简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

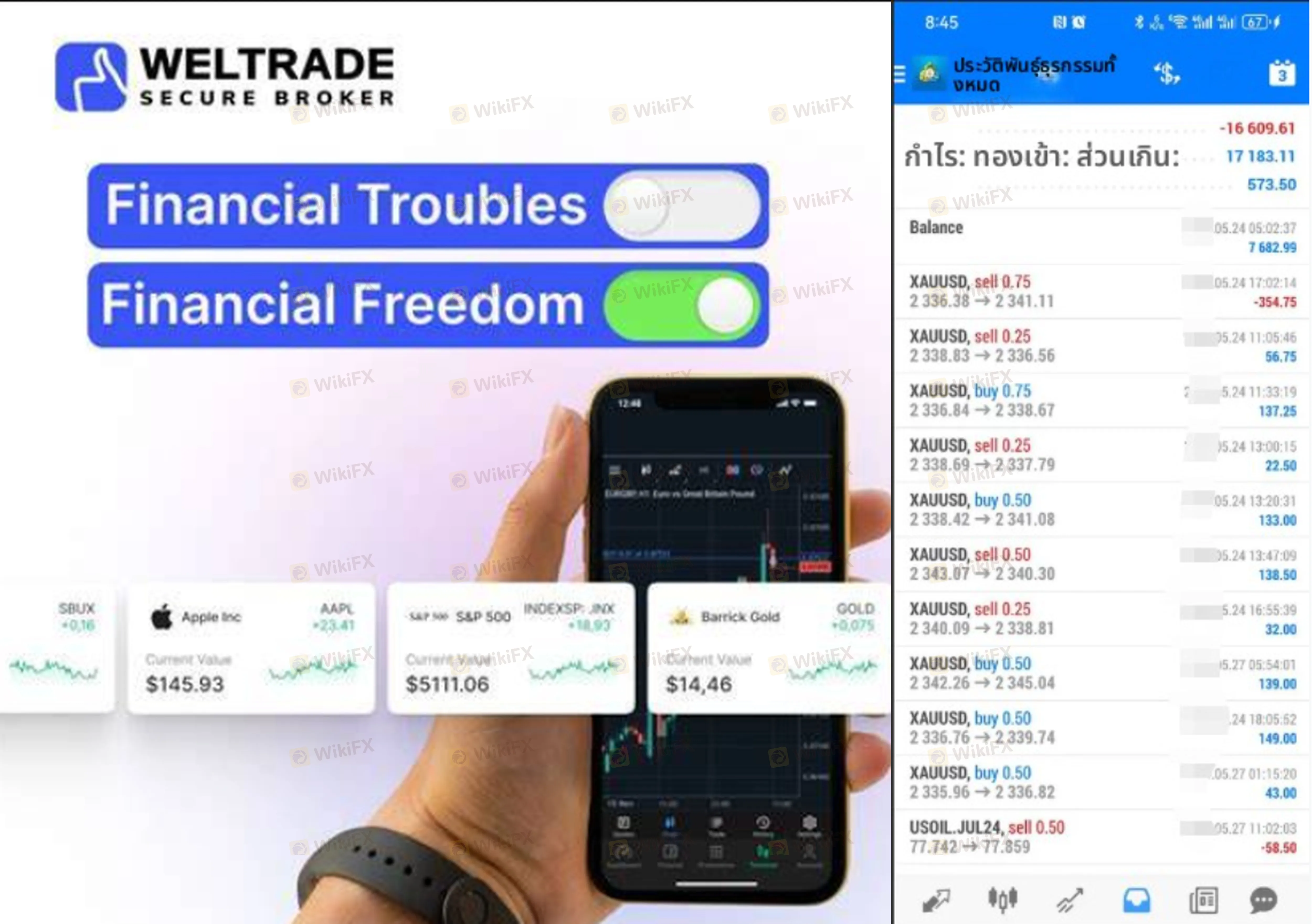

Weltrade Review 2025: Is This Forex Broker Safe?

Abstract:Weltrade, established in 2006 and headquartered in Saint Lucia, presents a conflicting profile in the 2025 landscape. While it holds a regulatory license from South Africa's FSCA, its overall WikiFX Score has dropped to a concerning 2.42/10 due to a high volume of investor complaints. Recent data highlights over 40 severe complaints within three months, ranging from withdrawal refusals to system instability. This review analyzes the dichotomy between its regulatory status and the practical risks reported by traders globally.

Weltrade is a veteran forex broker established in 2006, offering trading services on MetaTrader platforms. Despite its long operational history and a specific regulatory license in South Africa, the broker currently holds a low WikiFX Score of 2.42. This score reflects significant risk factors, primarily driven by a surge in user complaints regarding fund safety and operational integrity.

Pros and Cons of Weltrade

- ✅ Regulated by the FSCA (South Africa).

- ✅ Offers widely used MT4 and MT5 trading platforms.

- ✅ Low entry barrier with accounts starting from $1.

- ❌ Severe Regulatory Warnings: High number of resolved and unresolved complaints.

- ❌ License Revoked: The license from Belarus (NBRB) is no longer valid.

- ❌ Withdrawal Issues: Multiple reports of delayed or denied fund access.

Weltrade Regulation and License Safety

When evaluating the safety of a trading broker, regulatory oversight is paramount. Weltrade operates with a mixed regulatory background.

FSCA Regulation

The broker is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa under license number 50691 (WELTRADE SA (PTY) LTD). This license authorizes them to provide financial services within that specific jurisdiction, offering a layer of oversight for local traders.

Risk Warning: Revoked License and Offshore Status

Traders should exercise caution as Weltrade's license with the National Bank of the Republic of Belarus (NBRB) has been revoked. Furthermore, the entity is headquartered in Saint Lucia, an offshore jurisdiction with looser financial reporting standards compared to top-tier hubs like the UK or Australia. Additionally, regulatory bodies in Malaysia (SCM) and Indonesia have issued warnings or blocked the entity for operating without appropriate local authorization, highlighting potential compliance risks for international clients.

Real User Feedback and Complaints

The most concerning aspect of this broker review is the recent influx of negative user feedback. In the past three months alone, WikiFX has logged 41 complaints.

Common Grievances:

- Withdrawal Failures: Numerous traders from Thailand, Indonesia, and Malaysia have reported that withdrawal requests are delayed for weeks or rejected without valid reasons. One user noted their request had been pending for over 15 days.

- System Instability: Technical issues are frequently cited. A trader from Malaysia reported a critical incident where they experienced a system error and suddenly could not complete the Weltrade login process, causing them to miss a stop-loss trigger and incur significant financial damage.

- Bonus Traps: Complaints also highlight predatory bonus schemes, where accepting a deposit bonus allegedly locks the user's principal capital, making withdrawals impossible until unrealistic trading volumes are met.

Weltrade Forex Trading Conditions and Fees

Weltrade provides a variety of trading environments, though they come with distinct conditions that traders must navigate.

Leverage and Accounts

The broker offers three main account types: Pro, Micro, and SyntX. Leverage is exceptionally high, reaching up to 1:1000 for standard accounts and an aggressive 1:10000 for the SyntX account. While high leverage can amplify gains, it significantly increases the risk of rapid capital loss.

Platforms

Clients can access the markets via MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as a proprietary app. These platforms are industry standards, known for their charting capabilities and automated trading support.

Spreads

Spreads are floating, starting from 0.5 pips on the Pro account and 1.5 pips on the Micro account. However, user feedback suggests that spreads may widen significantly during news events or market volatility, leading to slippage that differs from the advertised conditions.

Final Verdict

Weltrade presents a high-risk environment for traders in 2025. Although it holds a valid license in South Africa, the revocation of its Belarus license and the overwhelming volume of complaints regarding withdrawals and systemic failures cannot be ignored. The low WikiFX score of 2.42 serves as a strong indicator of the current operational struggles.

Traders are advised to prioritize brokers with higher trust scores and unblemished regulatory records. To stay safe and view the latest regulatory certificates, check Weltrade on the WikiFX App.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Currency Calculator