Company Summary

| Marukuni Review Summary | |

| Founded | 1938 |

| Registered Country | Japan |

| Regulation | FSA |

| Products and Services | Domestic and foreign stocks, ETFs, ETNs, REITs |

| Demo Account | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Email: info@marukuni.co.jp |

Marukuni Information

The Financial Services Agency regulates Marukuni, a licensed securities firm that started in Japan in 1938. It mostly helps people trade stocks on the US stock market and buy exchange-traded funds (ETFs), exchange-traded notes (ETNs), and real estate investment trusts (REITs). Compared to other companies in the same field, the company's fees are thought to be exorbitant and complicated.

Pros and Cons

| Pros | Cons |

| Long-established (since 1938) | Higher than average fees |

| Regulated by FSA | Limited information about trading platforms |

| Offers a wide range of listed products | Limited information about deposit and withdrawal |

Is Marukuni Legit?

Yes, Marukuni is regulated. It holds a Retail Forex License issued by the Financial Services Agency (FSA) of Japan. The specific license number is 関東財務局長(金商)第166号, and it has been effective since September 30, 2007.

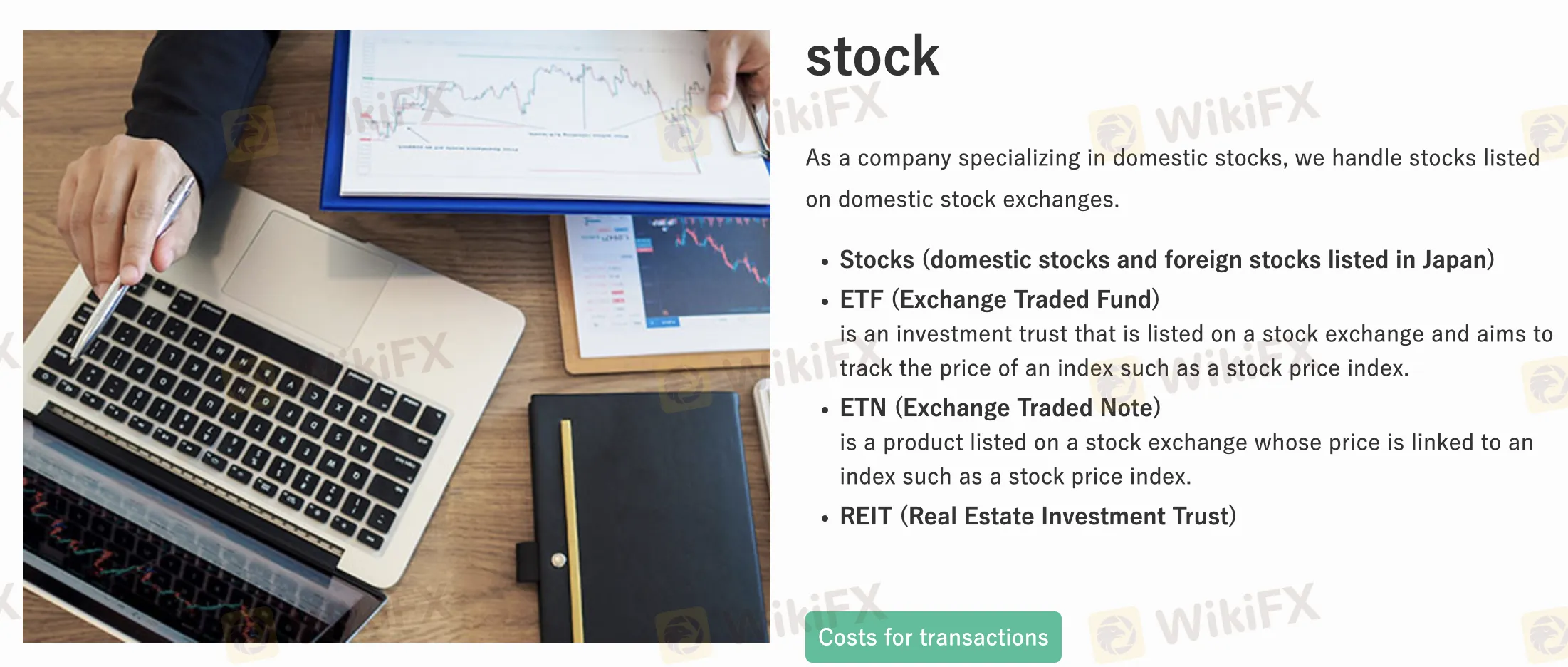

What Can I Trade on Marukuni?

Marukuni offers a range of domestic stock-related products and exchange-listed investment instruments.

| Trading Products | Supported |

| Stocks | ✔ |

| ETFs (Exchange Traded Funds) | ✔ |

| ETNs (Exchange Traded Notes) | ✔ |

| REITs (Real Estate Investment Trusts) | ✔ |

| Forex | × |

| Commodities | × |

| Indices | × |

| Cryptocurrencies | × |

| Bonds | × |

| Options | × |

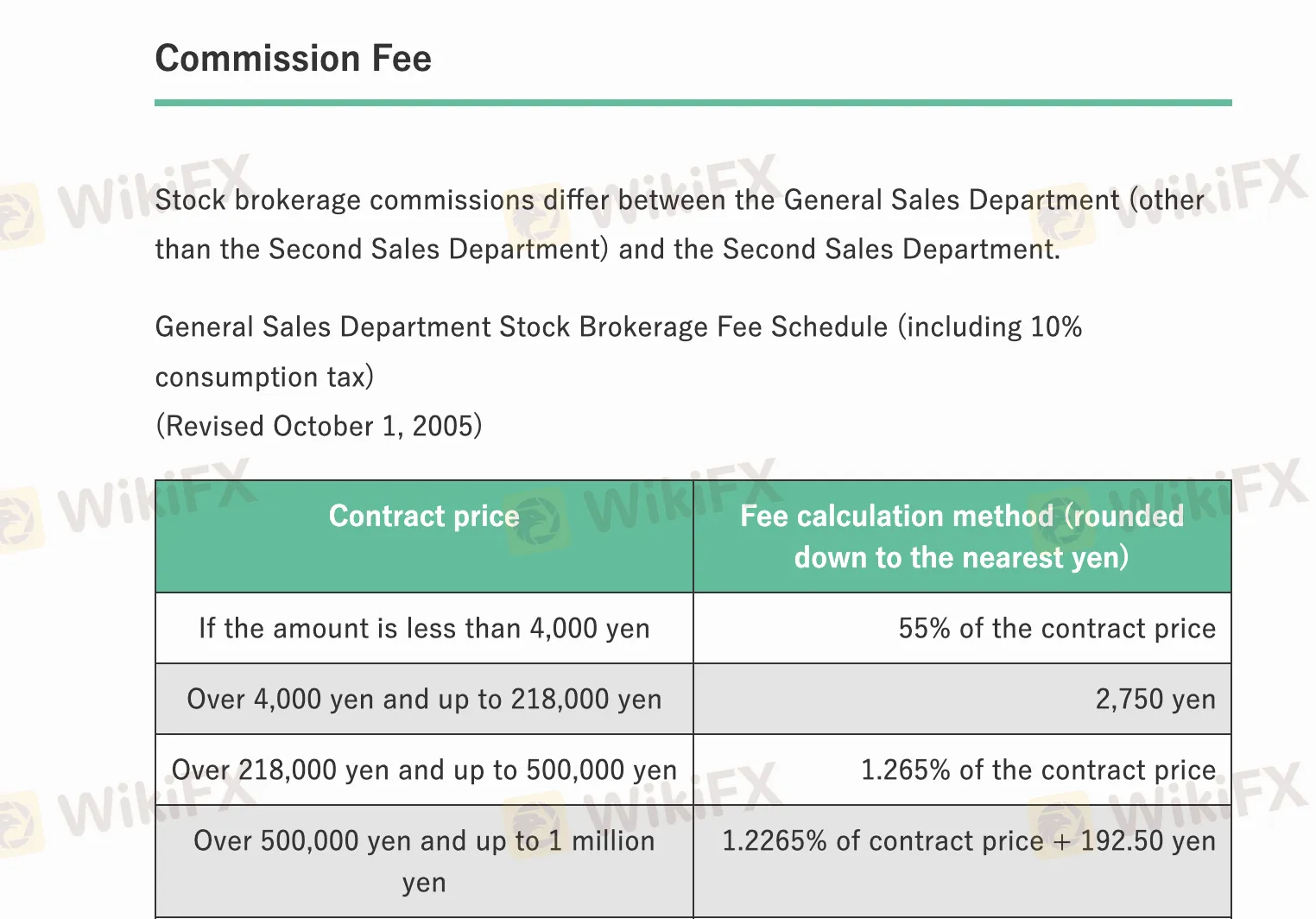

Marukuni Fees

Most people think that Marukuni's prices are more than average for the industry, notably for stock brokerage commissions, which are based on a complicated tiered system.

| Trading Fees (Stock Brokerage) | Amount |

| <4,000 yen | 55% of contract price |

| 4,000–218,000 yen | 2,750 yen |

| 218,000–1 million yen | ~1.26% of contract price |

| 1–5 million yen | ~0.95–0.99% + fixed fee |

| 5–10 million yen | ~0.71–0.77% + fixed fee |

| 10–30 million yen | ~0.53–0.63% + fixed fee |

| 30–50 million yen | ~0.33–0.41% + fixed fee |

| Over 50 million yen | Fixed, over ~264,000–299,750 yen |

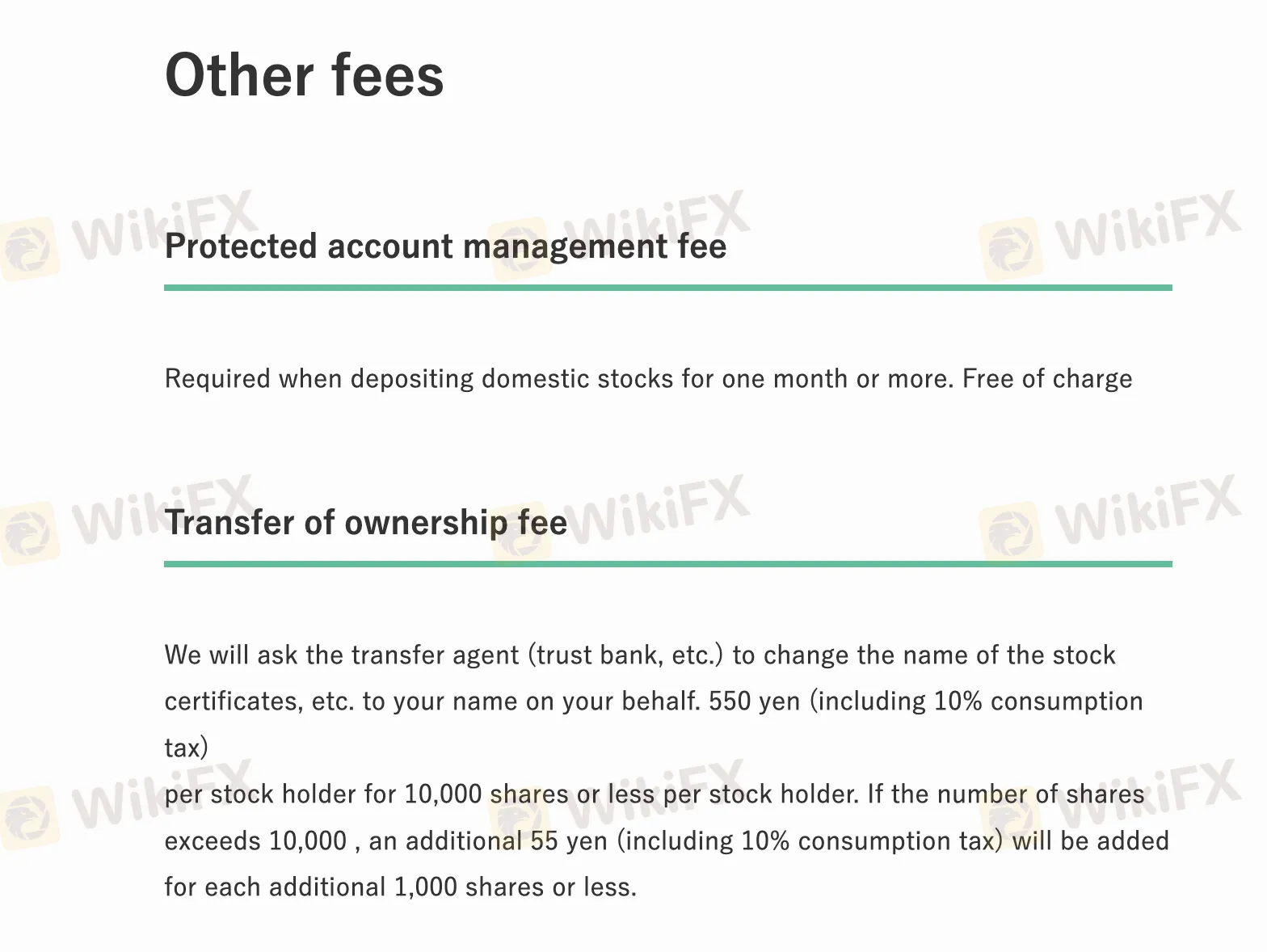

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 |

| Withdrawal Fee | 0 |

| Inactivity Fee | 0 |

| Protected Account Management Fee | 0 |

| Transfer of Ownership Fee | 550 yen (≤10,000 shares) + 55 yen per extra 1,000 shares |

| Odd Lot Purchase Request Fee | 550 yen per stock |

| Transfer Fee | 3,300 yen (≤5 units), 6,600 yen (>5 units) |

| Documentation Request Fee | 1,100 yen per request |