Şirket özeti

| China-Derivatives Futuresİnceleme Özeti | |

| Kuruluş Yılı | 1996 |

| Kayıtlı Ülke/Bölge | Çin |

| Düzenleme | CFFEX |

| Ürünler ve Hizmetler | Vadeli İşlemler, Aracılık, Yatırım, Danışmanlık, Varlık Yönetimi, Fon |

| Deneme Hesabı | ✅ |

| Kaldıraç | / |

| Spread | / |

| İşlem Platformu | China-Derivatives Futures App, Boyi İstemci Bulutu, Wenhua Finans, Yisheng Kutup Yıldızı ve TradeBlazer |

| Minimum Yatırım | / |

| Müşteri Desteği | Canlı Destek |

| E-posta: office@cdfco.com.cn | |

| Telefon: 400-688-1117 | |

| Adres: Zhongyan Futures Co., Ltd., Binası B, Jinchang'an Binası, Dongsi Dördüncü Çevre Yolu No. 82, Chaoyang Bölgesi, Pekin | |

China-Derivatives Futures Bilgileri

1996 yılında kurulan China-Derivatives Futures Co., Ltd., Çin Finansal Vadeli İşlemler Borsası (CFFEX) denetimi altında düzenlenmiş bir kuruluştur. Ancak yalnızca Çin'deki müşterilere hizmet verir ve iç piyasada önemli bir oyuncudur. Çin Menkul Kıymetler Düzenleme Komisyonu (CSRC) tarafından onaylanmış kapsamlı bir finansal şirkettir ve yerli emtia vadeli işlemler aracılığı, finansal vadeli işlemler aracılığı, vadeli işlem danışmanlığı, varlık yönetimi ve menkul kıymet yatırım fonu satışı konularında uzmanlaşmıştır.

Artıları ve Eksileri

| Artılar | Eksiler |

| CFFEX tarafından düzenlenir | Şeffaflık eksikliği |

| Vadeli işlemlere uzmanlaşmıştır | |

| Deneme işlemi desteklenir | |

| Çeşitli işlem platformları | |

| Uzun işletme geçmişi |

China-Derivatives Futures Güvenilir mi?

China-Derivatives Futures , CFFEX tarafından 0197 lisans numaralarıyla düzenlenmektedir.

| Düzenlenen Ülke | Düzenleyici Otorite | Düzenleme Durumu | Düzenlenen Kuruluş | Lisans Türü | Lisans Numarası |

| Çin | Çin Finansal Vadeli İşlemler Borsası (CFFEX) | Düzenlenmiş | Çin Emtia Vadeli İşlemler Co., Ltd. | Vadeli İşlem Lisansı | 0197 |

Ürünler & Hizmetler

China-Derivatives Futures genellikle vadeli işlemlere odaklanır ve aynı zamanda aracılık, yatırım, danışmanlık, varlık yönetimi ve fonlar gibi kapsamlı bir yatırım hizmetleri yelpazesi sunar.

| Ürünler & Hizmetler | Desteklenen |

| Vadeli İşlemler | ✔ |

| Fonlar | ✔ |

| Aracılık | ✔ |

| Yatırım | ✔ |

| Danışmanlık | ✔ |

| Varlık Yönetimi | ✔ |

İşlem Platformu

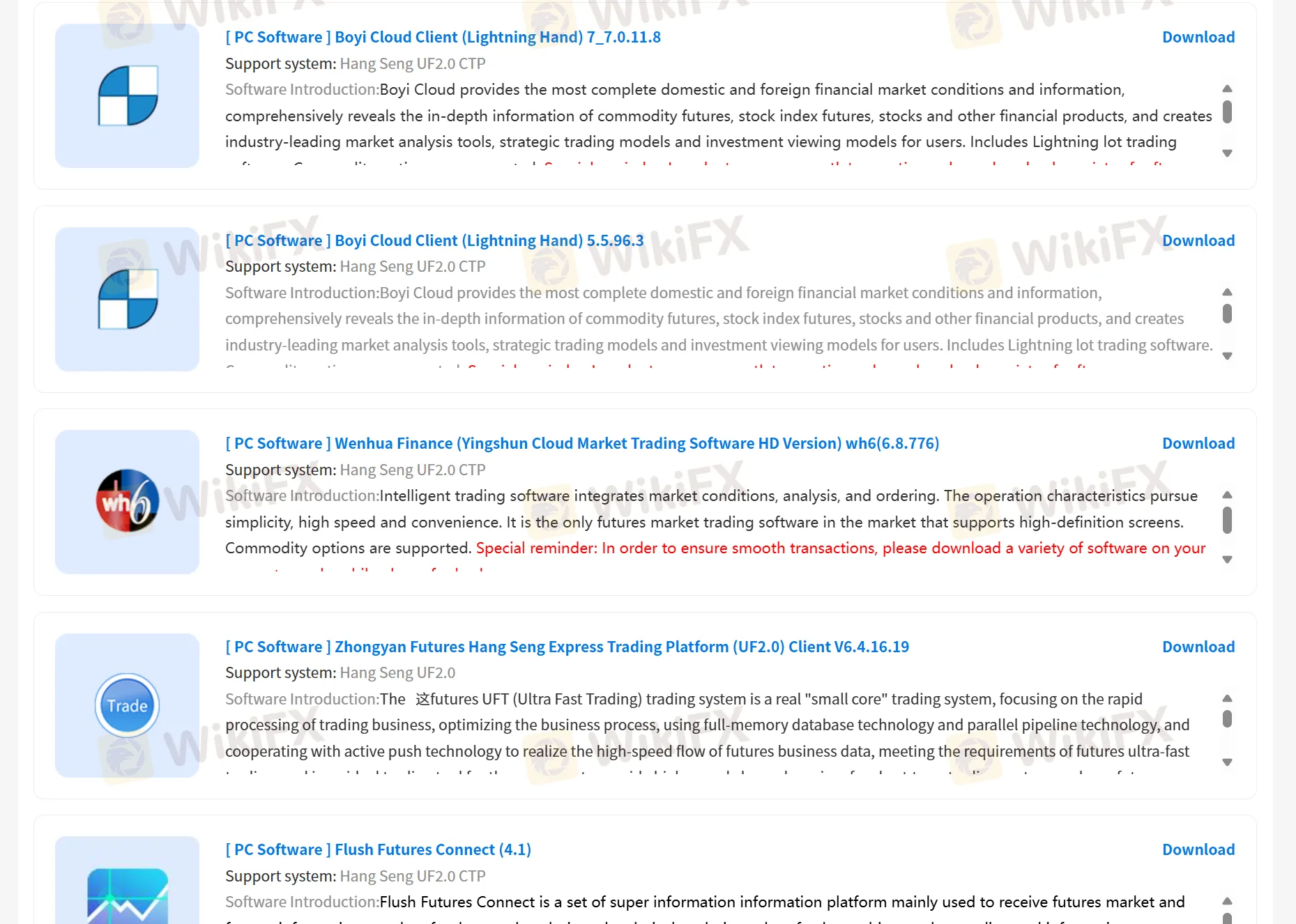

China Derivatives Futures, özel platformlar, China-Derivatives Futures App ve Boyi Client Cloud, Wenhua Finance, Yisheng Polar Star ve TradeBlazer aracılığıyla işlem yapmayı destekler. Ayrıca müşterilere işlem simülasyonu yapma fırsatı da sunar.

| İşlem Platformu | Desteklenen | Kullanılabilir Cihazlar | Uygun |

| China-Derivatives Futures App | ✔ | PC, Mobil | / |

| Boyi Client Cloud | ✔ | PC | / |

| Wenhua Finance | ✔ | PC | / |

| Yisheng Polar Star | ✔ | PC | / |

| TradeBlazer | ✔ | PC | / |

扶众法援

Hong Kong

今年3月,我收到了好友申请,因为我也最近在一些论坛留言过,所以觉得应该是某名股友找我讨论。添加好友之后,立刻被拉进了内幕操作预备群,他们先是操作股票,还公布了自己在平台账户盈利了几倍的截图,让我有点信服。刚好天天在家闲来无事做便想赚点零花钱,我也就没有退群,群里面每天有老师都会分享这方面的知识,也有很多群友在里面跟着老师在做,看他们都是赚了的,我来了兴趣也就私聊老师也开了个户每天跟他们操作。 后来这个老师一直强调跟我说,资金越大危险越小,让我加大资金加到50万,可以给我推荐更加专业老师喊单跟着老师操作,老师会帮我看着单子,不需要自己太费心。我说我没有这么多,就先这样操作吧,后来有托过来说跟着老师做,老师专业,自己做会亏得,将信将疑商量着给我先安排老师,条件是先把资金加到50万多,后面再加。开始老师操作有赚有亏。后来亏到剩下10W多的时候我想试一下出金通道,发现一直没有到账。再次申请时却发现之前的申请已经被驳回了,完全不是出入金自由的模式,这个时候我意识到不对劲,和平台联系被告知我账号有风险暂不给与出金。和老师联系也是一样的话敷衍,接着又是给我发什么“出入金延迟通告”什么的原因一直搁置了一个多星期。

Teşhir

Cris Men

Ekvador

hiçbir zaman para çekme veya benzeri şeylerle ilgili sorun yaşamadım

Pozitif

Maximilian 111

Nijerya

Burada sürekli olarak emtia ticareti yapıyorum. Şeffaf ücretler sunuyor ve her zaman sağlam bir tercih olan harika müşteri hizmetleri sunuyor.

Pozitif

Vegas

Kolombiya

China-Derivatives Futures co,.LTD. çeşitli ticaret uygulamaları sunmaktadır, ticaret hataları durumunda çok samimidir. Ve şirketin resmi bir düzenleyici kurumu vardır, ticaret bilgileri açık ve şeffaftır, çok güvende hissediyorum.

Pozitif