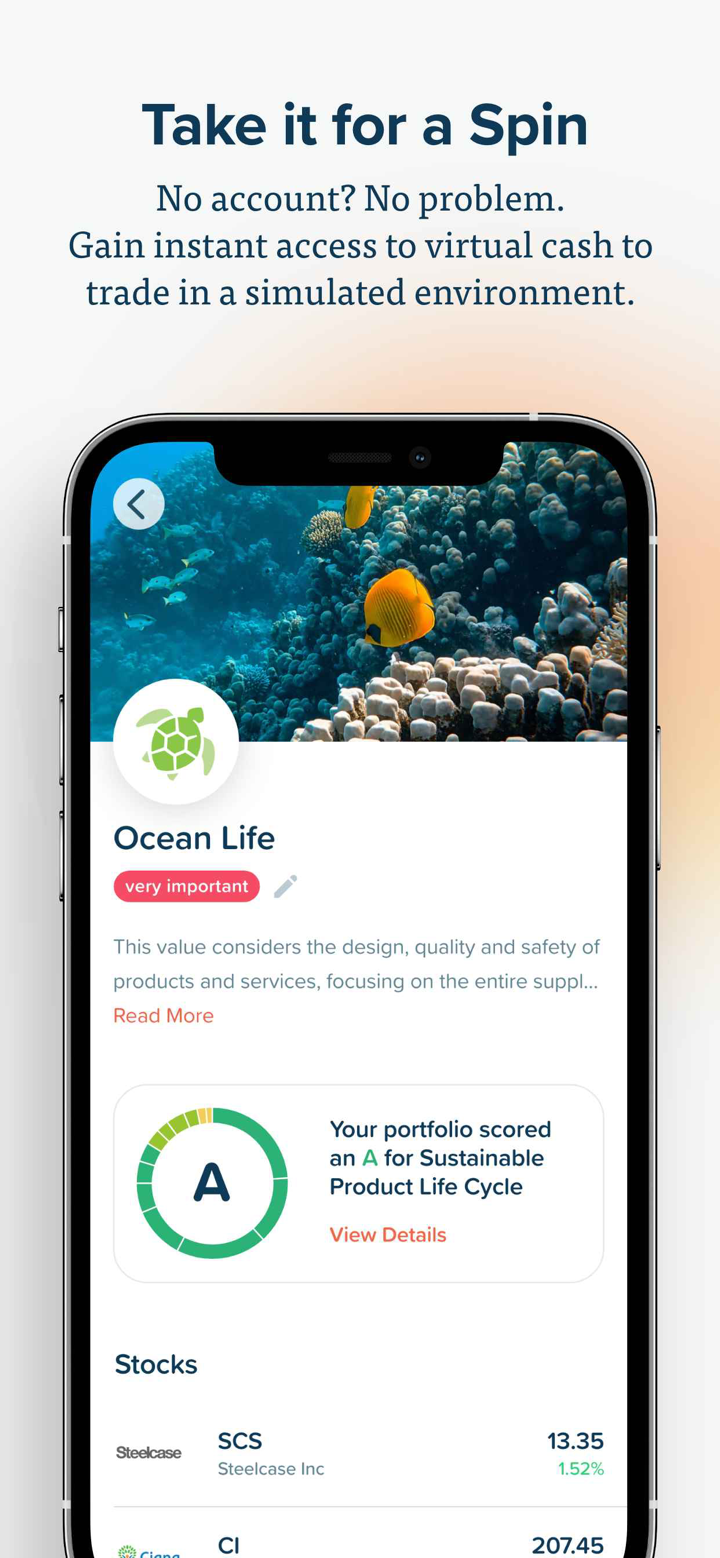

Education

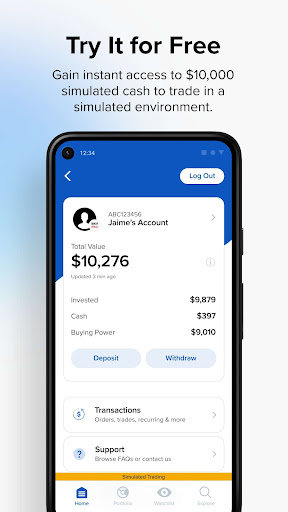

Interactive Brokers offers a variety of educational resources for traders, including webinars, courses, videos, and articles.

The education section of their website includes topics such as trading basics, options trading, technical analysis, and trading strategies. They also offer a wide range of educational videos on their YouTube channel.

In addition, Interactive Brokers offers a simulated trading account that allows traders to practice trading with virtual funds before risking real money. This is a useful tool for beginners who are learning to trade.

Conclusion

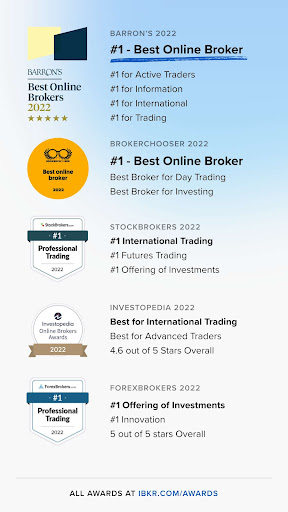

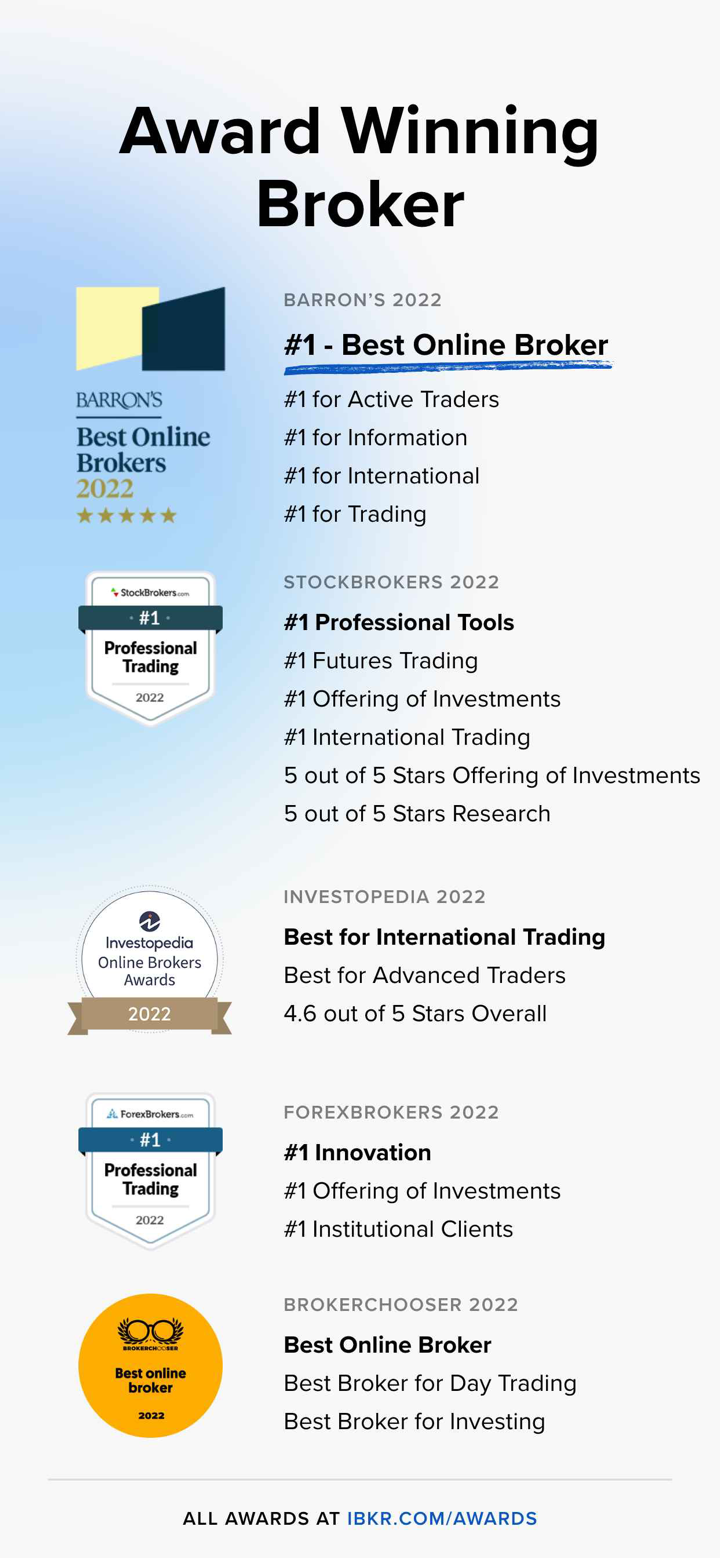

In conclusion, Interactive Brokers is a reputable and reliable broker that offers a wide range of investment products and trading platforms to its clients. The broker is known for its low commission rates and competitive pricing structure, making it a good choice for active traders and investors.

IB also provides a high level of security and protection to its clients, through various measures such as SIPC and excess SIPC insurance, and two-factor authentication. The broker also offers educational resources, customer support, and a variety of account types to meet the needs of different traders.

However, IB may not be the best fit for beginners due to its complex trading platforms and sophisticated tools.

Overall, Interactive Brokers is a good choice for experienced traders and investors who are looking for a reliable broker with low commissions and a wide range of investment products.

Frequently Asked Questions (FAQs)

| Q 1: | Is IB regulated? |

| A 1: | Yes. It is regulated by ASIC, FCA, FSA, SFC, and CIRO. |

| Q 2: | Does IB offer industry-standard MT4 & MT5? |

| A 2: | No. Instead, it offers IBKR GlobalTrader (Mobile), Client Portal (Web), IBKR Desktop, IBKR Mobile, Trader Workstation (TWS) (Desktop), IBKR APIs (Desktop), IBKR ForecastTrader (Web), and IMPACT (Mobile). |

| Q 3: | What is the minimum deposit for IB? |

| A 3: | There is no minimum initial deposit with IB. |

| Q 4: | Is IB a good broker for beginners? |

| A 4: | No. Beginners may find IB's trading platforms are difficult to uderstand. It is more suitable for experienced traders. |

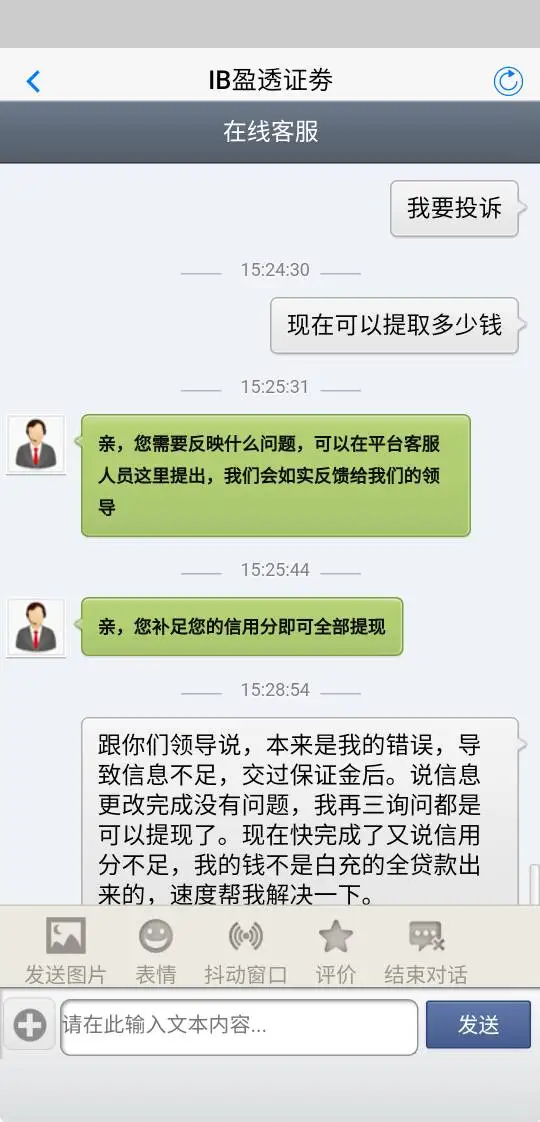

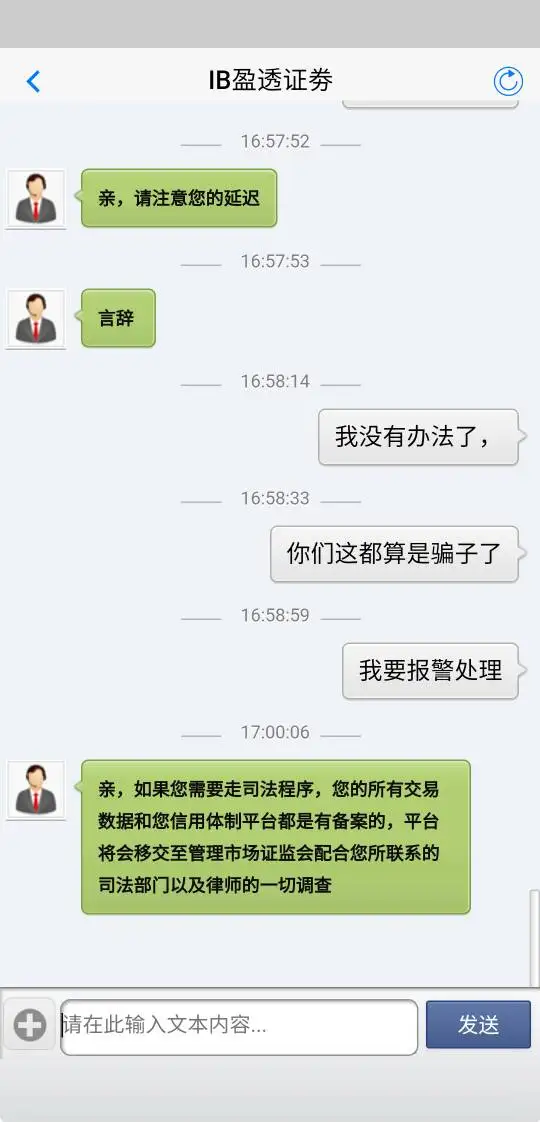

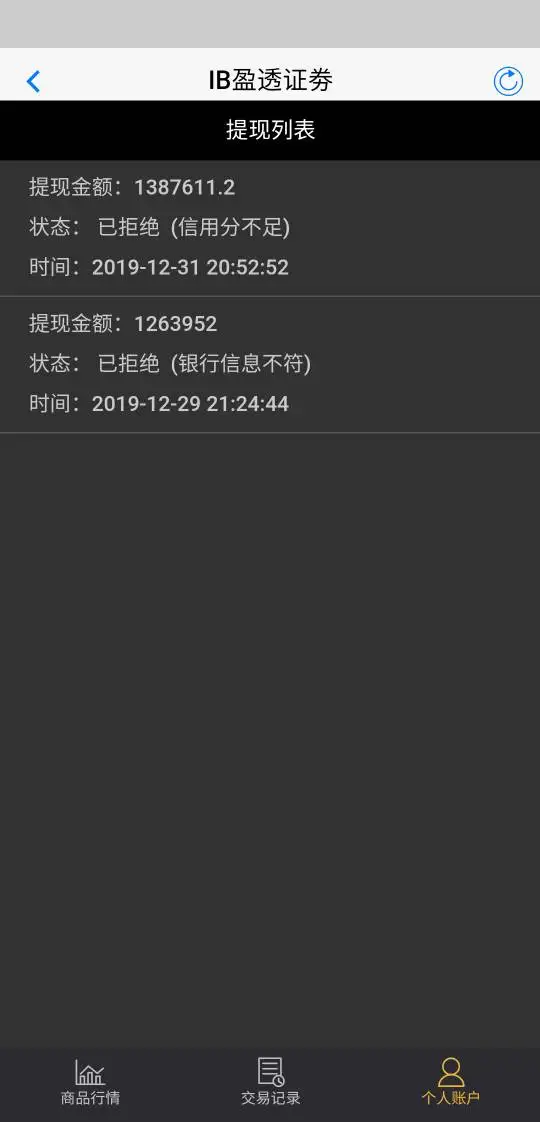

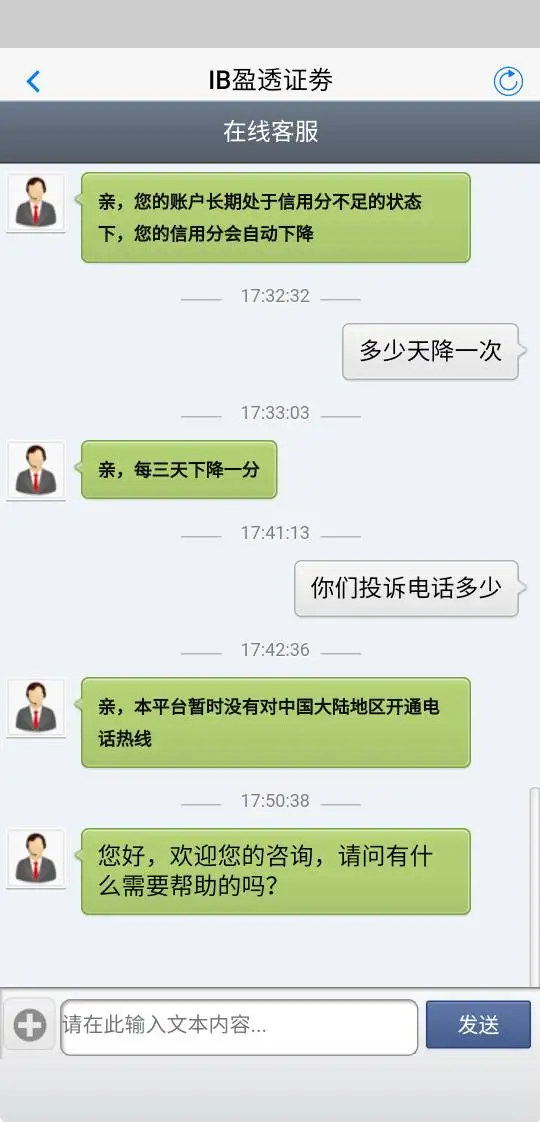

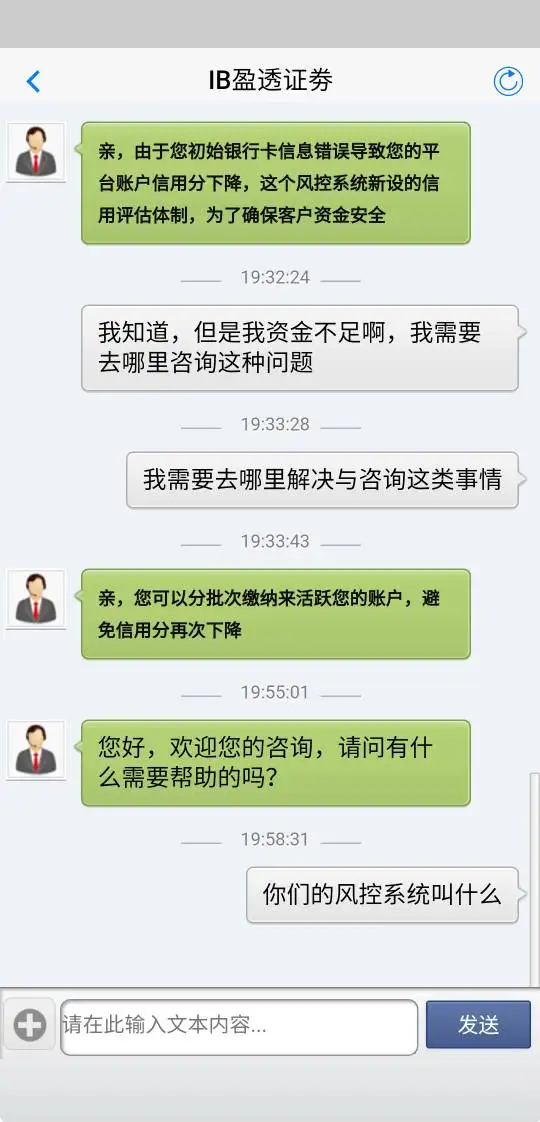

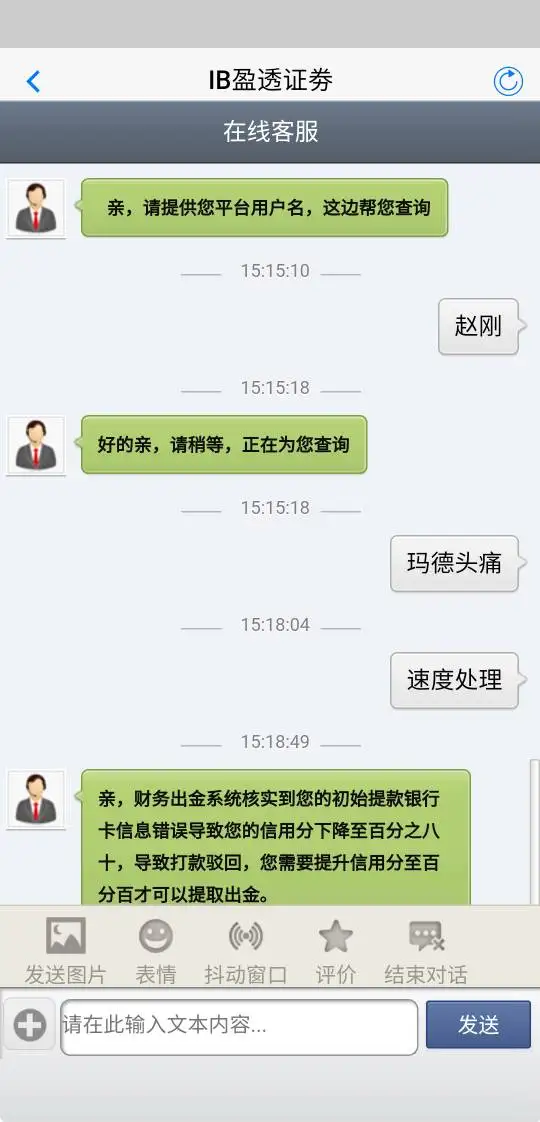

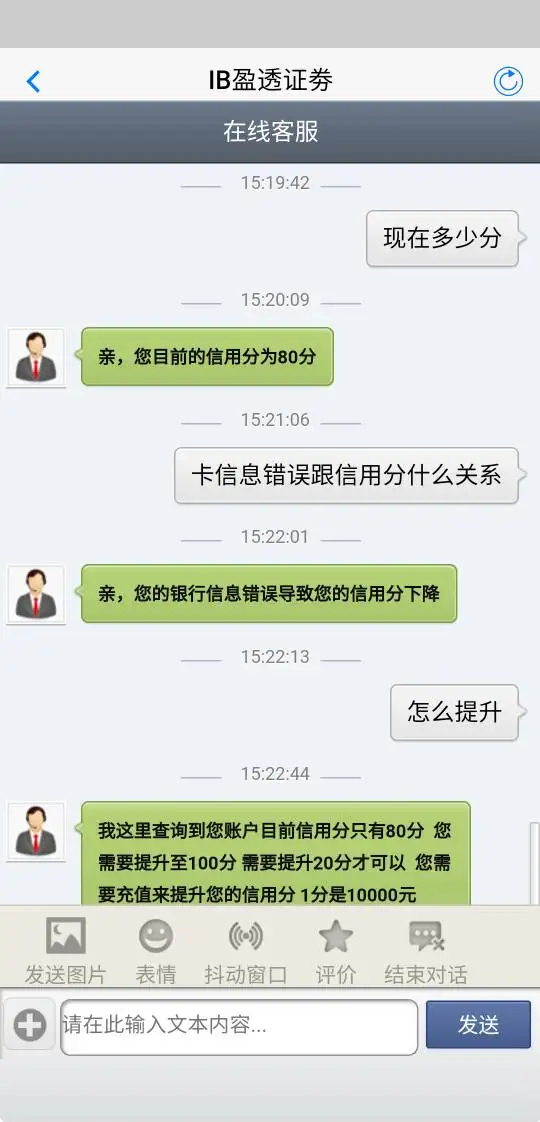

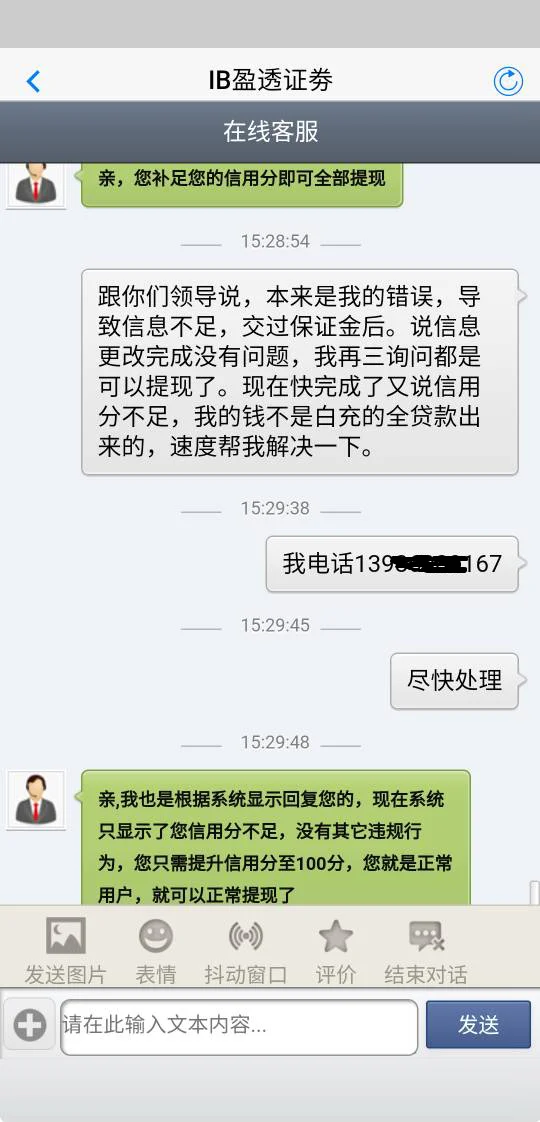

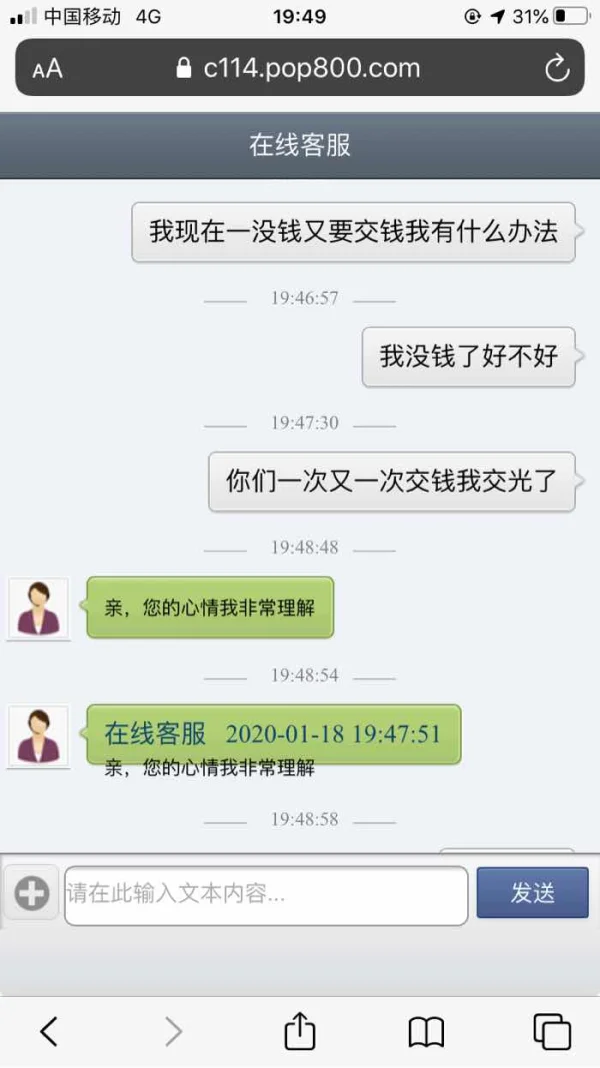

刚63227

Hong Kong

I’ve never encountered with such situation. I don’t know whether it is a scam.

Exposure

↑笔间字迹,续写,,,,

Hong Kong

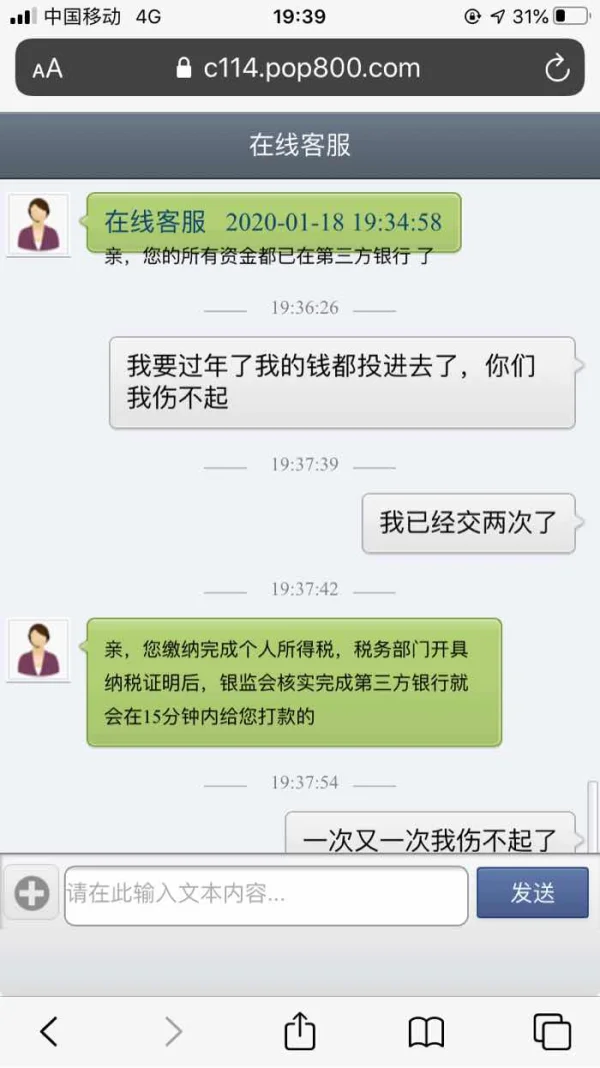

The platform gives no access to withdrawal with excises including wrong bank information, inadequate credit score and even unpaid individual tax. I have paid all fees, but the withdrawal is still unavailable.

Exposure

chương

Vietnam

The chart was manipulated. I wanted to make the withdrawal, while IB gave no access to it, suffering huge losses.

Exposure

黑山老妖1

Hong Kong

I have been in this industry for almost 10 years. I have encountered various platforms over the years, each with its own advantages and disadvantages. However, for beginners, there is still a certain threshold in this industry. At least, that's what I think. First of all, you must have a basic understanding of this industry, including indicators, operations, and so on. Secondly, choose a suitable platform. These basic things are extremely important. The best and fastest way is to practice, get hands-on, learn while playing. Time is the best teacher. Speaking of which, since you have come this far, of course, you can imagine that I am currently using the IB platform. Let me share my experience. First of all, it is undeniable that IB has a good reputation, strength, and a relatively large and formal platform. The spreads are also relatively low, and there are some indicator tools that are beginner-friendly, without a doubt. However, there are also obvious disadvantages, such as slow withdrawal and meticulous review, which may make users feel troublesome. But behind the strictness is actually security and reliability, which I strongly believe in. My evaluation is normal.

Neutral

老李4458

Hong Kong

According to the requirements, I submitted a lot of documents. They froze and closed my account on the grounds that my account was not compliant. I went to withdraw the remaining funds and confirmed the withdrawal over the phone. Until now, customer service, all consultation forms, and emails have not been replied to. It's really disappointing. This is how they treat us Chinese customers on such a big platform.

Exposure

Ethan1454

United Kingdom

My experiences with IBKR's customer service have been positive. They are efficient and helpful in resolving issues, which adds to my overall satisfaction with the broker.

Positive

HenryM

United Kingdom

I love that IBKR offers a wealth of educational resources and webinars. They have really helped me improve my trading skills and market understanding, which I consider a notable strength of the platform.

Positive

Daniel324

United Kingdom

I appreciate the advanced trading tools and analytics that IBKR provides. They cater to both professional and retail investors, which I find beneficial. However, I must admit that the complexity of the platform can be overwhelming for beginners.

Neutral

FX2510300550

United Kingdom

I've been impressed with Interactive Brokers' low trading fees, which make it an attractive option for someone like me who is cost-conscious. The platform offers a wide range of investment products, and I find it particularly favorable for my active trading style.

Positive

Isabella2322

United Kingdom

While the platform can be a bit complex for beginners, the wealth of tools and resources available make it worth the learning curve. Overall, Interactive Brokers is a solid choice for those who are serious about trading.

Positive

James7312

United Kingdom

I've been using IB for over a year now, and it has been a game-changer for my trading activities. The platform has a wide range of tools and features that are perfect for novice and experienced traders. The commission structure is very competitive, which has saved me a lot of money compared to other brokers. The trading platform is robust and reliable, providing real-time data and advanced charting tools that help me make informed decisions. Customer service is top-notch, always responsive and helpful. The educational resources are also incredibly valuable, helping me continuously improve my trading strategies. Overall, Interactive Brokers offers a comprehensive and professional trading experience that I highly recommend to anyone serious about investing.

Positive

Shaun9929

United Kingdom

I like IB. I'm not an advanced trader but they have some of the lowest rates on the market. Solid customer support. No complaints so far.

Positive

Suzette

United Kingdom

I've been an IB client for a year now and find it reliable and comprehensive. I appreciate the wide range of assets and I now use more advanced tools like TWS. It can be a bit overwhelming if you're a new trader but I recommend IB to anyone willing to invest the time.

Positive

Huikn

Belarus

After having some recent issues with the Company, they fully redeemed themselves and when it comes to the quality of the service they really are on top of their game. One thing that tis super annoying, however, is that their site keeps crashing. It's been happening for the past week now. For obvious reason, you don't want this to happen to your stocks. I hope they will address this and fix it soon.

Neutral

Thao3542

Vietnam

Fraudulent platform, intentionally not allowing withdrawals. Up to now, I have intentionally locked my account and not allowed me to access it. Currently, this floor has signs of fraud.

Exposure

Thao3542

Vietnam

I requested to withdraw the deposited money but I couldn't because the floor required a 3-month VIP upgrade. I sent a message to the customer base asking how to withdraw money but was not informed about this issue.

Exposure

迈特总部 直招

Hong Kong

IB is a broker that won’t let me down, I promise. It is a decent platform offering fair and superb trading conditions. But one thing you should note is that this broker does not provide online support, which result in some inconvenience.

Positive

净芳

Hong Kong

Have been trading with IB Investments for many years! I am still very optimistic about them and trust them very much, after all, they have never let me down. It felt like they were my friends and witnessed my growth along the way. Hope we are all getting better and better and making money together!

Positive

FX1161331972

Singapore

When I first set foot in the trading industry, I used Interactive Brokers as a platform. Big platform transactions are very formal. I did not lose money on this platform, but when I traded later, I found that the transaction fees on this platform were getting higher and higher, and the quality of customer service was not very good, so I switched to other platforms.

Neutral

阳谷电缆

Colombia

I just started trading at IB but I am very impressed with this company. The trading conditions it provides, such as spreads, platforms, leverage, etc., are very suitable for me. Customer service is also very good.

Positive

漫步咖啡

Hong Kong

I heard lots of complaints about this broker...in my opinion, this broker’s customer support is easy to access, and opening an account is quite easy and simple. However, its website is difficult to navigate, and you cannot even find forex details easily…

Positive

JLTrader

United States

Interactive Brokers is an external US stock futures platform, there is no mt4/5, don't be fooled by the black platform, it is not a foreign exchange platform at all, just like Futu Niu Niu

Positive

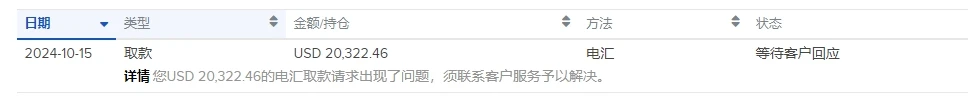

FX3453383040

Taiwan

The money in the account can’t be withdrawn, even if it’s delayed, it’s still asked me to pay the different fees. I can’t get the money. It is ok, but I will not give you any penny, and I want to find other people to be victimized by myself. Serious fraud.

Exposure