Moshiheya

1-2年

Is United Securities Co. overseen by any regulatory bodies, and if so, which financial authorities are responsible for its regulation?

In my thorough review of United Securities Co., I found that it is not currently overseen by any recognized regulatory body. Despite a long operational history since 1996 and the offering of services in Palestine, the absence of regulatory oversight is a significant concern for me as a trader. A lack of valid regulation means there’s no independent authority ensuring the broker adheres to strict financial standards, a factor which directly impacts client fund safety and dispute resolution mechanisms.

When considering any broker, especially one providing leverage up to 1:300 and dealing in international markets, I place high value on transparent, verifiable regulation from authorities like ASIC, FCA, or CySEC. United Securities Co.’s unregulated status means I would have far less recourse in cases of unexpected issues or disputes, and I know from experience that regulatory frameworks protect not just funds but also ensure sound operational practices. For these reasons, I am cautious about using or recommending United Securities Co. Without clear supervision from a recognized financial authority, I’m unable to consider this provider a secure option for my trading capital.

webgalaxy

1-2年

Is it possible to deposit funds into my United Securities Co. account with cryptocurrencies such as Bitcoin or USDT?

Based on my careful review of United Securities Co., I was unable to find any mention or indication that funding accounts via cryptocurrencies like Bitcoin or USDT is supported. From what I could see, their accepted payment methods are limited to VISA, Mastercard, and traditional bank transfers. This is a crucial point for me as a trader who often assesses the flexibility of deposit and withdrawal methods, particularly when dealing with an international broker. I tend to be especially cautious with unregulated entities, and the limited funding options here intensify that caution.

The absence of crypto funding not only rules out a potentially faster and sometimes more accessible transaction route, but it also serves as an indicator about the broker’s operational scope and regulatory posture. For me, reliable and diverse funding channels are important for both convenience and risk management. Since United Securities Co. currently offers no crypto deposit support and operates without valid regulatory oversight, I strongly advise being thorough and conservative in evaluating whether this matches your needs and risk tolerance. It’s essential to prioritize capital safety, especially when flexible, modern funding methods aren’t available.

Broker Issues

Deposit

Withdrawal

Rojas

1-2年

Are there any inactivity fees at United Securities Co., and if they exist, what are the specific terms and requirements?

In my experience, understanding the full fee structure of any broker is vital, especially when it comes to less obvious charges like inactivity fees. After carefully reviewing the available information about United Securities Co., I could not find any mention of inactivity fees or the specific terms and conditions tied to such charges. This lack of clarity concerned me, as brokers without clear, accessible information about all potential fees pose a heightened risk for unexpected costs down the line.

What stood out for me is that United Securities Co. does charge commissions on some account types and lacks regulatory oversight, which for me raises the bar for due diligence even higher. Typically, reputable brokers are transparent about all fees, including those related to dormant accounts, because hidden or surprise charges negatively impact a trader’s trust and overall cost assessment.

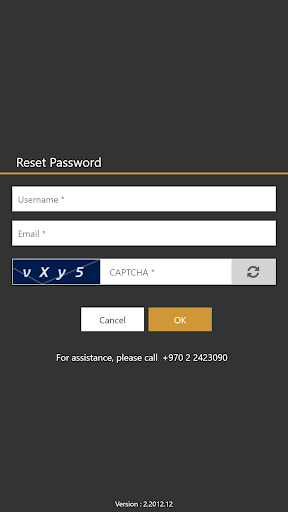

Given that United Securities Co. operates without valid regulation and doesn't provide robust fee disclosures, I would proceed with caution. Before committing funds or opening an account, I would directly contact their support to request explicit documentation regarding any inactivity or maintenance charges. In my view, a responsible trader should always obtain this information in writing before taking the next step, as part of a cautious and well-informed approach to broker selection.

Broker Issues

Fees and Spreads

Rpy Sundram

1-2年

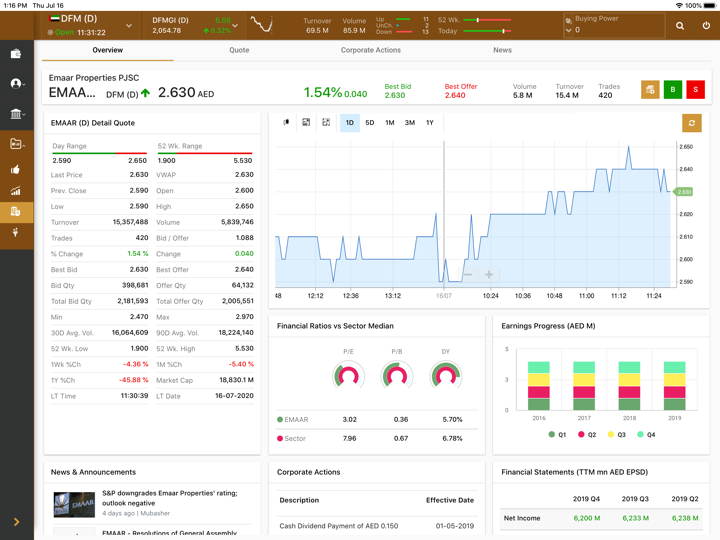

Have you noticed any drawbacks with United Securities Co.'s customer service or the reliability of their trading platform?

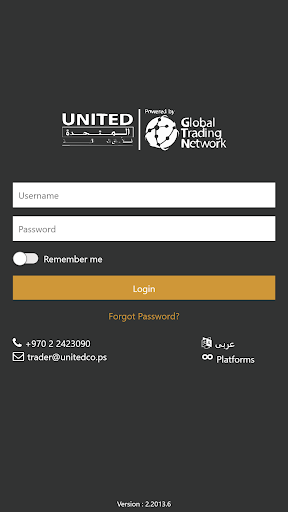

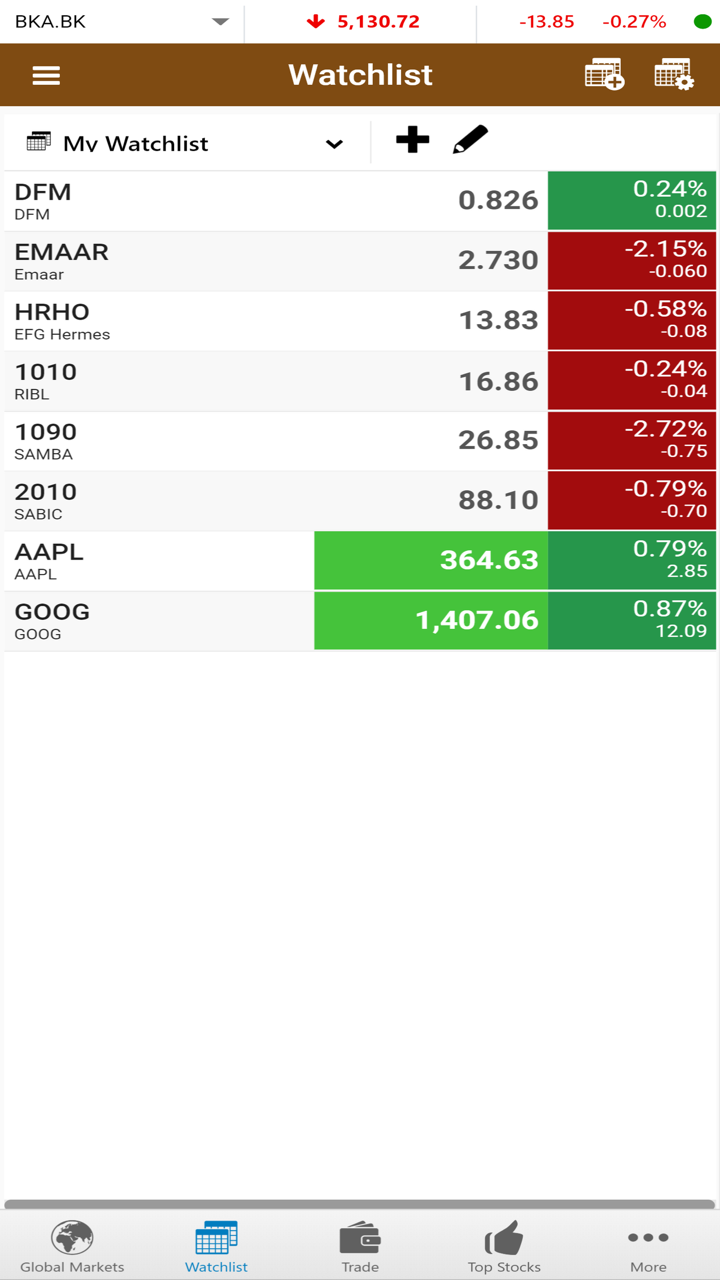

In my experience with United Securities Co., there are significant considerations around both customer service and platform reliability that any trader should weigh carefully. The biggest concern for me is their lack of regulation. Operating without oversight means there's no external authority to ensure fair practices or protect client interests, which adds an inherent layer of risk—not just financially, but also in terms of customer support accountability. While United Securities Co. does provide a range of contact options—phone, email, live chat, and social media—I personally found that this does not necessarily guarantee effective resolution of issues, especially in critical situations where regulated brokers would be held to clear standards.

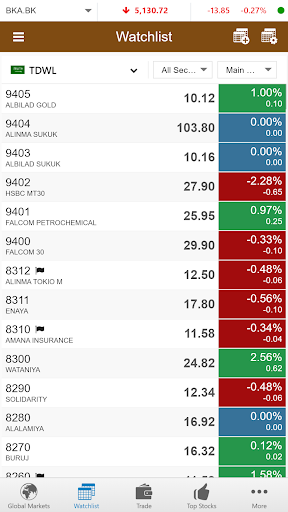

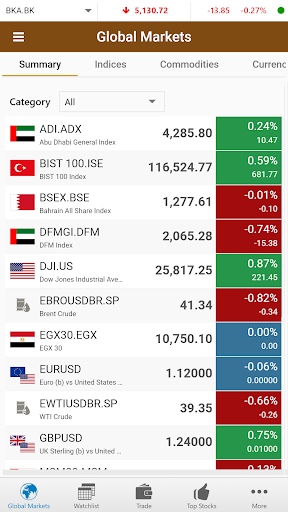

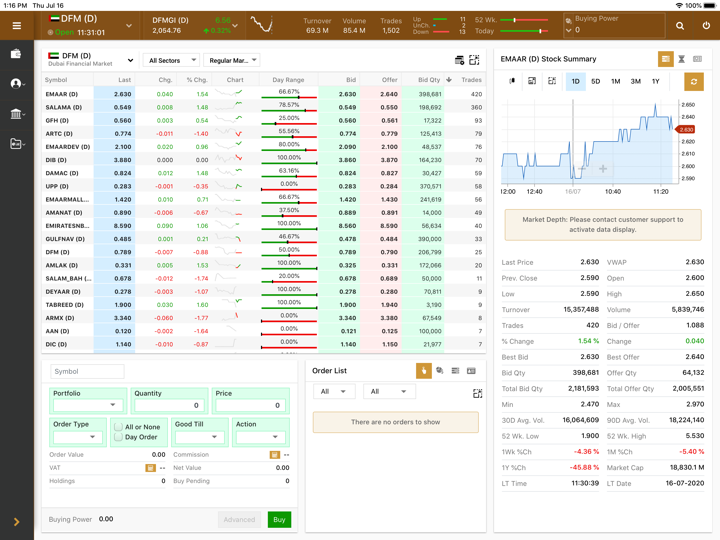

As for their trading platform, they primarily offer MT5, which, in my view, is robust and widely trusted among experienced traders. However, they do not support MT4, which many beginners and even seasoned traders still prefer for its ease of use and extensive community. Another drawback is their execution speed—averaging around 194 milliseconds—which is not exceptionally fast, especially when compared to leading global brokers. For traders who rely on rapid entries and exits, this could be a hindrance.

The absence of a demo account is another point of frustration for me, as it prevents new users from testing the platform and support systems without risk. For those who value high reliability and fully accountable support, the combination of non-regulation and these platform limitations makes United Securities Co. a less attractive choice, especially when compared to established, regulated competitors. I’d recommend a cautious approach and thorough due diligence if considering them.