مقدمة عن الشركة

| China-Derivatives Futuresملخص المراجعة | |

| تأسست | 1996 |

| البلد/المنطقة المسجلة | الصين |

| التنظيم | CFFEX |

| المنتجات والخدمات | العقود الآجلة، وساطة، استثمار، استشارات، إدارة الأصول، صندوق |

| حساب تجريبي | ✅ |

| الرافعة المالية | / |

| الانتشار | / |

| منصة التداول | China-Derivatives Futures App، Boyi Client Cloud، Wenhua Finance، Yisheng Polar Star، وTradeBlazer |

| الحد الأدنى للإيداع | / |

| دعم العملاء | الدردشة المباشرة |

| البريد الإلكتروني: office@cdfco.com.cn | |

| الهاتف: 400-688-1117 | |

| العنوان: Zhongyan Futures Co.، Ltd.، الطابق 7، المبنى B، Jinchang'an Building، رقم 82 طريق الدائري الرابع Dongsi، منطقة Chaoyang، بكين | |

China-Derivatives Futures معلومات

تأسست في عام 1996، China-Derivatives Futures Co.، Ltd. هي كيان محظور تحت إشراف بورصة العقود الآجلة المالية الصينية (CFFEX). ومع ذلك، تخدم فقط العملاء داخل الصين وتعتبر لاعبًا بارزًا في السوق المحلية للمشتقات. إنها شركة مالية شاملة معتمدة من قبل هيئة الرقابة على الأوراق المالية الصينية (CSRC) والتي تختص في وساطة السلع الآجلة المحلية، ووساطة العقود الآجلة المالية، واستشارات تداول العقود الآجلة، وإدارة الأصول، والعرض العام لمبيعات صندوق الاستثمار في الأوراق المالية.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تنظيمها بواسطة CFFEX | نقص في الشفافية |

| تخصص في تداول العقود الآجلة | |

| دعم تداول تجريبي | |

| منصات تداول متنوعة | |

| تاريخ عمل طويل |

هل China-Derivatives Futures شرعية؟

China-Derivatives Futures منظمة بواسطة CFFEX برقم ترخيص 0197.

| البلد المنظم | السلطة المنظمة | الحالة التنظيمية | الكيان المنظم | نوع الترخيص | رقم الترخيص |

| الصين | بورصة العقود الآجلة المالية الصينية (CFFEX) | منظم | شركة السلع الآجلة الصينية المحدودة | ترخيص العقود الآجلة | 0197 |

المنتجات والخدمات

China-Derivatives Futures يركز بشكل رئيسي على تداول العقود الآجلة، ويقدم أيضًا مجموعة شاملة من خدمات الاستثمار، مثل الوساطة، والاستثمار، والاستشارات، وإدارة الأصول، والصناديق.

| المنتجات والخدمات | مدعوم |

| العقود الآجلة | ✔ |

| الصناديق | ✔ |

| الوساطة | ✔ |

| الاستثمار | ✔ |

| الاستشارات | ✔ |

| إدارة الأصول | ✔ |

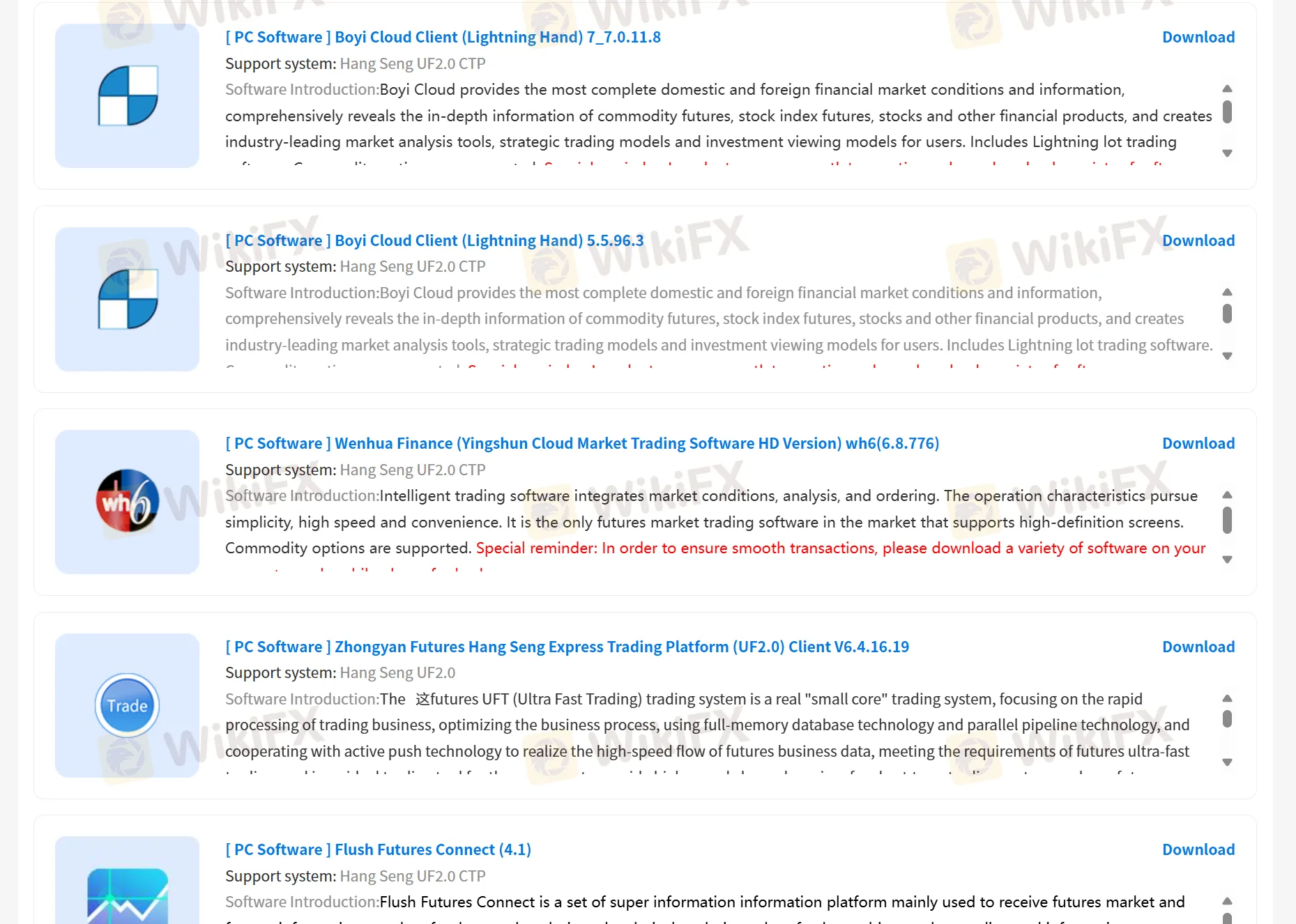

منصة التداول

تدعم شركة العقود الآجلة الصينية التداول من خلال منصات مملوكة، وتطبيق China-Derivatives Futures ، و Boyi Client Cloud، و Wenhua Finance، و Yisheng Polar Star، و TradeBlazer. بالإضافة إلى ذلك، توفر أيضًا فرصًا للعملاء لمحاكاة التداول.

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسب لـ |

| تطبيق China-Derivatives Futures | ✔ | كمبيوتر شخصي، هاتف محمول | / |

| Boyi Client Cloud | ✔ | كمبيوتر شخصي | / |

| Wenhua Finance | ✔ | كمبيوتر شخصي | / |

| Yisheng Polar Star | ✔ | كمبيوتر شخصي | / |

| TradeBlazer | ✔ | كمبيوتر شخصي | / |

扶众法援

هونغ كونغ

今年3月,我收到了好友申请,因为我也最近在一些论坛留言过,所以觉得应该是某名股友找我讨论。添加好友之后,立刻被拉进了内幕操作预备群,他们先是操作股票,还公布了自己在平台账户盈利了几倍的截图,让我有点信服。刚好天天在家闲来无事做便想赚点零花钱,我也就没有退群,群里面每天有老师都会分享这方面的知识,也有很多群友在里面跟着老师在做,看他们都是赚了的,我来了兴趣也就私聊老师也开了个户每天跟他们操作。 后来这个老师一直强调跟我说,资金越大危险越小,让我加大资金加到50万,可以给我推荐更加专业老师喊单跟着老师操作,老师会帮我看着单子,不需要自己太费心。我说我没有这么多,就先这样操作吧,后来有托过来说跟着老师做,老师专业,自己做会亏得,将信将疑商量着给我先安排老师,条件是先把资金加到50万多,后面再加。开始老师操作有赚有亏。后来亏到剩下10W多的时候我想试一下出金通道,发现一直没有到账。再次申请时却发现之前的申请已经被驳回了,完全不是出入金自由的模式,这个时候我意识到不对劲,和平台联系被告知我账号有风险暂不给与出金。和老师联系也是一样的话敷衍,接着又是给我发什么“出入金延迟通告”什么的原因一直搁置了一个多星期。

البلاغات

Cris Men

الإكوادور

لم يكن لدي أي مشاكل مع عمليات السحب أو أي شيء من هذا القبيل

إيجابي

Maximilian 111

نيجيريا

أنا أتداول السلع هنا طوال الوقت. يقدم رسوم شفافة وخدمة عملاء رائعة، وهذا هو دائمًا اختياري الثابت.

إيجابي

Vegas

كولومبيا

شركة China-Derivatives Futures co,.LTD. توفر مجموعة متنوعة من تطبيقات التداول، في حالة وقوع أخطاء في التداول، تكون ودية جدًا. والشركة لديها هيئة تنظيمية رسمية، ومعلومات التداول مفتوحة وشفافة، أشعر بالطمأنينة كثيرًا.

إيجابي