Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| Yamani Review Summary | |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Trading products | Securities |

| Demo Account | Unavailable |

| Customer Support | Phone, fax |

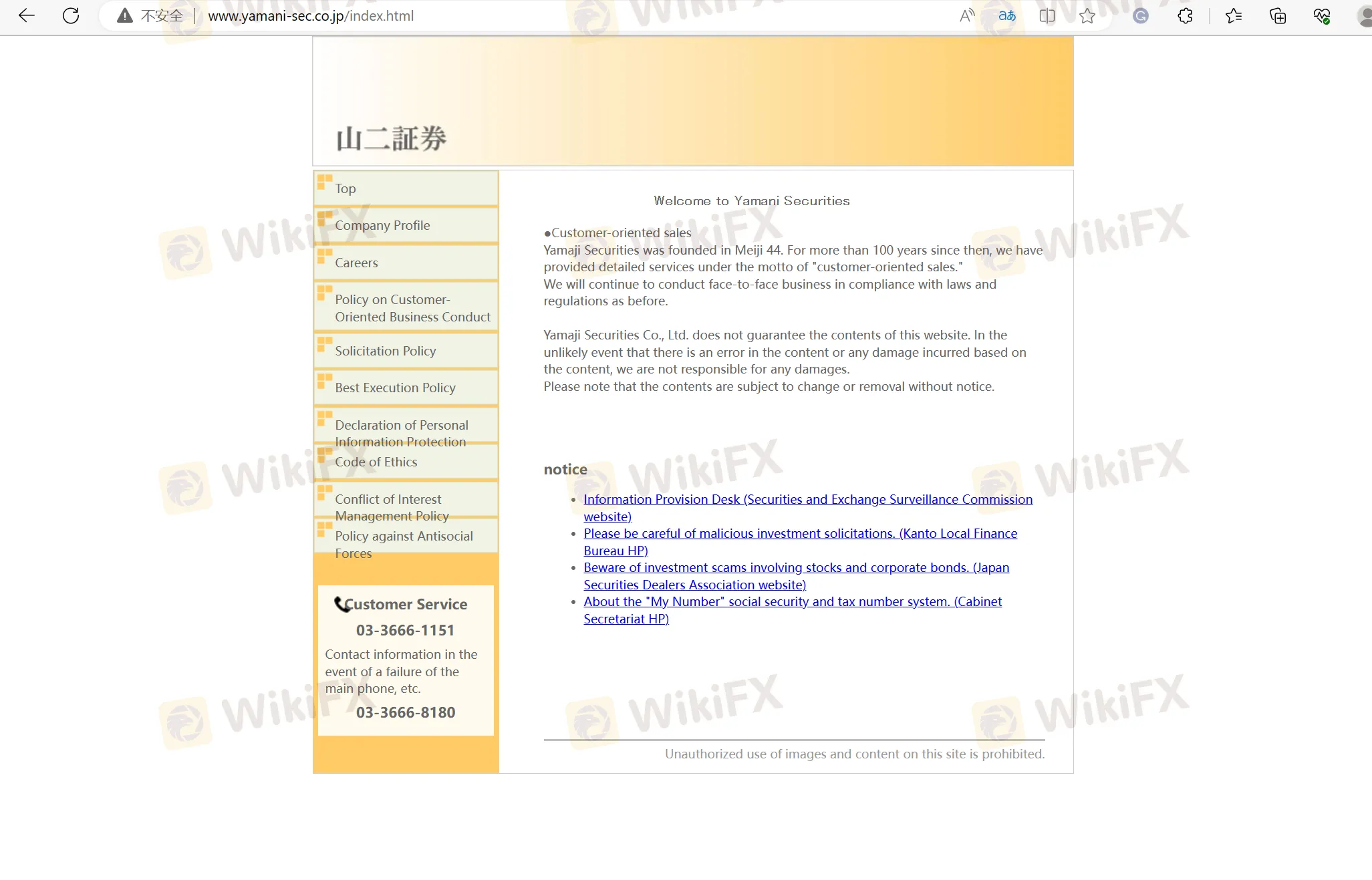

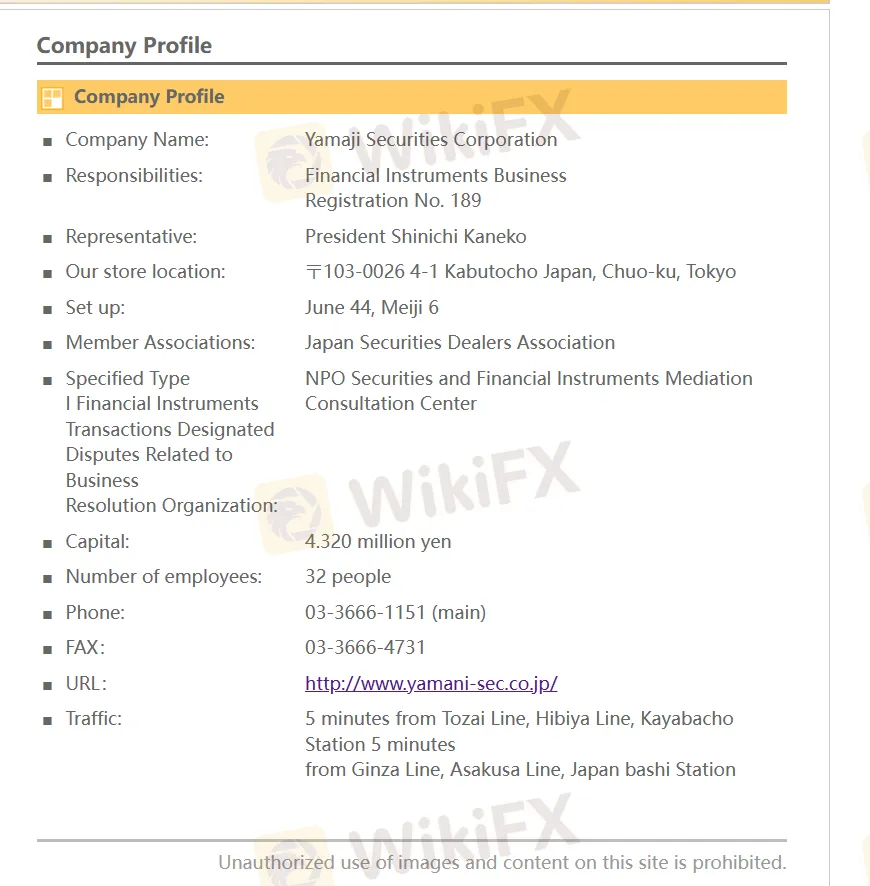

What is Yamani?

With a rich history dating back to Meiji 44, Yamani Securities has been providing comprehensive and detailed services for over a century. The steadfast commitment to “customer-oriented sales” has been at the core of the business philosophy, allowing it to cater to the unique needs of their clients. Yamani is regulated by the Financial Services Agency (FSA), the governing body that oversees all financial services providers, including Forex brokers, in Japan. At Yamani, it offers a wide range of trading options, allowing you to participate in the securities market.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

| Pros | Cons |

| • Regulated by FSA | • No demo accounts |

| • Phone and fax support available | • Limited research selection |

| • Limited educational resources | |

| • Phone and email support available |

Yamani Alternative Brokers

There are many alternative brokers to Yamani depending on the specific needs and preferences of the trader. Some popular options include:

Monex Securities - A renowned online brokerage firm offering a wide range of financial services and investment opportunities.

ACY Securities - A global financial services provider renowned for offering innovative trading solutions, including foreign exchange, contracts for difference (CFDs), and cryptocurrencies.

KIMURA SECURITIES – A trusted Japanese securities firm known for its comprehensive financial services, including stock trading, investment advisory, and wealth management.

Is Yamani Safe or Scam?

Yamani is regulated by the Financial Services Agency (FSA) oversees all financial services providers, including Forex brokers, in Japan. The ultimate aim of Japan's FSA is to maintain the countrys financial system and ensure its stability. It is regulated by reputable authorities, has been in operation for several years, and has received positive reviews from many customers.

Based on the information available, Yamani appears to be a reliable and trustworthy broker.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Trading Products

Yamani offers the trading of securities. Trading on securities refers to the buying and selling of financial instruments such as stocks, bonds, commodities, or derivatives in the financial markets. The goal of trading on securities is to make a profit by capitalizing on the price fluctuations of these instruments. Yamani allows investors to participate in the financial markets and potentially earn returns on their investments.

Customer Service

Customers can visit their office or get in touch with customer service line using the information provided below:

Telephone: +81 03-3666-1151

Fax: 03-3666-4731

Address:4-1 Nihonbashi Kabutocho, Chuo-ku, Tokyo 103-0026

Conclusion

In conclusion, Yamani Securities has a long-standing history of over a century, providing comprehensive and detailed services to its clients. The company's unwavering commitment to “customer-oriented sales” has been the driving force behind its success, ensuring that the unique needs of clients are met. Regulated by the Financial Services Agency (FSA), Yamani operates within a framework of strict oversight and compliance to ensure a secure trading experience. With a wide range of trading options available, Yamani enables clients to participate in the dynamic securities market. Trust Yamani Securities to deliver exceptional service and support as you navigate your investment journey.

Frequently Asked Questions (FAQs)

| Q 1: | Is Yamani regulated? |

| A 1: | Yes. It is regulated by FSA. |

| Q 2: | How can I contact the customer support team at Yamani? |

| A 2: | You can contact via telephone, +81 03-3666-1151and fax: 03-3666-4731. |

| Q 3: | Does Yamani offer demo accounts? |

| A 3: | No. |

| Q 4: | Is Yamani a good broker for beginners? |

| A 4: | Yes. It is a good choice for beginners because it is regulated well and offers various securities trading with competitive trading conditions |