公司简介

| Standard Bank评论摘要 | |

| 成立时间 | 1998 |

| 注册国家/地区 | 南非 |

| 监管 | 无监管 |

| 市场工具 | 差价合约、交易所交易基金、指数、外汇、股票和金属 |

| 模拟账户 | / |

| 杠杆 | / |

| 点差 | / |

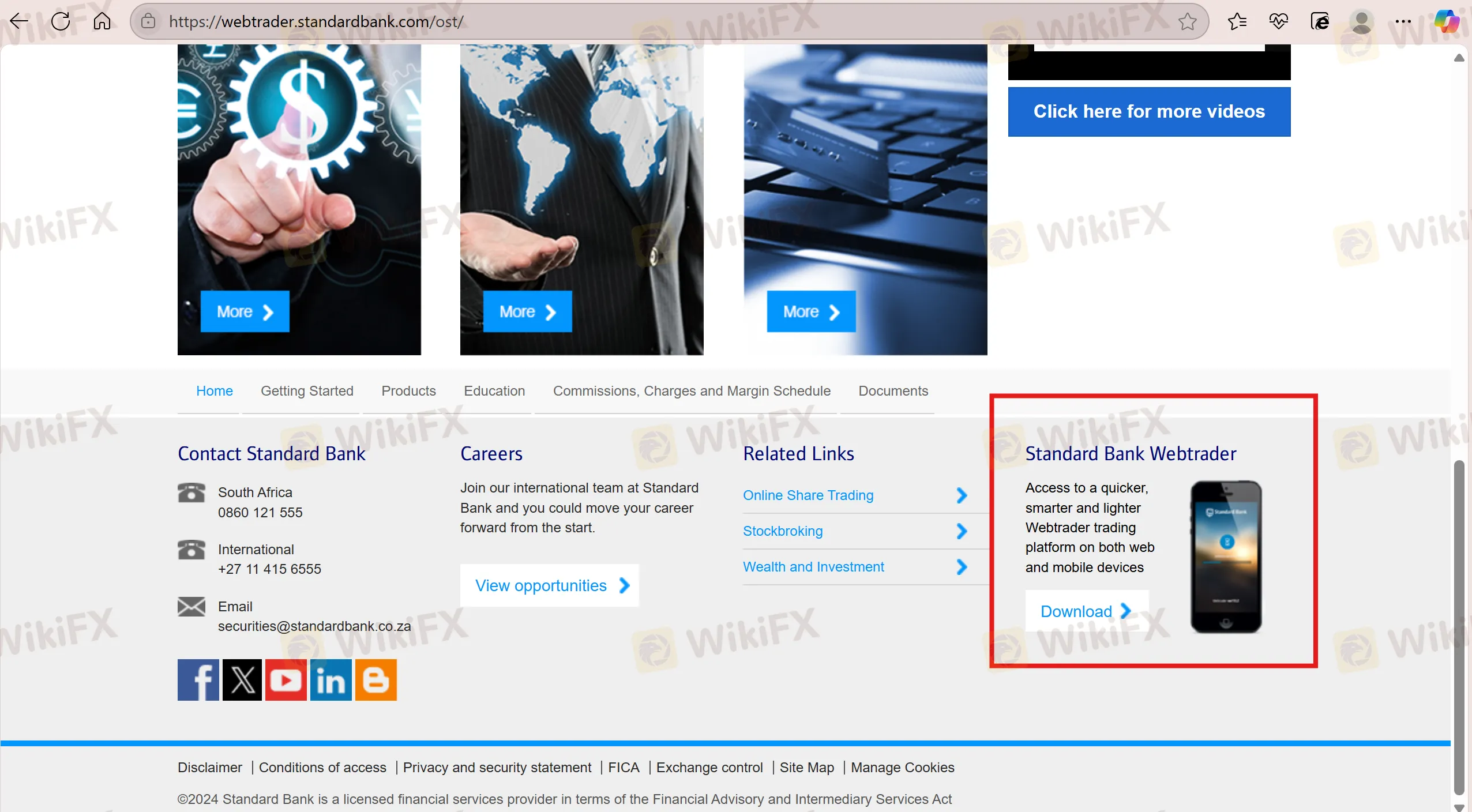

| 交易平台 | Standard Bank Webtrader |

| 最低存款 | / |

| 客户支持 | 电子邮件:securities@standardbank.co.za |

| 电话:0860 121 555(南非) | |

| 电话:+27 11 415 6555(国际) | |

| 社交媒体:Facebook、YouTube、LinkedIn、Twitter、Blogger | |

Standard Bank 信息

Standard Bank成立于1998年,注册地点为南非。它提供超过20,275种可交易工具,包括差价合约、交易所交易基金、指数、外汇、股票和金属,并支持通过Standard Bank Webtrader平台进行交易。尽管公司提供各种金融产品和服务而不收取交易费用,但该公司没有受到监管,并缺乏关于账户功能的详细信息。投资者应对其合法性和透明度保持谨慎。此外,存款会产生0.05美元的费用,结算通常需要两个工作日完成。

优点与缺点

| 优点 | 缺点 |

| 多样的金融产品 | 无监管 |

| 悠久的运营历史 | 交易细节信息有限 |

| 多种联系渠道 | 收取存款费用 |

Standard Bank 是否合法?

Standard Bank 未受监管,因此交易者在交易时需要保持谨慎。

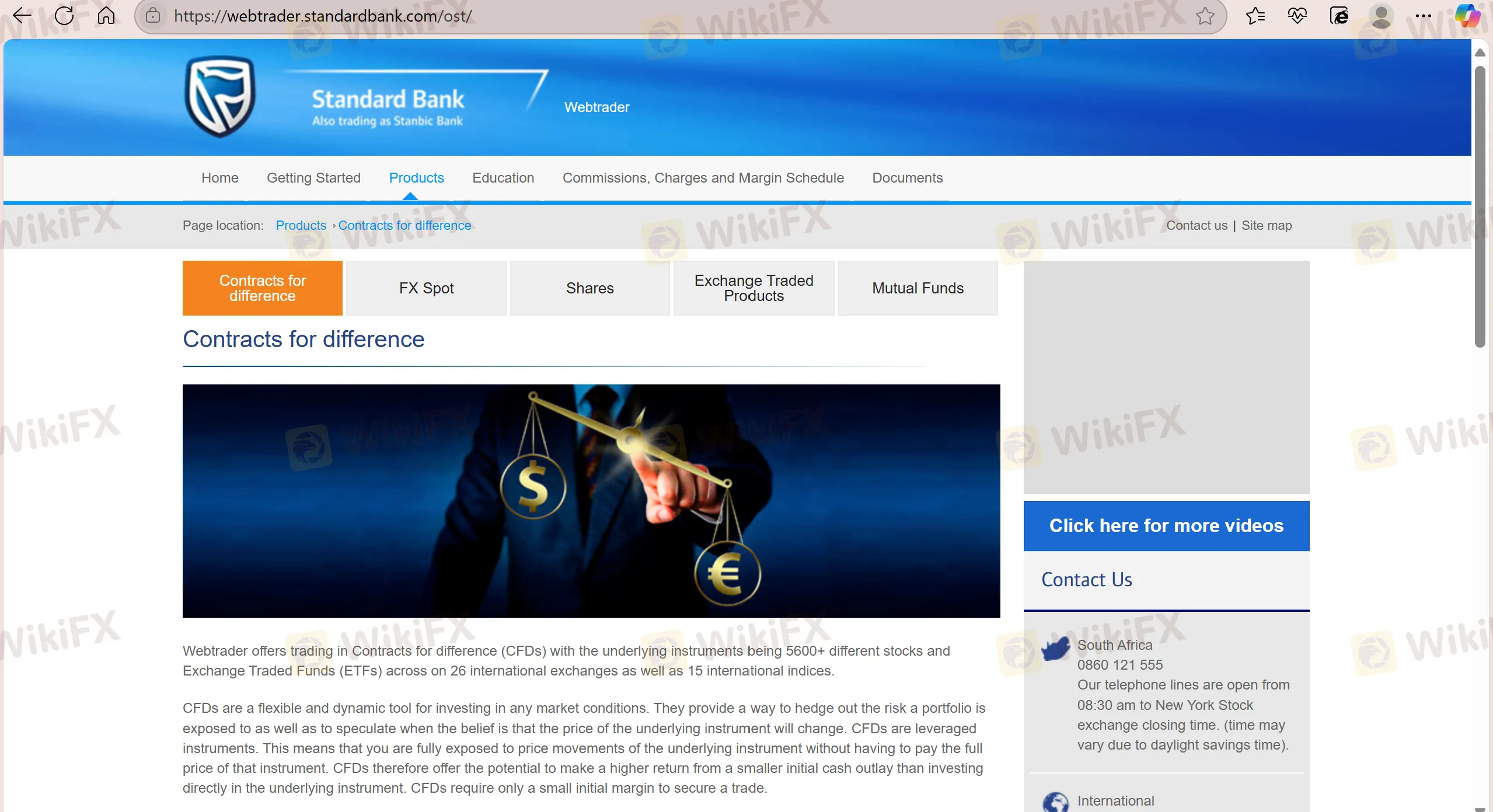

我可以在Standard Bank上交易什么?

Standard Bank 提供超过20,275种交易工具,包括差价合约、交易所交易基金、指数、外汇、股票和金属。

| 可交易工具 | 支持 |

| 差价合约 | ✔ |

| 交易所交易基金 | ✔ |

| 指数 | ✔ |

| 外汇 | ✔ |

| 基金 | ✔ |

| 股票 | ✔ |

| 金属 | ✔ |

| 债券 | ❌ |

| 加密货币 | ❌ |

| 期权 | ❌ |

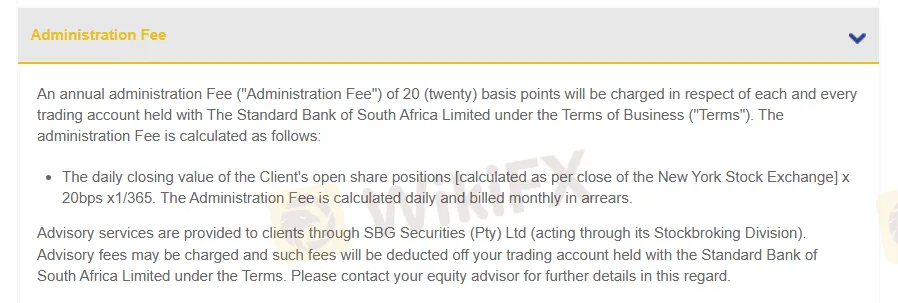

费用

管理费:将收取20个基点。

交易平台

Standard Bank 支持在Standard Bank Webtrader平台上交易。该平台不收取交易费用,结算在两个工作日内完成。

| 交易平台 | 支持 | 可用设备 | 适用人群 |

| Standard Bank Webtrader | ✔ | 手机,网络 | / |

| MT4 | ❌ | / | 初学者 |

| MT5 | ❌ | / | 经验丰富的交易者 |

存款和取款

客户主要可以通过银行转账进行存款和取款,存款将收取0.05美元的费用。