J Forex Trader

1-2年

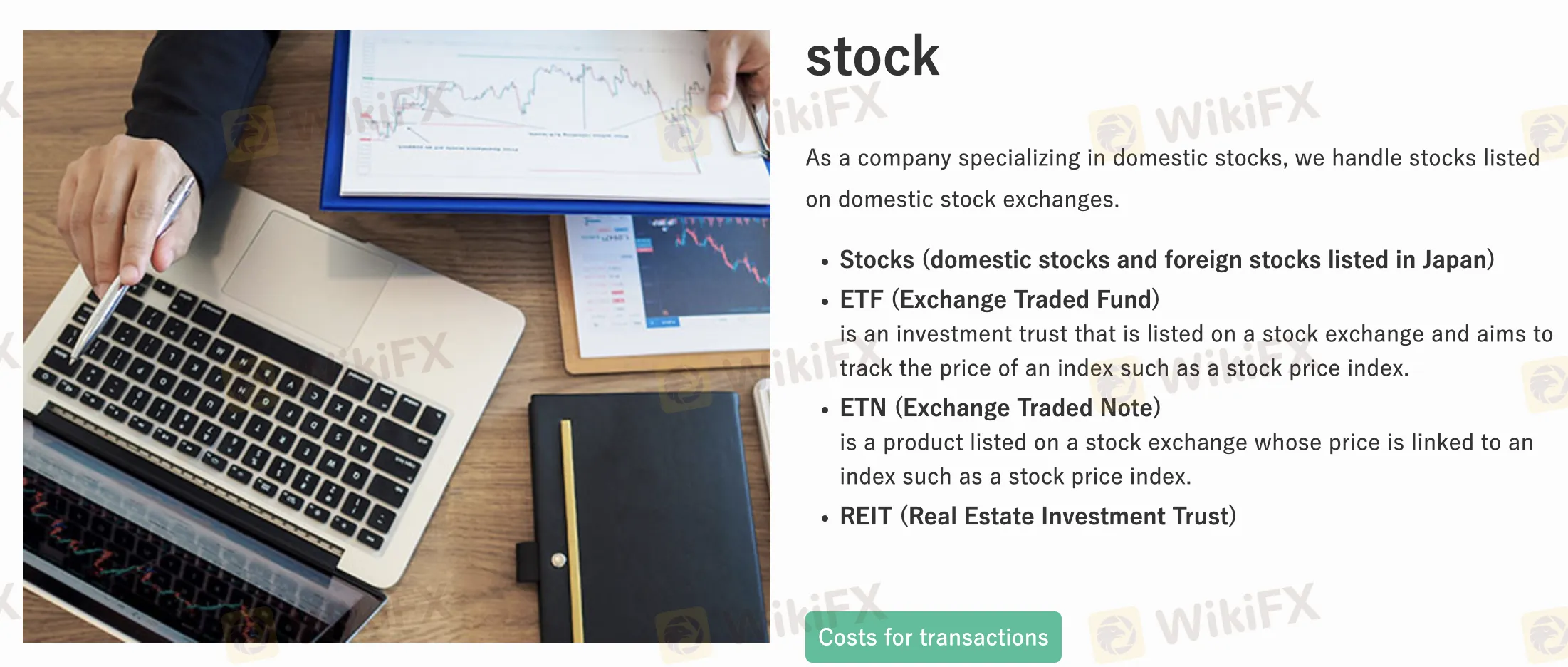

What are the trading fees at Marukuni?

Marukuni has a tiered fee structure for stock brokerage commissions, which can become quite expensive, especially for smaller trades. For instance, if the contract price is below ¥4,000, the fee is 55% of the contract price, which is steep. As the contract size increases, the fee becomes a percentage of the contract price, ranging from 1.26% to 0.33% for trades over ¥50 million. Personally, I find the tiered structure complicated and costly for smaller trades, making it less appealing for frequent or small investors.

Broker Issues

Fees and Spreads

Abu00saeed

1-2年

What trading instruments are available with Marukuni?

Marukuni offers a variety of trading instruments, including domestic and foreign stocks, ETFs, ETNs, and REITs. However, the platform does not provide access to forex, commodities, indices, or cryptocurrencies, which limits trading options for traders interested in those markets. Personally, I like that Marukuni focuses on traditional investment products, but for those looking to trade a wider range of assets, it may not be the best choice.

Broker Issues

Account

Platform

Instruments

Leverage

Tomas

1-2年

Are there any hidden fees when trading with Marukuni?

Marukuni’s fee structure is fairly transparent, with detailed pricing for both trading and non-trading services. However, the complex tiered commission structure for stock trading can be difficult for traders to navigate. The lack of clear communication about some fees, such as those for transferring shares and documentation requests, might catch traders off guard. From my perspective, I find the transparency of their fee structure lacking, as some charges are buried in the fine print.

Broker Issues

Fees and Spreads

joalund

1-2年

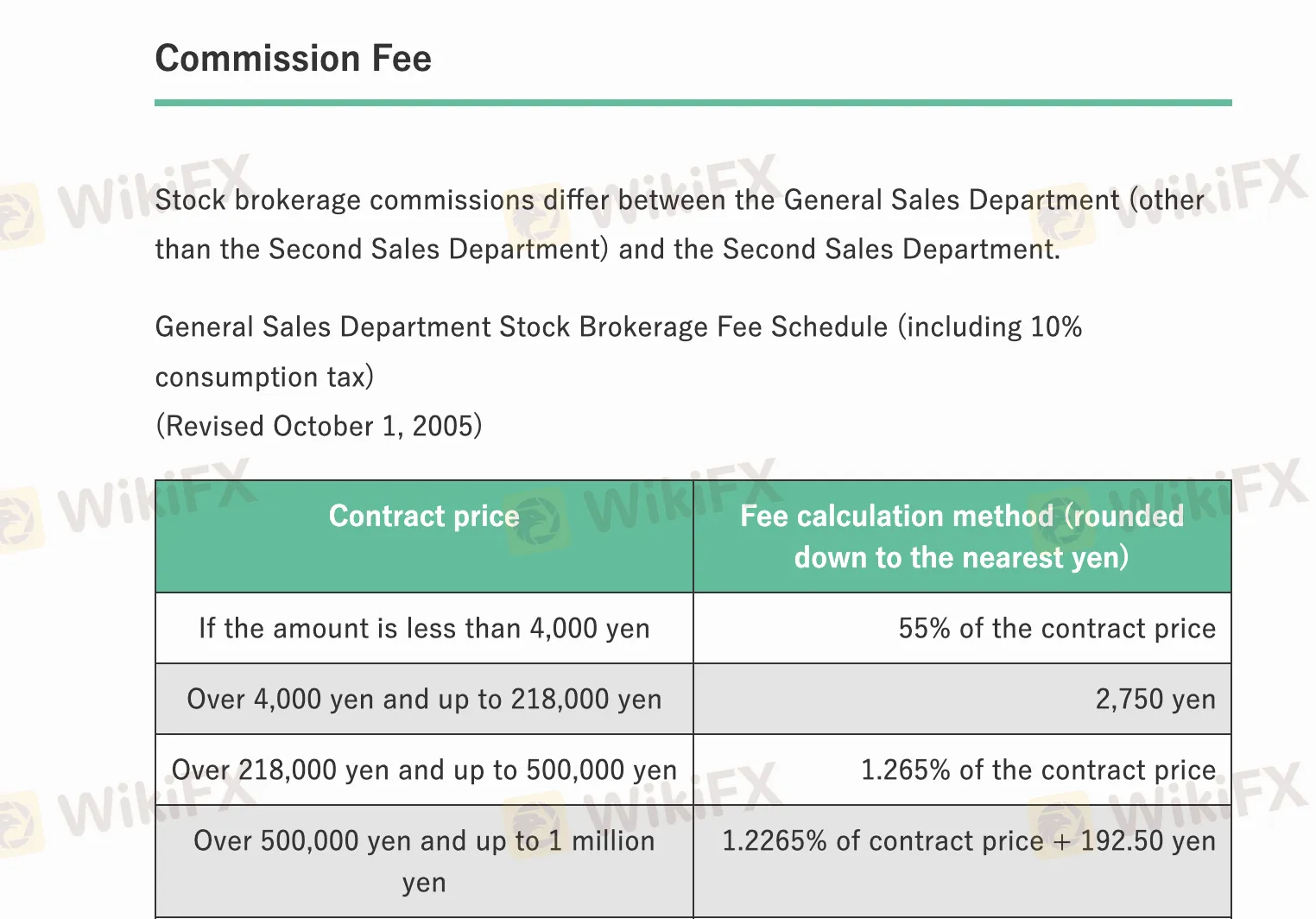

Are there non-trading fees at Marukuni?

Yes, Marukuni has a variety of non-trading fees, including charges for transferring ownership of stocks (ranging from ¥550 to ¥6,600), odd lot purchase requests (¥550 per stock), and documentation requests (¥1,100 per request). These fees may not be significant for casual traders but can add up quickly for those who frequently engage in stock transfers or require official documents. I personally think the additional fees are a bit excessive, especially considering that many online brokers do not charge for these services.

Broker Issues

Fees and Spreads