Company Summary

| FFG Securities Review Summary | |

| Founded | 2007 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Stocks, Bonds, ETFs, REITs, Investment Trusts |

| Demo Account | ❌ |

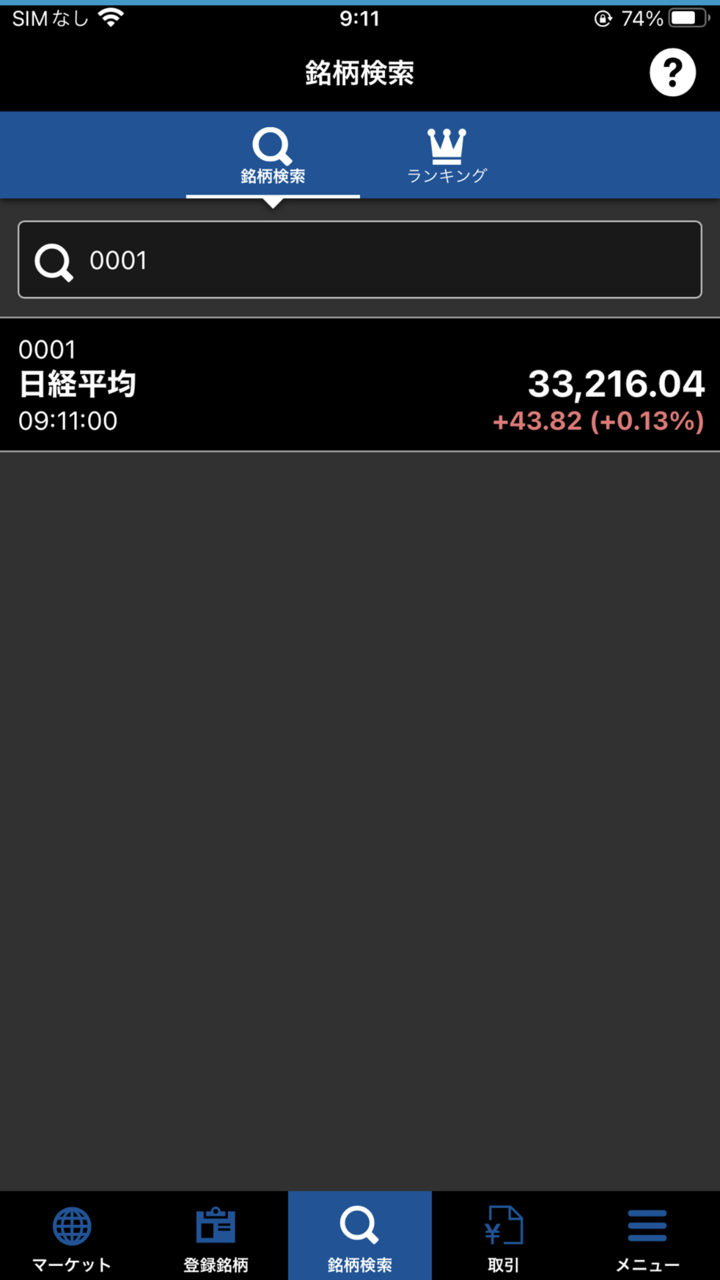

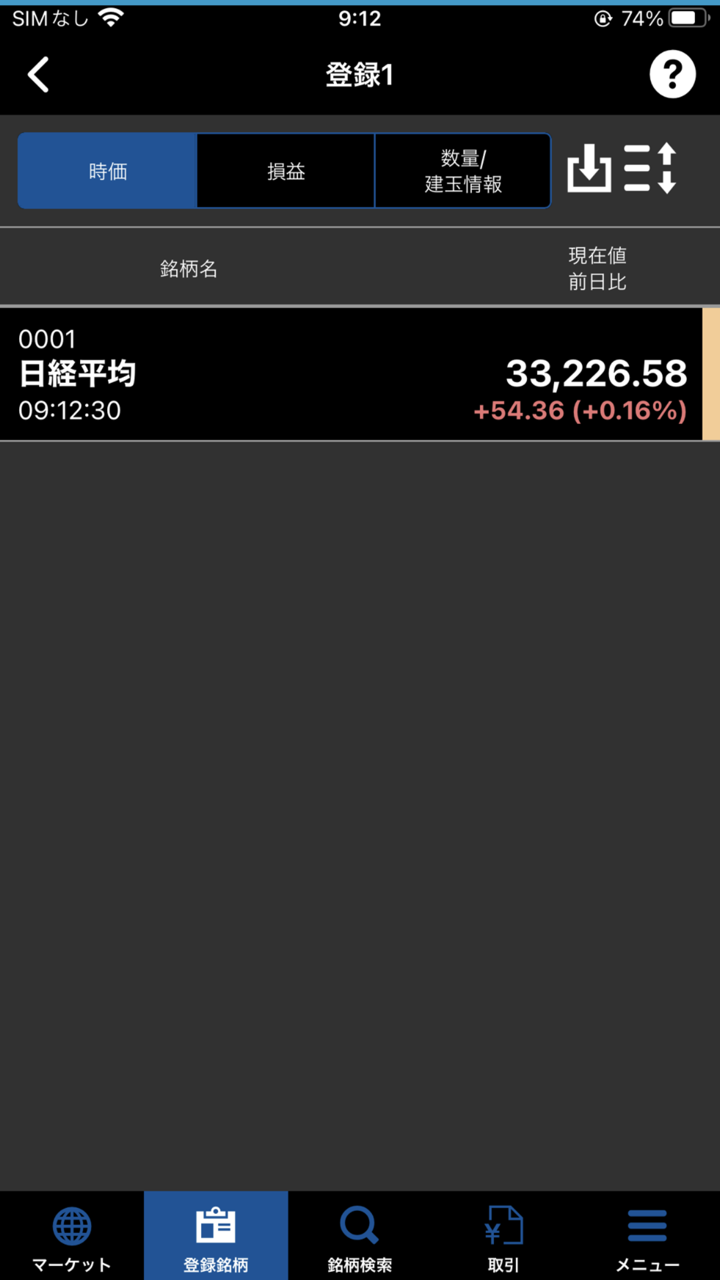

| Trading Platform | FFG Securities App, FFG Internet Trading |

| Minimum Deposit | / |

| Customer Support | Phone: 092-771-3836 |

| Address: 9F, Fukuoka Bank Head Office, Fukuoka | |

FFG Securities Information

Founded in 2007, FFG Securities Co., Ltd. is a Japanese financial services firm regulated by the FSA. It provides access to investment trusts, ETFs, bonds, U.S. and domestic equities. Although mobile and internet trading systems are accessible, the lack of MT4/MT5 and large offline costs can be a disadvantage for those on a budget.

Pros and Cons

| Pros | Cons |

| Regulated by FSA in Japan | No demo or Islamic accounts |

| Wide range of domestic and foreign instruments | Fees are high for in-person transactions |

| Discounted fees for internet-only orders | Minimum deposit not disclosed |

| Supports U.S. stocks and margin trading | |

| Long operation time |

Is FFG Securities Legit?

Yes, FFG Securities Co., Ltd. (FFG証券株式会社) is regulated. It holds a Retail Forex License issued by the Financial Services Agency (FSA) of Japan, with the license number 福岡財務支局長(金商)第5号.

What Can I Trade on FFG Securities?

Including stocks, bonds, ETFs, REITs, and investment trusts, FFG Securities offers wide range of domestic and foreign financial instruments. It also enables margin trading and provides a mobile app for market data and real-time trading.

| Trading Assets | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

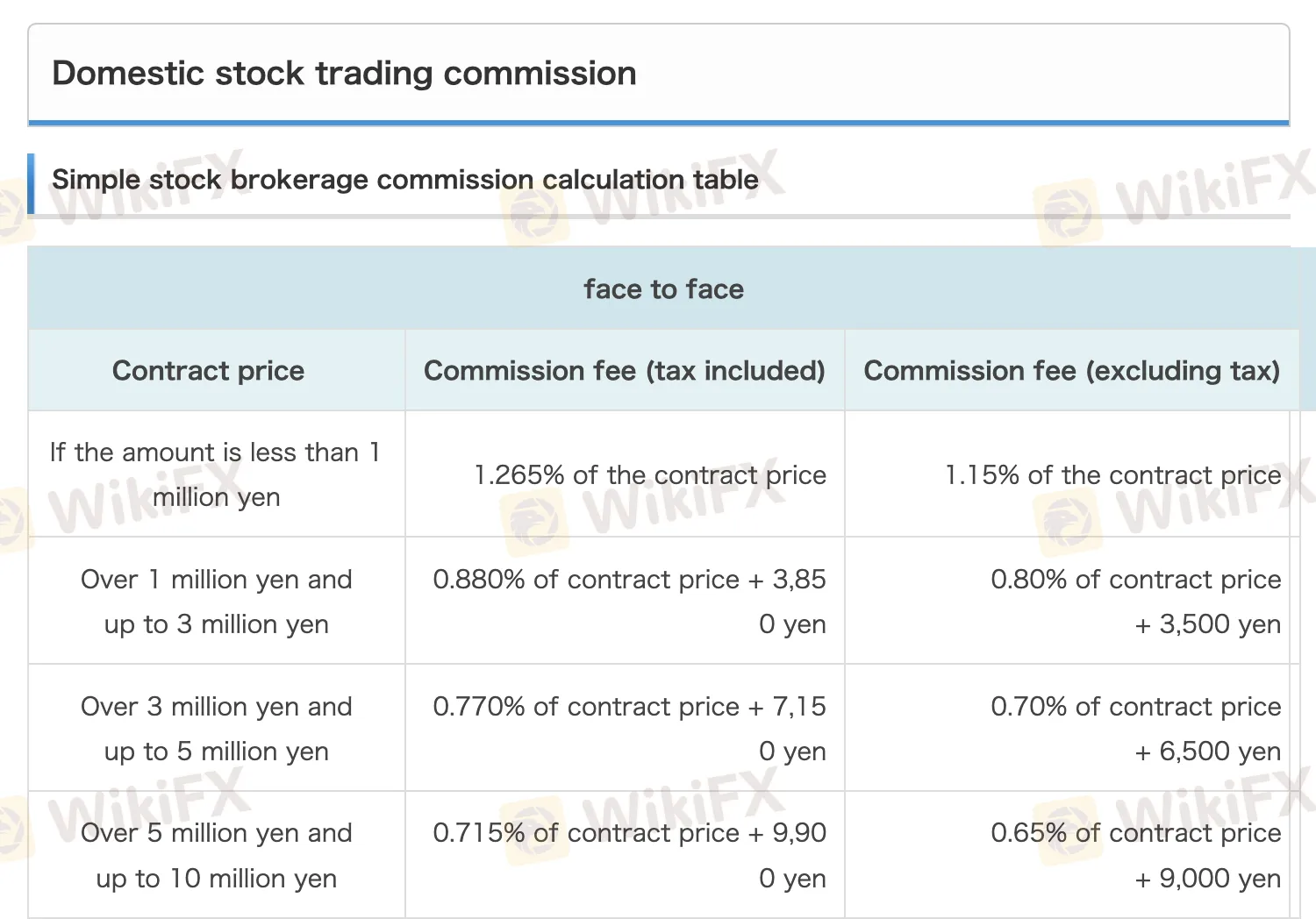

FFG Securities Fees

FFG Securities' overall fees are relatively high compared to standard online brokers, especially for face-to-face transactions and large contract sizes. However, significant discounts (up to 90%) are applied to online-only trading, making it more cost-effective for digital users.

| Fee Type | Detail |

| Domestic Stock Trading | Up to 1.265% of contract price (face-to-face); 90% discount for online-only |

| Minimum Commission Fee | Face-to-face: ¥2,750; Online-only: ¥275 |

| Margin Trading | Buy interest: 1.97% p.a.; Stock lending fee (short): 1.15% |

| Foreign Stocks | 1.10% for <¥1M; 0.33% + ¥218,900 for >¥100M |

| Convertible Bonds (CB) | 1.10% for <¥1M; 0.165% + ¥765,600 for >¥1B |

| Investment Trusts | Varies by product; Online discounts available (up to 10% off) |

| Account Management Fees | Domestic: Free; Foreign: Free |

| Transfer Fees (Stocks) | Starts at ¥1,100 (1 unit or less); capped at ¥6,600 |

| Paper Delivery (Shareholder materials) | ¥660 per stock |

Trading Platform

| Trading Platform | Supported | Available Devices |

| FFG Securities App | ✔ | iOS, Android |

| FFG Internet Trading | ✔ | PC, Mac, web, mobile |

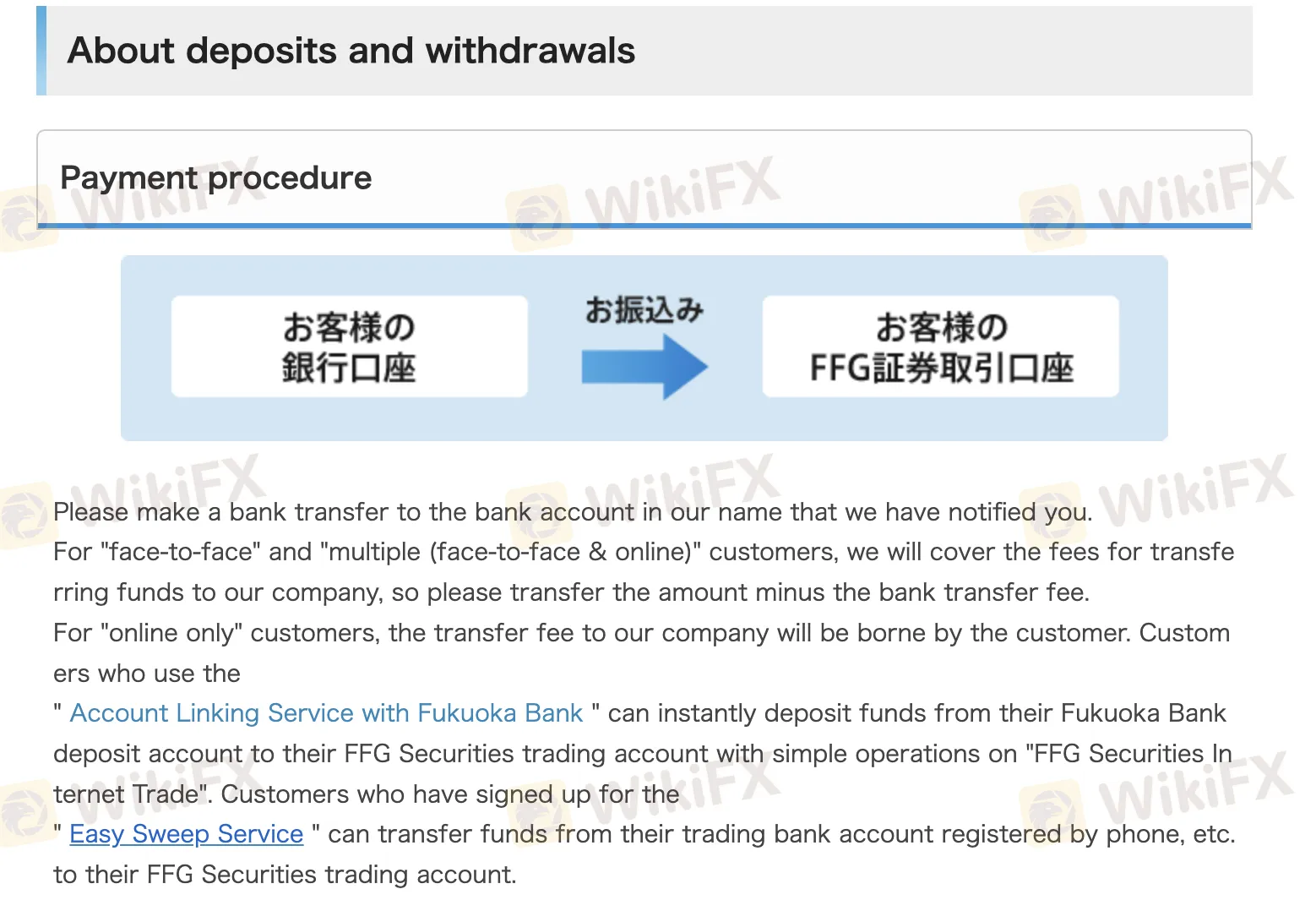

Deposit and Withdrawal

FFG Securities does not charge fees for deposits or withdrawals for face-to-face or hybrid (face-to-face & online) customers. However, online-only customers must bear the deposit transfer fee themselves.

| Payment Method | Fees | Processing Time |

| Bank Transfer (Face-to-face/Hybrid) | ❌ | Same day if before noon |

| Bank Transfer (Online-only) | ✔ | May be next business day |

| Fukuoka Bank Account Link | ❌ (via linked account) | Instant |