公司简介

| Gleneagle 评论摘要 | |

| 成立时间 | 2010 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | ASIC |

| 服务 | 房地产贷款、资本筹集、管理基金、策略、收入支付、股权增长 |

| 交易平台 | GleneagleWeb |

| 客户支持 | 联系表单 |

| 电话:1300 123 345 | |

| 电子邮件:members@gleneagle.com.au | |

| 地址:Level 27, 25 Bligh Street, Sydney NSW 2000 | |

| Facebook, LinkedIn | |

Gleneagle 信息

Gleneagle 是一家受监管的一流经纪和金融服务提供商,于2010年在澳大利亚成立。它提供房地产贷款、资本筹集、管理基金、策略、收入支付和股权增长等服务。

优缺点

| 优点 | 缺点 |

| 运营时间长 | 收取佣金手续费 |

| 多种联系渠道 | |

| 提供多种金融服务 |

Gleneagle 是否合法?

是的。Gleneagle 已获ASIC许可提供服务。其许可编号为000337985。澳大利亚证券和投资委员会(ASIC)是澳大利亚独立的政府机构,充当澳大利亚的公司监管机构,该机构于1998年7月1日成立,是根据沃利斯调查的建议设立的。

| 受监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可类型 | 许可证号 |

| 澳大利亚证券和投资委员会(ASIC) | 受监管 | GLENEAGLE SECURITIES(AUST)PTY LIMITED | 做市商(MM) | 000337985 |

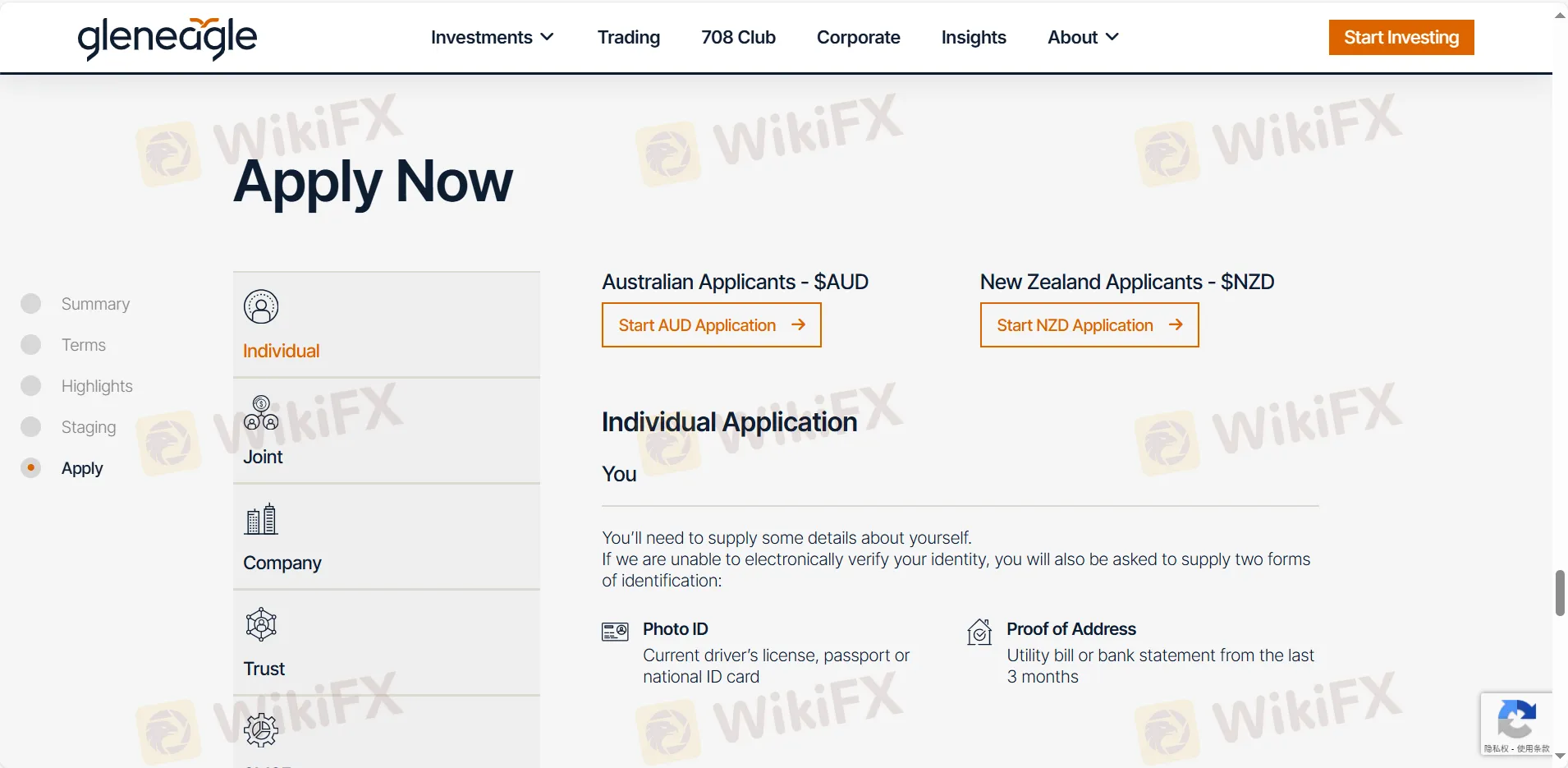

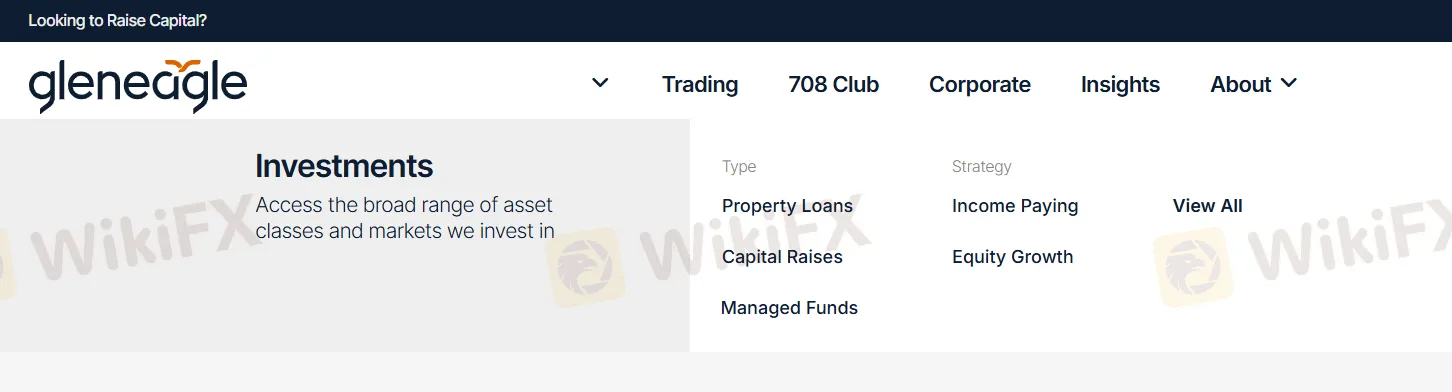

Gleneagle 服务

| 服务 | 支持 |

| 房地产贷款 | ✔ |

| 资本筹集 | ✔ |

| 管理基金 | ✔ |

| 策略 | ✔ |

| 收入支付 | ✔ |

| 股权增长 | ✔ |

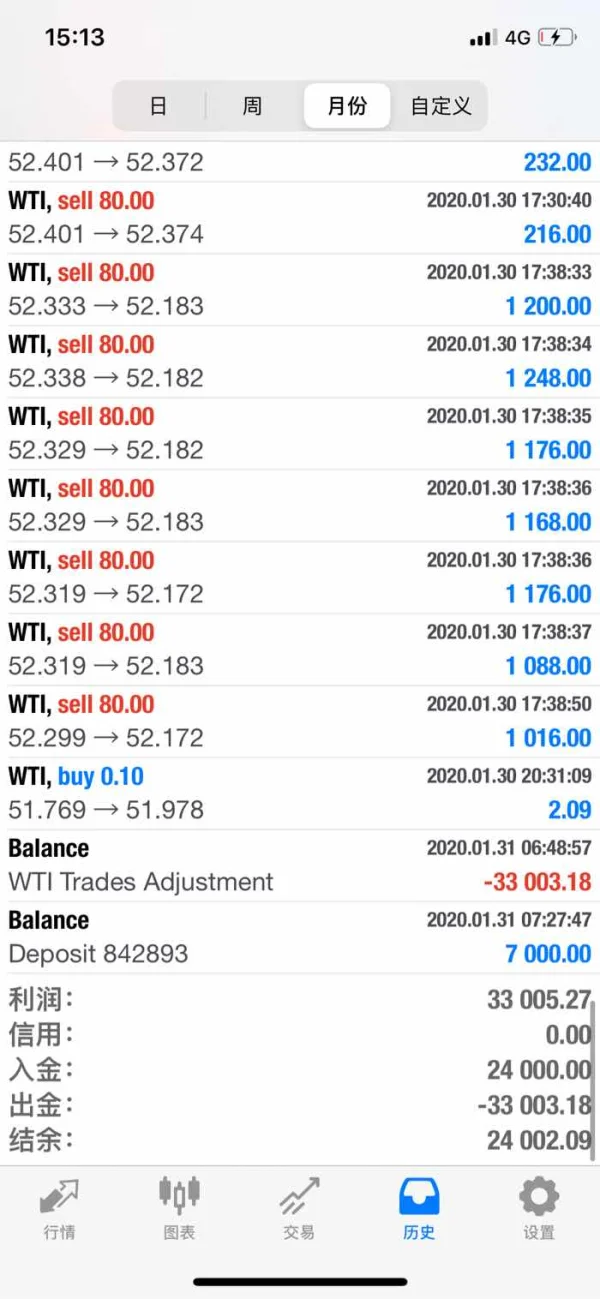

Gleneagle 费用

股票 手续费 和费率

您在ASX交易的股票交易中通常会被收取的标准 手续费 是交易价值的1.1%(包括GST),最低为82.50美元,但最高为1.65%和150美元(包括GST)。

ASX衍生品 手续费

您在 交易所 交易的衍生品通常会被收取的标准 手续费 是保费金额的1.1%(包括GST),最低为82.50美元,但最高为1.65%和150美元(包括GST)。

场外交易 交易 手续费

场外交易 交易的费用、成本和收费在这些产品的PDS中披露。

| 费用详情 | 金额 |

| 银行拒付费 | $82.50 |

| 手动预订费 | $33.00 |

| 重新预订费 | $33.00 |

| 客户追踪费 | $30 |

| 实时毛额结算(国内) | $55 |

| 场外转账 | $55 每 安全 |

| SRN请求到股份登记处 | $27.50 每持股 |

| 股票借用费 | $110 |

| 邮寄交易确认 | $3.30 每次确认 |

交易平台

| 交易平台 | 支持 | 可用设备 |

| Gleneagle 网页 | ✔ | PC,笔记本电脑,平板电脑 |