Company Summary

| Japan Private AssetReview Summary | |

| Founded | 2009 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Domestic stocks, mutual funds, Nikkei 225 Mini, ETFs & ETNs |

| Demo Account | / |

| Leverage | / |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Tel: 03-5695-5681 |

| Fax: 03-5695-5685 | |

| Social media: YouTube, X, Instagram, Facebook | |

| Office: Japanbashi Ningyocho, Chuo-ku, Tokyo 103-0013 | |

Japan Private Asset was registered in 2009 in Japan, which focuses on domestic stocks, mutual funds, Nikkei 225 Mini, ETFs and ETNs. Currently, it is regulated by FSA in Japan.

Pros and Cons

| Pros | Cons |

| Regulated well | Limited info on trading conditions |

| Long operation time | No details on trading platforms |

| Various trading products provided | Fees charged |

| Multiple channels for customer support |

Is Japan Private Asset Legit?

Japan Private Asset is regulated by Financial Services Agency (FSA) in Japan.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Services Agency (FSA) | Regulated | JPアセット証券株式会社 | Japan | Retail Forex License | 関東財務局長(金商)第2410号 |

WikiFX Field Survey

WikiFX field survey team visited Japan Private Asset's address in Japan, and we found its physical office on site.

What Can I Trade on Japan Private Asset?

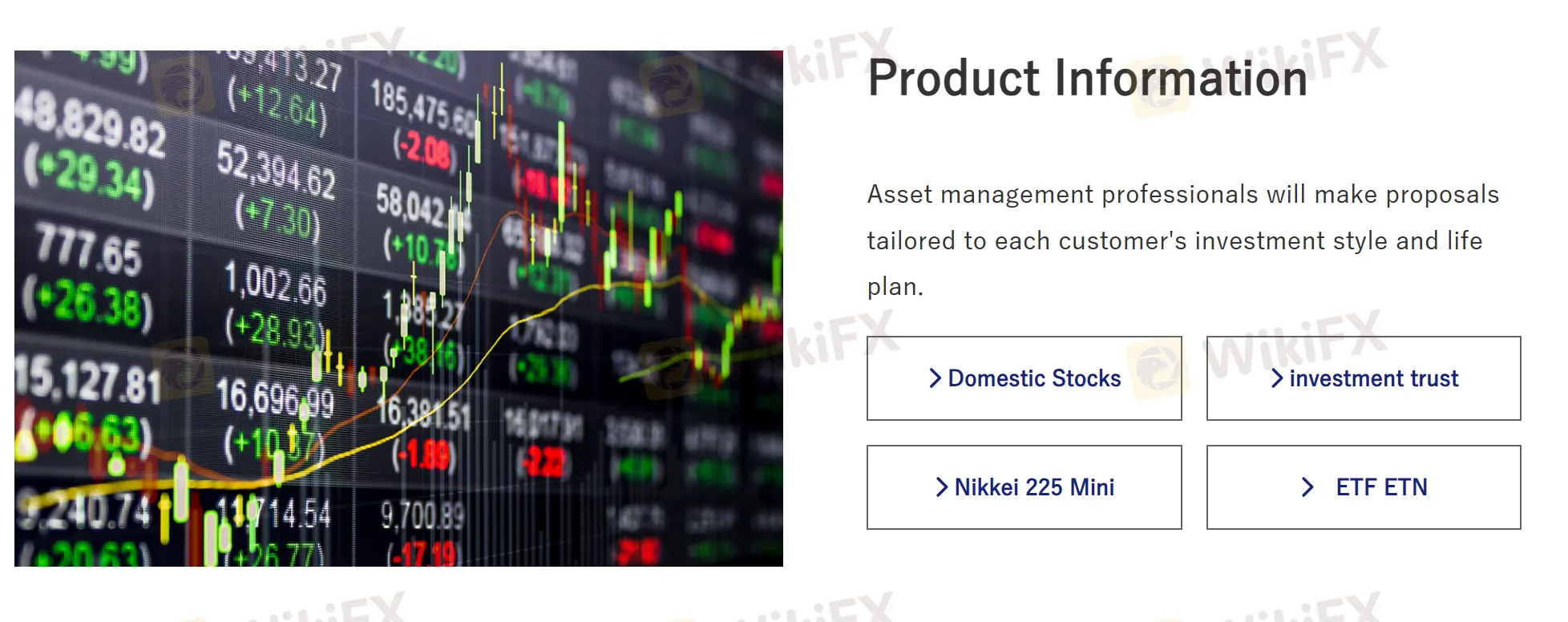

Japan Private Asset provides four types of trading products, including domestic stocks, mutual funds, Nikkei 225 Mini, ETF & ETN.

| Tradable Assets | Supported |

| Domestic Stocks | ✔ |

| Mutual Funds | ✔ |

| Nikkei 225 Mini | ✔ |

| ETF & ETN | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

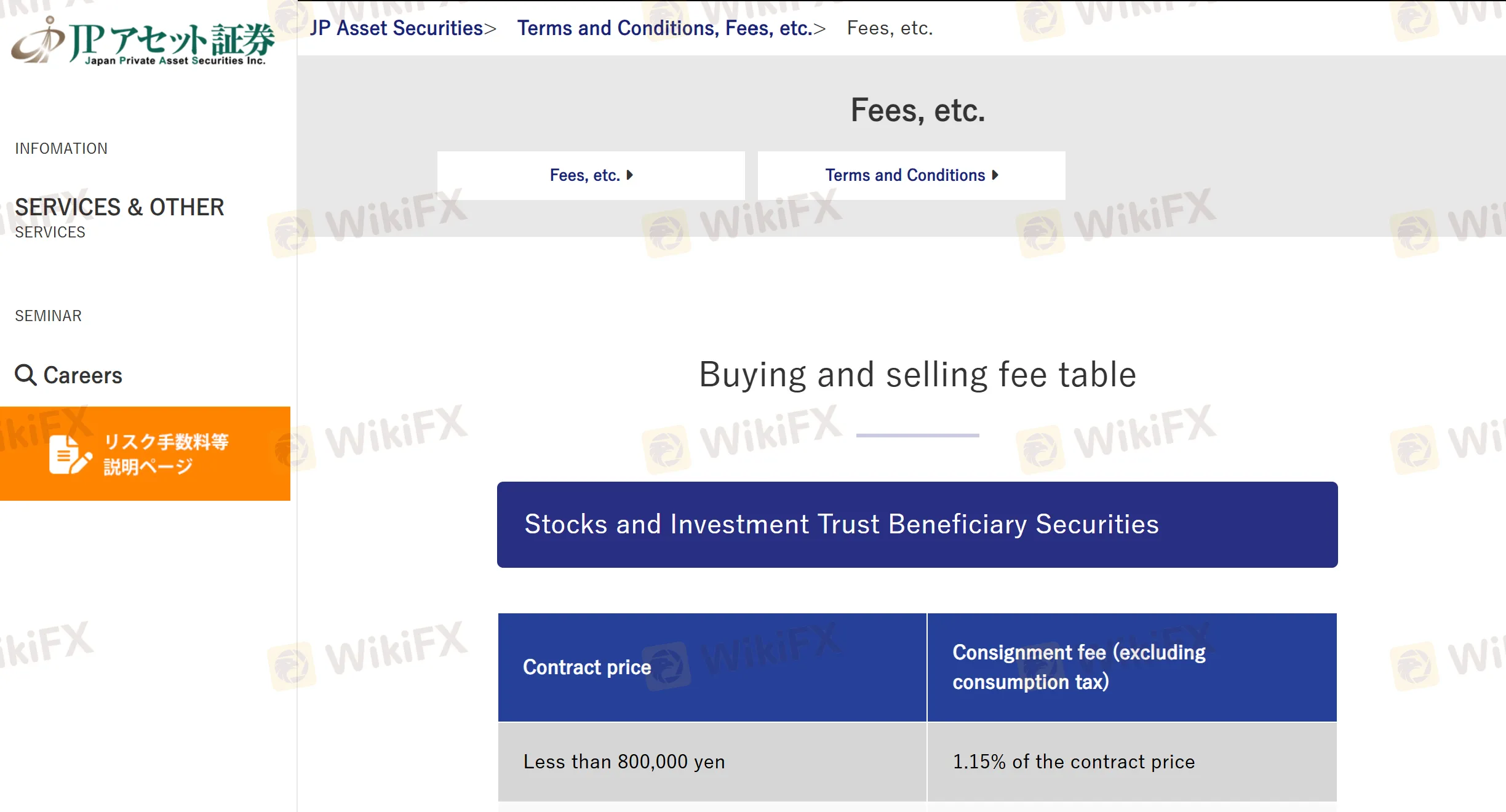

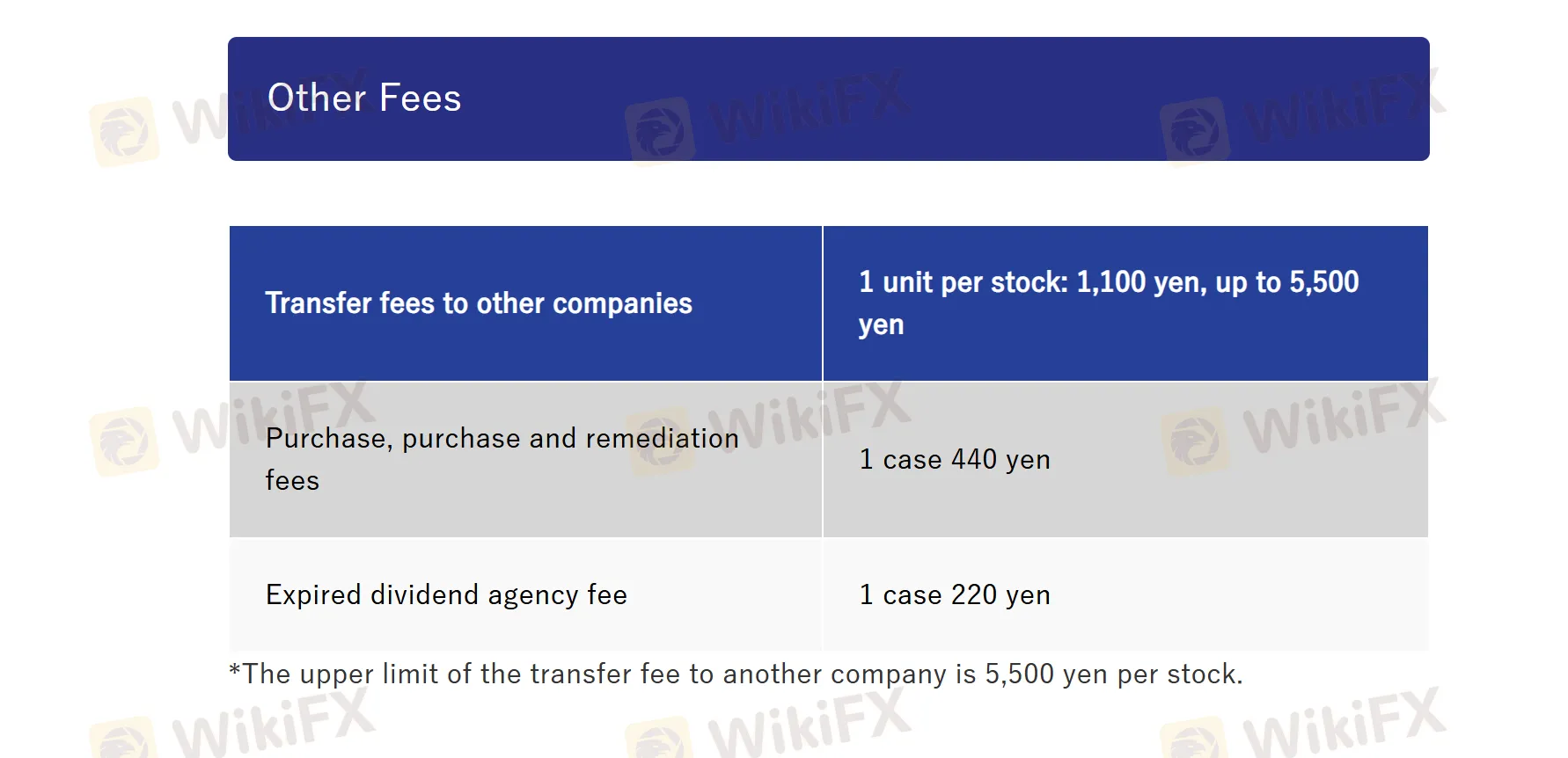

Japan Private Asset Fees

Japan Private Asset charges a certain amount of fees depending on trading volume. Fees vary, and detailed information is displayed on its official website.