Company Summary

| Quick Robinhood Review Summary | |

| Founded in | 2013 |

| Registered Country/Region | United States |

| Regulation | No license |

| Tradable Instruments | Cryptos, retirement, options, futures |

| Min Deposit | $1 |

| Commission | ❌ |

| Trading Platform | Web, mobile |

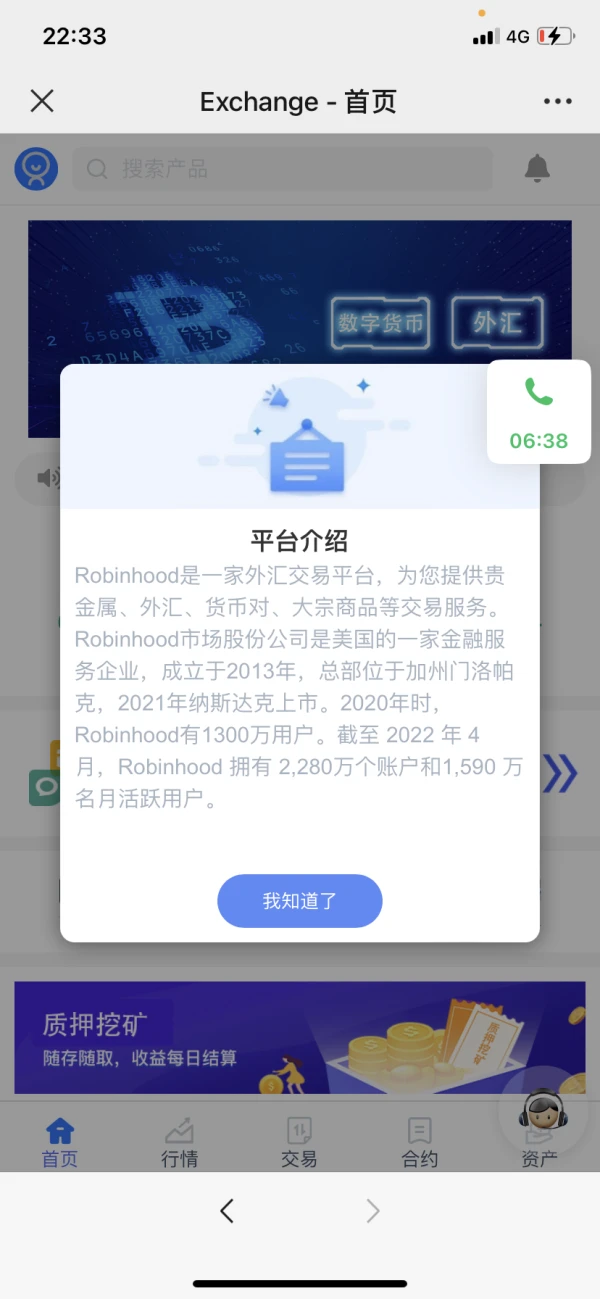

Overview of Robinhood

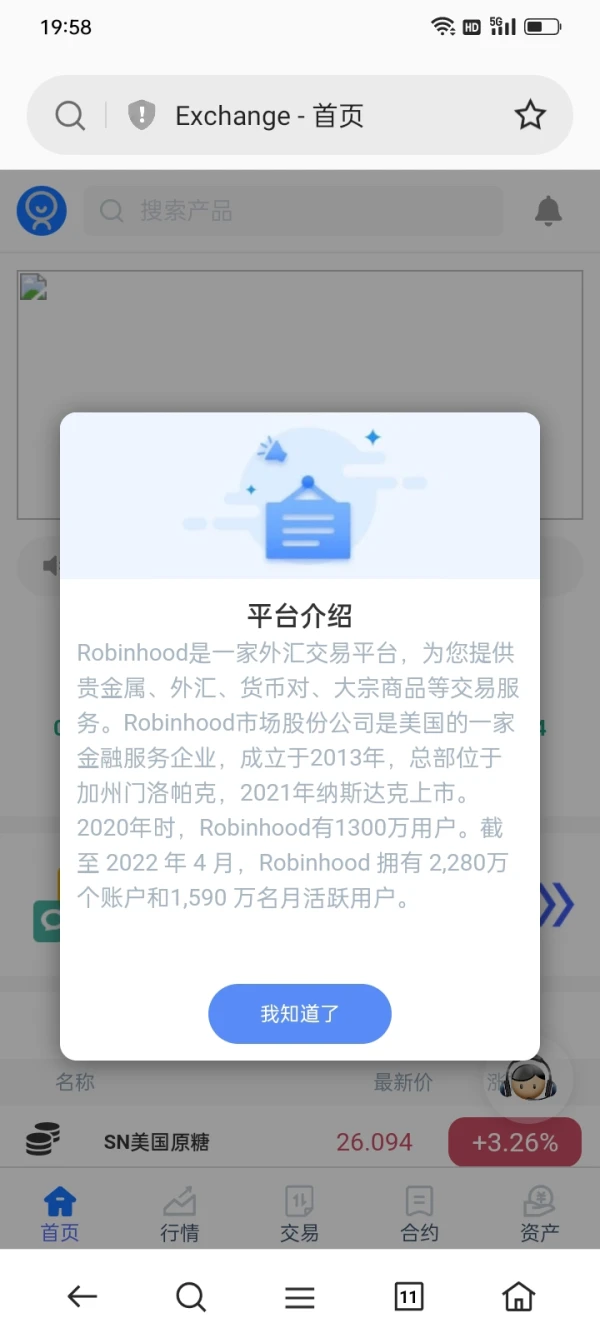

Founded in 2013, Robinhood is an online Forex broker based in the United States, which offers products and services in cryptos, retirement, options, and futures. Additionally, Robinhood provides access to American Depositary Receipts for over 650 global companies and the ability to trade fractional shares.

The broker supports both web and mobile trading, allowing users to access their accounts and trade on-the-go with no minimum deposit requirement, making it accessible to investors with various budget levels. The platform offers individual accounts as well as retirement accounts without any commission fees.

However, it is important to note that Robinhood operates without regulation, which may be a consideration for some investors seeking a regulated brokerage.

Pros and Cons

Robinhood offers both advantages and disadvantages to its users. On the positive side, Robinhood provides a very simple and intuitive trading experience. Its streamlined interface makes it easy for users to navigate and execute trades efficiently.

Additionally, one of the standout features of Robinhood is its no commissions policy. This allows users to trade without incurring additional costs.

Furthermore, Robinhood offers fractional share trading and direct access to cryptocurrencies, giving users the opportunity to invest in smaller portions of shares and participate in the cryptocurrency market.

| Pros | Cons |

| Very simple, intuitive trading experience | No regulation |

| No commissions | Limited educational content |

| Fractional share trading and direct cryptocurrency access | No MT4/MT5 trading platforms |

| Streamlined interface | Account types not specified |

| No minimum deposit requirement |

However, there are also some drawbacks to consider when using Robinhood. Firstly, Robinhood is not specifically regulated. While Robinhood provides a user-friendly interface, it lacks comprehensive educational content. This could be a drawback for users who are new to trading and would benefit from educational resources to enhance their understanding of the markets and trading strategies.

Furthermore, Robinhood does not support popular trading platforms like MT4 or MT5, limiting options for traders who prefer those platforms. The broker also does not specify different types of accounts available, which may limit customization options for individual users.

Is Robinhood Legit?

To assess the credibility of a broker, it is crucial to verify their regulatory status through reputable regulatory agencies such as the FCA or CySEC. In the case of Robinhood, it is important to note that they lack authorization or regulation from any regulatory authorities. As a result, it is strongly advised to avoid trading with this broker due to their anonymity and the risk of sudden disappearance without any notice.

Market Instruments

Robinhood offers products and services in cryptos, retirement, options, and futures.

| Trading Assets | Supported |

| Cryptos | ✔ |

| Options | ✔ |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Bonds | ❌ |

| ETFs | ❌ |

Please be aware that due to the lack of regulation, it is essential to carefully consider the associated risks before engaging in any trading activities on Robinhood.

Account Types

Robinhood only offers brokerage account options as either margin or cash accounts.

Robinhood also offers 2 different types of retirement accounts: traditional IRA and Roth IRA. You can open 1 of each type of IRA account at Robinhood, even if you already have an IRA at another financial institution or a workplace retirement plan, like a 401(k).

How to Open an Account?

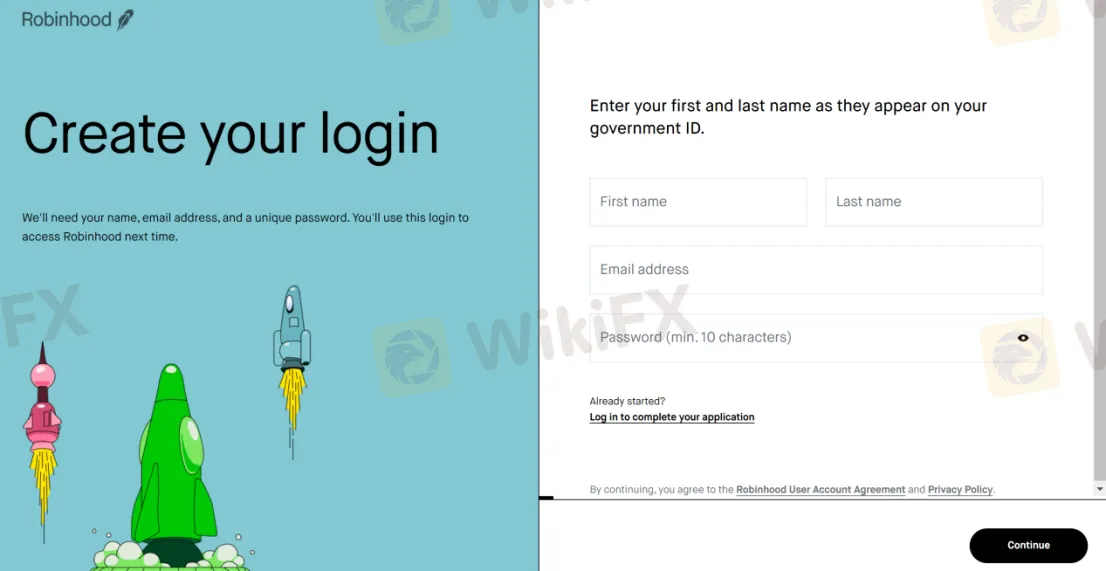

To open an account with Robinhood, please follow these steps:

Step 1: Visit the Robinhood website: Go to https://robinhood.com/

Step 2: Click on the“Sign up” button located in the top-right corner of the website.

Step 3: Provide personal information: Once your email is verified, Robinhood will ask you to provide personal information, including your name, address, date of birth, and social security number (for U.S. residents). This information is necessary to comply with regulatory requirements.

Step 4: Complete the application: Fill in the required information accurately and review the terms and conditions. You may need to answer additional questions about your investment experience, financial goals, and risk tolerance.

Step 5: Set up funding: Once your account application is approved, you will need to link a bank account to fund your Robinhood account. Follow the instructions provided in the app to securely link your bank account.

Step 6: Review and agree to disclosures: Robinhood will present you with various disclosures and agreements, including the customer agreement and privacy policy. Read these documents carefully and agree to the terms.

Step 7: Fund your account: Transfer funds from your linked bank account to your Robinhood account to start investing. Once your account is funded, you can start trading stocks, ETFs, options, and cryptocurrencies directly.

Commissions

RobinHood eliminated transaction fees. Such a move is now a general trend, with many other brokers either lowering fees or eliminating them altogether to stay competitive.

Non-trading Fees

Robinhood offers commission-free trading for stocks and ETFs, similar to its competitors.

Options trades also have no fees. The standard margin interest rate is 11.75% as of April 21st, 2023. Robinhood Gold members receive $1,000 in free margin trading and a discounted rate of 7.75% for borrowing above that, with a subscription fee of $5 per month. A $100 account transfer out fee is applicable.

There are no fees for domestic or international wire transfers, account opening, account maintenance, or account inactivity. However, there is a $20 fee for sending a domestic check overnight.

Trading Platform

Robinhood does not offer popular trading platforms such as MT4 and MT5. Instead, it offers two proprietary platforms, web and mobile, which may have limitations.

Trade Experience

Robinhood‘s trading experience is fast and easy to use, appealing to new investors in particular as it allows them to get up and running quickly. Robinhood users get access to basic watch lists and stock quotes paired with charts, analyst ratings, and news. The improved chart overlays give investors a more comprehensive look into stocks and their positions. Beyond this, there’s not much in the way of in-depth insights and customization ability.

Mobile Trade Experience

Robinhood is a mobile-first brokerage that aims to make trading simple without complicating the experience with more in-depth features. It makes sense then that more complex trading tools and research options are largely absent from the mobile trade experience. For instance, no chart drawing tools are available on mobile and trades cant be executed directly from charts. Order staging and simultaneous order entry options are also not available.

Educational Resources

In terms of educational resources, Robinhood provides the “Learn” section including Investing 101, Options trading essentials, and Library. Educational content, while improving, still isn‘t up to par with many of Robinhood’s competitors offerings. An intentional focus on enhancing this area is apparent, though. Robinhood continues to expand its Learn section with more material and has enhanced the onboarding questionnaire to help users understand investing basics.

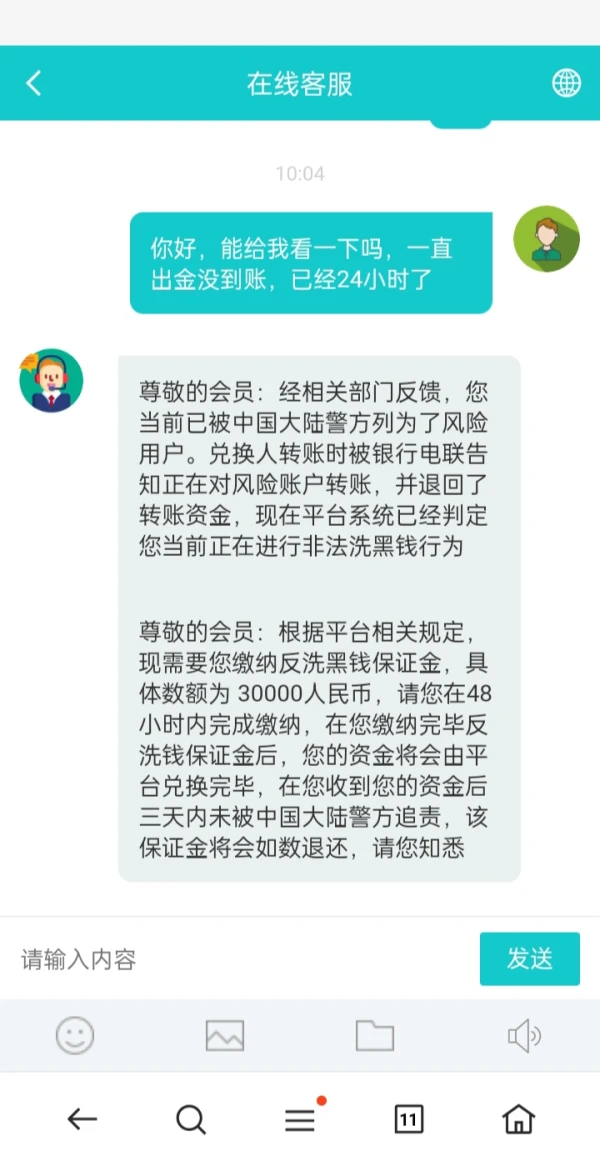

亭7919

Hong Kong

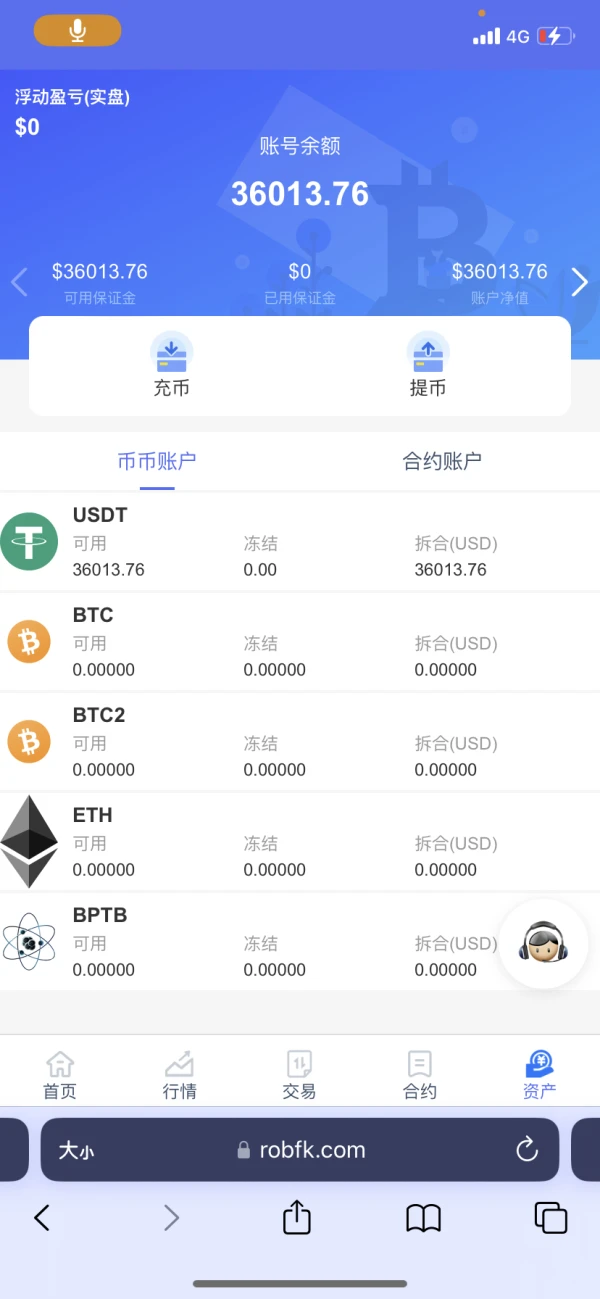

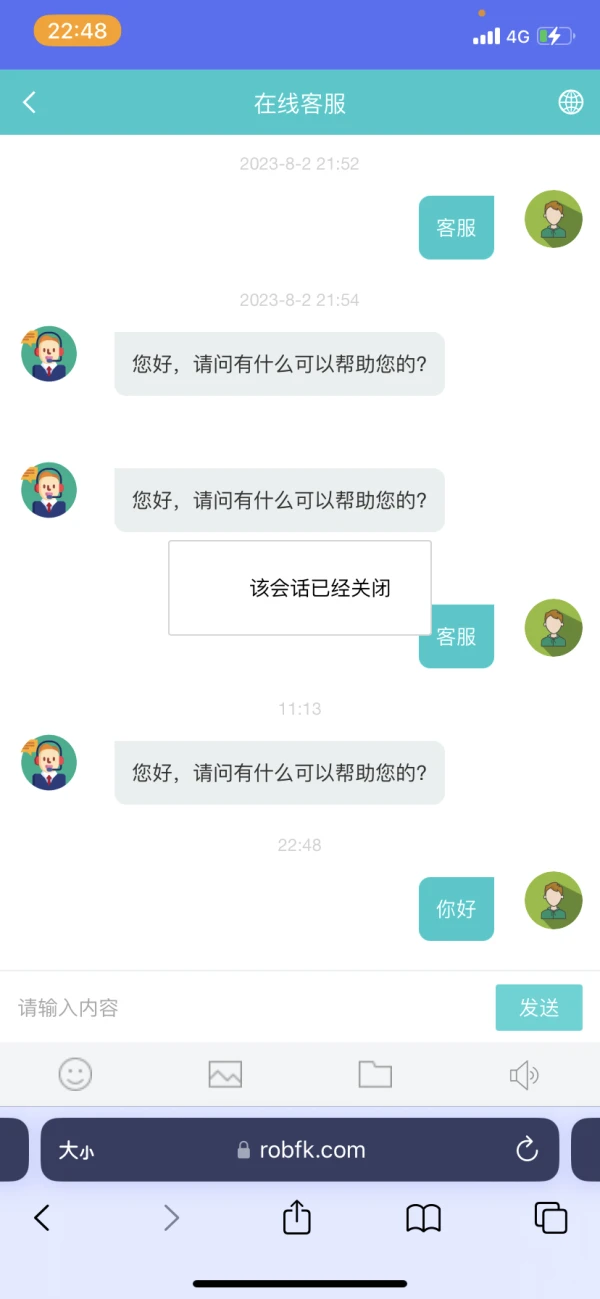

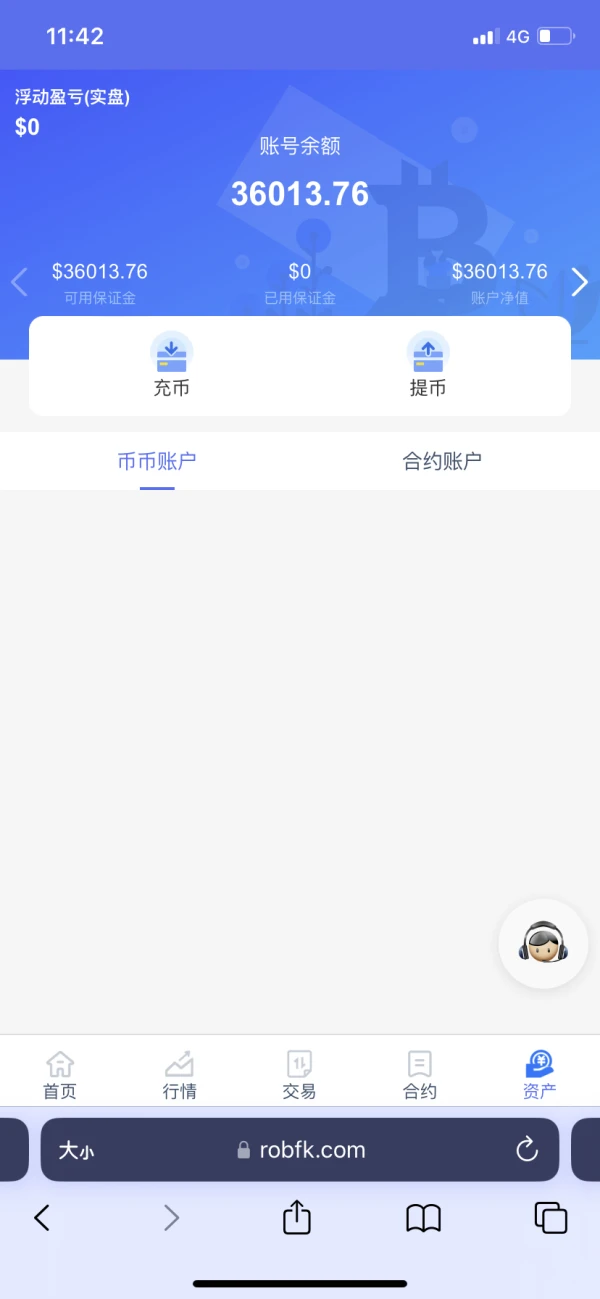

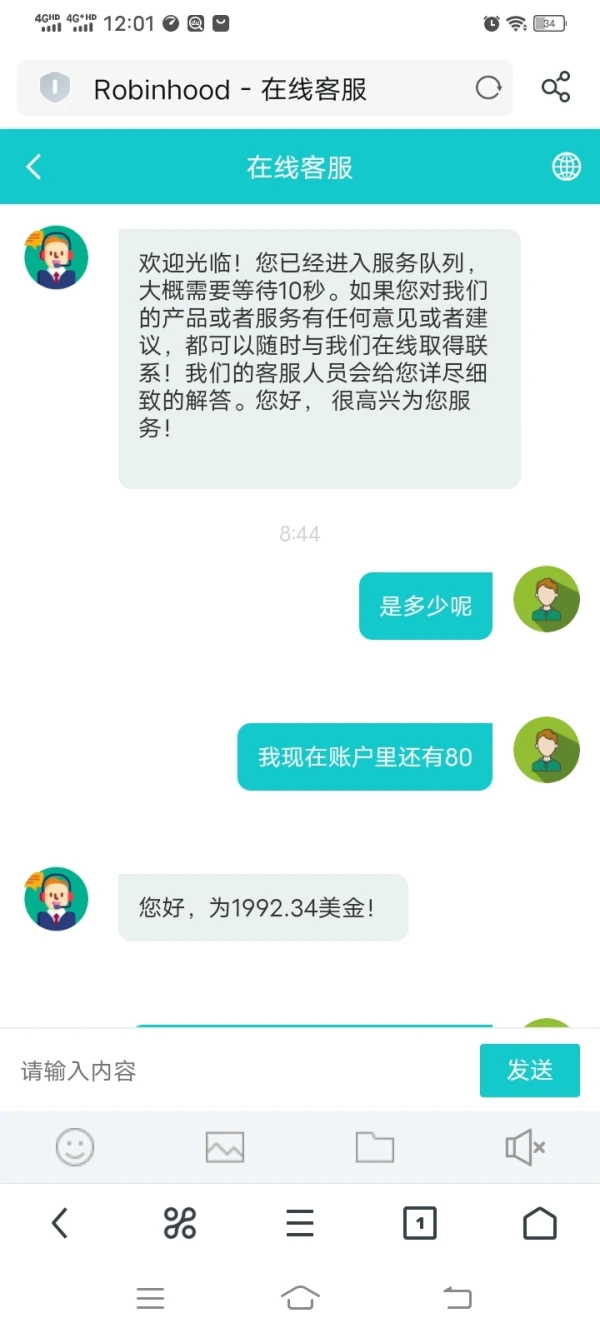

Robinhood can’t withdraw money, the website can’t be opened now, and requires an anti-laundering deposit of 100,000 yuan

Exposure

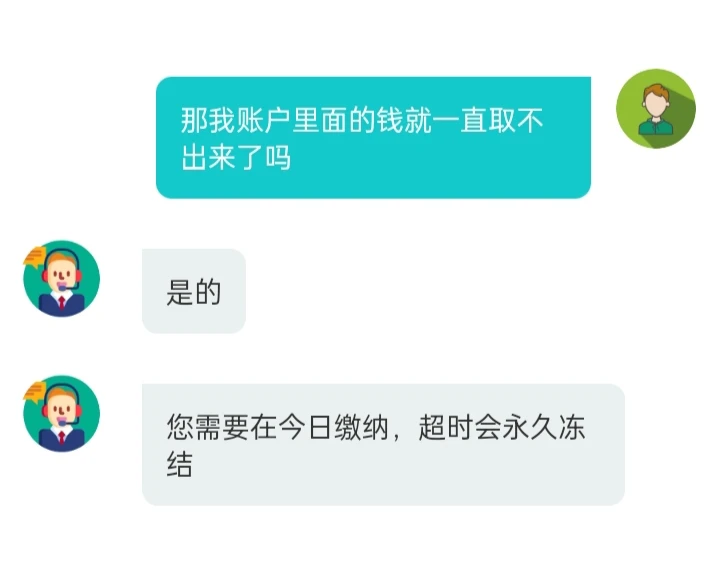

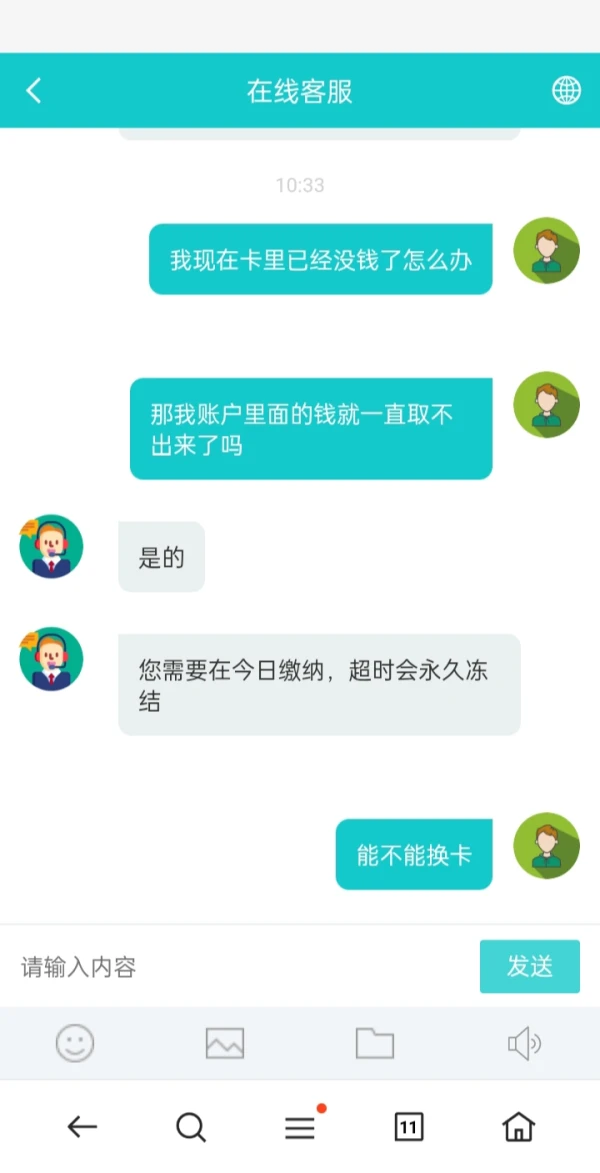

夏天473

Hong Kong

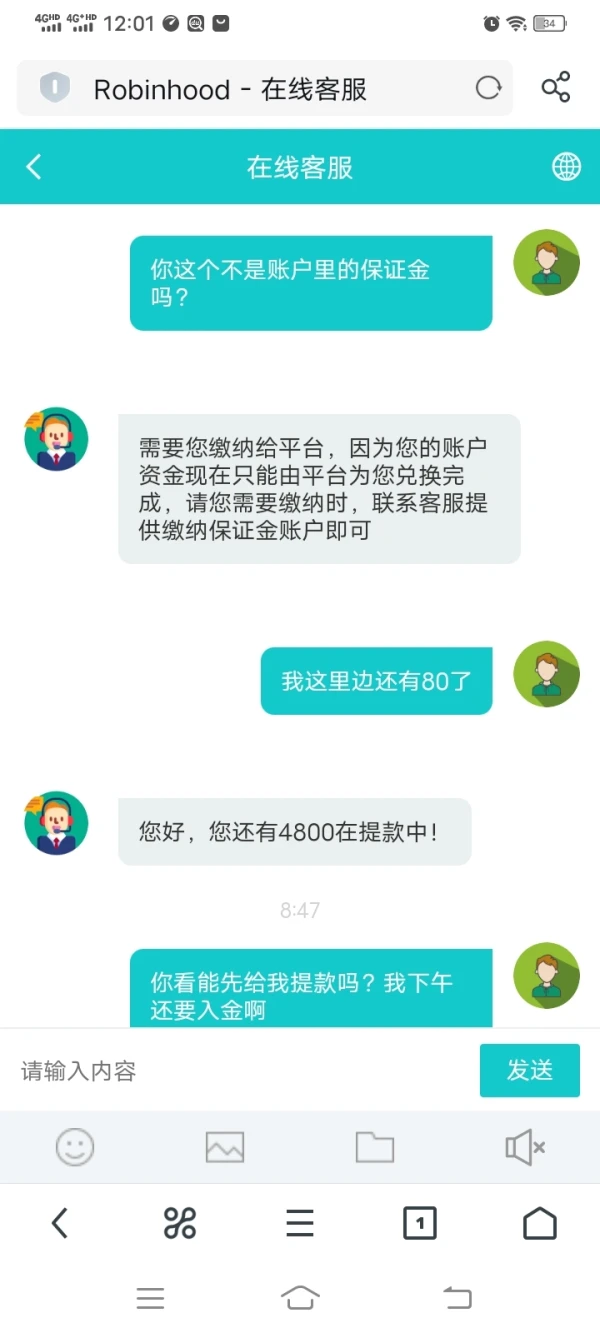

Unable to withdraw funds, the platform requires you to pay a margin before allowing you to withdraw funds. It is a typical scam, and any forex platform does not need to pay a margin for withdrawals. Don't be fooled, everyone, the customer service said that if you don't pay, your assets will be permanently frozen.

Exposure

夏天473

Hong Kong

Everyone be cautious about this platform, it is impossible to withdraw funds at all. At the beginning, you can withdraw funds normally, and later you can’t withdraw funds at all if you deposit too much. You need to pay a deposit before you can withdraw funds. Don’t be deceived.

Exposure

awakemime

Thailand

A clean and user-friendly trading system, but the drawback is that assets are limited.

Neutral

小碗

Hong Kong

The customer service provided the acceptor card number for transfer, the platform exchanged virtual currency platform transactions, and the withdrawal of gold and cash was not allowed, and the customer service also blocked me.

Exposure

小碗

Hong Kong

I transferred the money to multiple accounts of acceptor, and the platform gave me the currency. Now the customer service blocks me, and my funds cannot be withdrawn.

Exposure

FX3071647358

Hong Kong

According to the relevant regulations of the platform, you are now required to pay an anti-money laundering deposit. The specific amount is 40% of your account balance. Please complete the payment within 48 hours. After you pay the anti-money laundering deposit, your funds will be exchanged by the platform Finished, if you are not held accountable by the mainland Chinese police within three days after you receive your funds, the security deposit will be refunded in full. Please know that when I first deposited 500 dollars, I won a little and he asked me to withdraw cash. Later, if I recharge too much, I will not be allowed to withdraw cash, so I will be asked to pay a deposit

Exposure

FX1194475069

Hong Kong

Their guys kept dialing my number again and again, saying it is a precious opportunity to make large profits. As a experienced trader, I always met this situation. However, the layout of its website is so cluttered with promotion meterials that I know it's not a decent platform — at least, not for me. I would not give it a shot, and I will tell you guys that it is not your ideal choice, either.

Neutral

张浩32357

Taiwan

The company's website is so green! Is it the meaning of "green forest hero" hahaha! anyway although it looks good, I wouldn't trade here for safety reasons as it doesn't have any regulatory licenses. Be careful!

Neutral