Forex Technicals: Sterling and Euro Capitalize on Dollar Weakness

European majors capitalize on Dollar weakness, with GBP/USD hitting multi-month highs on robust retail data and EUR/USD nearing the 1.1920 threshold.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

European majors capitalize on Dollar weakness, with GBP/USD hitting multi-month highs on robust retail data and EUR/USD nearing the 1.1920 threshold.

Weltrade, established in 2006 and headquartered in Saint Lucia, presents a conflicting profile in the 2025 landscape. While it holds a regulatory license from South Africa's FSCA, its overall WikiFX Score has dropped to a concerning 2.42/10 due to a high volume of investor complaints. Recent data highlights over 40 severe complaints within three months, ranging from withdrawal refusals to system instability. This review analyzes the dichotomy between its regulatory status and the practical risks reported by traders globally.

Gold surges to record highs on safe-haven flows, while Oil prices remain trapped in a tug-of-war between Middle East geopolitical risks and grim oversupply data.

The US Dollar faces a double threat from a looming government shutdown over immigration disputes and a structural sell-off of US Treasuries by major European pension funds.

A rate check by the New York Fed has triggered a sharp sell-off in USD/JPY, signaling a pivotal shift in US foreign exchange policy toward coordinated intervention with Japan.

Private sector credit in Nigeria rose to N75.8 trillion in December 2025 according to Central Bank data, signaling a modest rebound in lending activity. This expansion in domestic liquidity marks a recovery from November's figures, potentially influencing broader monetary conditions in the region.

Quotex receives a low safety score of 1.52/10 due to its unregulated status and multiple investor warnings from authorities like BAPPEBTI and CMVM. User feedback highlights severe issues including deposit failures, account suspensions upon profit generation, and withdrawal obstructions.

Stronger-than-expected Australian inflation and employment data have pushed the AUD/USD to a 15-month high, with markets now pricing in a greater than 50% chance of an RBA rate hike in February.

Market speculation regarding a 'Plaza Accord 2.0' has intensified following reports of a rare rate check by the New York Fed, signaling potential coordinated US-Japan intervention to support the yen.

The US Dollar Index has erased year-to-date gains, falling 1.88% as geopolitical tensions over Greenland and looming US government shutdown risks drive a massive flight to commodities.

Spot gold has shattered the psychological $5,000 barrier, driven by fears of a global sovereign debt crisis and de-basement trades rather than traditional rate cut expectations.

The Japanese Yen staged a dramatic 1.7% rally following suspected joint intervention by US and Japanese authorities, overshadowing the Bank of Japan's decision to hold rates steady.

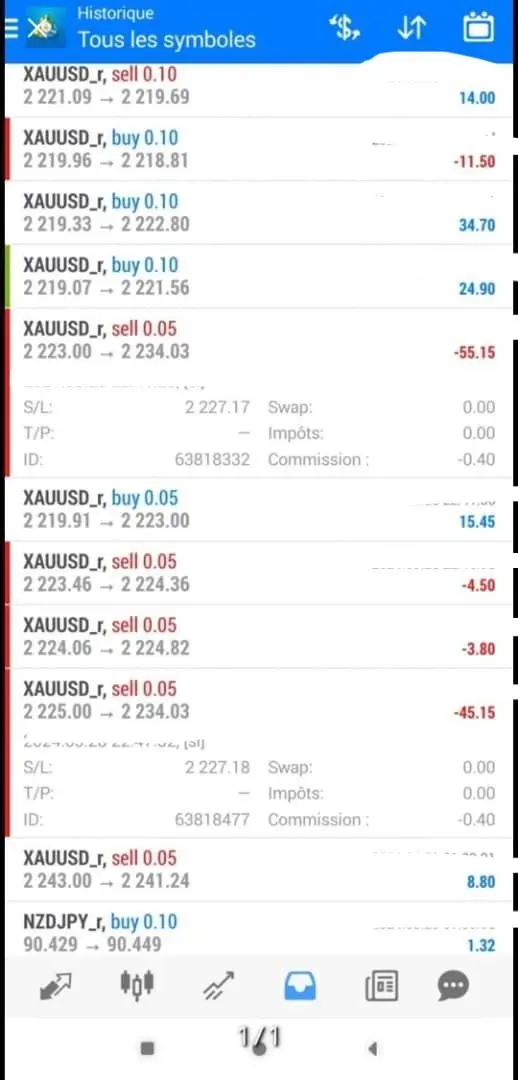

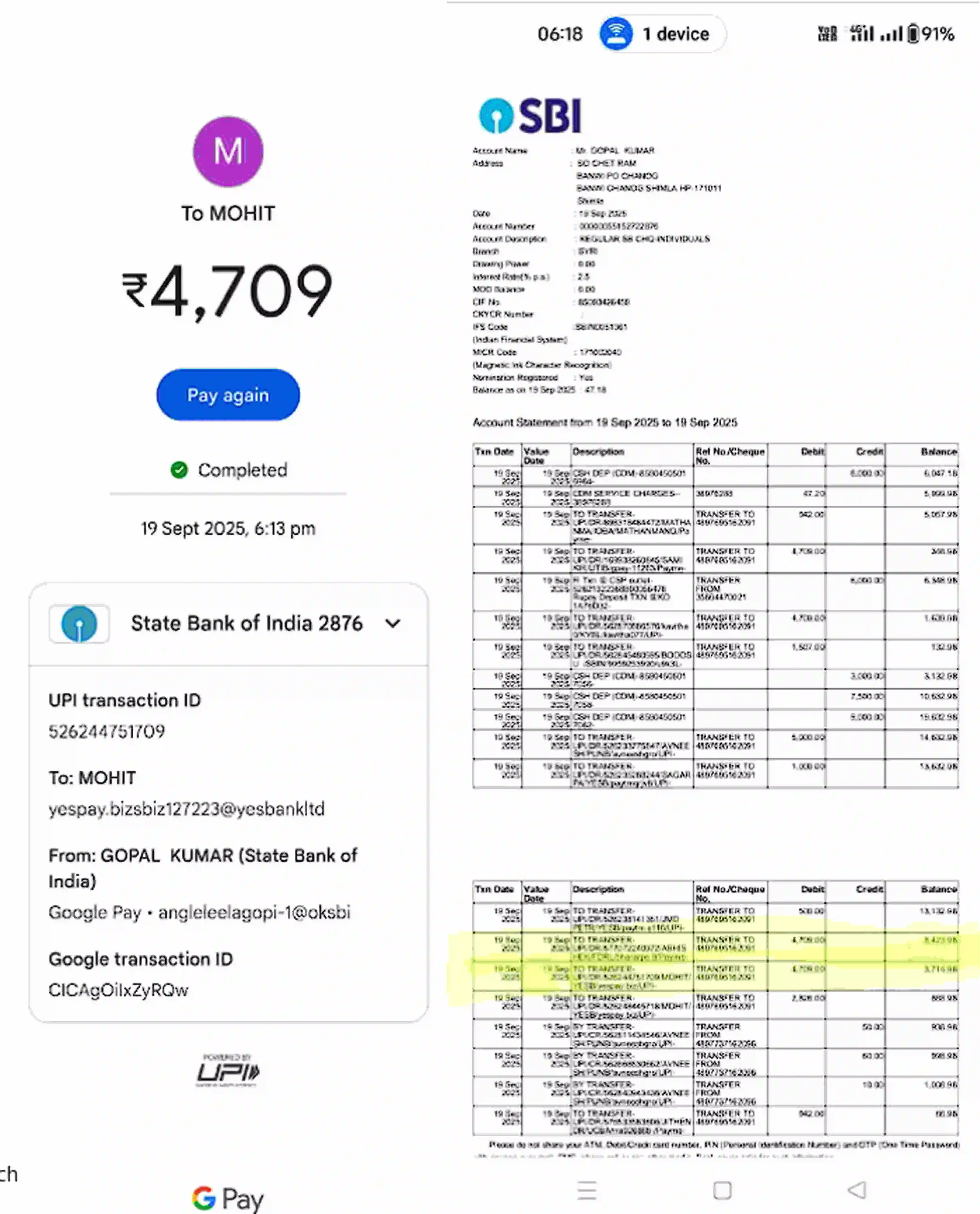

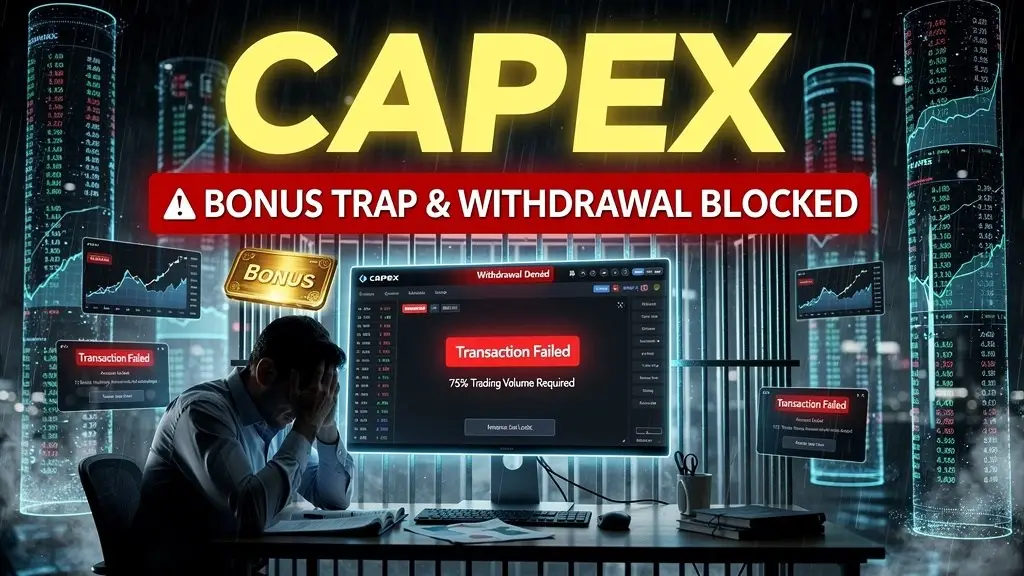

Our investigation into Capex reveals severe anomalies, including blocked withdrawals and aggressive retention tactics. With 10 complaints in just three months and confirmed reports of platform access failures, the safety of client funds is currently at critical risk.

The Federal Reserve faces a deepening internal divide between prioritizing labor weakness or fighting sticky inflation, leading to market uncertainty about the 2025-2026 rate path.

Crude oil prices surged over 3% as the US threatens actions against Iraqi oil exports and geopolitical tensions escalate involving Iran and Israel.

VITTAVERSE currently operates under offshore Seychelles regulation but faces a surge in complaints regarding profit cancellations and withdrawal denials. With a low WikiFX safety score of 3.27, traders should exercise extreme caution due to reports of account restrictions and deducted funds.

A comprehensive 2025 review of Plus500, analyzing its high WikiFX Score of 7.99, extensive regulatory framework (FCA, ASIC, CySEC), trading apps, and recent user complaints regarding withdrawals.

Trive holds a strong 7.84 WikiFX score with regulation from ASIC and MFSA, offering competitive trading conditions on MT4 and MT5 platforms. However, despite high regulatory marks, a recent surge in client complaints regarding withdrawal delays and profit deductions warrants caution.

Multibank Group scams warning: denied withdrawals & fake trading profits. Don’t fall victim—read the latest scam cases today!

Our 2025 investigation into dbinvesting reveals a critical pattern of profit erasure and withdrawal denials, with traders reporting over $16,000 in withheld funds under vague "violation" clauses. Operating with a low WikiFX score of 2.14 and offshore regulation, this platform presents a severe risk of capital loss for mobile and retail investors.