Profil perusahaan

| NAGANO Ringkasan Ulasan | |

| Didirikan | 1900 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Instrumen Pasar | Saham, Saham AS, obligasi, trust investasi, Hifumi Plus, ETF/ETN, J-REIT |

| Akun Demo | ❌ |

| Platform Perdagangan | / |

| Deposit Minimum | / |

| Dukungan Pelanggan | Jam penerimaan: 9:00 - 17:00, Tutup pada hari Sabtu, Minggu, libur nasional, dan libur akhir tahun dan Tahun Baru |

| Telepon: 026-228-3113 | |

| Alamat: 〒380-0826 長野県長野市北石堂町1448番地 | |

NAGANO adalah perusahaan keuangan Jepang yang didirikan pada tahun 1900 dan diatur oleh Financial Services Agency (FSA), memegang Izin Forex Ritel. Perusahaan ini menawarkan beragam instrumen perdagangan, termasuk saham domestik dan AS, obligasi, trust investasi, Hifumi Plus, ETF/ETN, dan J-REIT. Perusahaan menyediakan tiga jenis akun: Akun Tertentu (dengan pemotongan pajak), Akun Tertentu (tanpa pemotongan pajak), dan Akun Umum, tanpa biaya pengelolaan akun.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA | Website tidak mendukung bahasa Inggris |

| Beragam saluran dukungan pelanggan | |

| Tidak ada biaya pengelolaan akun | |

| Produk dan layanan yang beragam |

Apakah NAGANO Legal?

Ya, NAGANO saat ini diatur oleh FSA, memegang Izin Forex Ritel.

| Negara yang Diatur | Otoritas yang Diatur | Entitas yang Diatur | Status Saat Ini | Jenis Lisensi | Nomor Lisensi |

| Financial Services Agency (FSA) | NAGANO株式会社 | Diatur | Izin Forex Ritel | 関東財務局長(金商)第125号 |

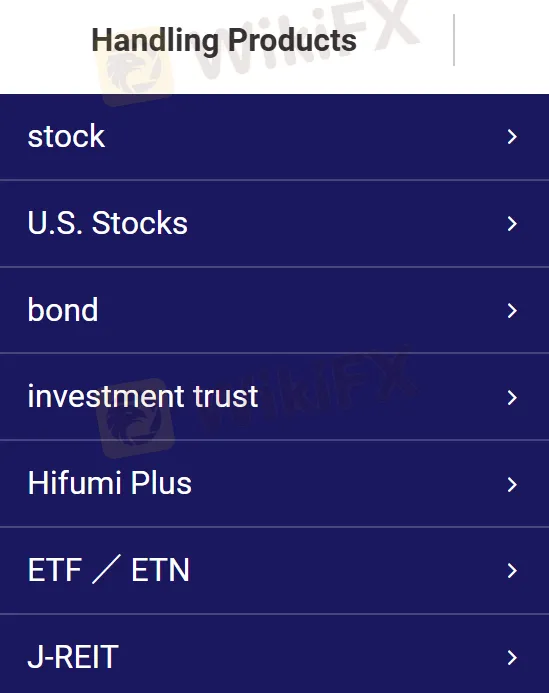

Apa yang Dapat Saya Perdagangkan di NAGANO?

Pada NAGANO, Anda dapat melakukan perdagangan dengan saham, Saham AS, obligasi, trust investasi, Hifumi Plus, ETF/ETN, J-REIT.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Saham | ✔ |

| Obligasi | ✔ |

| Trust Investasi | ✔ |

| Hifumi Plus | ✔ |

| ETF/ETN | ✔ |

| J-REIT | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Opsi | ✔ |

| ETF | ✔ |

| Dana Investasi | ✔ |

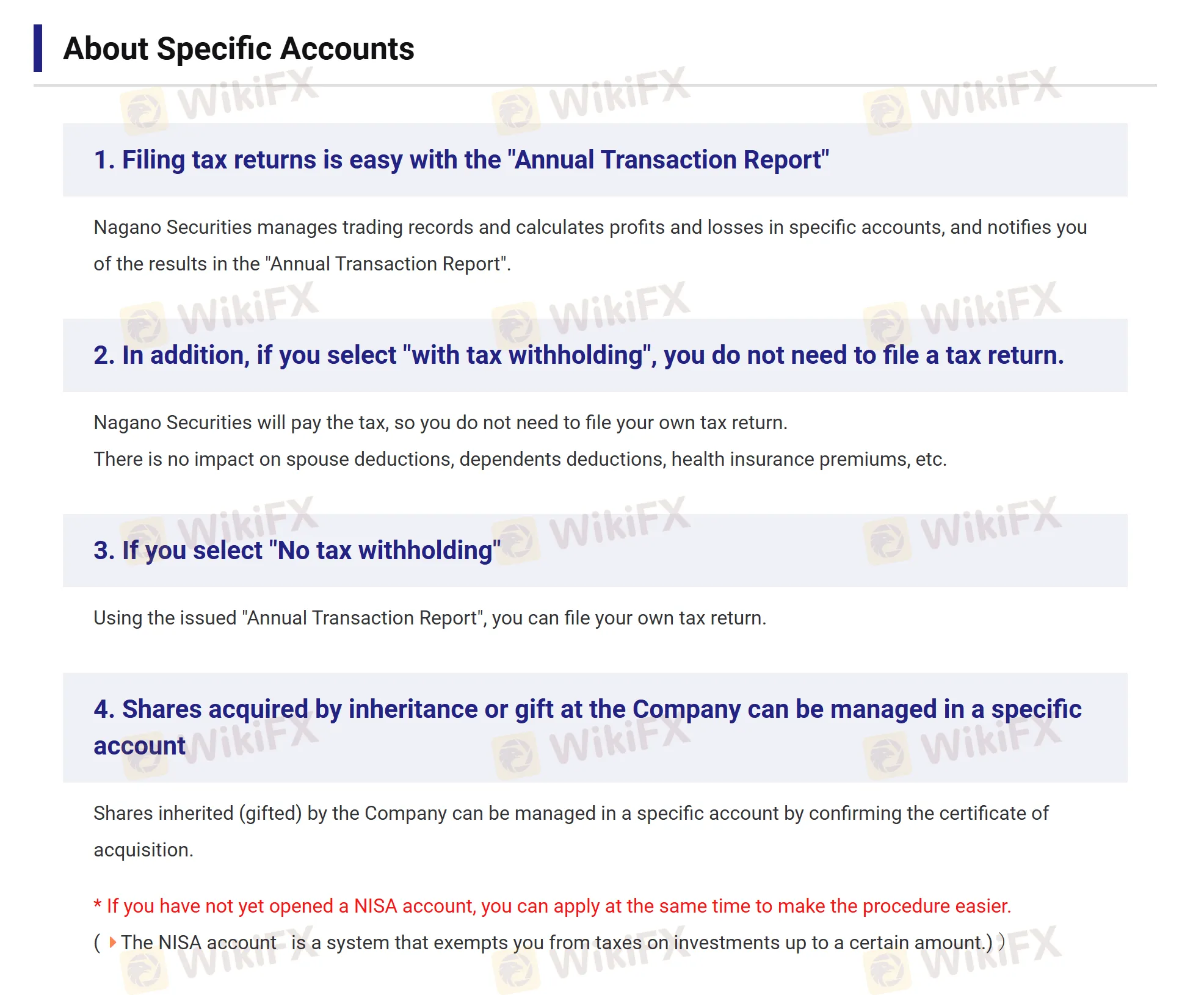

Akun

NAGANO menyediakan Akun Tertentu (dengan pemotongan pajak), Akun Tertentu (tanpa pemotongan pajak), dan Akun Umum.

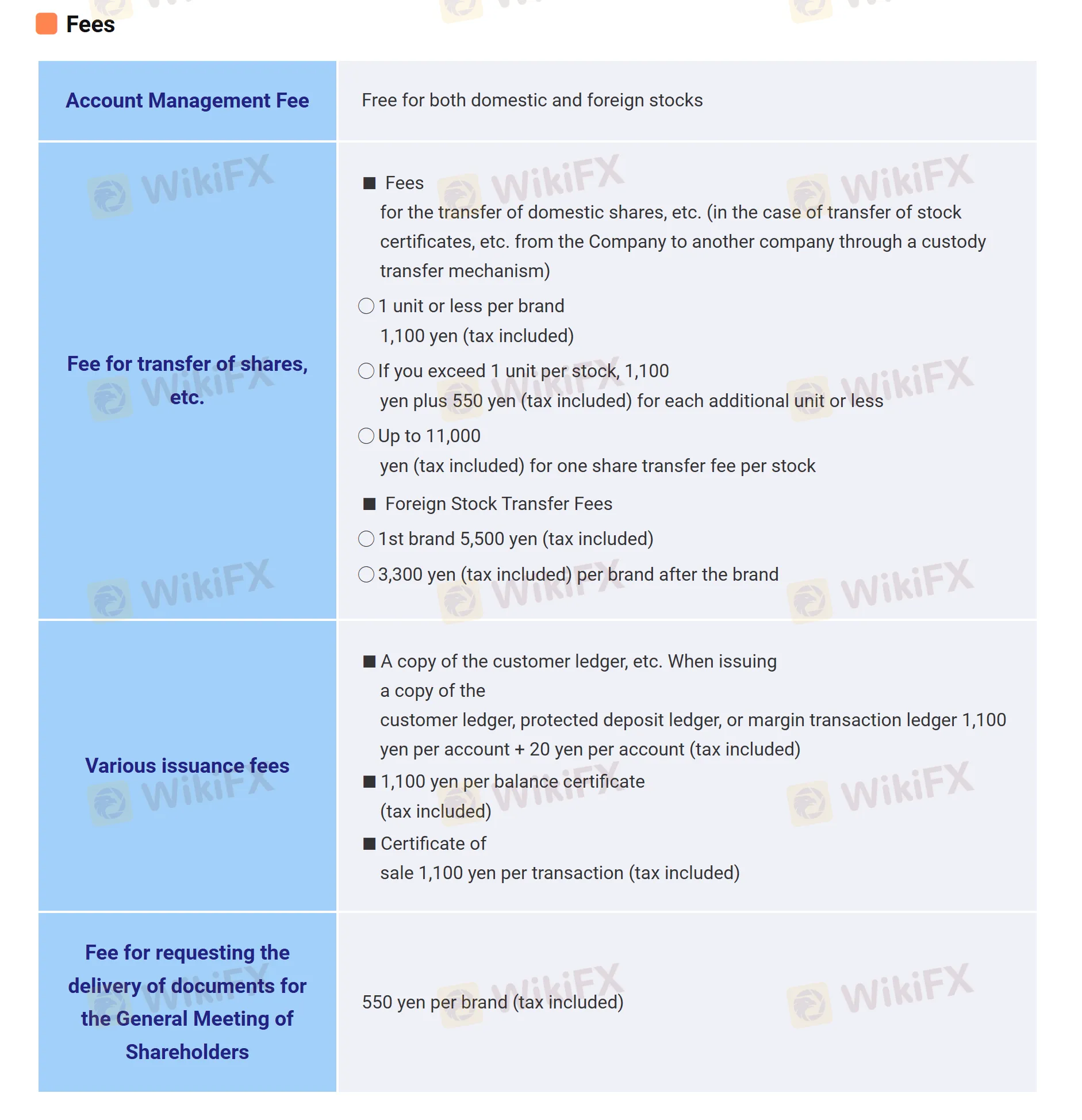

Biaya

| Kategori Biaya | Detail |

| Biaya pengelolaan akun | Gratis untuk saham domestik maupun asing |

| Biaya transfer saham domestik | 1 unit atau kurang per brand: 1.100 yen (termasuk pajak). Jika melebihi 1 unit per saham: 1.100 yen ditambah 550 yen (termasuk pajak) untuk setiap unit tambahan atau kurang, hingga 11.000 yen (termasuk pajak) untuk biaya transfer saham per saham. |

| Biaya transfer saham asing | Brand pertama: 5.500 yen (termasuk pajak). 3.300 yen (termasuk pajak) per brand setelah yang pertama. |

| Berbagai biaya penerbitan | Salinan buku besar pelanggan, buku besar deposito terlindungi, atau buku besar transaksi marjin: 1.100 yen per akun + 20 yen per akun (termasuk pajak). Sertifikat saldo: 1.100 yen (termasuk pajak). Sertifikat penjualan: 1.100 yen per transaksi (termasuk pajak). |

| Biaya permintaan pengiriman dokumen untuk Rapat Umum Pemegang Saham | 550 yen per brand (termasuk pajak) |