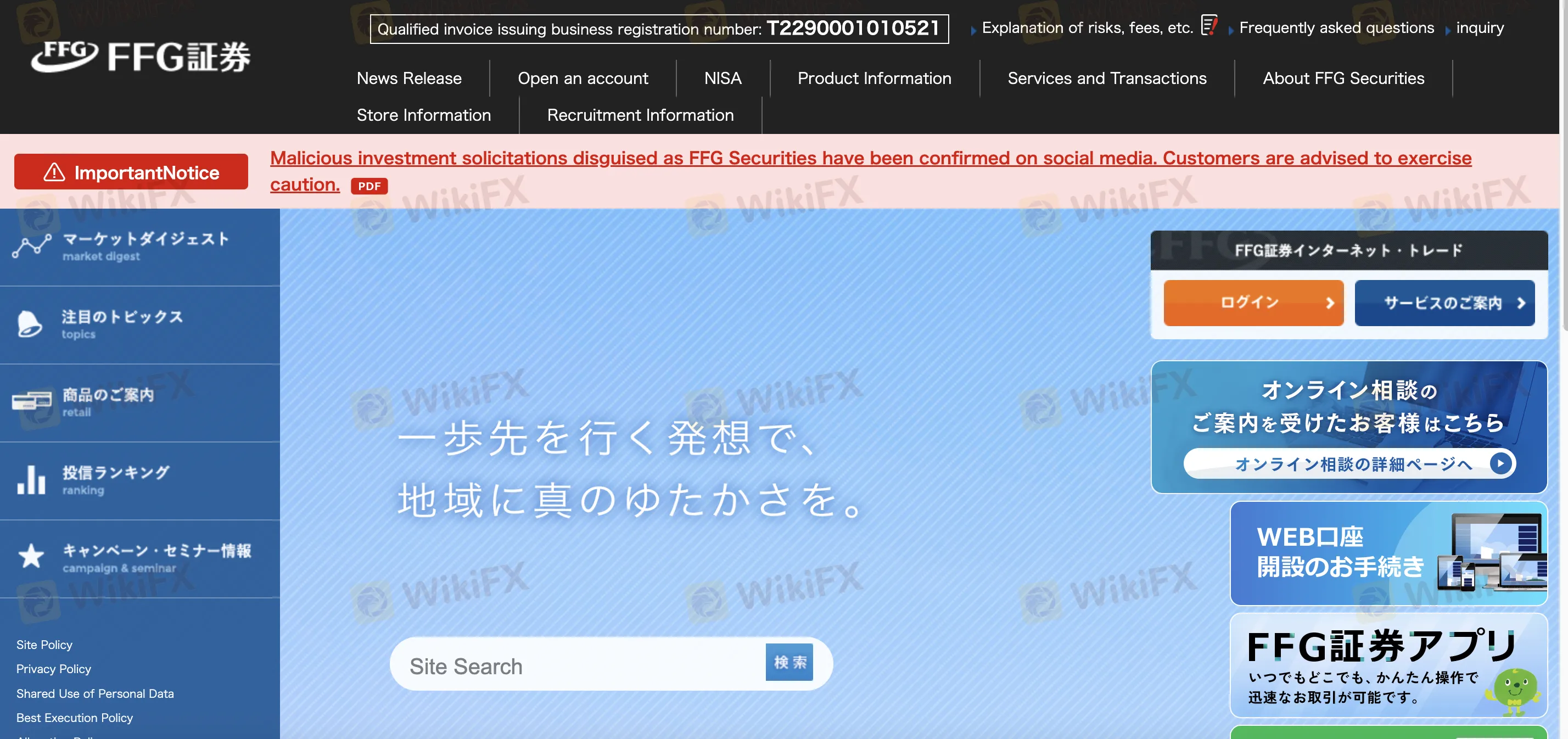

Profil perusahaan

| FFG Securities Ringkasan Ulasan | |

| Didirikan | 2007 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Instrumen Pasar | Saham, Obligasi, ETF, REIT, Trust Investasi |

| Akun Demo | ❌ |

| Platform Perdagangan | Aplikasi FFG Securities, Perdagangan Internet FFG |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: 092-771-3836 |

| Alamat: Lantai 9, Kantor Pusat Bank Fukuoka, Fukuoka | |

Informasi FFG Securities

Didirikan pada tahun 2007, FFG Securities Co., Ltd. adalah perusahaan layanan keuangan Jepang yang diatur oleh FSA. Perusahaan ini memberikan akses ke trust investasi, ETF, obligasi, saham AS dan domestik. Meskipun sistem perdagangan seluler dan internet dapat diakses, kurangnya MT4/MT5 dan biaya offline yang tinggi dapat menjadi kekurangan bagi mereka dengan anggaran terbatas.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA di Jepang | Tidak ada akun demo atau Islami |

| Rentang instrumen domestik dan asing yang luas | Biaya tinggi untuk transaksi langsung |

| Biaya diskon untuk pesanan hanya melalui internet | Deposit minimum tidak diungkapkan |

| Mendukung saham AS dan perdagangan marjin | |

| Waktu operasi panjang |

Apakah FFG Securities Legal?

Ya, FFG Securities Co., Ltd. (FFG証券株式会社) diatur. Perusahaan ini memegang Lisensi Forex Ritel yang dikeluarkan oleh Otoritas Jasa Keuangan (FSA) Jepang, dengan nomor lisensi 福岡財務支局長(金商)第5号.

Apa yang Dapat Saya Perdagangkan di FFG Securities?

Termasuk saham, obligasi, ETF, REIT, dan trust investasi, FFG Securities menawarkan berbagai instrumen keuangan domestik dan asing. Ini juga memungkinkan perdagangan marjin dan menyediakan aplikasi seluler untuk data pasar dan perdagangan real-time.

| Aset Perdagangan | Didukung |

| Saham | ✔ |

| Obligasi | ✔ |

| ETF | ✔ |

| REIT | ✔ |

| Trust Investasi | ✔ |

| Forex | ❌ |

| Komoditas | ❌ |

| Indeks | ❌ |

| Kriptokurensi | ❌ |

| Opsi | ❌ |

Biaya FFG Securities

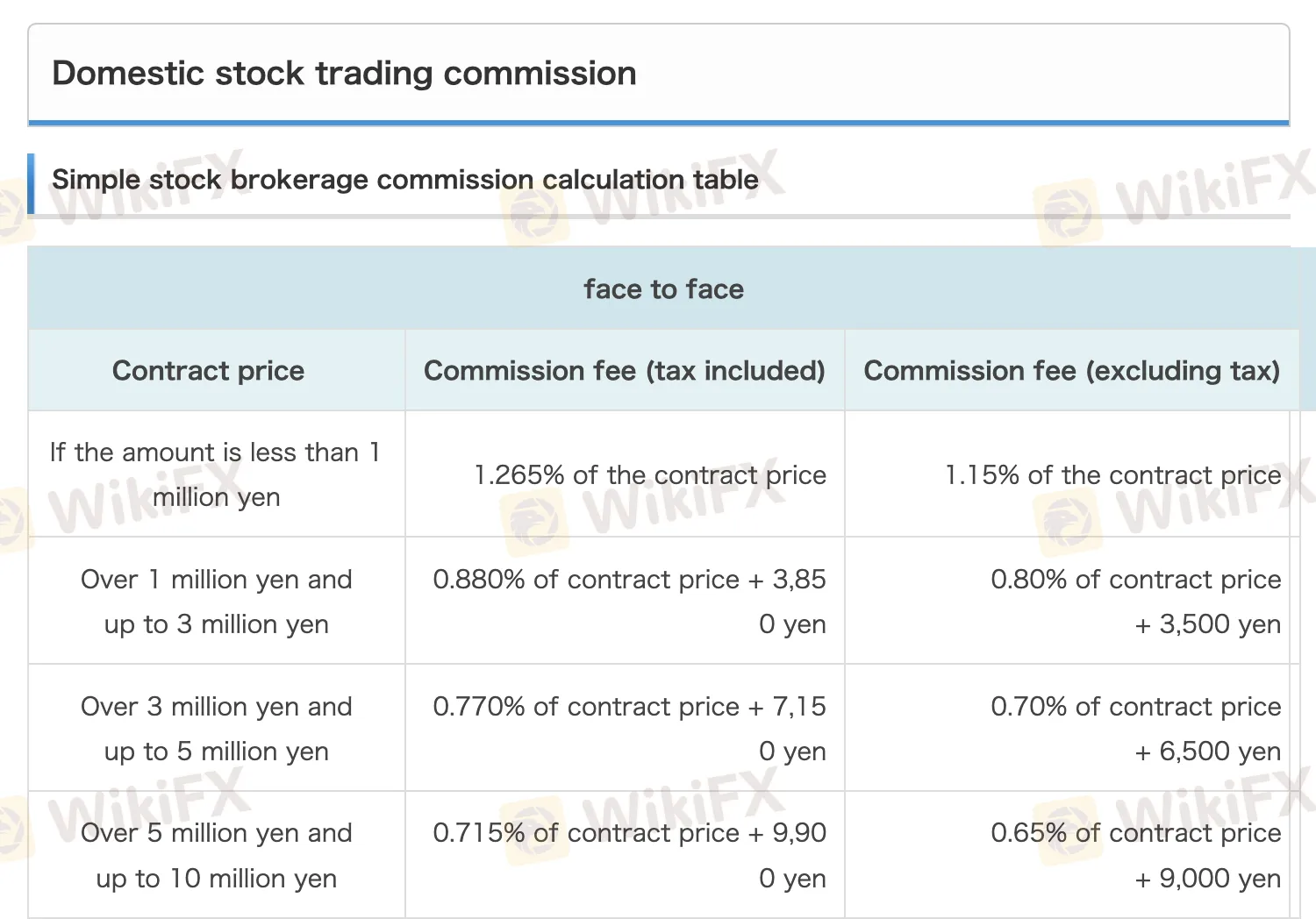

Biaya keseluruhan FFG Securities relatif tinggi dibandingkan dengan pialang online standar, terutama untuk transaksi tatap muka dan ukuran kontrak besar. Namun, diskon signifikan (hingga 90%) diterapkan untuk perdagangan hanya daring, menjadikannya lebih hemat biaya bagi pengguna digital.

| Jenis Biaya | Detail |

| Perdagangan Saham Domestik | Hingga 1,265% dari harga kontrak (tatap muka); diskon 90% untuk hanya daring |

| Biaya Komisi Minimum | Tatap muka: ¥2.750; Hanya daring: ¥275 |

| Perdagangan Marjin | Bunga beli: 1,97% p.a.; Biaya peminjaman saham (pendek): 1,15% |

| Saham Asing | 1,10% untuk <¥1M; 0,33% + ¥218.900 untuk >¥100M |

| Obligasi Konvertibel (CB) | 1,10% untuk <¥1M; 0,165% + ¥765.600 untuk >¥1M |

| Trust Investasi | Bervariasi berdasarkan produk; Diskon daring tersedia (hingga 10% off) |

| Biaya Pengelolaan Akun | Domestik: Gratis; Asing: Gratis |

| Biaya Transfer (Saham) | Mulai dari ¥1.100 (1 unit atau kurang); dibatasi pada ¥6.600 |

| Pengiriman Kertas (Material Pemegang Saham) | ¥660 per saham |

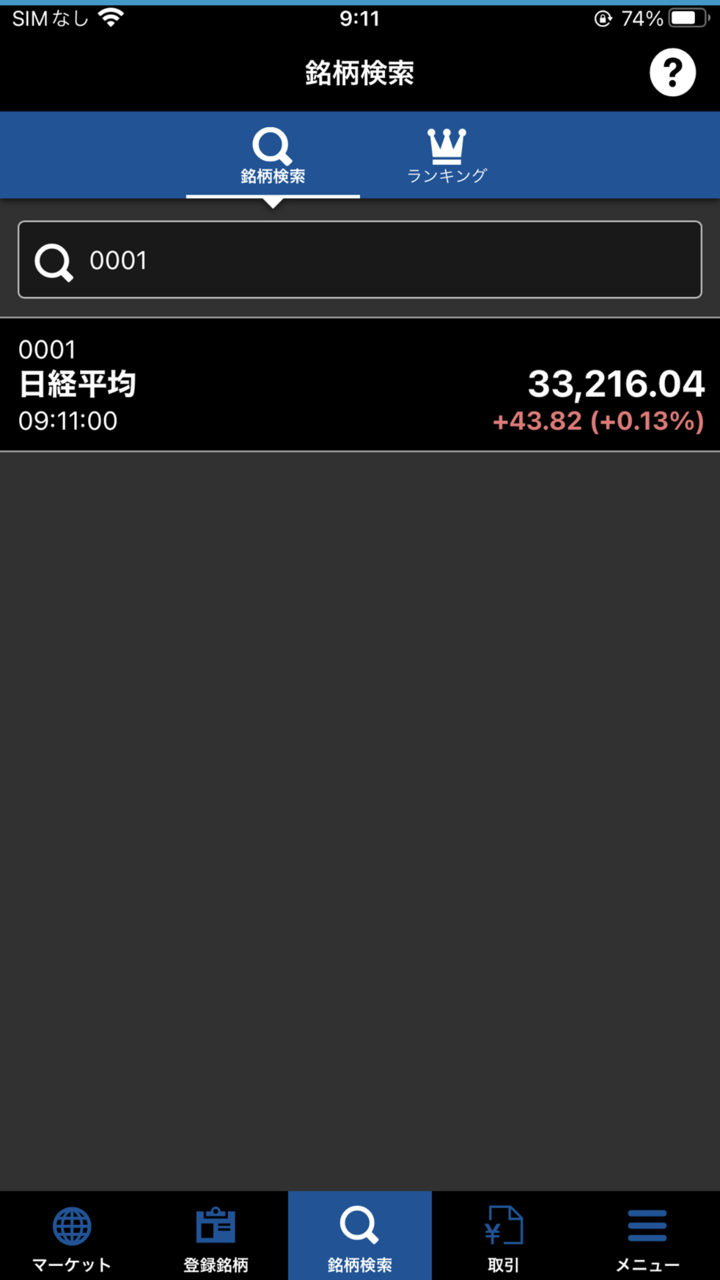

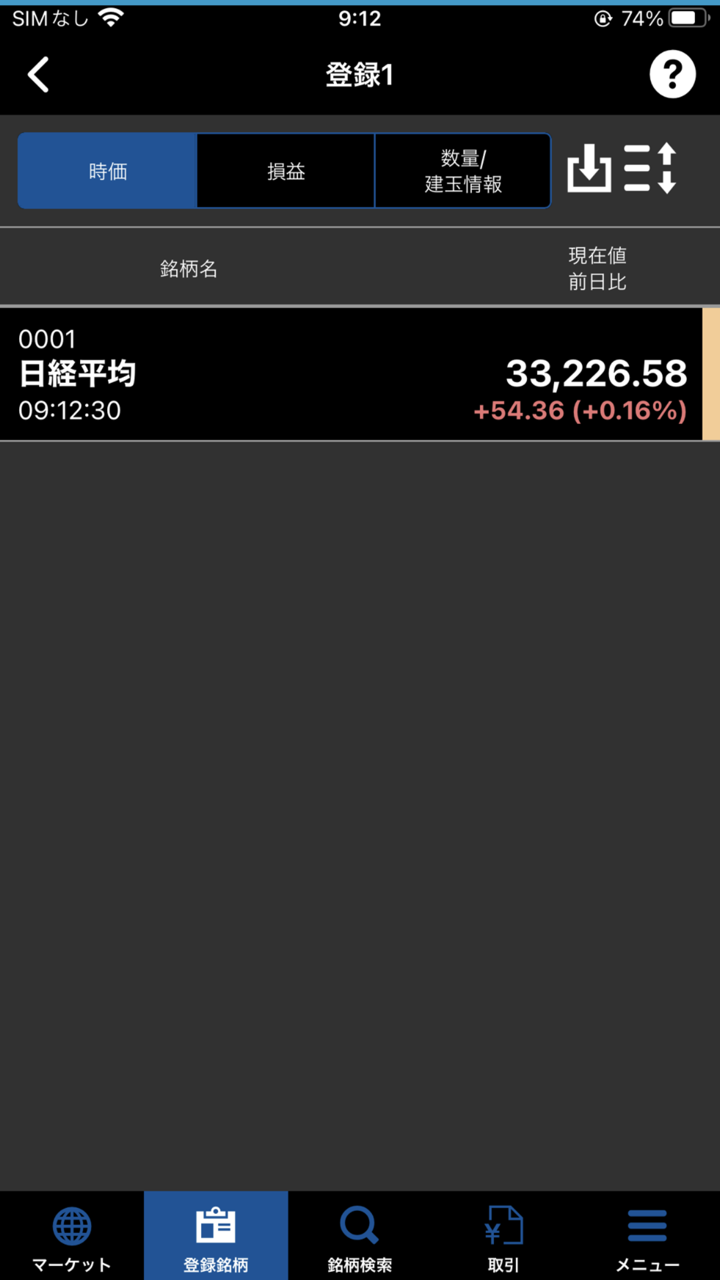

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Aplikasi FFG Securities | ✔ | iOS, Android |

| Perdagangan Internet FFG | ✔ | PC, Mac, web, seluler |

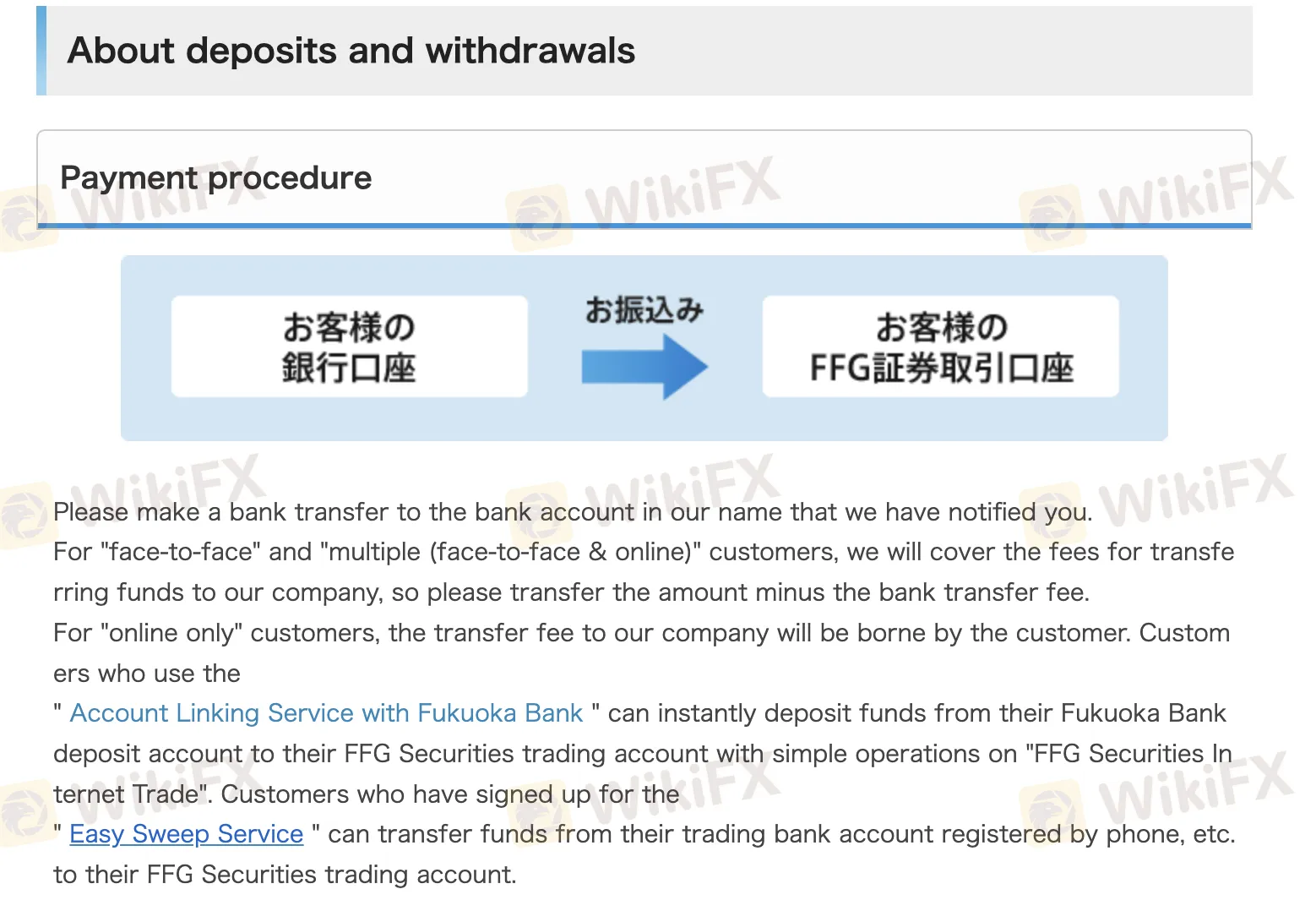

Deposit dan Penarikan

FFG Securities tidak mengenakan biaya untuk deposit atau penarikan bagi pelanggan tatap muka atau hibrida (tatap muka & online). Namun, pelanggan hanya online harus menanggung biaya transfer deposit mereka sendiri.

| Metode Pembayaran | Biaya | Waktu Pemrosesan |

| Transfer Bank (Tatap muka/Hibrida) | ❌ | Sama hari jika sebelum tengah hari |

| Transfer Bank (Hanya online) | ✔ | Mungkin hari kerja berikutnya |

| Tautan Rekening Bank Fukuoka | ❌ (melalui akun terhubung) | Instan |