公司简介

| 元富证券评论摘要 | |

| 成立时间 | 1989年 |

| 注册国家/地区 | 台湾 |

| 监管 | 由台北证券交易所监管 |

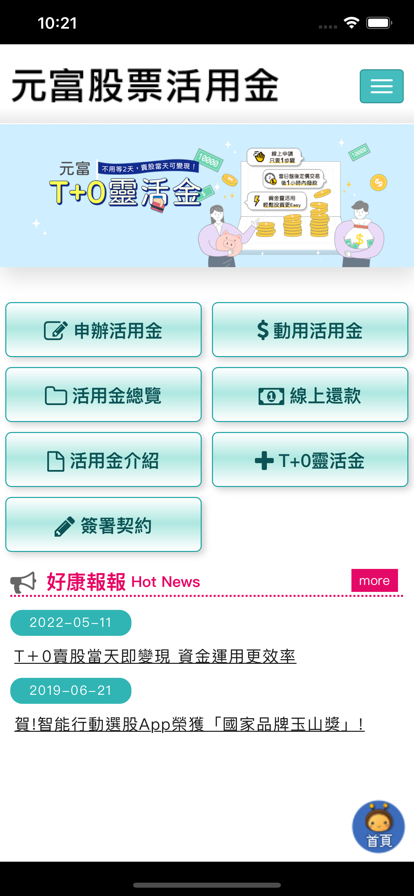

| 市场工具 | 经纪业务、财富管理、承销、股票登记与转让、自营交易、期货自营交易、固定收益、衍生品、元富证券投资咨询、MasterLink期货、MasterLink保险代理、MasterLink风险投资和MasterLink风险管理 |

| 模拟账户 | 未提及 |

| 杠杆 | 最高可达1:600 |

| 点差 | 最低0.5点 |

| 交易平台 | MetaTrader 4 |

| 最低存款 | $100 |

| 客户支持 | 电话:+886-2-27313888 |

| 电子邮件:sylvia0704@masterlink.com.tw | |

元富证券信息

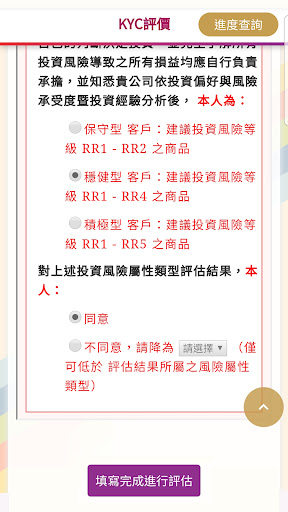

元富证券总部位于台湾,成立于1989年。该经纪商提供外汇、差价合约、大宗商品和指数交易。它还提供最高1:600的杠杆,点差从0.5点到1.5点不等,并提供三种账户类型供选择。

优点和缺点

| 优点 | 缺点 |

| 提供多种交易资产 | 缺乏在线聊天支持 |

| 提供账户类型 | |

| 由台北证券交易所监管 | |

| 提供竞争力强大的1:600杠杆 | |

| 提供MetaTrader 4交易平台 |

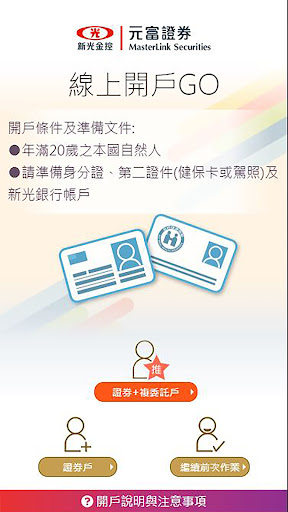

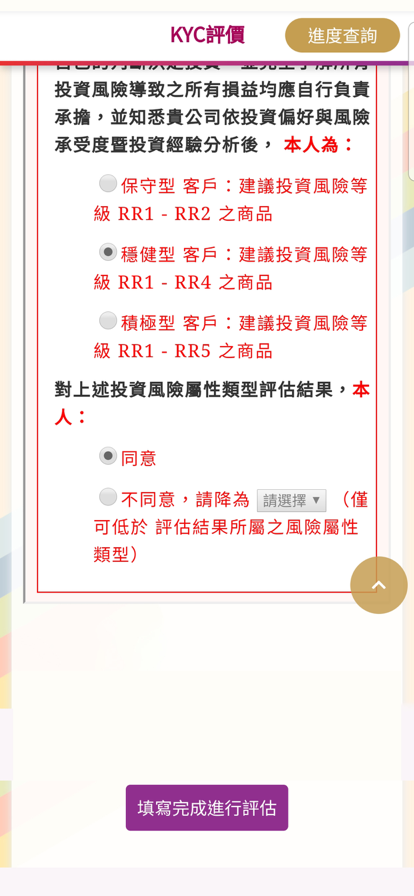

元富证券是否合法?

元富证券受台北证券交易所监管。其许可证类型为无共享。

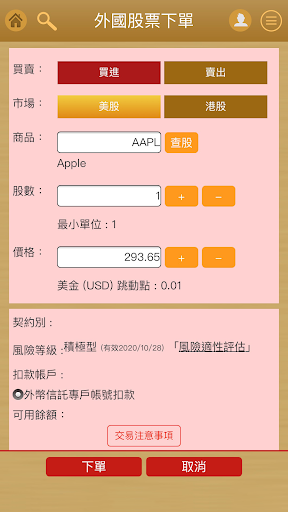

我可以在元富证券上交易什么?

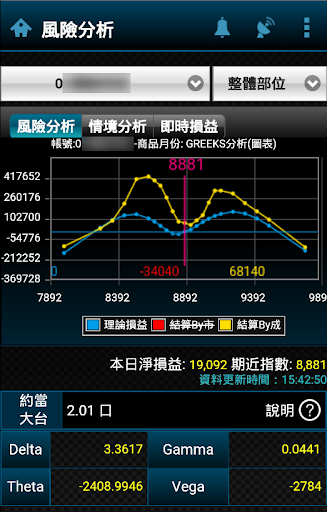

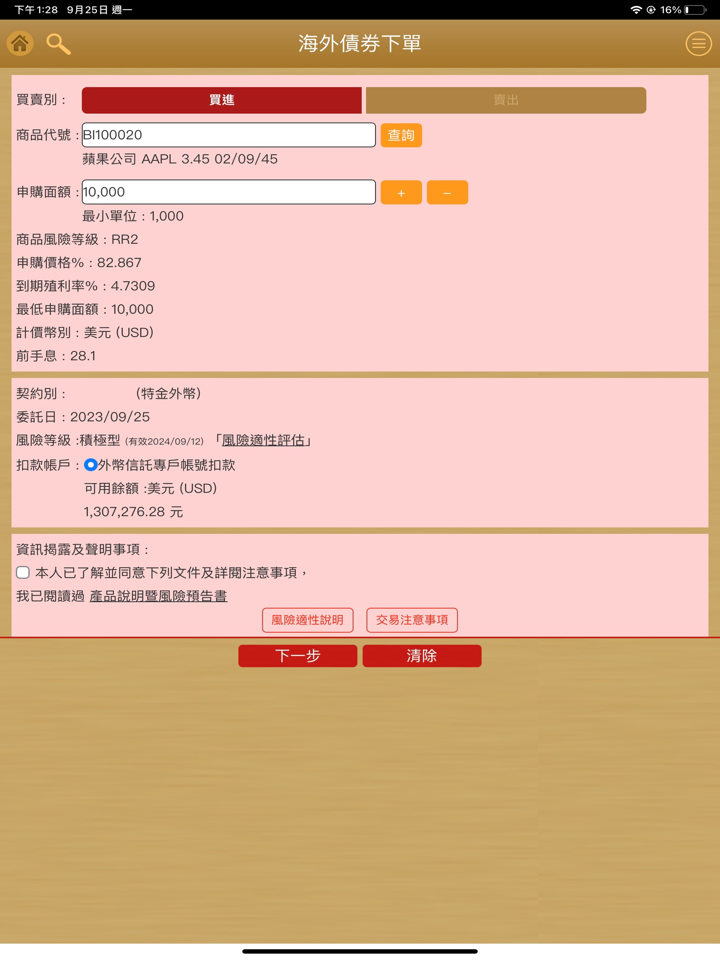

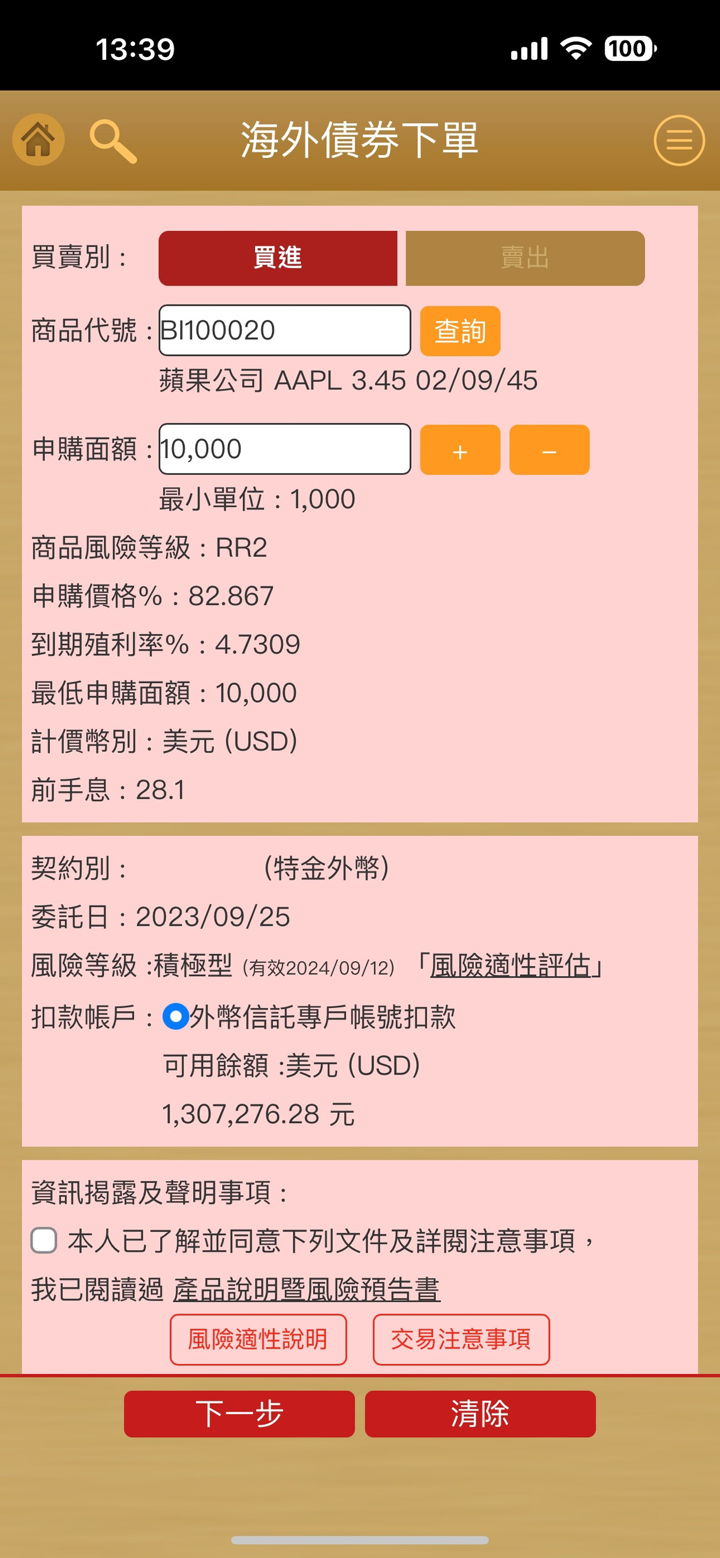

元富证券提供经纪业务、财富管理、承销、股票登记与转让、自营交易、期货自营交易、固定收益、衍生品、元富证券投资咨询、MasterLink期货、MasterLink保险代理、MasterLink风险投资和MasterLink风险管理等,包括外汇、指数和大宗商品的差价合约、大宗商品和指数交易。

| 可交易工具 | 支持 |

| 外汇 | ✔ |

| 大宗商品 | ✔ |

| 加密货币 | ❌ |

| 差价合约 | ✔ |

| 期货 | ✔ |

| 股票 | ✔ |

| 指数 | ✔ |

| 期权 | ❌ |

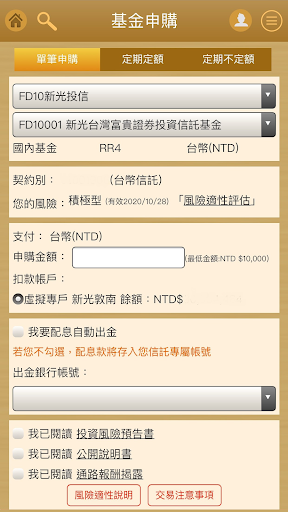

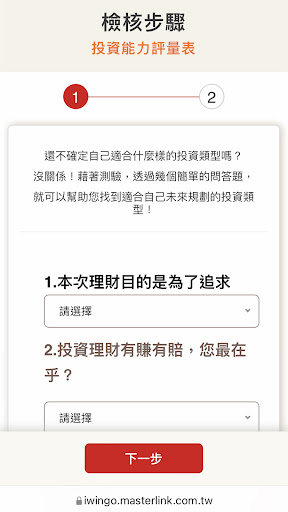

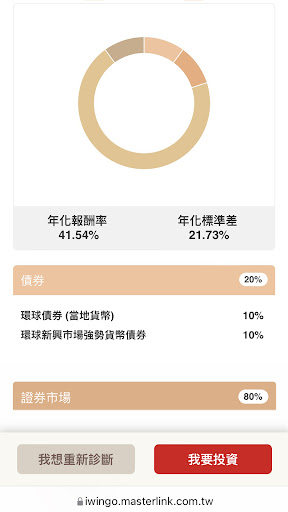

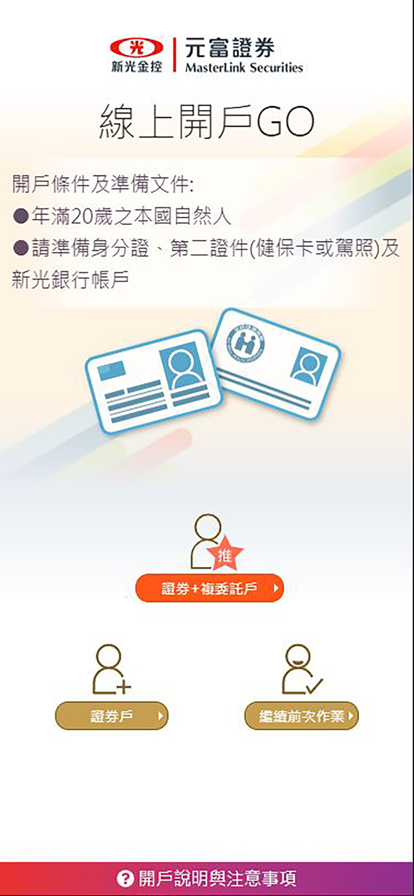

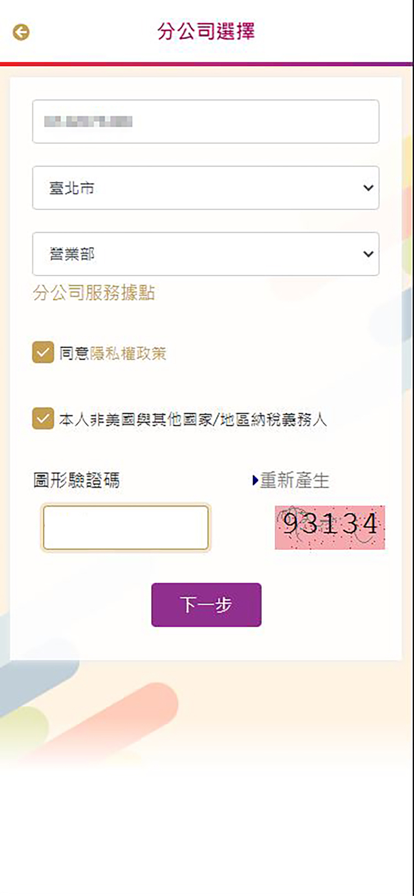

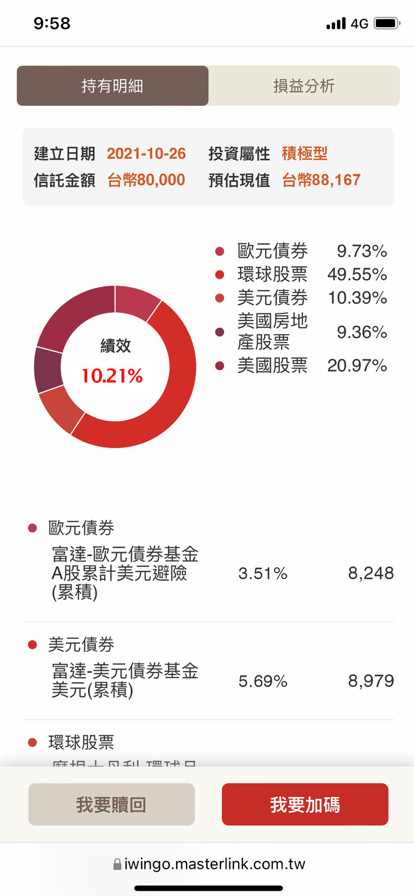

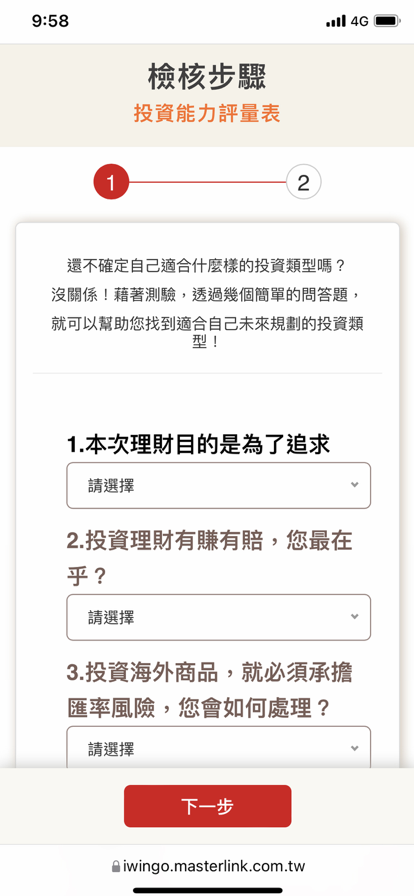

账户类型

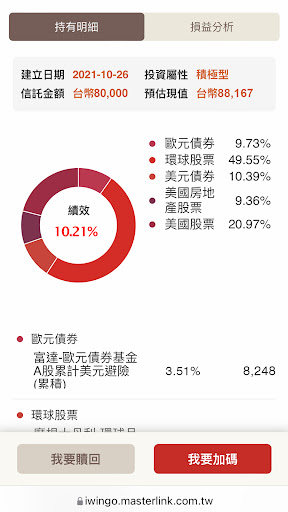

元富证券 提供三种账户类型,包括标准账户、黄金账户和白金账户账户。

标准账户:

标准账户最低存款金额为$100,提供1.5点差和零佣金。此外,它还提供最高1:600的杠杆。

黄金账户:

黄金账户最低存款金额为$500,提供更紧密的1.0点差和无佣金。它也提供最高1:600的杠杆。

白金账户:

白金账户最低存款金额为$1,000,其点差从0.5点开始。与其他账户类型一样,它提供最高1:600的杠杆。

| 特点 | 标准账户 | 黄金账户 | 白金账户 |

| 杠杆 | 最高1:600 | 最高1:600 | 最高1:600 |

| 点差 | 从1.5点开始 | 从1.0点开始 | 从0.5点开始 |

| 佣金 | 无 | 无 | 无 |

| 最低存款金额 | $100 | $500 | $1,000 |

| 交易工具 | MetaTrader 4 | MetaTrader 4 | MetaTrader 4 |

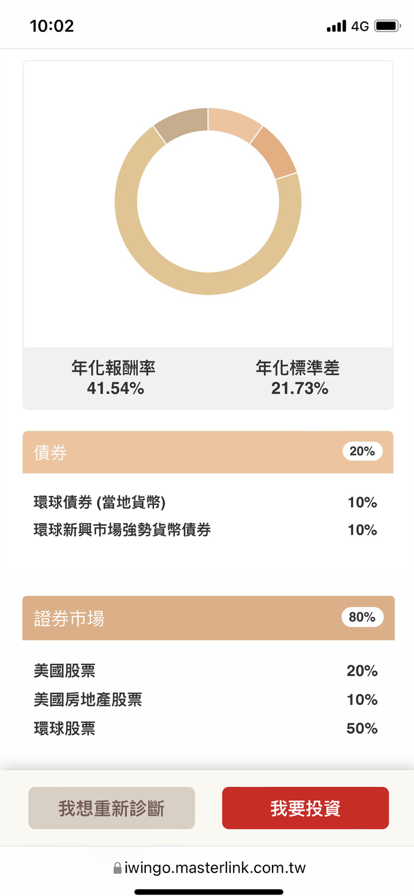

杠杆

元富证券 提供的最高杠杆为1:600。这意味着交易者可以控制市场上多达600倍于其交易资本的头寸。

元富证券 费用

在标准账户中,交易者可以享受主要货币对的点差低至1.5点。

在黄金账户中,点差从1.0点开始。

在白金账户中,主要货币对的点差从0.5点开始。

而且所有账户类型都不收取佣金。

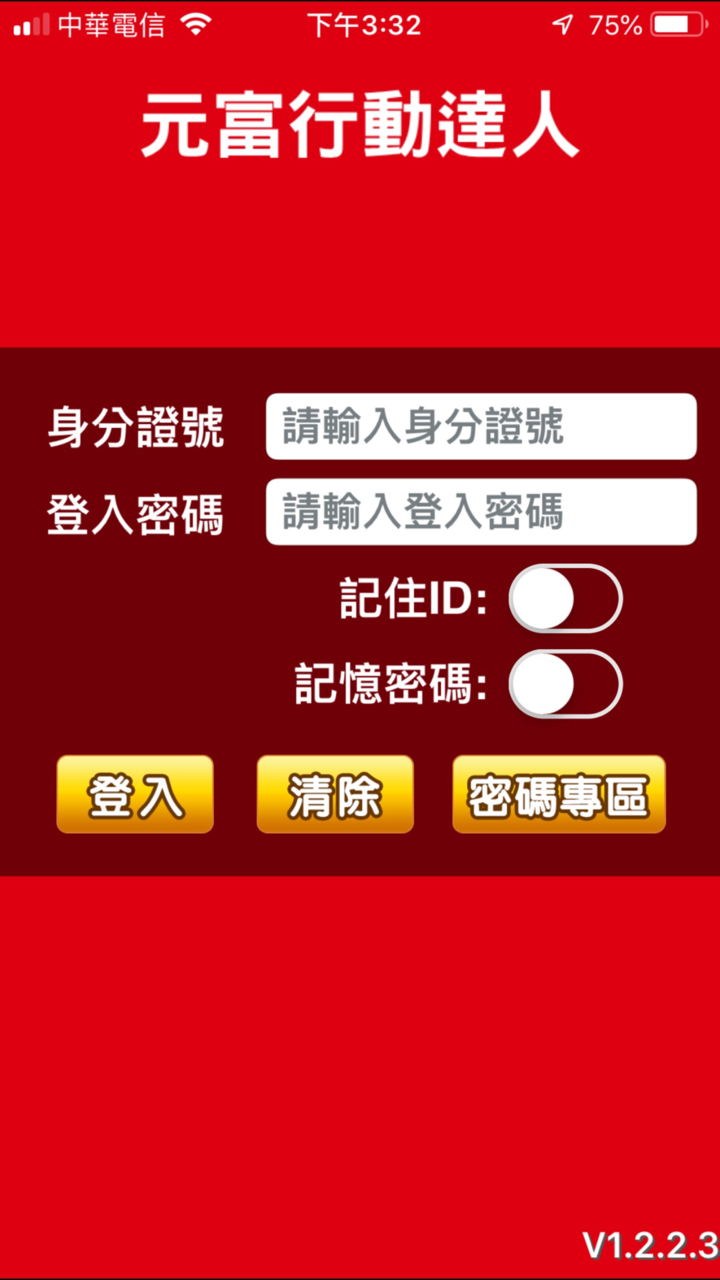

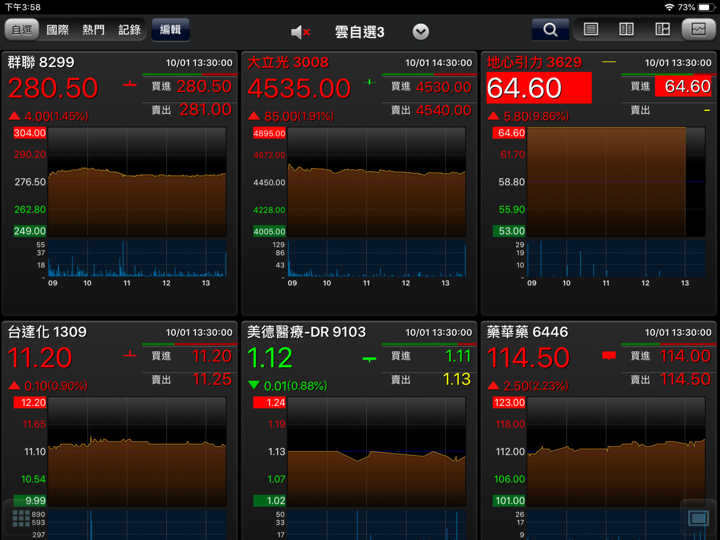

交易平台

| 交易平台 | 支持 | 可用设备 | 适合哪种投资者 |

| MetaTrader 4 | ✔ | Windows、MAC、IOS和Android | 所有经验水平的投资者 |

| MetaTrader 5 | ❌ | ||

| Web Trader | ❌ |

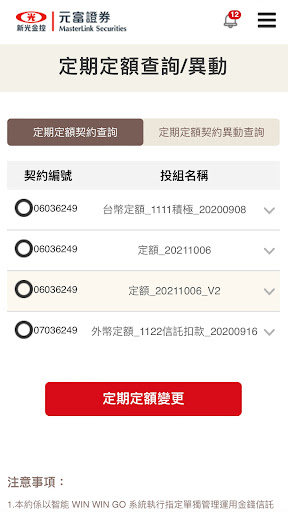

存款和取款

使用元富证券开设交易账户的最低存款金额为标准账户账户的$100,黄金账户账户的$500和白金账户账户的$1,000。