Profil perusahaan

| Capital Trader Ringkasan Ulasan | |

| Dibentuk | 2024-07-10 |

| Negara/Daerah Terdaftar | Siprus |

| Regulasi | Tidak Diatur |

| Instrumen Pasar | Forex, CFD, Saham |

| Akun Demo | ❌ |

| Daya Ungkit | Hingga 1:500 |

| Spread | Mulai dari 0,2 pip (EUR/USD, Rata-rata) |

| Platform Perdagangan | Capital Trader WebTrader (Web) |

| Deposit Minimum | $250 |

| Dukungan Pelanggan | info@capitalltraders.com |

| +442038973562 | |

| 256 Archiepiskopou Makariou III Avenue, Eftapaton Court 3105 Limassol, Siprus | |

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Beragam instrumen perdagangan | Tidak Diatur |

| Jenis akun fleksibel | Informasi ambigu (misalnya, rasio daya ungkit CFD) |

| Daya ungkit tinggi hingga 1:500 | Deposit minimum tinggi untuk akun premium (dimulai dari $100,000) |

| Dukungan pelanggan 24/5 multibahasa | Komisi tinggi sebesar $30 per lot untuk XAU/USD dalam akun MIKRO |

| MT4/MT5 tidak tersedia |

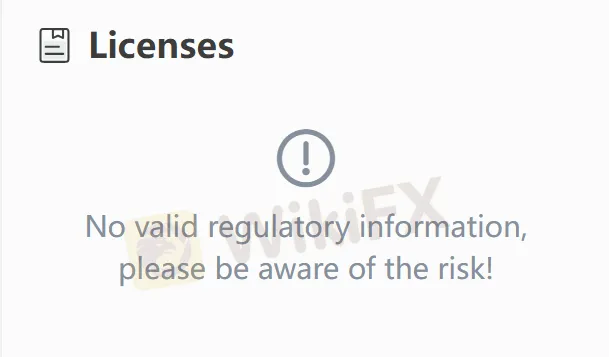

Apakah Capital Trader Legal?

Capital Trader tidak diatur. Meskipun mengklaim memiliki lisensi regulasi utama seperti FCA dan CySEC, trader disarankan untuk memeriksa dan memverifikasi di situs web resmi otoritas regulasi terkait dan memprioritaskan berinvestasi dengan broker yang diatur.

Apa yang Bisa Saya Perdagangkan di Capital Trader?

Capital Trader menyediakan layanan perdagangan forex, saham, dan CFD.

| Instrumen yang Dapat Diperdagangkan | Didukung |

| Forex | ✔ |

| CFDs | ✔ |

| Saham | ✔ |

| Saham | ❌ |

| ETFs | ❌ |

| Obligasi | ❌ |

| Reksa Dana | ❌ |

Jenis Akun

| Jenis Akun | STANDAR | PROFESIONAL | BISNIS | BISNIS PLUS |

| Deposit Minimum | Mulai dari $250 | Mulai dari $10000 | Mulai dari $30000 | Mulai dari $100000 |

| Ukuran Lot Minimum | 0.01 | 0.01 | 0.01 | 0.01 |

| Platform Perdagangan | Capital Trader webtrader | Capital Trader webtrader | Capital Trader webtrader | Capital Trader webtrader |

| Deposit Minimum | $250 | $10000 | $30000 | $100000 |

| Perdagangan Mobile | Perdagangan Mobile | Perdagangan Mobile | Perdagangan Mobile | Kondisi yang Disesuaikan |

| Perdagangan 24 Jam | ✔ | ✔ | ✔ | ✔ |

| Bonus Deposit | 30% | 50% | 100% | |

| Akun Islami | ✔ | ✔ | ✔ |

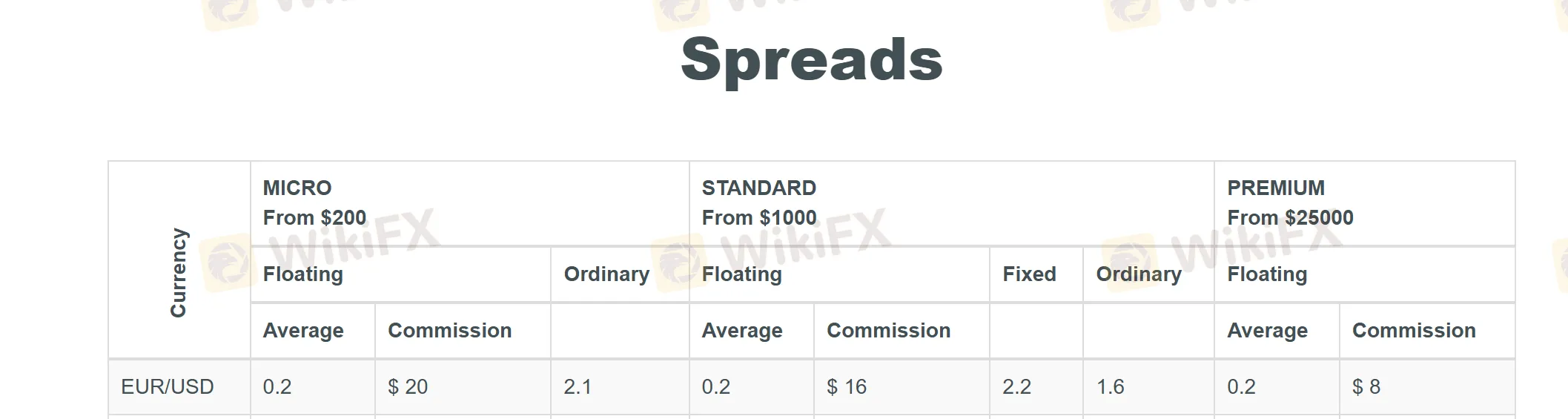

Biaya Capital Trader

Capital Trader menawarkan spread mengambang forex serendah 0.2 (misalnya, EUR/USD dalam akun mikro), sementara spread tetap lebih tinggi (misalnya, spread tetap GBP/USD dimulai dari 2.1). Logam mulia memiliki spread lebih lebar, seperti emas/USD dengan spread mengambang sebesar 0.9 (akun mikro).

Komisi untuk logam mulia adalah $30 per lot. Untuk forex dalam akun mikro, komisi adalah $20 per lot (misalnya, EUR/USD), sementara akun premium menawarkan komisi serendah $8 per lot.

Leverage

Leverage maksimum forex adalah 1:500 (berlaku untuk pasangan mata uang utama seperti EUR/USD). Leverage tinggi cocok untuk spekulasi jangka pendek tetapi membawa risiko yang sangat tinggi.

Platform Perdagangan

Capital Trader WebTrader mendukung operasi berbasis web. Akun dasar mendukung perdagangan seluler biasa, sementara akun BUSINESS PLUS memungkinkan kondisi perdagangan yang disesuaikan.

| Platform Perdagangan | Didukung | Perangkat Tersedia | Cocok untuk |

| Capital Trader WebTrader | ✔ | Web | / |

Bonus

Bonus deposit meningkat dengan tingkat akun: 30% untuk akun PROFESSIONAL, 50% untuk akun BUSINESS, dan 100% untuk akun BUSINESS PLUS.