Company Summary

| Yutaka SecuritiesReview Summary | |

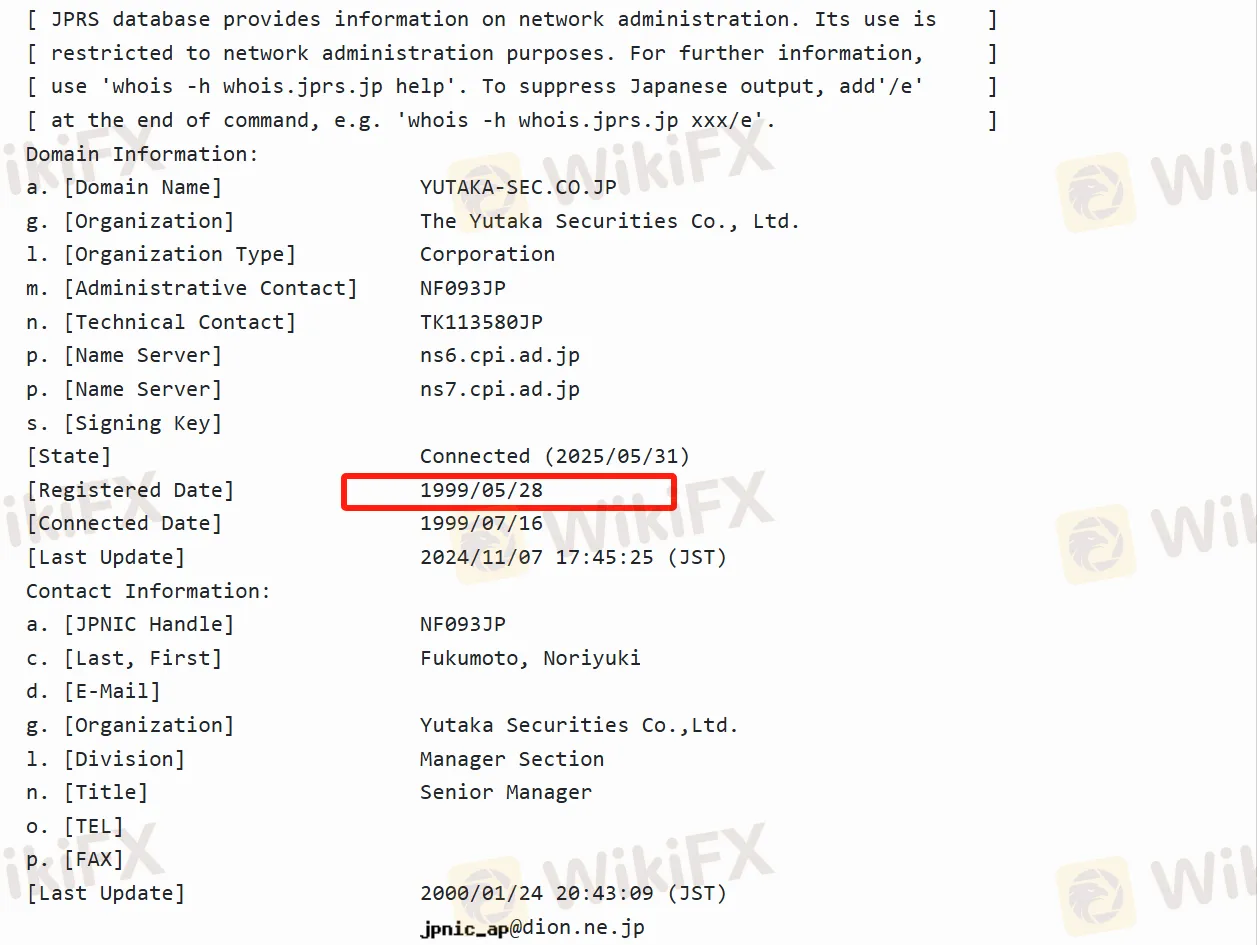

| Founded | 1999/05/28 |

| Registered Country/Region | Japan |

| Regulation | Regulated |

| Market Instruments | Derivative transactions, bonds, stocks, investment trusts, and insurance |

| Trading Platform | Yutaka Net and Yutaka Call |

| Customer Support | / |

Yutaka Securities Information

Yutaka Securities (ゆたか证券) is a regional, close-knit securities company based in Nagoya City, Aichi Prefecture, Japan, with a history of up to 50 years. It meets the needs of investors with diverse trading methods (face-to-face in stores, online, via phone) and a rich variety of products (stocks, bonds, trusts, etc.), and also offers time-limited discounts such as a 20% rebate rate for online transactions. Currently, it has multiple branches in the Tokai region (Aichi Prefecture, Gifu Prefecture, Mie Prefecture, Shizuoka Prefecture) and Tokyo Metropolis, facilitating offline consultations and business handling for customers.

Pros and Cons

| Pros | Cons |

| Regulated | Business regional limitations |

| A regional, close-knit securities company | Limited degree of internationalization |

| Diverse trading methods | |

| Various trading products | |

| Numerous preferential activities |

Is Yutaka Securities Legit?

Yutaka Securities is a legitimate and compliant securities institution. It is regulated by the Financial Services Agency, and its securities company license number is No. 21 issued by the Director of the Tokai Regional Finance Bureau (Financial Merchants).

What Can I Trade on Yutaka Securities?

At Yutaka Securities, investors have access to a wide variety of tradable products. In terms of stocks, they can participate in transactions of domestic stocks and US stocks. In the field of bonds, there are domestic bonds, foreign bonds, and structured bonds (EB bonds) to choose from. In addition, investment trusts, derivative transactions (involving financial derivative transactions), and insurance products are also provided.

| Tradable Instruments | Supported |

| Derivative transactions | ✔ |

| Bonds | ✔ |

| Stocks | ✔ |

| Investment trusts | ✔ |

| Insurance | ✔ |

| Shares | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

Trading Platform

Yutaka Securities offers the “Yutaka Net” online trading platform, which facilitates investors' online trading operations. This platform should have basic functions such as real-time market quotation viewing, trading order placement, and account management. Combining with the company's rich variety of products, it supports online trading of multiple financial products. Moreover, store face-to-face trading and communication trading via “Yutaka Call” are also provided.

Bonus

Yutaka Securities will irregularly launch various preferential activities as rewards. For example, in online trading, investors can enjoy a maximum rebate rate of 20%, the handling fee for US ETFs is waived, and customers who purchase national bonds with cash can receive QUO cards corresponding to the purchase amount, and so on.