Resumo da empresa

| Fidelity Resumo da Revisão | |

| Fundação | 1969 |

| País/Região Registrada | EUA |

| Regulação | SFC |

| Produtos e Serviços | Fundos mútuos globais, planos de aposentadoria MPF & ORSO, soluções de investimento temático e multiativos |

| Conta Demonstrativa | ❌ |

| Plataforma de Negociação | Fidelity Online, Fidelity Aplicativo Móvel |

| Depósito Mínimo | HK$1.000/mês (Plano de Investimento Mensal) |

| Suporte ao Cliente | Telefone: (852) 2629 2629 |

| Email: hkenquiry@fil.com | |

Informações sobre Fidelity

Fundada em 1969, Fidelity é uma empresa financeira regulamentada pela SFC, oferecendo soluções de investimento internacionais. Não oferece FX ou CFDs, mas concentra-se em fundos mútuos, planos de aposentadoria (MPF/ORSO) e estratégias temáticas.

Prós e Contras

| Prós | Contras |

| Regulado pela SFC | Sem conta demo ou conta islâmica (livre de swap) |

| Ampla seleção de fundos mútuos e soluções de aposentadoria | Taxas relativamente altas |

| Estrutura de taxas escalonadas beneficia investidores com saldos altos | |

| Tempo de operação longo | |

| Vários tipos de conta |

Fidelity é Legítimo?

Sim, Fidelity é regulado. É autorizado pela Comissão de Valores Mobiliários e Futuros (SFC) de Hong Kong com uma licença de Negociação em contratos futuros. O número da licença é AAG408.

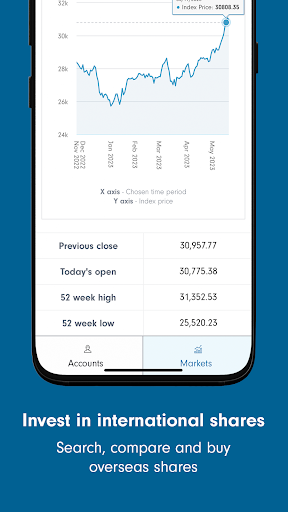

Produtos e Serviços

Fidelity oferece fundos mútuos globais, planos de aposentadoria (MPF & ORSO) e investimentos temáticos para atender aos objetivos financeiros dos investidores. Eles oferecem criação de renda, investimento sustentável e estratégias multiativos.

| Produtos & Serviços | Característica |

| Fundos Mútuos | Fundos globais em várias moedas e classes de ativos |

| Investimento Temático | Investimentos de longo prazo com base em tendências globais e temas de inovação |

| Soluções Multiativos | Portfólios diversificados combinando diferentes tipos de ativos |

| Investimento Sustentável | Focado em estratégias de investimento ESG e responsáveis |

| MPF (Fundo Providencial Obrigatório) | Fundos de aposentadoria adaptados a diferentes perfis de risco e renda |

| ORSO (Ordenança de Esquemas de Aposentadoria Ocupacional) | Planos de investimento de aposentadoria patrocinados pelo empregador |

| Estratégias de Renda | Opções de investimento globais focadas em renda |

| Investimentos com Foco na Ásia | Fundos que visam oportunidades de crescimento nos mercados asiáticos |

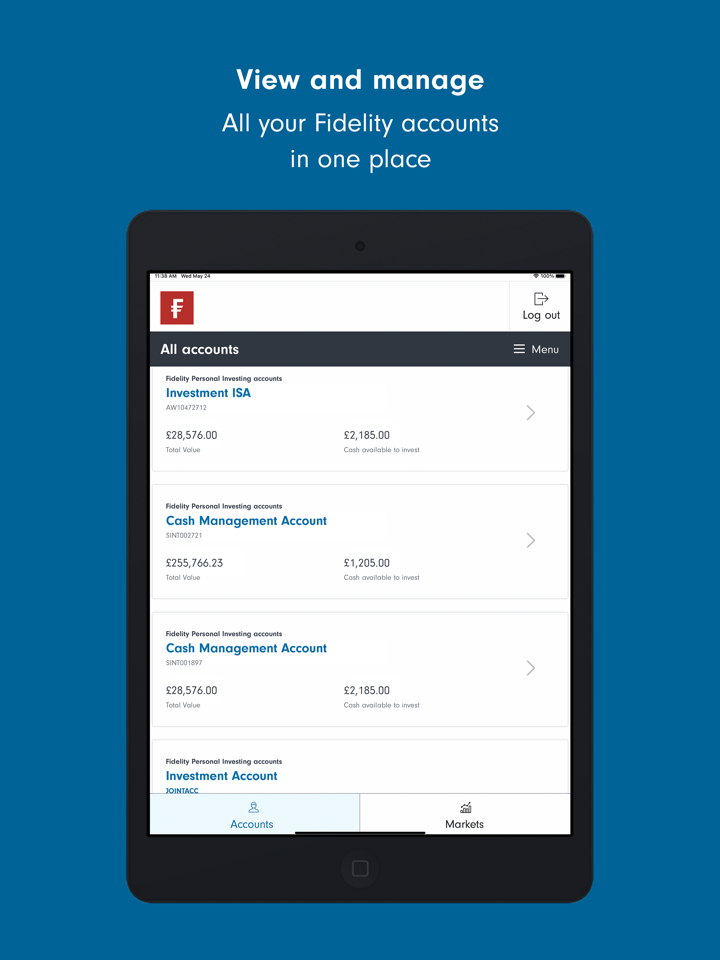

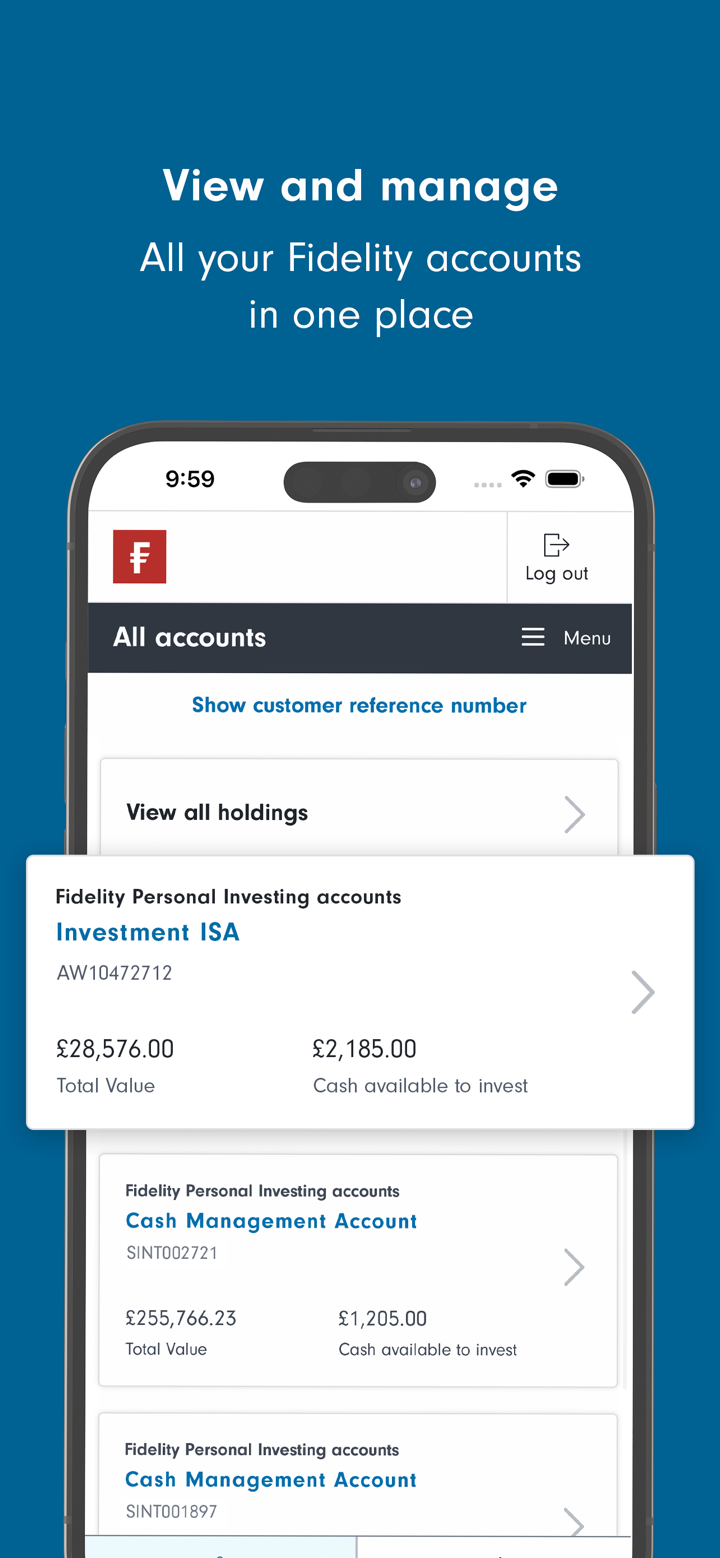

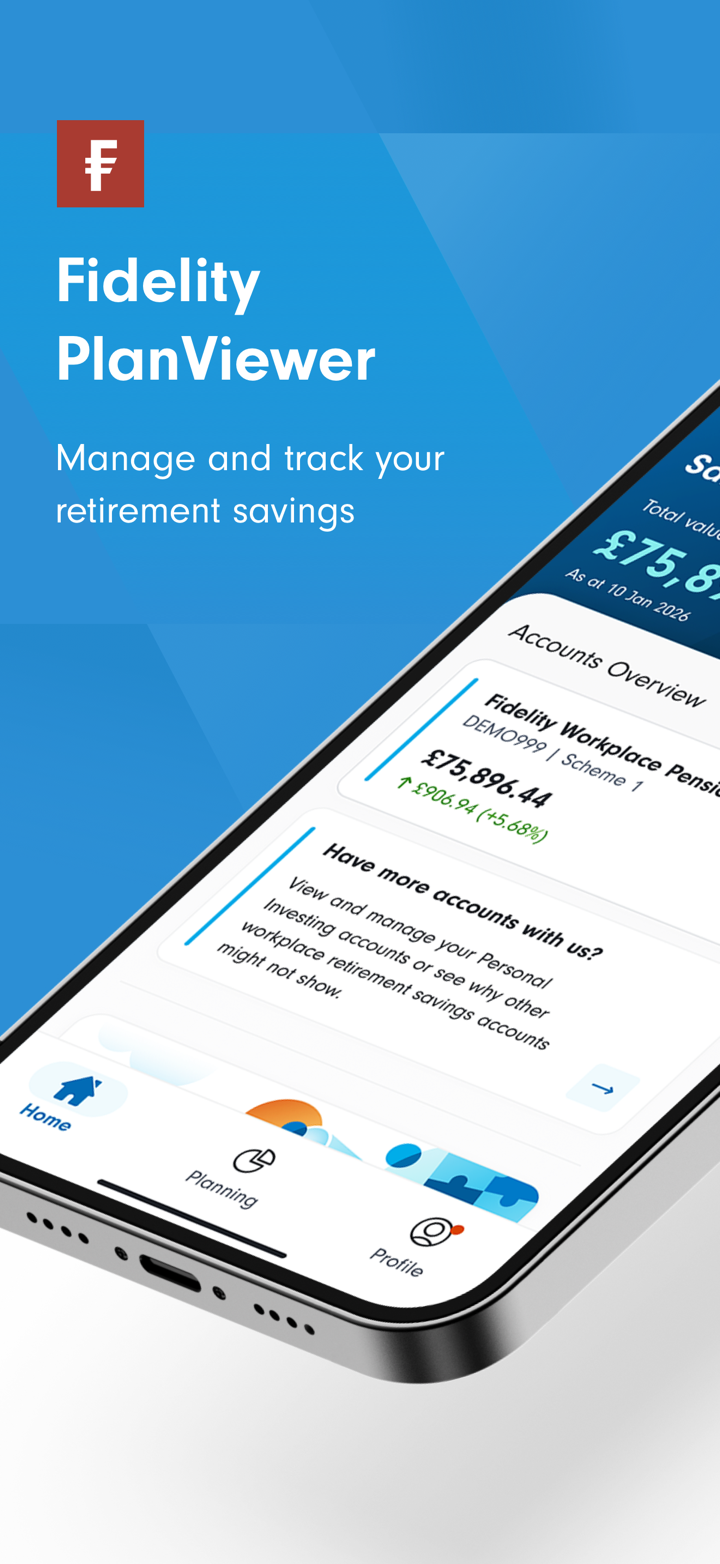

Tipo de Conta

Fidelity oferece quatro tipos de contas ao vivo: Investidores Pessoais, membros do MPF/ORSO, Intermediários e Investidores Institucionais. Não há contas de demonstração ou contas islâmicas (sem swap) disponíveis.

| Tipo de Conta | Adequado para |

| Investidores Pessoais | Indivíduos que gerenciam seus próprios investimentos |

| Contas MPF / ORSO | Funcionários e empregadores sob os esquemas de aposentadoria de Hong Kong |

| Intermediários | Consultores, gestores de patrimônio, consultores financeiros |

| Investidores Institucionais | Instituições como fundos de pensão, empresas e escritórios de família |

Taxas do Fidelity

As taxas do Fidelity seguem uma estrutura escalonada - quantias de investimento maiores têm taxas mais baixas, enquanto investimentos menores enfrentam taxas mais altas. No geral, sua estrutura de custos é moderada a alta pelos padrões da indústria.

| Método de Investimento | Tipo de Taxa | Saldo do Investimento (USD) | Recursos em Dinheiro | Recursos em Títulos | Recursos em Ações e Outros |

| Investimento Único | Taxa de Venda | ≥ 1.000.000 | 0,00% | 0,30% | 0,60% |

| 500.000 - <1.000.000 | 0,45% | 0,90% | |||

| 250.000 - <500.000 | 0,60% | 1,20% | |||

| 100.000 - <250.000 | 0,75% | 1,50% | |||

| 50.000 - <100.000 | 1,05% | 2,10% | |||

| <50.000 | 1,50% | 3,00% | |||

| Taxa de Troca | ≥ 1.000.000 | 0,10% | - | ||

| 500.000 - <1.000.000 | 0,15% | - | |||

| 250.000 - <500.000 | 0,20% | - | |||

| 100.000 - <250.000 | 0,25% | - | |||

| 50.000 - <100.000 | 0,35% | - | |||

| <50.000 | 0,50% | - | |||

| Plano de Investimento Mensal | Taxa de Venda | <HK$20.000/mês | 1,00% | - | - |

| ≥HK$20.000/mês | 0,00% | - | - |

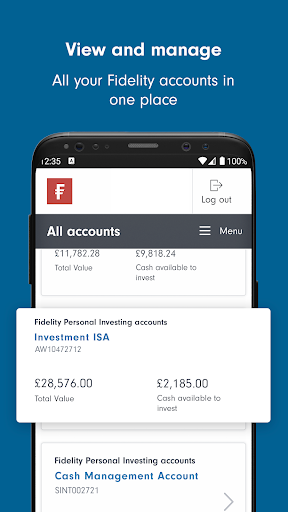

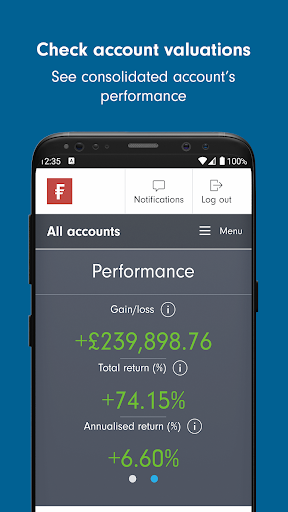

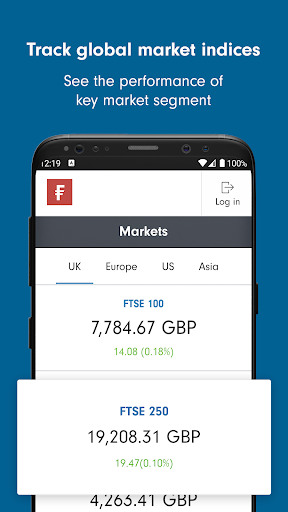

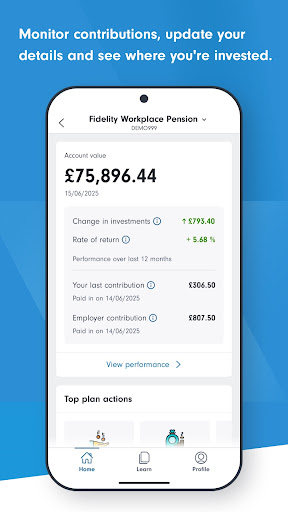

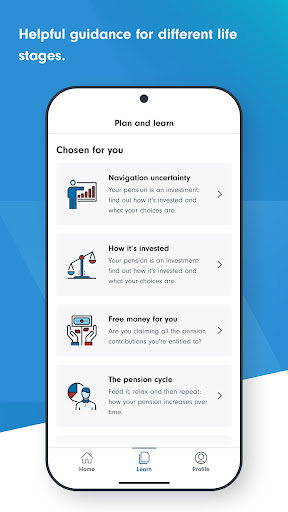

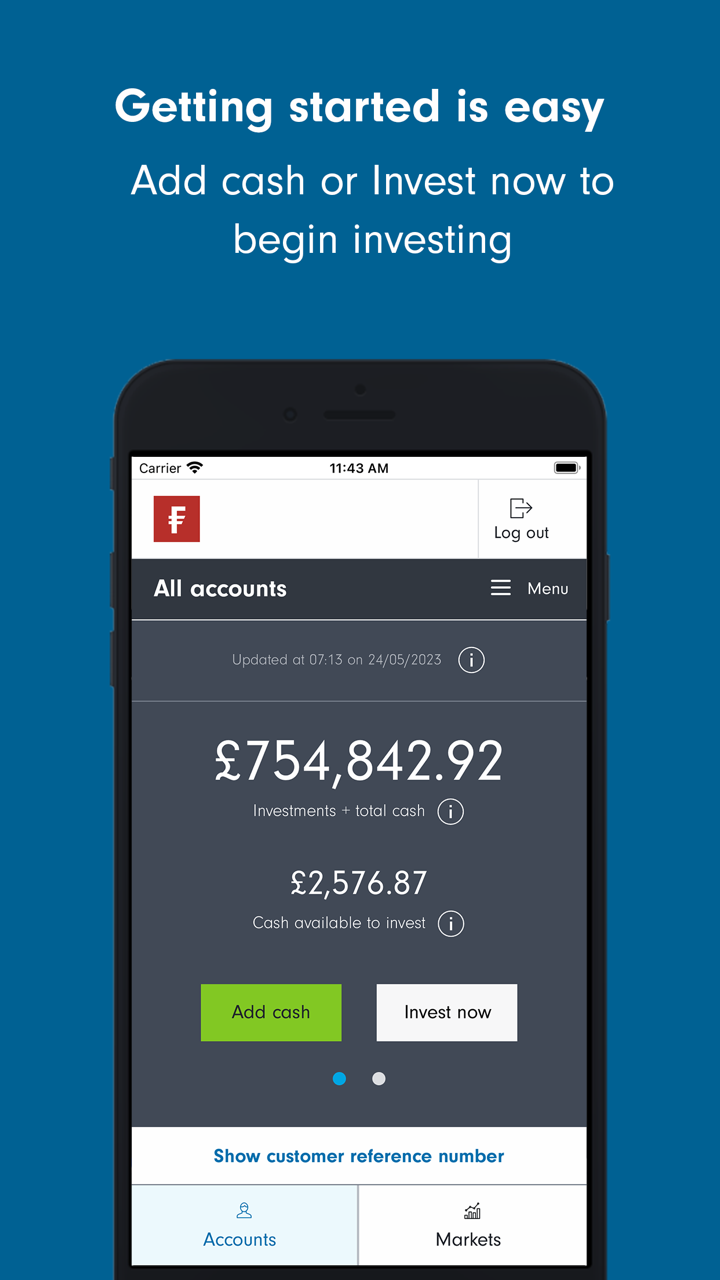

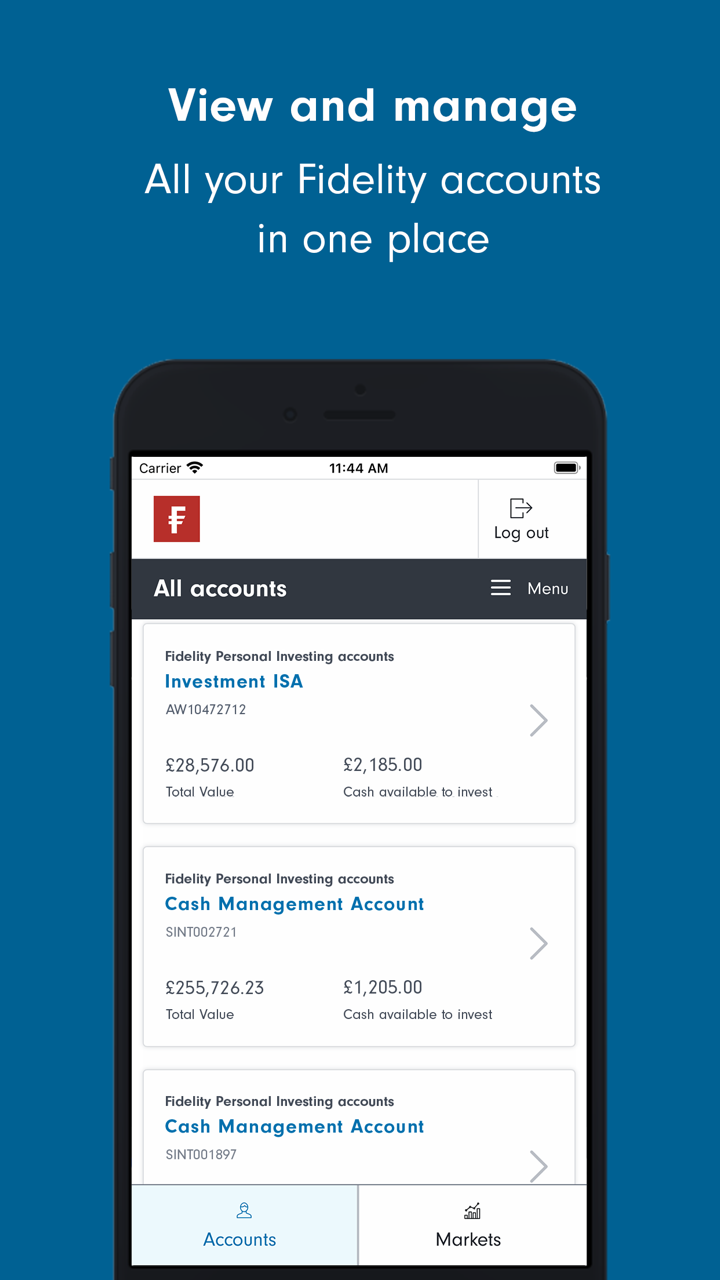

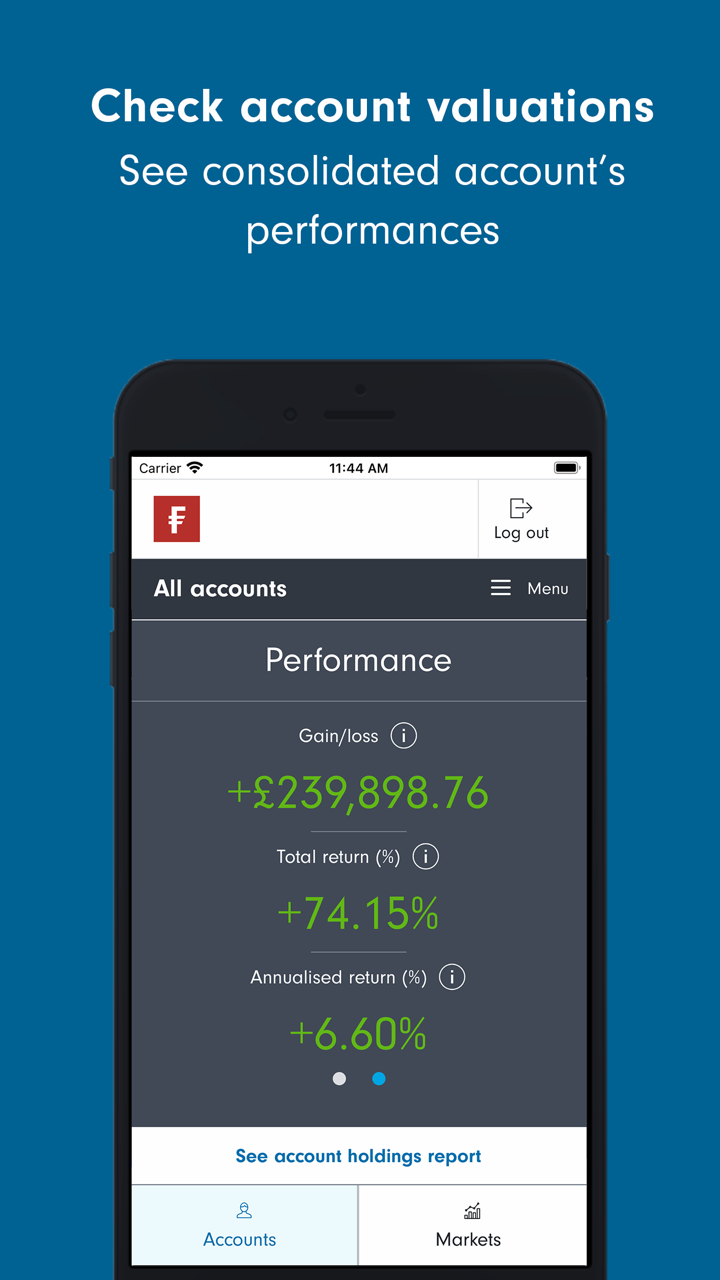

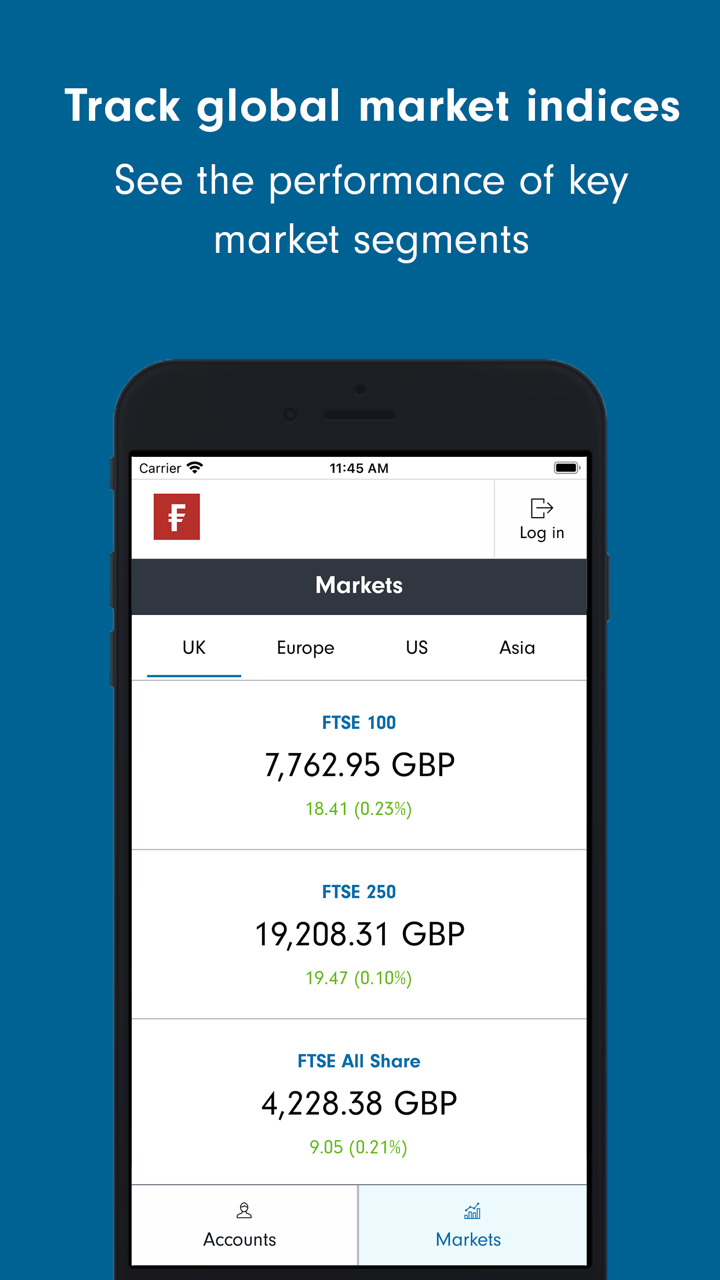

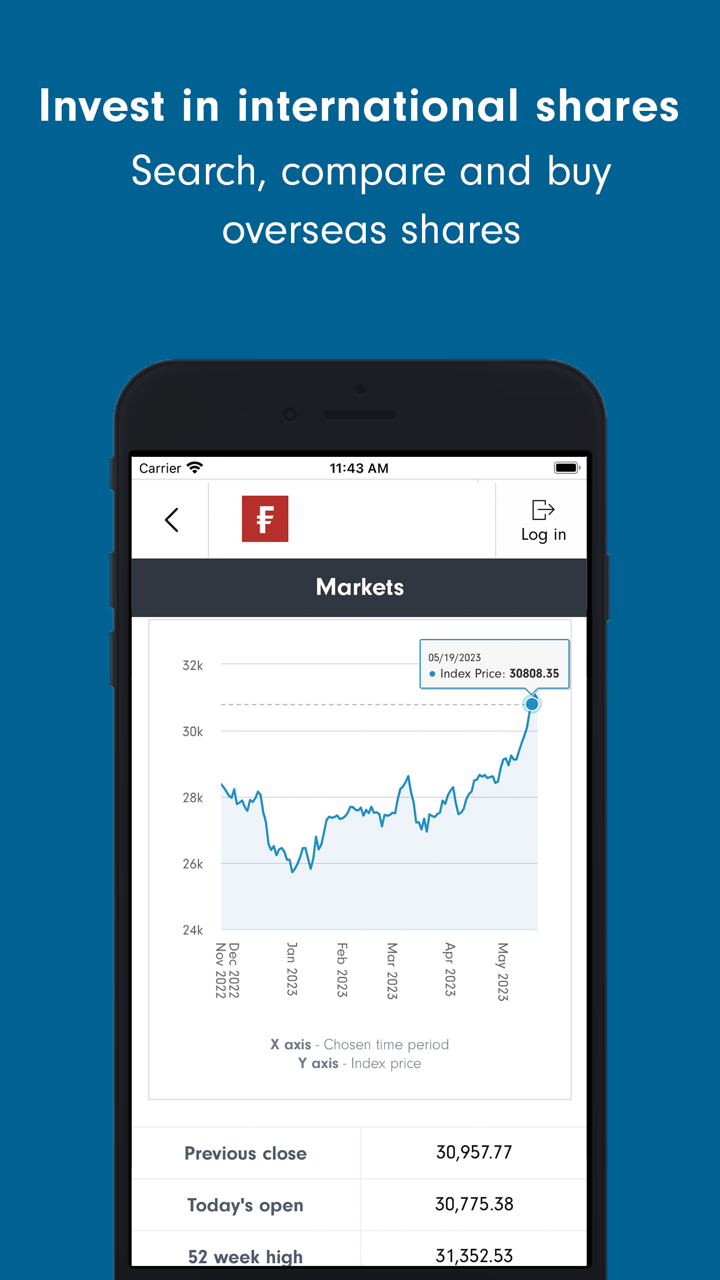

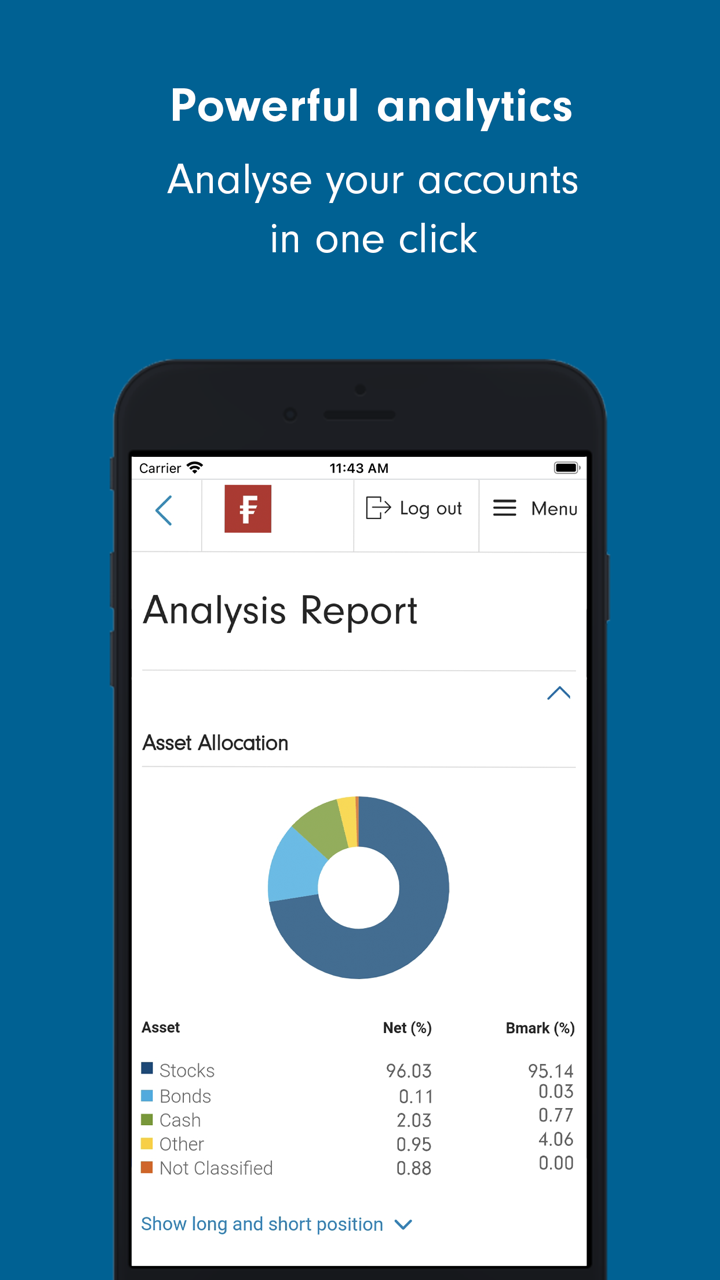

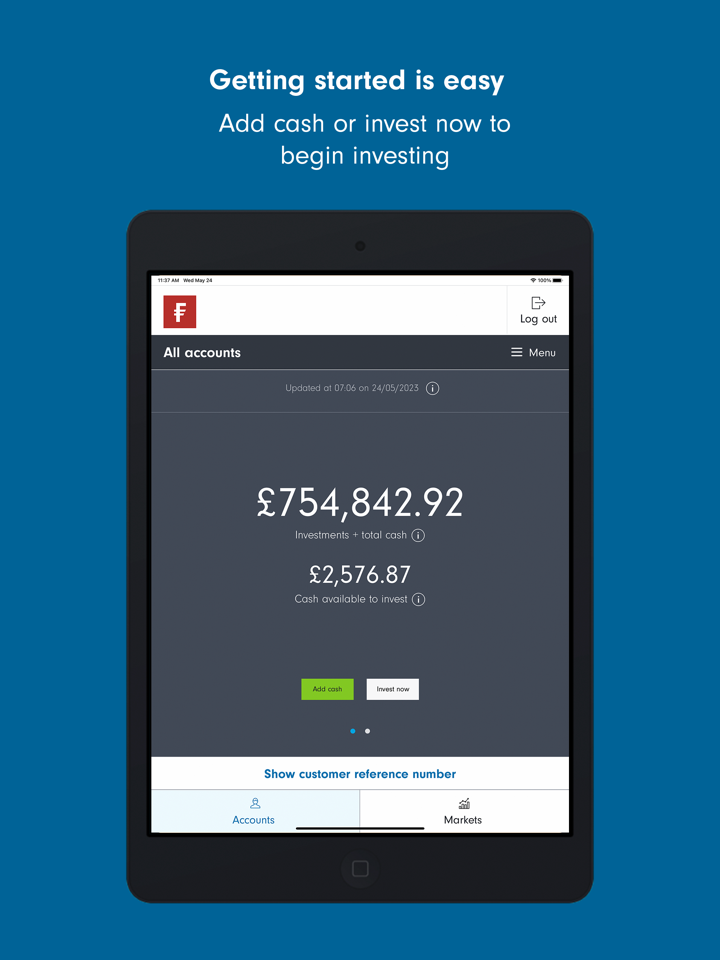

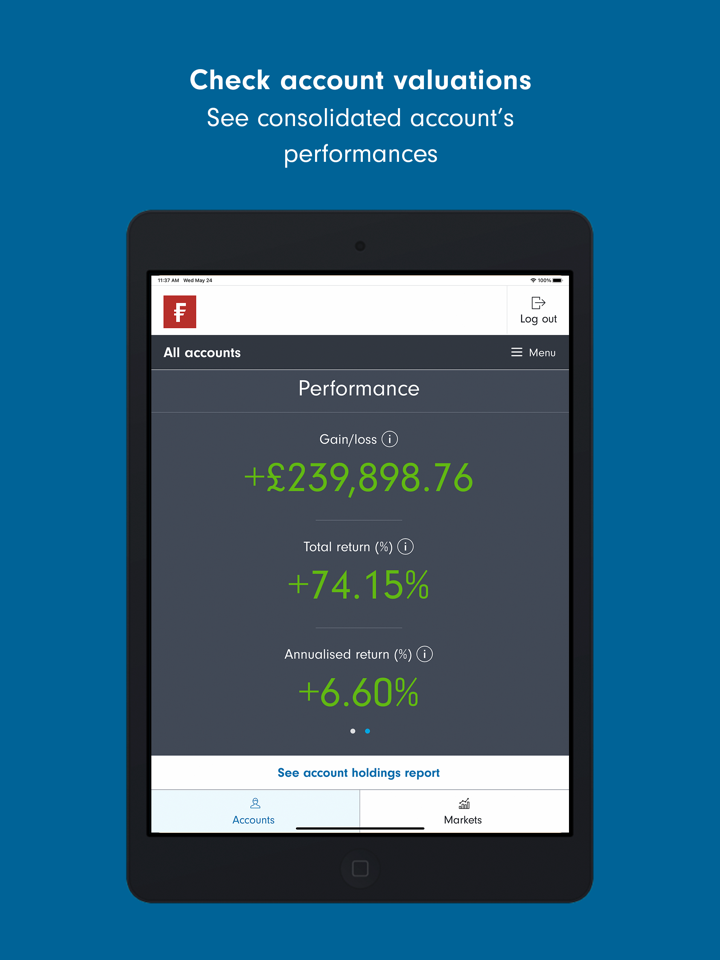

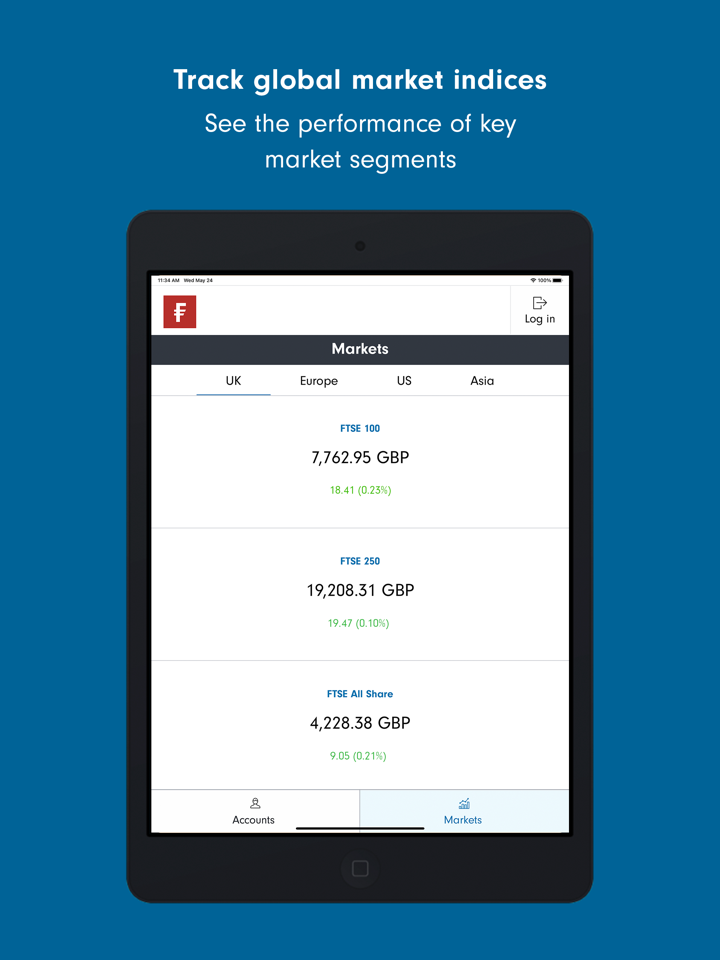

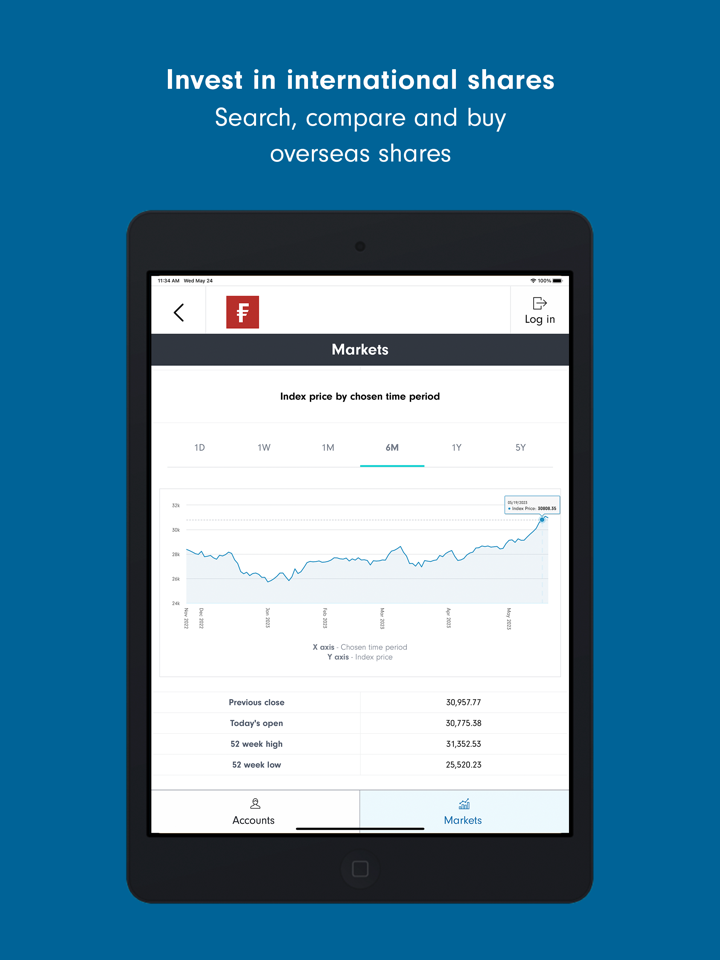

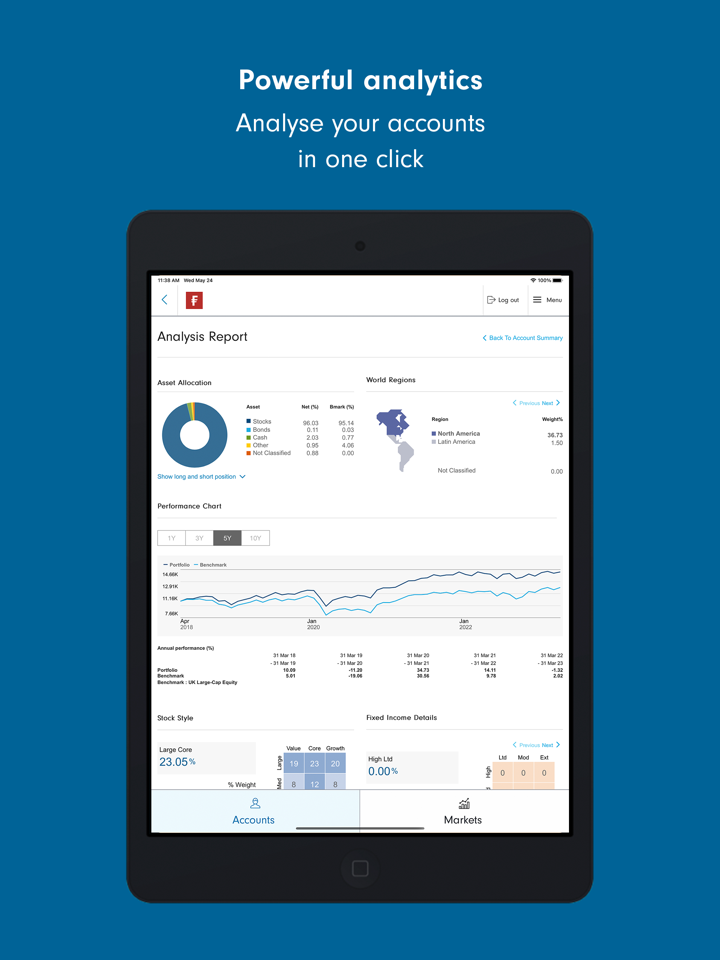

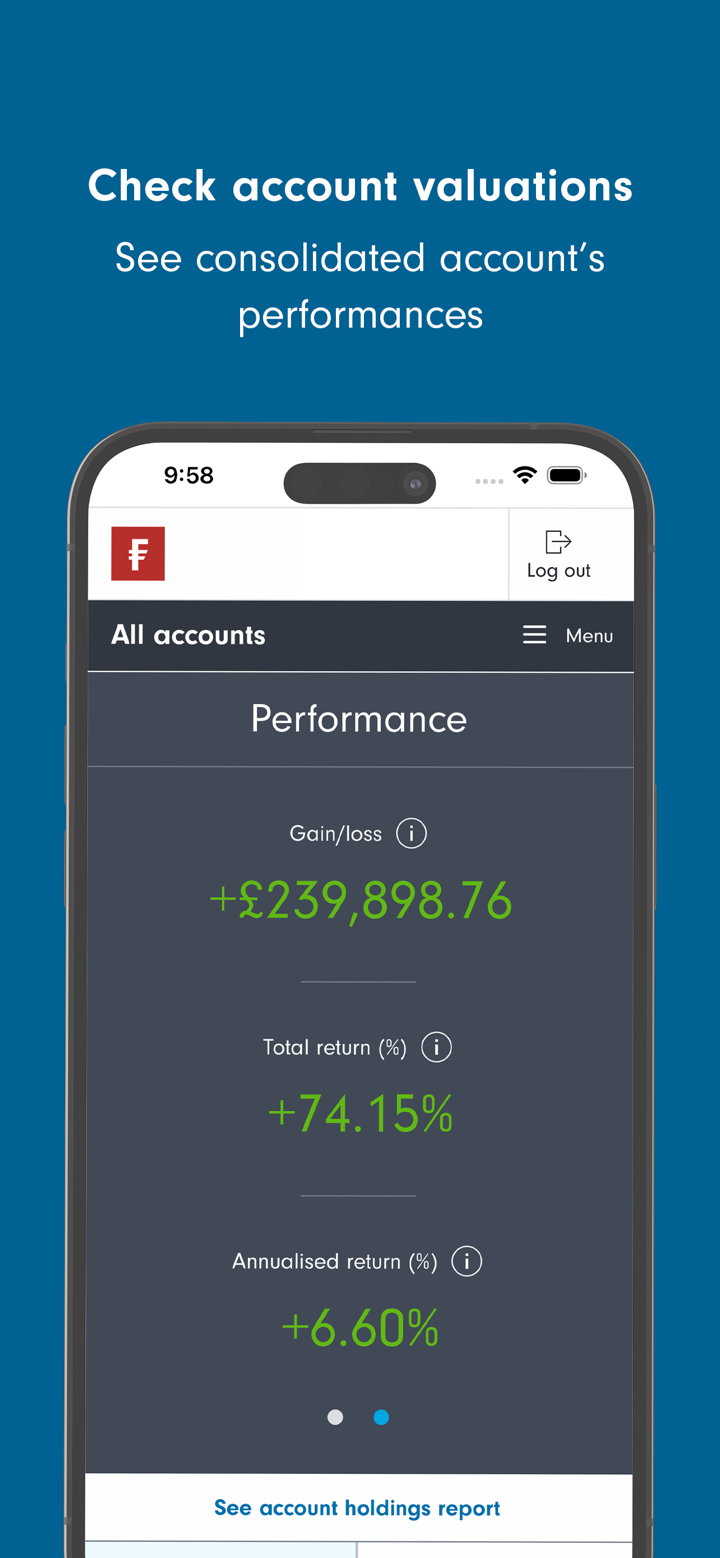

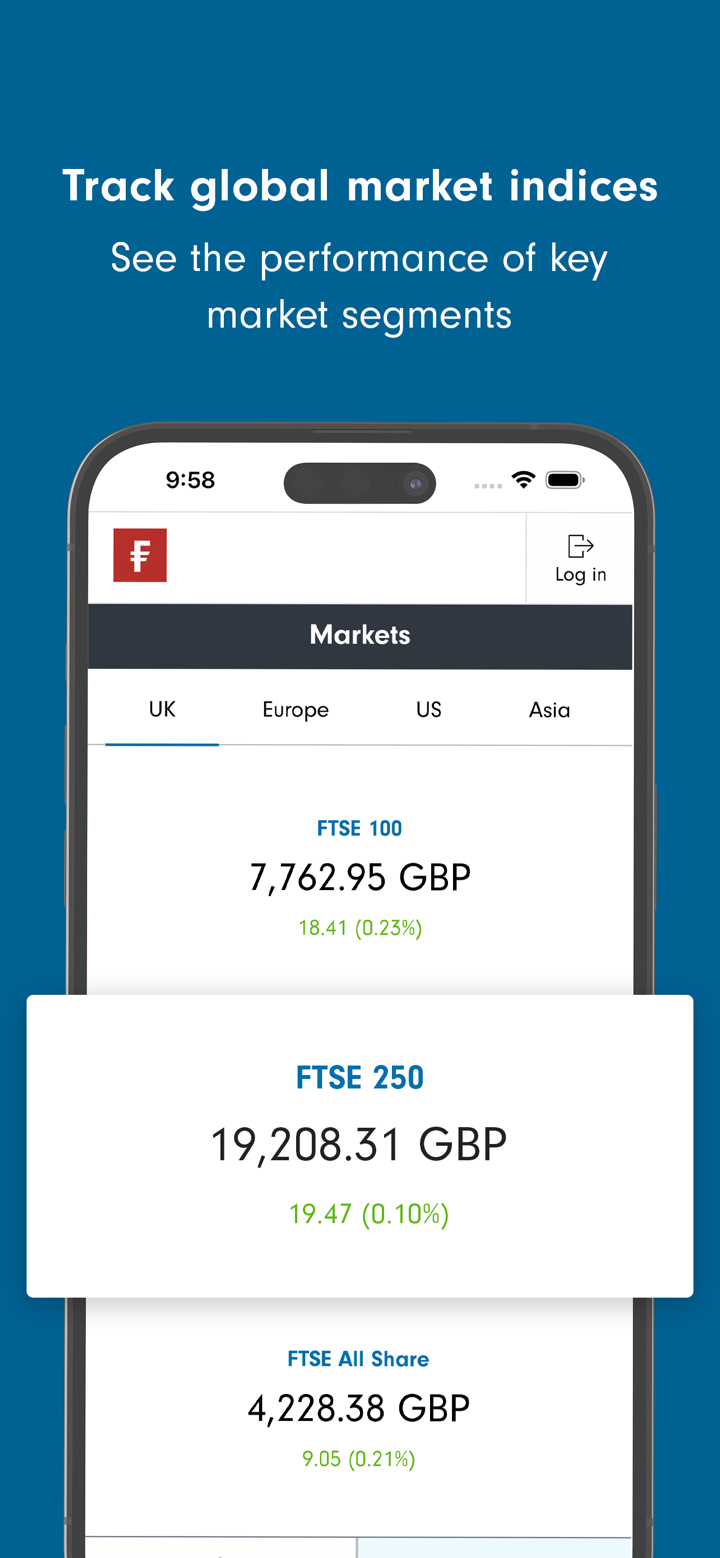

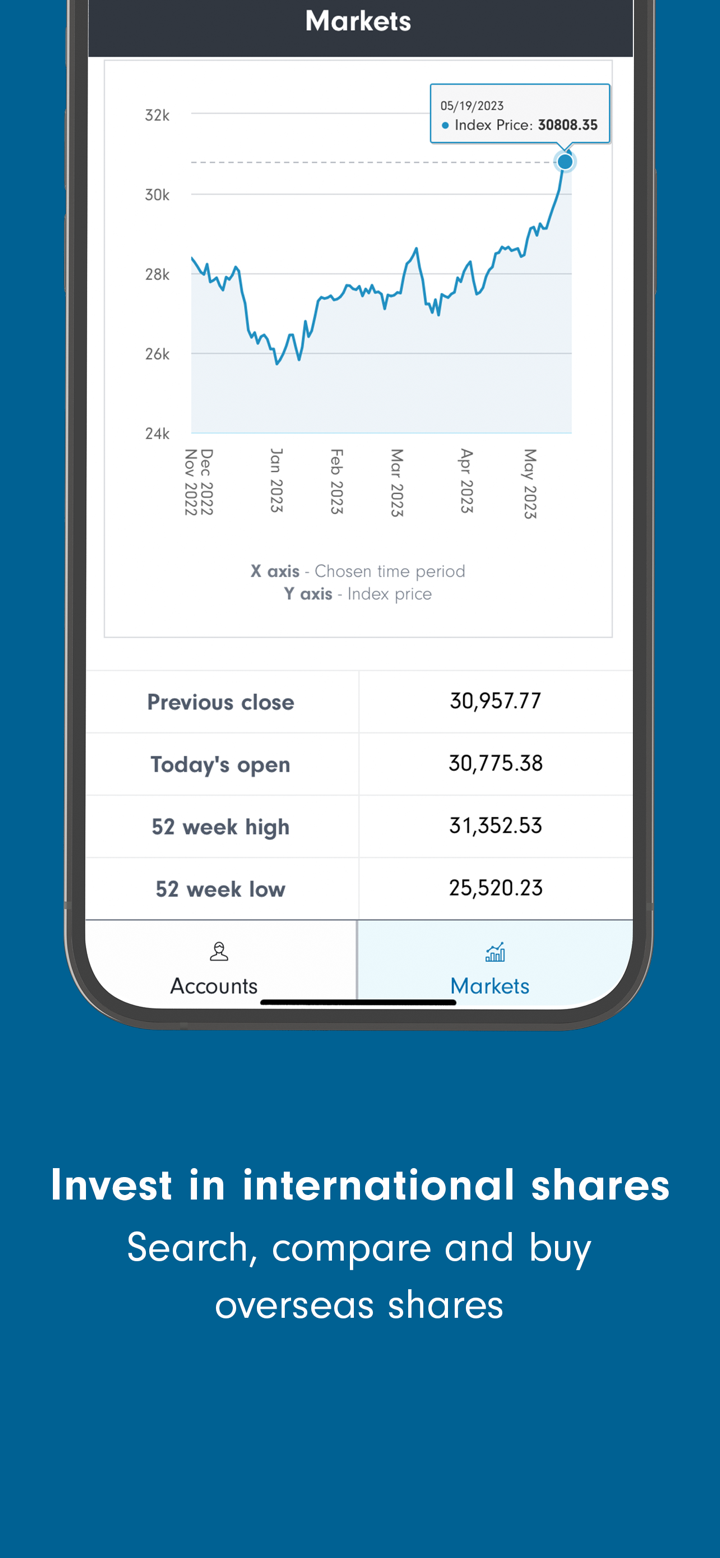

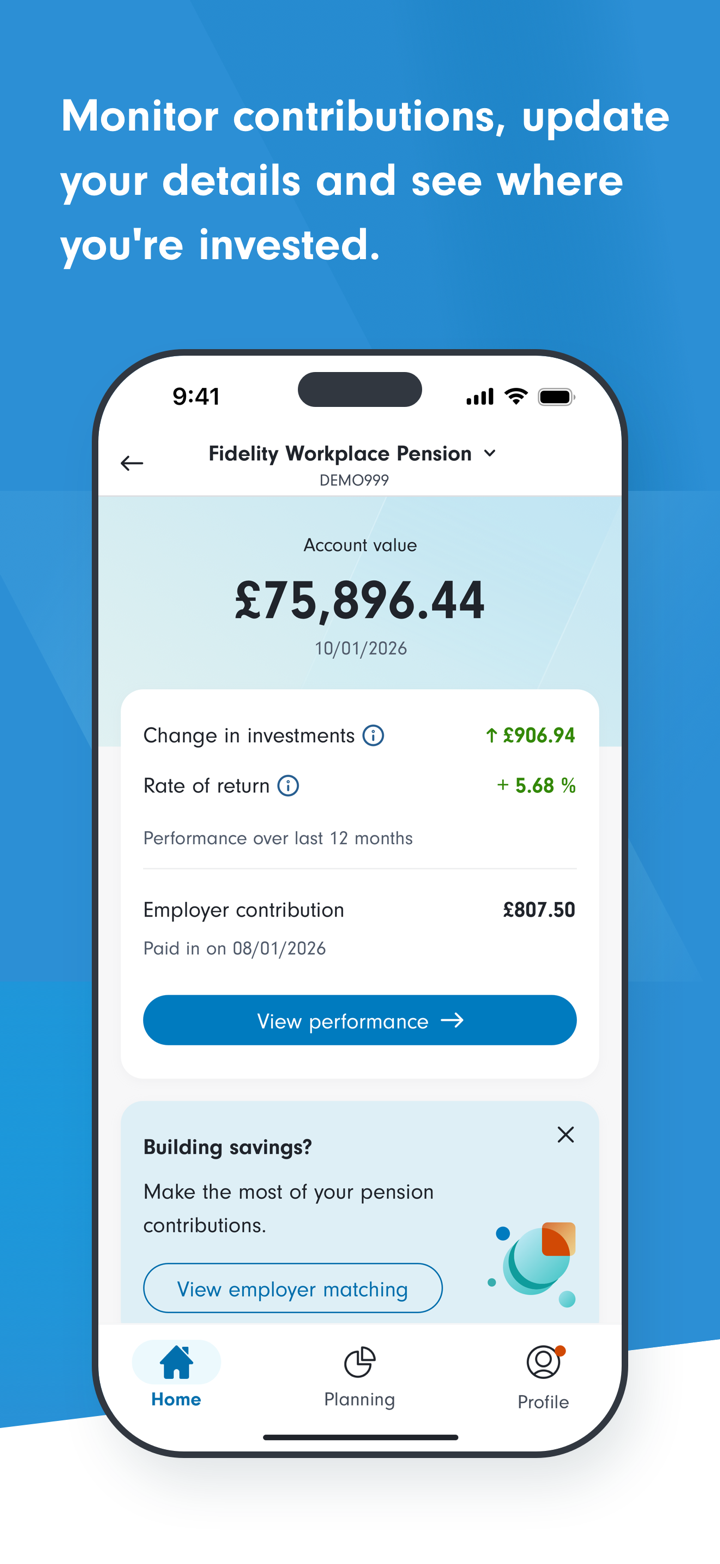

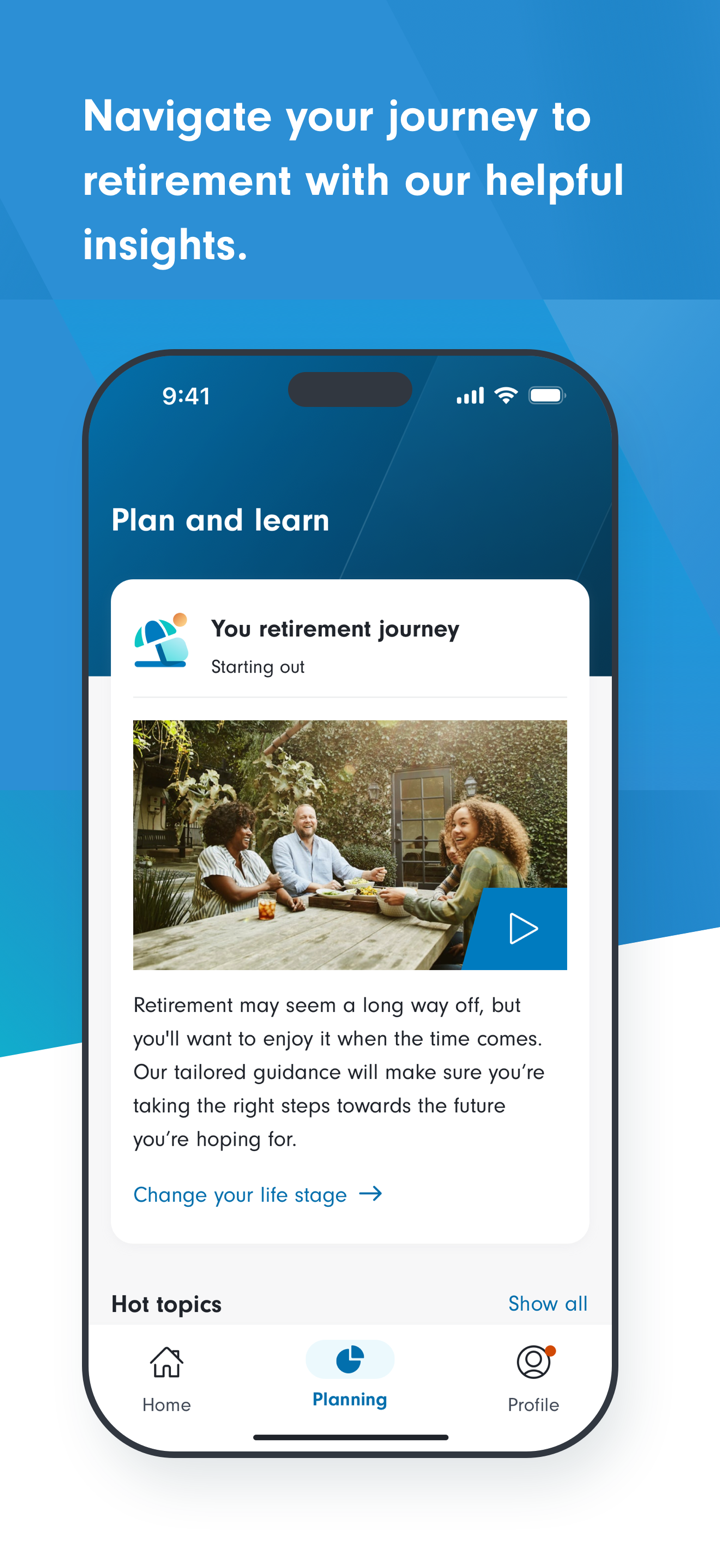

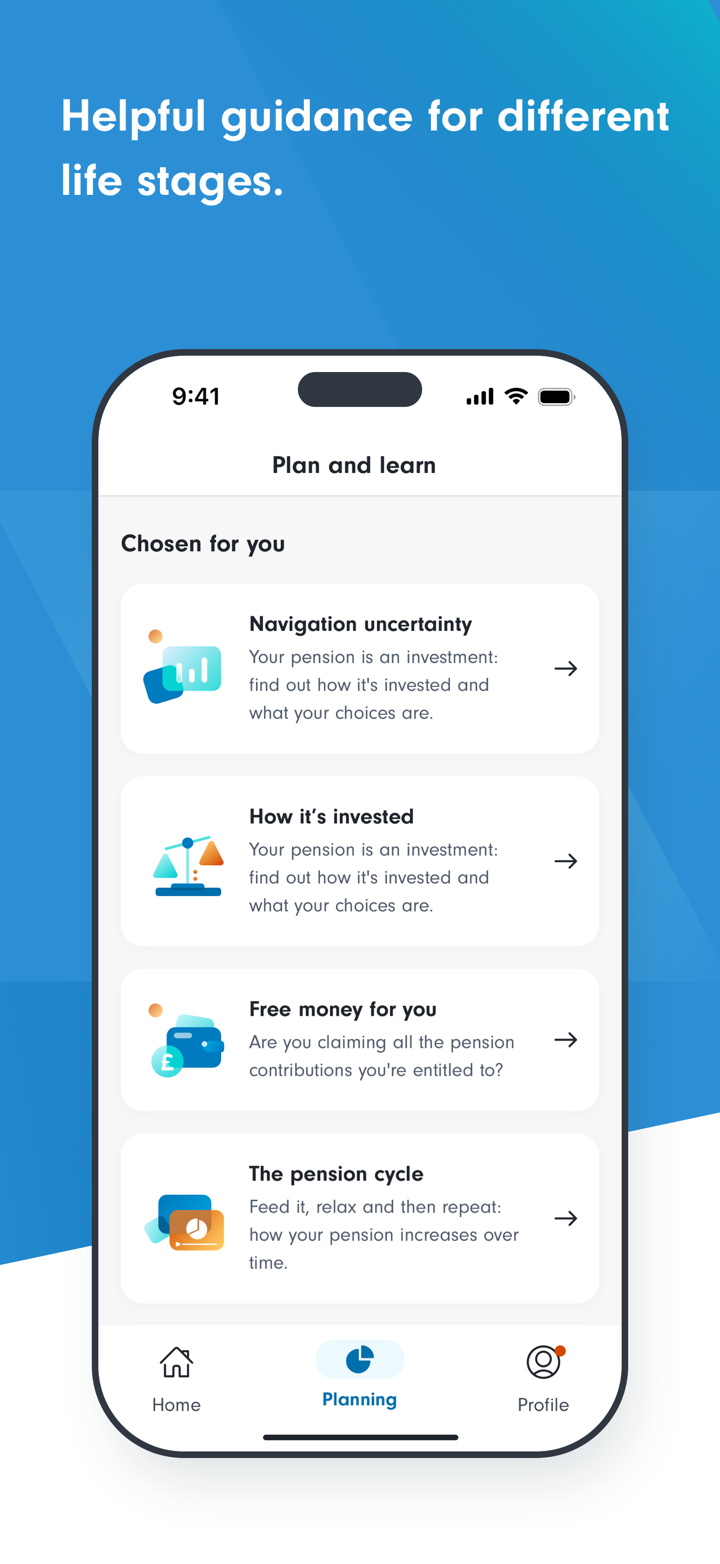

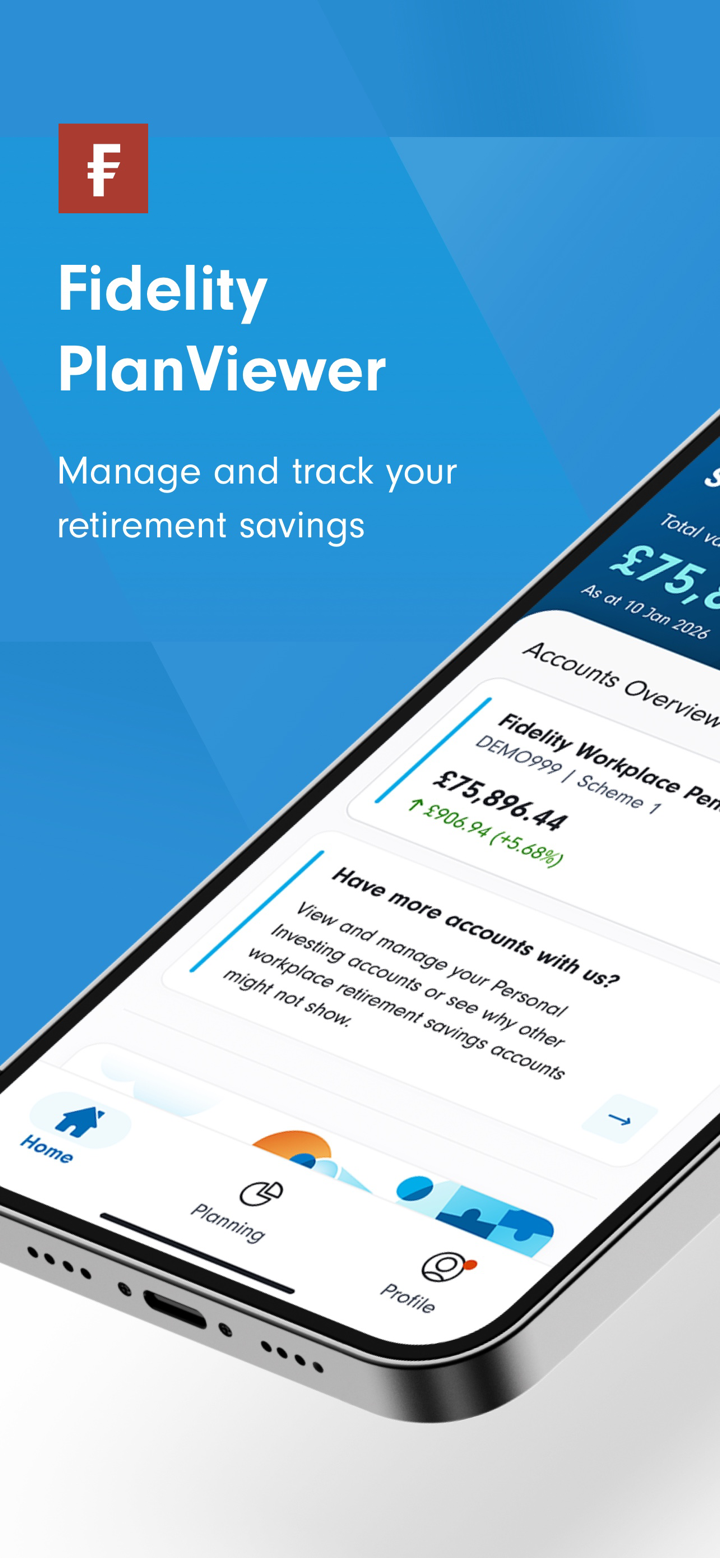

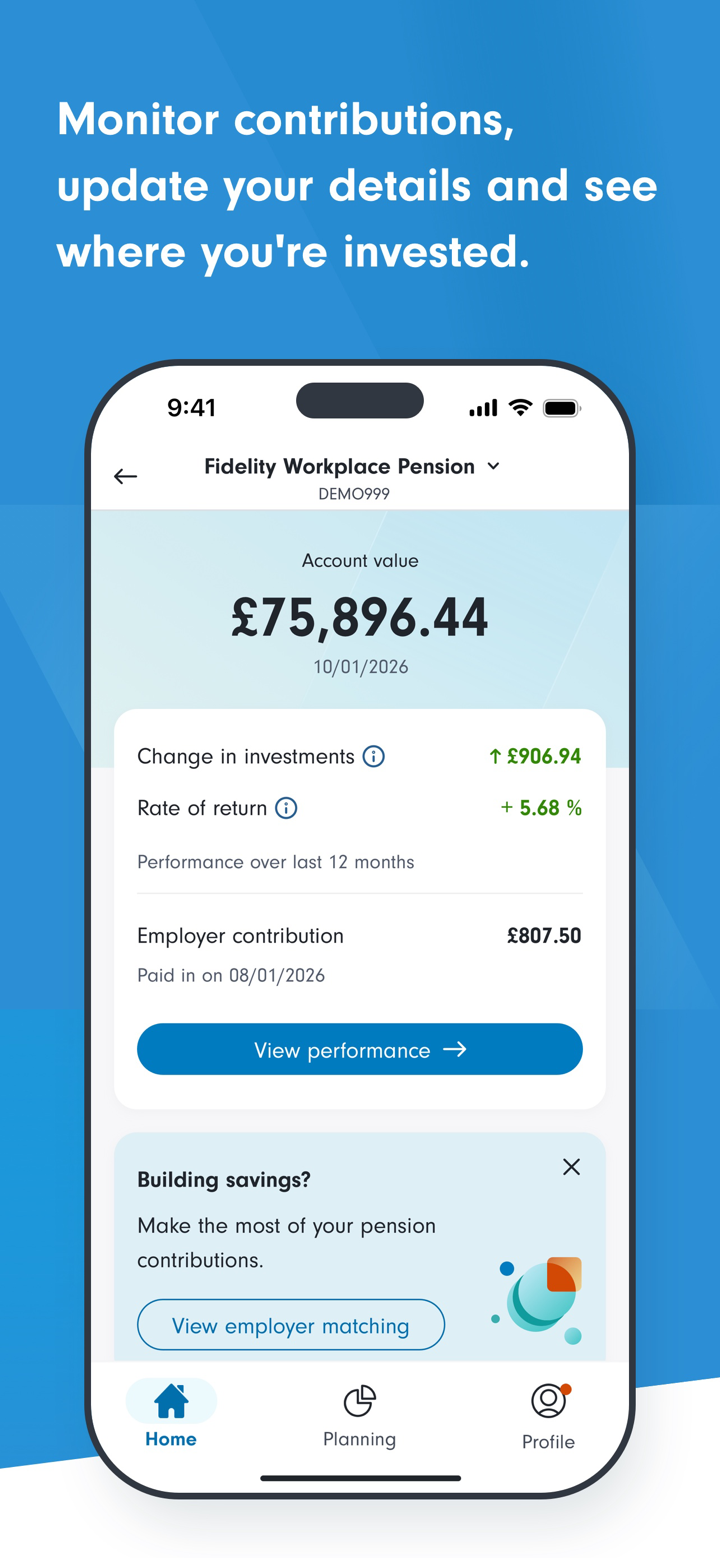

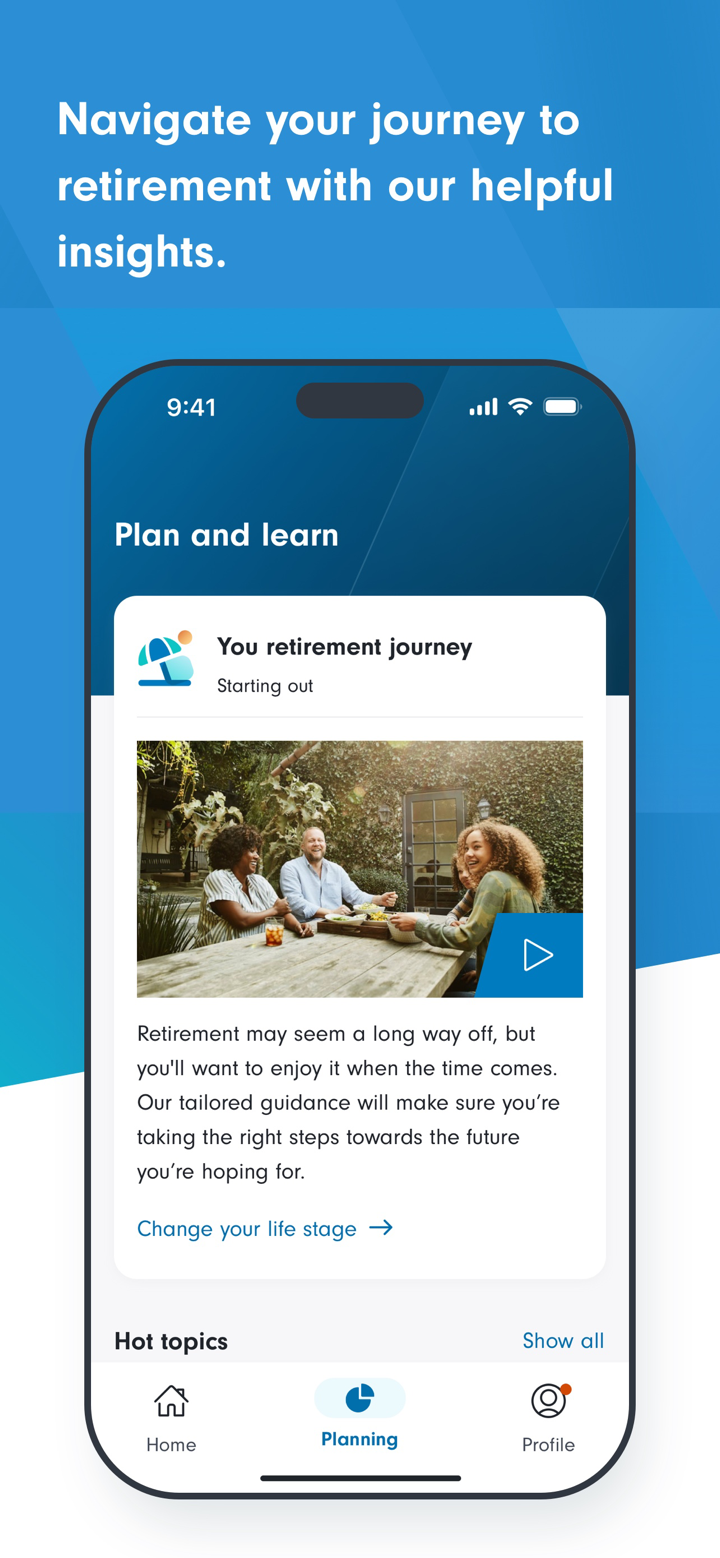

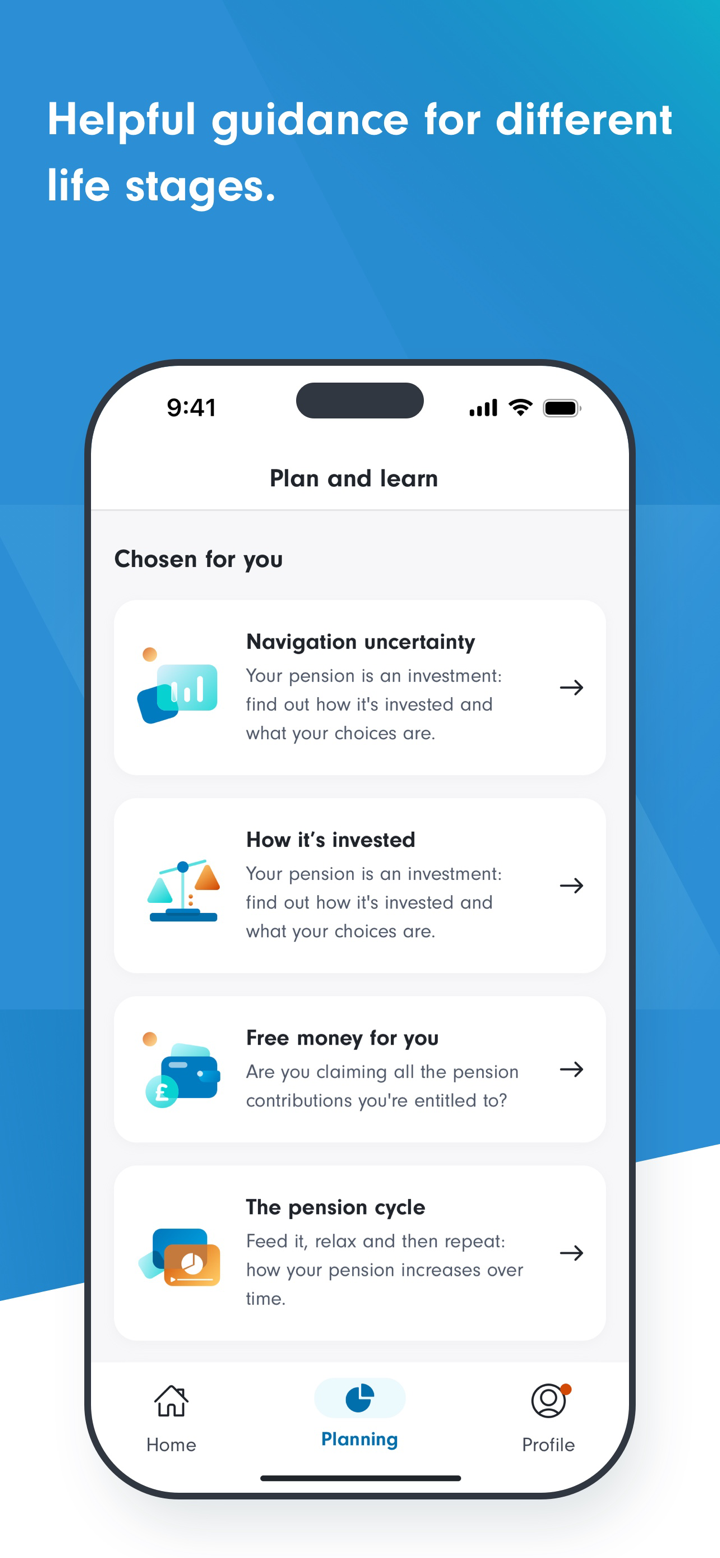

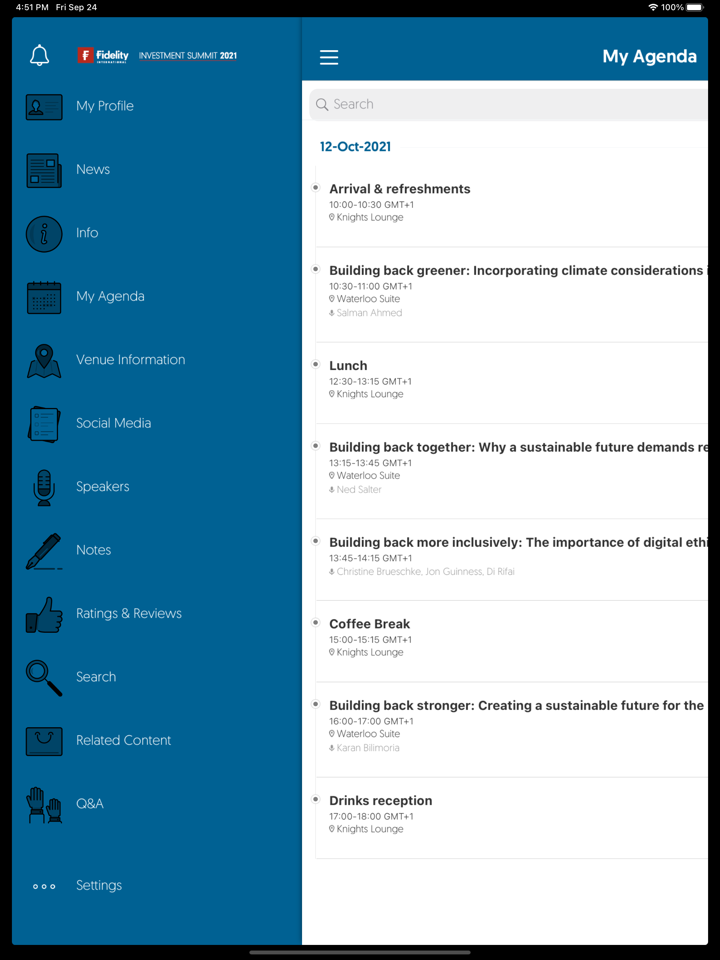

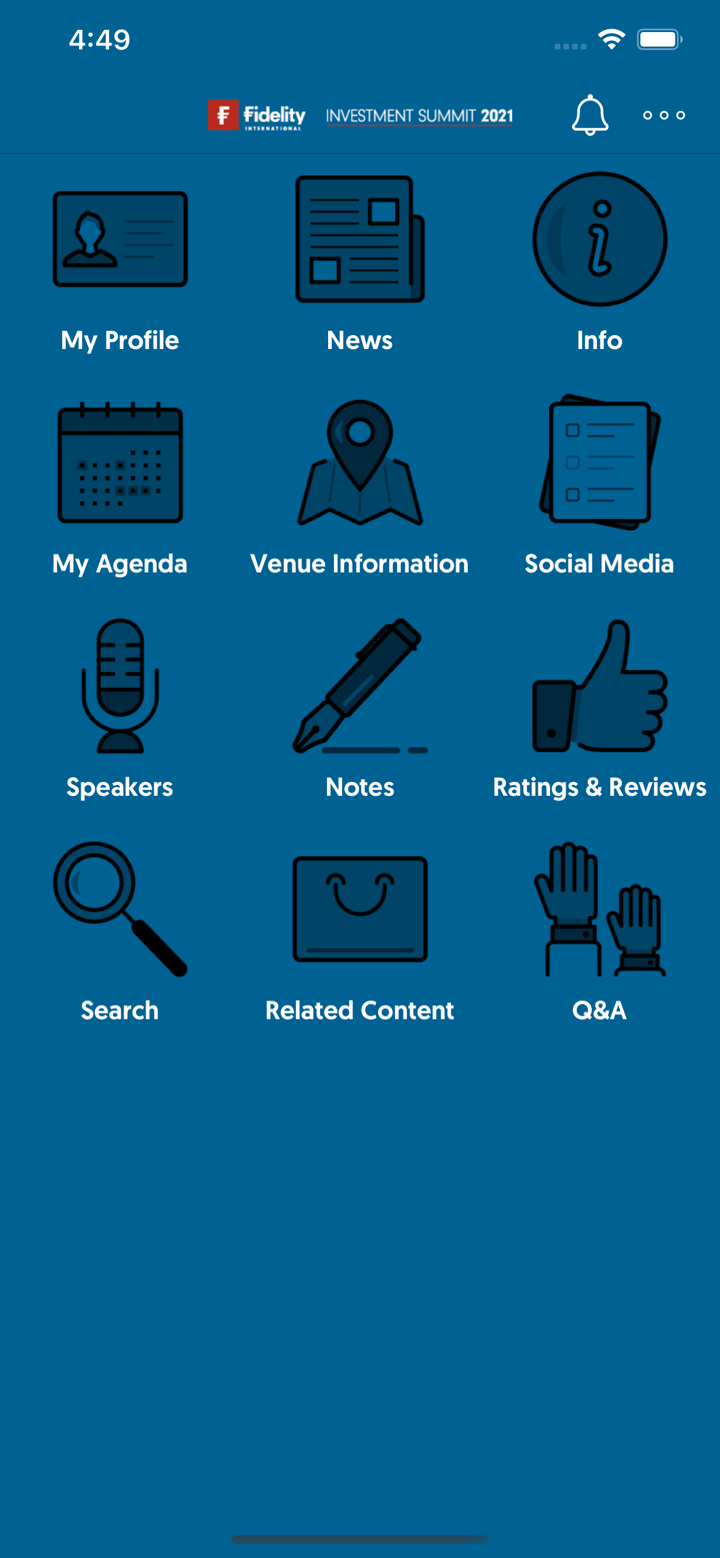

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis | Adequado para |

| Fidelity Online | ✔ | Web (PC, Mac) | Investidores de longo prazo gerenciando carteiras online |

| Fidelity Mobile App | ✔ | iOS, Android | Investidores que precisam de acesso à carteira em movimento |

Depósito e Retirada

Fidelity não cobra taxas adicionais para métodos padrão de depósito ou saque. No entanto, podem ser aplicadas taxas bancárias ou intermediárias, dependendo do método utilizado. O depósito mínimo é de HK$1.000 por fundo por mês para Planos de Investimento Mensais; não é especificado um mínimo para investimentos em montante fixo.

| Método de Pagamento | Valor Mínimo | Taxas | Tempo de Processamento |

| Transferência Telegráfica | / | Taxas bancárias/intermediárias | Após o recebimento dos fundos compensados |

| Pagamento de Conta HSBC (Internet Banking) | / | ❌ (exceto taxas de agente) | Imediato |

| Ordem Bancária / Cheque Bancário | / | Tarifas bancárias do agente | |

| Débito Direto no Mesmo Dia HSBC / Hang Seng | / | ❌ (fundos insuficientes podem incorrer em taxas bancárias) | |

| Cheque Pessoal (HK compensado) | HK$1.000.000 ou menos | ❌ | |

| Cheque Pessoal (não compensado em HK) | / | Podem ser aplicadas taxas de cobrança | Após a compensação |