简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Abstract:Titan Capital Markets, established in 2021, currently holds a critical warning status with a WikiFX score of 1.45 due to a lack of valid regulation and inclusion on the Philippines SEC blacklist. By 2026, the entity is heavily associated with withdrawal failures, forced crypto-token conversions, and 'Ponzi scheme' allegations, indicating extreme risk for investors.

Executive Summary

In this in-depth review, we analyze the key metrics and safety profile of Titan Capital Markets. The broker was established in 2021, claiming headquarters in Australia, but has failed to secure a reputable reputation in the financial industry. As a broker entity operating since the early 2020s, it has been the subject of severe regulatory warnings and client dissatisfaction. With a WikiFX score of only 1.45/10, the platform is categorized as high-risk, primarily due to the absence of valid licensing and a history of unresolved investor complaints ranging from suspended withdrawals to allegations of fraud.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation operates under. For Titan Capital Markets, the safety indicators are nonexistent. While the company claimed Australian origins, there is no evidence of regulation by the Australian Securities and Investments Commission (ASIC) or any other Tier-1 authority.

More alarmingly, the regulation status is flagged by the Philippines Securities and Exchange Commission (SEC). In January 2024, the SEC issued a public advisory against Titan Capital Markets, identifying its operations as having the characteristics of a “Ponzi scheme.” The regulator noted that the entity was illegally soliciting investments from the public without the necessary license to sell securities. This blacklist status implies that client funds are not segregated and are at imminent risk of misappropriation.

2. Forex Trading Claims vs. Reality

For traders focusing on Forex instruments, the conditions offered by this entity appear to have been misleading. While initially marketing itself as a provider for Forex trading with AI technology updates, user reports indicate a drastic pivot in its business model.

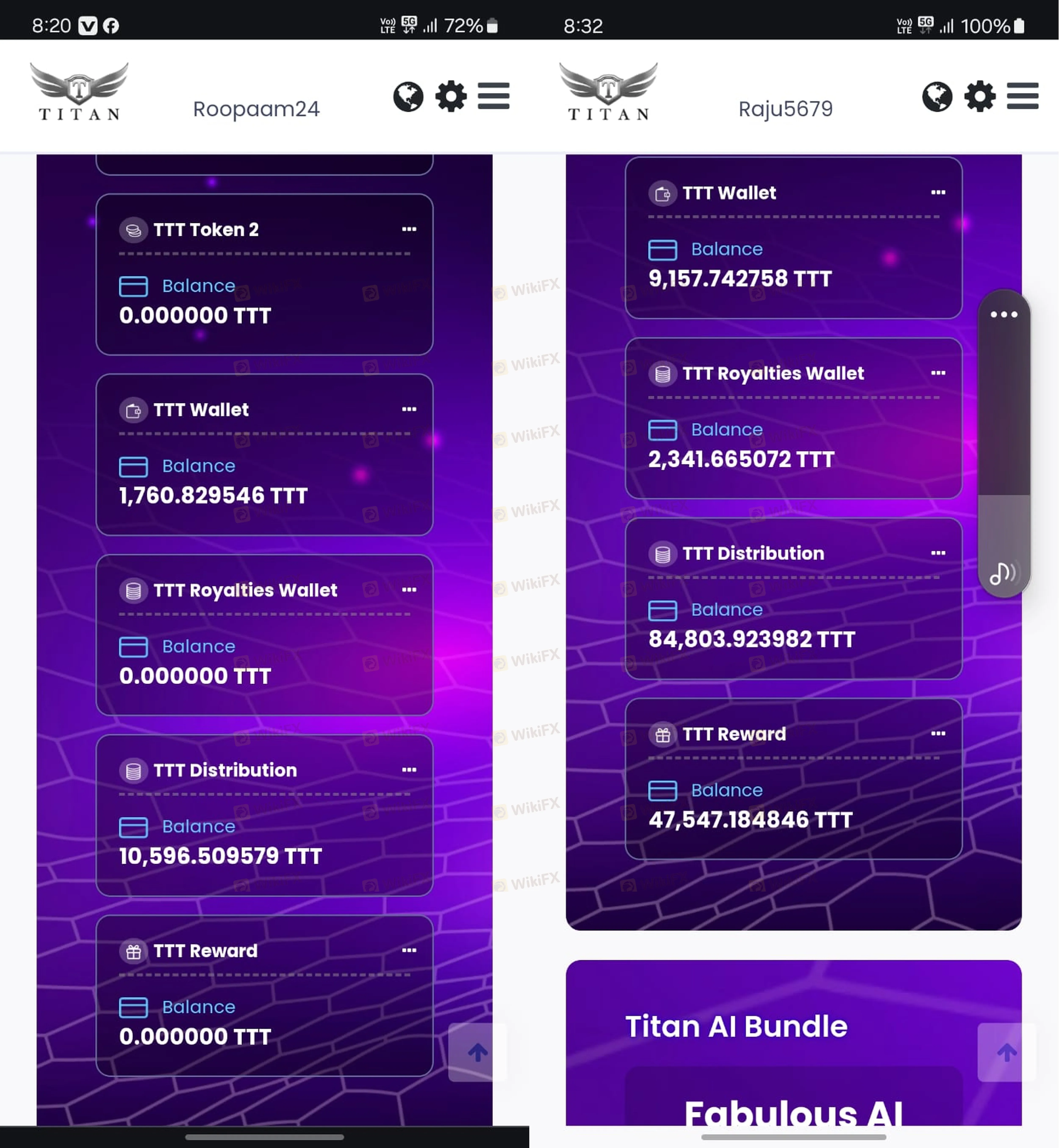

Complaints reveal that funds deposited for currency trading were forcibly converted into a proprietary crypto token known as “TTT.” Investors expecting standard Forex market exposure found their capital locked in these tokens, which reportedly plummeted in value. This “bait and switch” tactic—moving from liquid currency markets to illiquid proprietary tokens—is a significant red flag often associated with fraudulent schemes.

3. User Feedback & Complaints

The user feedback for Titan Capital Markets is overwhelmingly negative, with over 40 complaints filed in recent months. The thematic consistency of these reports points to a systemic collapse of the platform's services.

Key Complaint Themes:

- Withdrawal Paralysis: Numerous users report that withdrawals have been stalled for months (e.g., “unable to withdraw money,” “my money is stuck from last 8 months”).

- Forced Token Conversion: Investors claim their principal amounts were vested into “TTT” tokens without permission, rendering the funds inaccessible.

- Account Blocking: Several users have reported difficulties with their login stability, stating that their accounts were frozen or deleted after they requested refunds.

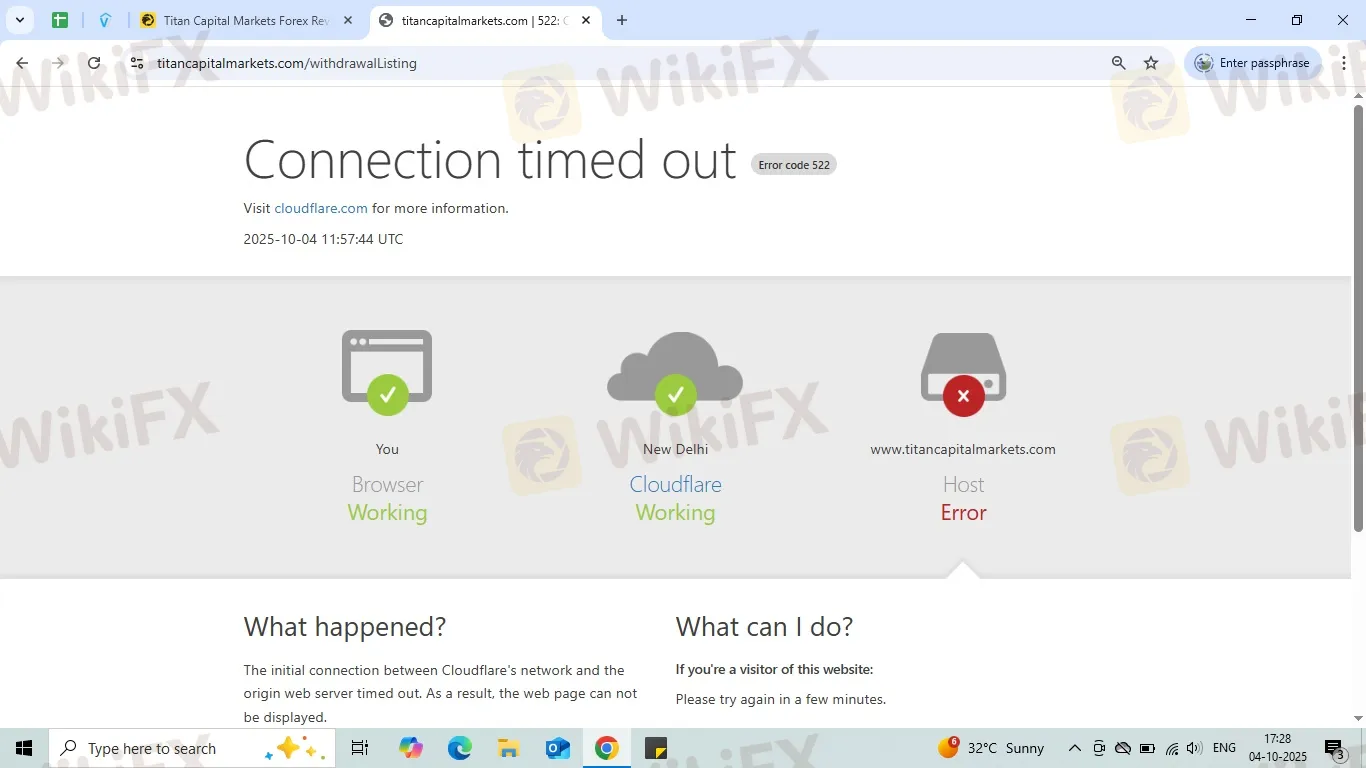

- Operational Closure: Recent reports from 2025 explicitly state, “The company closed now,” suggesting the entity may have ceased operations entirely.

Case Evidence:

One user from India detailed a common scenario (translated): “I invested $50,000. They put the funds in Forex and then converted it to crypto. After that, withdrawals stopped, and the site closed.”

Another user noted, “Titan Capital Markets blocked my username without notice... I am not an employee, I am an investor.”

Final Verdict

Titan Capital Markets represents a severe danger to capital. The combination of a regulatory blacklist by the Philippines SEC, the lack of a valid license, and a torrent of complaints regarding unpaid withdrawals confirms its status as an unsafe trading venue.

Pros:

- None identified.

Cons:

- Blacklisted by the Philippines SEC (Ponzi scheme warning).

- Unauthorized conversion of client funds to tokens.

- Widespread withdrawal failures and account blocks.

- Extremely low safety score (1.45).

Traders are strongly advised to avoid this entity. For real-time updates on regulation status or to verify the official login page for recovery purposes, consult the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator