Vahid

1-2年

Are there any inactivity fees associated with Ichiyoshi Securities accounts, and if yes, under what circumstances are they applied?

As an experienced trader who frequently evaluates brokers, one thing I pay close attention to is fee transparency—especially concerning inactivity fees, since these can significantly impact long-term traders or investors who prefer to hold positions. Based on my review of the available information for Ichiyoshi Securities, I could not find any expressly stated details regarding inactivity fees in their public documentation. The WikiFX listing does note an “unclear fee structure” as a con, which, for me, means the absence of clarity around all account-related costs, including any fees that might be charged due to account inactivity.

Because Ichiyoshi Securities is a long-established, FSA-regulated broker in Japan, I would expect them to adhere to local regulatory standards, which generally require transparent customer communications. However, without explicit confirmation in their materials, I cannot definitively state whether inactivity fees are charged or under what exact circumstances they might apply. In situations like this, I personally take a conservative stance: before opening any account or leaving funds dormant, I would directly contact their customer support and explicitly request a written outline of all possible fees, so I can make a fully informed decision. Given the limited contact channels reported, this process might take some persistence. In my experience, caution is always advisable—unexpected fees can erode profits or even turn a passive position into a liability. For anyone considering Ichiyoshi Securities, I strongly recommend obtaining written clarification on inactivity and other account maintenance fees before proceeding.

Broker Issues

Fees and Spreads

tabawan_dreamer

1-2年

Can you outline the particular advantages Ichiyoshi Securities offers regarding its available trading instruments and how its fee structure is designed?

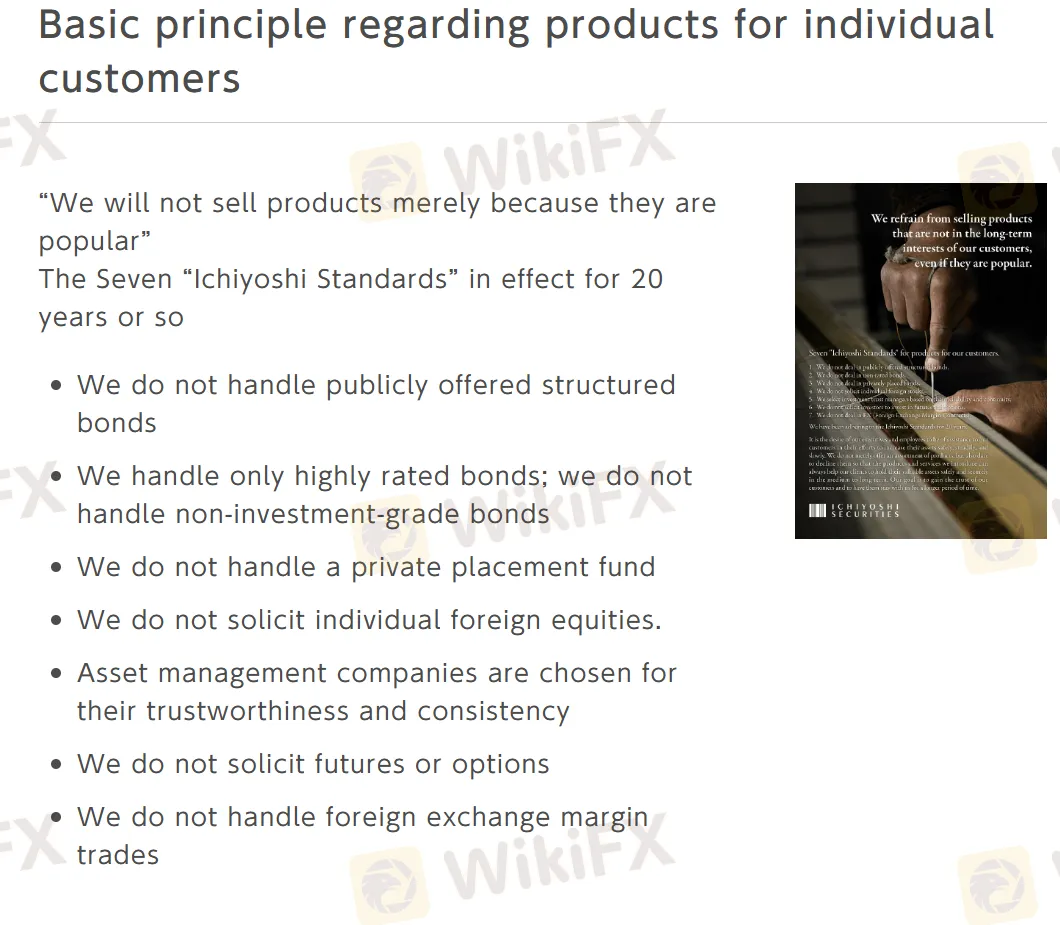

In my experience evaluating brokers, Ichiyoshi Securities distinguishes itself mainly by its conservative, client-focused approach rather than an expansive suite of trading instruments. The core advantage, for me, lies in their commitment to simplicity and trustworthiness. Ichiyoshi has long prioritized individual investors’ interests by actively avoiding complex or higher-risk products such as structured bonds, non-investment grade bonds, private placements, foreign equities, futures/options, and forex margin trading. This means that the instruments available here are centered around traditional securities, which fits well if your priority is capital preservation rather than aggressive speculation.

I also recognize that Ichiyoshi operates under strict oversight by the Japanese Financial Services Agency (FSA), which adds a level of regulatory confidence. Their “Seven Ichiyoshi Standards” further emphasize quality and client suitability, so I don’t worry about being confronted with opaque or risky financial products.

However, while this setup offers safety and clarity around available products, I have found the fee structure to be less transparent. The specifics of commissions or charges are not markedly outlined in their public material, making it hard for me as a trader to predict costs with certainty without direct inquiry. This could be a drawback for active traders or those who demand upfront pricing clarity.

Overall, Ichiyoshi Securities fits a conservative trader seeking stability and regulatory assurance, but for those who value a broad range of trading instruments or transparent and detailed fee disclosures, I’d be cautious and recommend clarifying these points directly before committing significant funds.

Franko Knavs

1-2年

Could you give a comprehensive overview of the fees charged by Ichiyoshi Securities, such as commissions, spreads, and any related costs?

In my experience assessing brokerage services, fee transparency is absolutely crucial, especially when it comes to commissions, spreads, and related trading costs. With Ichiyoshi Securities, I found that publicly available information on their exact fee structure remains unclear. According to their profile, they are regulated by Japan’s Financial Services Agency (FSA), which generally enforces a degree of oversight, helping ensure that costs are neither arbitrary nor predatory. However, despite being well-established and focusing on trustworthy, “less complex” investment products, Ichiyoshi Securities does not provide explicit details on spreads, commissions, or additional charges on readily accessible platforms.

This lack of detail is notable—especially from a risk management perspective—because as a trader, I consider upfront cost structure among my highest priorities. Without clear fee schedules, there is some uncertainty when planning position sizes or anticipating overall trading costs. That said, their conservative approach to product offerings (avoiding complex and higher-risk instruments) could potentially extend to their pricing, but as a prudent trader, I would not make assumptions about cost-effectiveness or competitiveness without first seeking clarification directly from the broker.

Ultimately, while Ichiyoshi Securities’ regulatory standing and reputation in Japan give me some confidence in their operational integrity, the absence of clear, public information on fees means I would proceed cautiously. Before opening an account or executing trades, I would contact their support directly and request a comprehensive breakdown of commissions, spreads, and any hidden costs, ensuring I fully understand the financial implications of trading with them.

Broker Issues

Fees and Spreads

helpneeded

1-2年

What's the lowest amount I can take out from my Ichiyoshi Securities account in a single transaction?

Based on my experience using Ichiyoshi Securities and carefully reviewing the information available, I must point out that the specific minimum withdrawal amount for an Ichiyoshi Securities account isn’t clearly stated in the publicly accessible details. While I am always diligent in understanding withdrawal policies before transacting, transparency about such operational rules—like minimum withdrawal thresholds—is essential for building trust with clients. For me, this lack of explicit information presents a degree of uncertainty and prompts caution. Given that Ichiyoshi Securities is regulated by Japan’s Financial Services Agency and follows a conservative business model—prioritizing safe and straightforward financial products and procedures—I believe they are unlikely to have arbitrary or exorbitant withdrawal restrictions. However, prudent financial practice means I would contact their customer support directly via the official phone number or through their Japanese office for clarity before attempting any withdrawal, especially if I am considering moving a small balance. This careful approach helps to avoid any misunderstandings or inadvertent errors with my funds. In summary, while the broker demonstrates sound regulation and a long-standing presence, the absence of a clearly published minimum withdrawal amount is something to confirm directly with them before acting.

Broker Issues

Withdrawal

Deposit