公司简介

| 光大证券 评论摘要 | |

| 成立时间 | 1969 |

| 注册国家/地区 | 香港 |

| 监管 | SFC, HKGX(未经验证) |

| 服务 | 财富管理、企业金融与资本市场、机构业务、资产管理和投资与融资 |

| 交易平台 | 光大证券 GO!、MT4、eMO! 等 |

| 客户支持 | 电话:+852 3920 2888;传真:+852 3920 2789 |

| 电子邮件:cs@ebshk.com;enquiry@ebshkforex.com;corporatefinance@ebshk.com;insurance@ebshk.com;ecm@ebshk.com | |

| 总部及接待处:香港湾仔告士打道108号光大中心33楼 | |

| 社交平台:微信、Facebook、新浪微博、LinkedIn | |

| 分支机构其他联系信息:https://www.ebshk.com/contact.php?s=1 | |

光大证券 信息

光大证券,全名为光大证券国际,最初成立于1969年,当时名为“新鸿基有限公司”,并于2021年成为光大证券股份有限公司的全资子公司。该公司提供的金融服务包括财富管理、企业金融与资本市场、机构业务、资产管理以及投资与融资。其客户群涵盖个人、公司和机构。

2024年,该公司推出了自己的交易平台移动应用程序“光大证券 GO!”,使交易者能够更轻松、更便捷地执行交易。

该公司目前受 SFC 监管,这表明一定程度的可信度和客户保护。然而,同时也应谨慎,因为该公司声称的 HKGX 许可尚未经验证。

优缺点

| 优点 | 缺点 |

| 受SFC监管 | 未经验证的HKGX监管 |

| 广泛的金融服务范围 | |

| 多个交易平台 |

光大证券 是否合法?

光大证券 目前受到香港证监会(SFC)监管,持有执照号码AAF237和ACI995。

然而,需要注意的一个关键点是,HKGX(香港金银交易所)的许可证编号为044,尚未经当局验证,这表明它可能从事超出HKGX法律许可范围的金融活动。

| 监管国家 | 监管机构 | 当前状态 | 受监管实体 | 许可证类型 | 许可证号码 |

| SFC | 已监管 | CES Commodities(HK)有限公司 | 期货合约交易 | AAF237 |

| SFC | 已监管 | CES Forex(HK)有限公司 | 杠杆外汇交易 | ACI995 |

| HKGX | 未经验证 | 新鸿基珠江三角洲投资有限公司 | E类许可证 | 044 |

服务

光大证券 在五个关键领域提供全方位的金融服务。

- 财富管理 为个人和公司提供基于目标的咨询和投资解决方案。

- 企业融资与资本市场 支持客户进行IPO、财务咨询和筹资。

- 机构业务 为机构客户提供定制交易、研究和保险服务。

- 资产管理 提供包括共同基金和私募基金在内的多样化投资产品。

- 投资与融资 提供离岸融资和结构化解决方案,支持业务增长和资本需求。

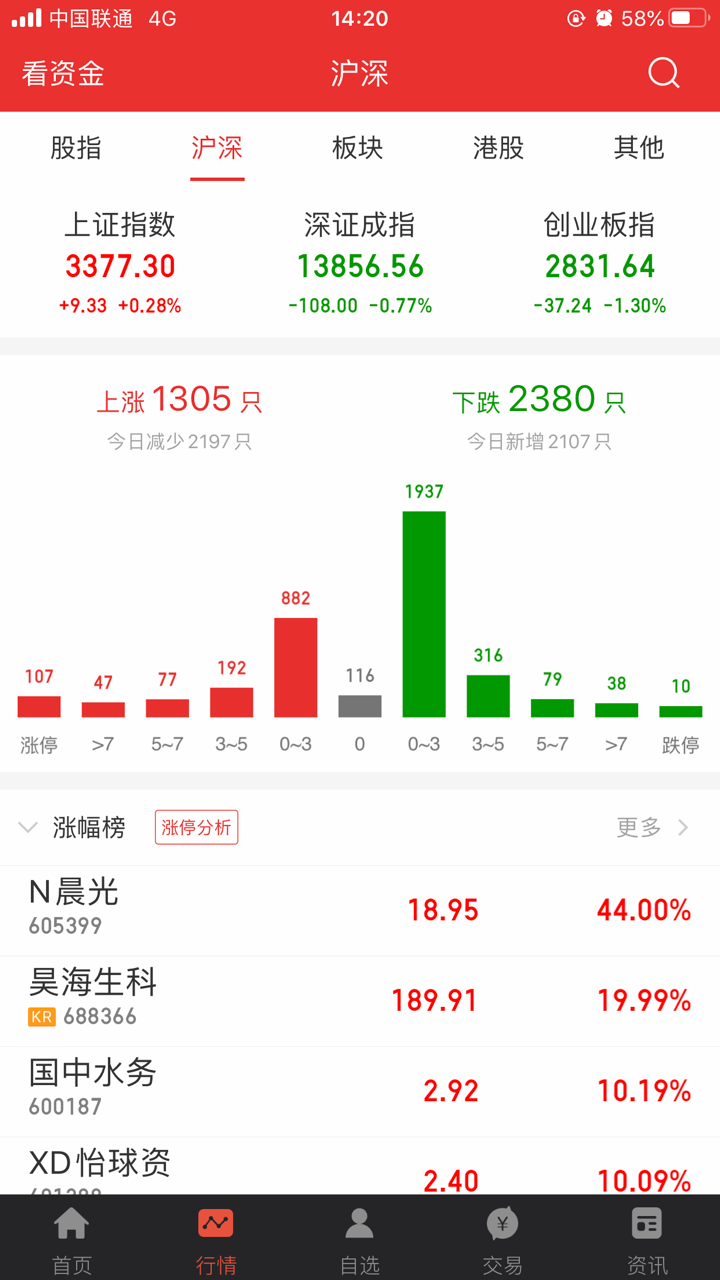

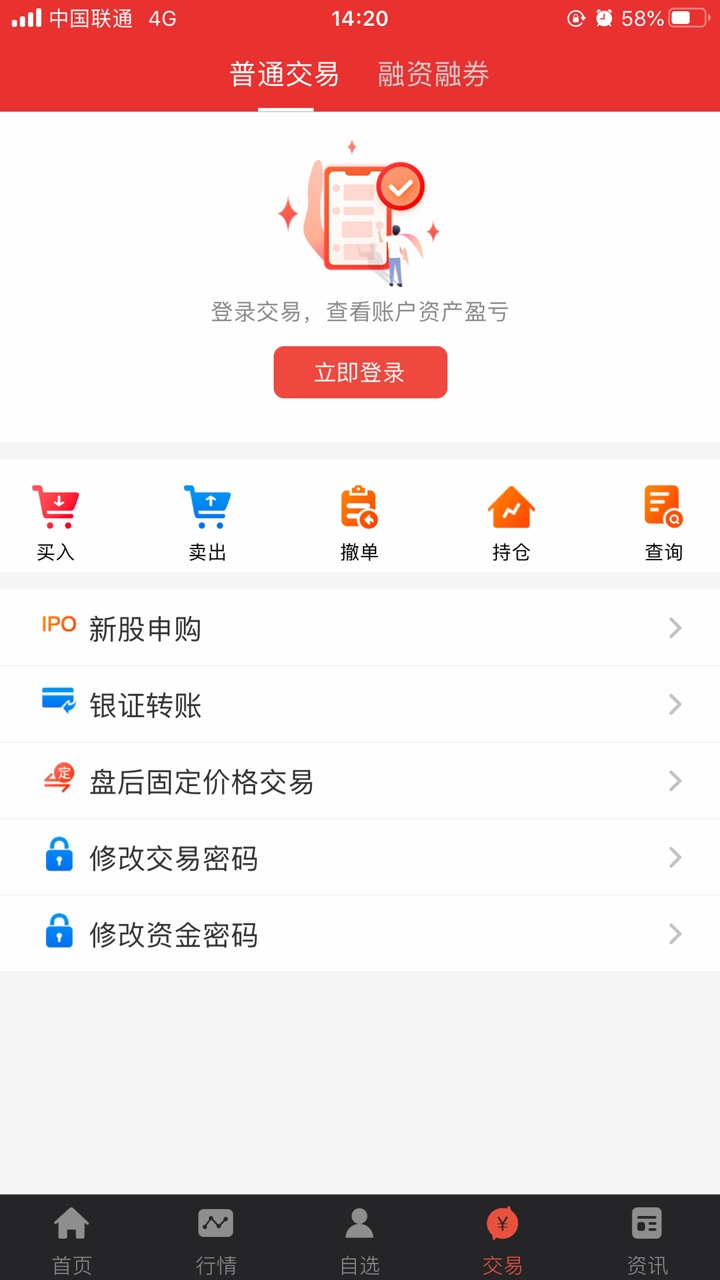

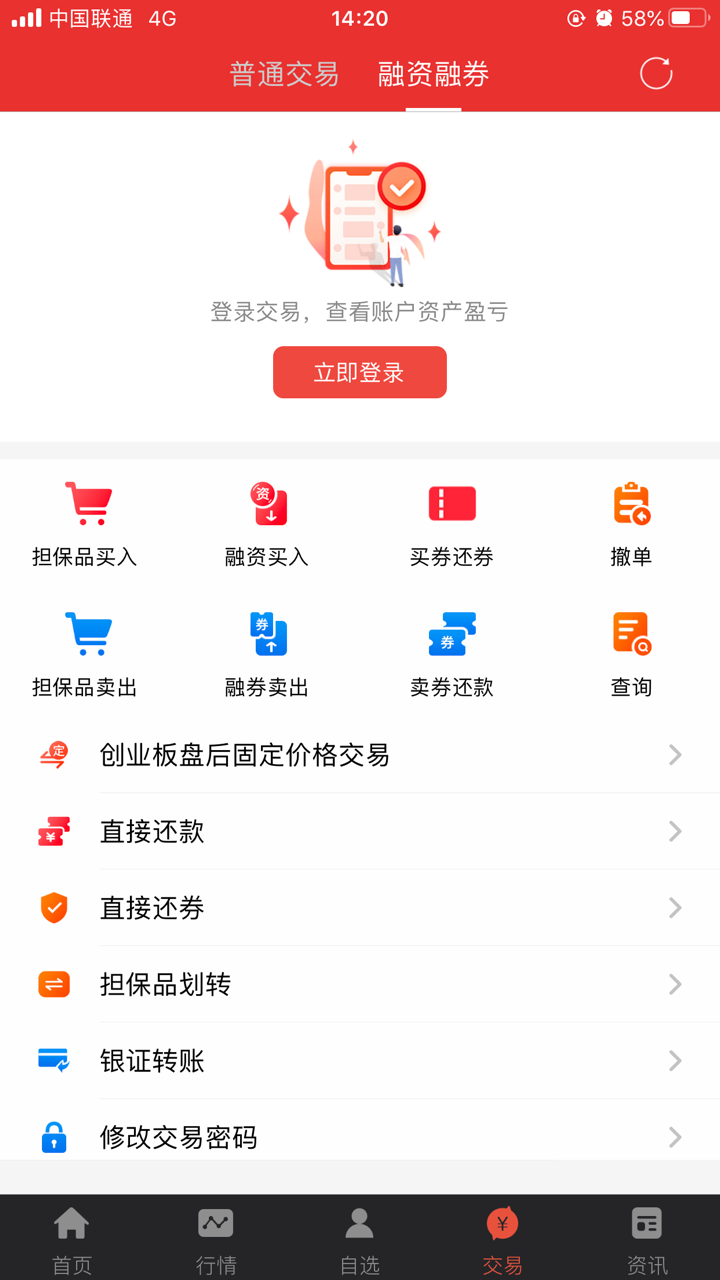

交易平台

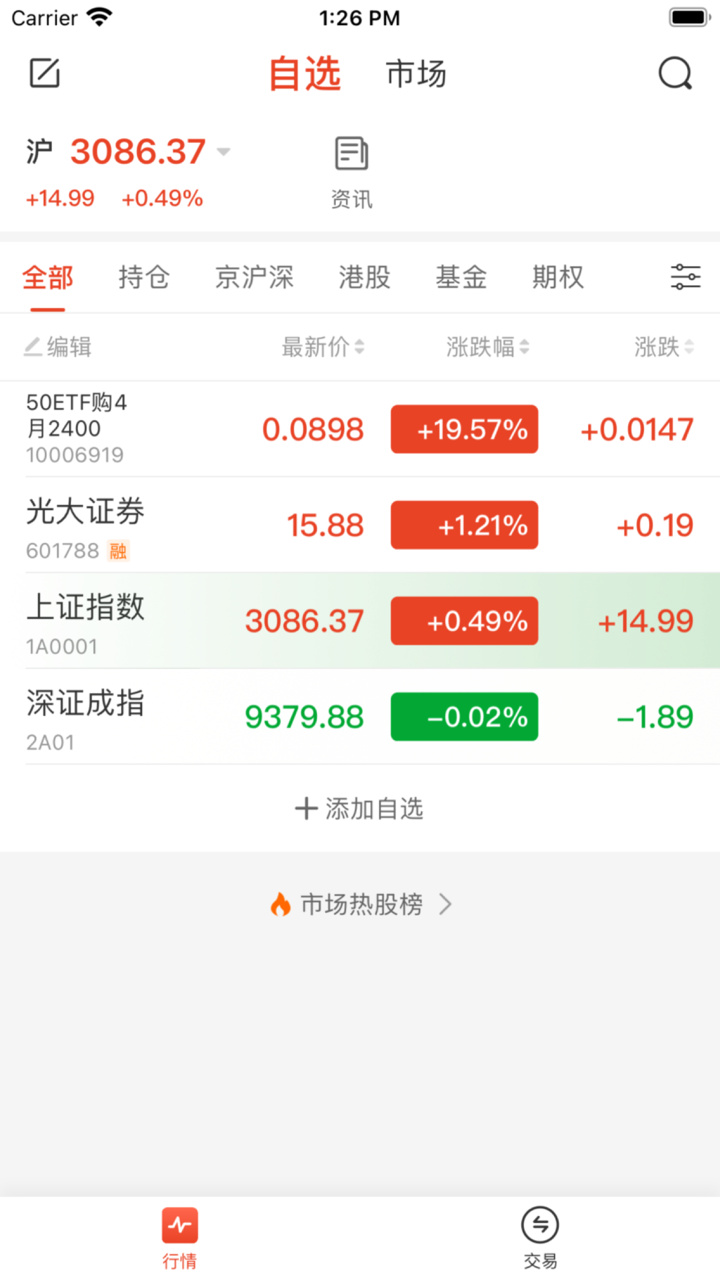

光大证券 声称使用世界著名的MetaTrader 4平台,以其先进的图表工具和强大的功能而闻名。

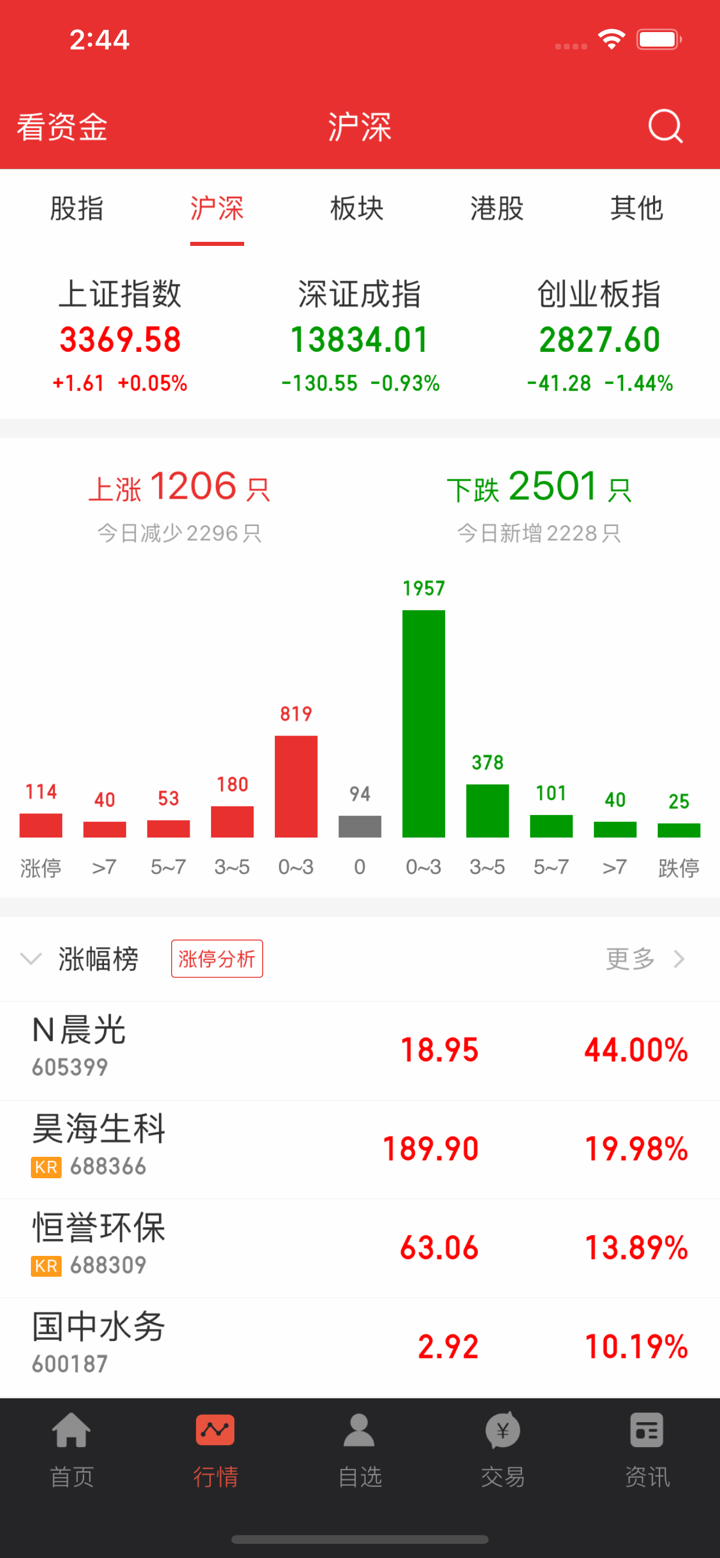

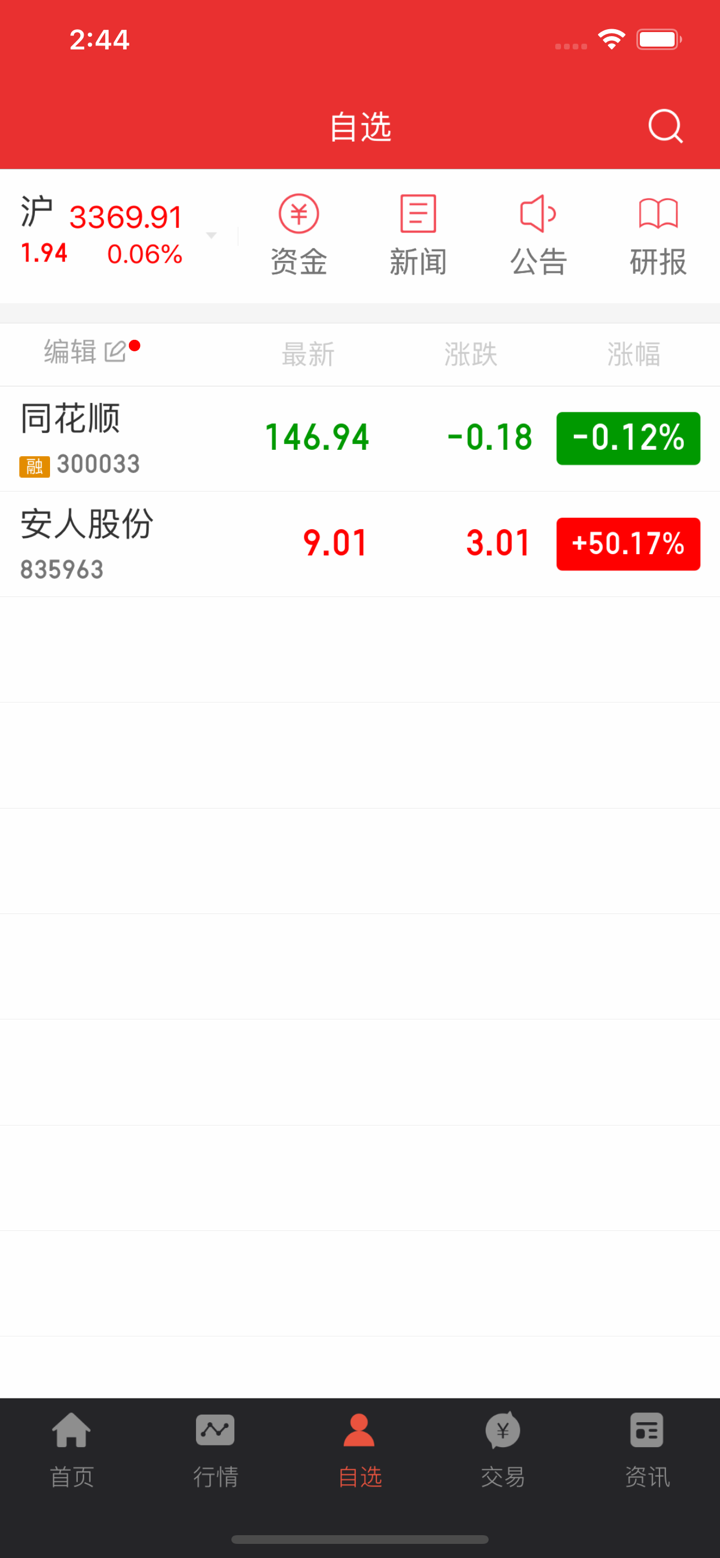

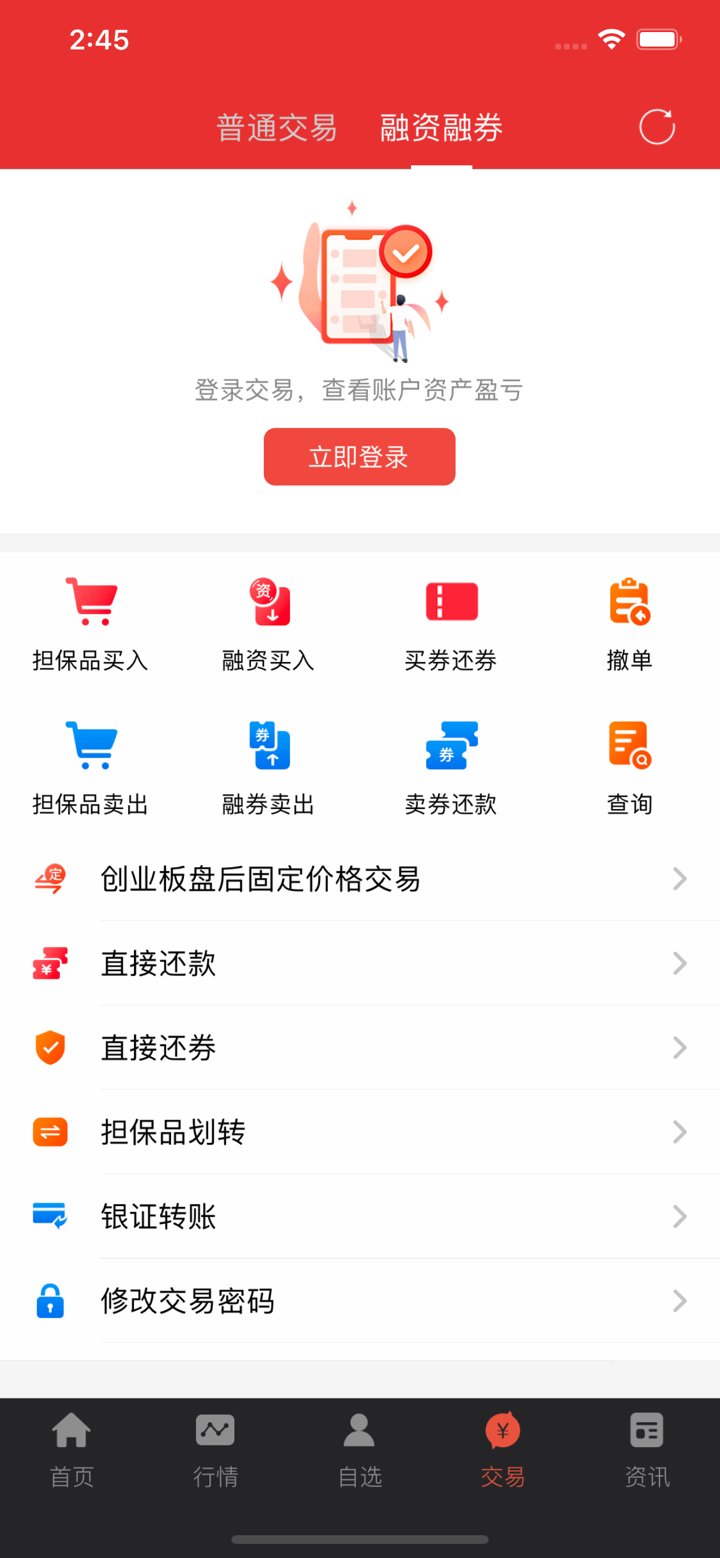

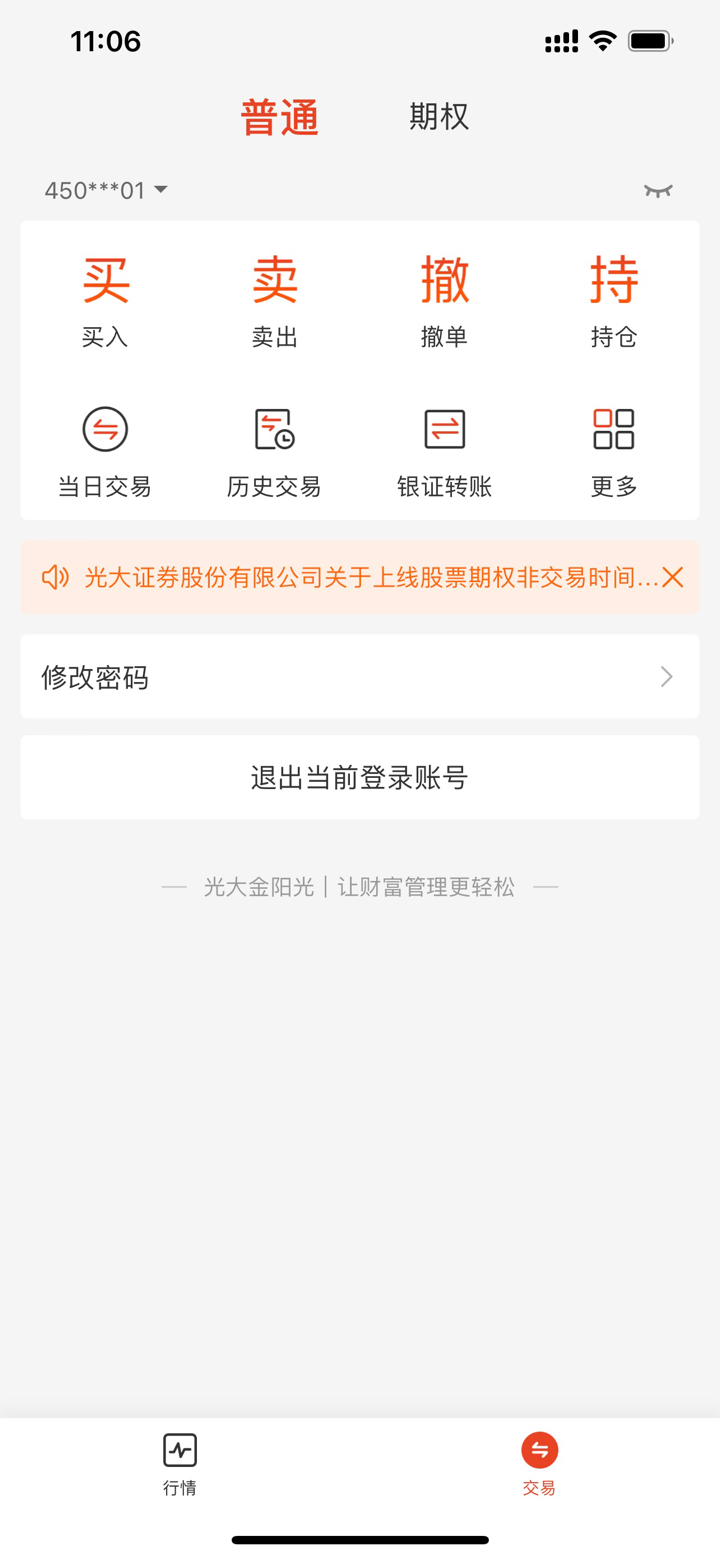

此外,它推出了自己开发的交易应用 光大证券 GO!,可以通过iOS和Android设备进行访问。

除了上述两款应用之外,该公司还提供了诸如eMO!、HK Trader Pro、USstock Pro等多种交易系统,让投资者选择最适合他们交易习惯和经验的系统。