Company Summary

| NAGANO Review Summary | |

| Founded | 1900 |

| Registered Country/Region | Japan |

| Regulation | FSA |

| Market Instruments | Stocks, U.S. Stocks, bonds, investment trust, Hifumi Plus, ETF/ETN, J-REIT |

| Demo Account | ❌ |

| Trading Platform | / |

| Minimum Deposit | / |

| Customer Support | Reception hours: 9:00 - 17:00, Closed on Saturdays, Sundays, national holidays, and year-end and New Year holidays |

| Phone: 026-228-3113 | |

| Address: 〒380-0826 長野県長野市北石堂町1448番地 | |

NAGANO is a Japanese financial firm founded in 1900 and regulated by the Financial Services Agency (FSA), holding a Retail Forex License. It offers diverse tradable instruments, including domestic and U.S. stocks, bonds, investment trusts, Hifumi Plus, ETFs/ETNs, and J-REITs. The firm provides three account types: Specified account (with tax withholding), Specified account (no tax withholding), and General Account, with no account management fees.

Pros and Cons

| Pros | Cons |

| Regulated by FSA | Website do not support English |

| Diverse customer support channels | |

| No account management fees | |

| Diverse products and services |

Is NAGANO Legit?

Yes, NAGANO is currently regulated by FSA, holding a Retail Forex License.

| Regulated Country | Regulated Authority | Regulated Entity | Current Status | License Type | License Number |

| Financial Services Agency (FSA) | 長野證券株式会社 | Regulated | Retail Forex License | 関東財務局長(金商)第125号 |

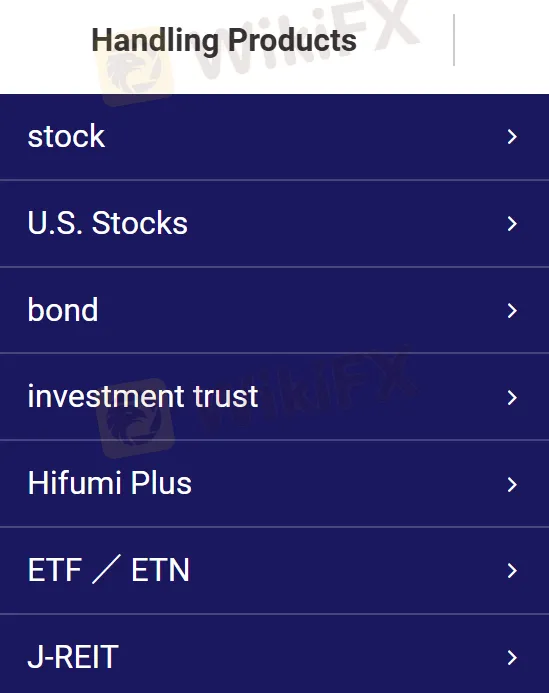

What Can I Trade on NAGANO?

On NAGANO, you can trade with stocks, U.S. Stocks, bonds, investment trust, Hifumi Plus, ETF/ETN, J-REIT.

| Tradable Instruments | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment Trust | ✔ |

| Hifumi Plus | ✔ |

| ETF/ETN | ✔ |

| J-REIT | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ✔ |

| ETFs | ✔ |

| Mutual Funds | ✔ |

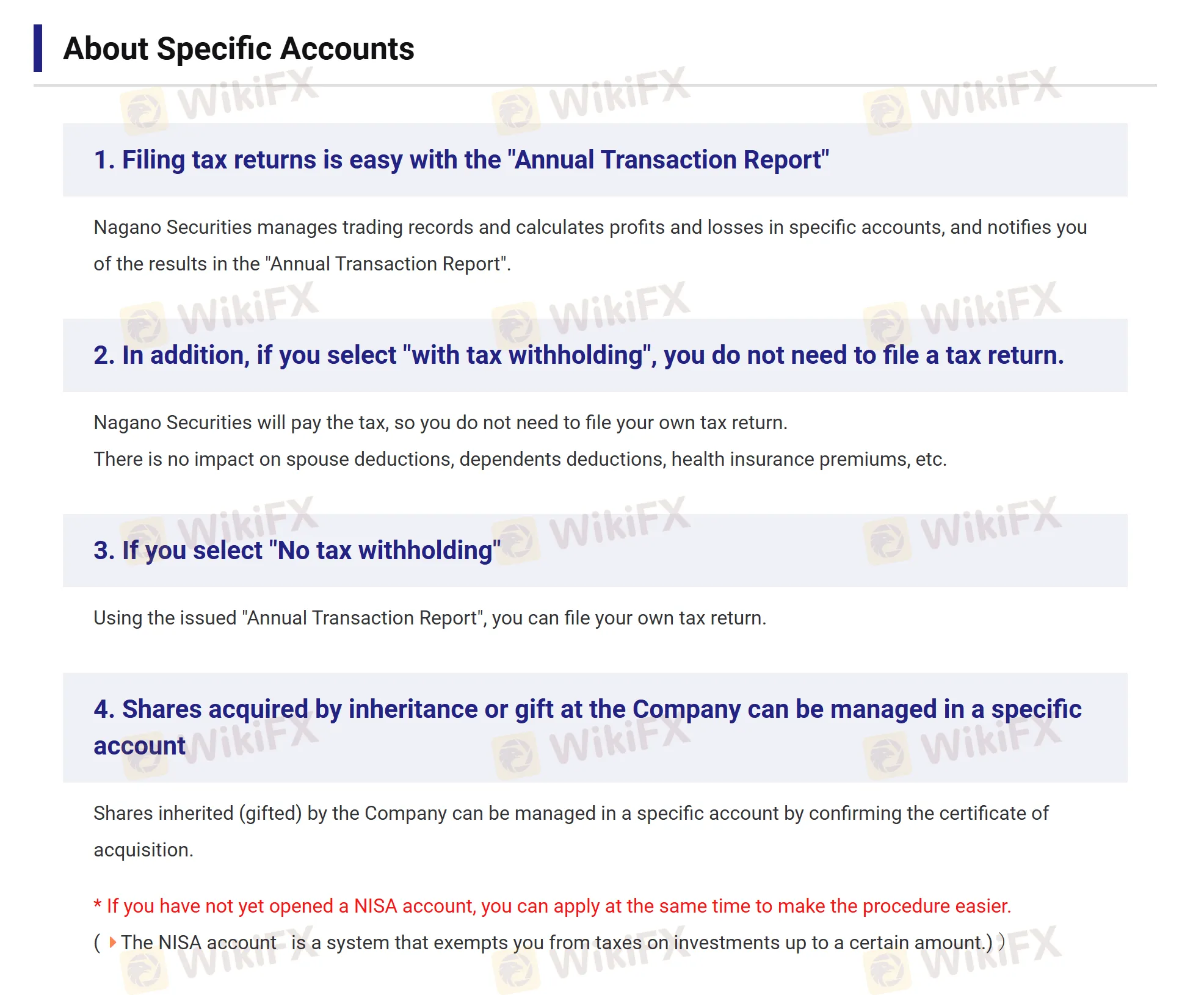

Account

NAGANO provides Specified account (with tax withholding), Specified account (no tax withholding), and General Account.

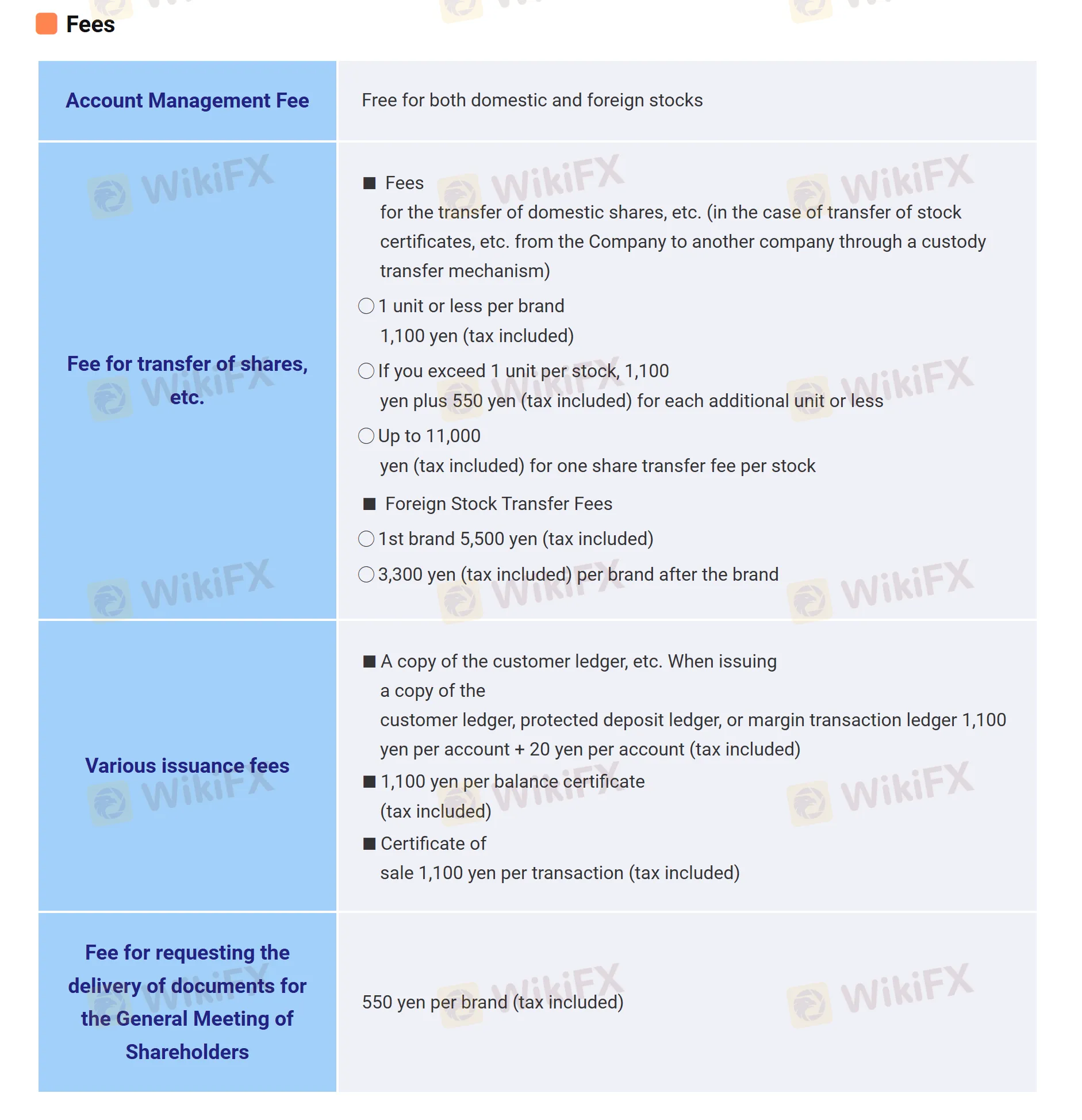

Fees

| Fee Category | Detail |

| Account management fee | Free for both domestic and foreign stocks |

| Domestic stock transfer fees | 1 unit or less per brand: 1,100 yen (tax included). If you exceed 1 unit per stock: 1,100 yen plus 550 yen (tax included) for each additional unit or less, up to 11,000 yen (tax included) for one share transfer fee per stock. |

| Foreign stock transfer fees | 1st brand: 5,500 yen (tax included). 3,300 yen (tax included) per brand after the first. |

| Various issuance fees | Copy of customer ledger, protected deposit ledger, or margin transaction ledger: 1,100 yen per account + 20 yen per account (tax included). Balance certificate: 1,100 yen (tax included). Certificate of sale: 1,100 yen per transaction (tax included). |

| Fee for requesting the delivery of documents for the General Meeting of Shareholders | 550 yen per brand (tax included) |