Profil perusahaan

| Japan Private AssetRingkasan Ulasan | |

| Didirikan | 2009 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Instrumen Pasar | Saham domestik, reksadana, Nikkei 225 Mini, ETF & ETN |

| Akun Demo | / |

| Leverage | / |

| Platform Perdagangan | / |

| Deposit Minimum | / |

| Dukungan Pelanggan | Tel: 03-5695-5681 |

| Fax: 03-5695-5685 | |

| Media sosial: YouTube, X, Instagram, Facebook | |

| Kantor: Japanbashi Ningyocho, Chuo-ku, Tokyo 103-0013 | |

Japan Private Asset didaftarkan pada tahun 2009 di Jepang, yang berfokus pada saham domestik, reksadana, Nikkei 225 Mini, ETF, dan ETN. Saat ini, diatur oleh FSA di Jepang.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur dengan baik | Info terbatas tentang kondisi perdagangan |

| Waktu operasi panjang | Tidak ada detail tentang platform perdagangan |

| Berbagai produk perdagangan disediakan | Biaya yang dibebankan |

| Berbagai saluran dukungan pelanggan |

Apakah Japan Private Asset Legal?

Japan Private Asset diatur oleh Financial Services Agency (FSA) di Jepang.

| Otoritas yang Diatur | Status Saat Ini | Entitas Berlisensi | Negara yang Diatur | Jenis Lisensi | No. Lisensi |

| Financial Services Agency (FSA) | Diatur | Japan Private Asset株式会社 | Jepang | Lisensi Forex Ritel | 関東財務局長(金商)第2410号 |

Survei Lapangan WikiFX

Tim survei lapangan WikiFX mengunjungi alamat Japan Private Asset di Jepang, dan kami menemukan kantor fisiknya di lokasi.

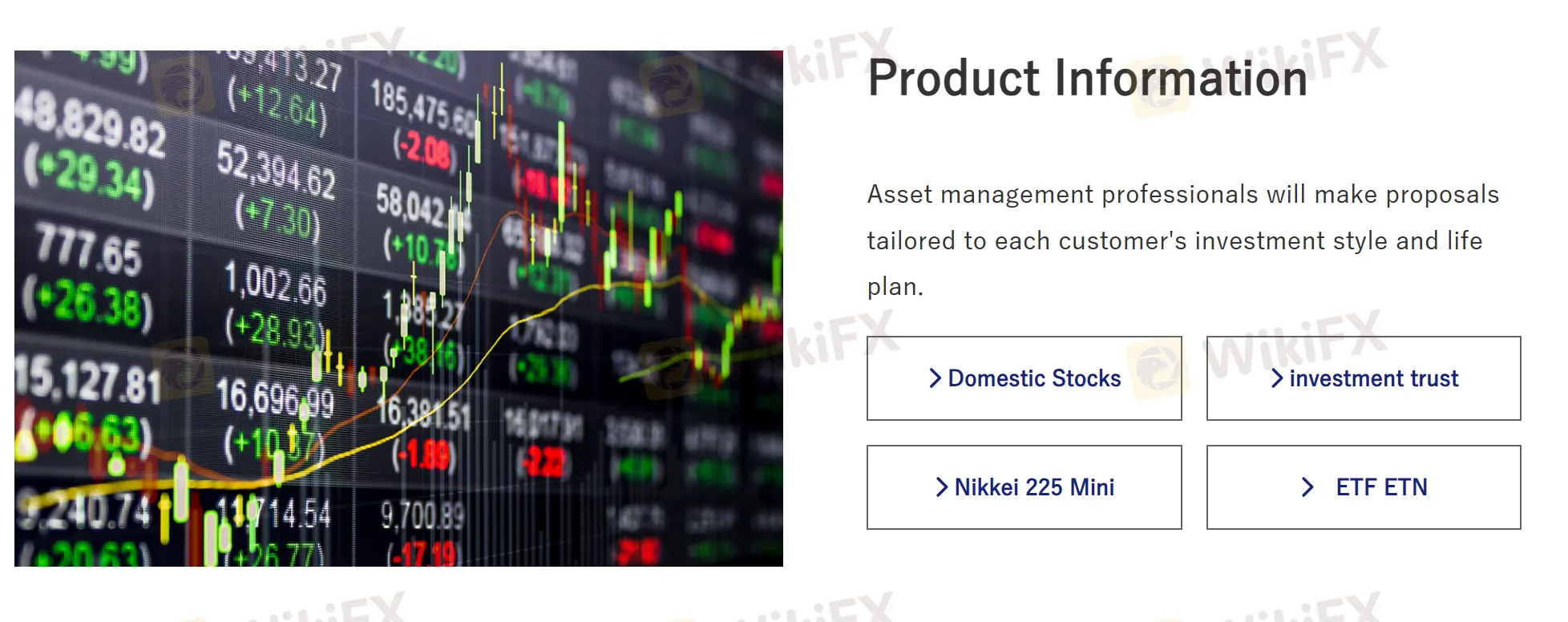

Apa yang Bisa Saya Perdagangkan di Japan Private Asset?

Japan Private Asset menyediakan empat jenis produk perdagangan, termasuk saham domestik, reksa dana, Nikkei 225 Mini, ETF & ETN.

| Aset yang Dapat Diperdagangkan | Didukung |

| Saham Domestik | ✔ |

| Reksa Dana | ✔ |

| Nikkei 225 Mini | ✔ |

| ETF & ETN | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kripto | ❌ |

| Obligasi | ❌ |

| Opsi | ❌ |

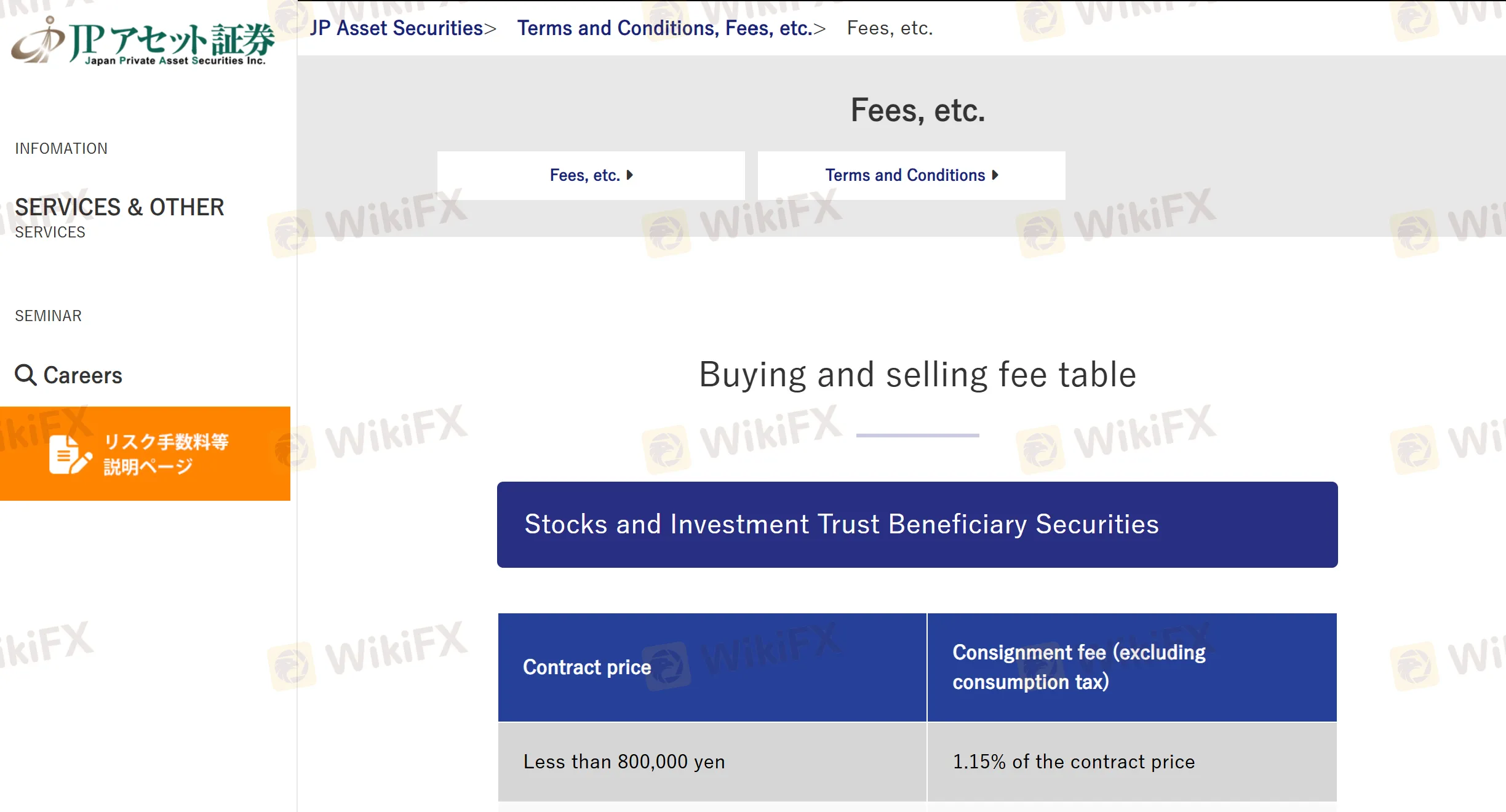

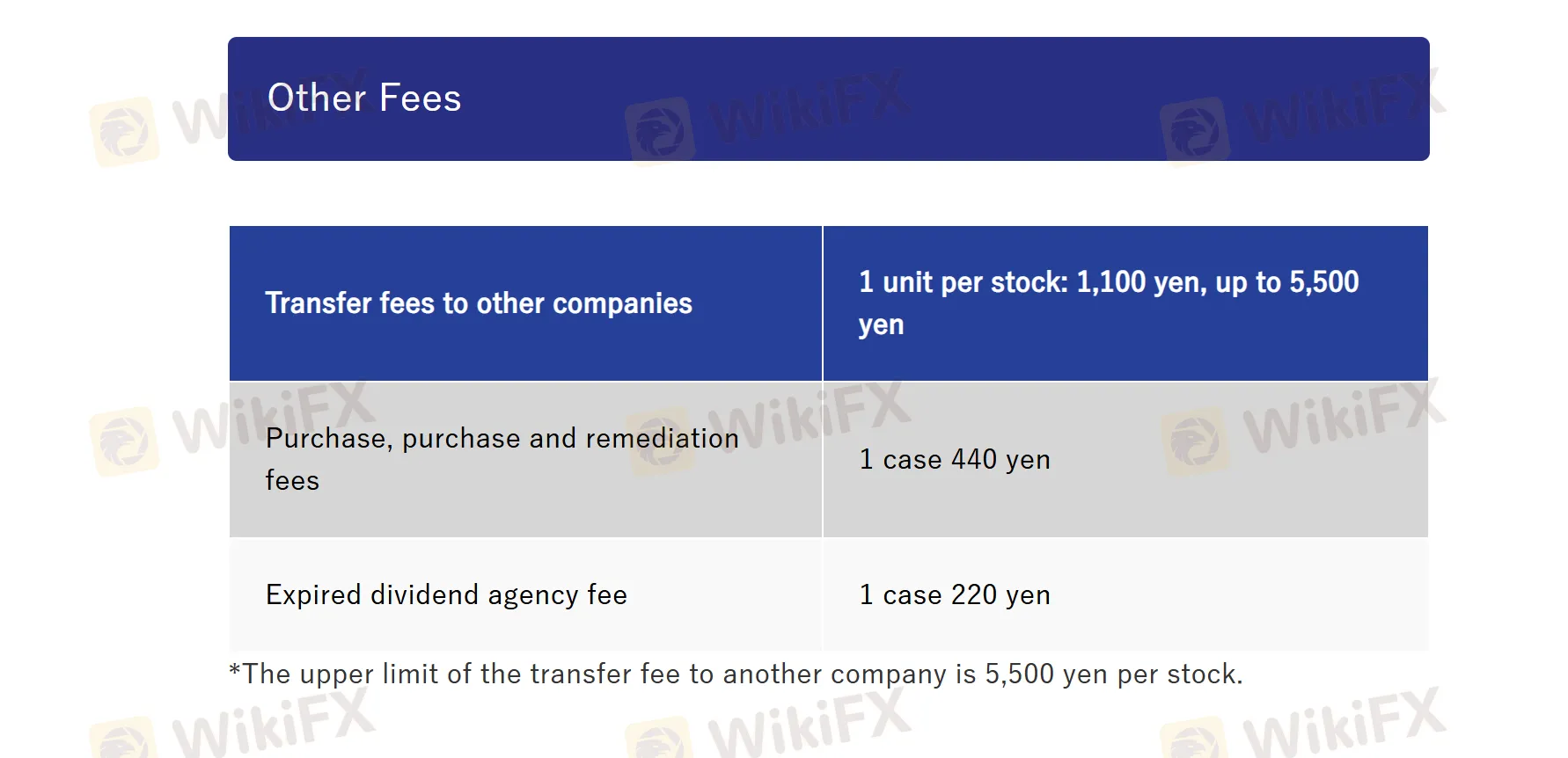

Biaya Japan Private Asset

Japan Private Asset mengenakan sejumlah biaya tergantung pada volume perdagangan. Biaya bervariasi, dan informasi terperinci ditampilkan di situs web resminya.