Exposure

Should one be removed off if he/she doesn’t add fund?

Foreword: All kinds of futures trading platforms on the Internet have not obtained the approval of the financial regulatory authorities. They have not established relevant institutions to provide business services in China, and have not filed with the telecommunications department according to law,all of them are illegal exhibitions. Moreover, all types of entities involved in the futures trading platform, including domestic agents, propaganda agencies and investors, are required to bear corresponding legal responsibilities. That is to say, even if it is a legal foreign regulated institution, it is at least illegal to conduct business in China. The futures trading model carried out by Dogan International is a market-making trading, which is different from the futures and stocks, and one party will buy the corresponding party. Dogan International is suspected of providing illegal futures trading platforms to the public, and may even be a party to direct trading. It is considered to be a serious violation of the law, both as an athlete and as a referee. Remind everyone that the current futures virtual currency trading platform, especially some unknown foreign exchange platforms, often pretend to be advanced official website by buying relevant licenses and renting a server. Trading software is also counterfeit, costing a few thousand dollars per month. For traders who have not been exposed to foreign exchange and want to trade are doomed to fall into their pitfalls.In this April,I received a phone call from Dagon’s salesman,which I didn’t notice.They kept calling me and added,advising me to follow them on Wechat rather than follow their operations.At that time,I regarded it as a reference.Actually,I have stepped into their pitfalls.I found that the recommended stock was really on the rise.Since I was still vigilant,I have only deposited 50000 RMB.With teacher’s instruction,I made some profits of 20000 RMB.One day,they suddenly ceased.I asked what happened and they said that the company only allowed them to trade in the internal news shares instead of instructing clients.The benefit of short term was 20%-25% with 3-5 days delivery,but the threshold is 200000 RMB.I joined.At that time,the stock market was volatile,I made a loss of hundreds thousand of yuan.The teacher treated me perfunctorily with grinding reasons.Two days later,that teacher advised us to trade CHINA50, Hu shen 300 and Forex Limited to recover the losses.We were pulled into a live-broadcasting room without knowing that the member were all fraudsters.Then I made a loss of more than 100000 RMB within a week.They kept asking me add fund to earn doubly.I deposited more than 500000 RMB in all,keeping constant losses.I felt something wrong because the withdrawal was unavailable.

FX4381686212

Hong Kong

Foreword: All kinds of futures trading platforms on the Internet have not obtained the approval of the financial regulatory authorities. They have not established relevant institutions to provide business services in China, and have not filed with the telecommunications department according to law,all of them are illegal exhibitions. Moreover, all types of entities involved in the futures trading platform, including domestic agents, propaganda agencies and investors, are required to bear corresponding legal responsibilities. That is to say, even if it is a legal foreign regulated institution, it is at least illegal to conduct business in China. The futures trading model carried out by Dogan International is a market-making trading, which is different from the futures and stocks, and one party will buy the corresponding party. Dogan International is suspected of providing illegal futures trading platforms to the public, and may even be a party to direct trading. It is considered to be a serious violation of the law, both as an athlete and as a referee. Remind everyone that the current futures virtual currency trading platform, especially some unknown foreign exchange platforms, often pretend to be advanced official website by buying relevant licenses and renting a server. Trading software is also counterfeit, costing a few thousand dollars per month. For traders who have not been exposed to foreign exchange and want to trade are doomed to fall into their pitfalls.In this April,I received a phone call from Dagon’s salesman,which I didn’t notice.They kept calling me and added,advising me to follow them on Wechat rather than follow their operations.At that time,I regarded it as a reference.Actually,I have stepped into their pitfalls.I found that the recommended stock was really on the rise.Since I was still vigilant,I have only deposited 50000 RMB.With teacher’s instruction,I made some profits of 20000 RMB.One day,they suddenly ceased.I asked what happened and they said that the company only allowed them to trade in the internal news shares instead of instructing clients.The benefit of short term was 20%-25% with 3-5 days delivery,but the threshold is 200000 RMB.I joined.At that time,the stock market was volatile,I made a loss of hundreds thousand of yuan.The teacher treated me perfunctorily with grinding reasons.Two days later,that teacher advised us to trade CHINA50, Hu shen 300 and Forex Limited to recover the losses.We were pulled into a live-broadcasting room without knowing that the member were all fraudsters.Then I made a loss of more than 100000 RMB within a week.They kept asking me add fund to earn doubly.I deposited more than 500000 RMB in all,keeping constant losses.I felt something wrong because the withdrawal was unavailable.

Exposure

FX4111098624

Sri Lanka

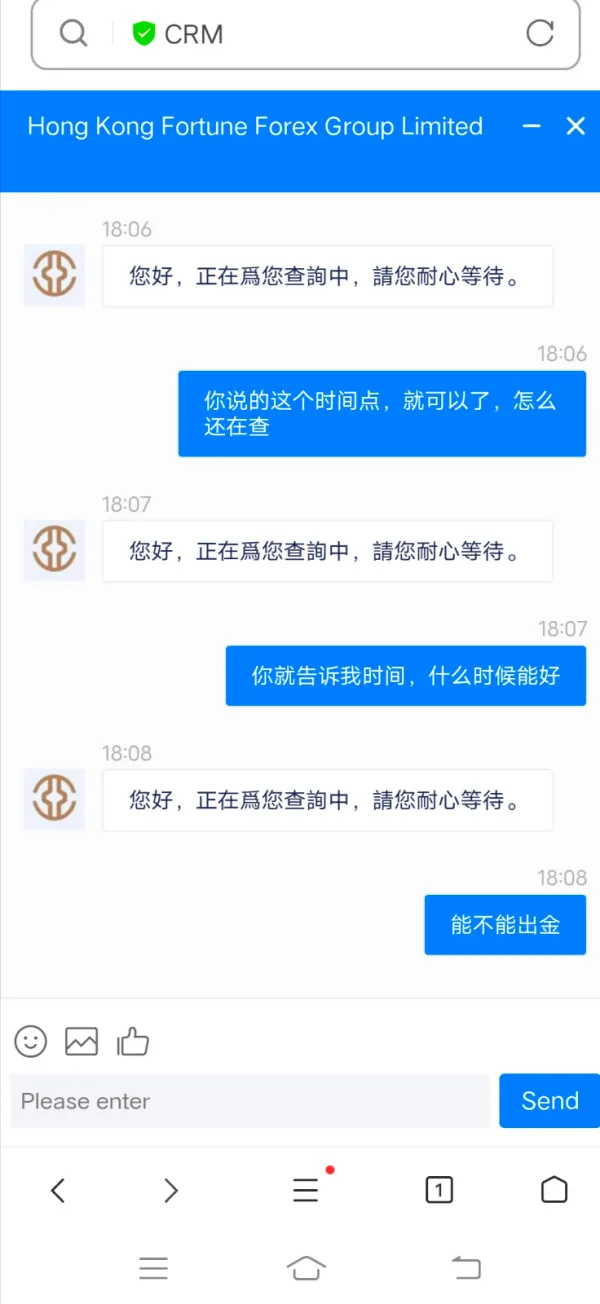

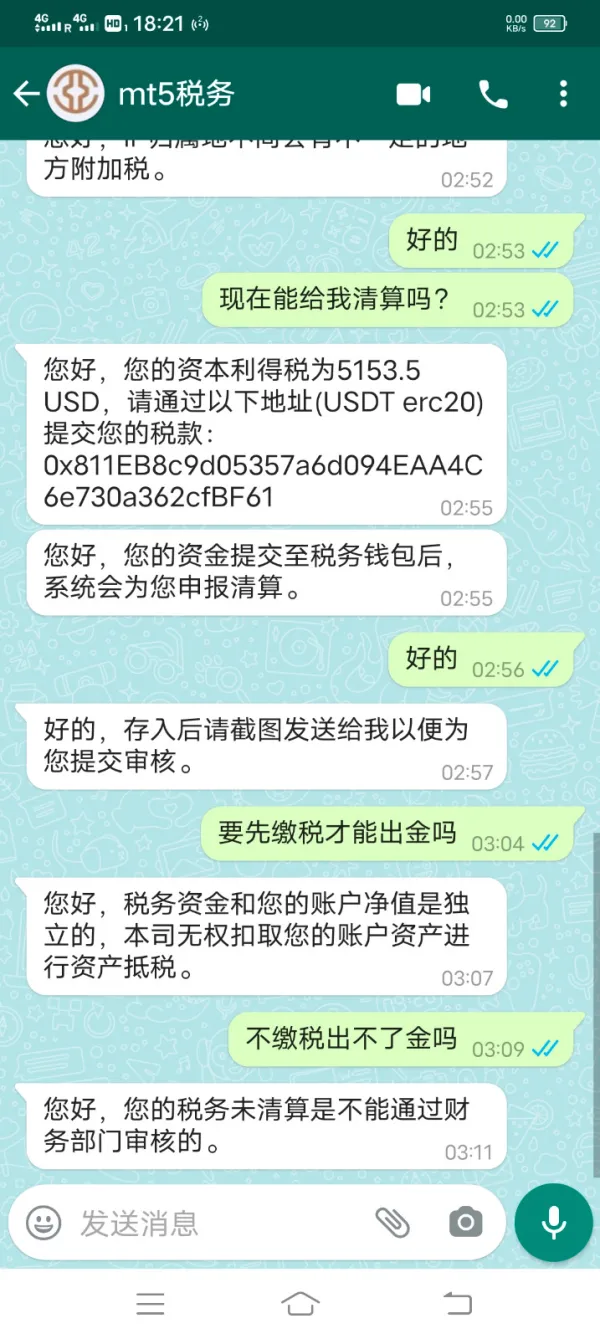

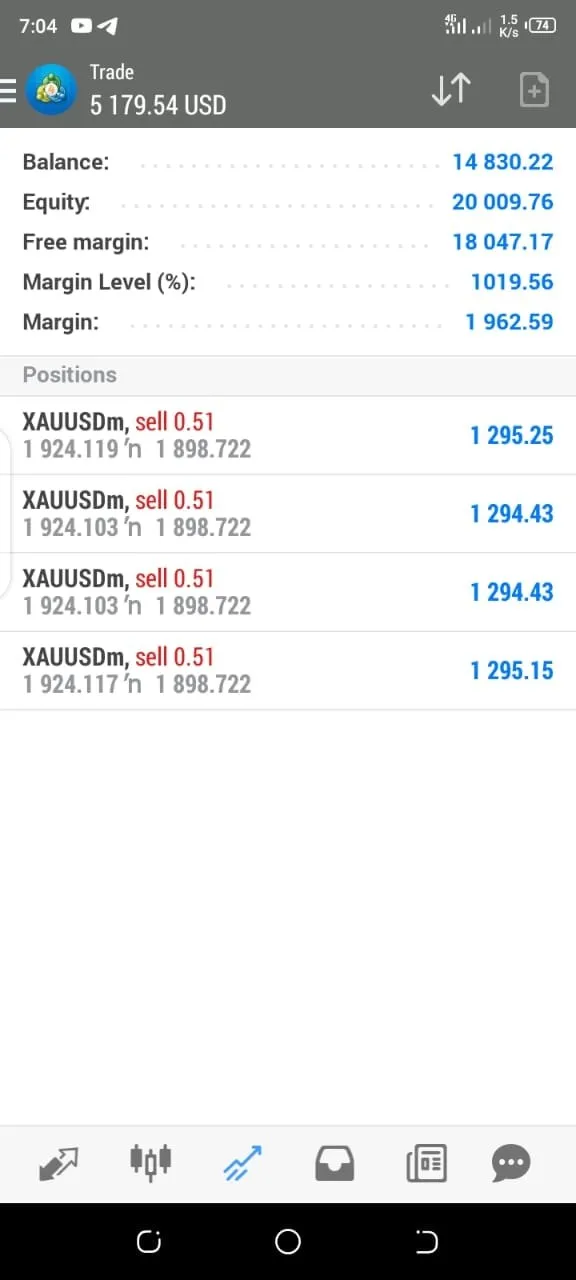

She asked me to pay taxes before I withdraw money. I didn't do as she told. I made money in the account exact the same as the deposit. And she kept saying it was still in the process of inquiring and unable to withdraw. The woman in the picture, from Chongqing, China, lived in Chicago, she said her brother who worked in financial industry had a team. Every time you did as she told, you can make money, but she asked you to withdraw when the profit is higher than the deposit, and you have to pay taxes before that. Do not believe in her! Their data on MT5 platform is fake, their company isForex Limited.

Exposure

FX3739673730

Philippines

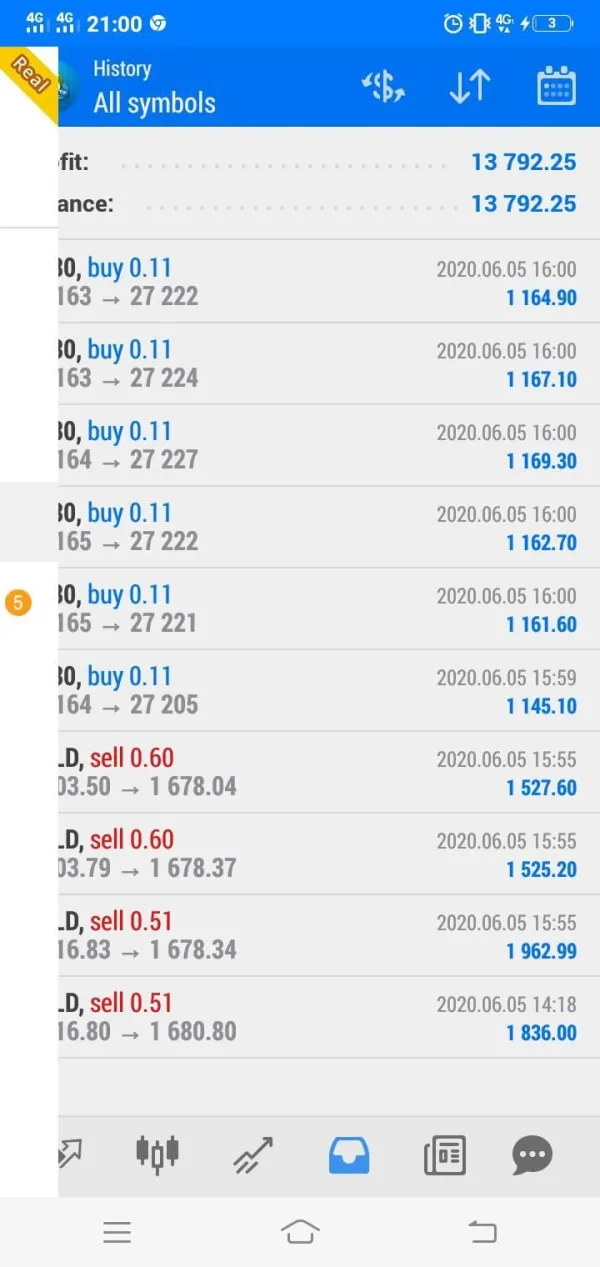

I also just got scam by this broker steady168, met some guy online said from hongkong, we talked and he introduce me to MT5 and steady 168. I first deposit 5k and on my first trade i made 1100$. I able to with 2 twice, first 500$ then 4500$. Then this guy keep encourage me to deposit more and more money in which i said i cant, he transfer me 2000$ from his account which i got a message from customer services saying i have to deposit 3000$ for risk deposit. I did and on monday sep 13 with this guy instruction again, i made 11k in profit and want to withdraw money out and customer service said now i have to pay personal income tax 30% of the profit. That trigger my suspicion because I never heard a thing as such paying personal income tax before withdrawing. Then i search on google and found this post. Now i cant withdraw any money out. My account will be freeze and deduct 10% if i do not pay the personal income taxes. Now i lost my 11k, feel so shitty to get scam

Exposure

FX1046772946

Venezuela

I am very happy to share my opinion about Forex Limited with you. Although I haven't really traded Forexlimited yet, and don't plan to, I still want to say a few words. First of all, the information provided on their website is very little and there is no basic information such as minimum deposit and leverage. The second is that I saw a lot of negative reviews on wikifx, presumably this broker is not worth trading.

Neutral

不吃香菜的女孩

Malaysia

I thought this was the most profitable way to make money online, but then I found out that I was cheated and lost more than $12,000. The company runs on Telegram and Whats App with no registered address. They provide free signals and seem to be more profitable than any other trading company in the world. These people treated you as if you were their god before you paid their expenses, but after that hey ignored you. They use "SIR" all the time in their conversations. They can pre-collect profit sharing fees from you, and then randomly place transactions in your account. Some transactions have no stop loss. Be careful that their system looks real, but they are scammers.

Exposure

FX5944873722

Malaysia

My withdrawal took more than 2 months.

Exposure

FX5944873722

Malaysia

The man introduced MT5 to me and led me to deposit 5000. At first I gained $1100 and he persuaded me to deposit more. On September 13, I gained $11000 but when I tried to withdraw, the customer service told me to pay 30% personal tax. Otherwise my account would be locked. Beware.

Exposure