Описание компании

| YM Securities Обзор | |

| Основана | 2007 |

| Страна/Регион регистрации | Япония |

| Регулирование | FSA |

| Торговые продукты | Акции, Облигации и Инвестиционные фонды |

| Торговая платформа | / |

| Минимальный депозит | / |

| Поддержка клиентов | / |

Информация о YM Securities

YM Securities - это финансовая компания, входящая в состав японской финансовой группы Ямагучи (YMFG), с головным офисом в Японии. Основная деятельность компании - торговля акциями, облигациями и инвестиционными фондами.

Плюсы и минусы

| Плюсы | Минусы |

| Регулируется FSA | Сложная структура комиссий |

| Длительная история работы | Высокий порог членства |

| Система льгот для членов (скидка 80% на предварительно внесенные средства свыше 10 000 000 JPY) | Преимущественно японский контент |

| Ограниченное количество торговых продуктов | |

| Неясные каналы поддержки клиентов |

YM Securities Легальность

YM Securities - это юридически зарегистрированный брокерский дом в Японии, регулируемыйФинансовым агентством Японии (FSA). Его регистрационный номер - 中国財務局長(金商)第8号.

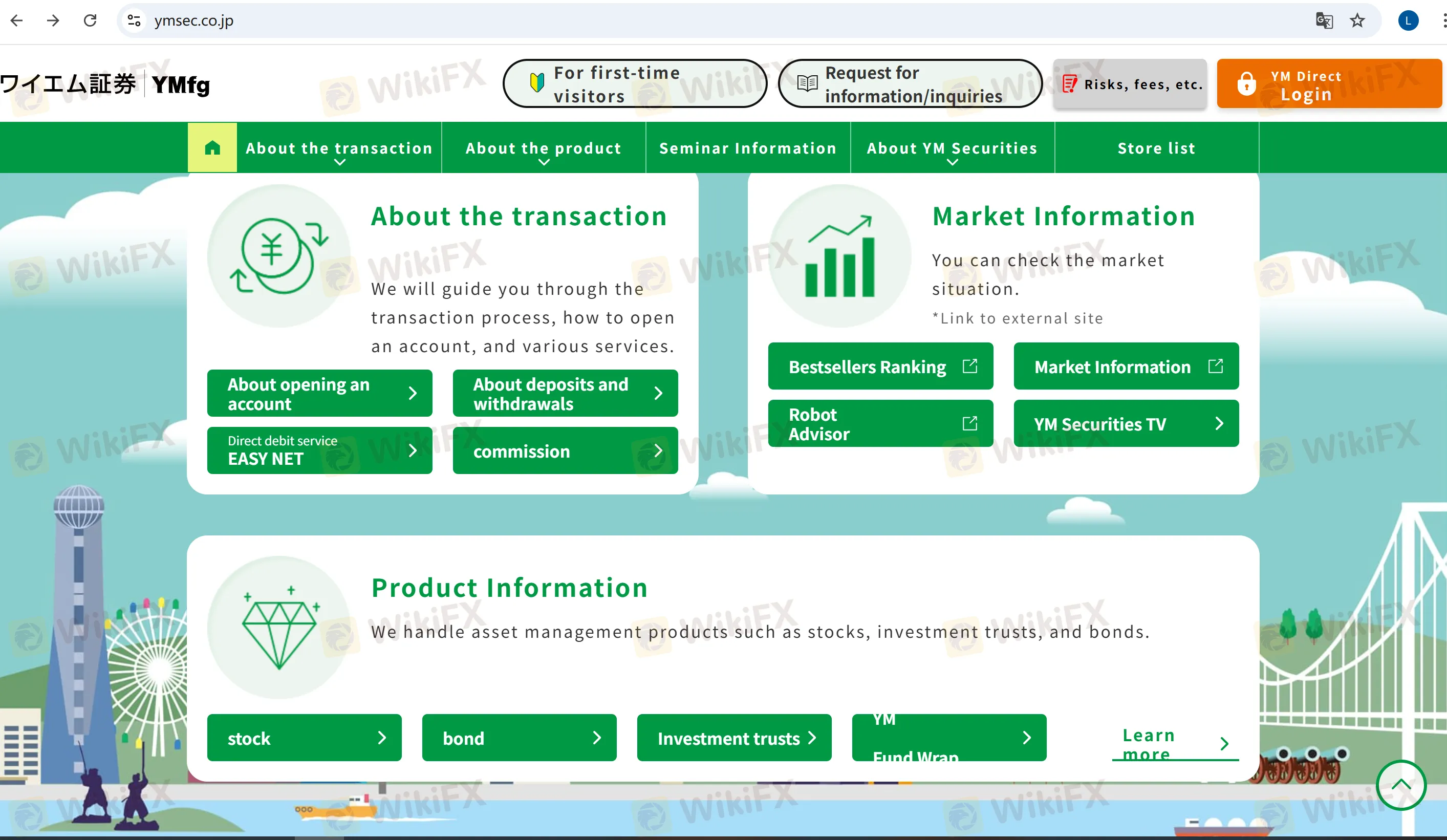

На что я могу торговать на YM Securities?

YM Securities предлагает внутренние и иностранные акции, облигации и инвестиционные фонды (фонды), инвестирующие в темы, такие как внутренние и иностранные акции, облигации и недвижимость, и поддерживает планы регулярного накопления (накопление инвестиционных фондов).

| Торговые продукты | Поддерживается |

| Акции | ✔ |

| Облигации | ✔ |

| Инвестиционные фонды | ✔ |

| Форекс | ❌ |

| Товары | ❌ |

| Индексы | ❌ |

| Криптовалюты | ❌ |

| Опционы | ❌ |

| ETF | ❌ |

| Инвестиционные фонды | ❌ |

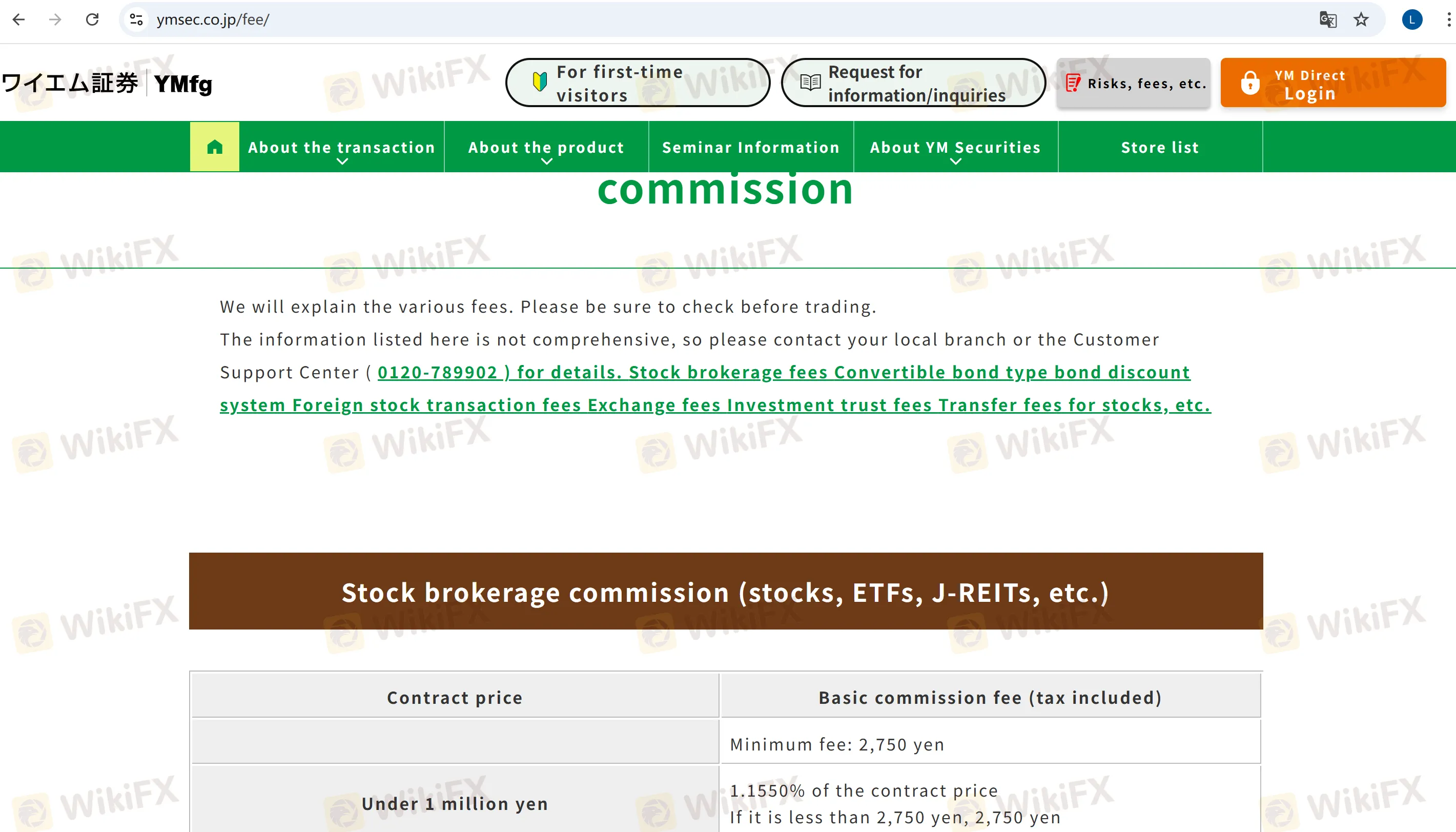

Сборы YM Securities

Основные сборы YM Securities следующие:

Сборы за торговлю акциями (Внутренние акции, ETF и т. д.): Минимум 2 750 JPY (включая налоги), взимается по тарифам в зависимости от суммы сделки (например, 1,155% для сумм менее 1 000 000 JPY; 0,88% + 2 750 JPY для 1 000 000–5 000 000 JPY). Для членов доступна скидка 20%.

Иностранные сборы за торговлю акциями: Включают местные сборы (например, биржевые сборы) и внутренние агентские сборы (например, 1,43% для сумм менее 1 000 000 JPY).

Сборы за торговлю облигациями: Продукты типа конвертируемых облигаций имеют минимальную плату в размере 2 750 JPY, взимаемую по тарифам в зависимости от суммы сделки (например, 1,1% для сумм менее 1 000 000 JPY).

Прочие сборы: Сбор за перевод счета: начинается с 1 100 JPY за единицу, с максимальной суммой 6 600 JPY.

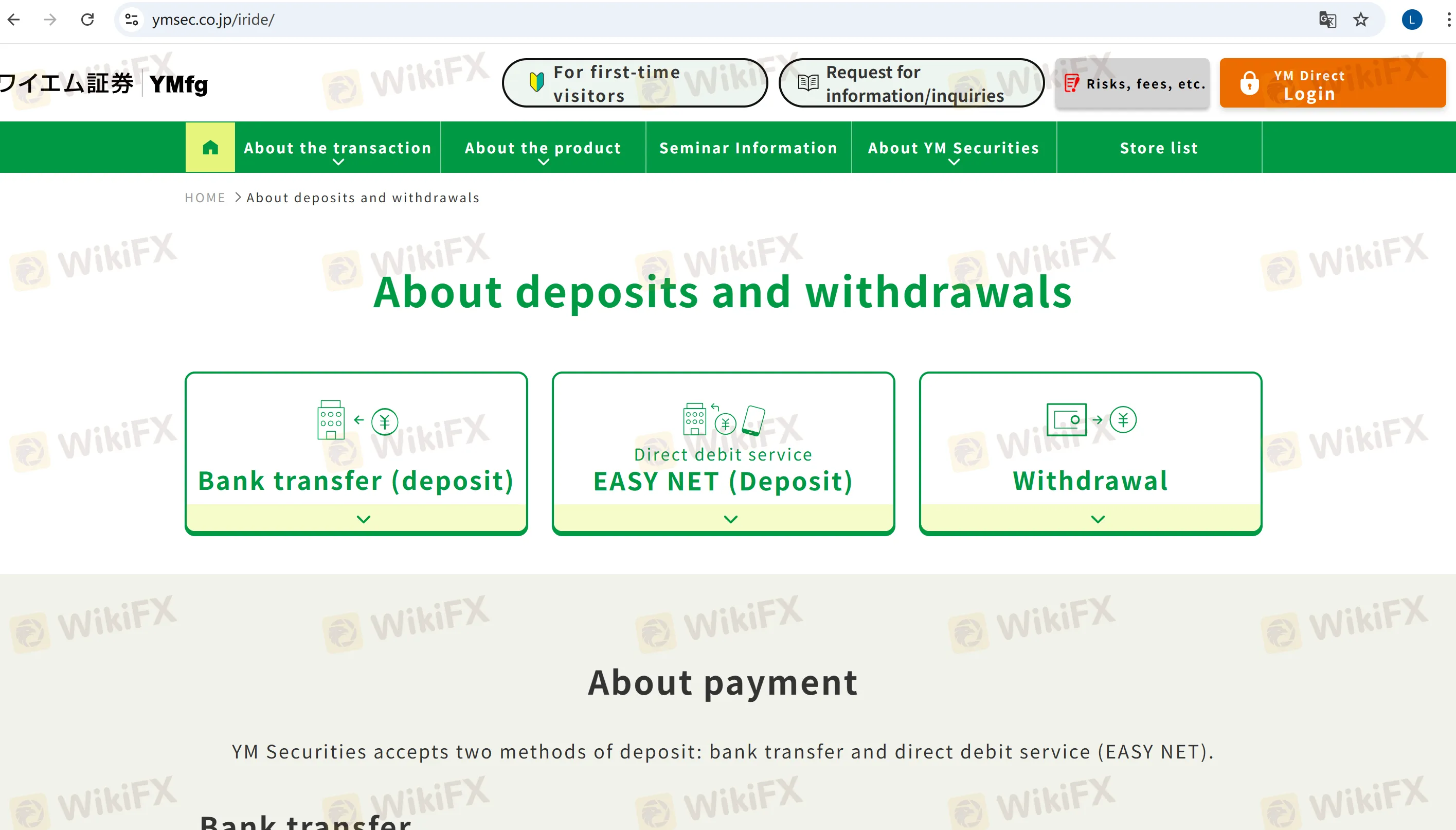

Депозит и вывод средств

Депозит

Банковский перевод: Поддерживает счета в банках Ямагучи, Момидзи и Китакюшу. Расходы на обслуживание обычно покрываются брокером.

EASY NET: Бесплатная услуга мгновенного перевода средств, связанная с групповыми банками, доступная через онлайн-платформу или по телефонным инструкциям.

Вывод

Запросы можно делать через онлайн-платформу или по телефону, и средства будут автоматически переведены на предварительно зарегистрированный банковский счет. Вы можете указать рабочий день с следующего дня для получения средств.