简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets:The “Most Watched” Number in Financial Markets: What Is CPI Really About?

Sommario:The “Most Watched” Number in Financial Markets: What Is CPI Really About?When the US Bureau of Labor Statistics releases the latest Consumer Price Index (CPI) report, the market often holds its breath

The “Most Watched” Number in Financial Markets: What Is CPI Really About?

When the US Bureau of Labor Statistics releases the latest Consumer Price Index (CPI) report, the market often holds its breath. The resulting volatility can rival—and sometimes exceed—the chaos seen during a Non-Farm Payrolls (NFP) release.

Why the anxiety? Why does a report about the price of milk and rent cause billion-dollar swings in stocks and currencies?

In this article, DBG Markets breaks down exactly what the CPI is, how its calculated, and why it is the "True North" for financial market trends.

1. What Is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) is one of the most important economic indicators used to measure inflation, the rate at which the general price level of goods and services rises over time.

A useful way to think about CPI is as a nationwide shopping receipt. It tracks the average price changes of a fixed basket of goods and services that households typically consume. This includes everything from groceries and fuel to rent, healthcare, and personal services.

In simple terms, CPI answers a fundamental question: Is your purchasing power increasing or eroding over time?

· Rising CPI = inflation (money buys less)

· Falling CPI = deflation (money buys more)

2. How Is the CPI Calculated?

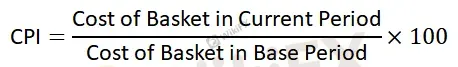

CPI is calculated by comparing the cost of a fixed basket of goods and services in the current period with the cost of that same basket in a base period.

The Formula:

This basket is designed to reflect real household spending patterns. It includes categories such as food, housing, transportation, healthcare, and education, allowing economists to track changes in the overall cost of living.

Importantly, CPI baskets are country-specific. Each country designs its basket based on domestic consumption habits to ensure the index accurately reflects local economic reality.

In the United States, the CPI basket spans more than 200 categories, grouped into eight major sectors:

3. Why CPI Matters to the Financial Market

CPI is a measure of inflation, but in the financial market, it is more than just economic data that reflects our daily lives. It plays a crucial role in shaping economic and financial policy decisions across the board:

· It helps central banks evaluate inflation trends and guide monetary policy, such as raising or lowering interest rates.

· It serves as a reference for governments when adjusting wages, tax brackets, and social benefits like pensions.

· It provides investors and financial markets with key insights into the health of the economy, helping them anticipate policy changes and make informed investment decisions.

Because CPI directly feeds into monetary policy expectations, it is one of the most closely watched data releases globally.

4. What Is Core CPI?

Alongside headline CPI, markets closely monitor Core CPI.

Core CPI excludes two highly volatile components: food and energy. These prices are often affected by temporary or external factors such as weather events, geopolitical tensions, or commodity supply shocks.

By stripping out these volatile elements, Core CPI provides a clearer view of underlying, persistent inflation trends. This is why central banks typically place greater emphasis on Core CPI when evaluating inflation risks and policy responses.

In short, headline CPI shows what is happening now, while Core CPI helps policymakers judge whether inflation pressures are likely to last.

5. How Does CPI Affect Financial Markets?

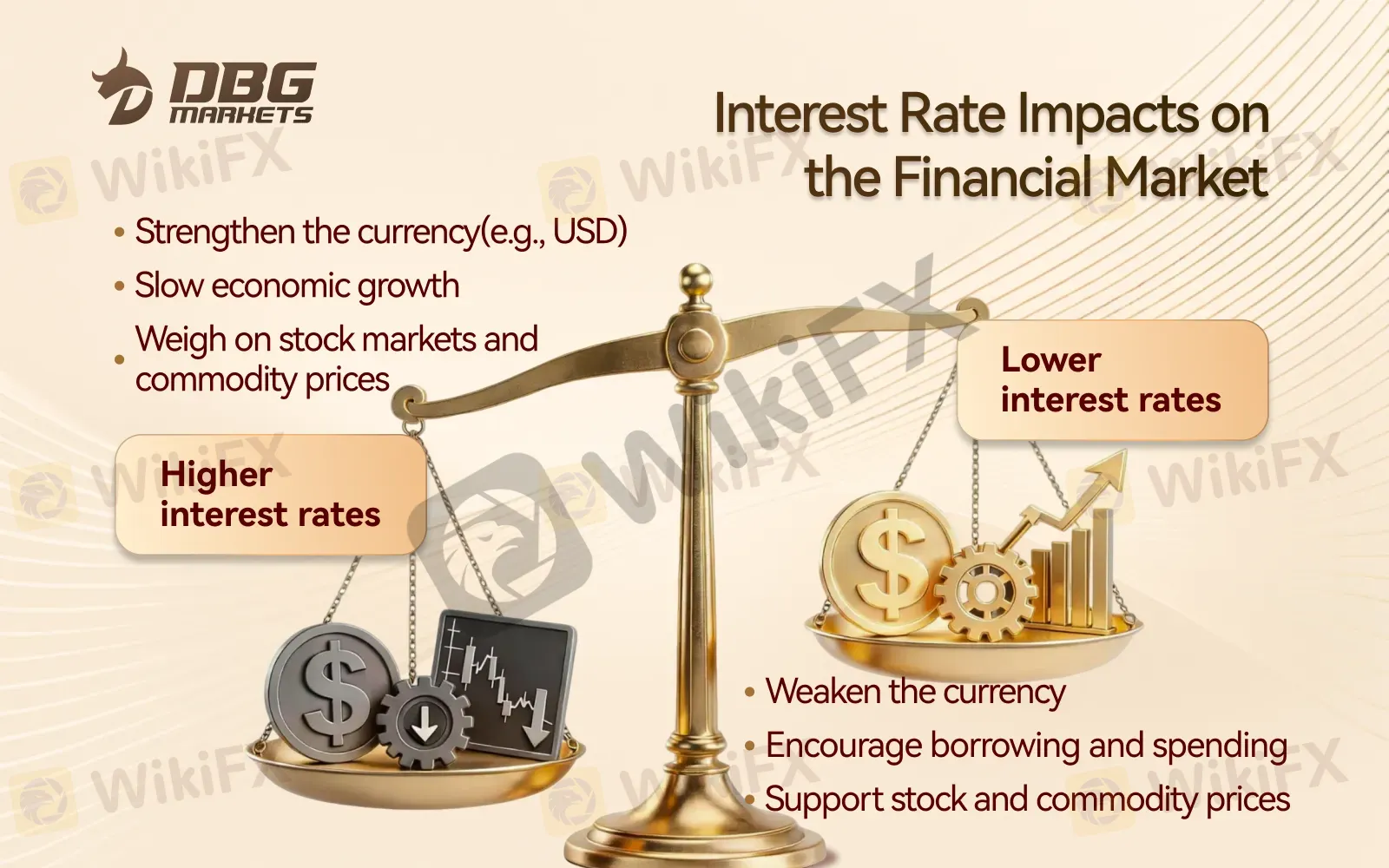

CPI itself does not directly move markets. What matters is how central banks are expected to respond to the data.

Inflation data shapes interest rate expectations, and interest rates are a primary driver of asset prices across financial markets.

Heres how it works:

· When CPI Rises (Higher Inflation): Central banks may raise interest rates to slow down inflation (tightening policy)

· When CPI Falls (Low Inflation or Deflation): Central banks may lower interest rates or introduce stimulus measures (easing policy)

6. How to Read a CPI Report?

To interpret CPI effectively, its essential to focus on the structure of the data—not just the headline number.

7. CPI Impact: Context Matters

It‘s important for traders and investors to remember: A higher CPI reading doesn’t always mean a currency will strengthen, and a lower CPI doesnt always mean it will weaken.

The markets reaction to CPI data often depends on the broader economic context, policy expectations, and investor sentiment at the time of release.

Final Thought: Why CPI Matters for Every Market Participant

Whether you‘re a trader, investor, policymaker, or simply trying to understand the economy, CPI is not just another data point—it’s a decision-making anchor.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Rate Calc