公司简介

| CommBank 评论摘要 | |

| 成立时间 | 1911 |

| 注册国家/地区 | 澳大利亚 |

| 监管 | 受监管 |

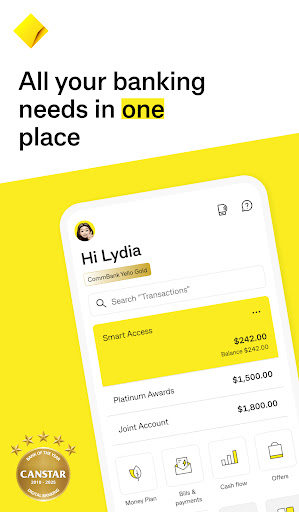

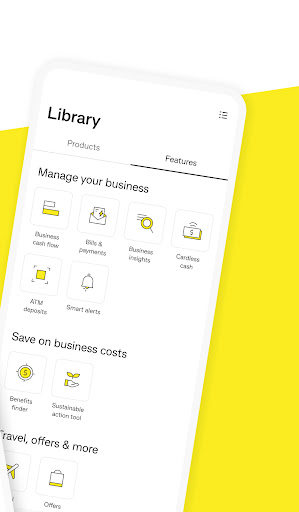

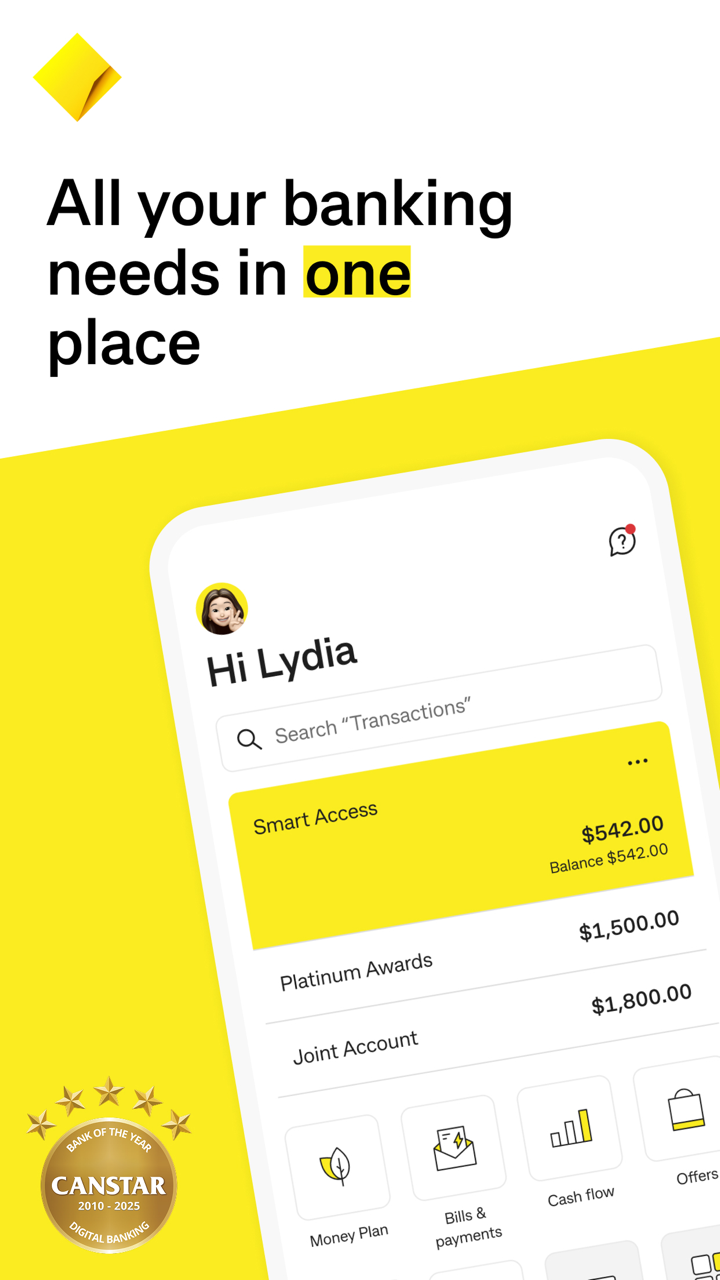

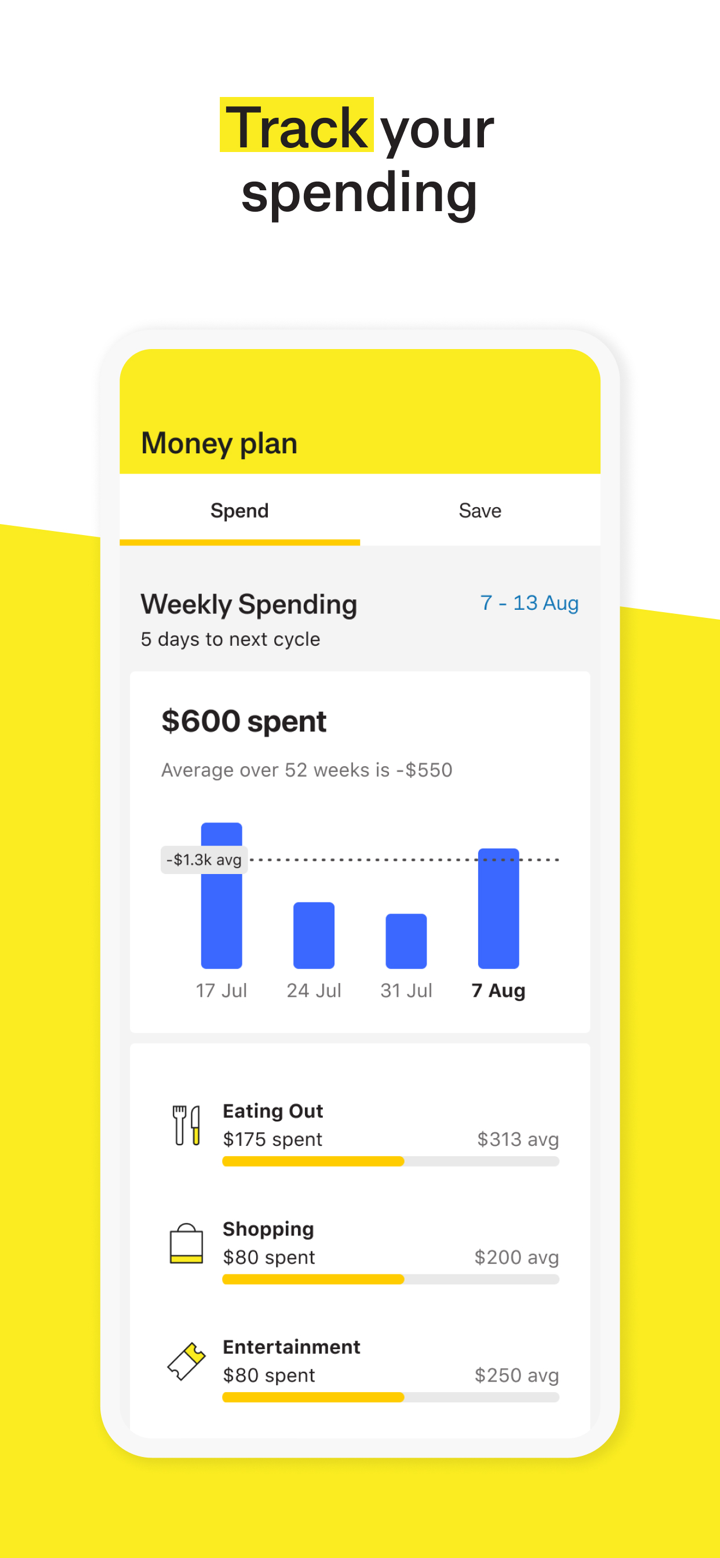

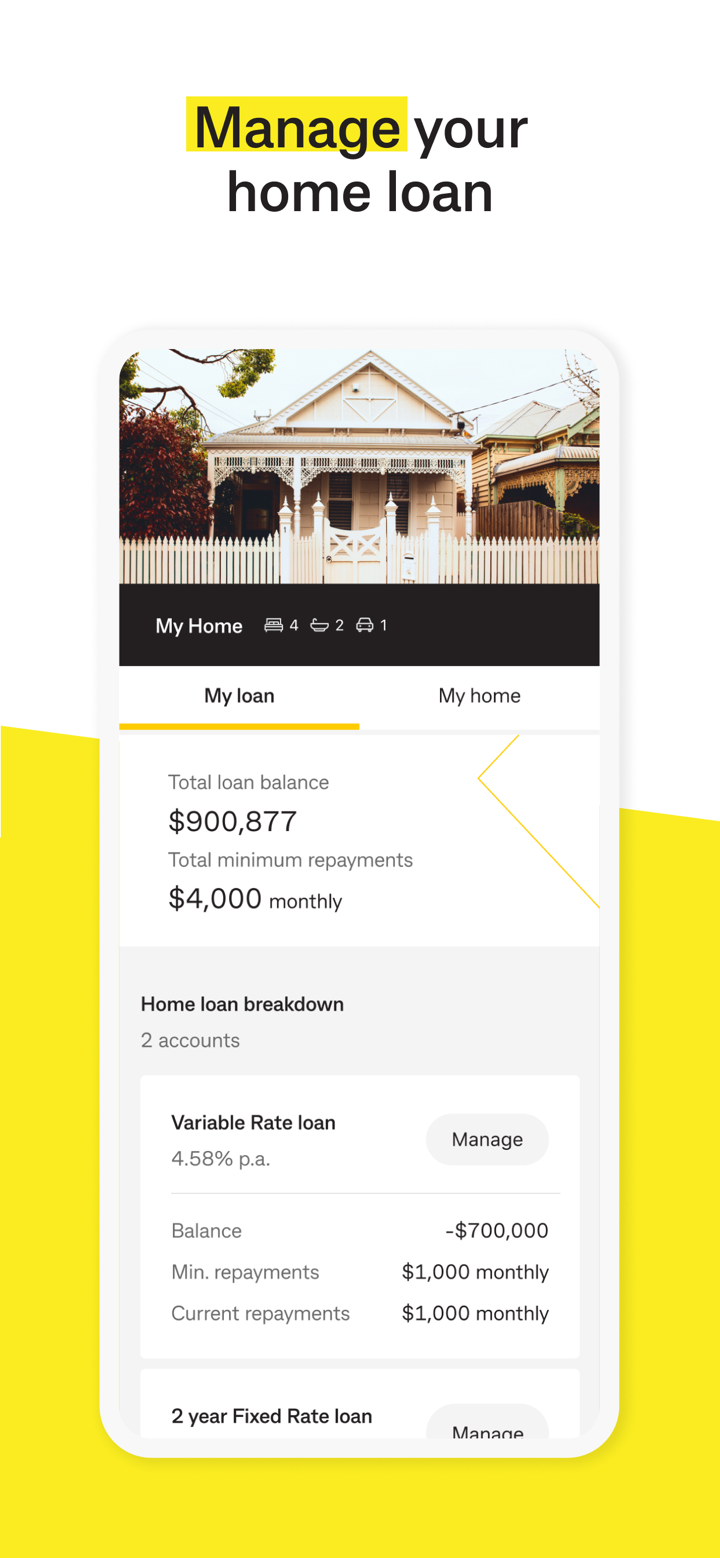

| 产品和服务 | 零售银行业务、商业银行业务、投资、保险、养老金等 |

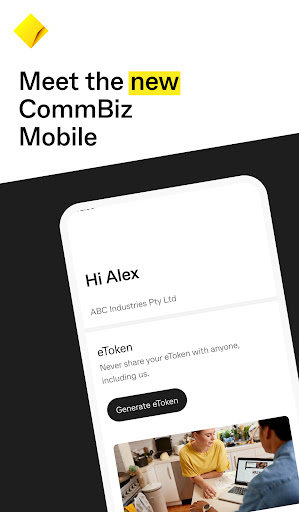

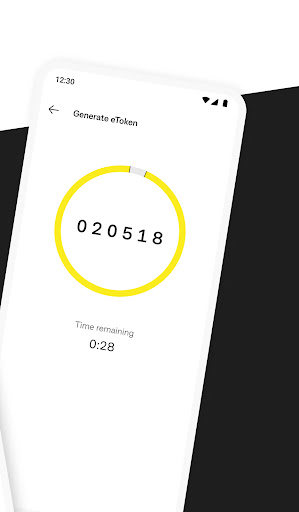

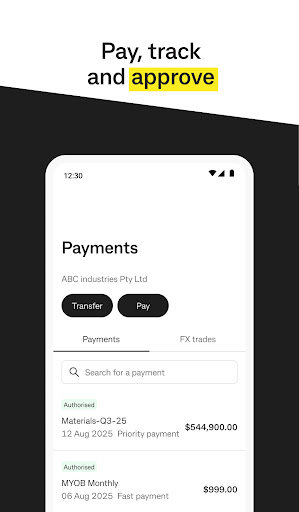

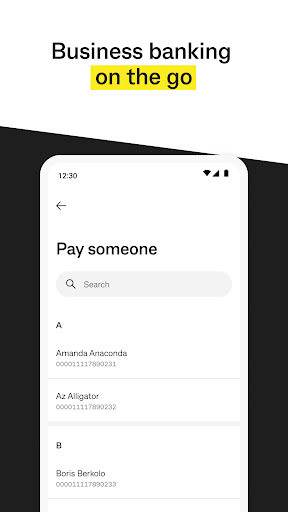

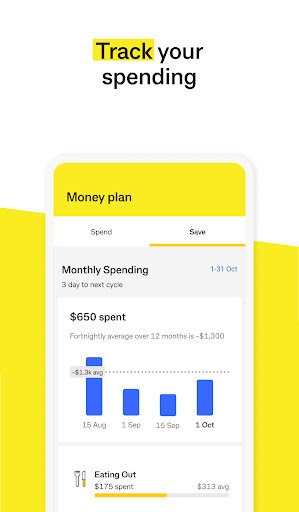

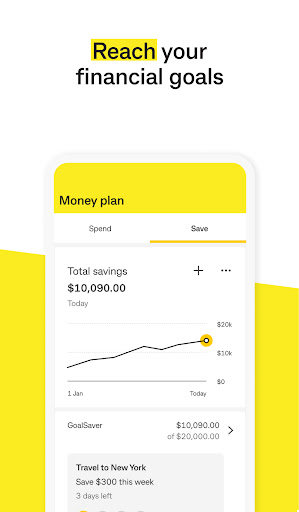

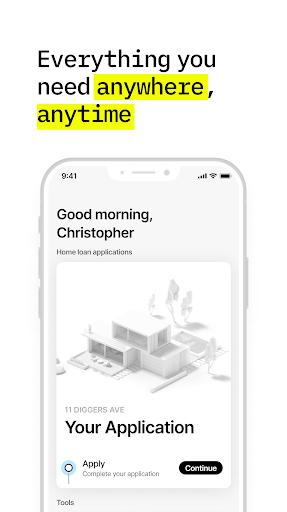

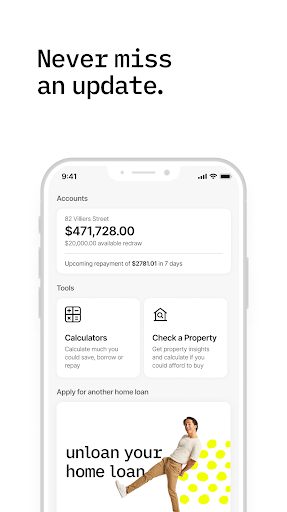

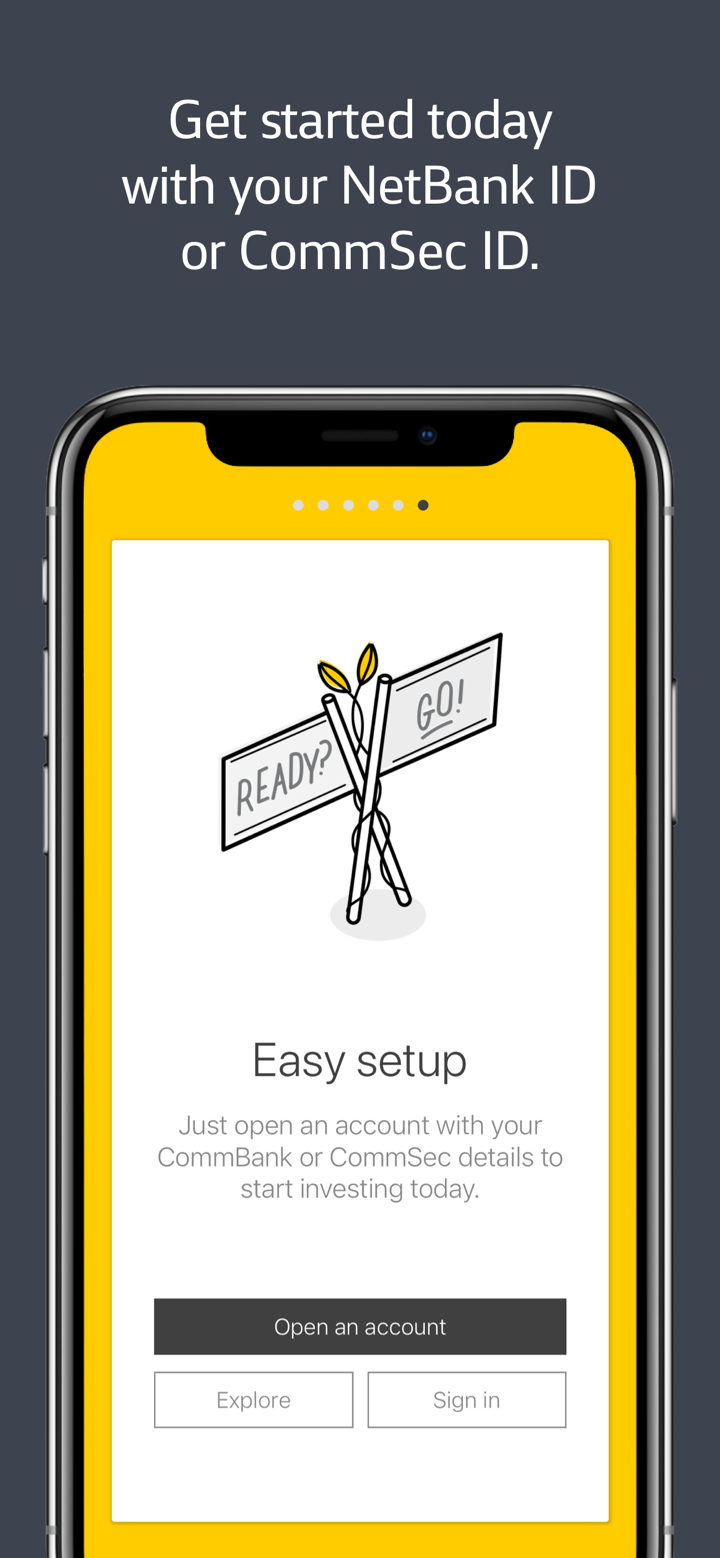

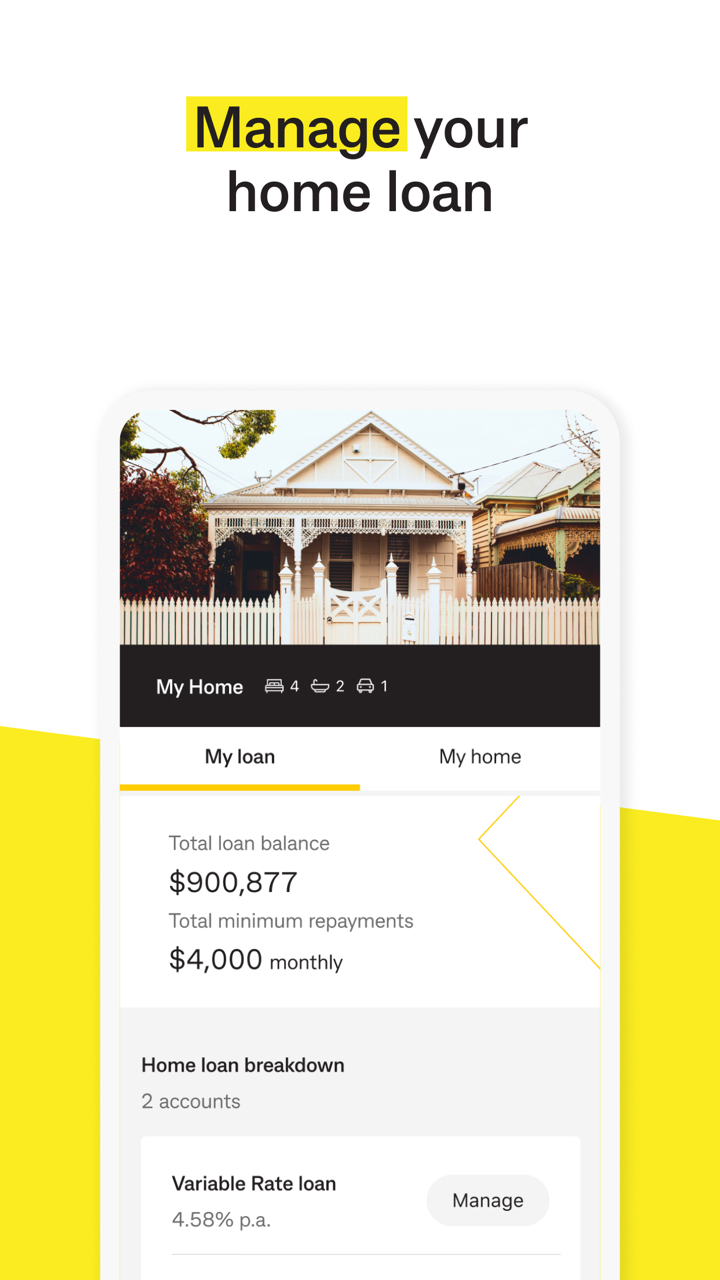

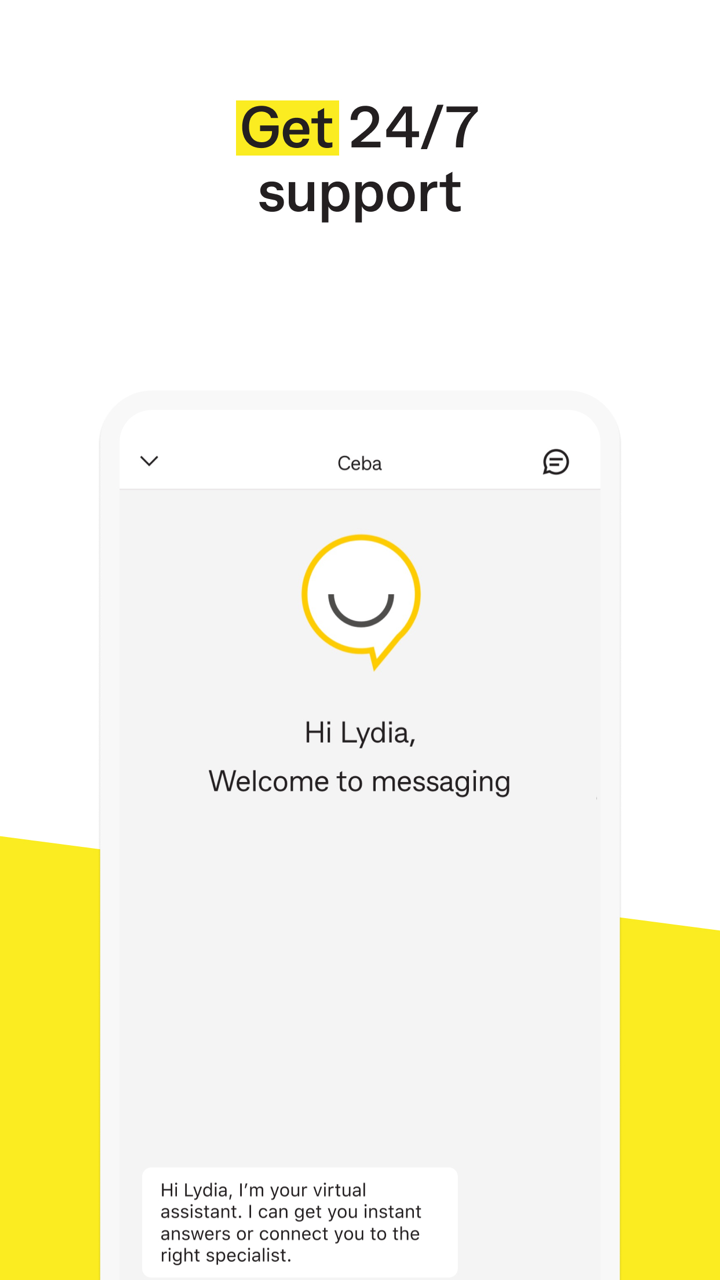

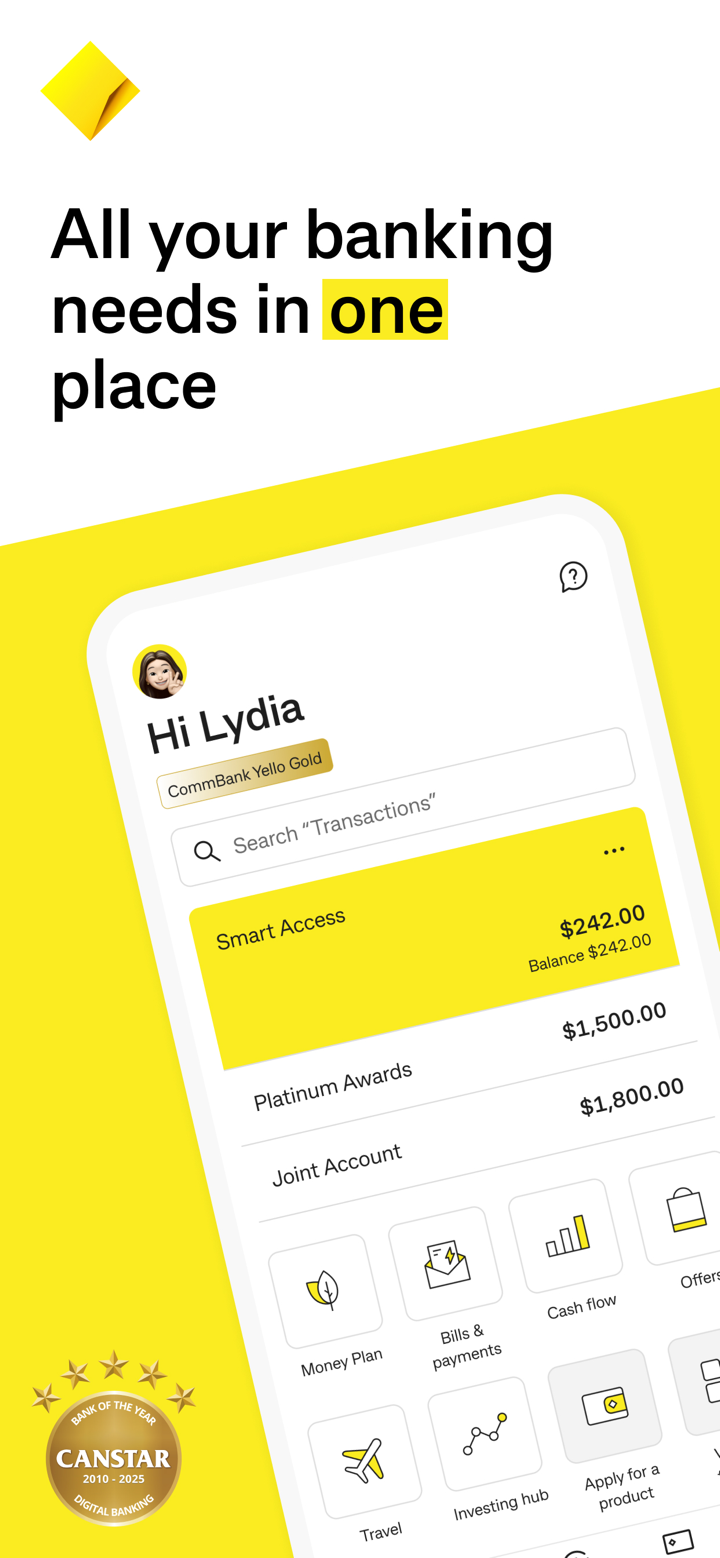

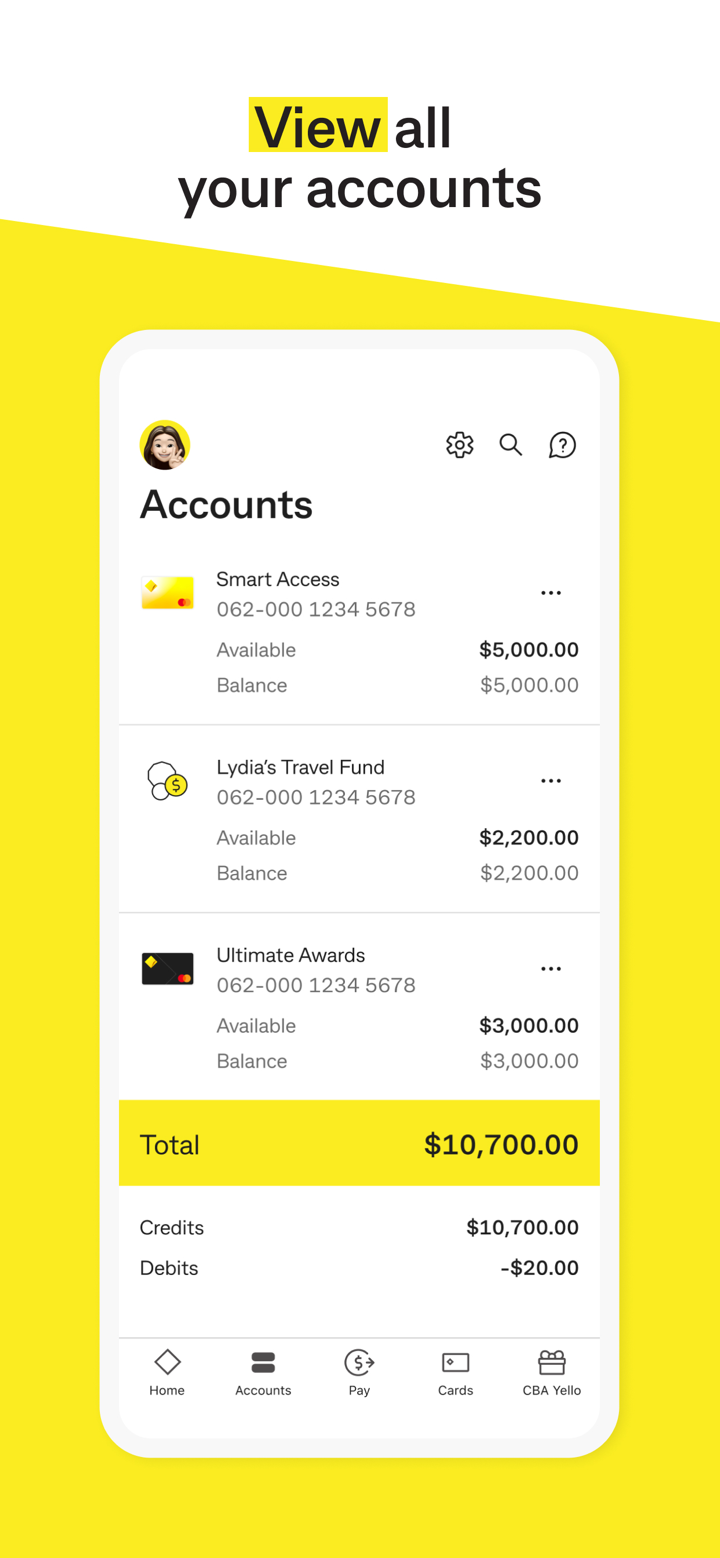

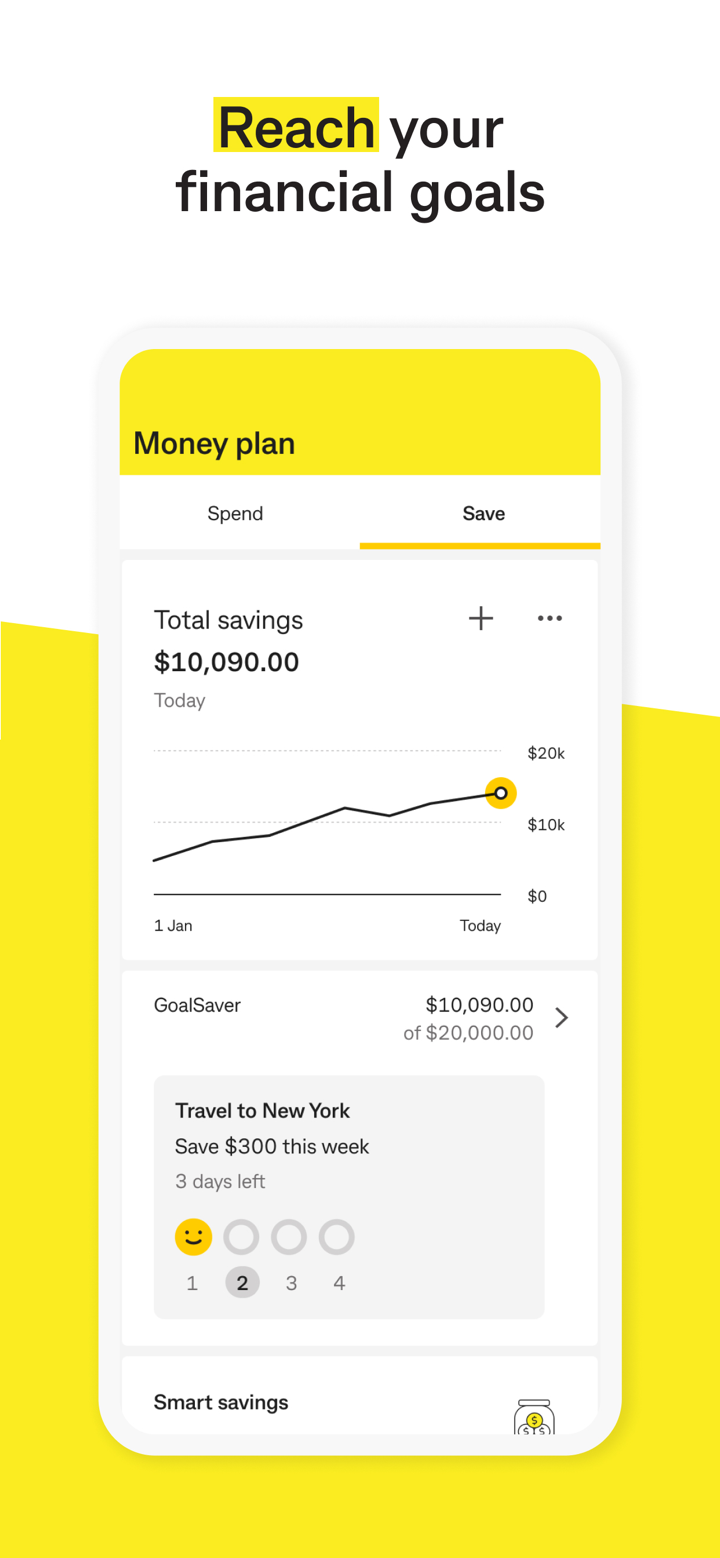

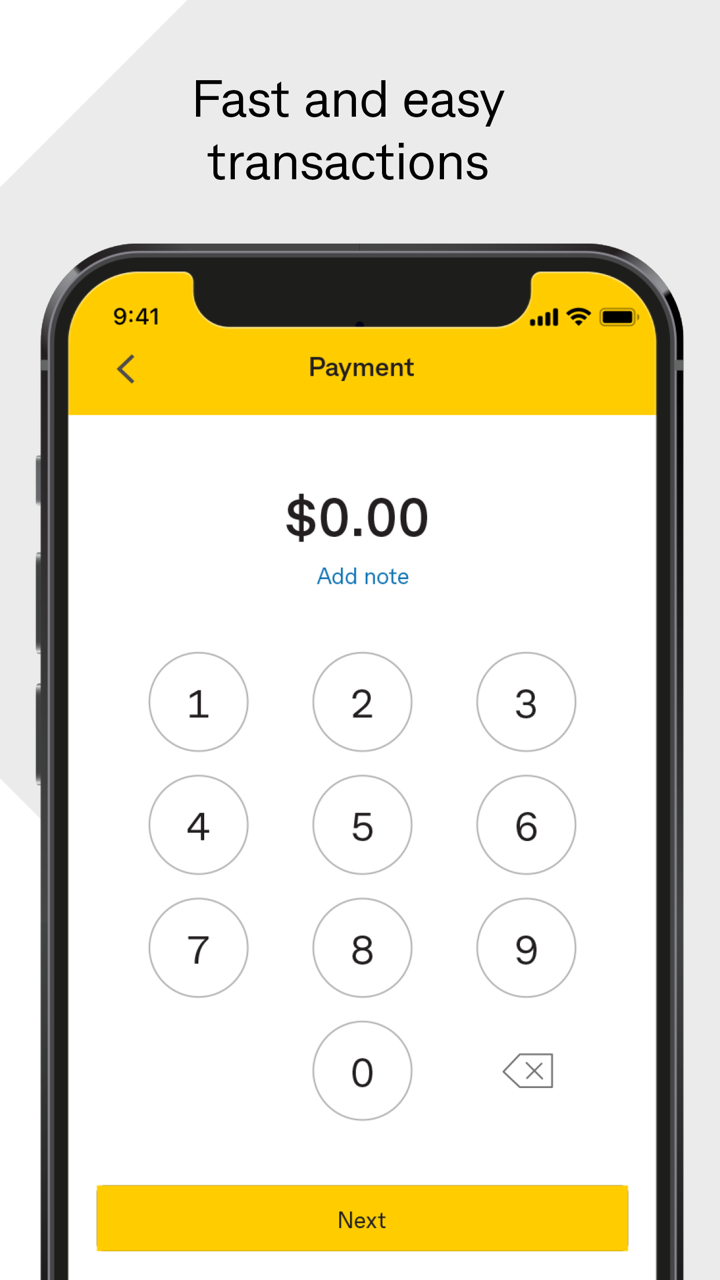

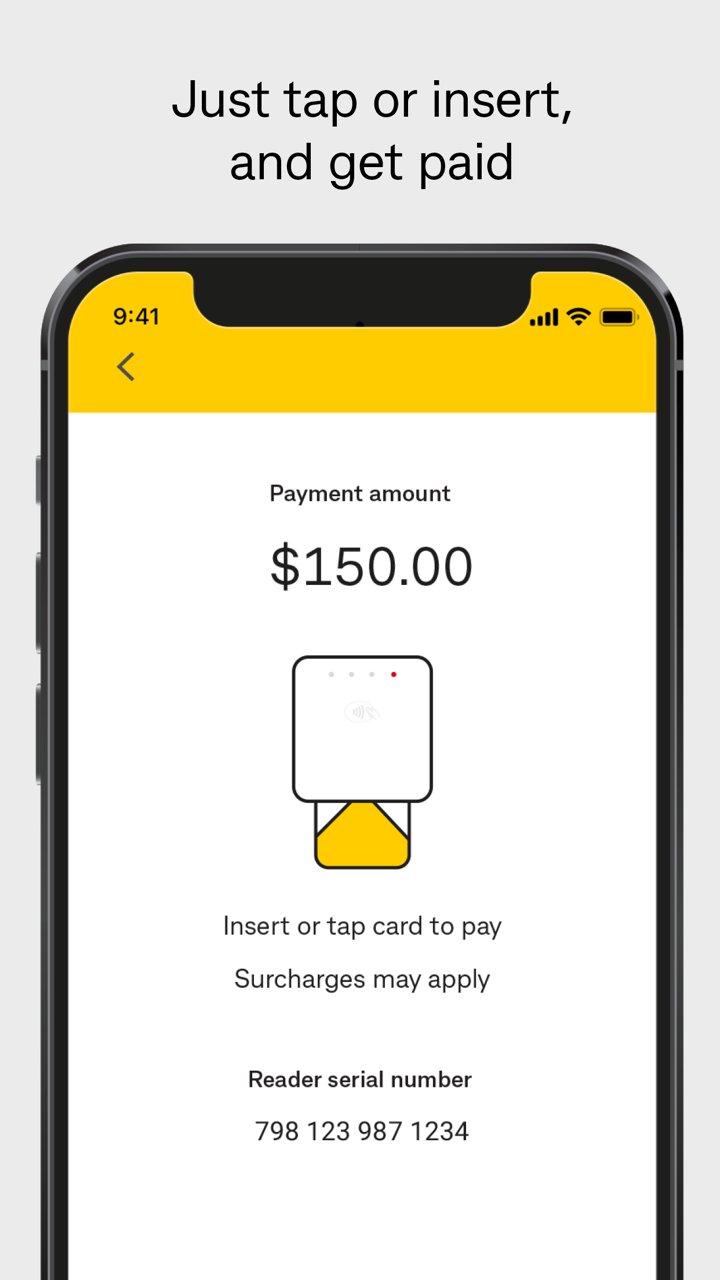

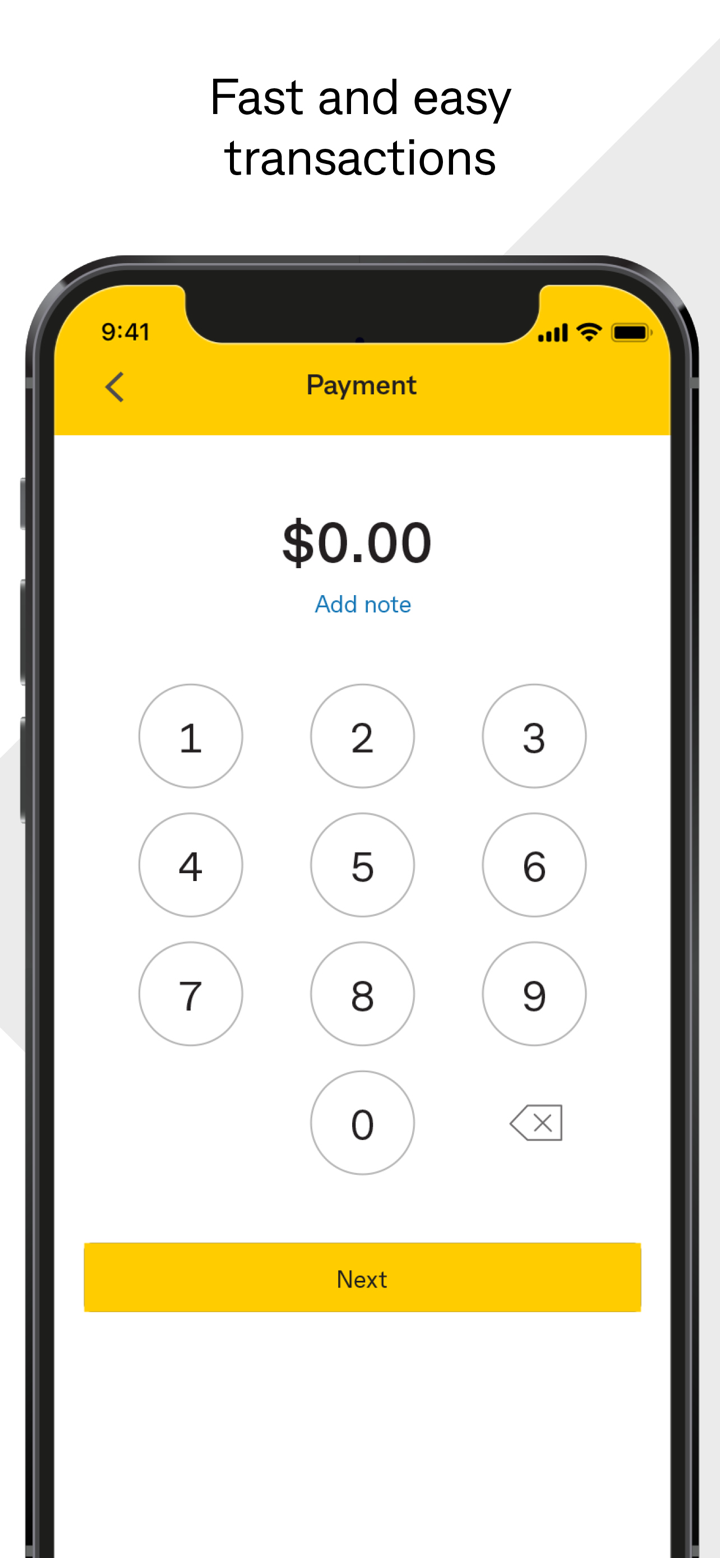

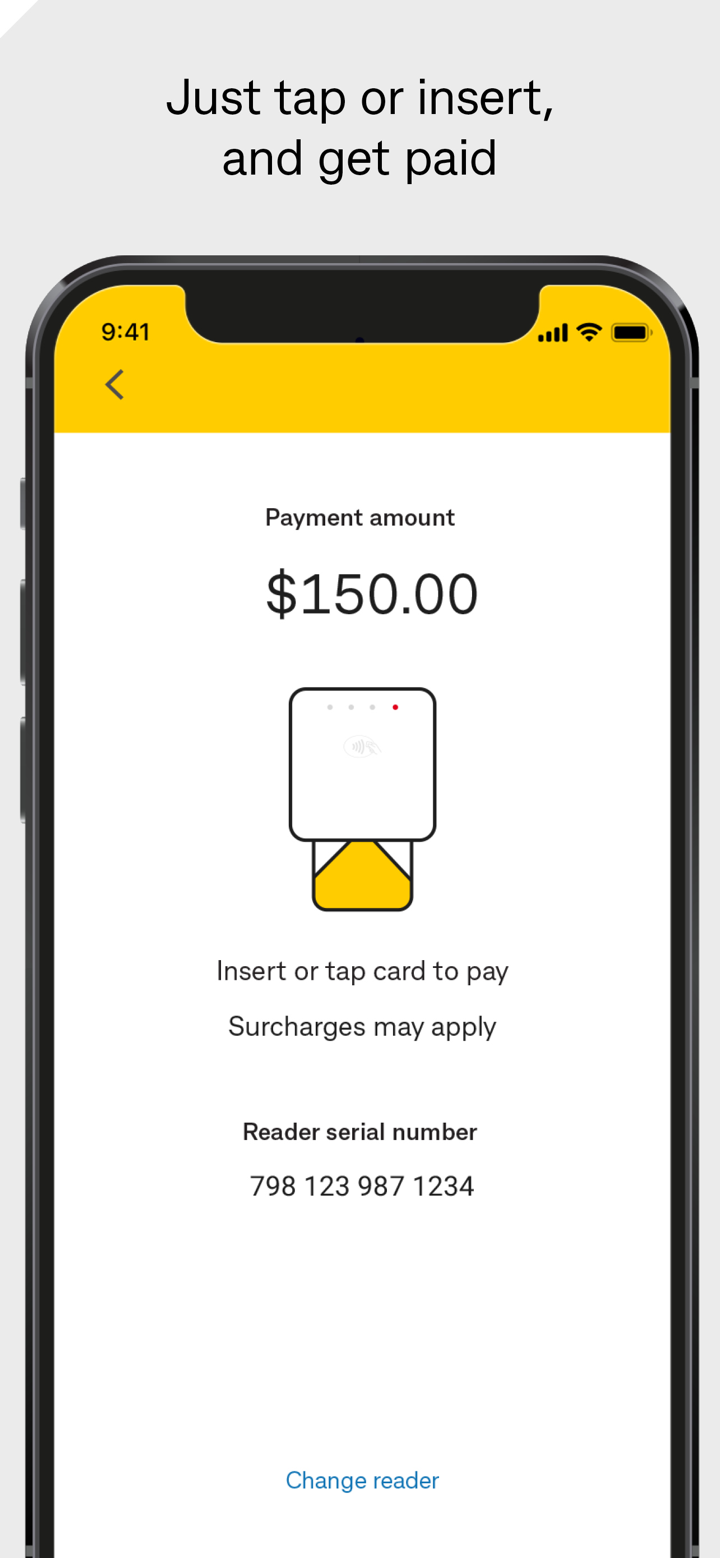

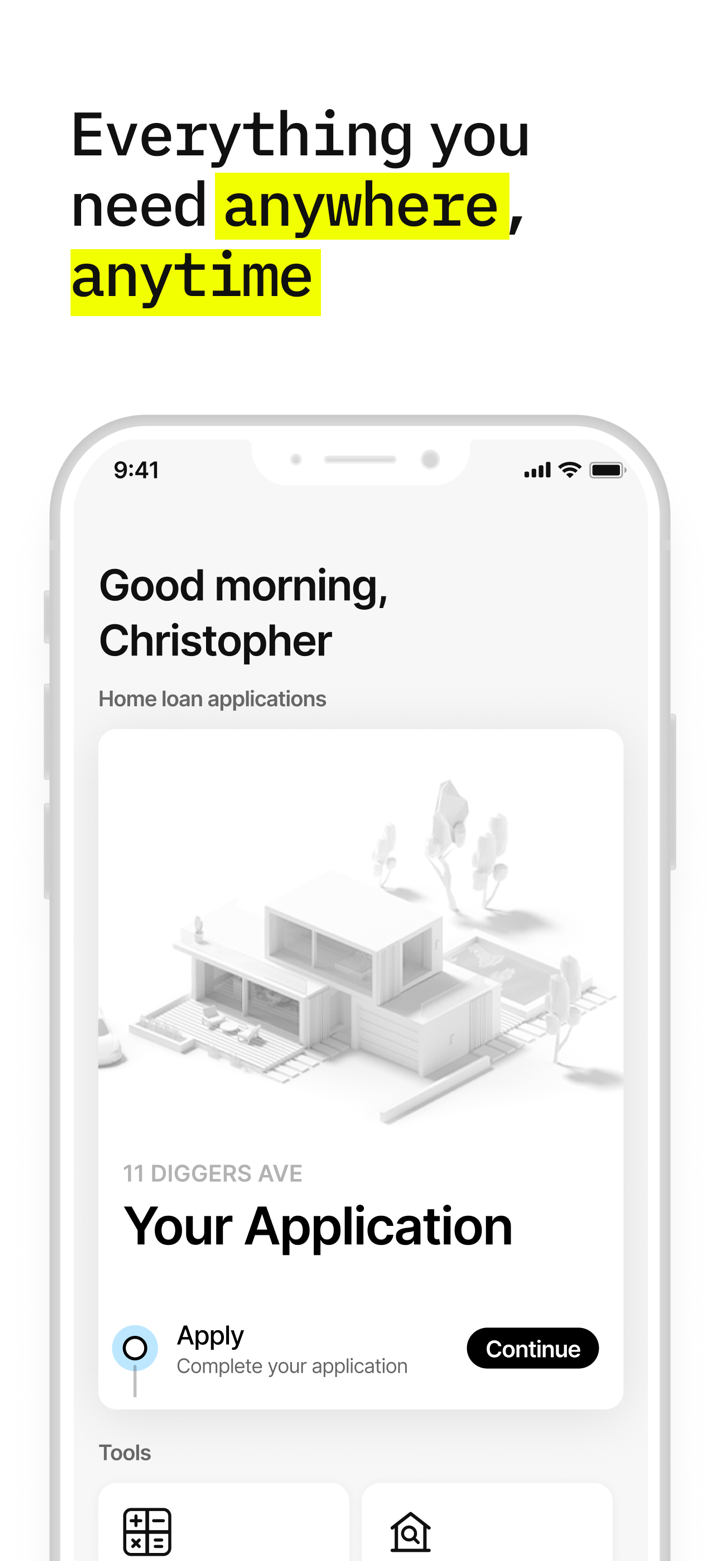

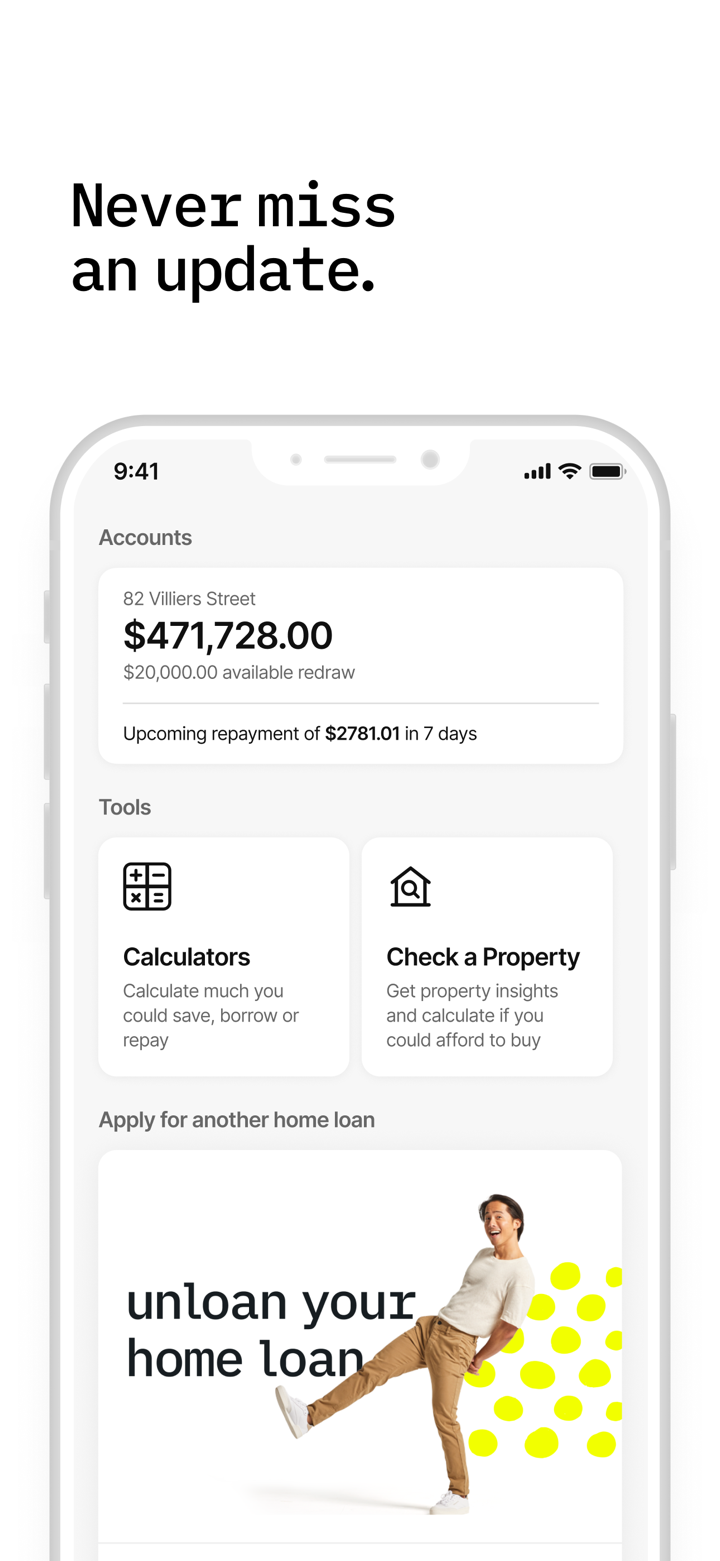

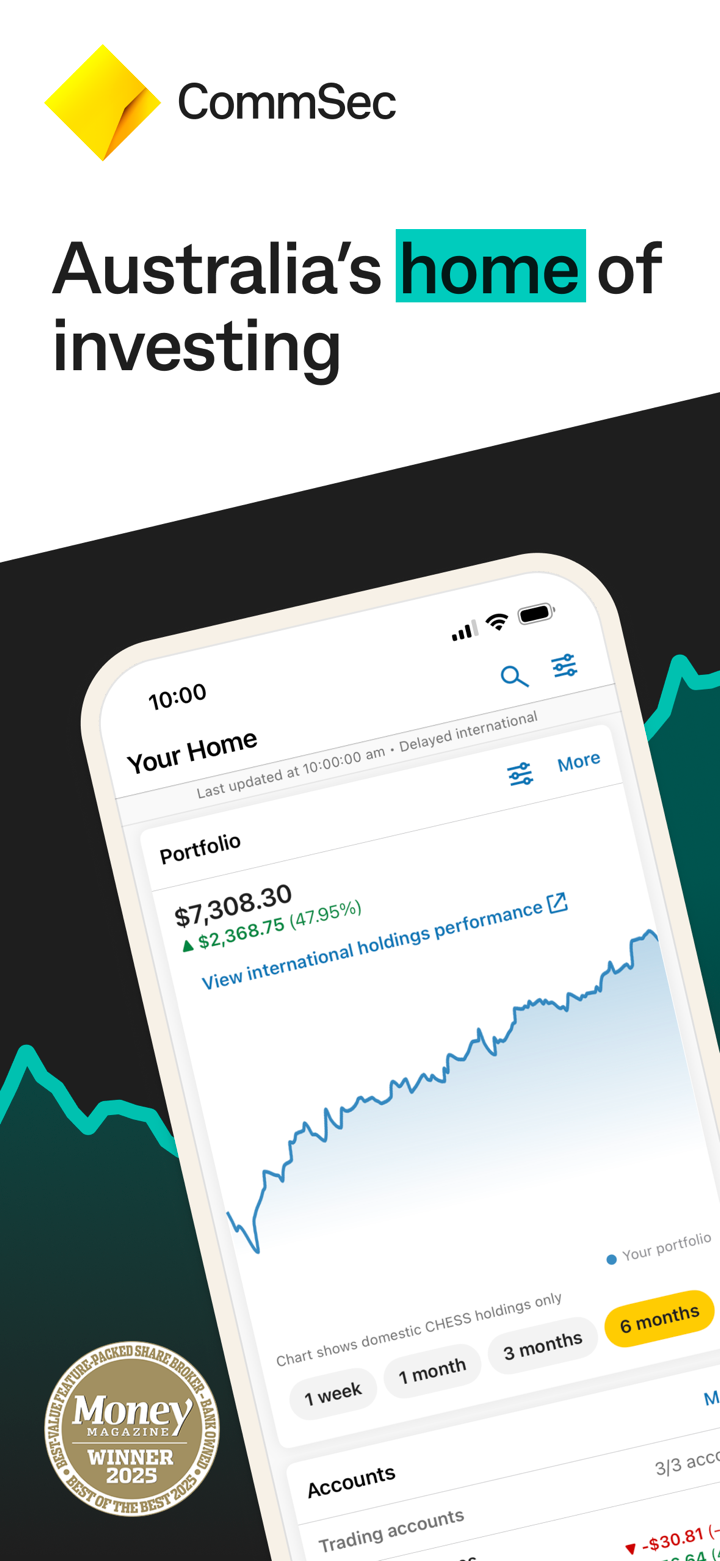

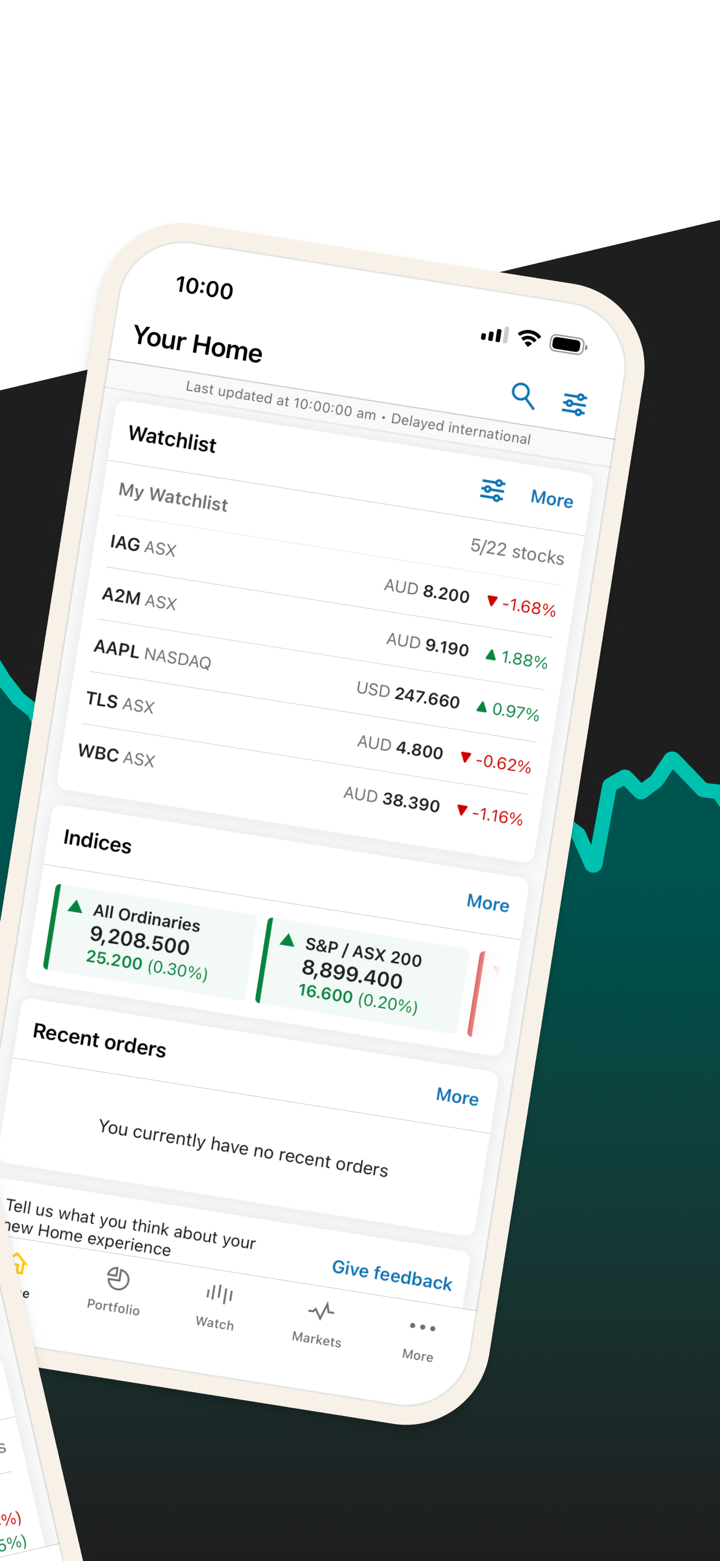

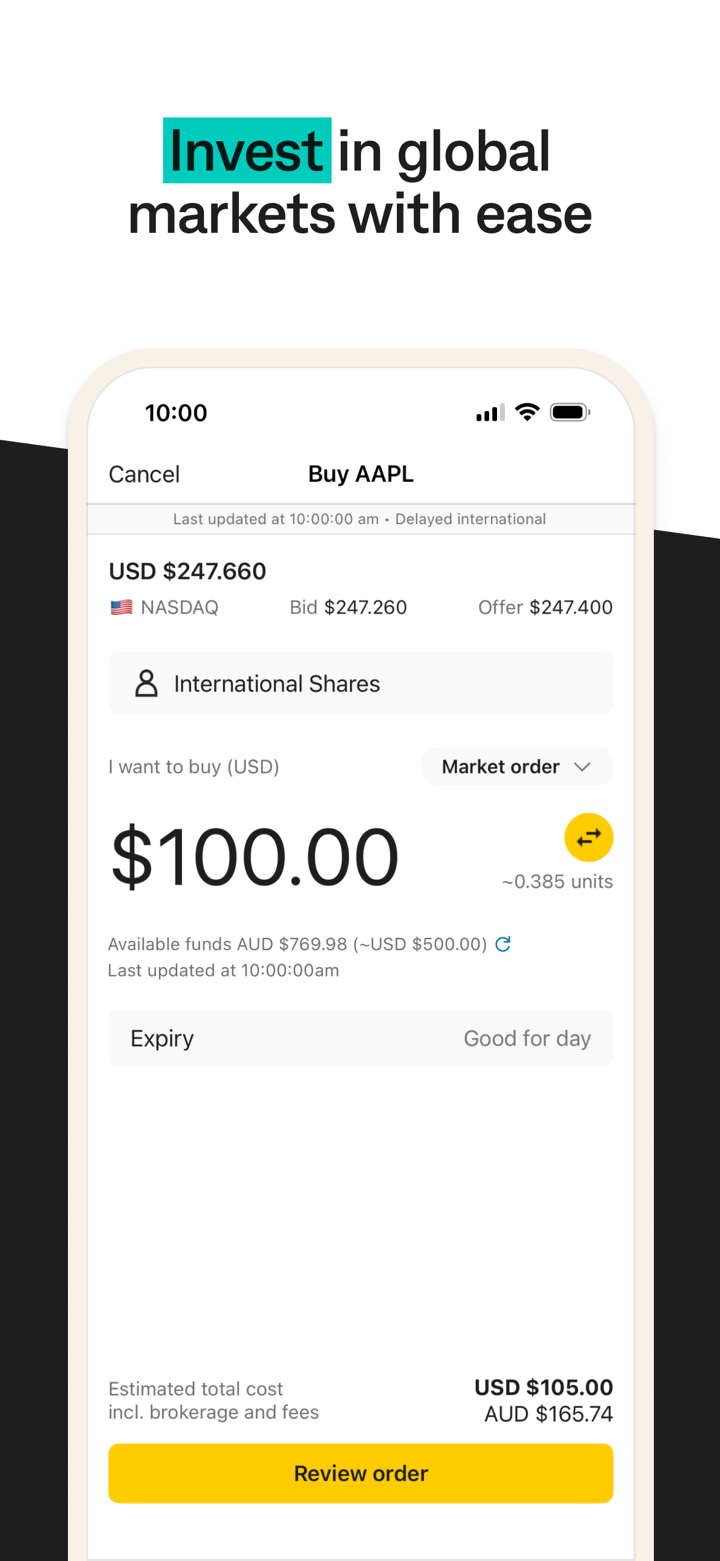

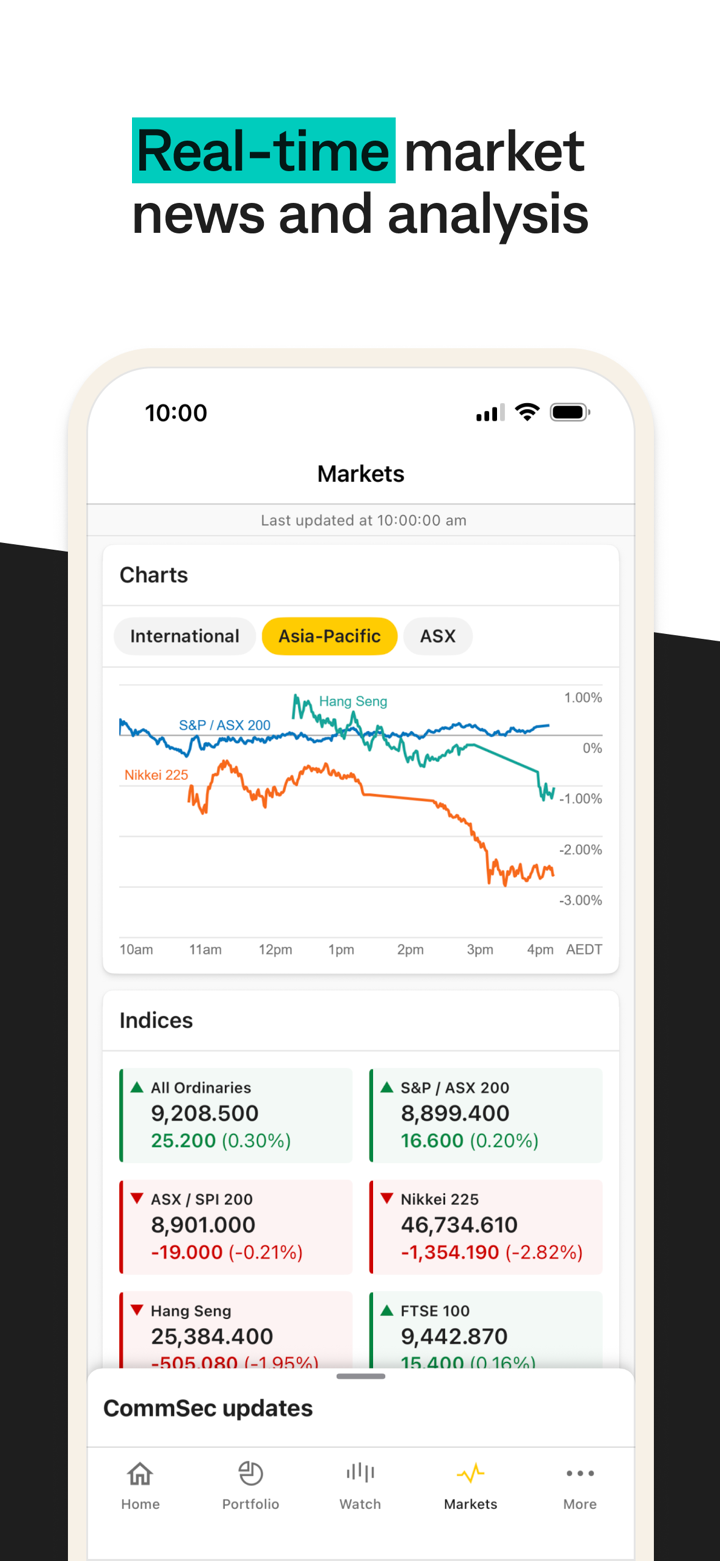

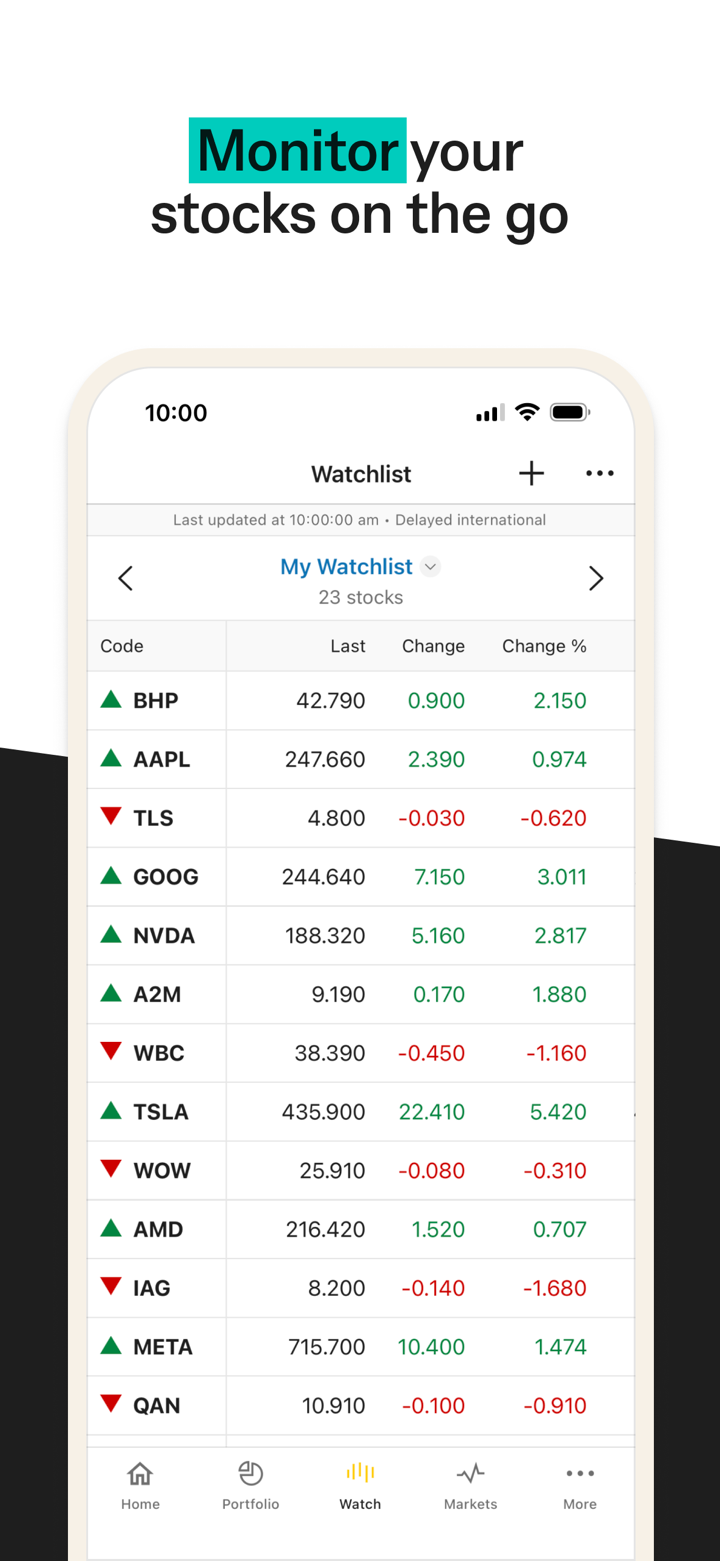

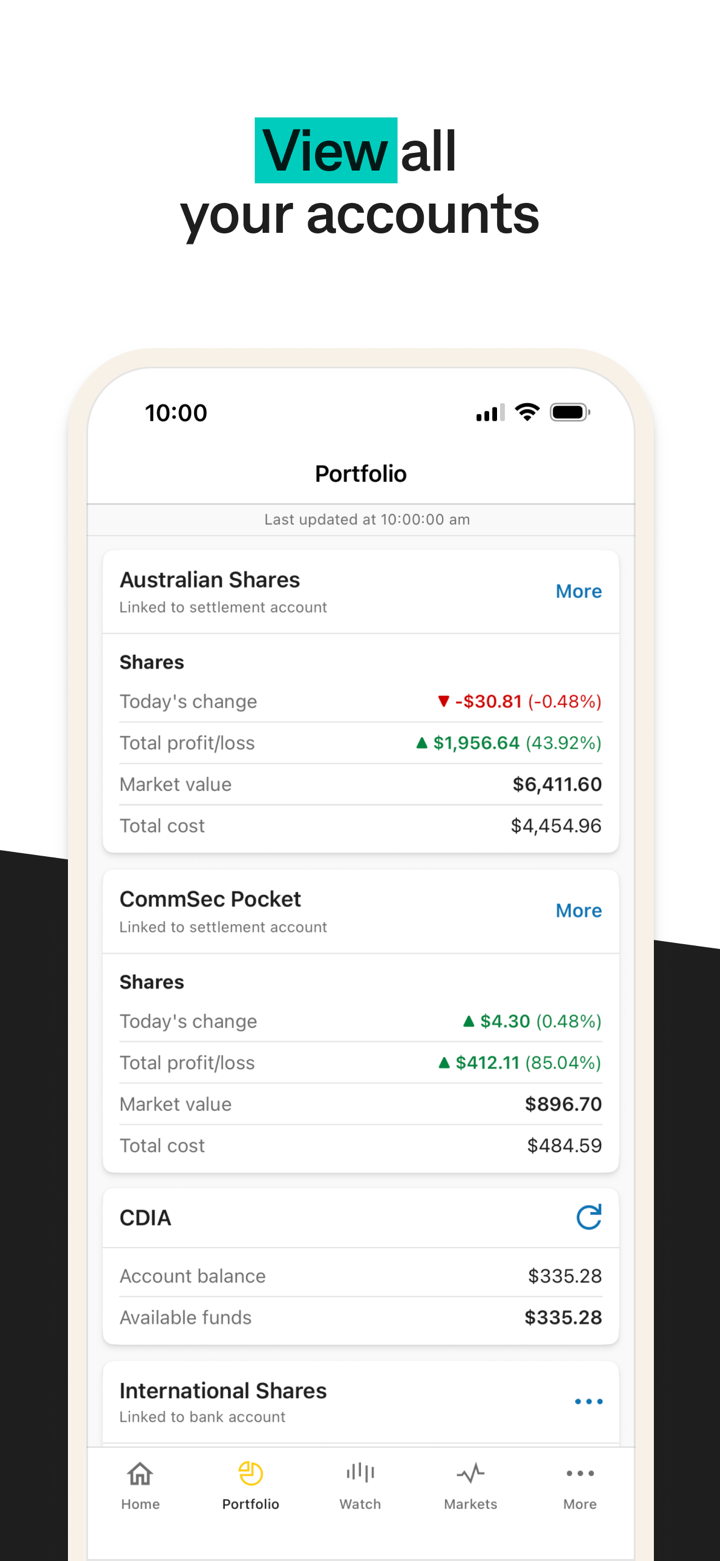

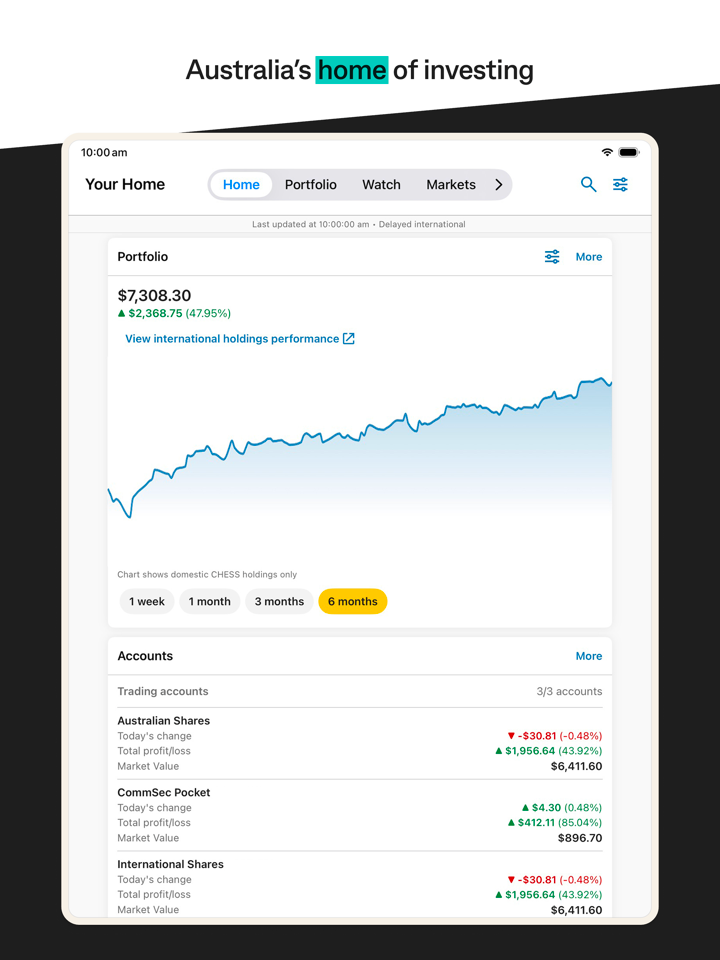

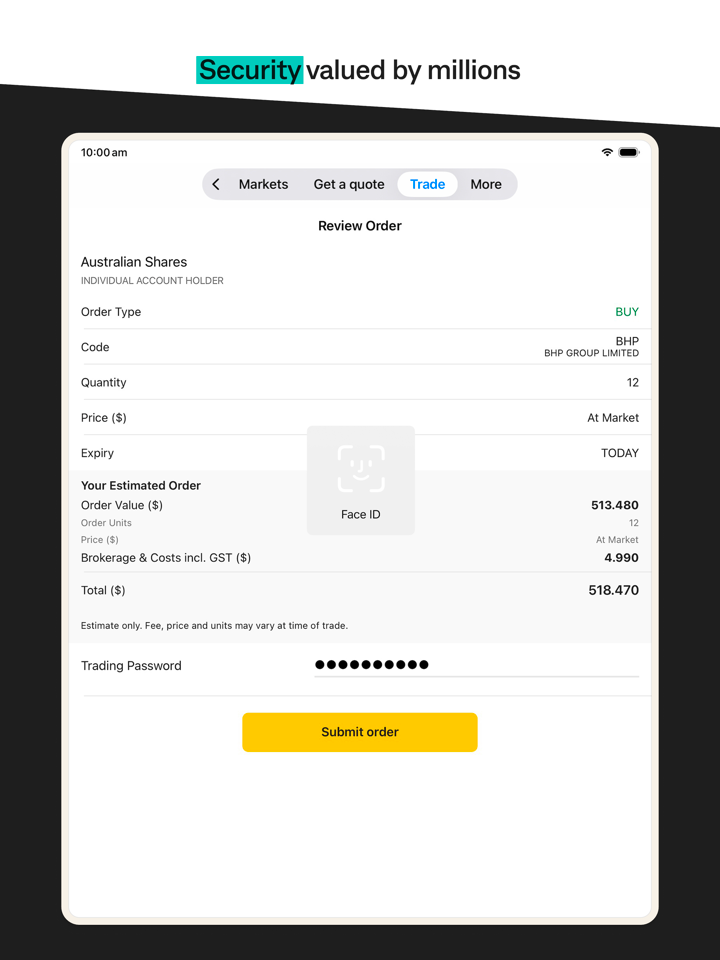

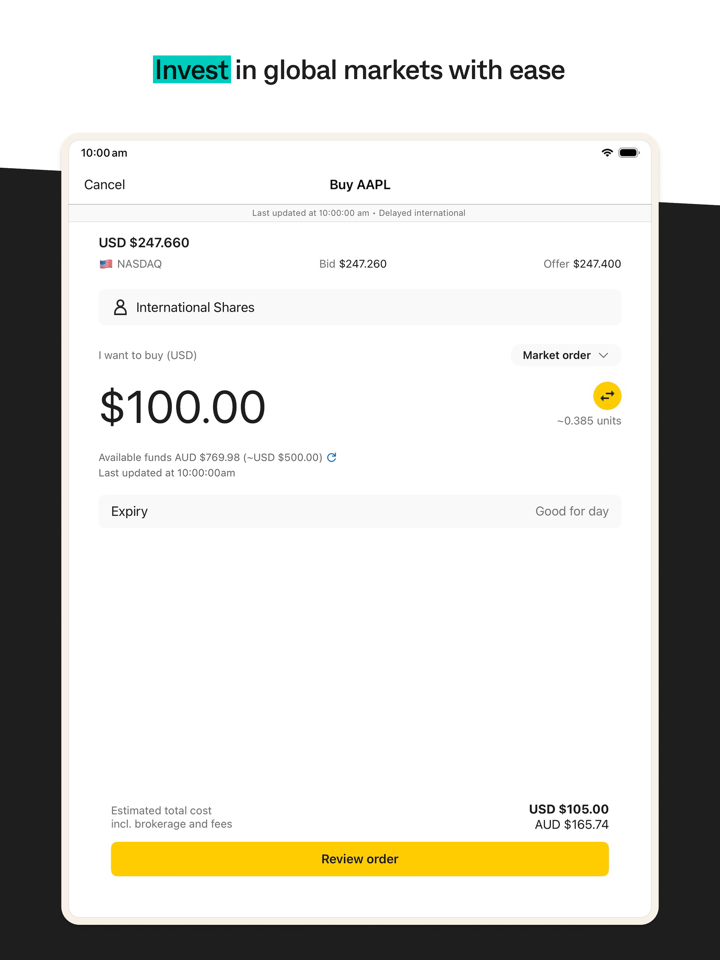

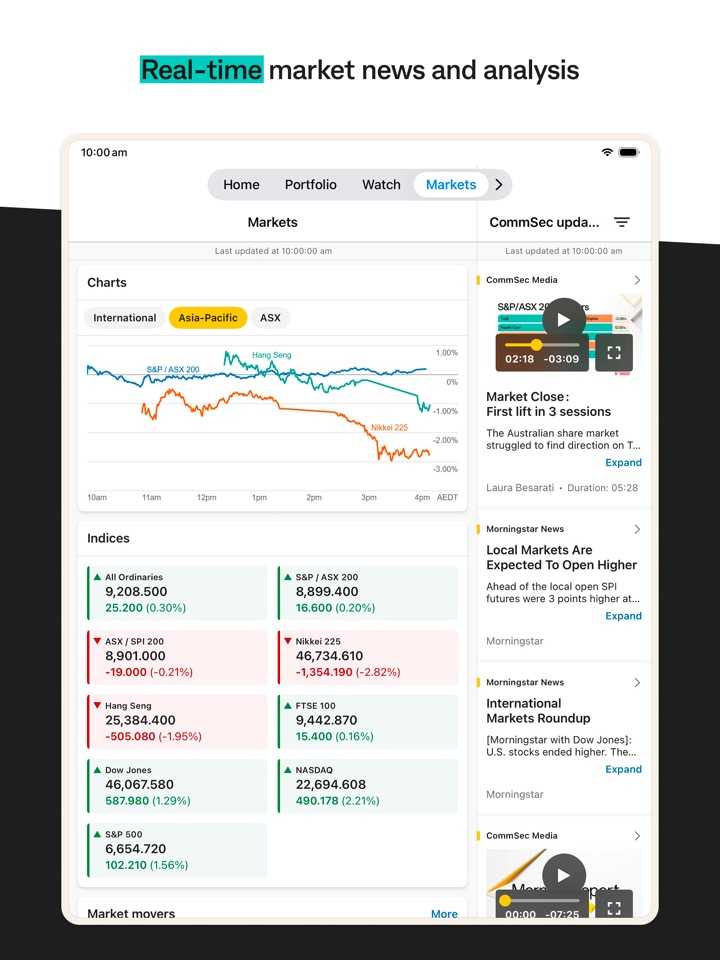

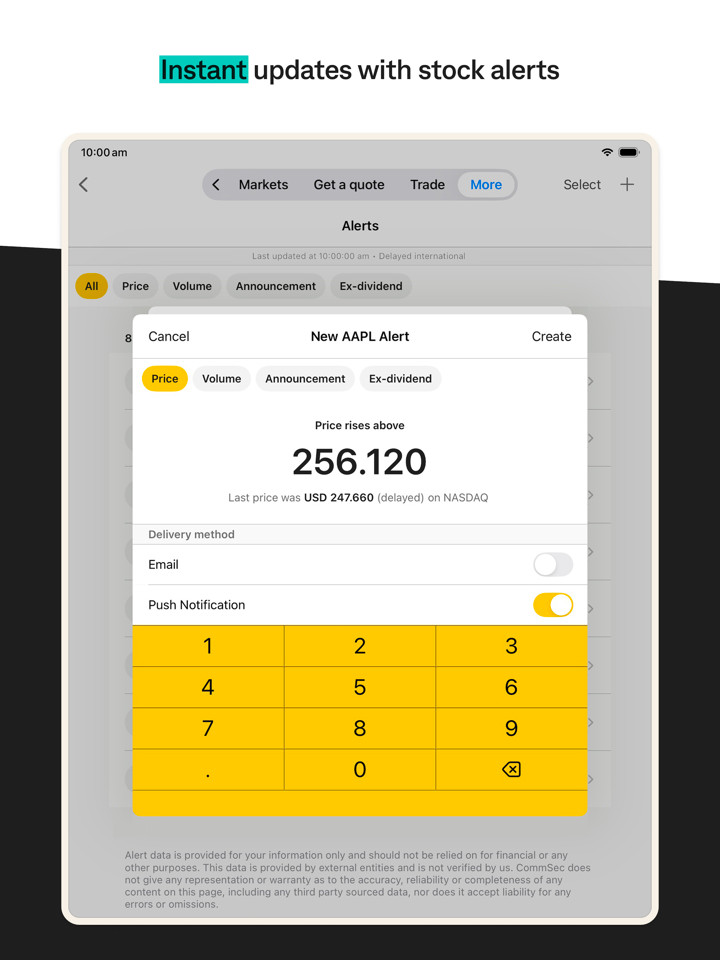

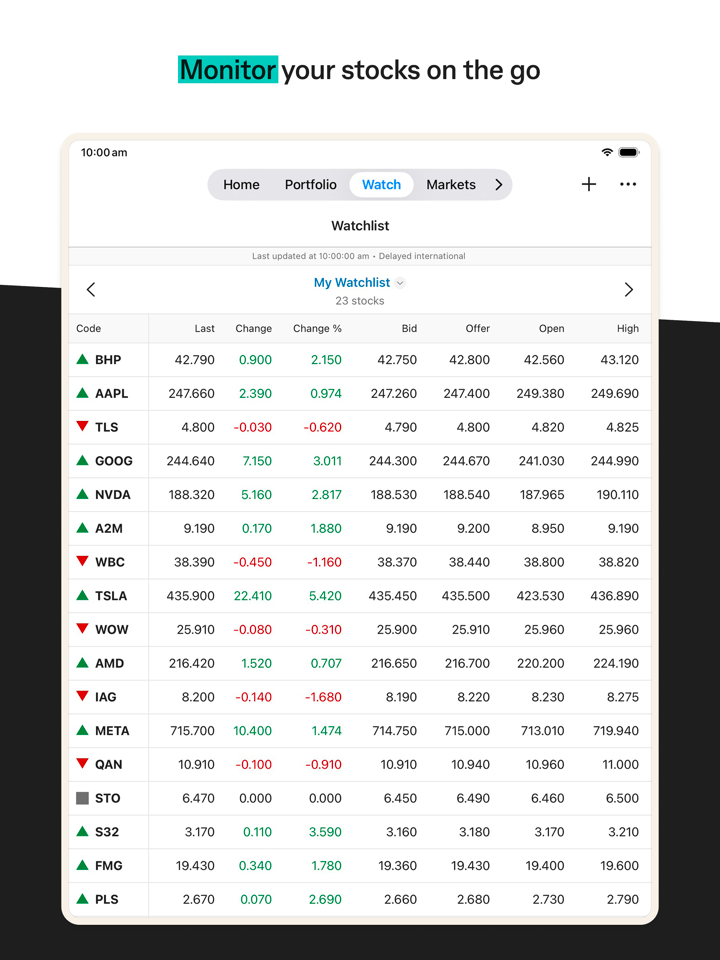

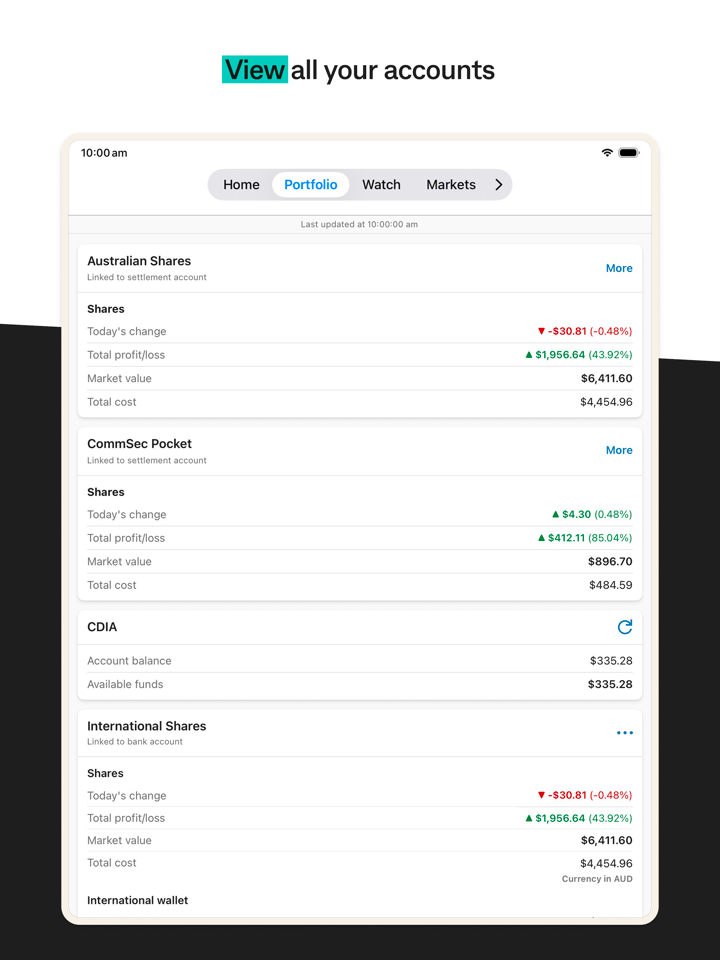

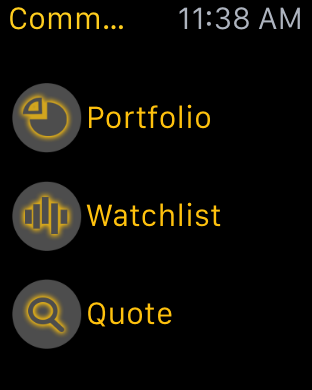

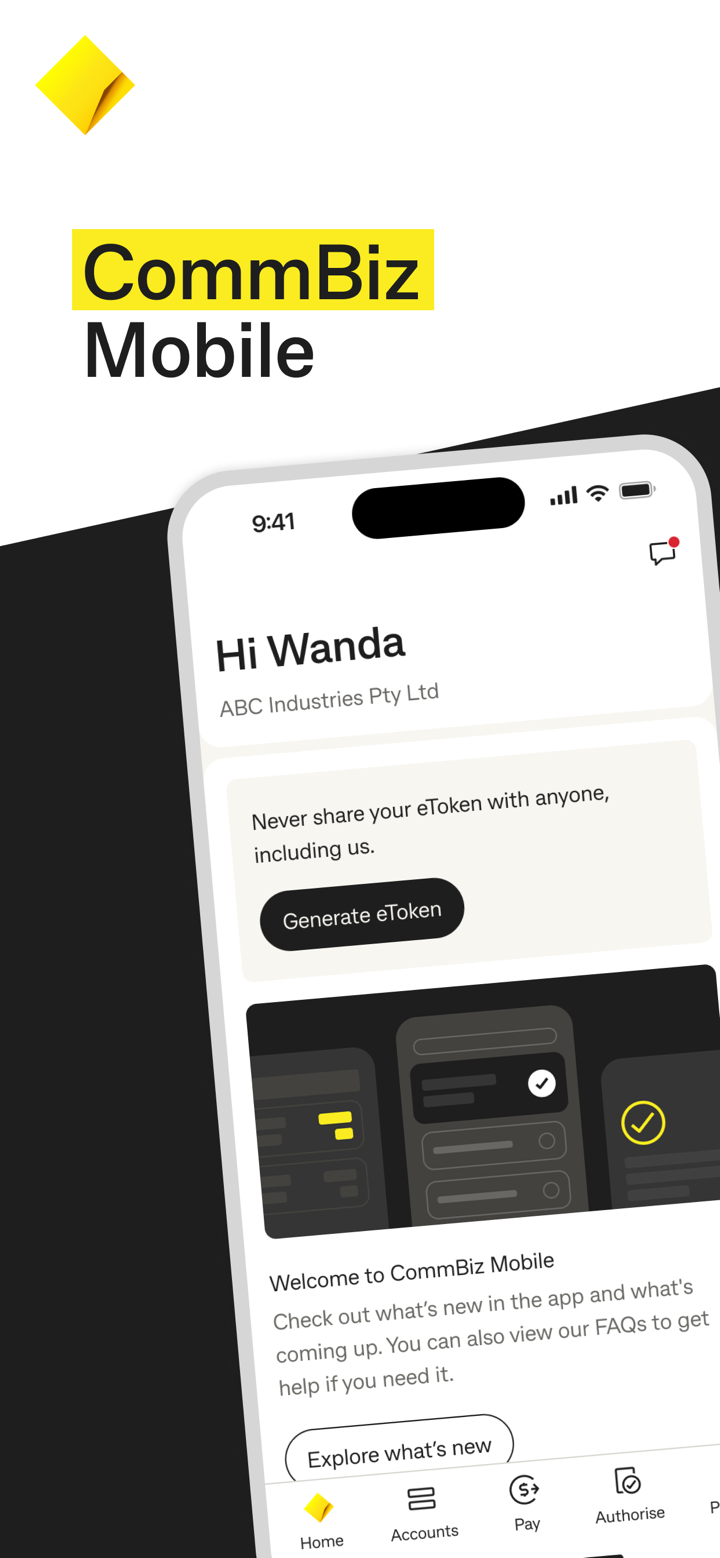

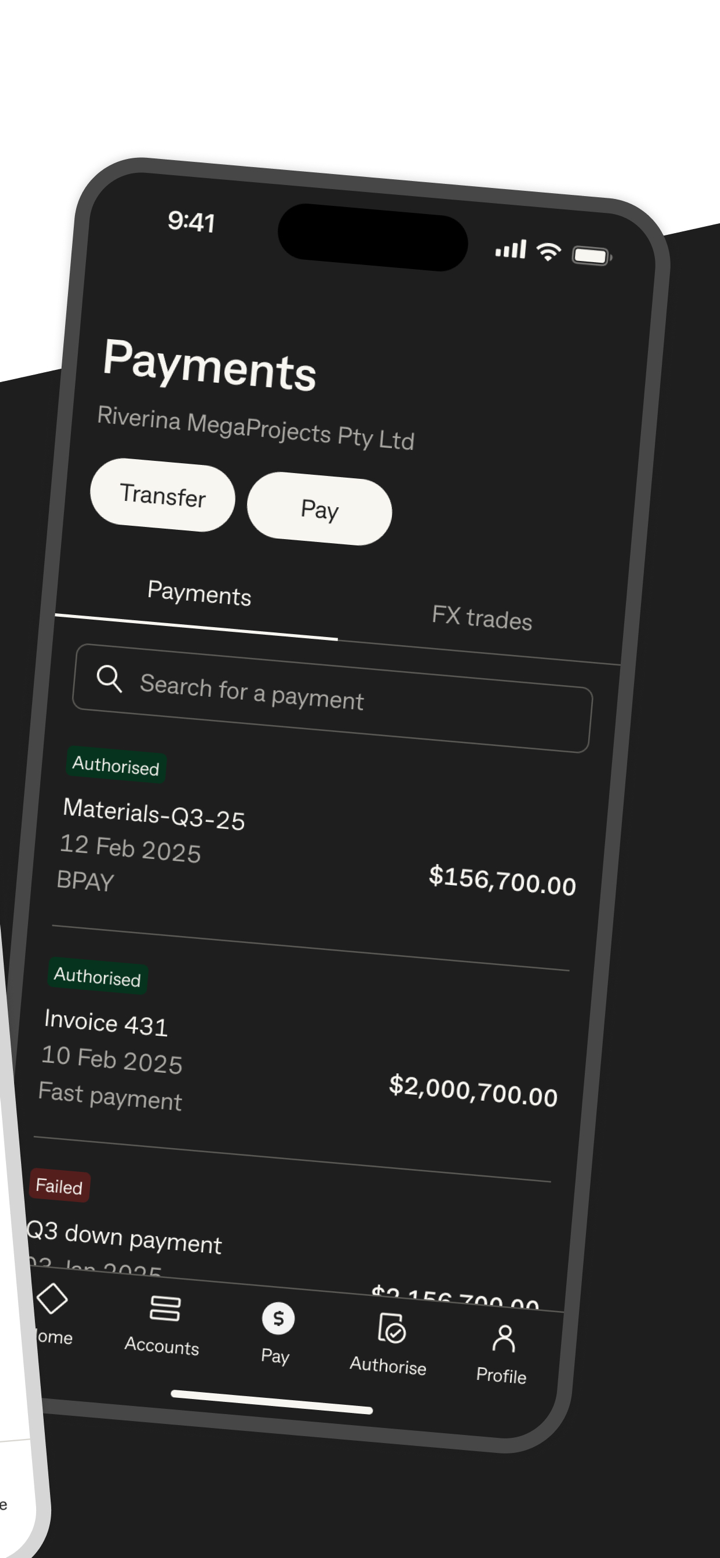

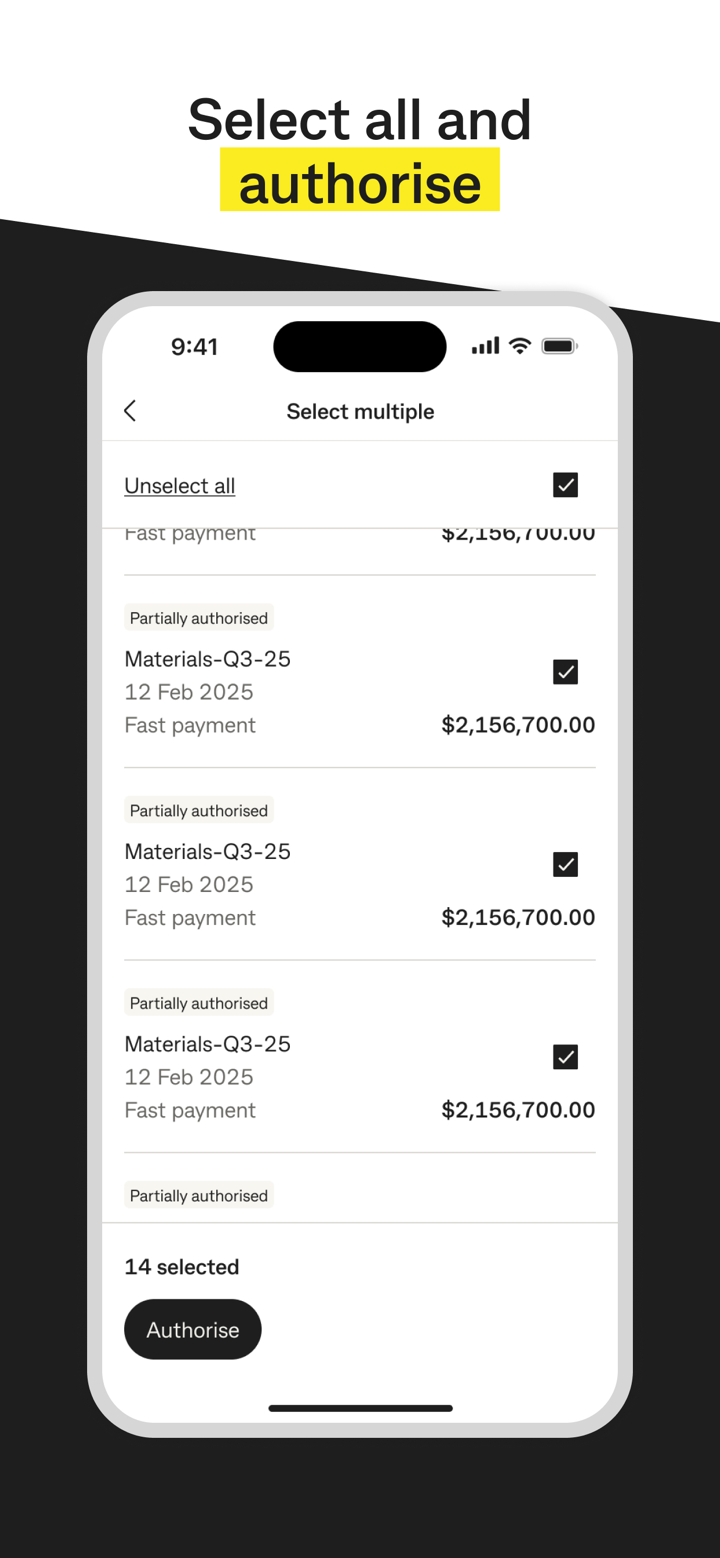

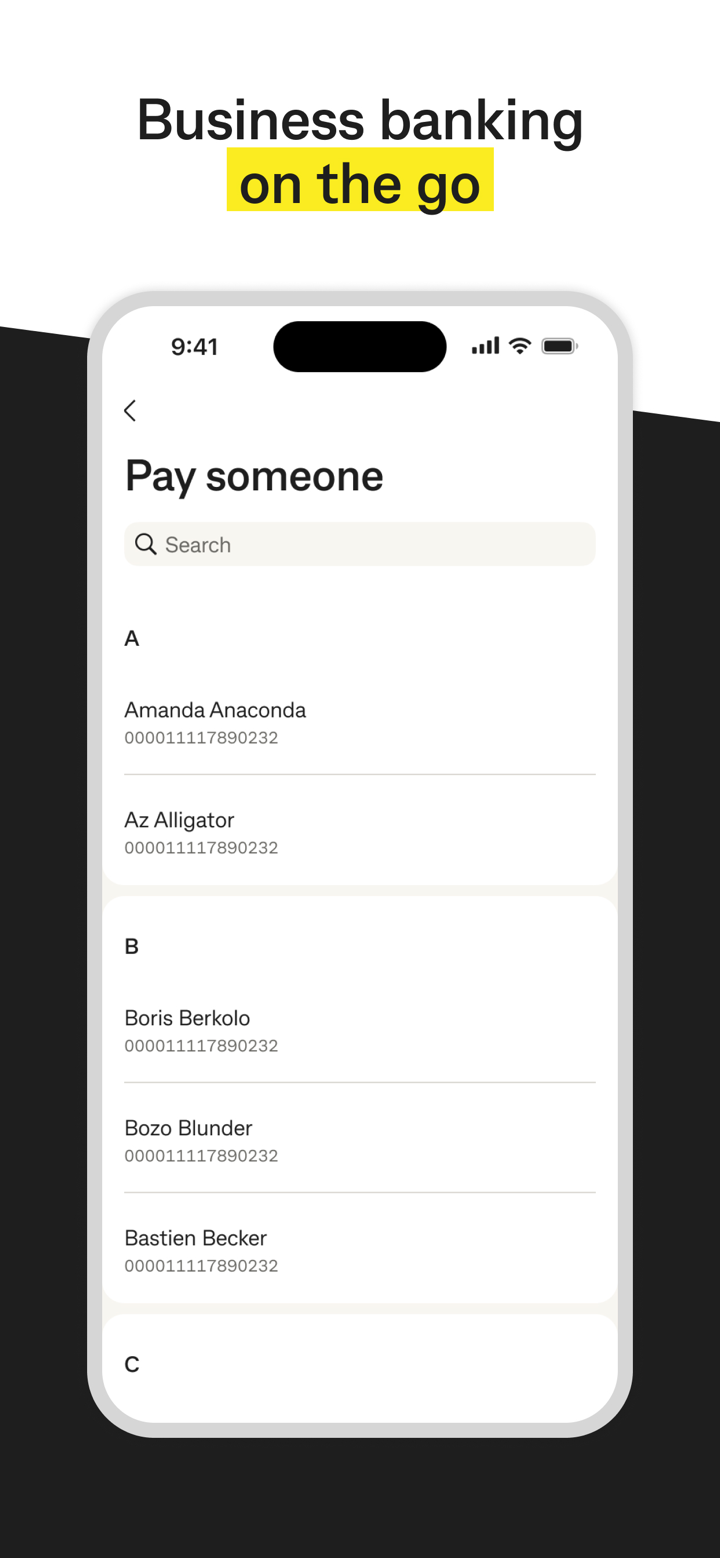

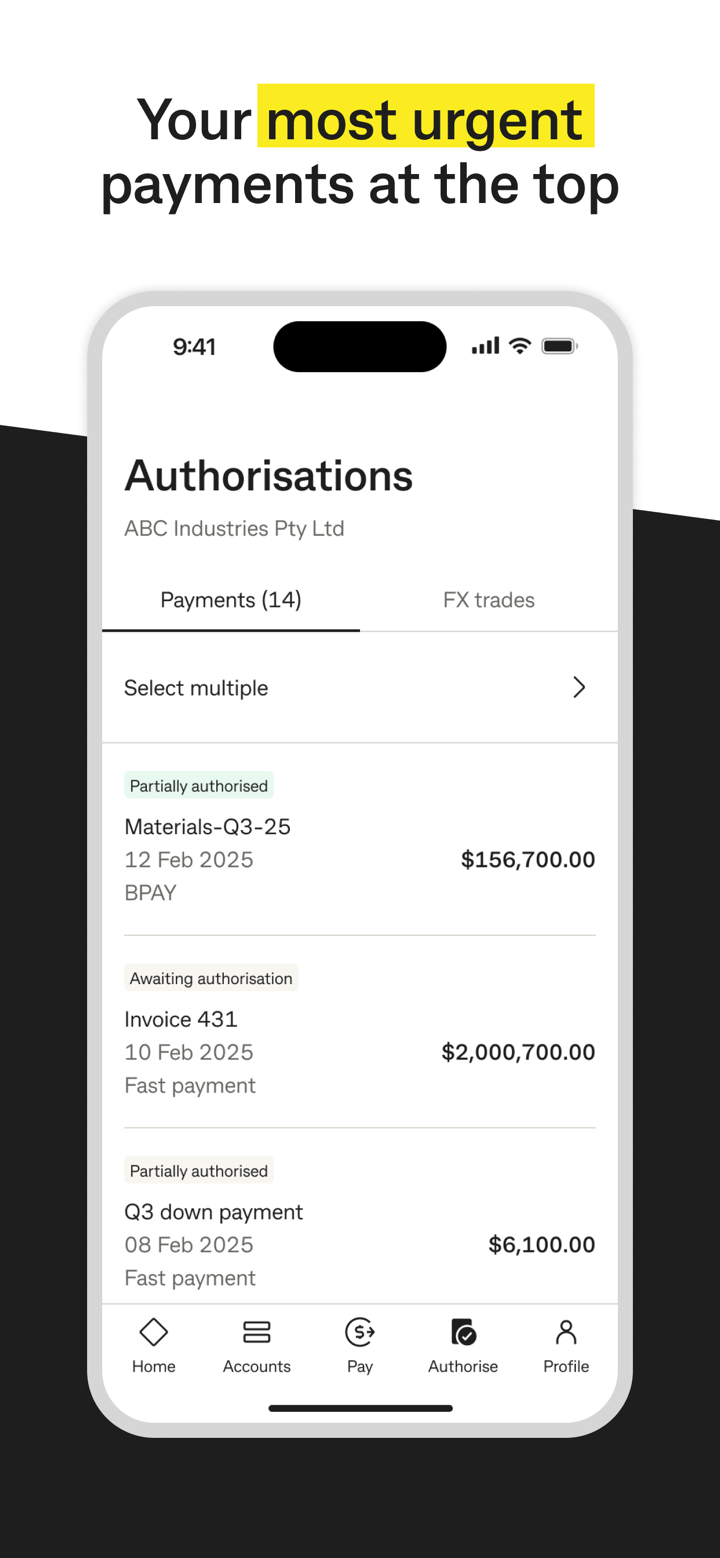

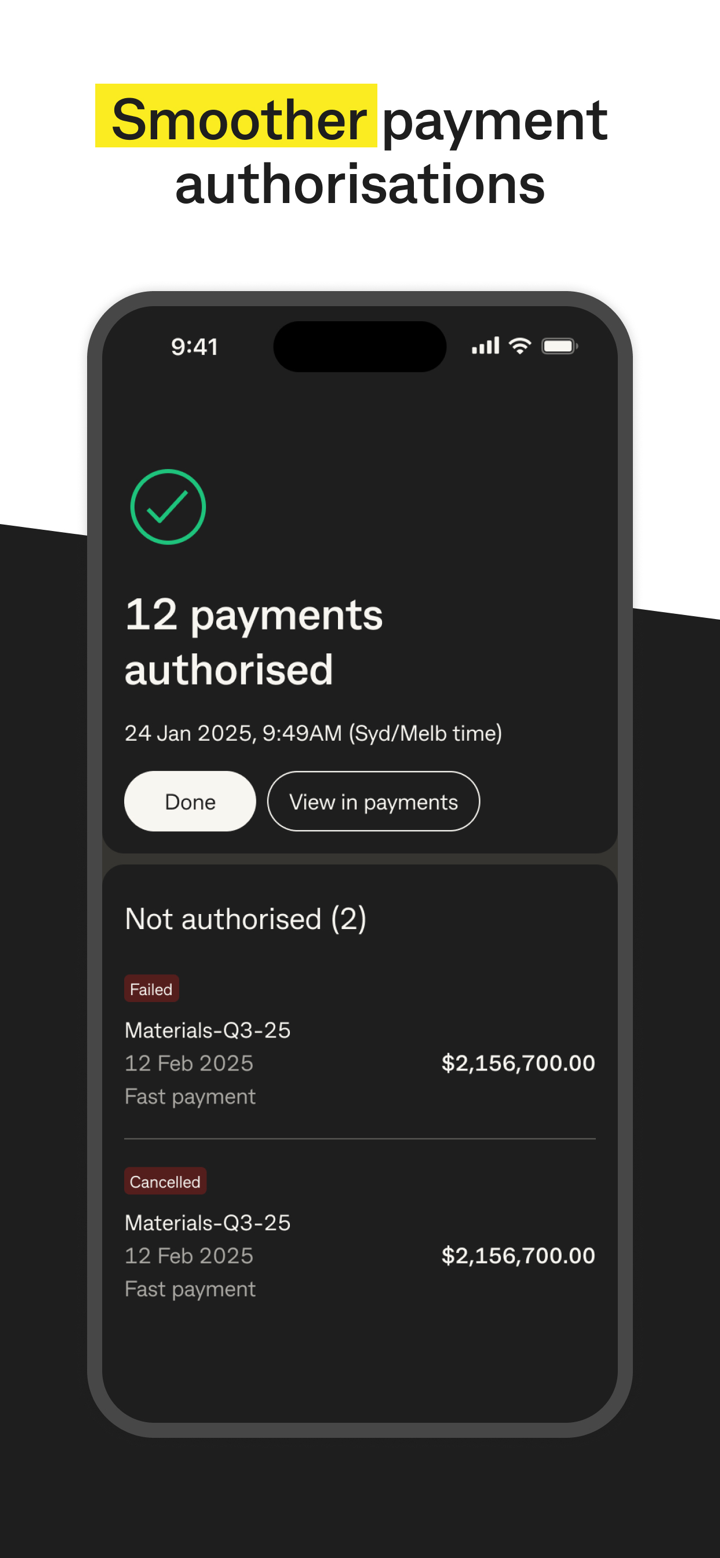

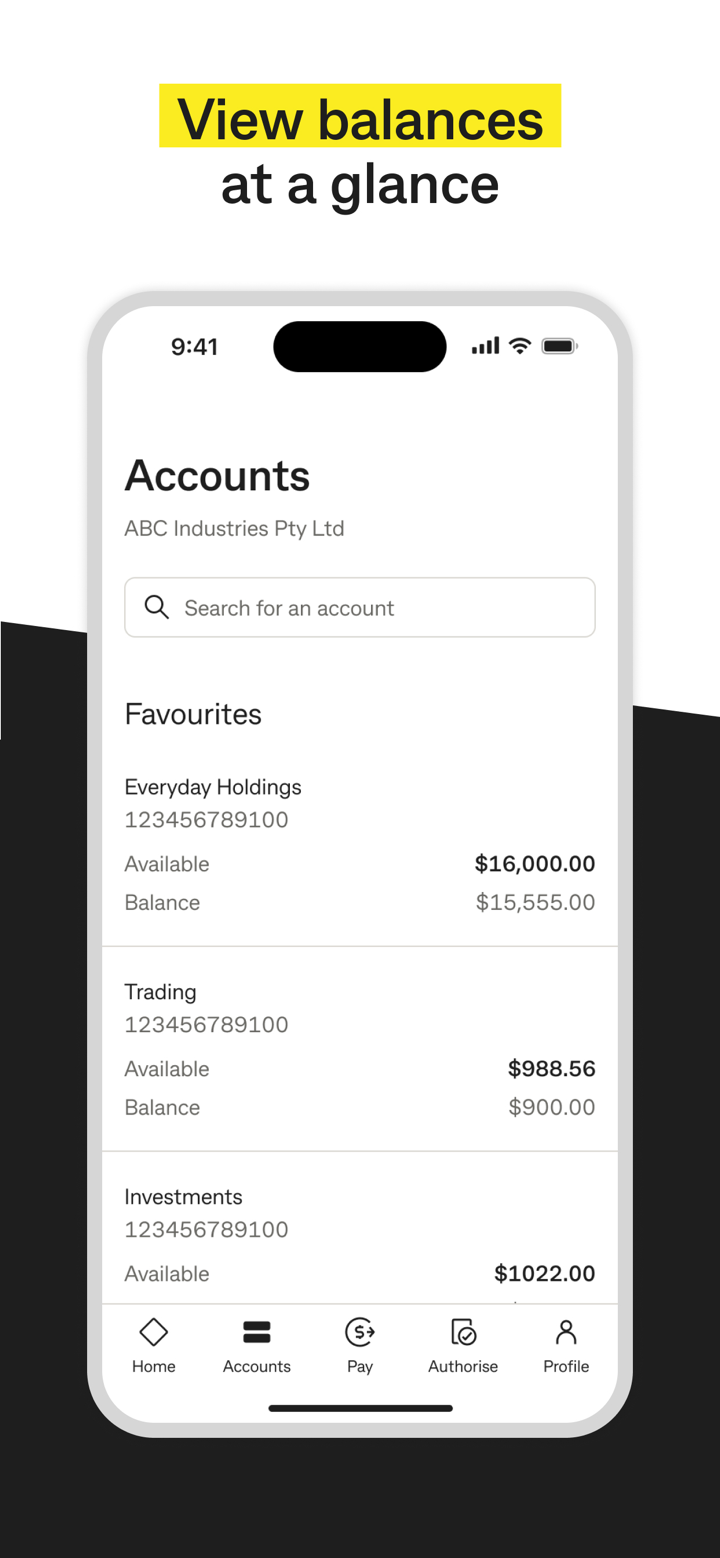

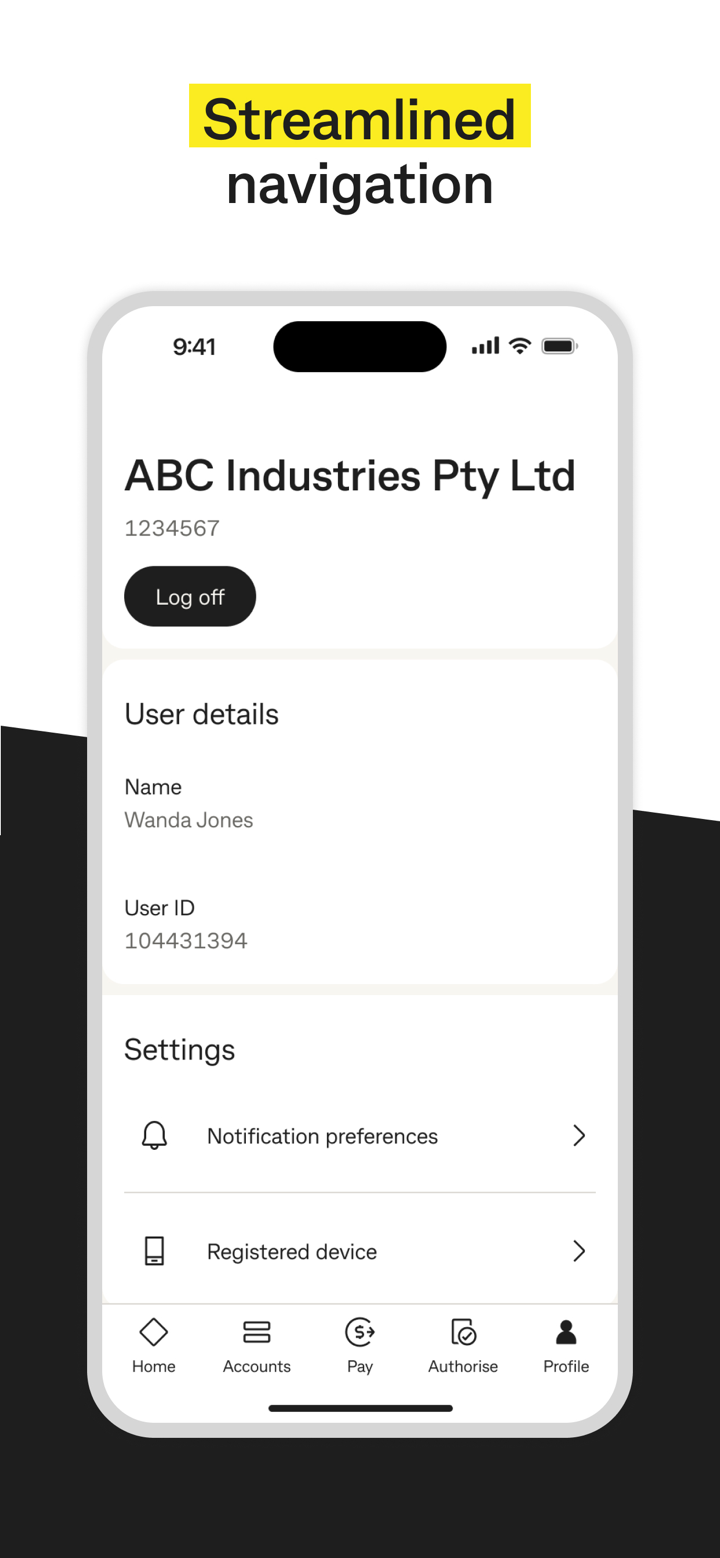

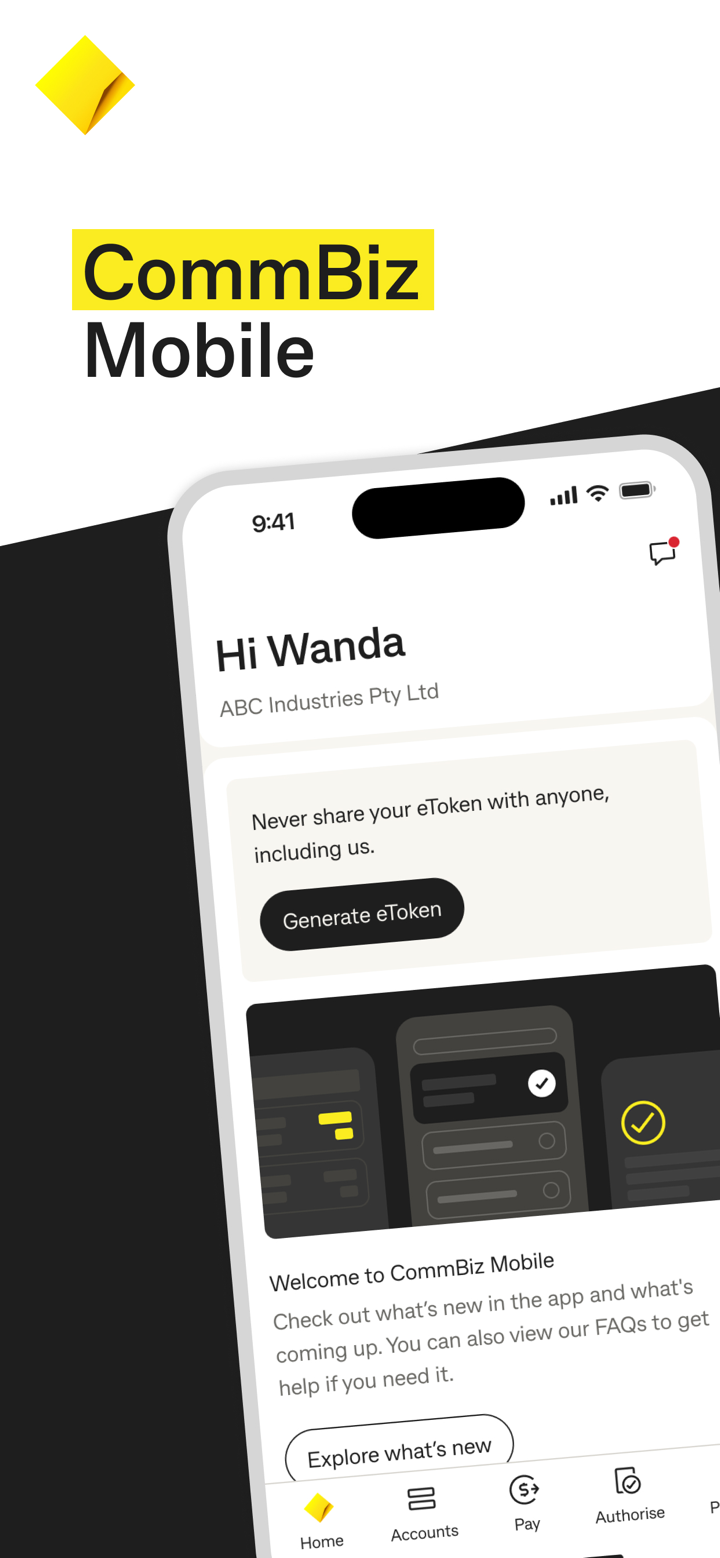

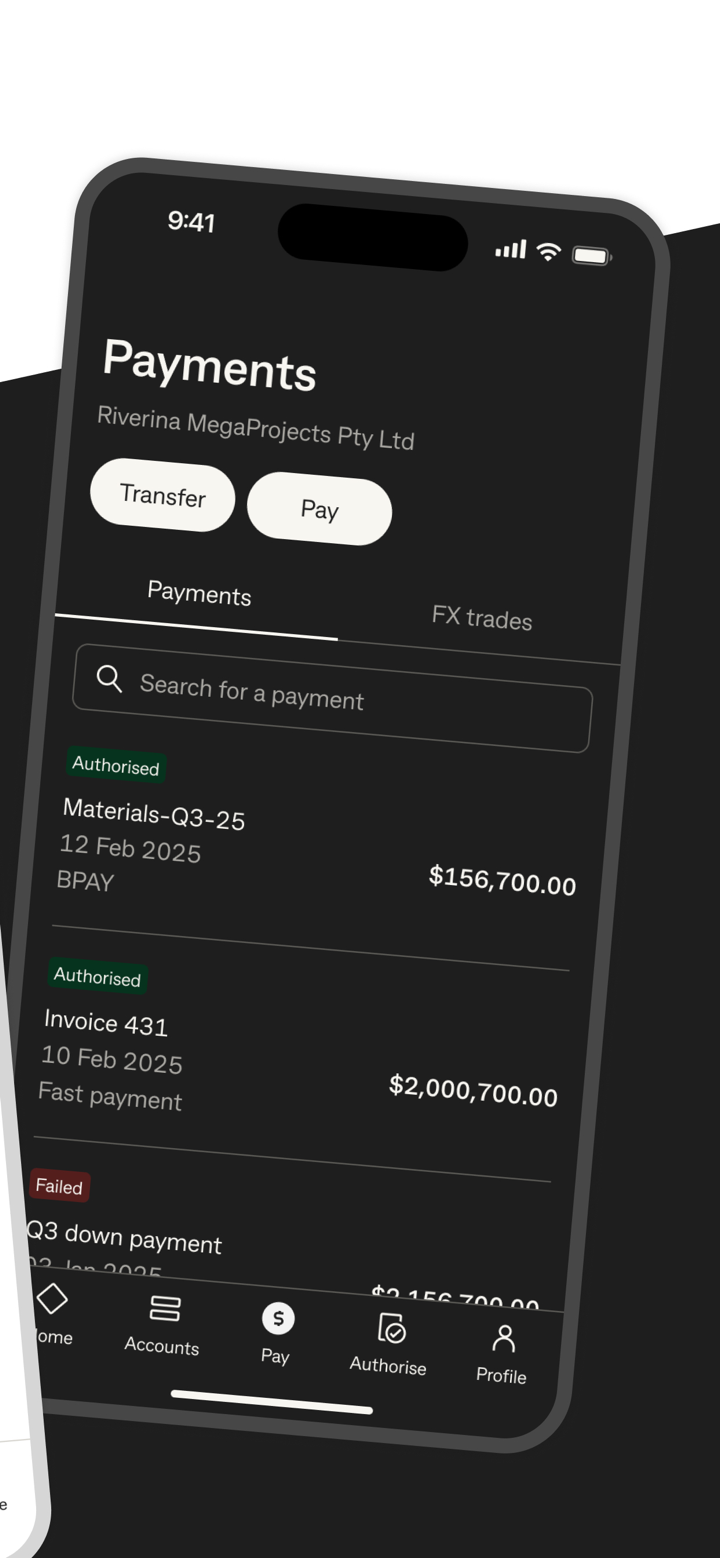

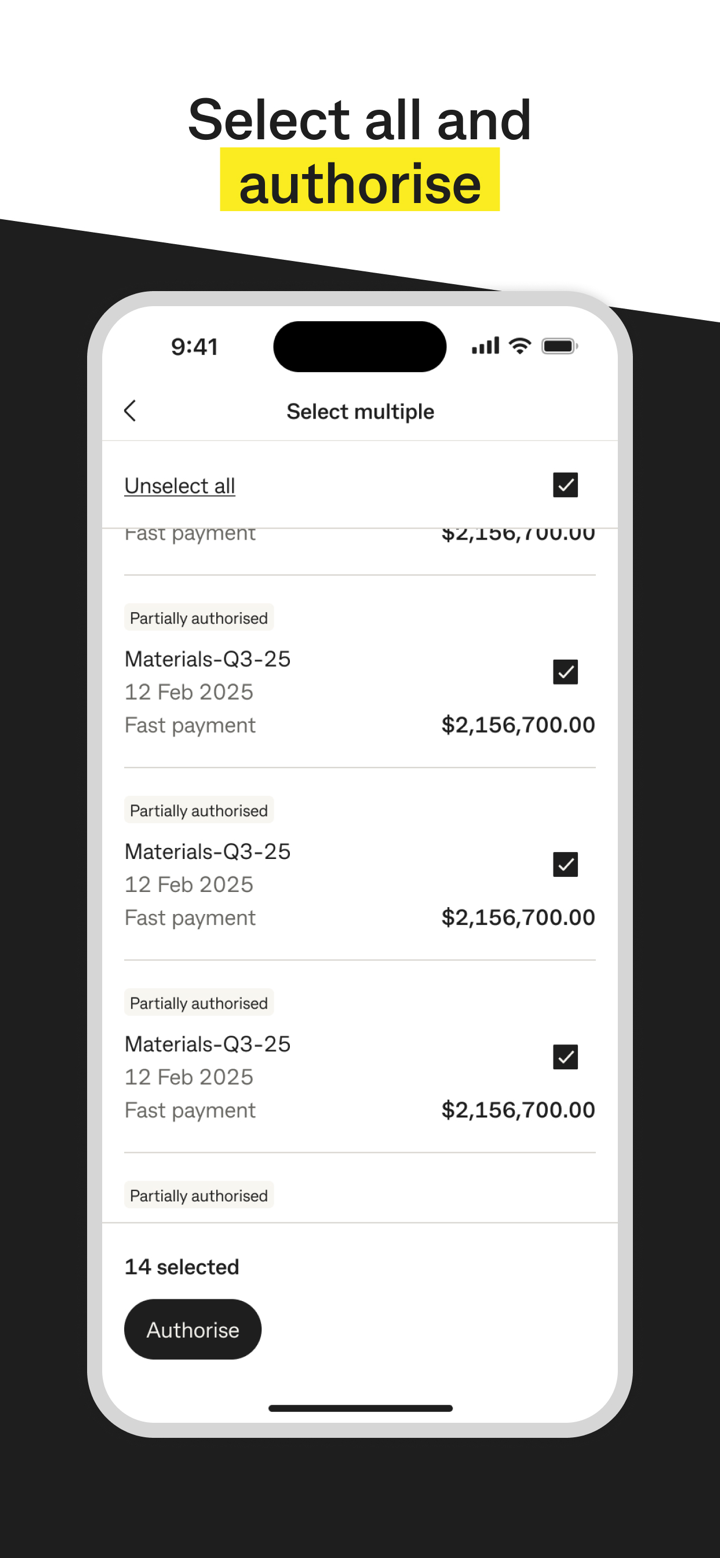

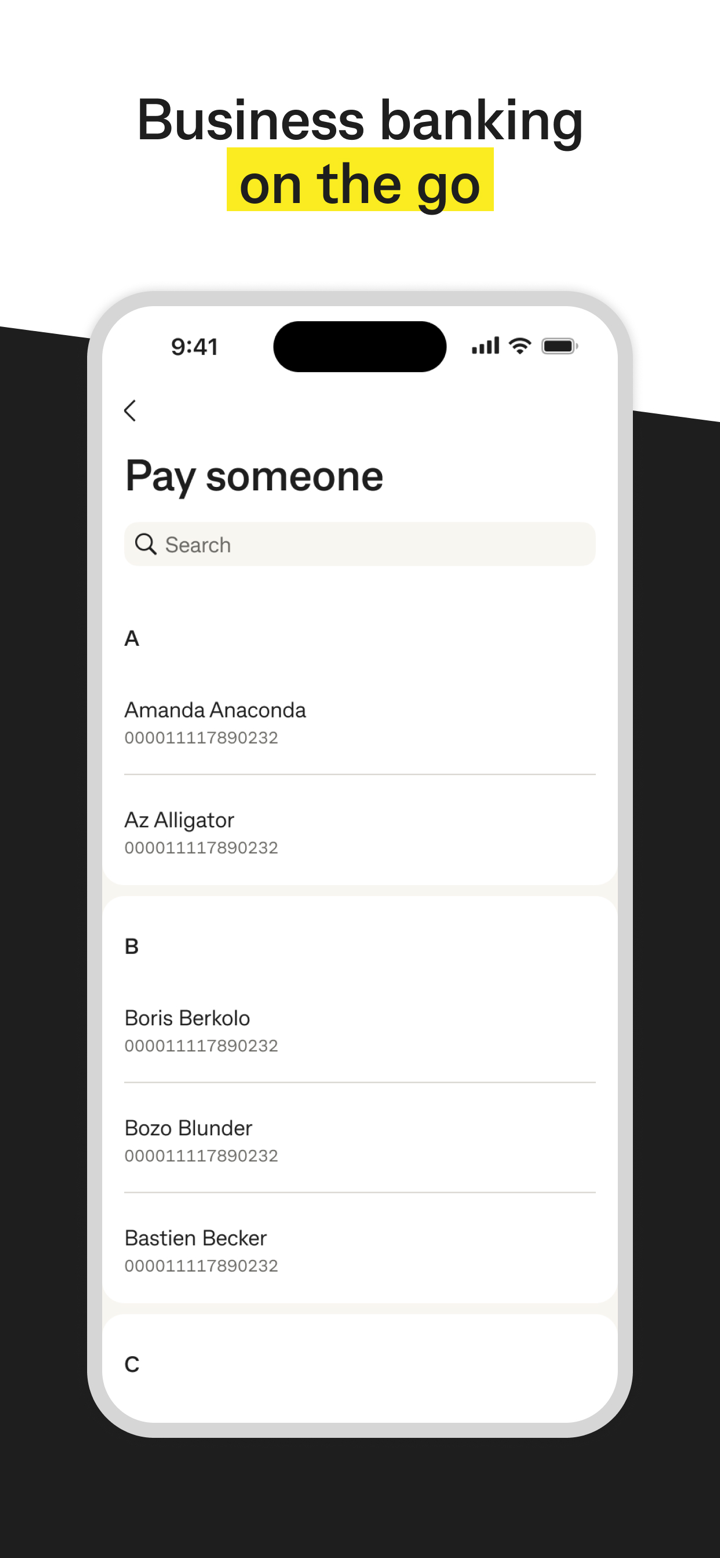

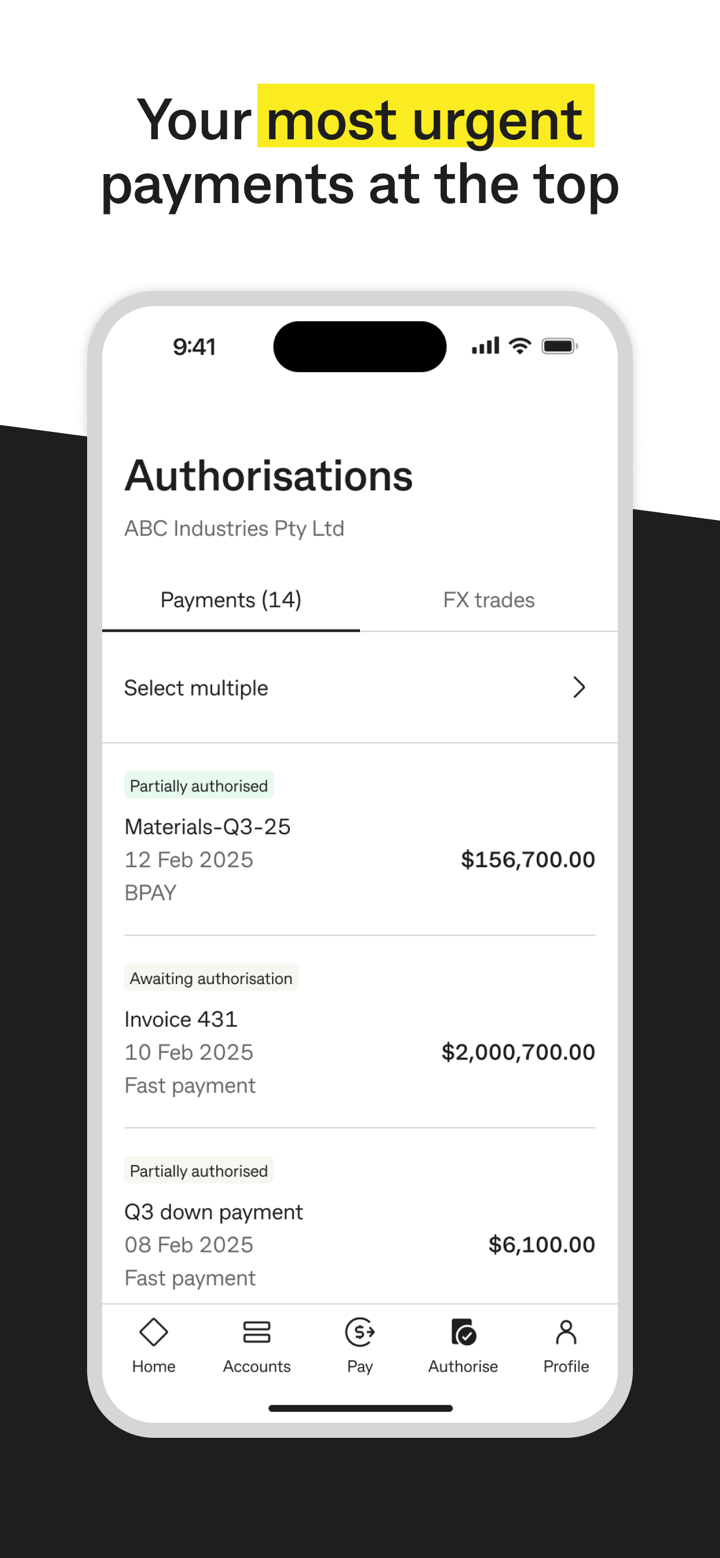

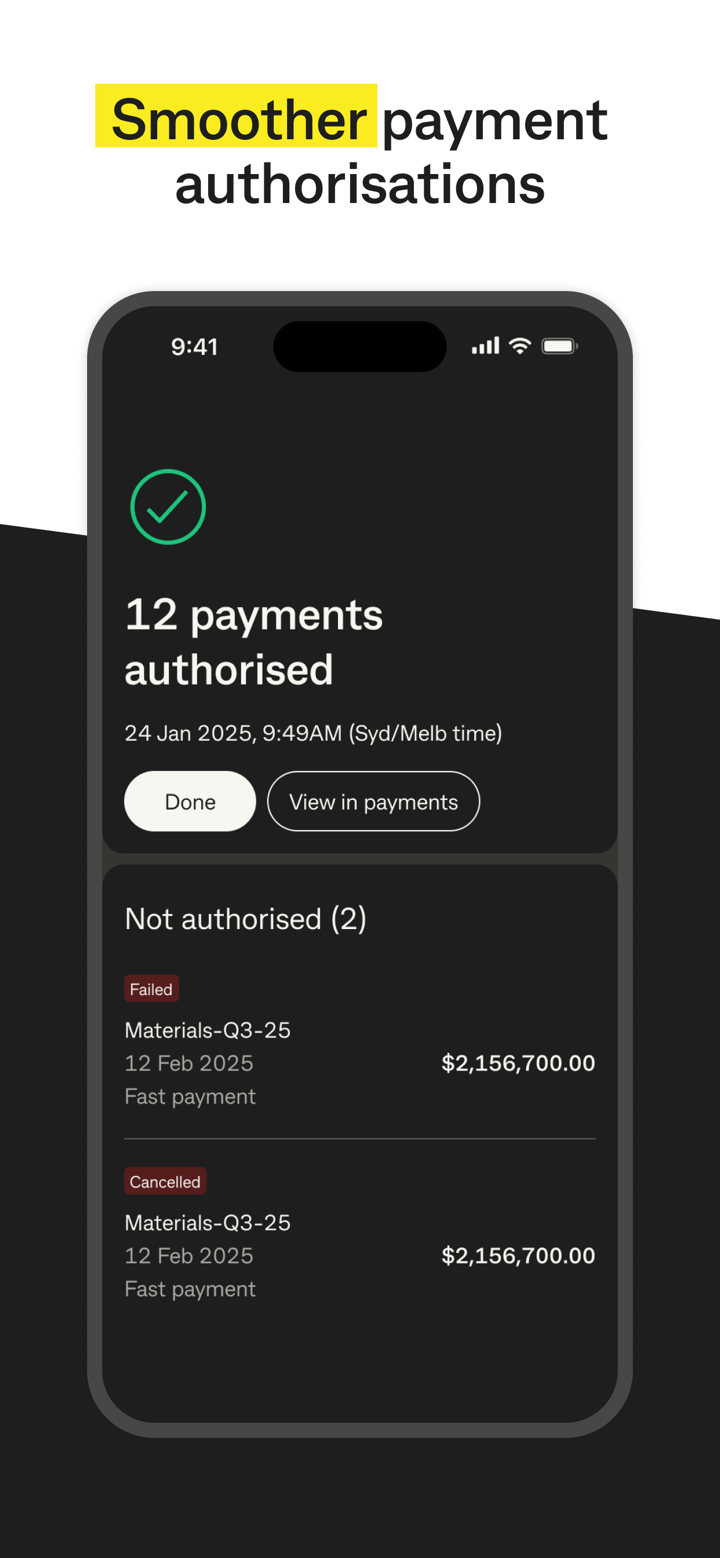

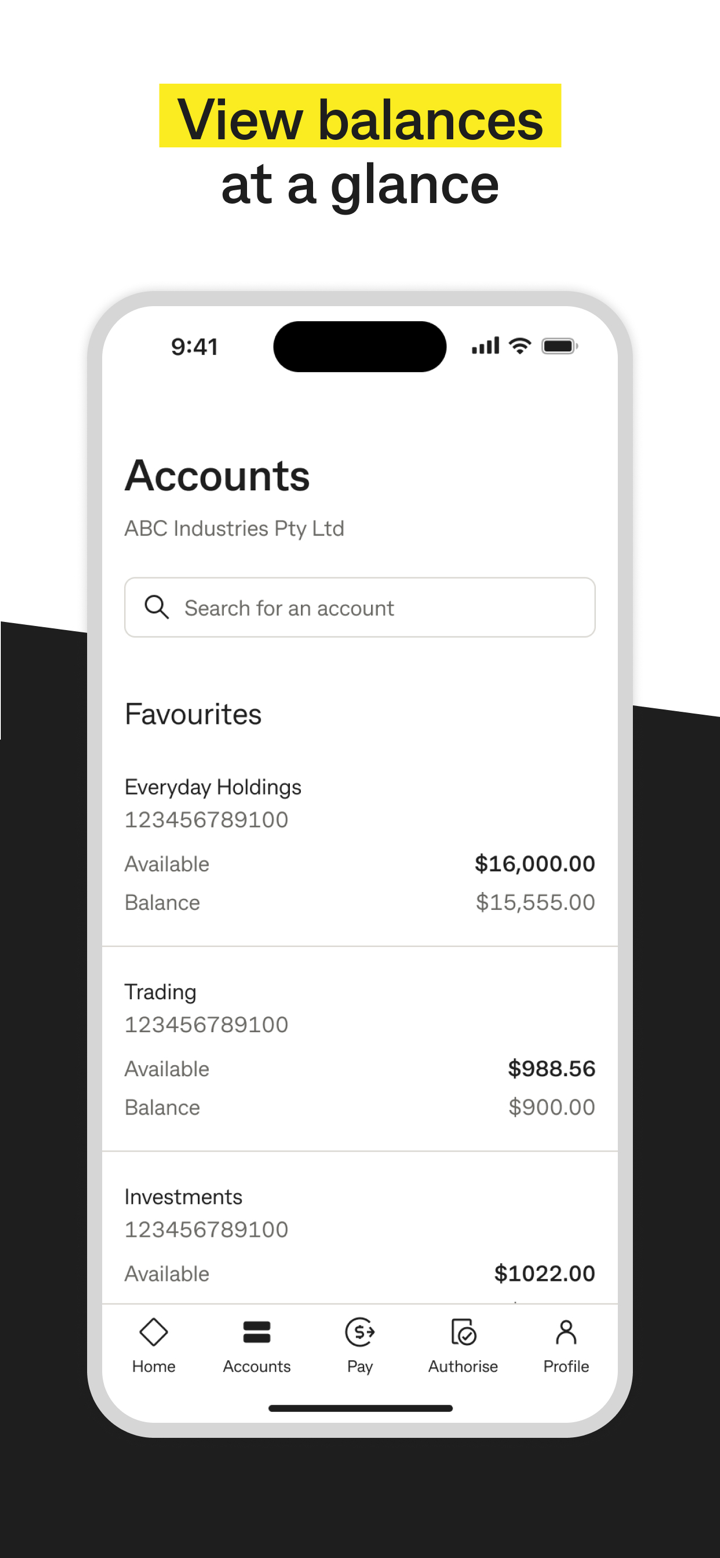

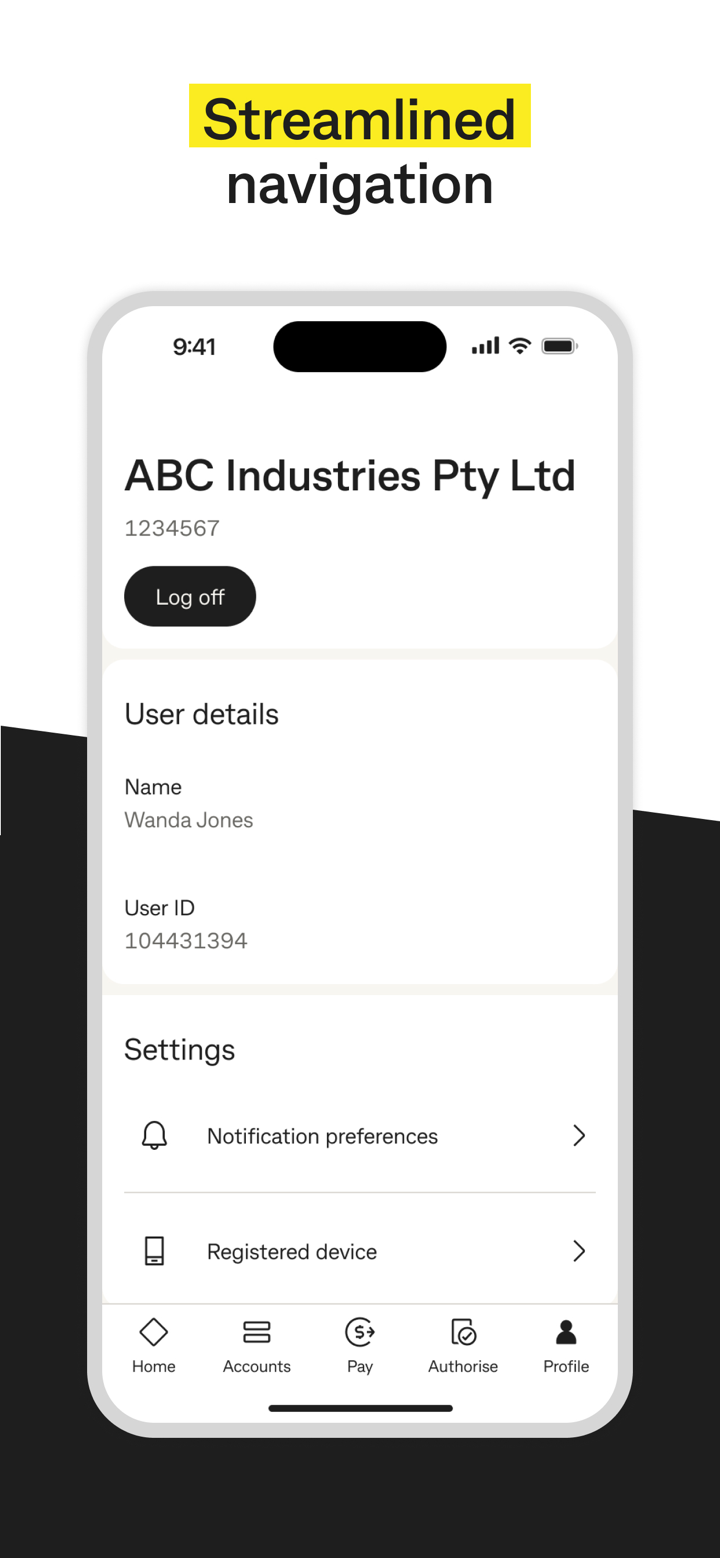

| 交易平台 | CommBank 应用、NetBank(Web)和CommSec |

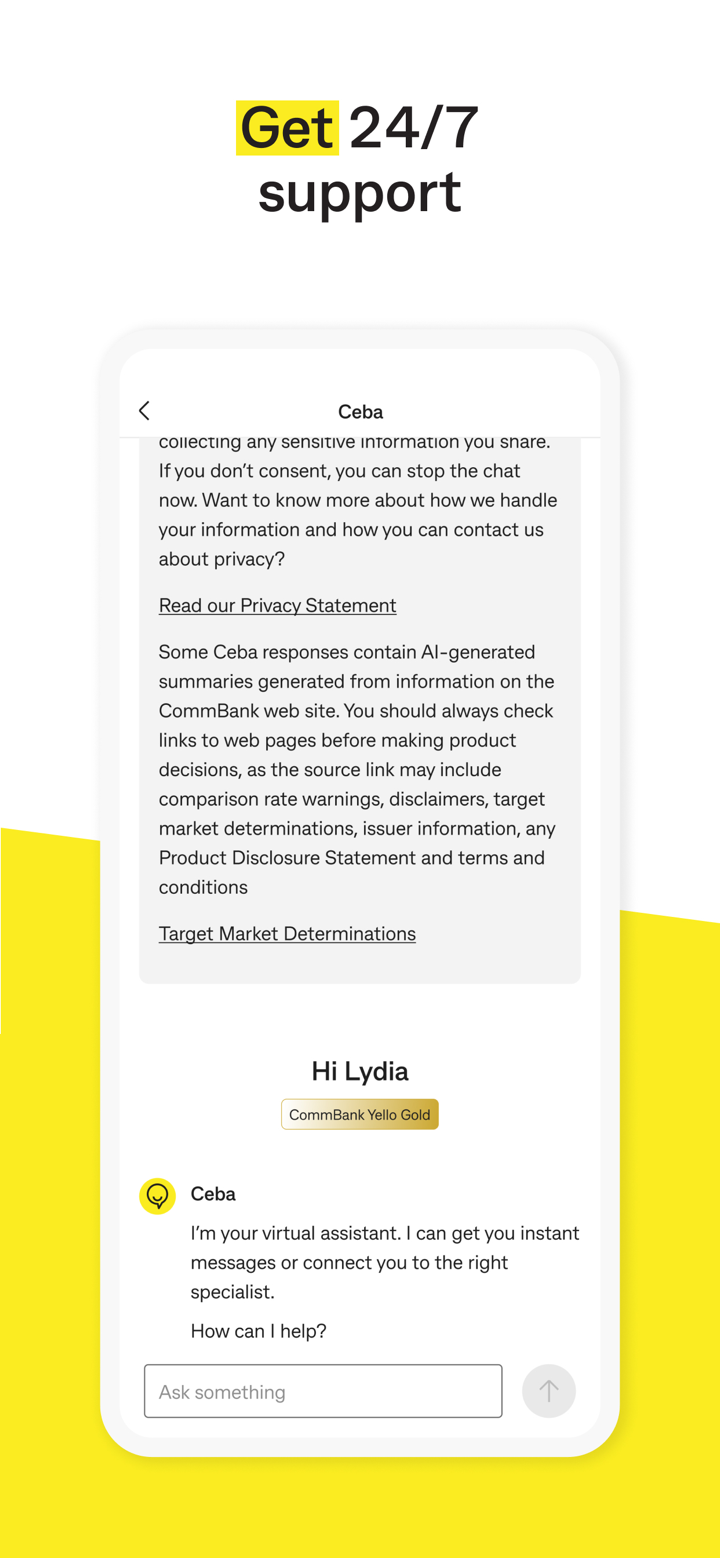

| 客户支持 | +61 2 9999 3283 |

| 13 2221 | |

CommBank 信息

CommBank 成立于1911年,总部位于澳大利亚悉尼。作为澳大利亚“四大银行”之一,其业务范围涵盖零售银行业务、商业银行业务、投资、保险、养老金等。适合重视本地服务、追求稳定性的个人和企业客户,特别是在房屋贷款、养老金和日常财务管理方面。

优缺点

| 优点 | 缺点 |

| 受监管 | 国际投资产品有限(澳大利亚市场) |

| 多样化的金融服务 | 复杂的费用结构 |

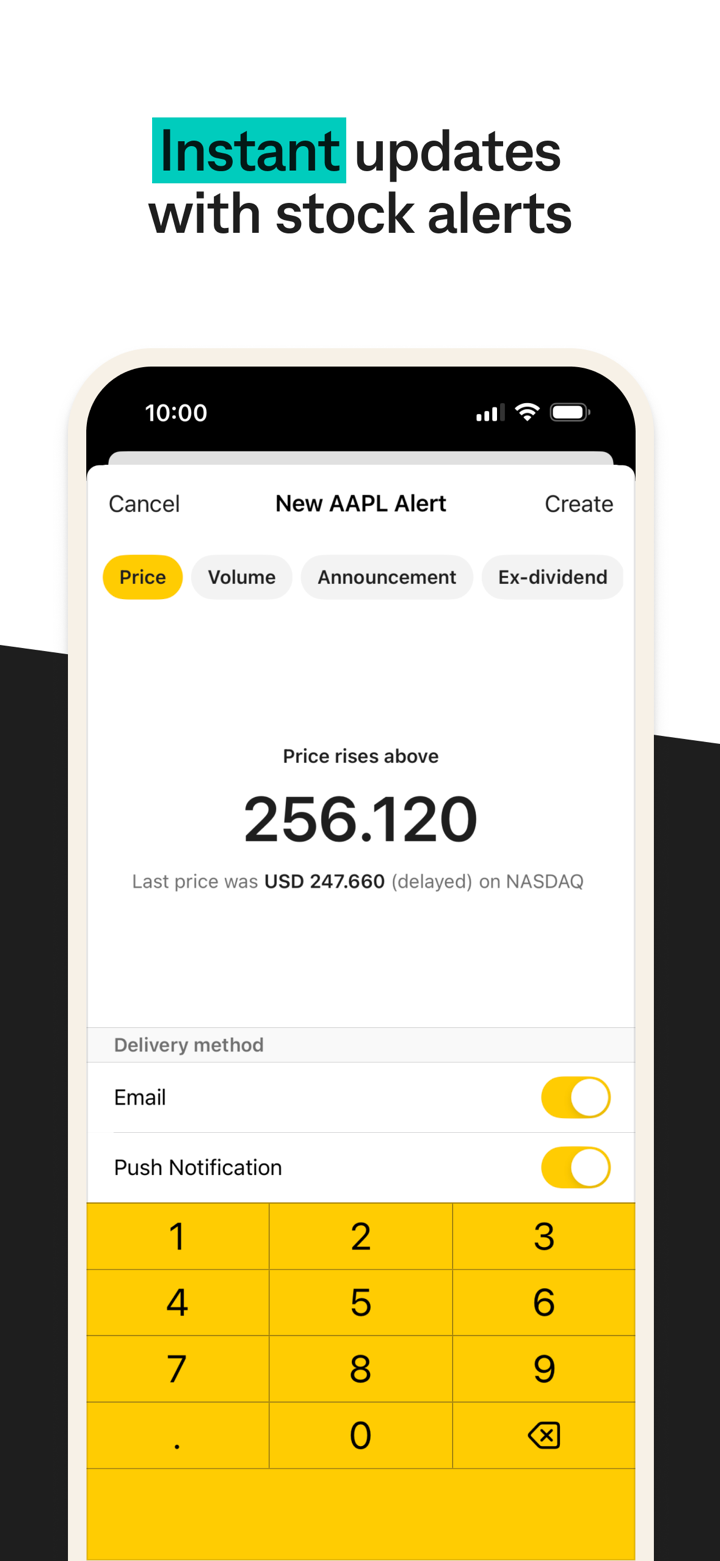

| 先进的数字工具(例如,CommBank 应用) | 对海外服务的限制 |

| 客户忠诚度奖励计划 |

CommBank 是否合法?

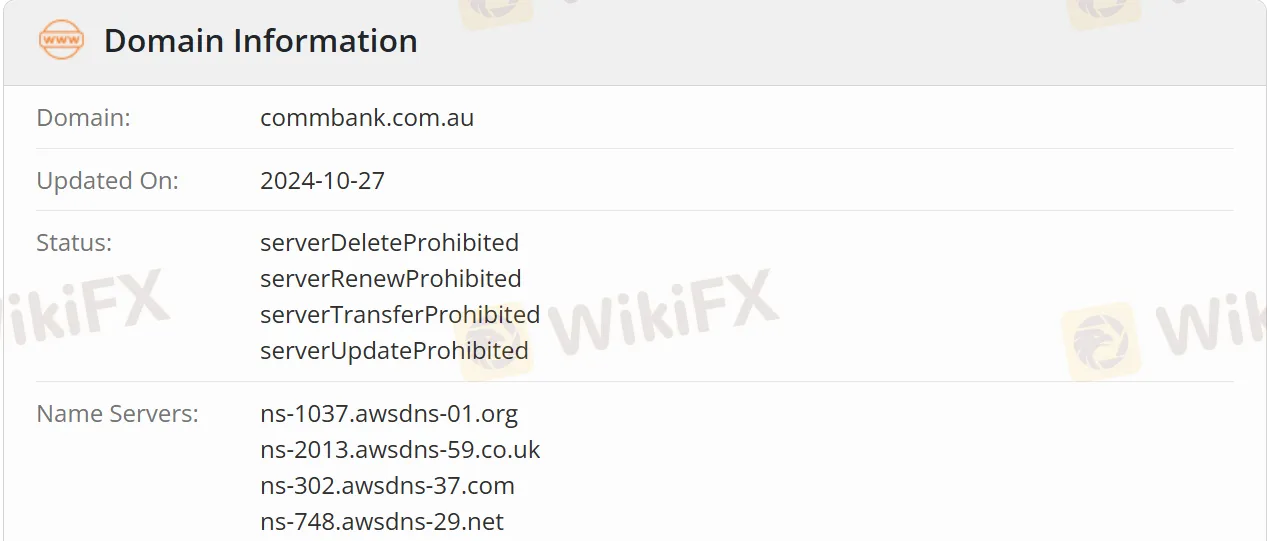

CommBank 是一家在澳大利亚历史悠久的银行。它受澳大利亚金融监管局(APRA)严格监管,并是澳大利亚金融索赔计划的成员。澳大利亚证券投资委员会(ASIC)监管该银行,其许可证号为000234945。因此,存款保障。

CommBank 提供哪些服务?

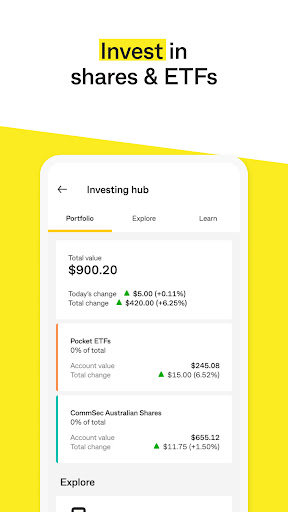

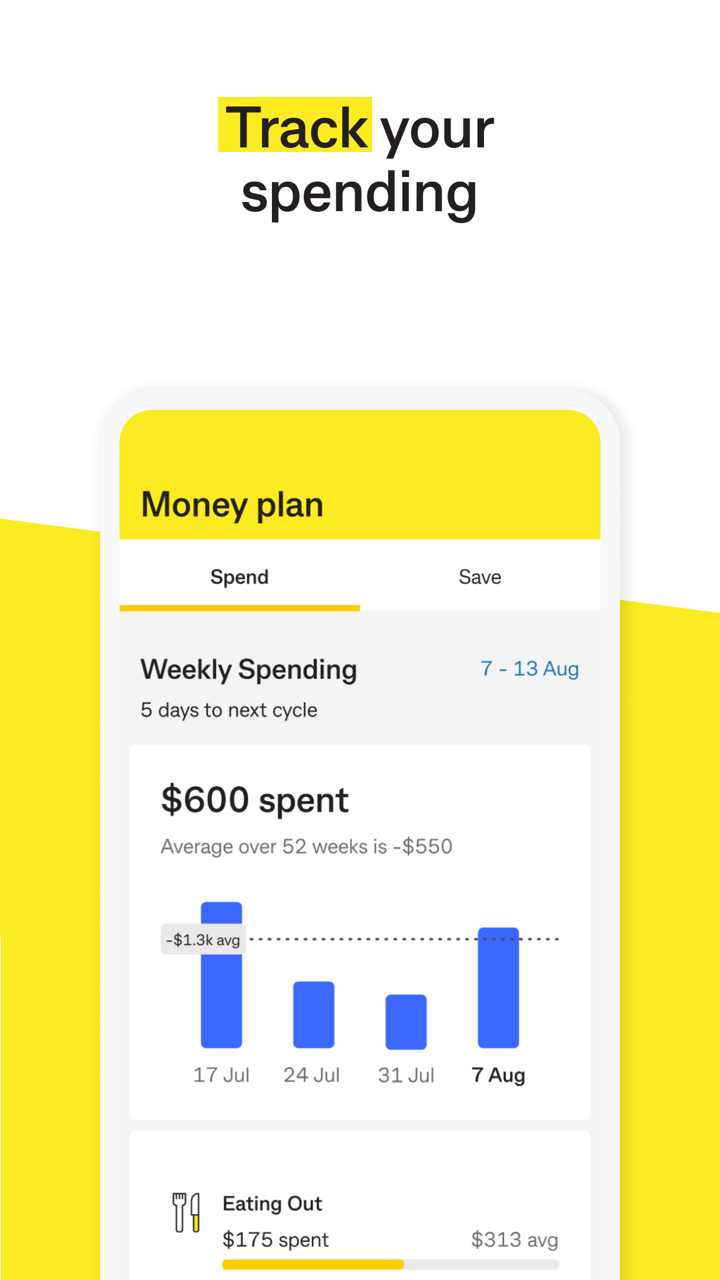

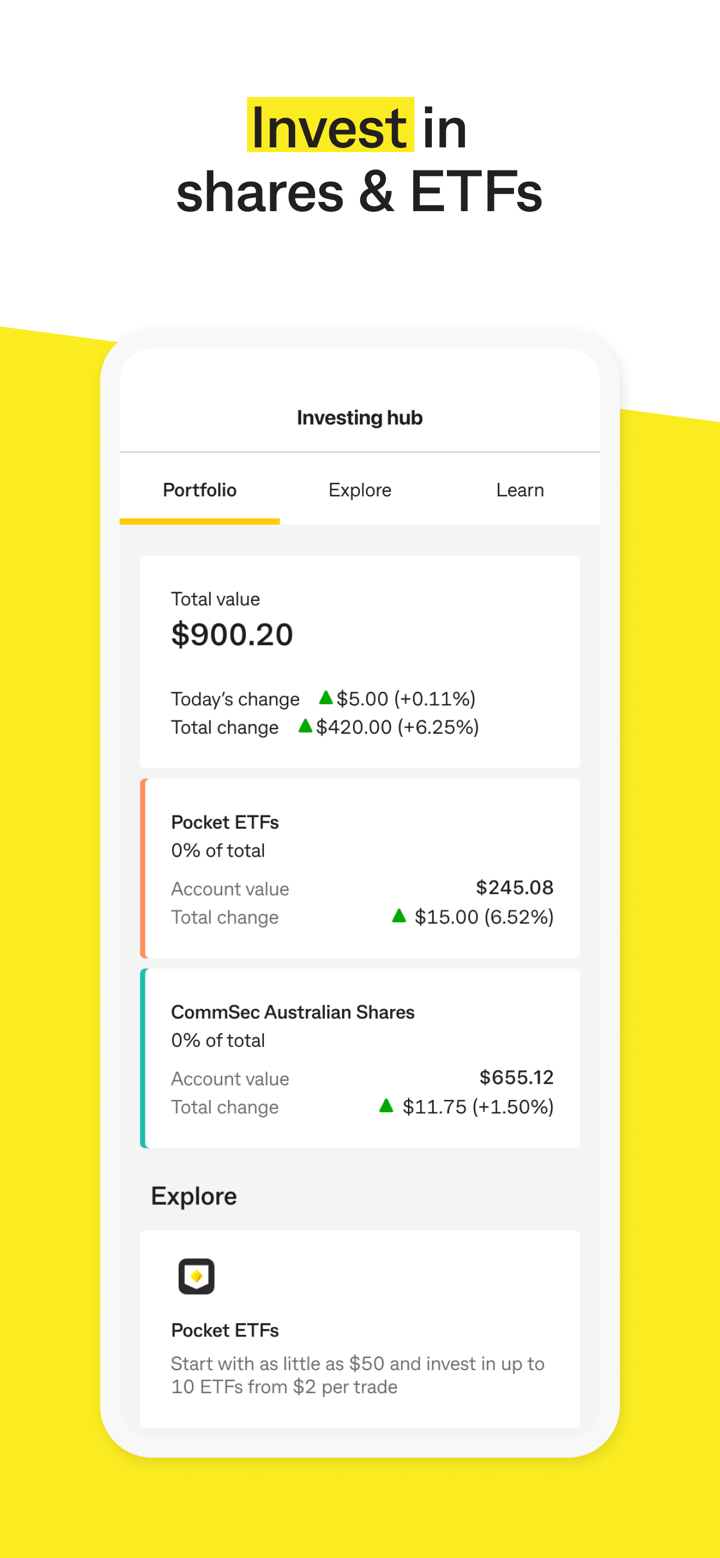

投资交易类型包括以下四类:

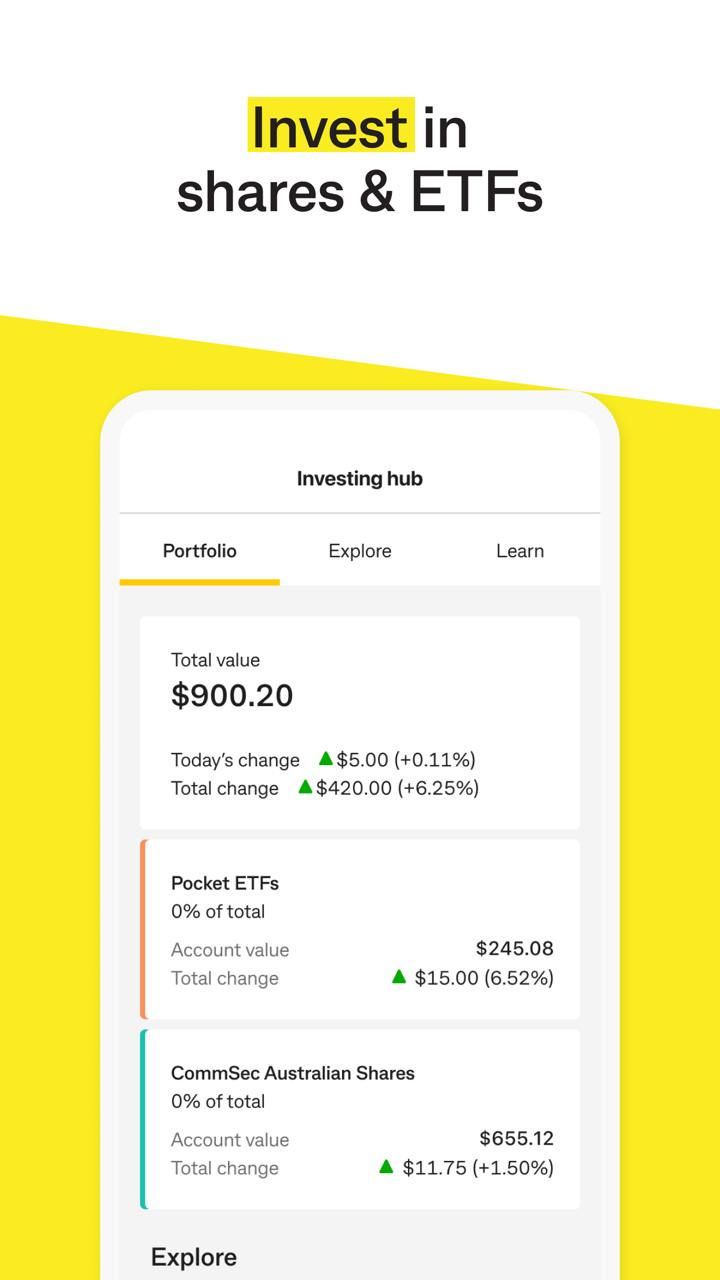

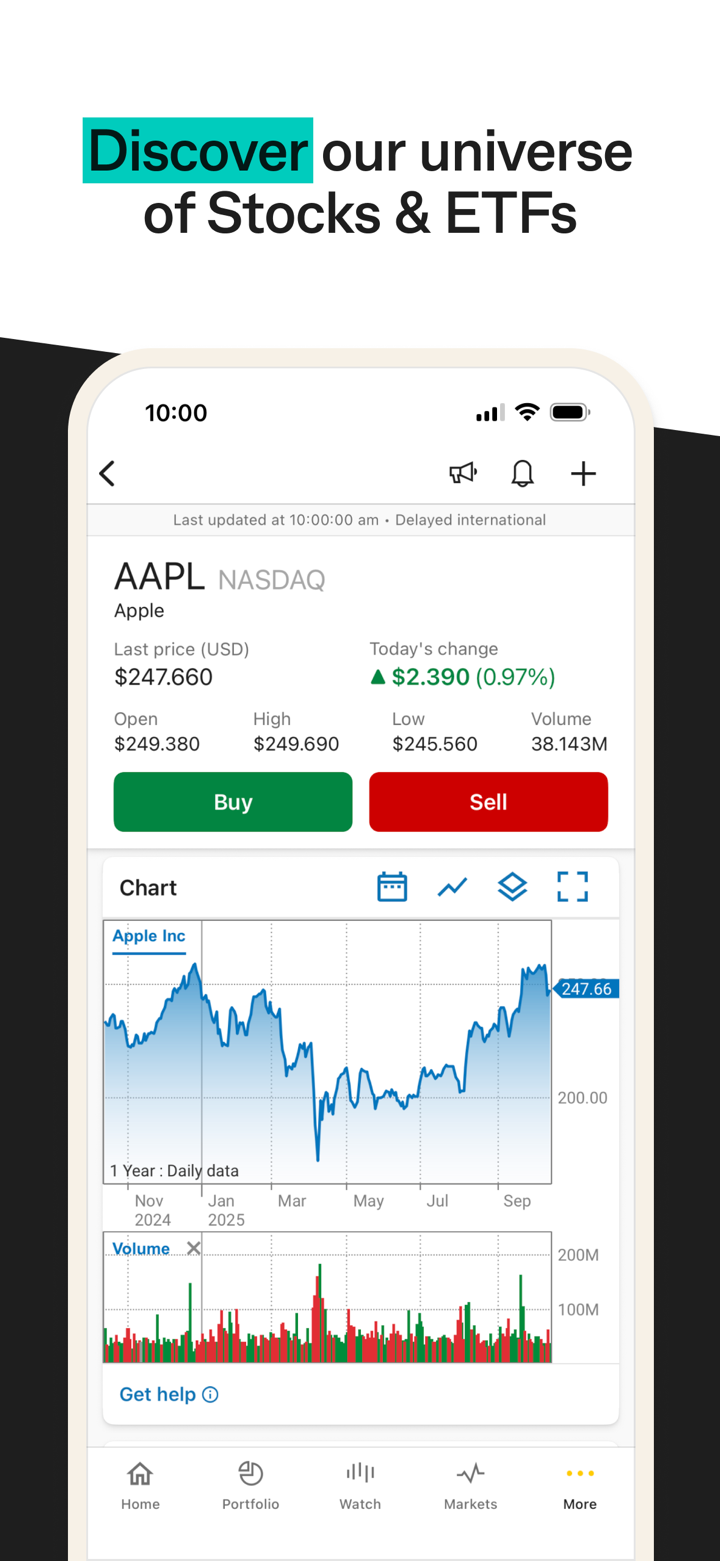

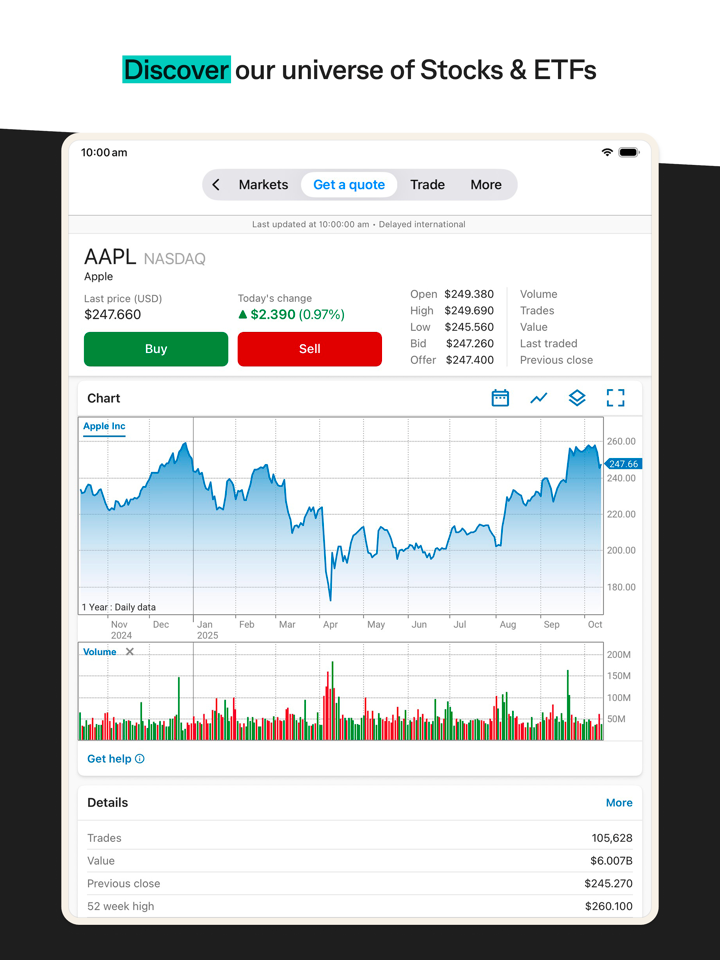

澳大利亚股票(ASX):通过CommSec平台交易超过2,000只澳大利亚股票。首次交易最低为$500,后续交易从$100起。

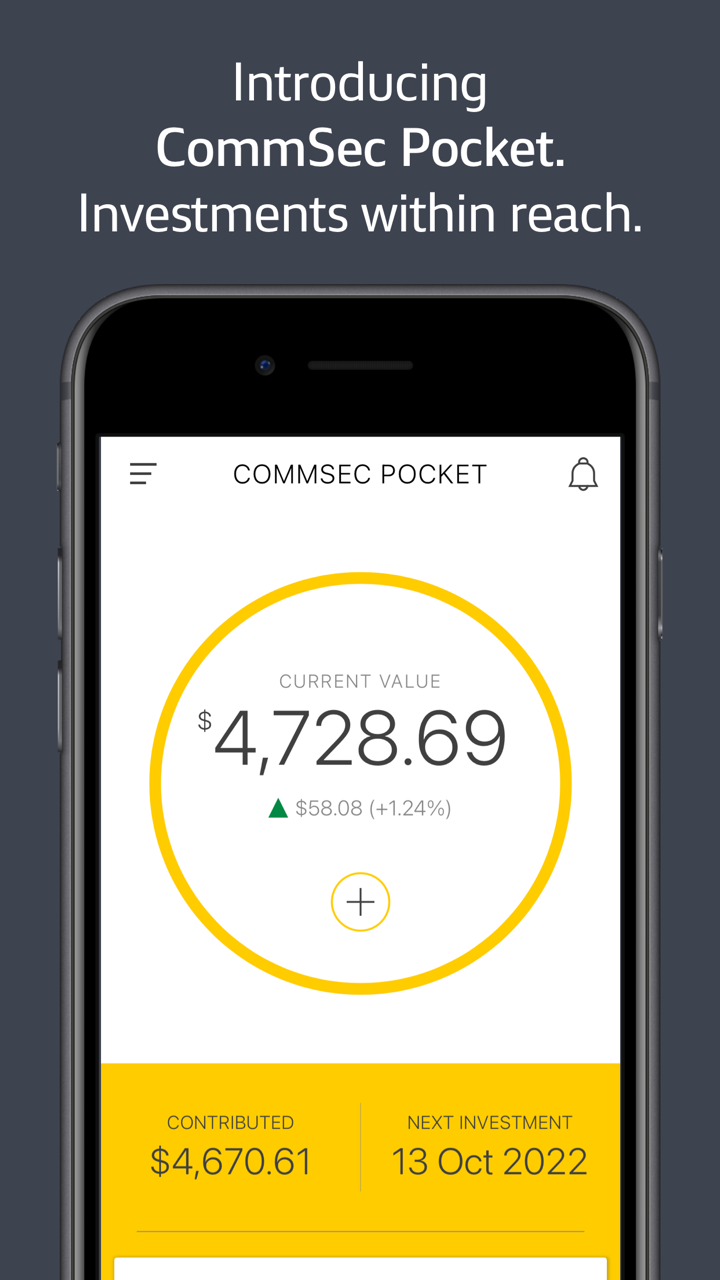

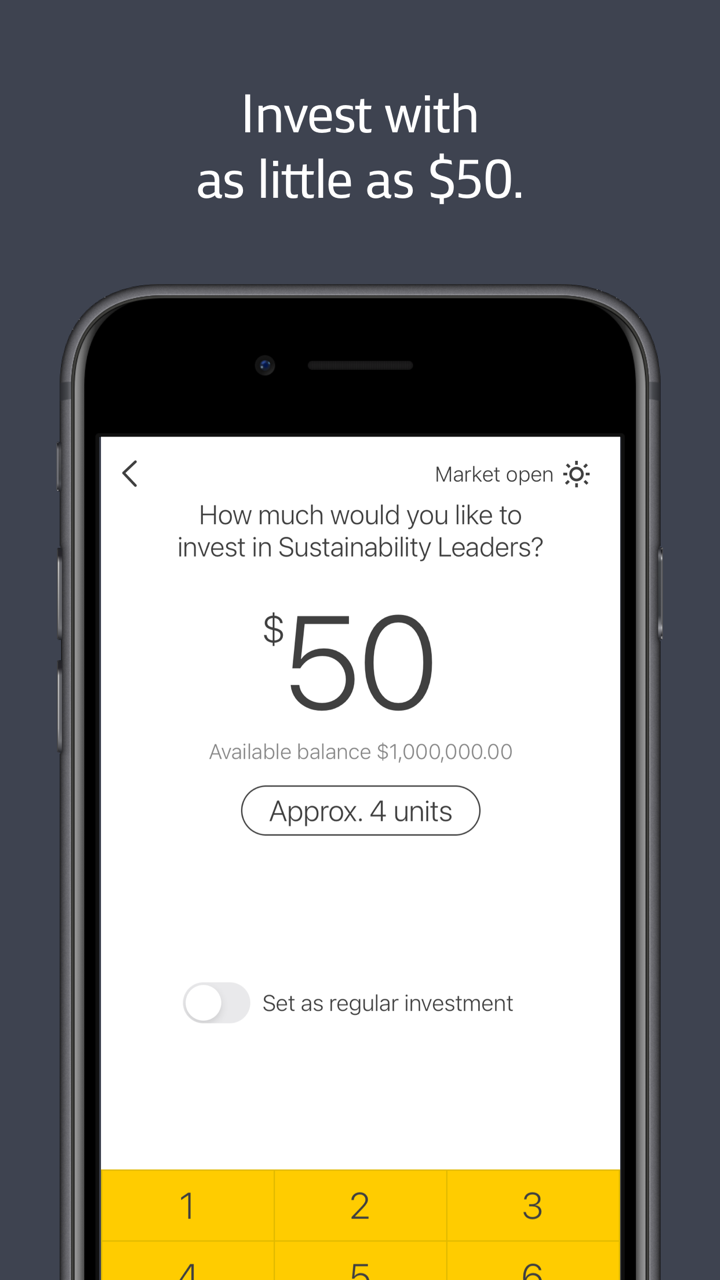

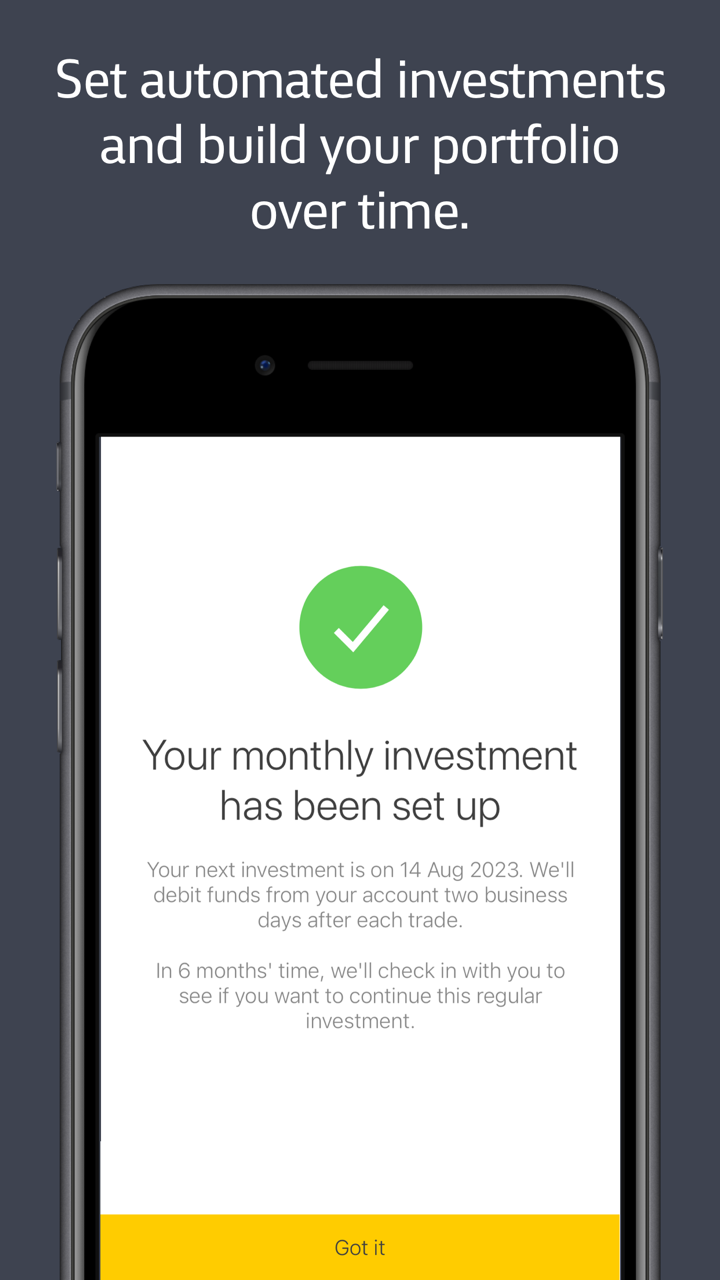

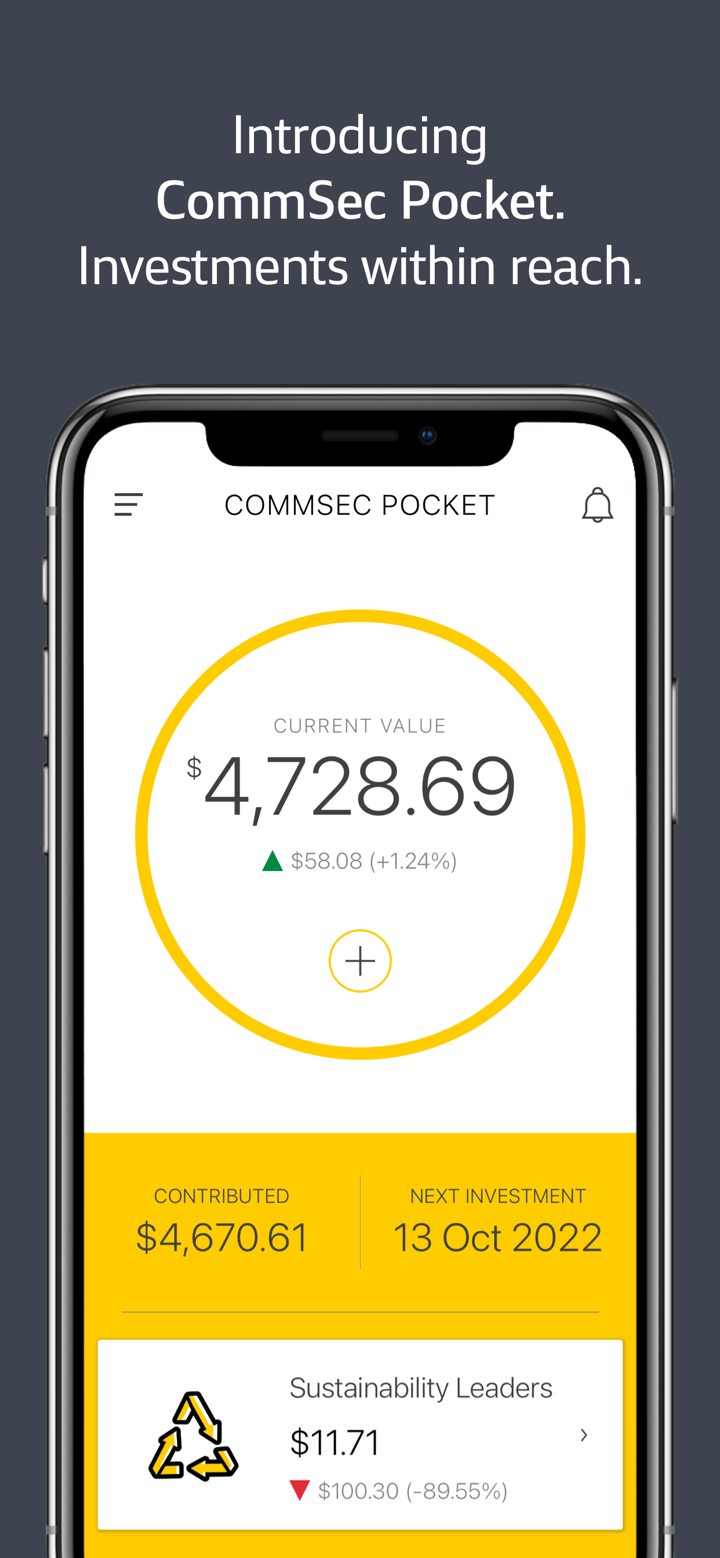

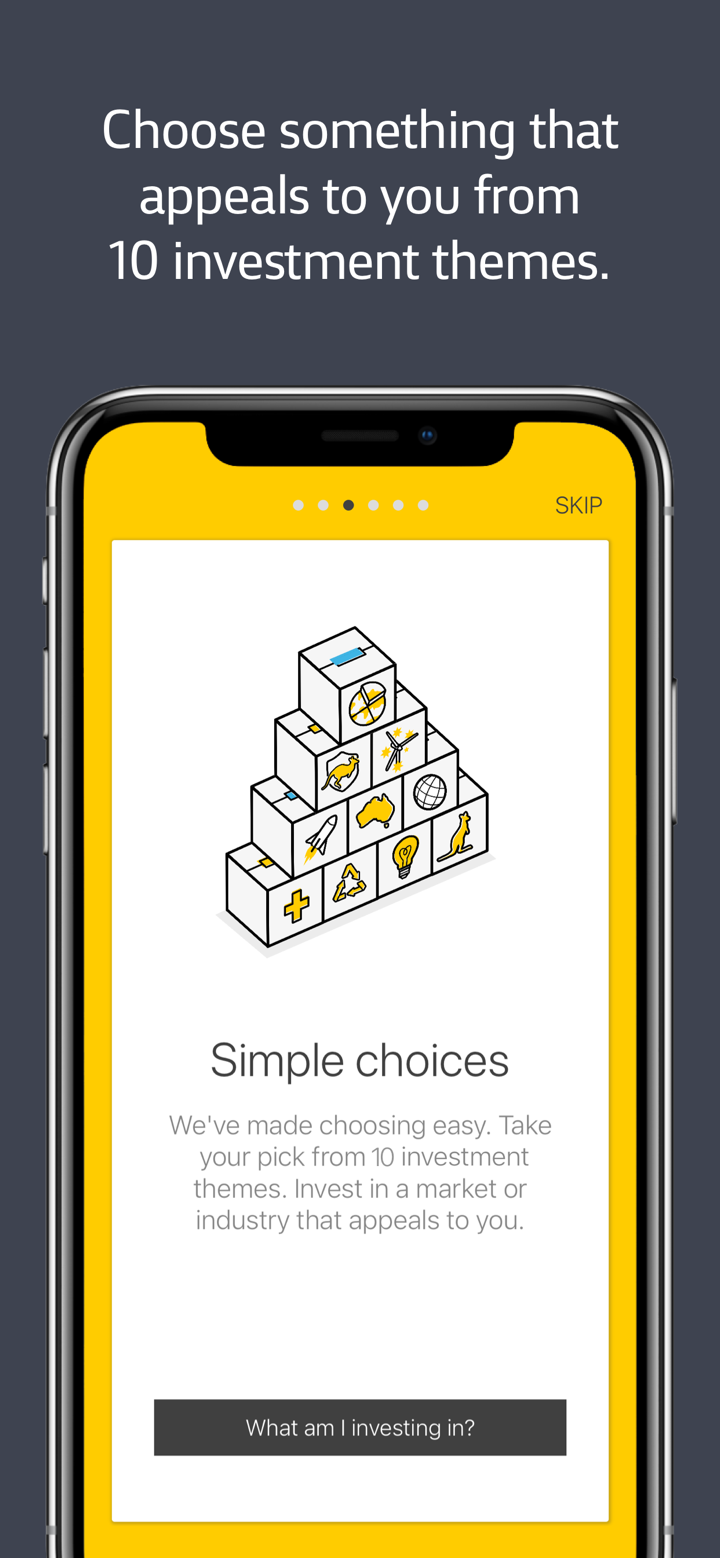

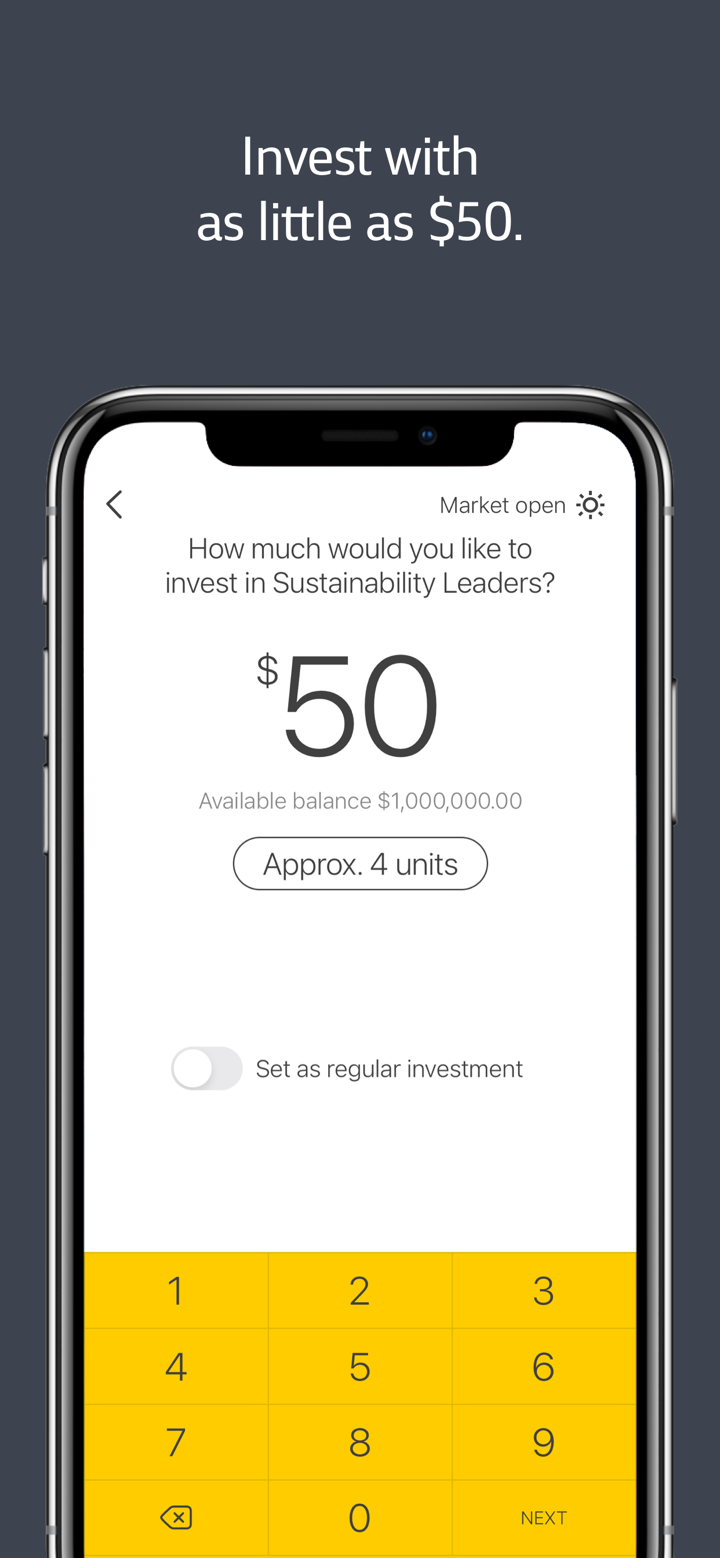

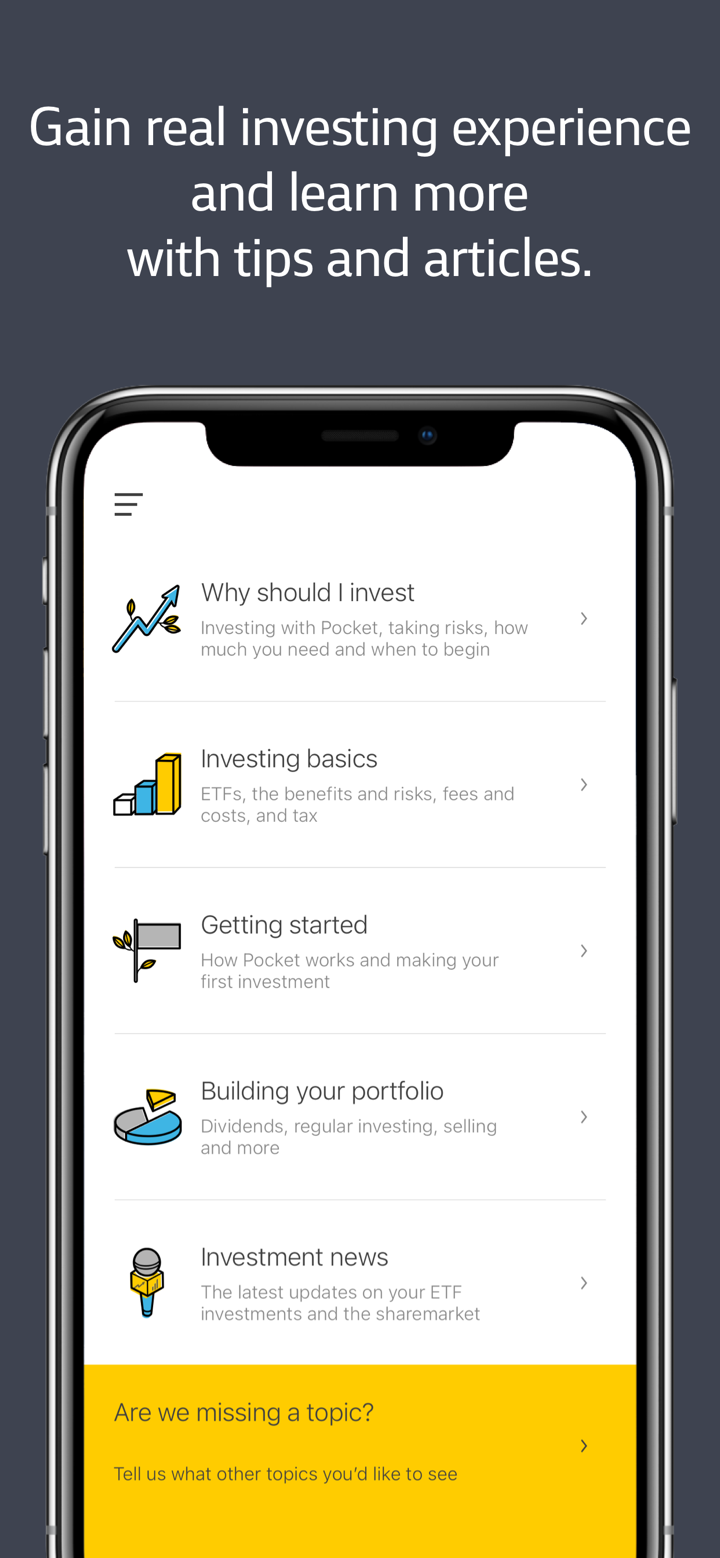

交易所交易基金(ETFs):Pocket ETFs提供10多种主题ETF(例如,技术、医疗保健),最低投资额为$50。佣金为每笔交易$2(交易金额≤$1,000)或0.2%(交易金额>$1,000)。

养老金:由Colonial First State提供,产品如Essential Super的费用比行业平均水平低15%。

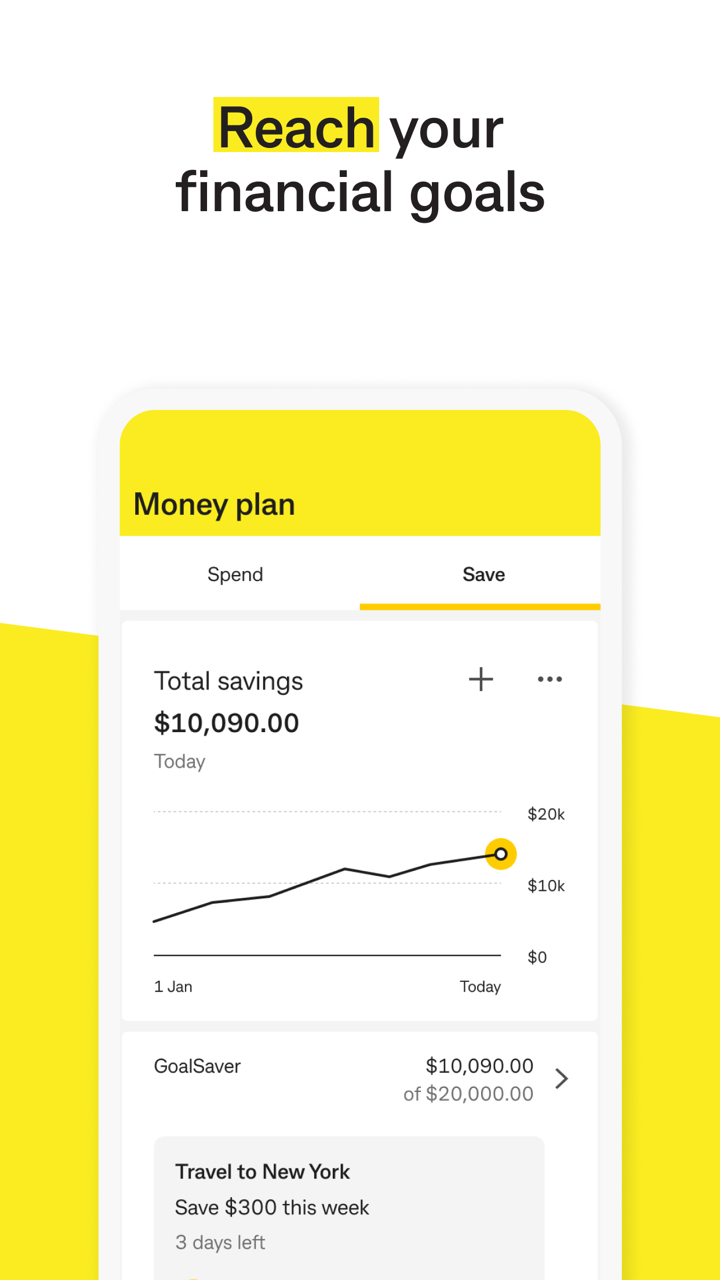

- 定期存款和储蓄账户:为9个月的商业投资提供4.05%的限时利率,而普通储蓄账户利率随市场波动。

| 服务 | 支持 |

| 澳大利亚股票(ASX) | ✔ |

| 交易所交易基金(ETFs) | ✔ |

| 养老金 | ✔ |

| 定期存款和储蓄账户 | ✔ |

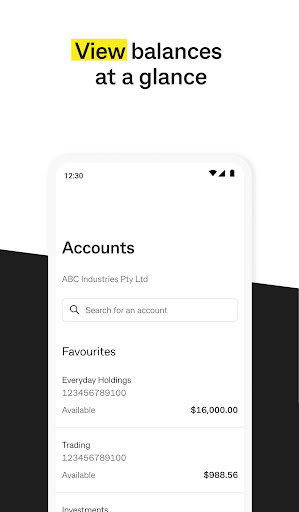

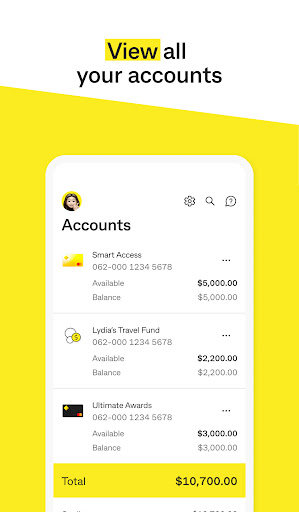

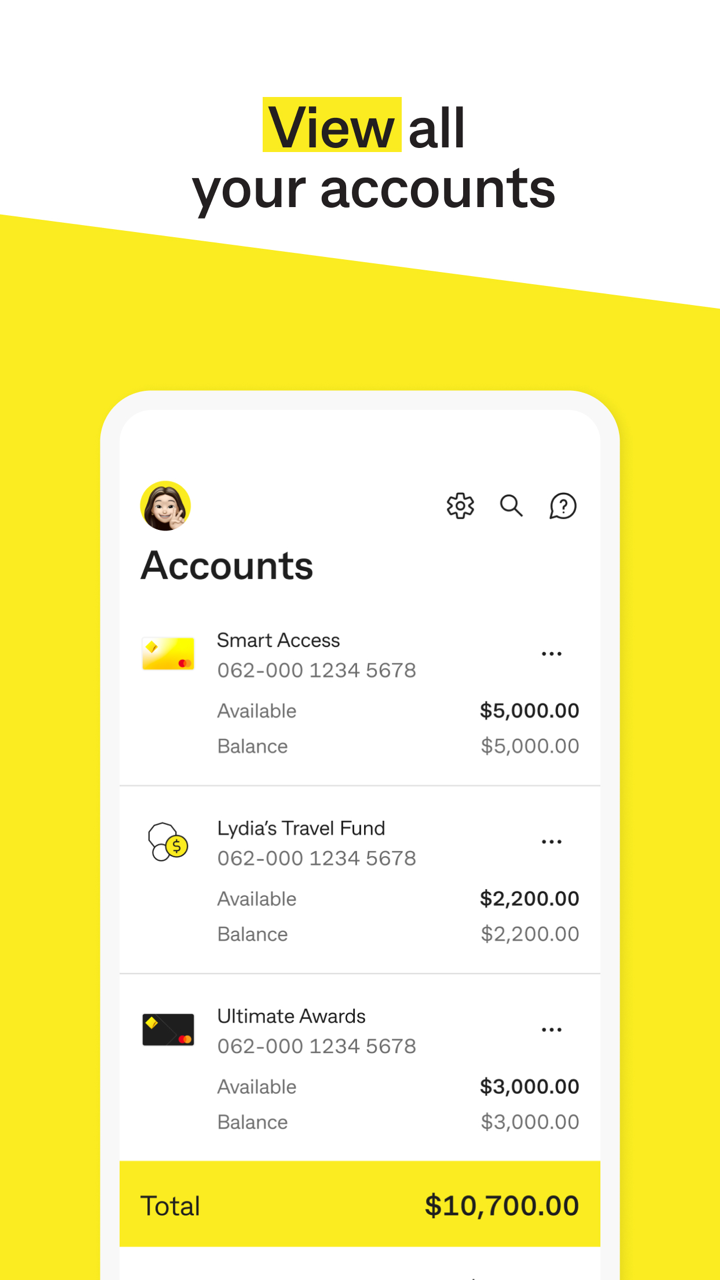

账户类型

个人账户

| 账户类型 | 账户名称 | 主要特点 |

| 日常交易账户 | 智能访问 | • 无月费• 支持通过 PayID 进行快速转账• 无卡取款 |

| 日常抵消 | • 与房屋贷款关联,账户余额可抵消利息 | |

| 储蓄账户 | NetBank 储蓄 | • 灵活的利率• 适用于短期储蓄 |

| 定期存款 | • 固定利率• 存款期限从 3 个月到 5 年不等 | |

| 投资账户 | CommSec 股票交易账户 | • 用于交易澳大利亚股票• 需要与 CDIA(现金管理账户)关联 |

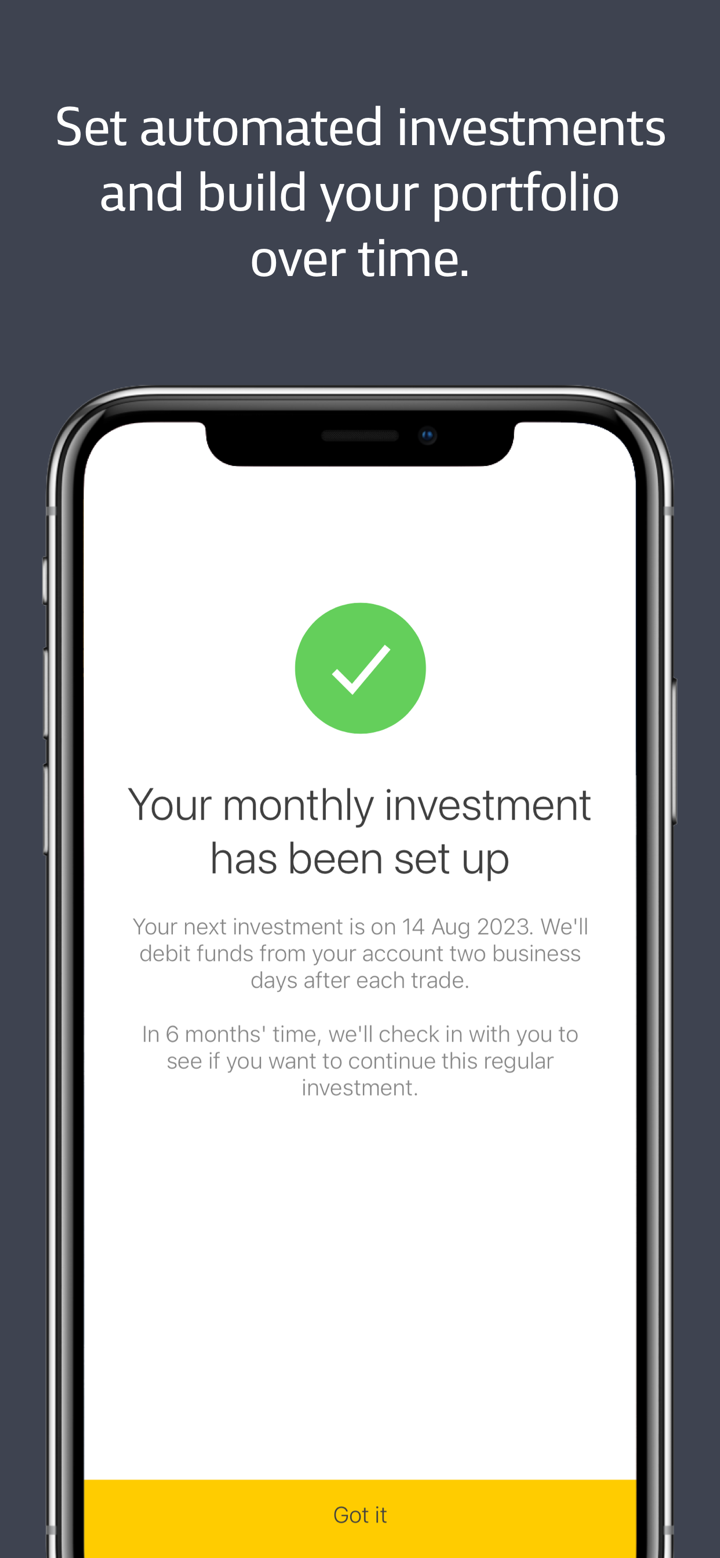

| 口袋账户 | • 专注于 ETF 交易• 最低投资额为 $50 |

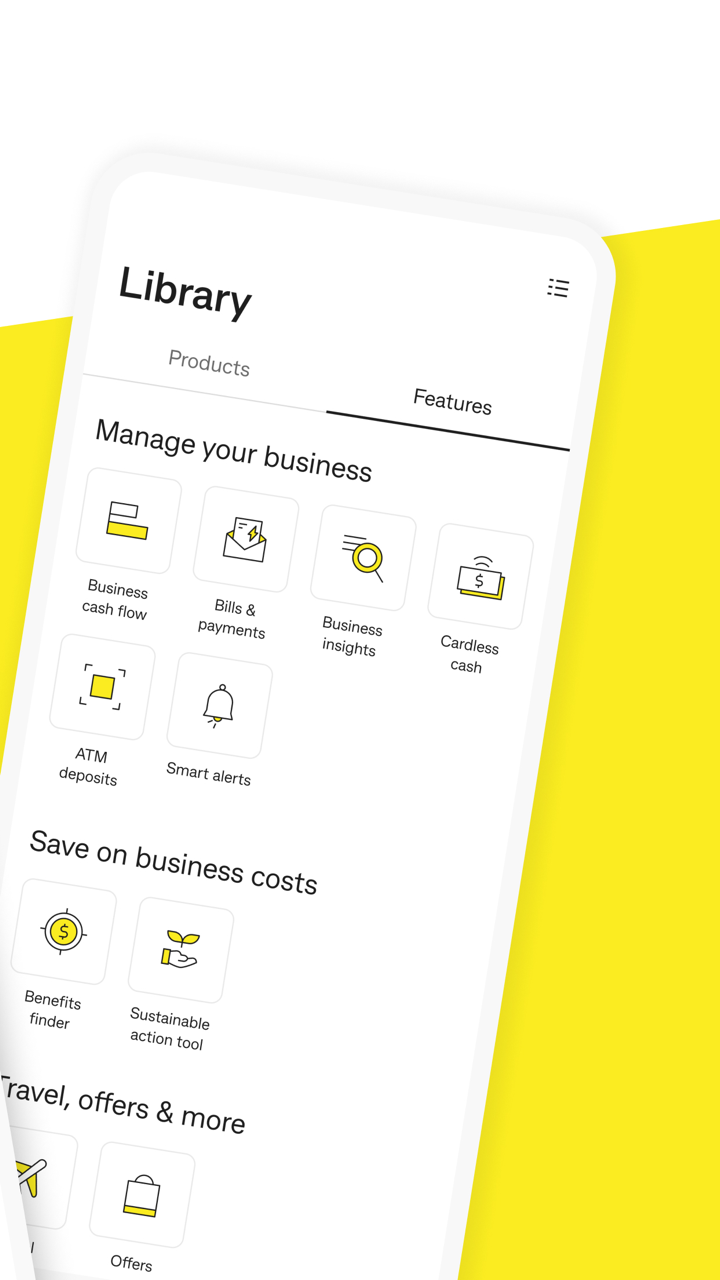

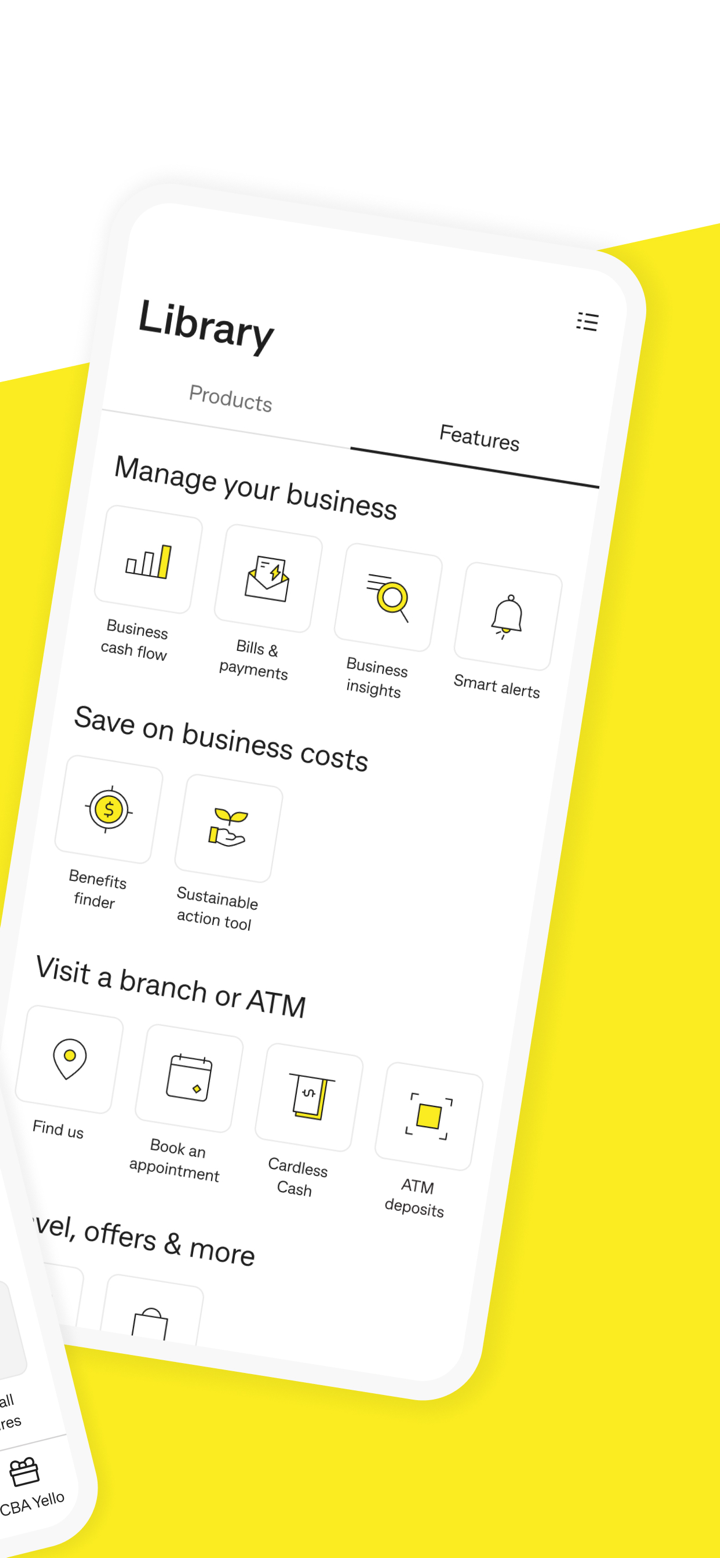

商业账户

CommBank 为小型企业提供适用的商业交易账户,月费为 $0,需要 ASIC 验证。此外,用户可以选择商业贷款 账户,如更好的商业贷款(无抵押小额贷款)以及车辆和设备融资。

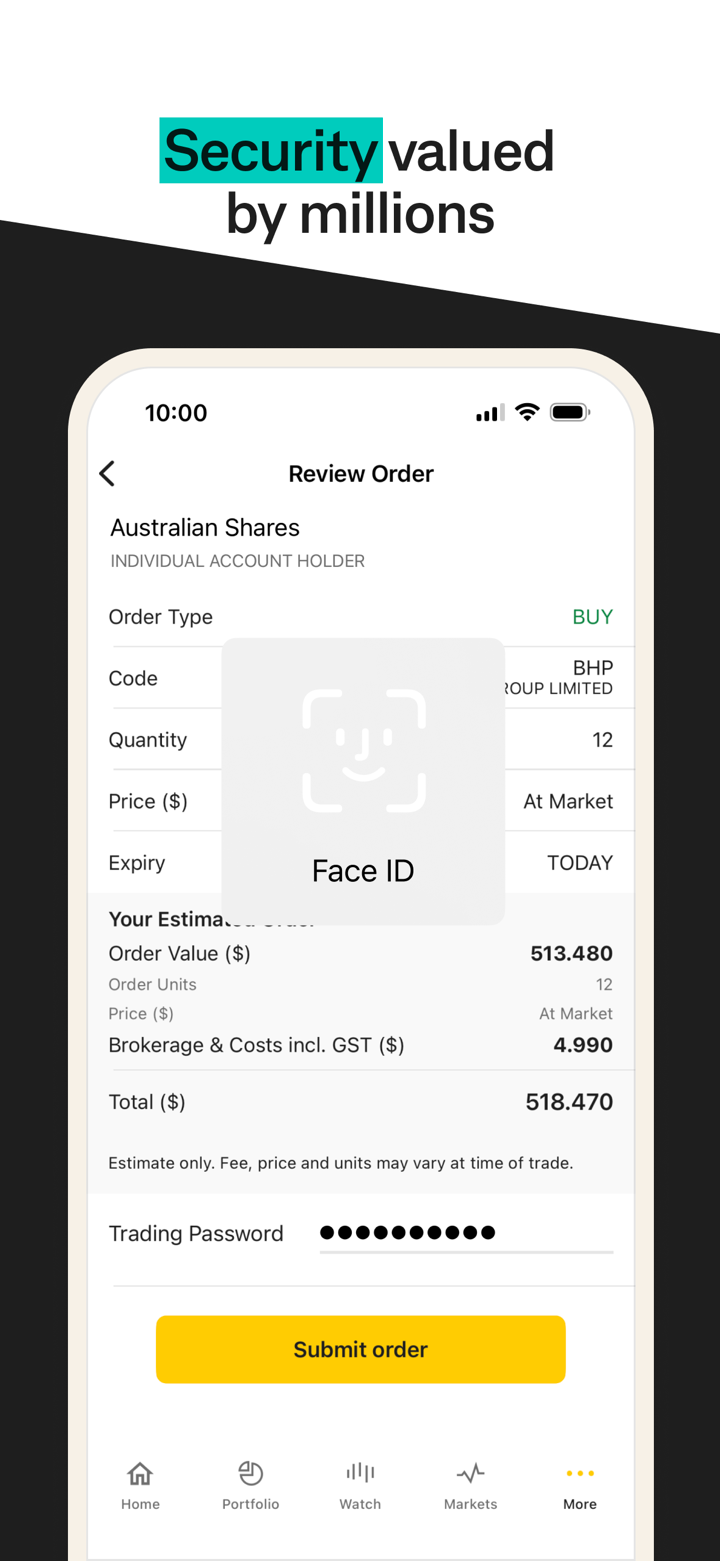

CommBank 费用

| 服务类型 | 项目 | 费用标准 |

| 交易账户 | 基本账户月费 | 大多数无月费 |

| 跨境转账 | 每笔 $15–$25 | |

| 外汇兑换费 | 1%–3% | |

| 投资交易 | 澳大利亚股票交易佣金 | 每笔 $10–$29.95 |

| ETF 交易佣金 | ≤ $1,000:每笔 $2;> $1,000:0.2% | |

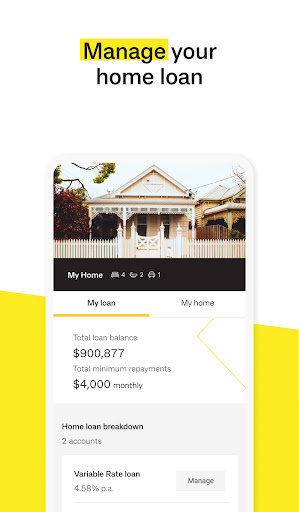

| 房屋贷款 | 房屋贷款申请费 | $495–$995 |

| 再融资费 | 约 $395 | |

| 财富套餐年费 | $395(包括房屋贷款利率折扣) | |

| 保险 | 宠物保险(首年优惠) | 头两个月免费 |

| 宠物保险(后续月费) | $20–$80 |

杠杆

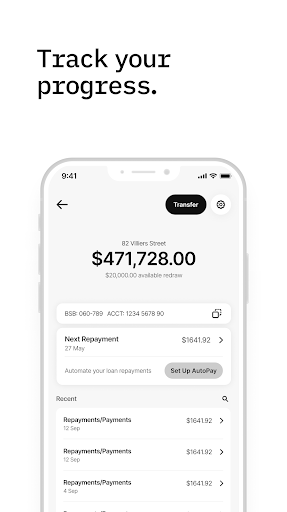

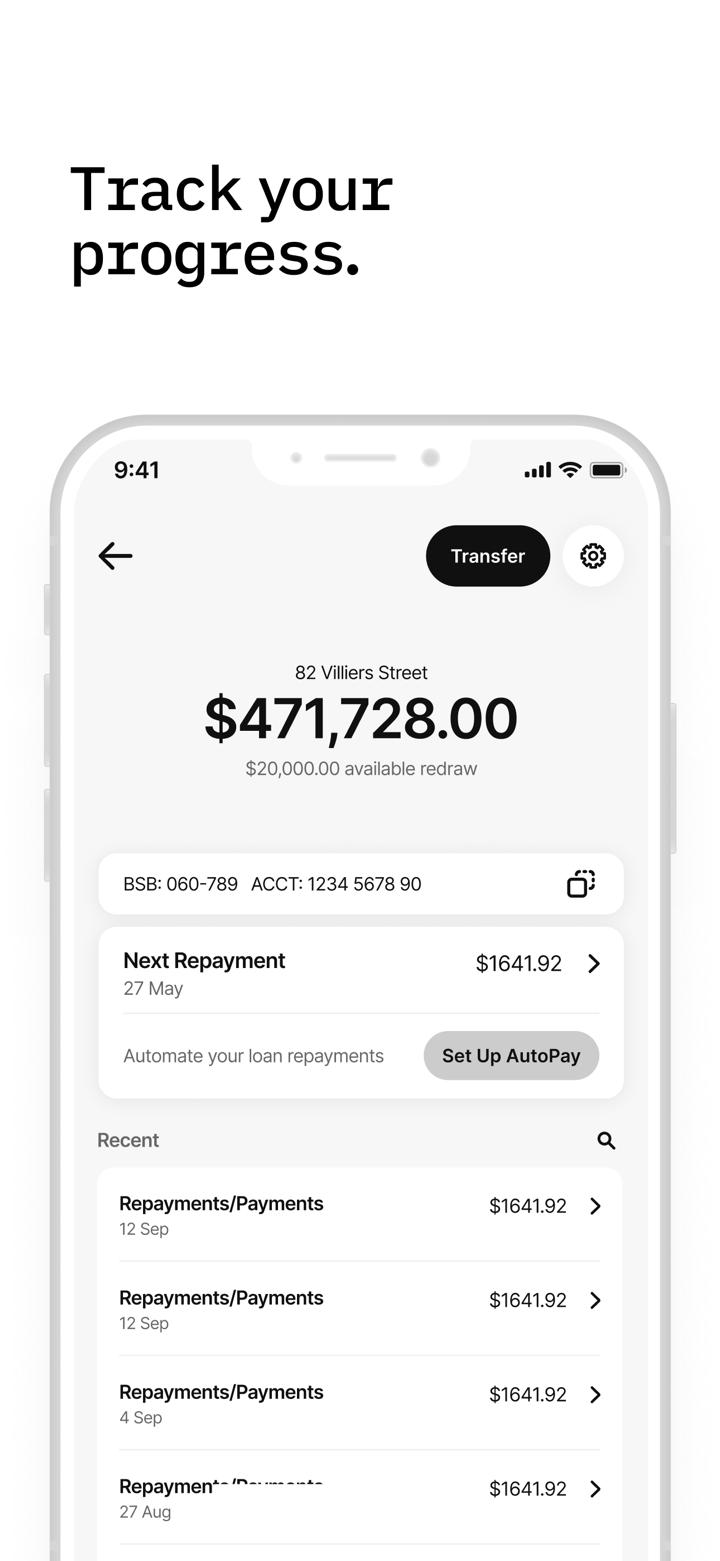

对于CommBank房屋贷款杠杆,最大贷款金额可达到房产价值的80%(LVR ≤ 80%)。

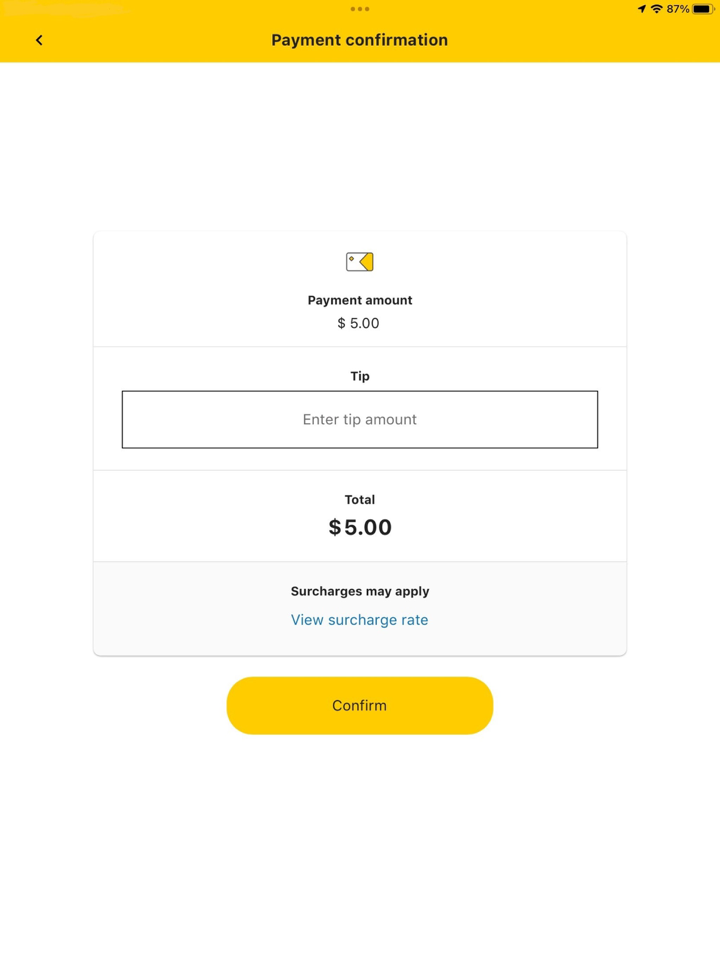

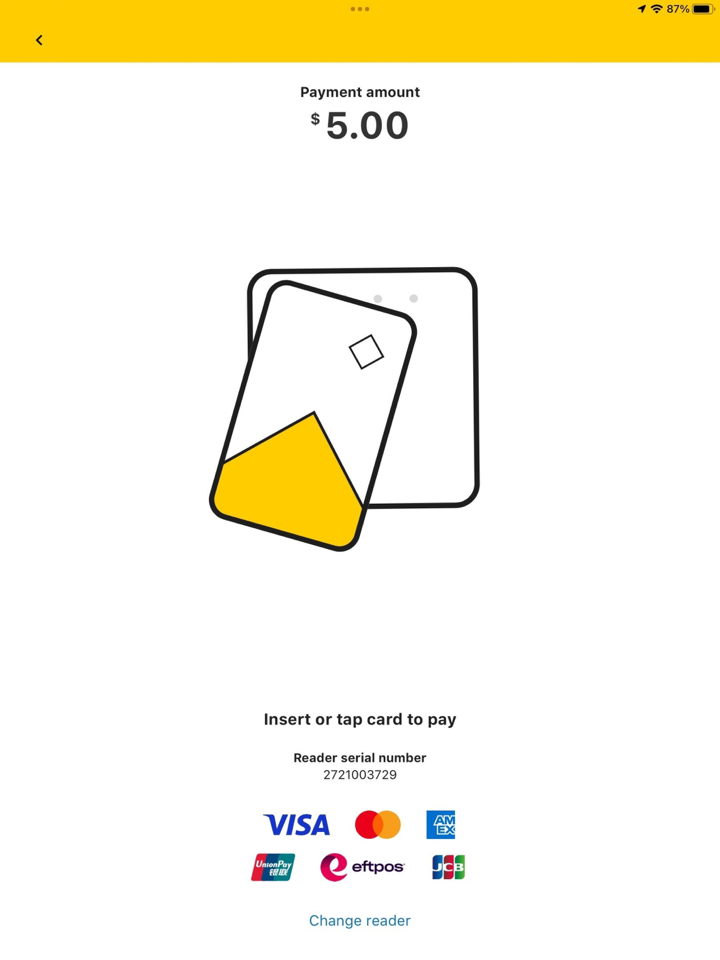

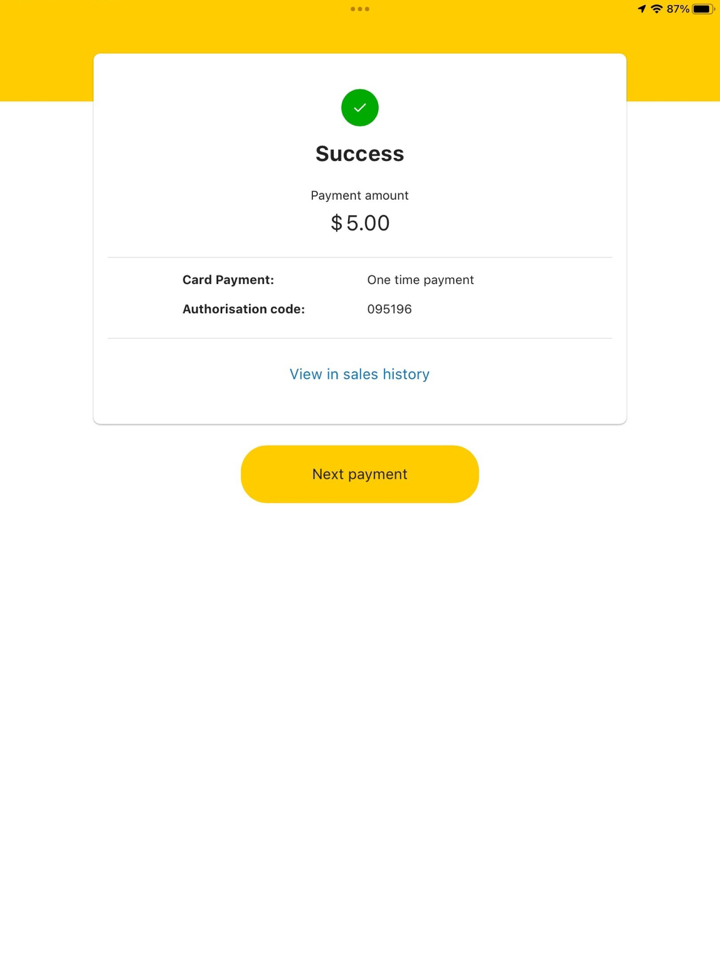

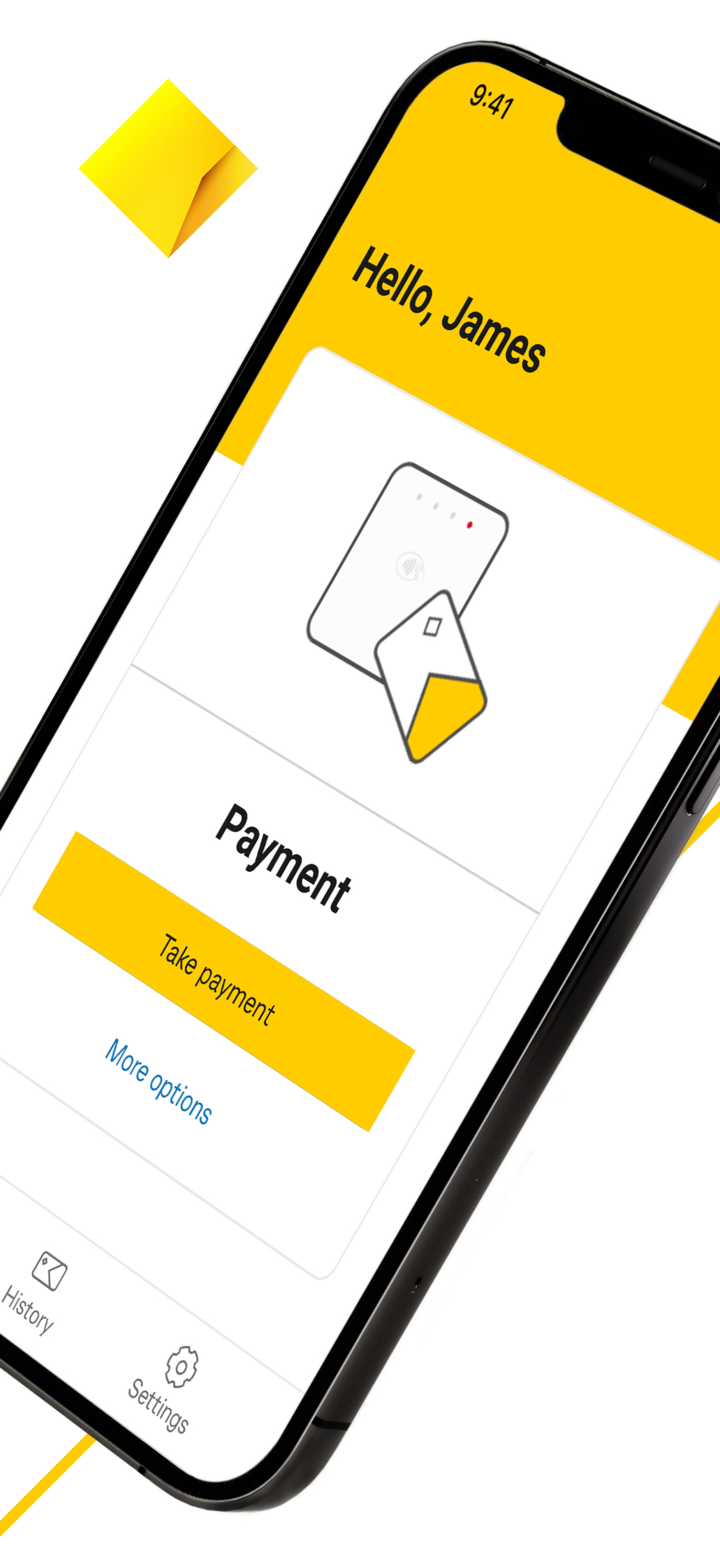

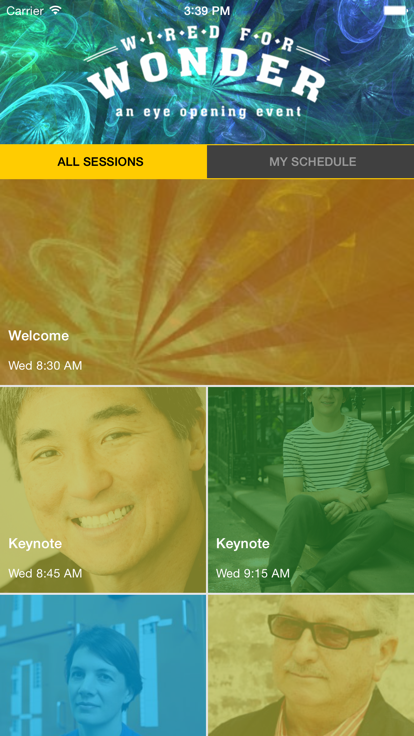

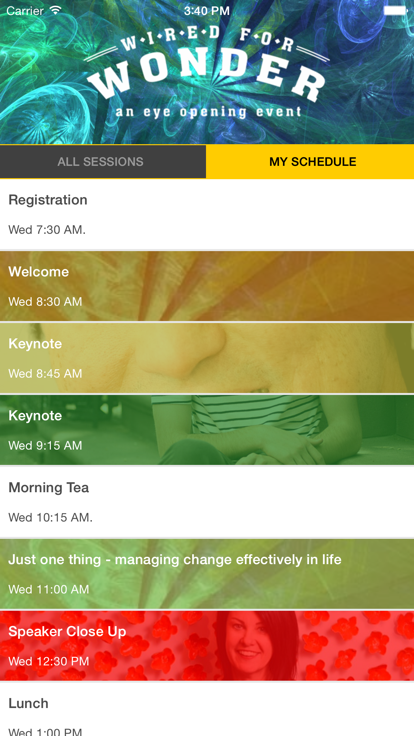

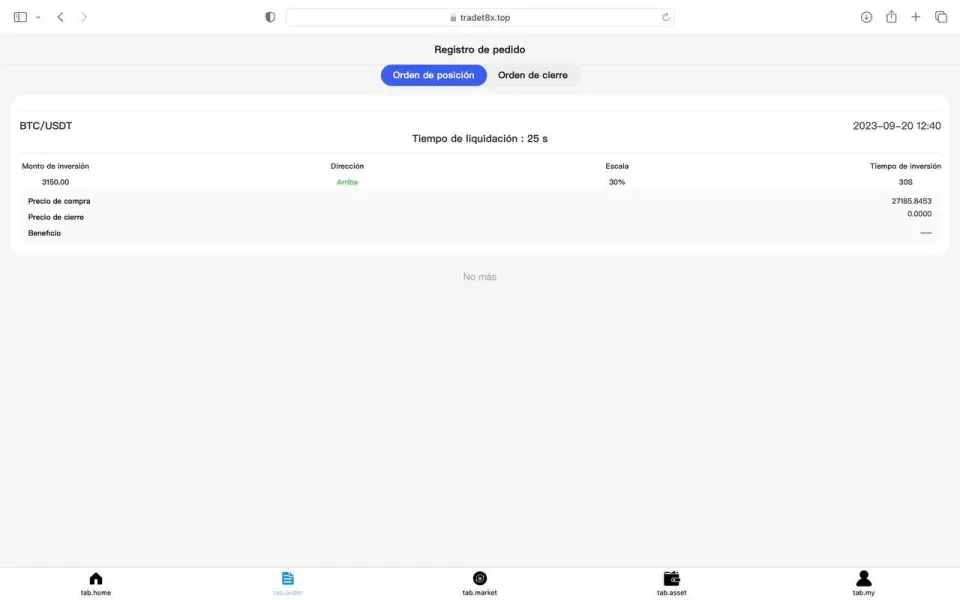

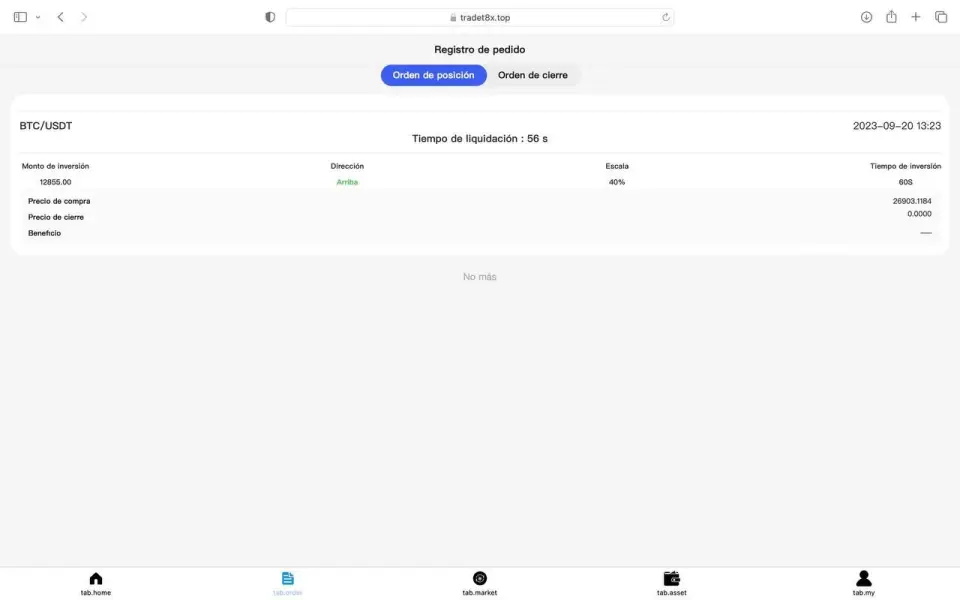

交易平台

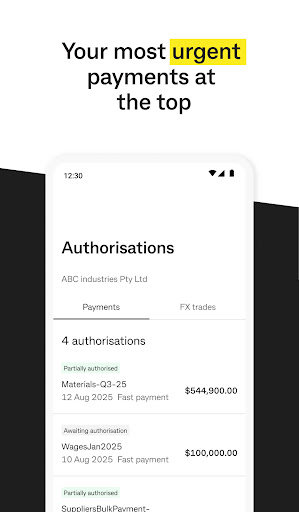

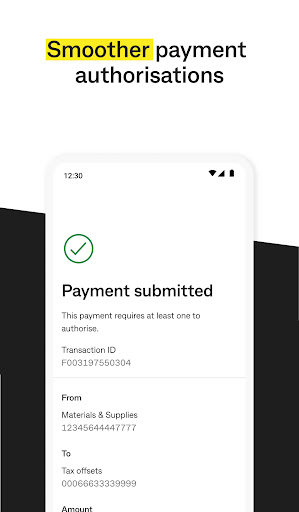

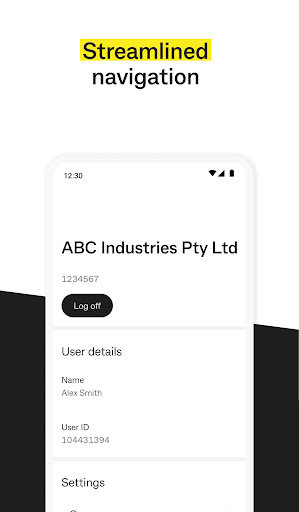

| 交易平台 | 支持 | 可用设备 |

| CommBank 应用 | ✔ | - |

| NetBank | ✔ | Web |

| CommSec | ✔ | - |

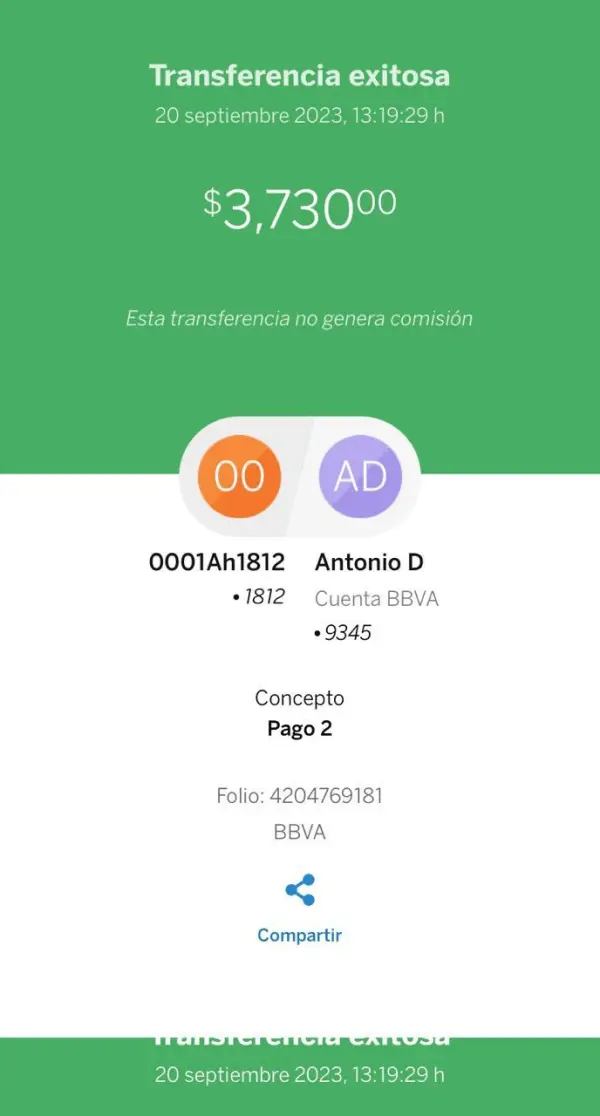

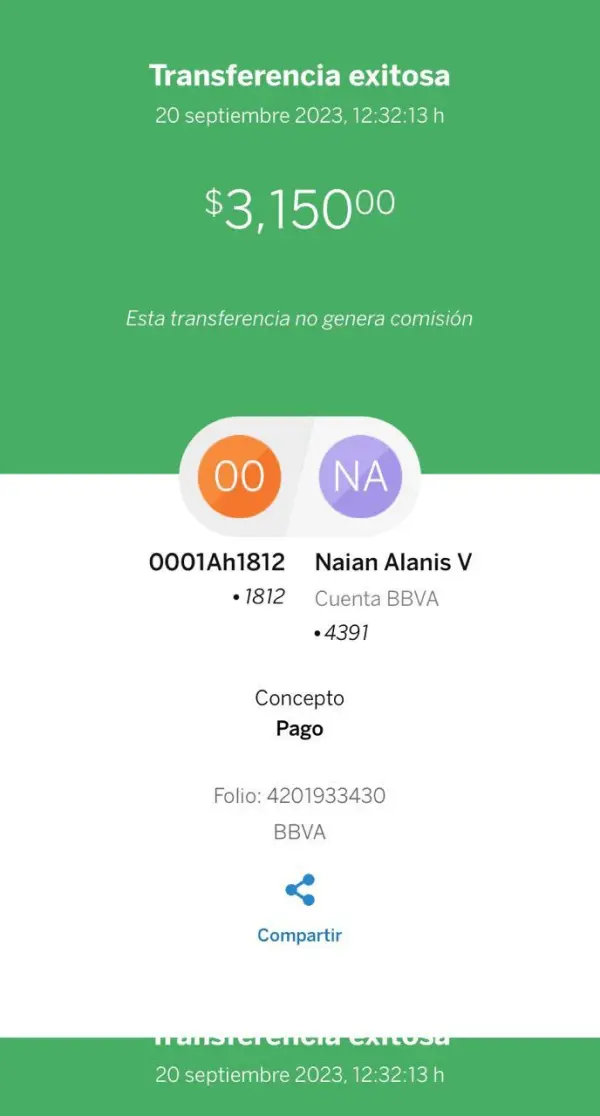

存款和取款

| 类别 | 方法 | 详情 |

| 存款 | 银行转账 | 支持本地/国际转账;国际转账需要S钱包导入格T代码:CBAUAT22。 |

| ATM存款 | 在澳大利亚CommBank ATM免费存入现金/支票 | |

| 直接工资存款 | 允许雇主直接存入工资;某些账户有资格获得奖励(例如,智能奖励信用卡积分) | |

| 取款 | ATM取款 | 在全球Mastercard ATM取款澳大利亚元或当地货币;海外取款费用:每笔交易5美元 + 货币兑换费用 |

| 转账至关联账户 | 免费实时转账至其他CommBank 账户 或第三方 账户(需要PayID/BSB号码) |

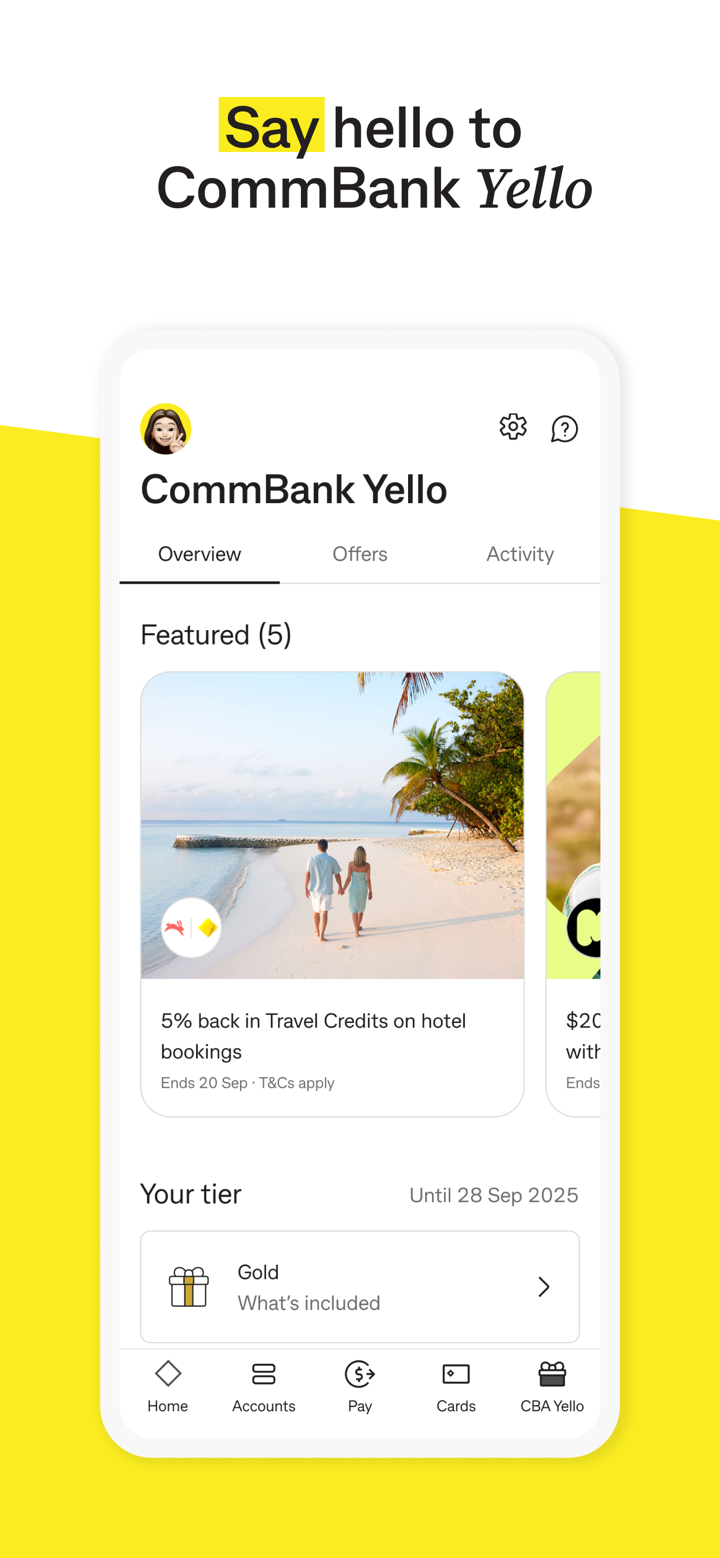

奖励

CommBank的新客户奖励包括:开设指定交易账户并完成交易即可获得200美元现金奖励(限时优惠);新房屋贷款客户可享受699美元的房地产转让折扣(通过Home-in服务)。

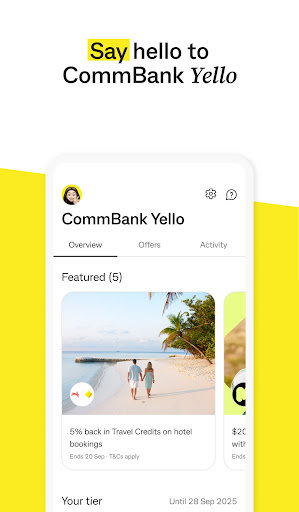

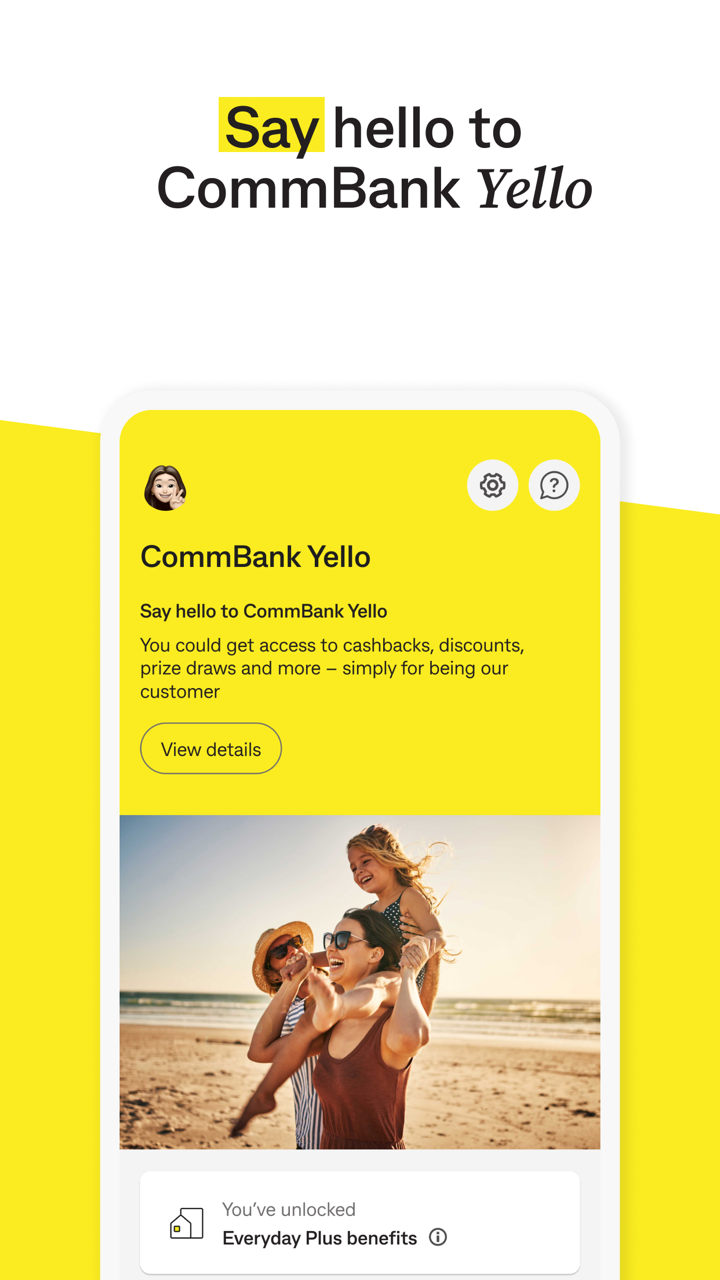

此外,投资者可以获得忠诚度奖励,如CommBank Yello计划,提供积分、返现(例如,房屋贷款每月最高40美元返现)和服务折扣。信用卡消费积累CommBank奖励积分,可兑换礼品卡或Qantas常旅客里程。